[ad_1]

Up to date on November twenty fourth, 2023

There are numerous methods to worth shares. There are strategies primarily based on money circulate, earnings, dividend yield, income, and the topic of this text, ebook worth. The idea of ebook worth is kind of easy. The corporate’s property should be valued no less than quarterly on the stability sheet for buyers to see, and primarily based upon that worth, buyers can then examine the market worth of the inventory to the asset worth on the stability sheet.

By doing this, an investor can see if a inventory trades under its theoretical liquidation worth, which is the web worth of the corporate’s property minus the web worth of its liabilities. For example, if an organization has $2 billion in property and $1 billion in whole liabilities, its ebook worth could be $1 billion. That will be the theoretical worth of the corporate if it had been to shut down and liquidate its property. If the inventory had a market cap of $500 million, that might be 50% of the ebook worth.

In doing this, buyers can display for shares which are buying and selling fairly cheaply, as most shares by no means commerce under ebook worth, and for people who do, they have a tendency to not keep there for lengthy.

Sectors that are likely to see shares under ebook worth are financials, utilities, and sure shopper staples. It could occur in any sector, however these are those which are most liable to it.

On this article, we’ll check out 10 shares which are buying and selling under ebook worth and that additionally pay robust dividends.

We’ve got created a spreadsheet of shares (and carefully associated REITs and MLPs, and so on.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full record of securities with 5%+ yields (together with necessary monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

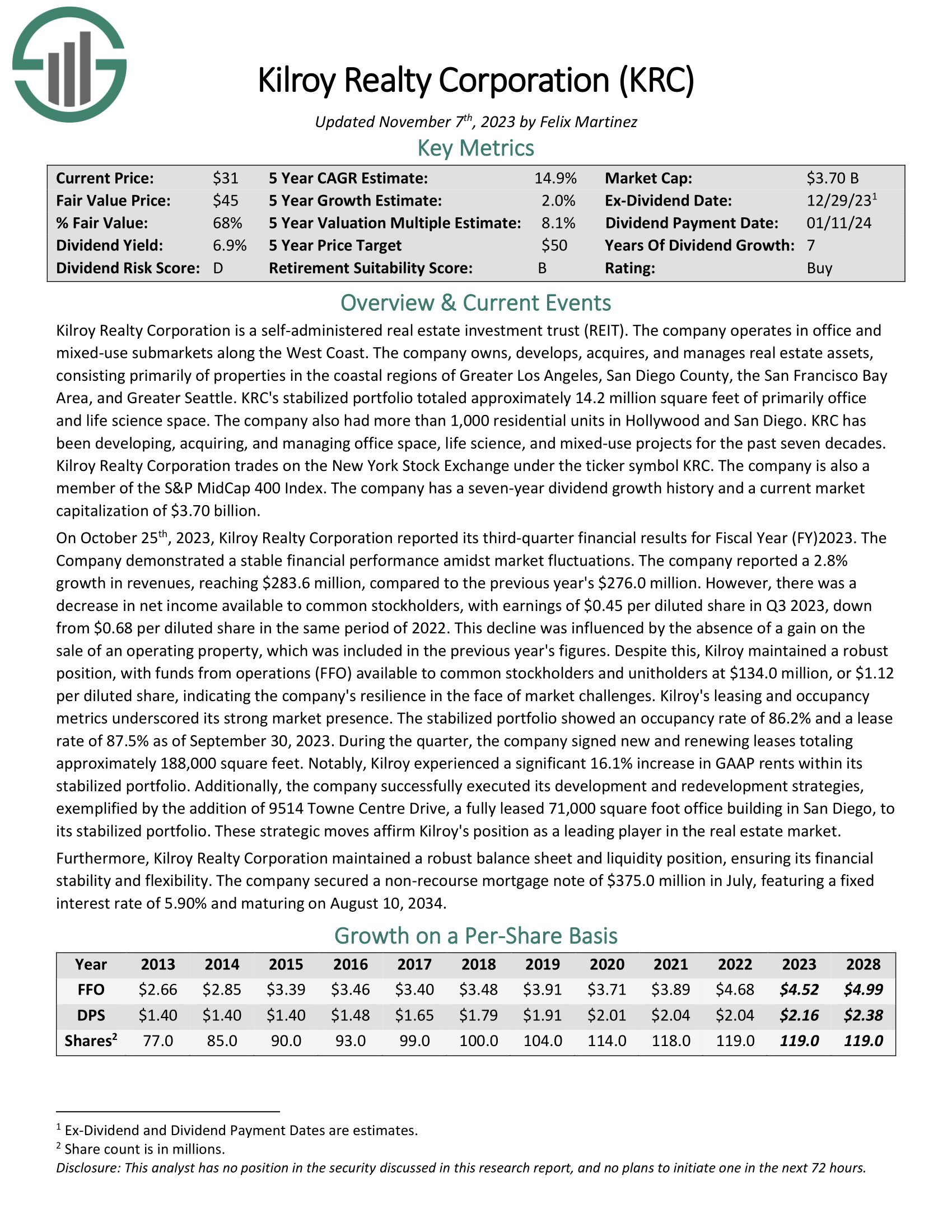

Kilroy Realty (KRC)

Value-to-book ratio: 0.65

Kilroy Realty Company is a self-administered actual property funding belief (REIT). The corporate operates in workplace and mixed-use submarkets alongside the West Coast. The corporate owns, develops, acquires, and manages actual property property, consisting primarily of properties within the coastal areas of Larger Los Angeles, San Diego County, the San Francisco Bay Space, and Larger Seattle.

KRC’s stabilized portfolio totaled roughly 14.2 million sq. ft of primarily workplace and life science house. The corporate additionally had greater than 1,000 residential models in Hollywood and San Diego.

On October twenty fifth, 2023, Kilroy Realty Company reported its third-quarter monetary outcomes for Fiscal Yr (FY)2023. The corporate demonstrated a steady monetary efficiency amidst market fluctuations. The corporate reported a 2.8% development in revenues, reaching $283.6 million, in comparison with the earlier yr’s $276.0 million.

Kilroy maintained strong place, with funds from operations (FFO) obtainable to widespread stockholders and unitholders at $134.0 million, or $1.12 per diluted share, indicating the corporate’s resilience within the face of market challenges. Kilroy’s leasing and occupancy metrics underscored its robust market presence. The stabilized portfolio confirmed an occupancy price of 86.2% and a lease price of 87.5% as of September 30, 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on KRC (preview of web page 1 of three proven under):

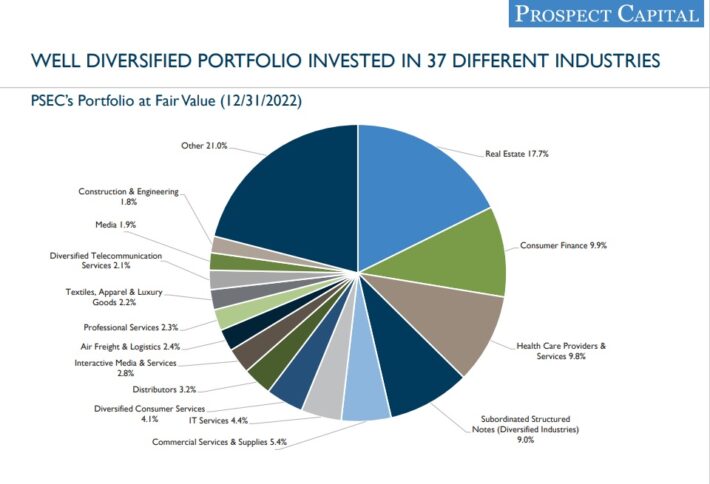

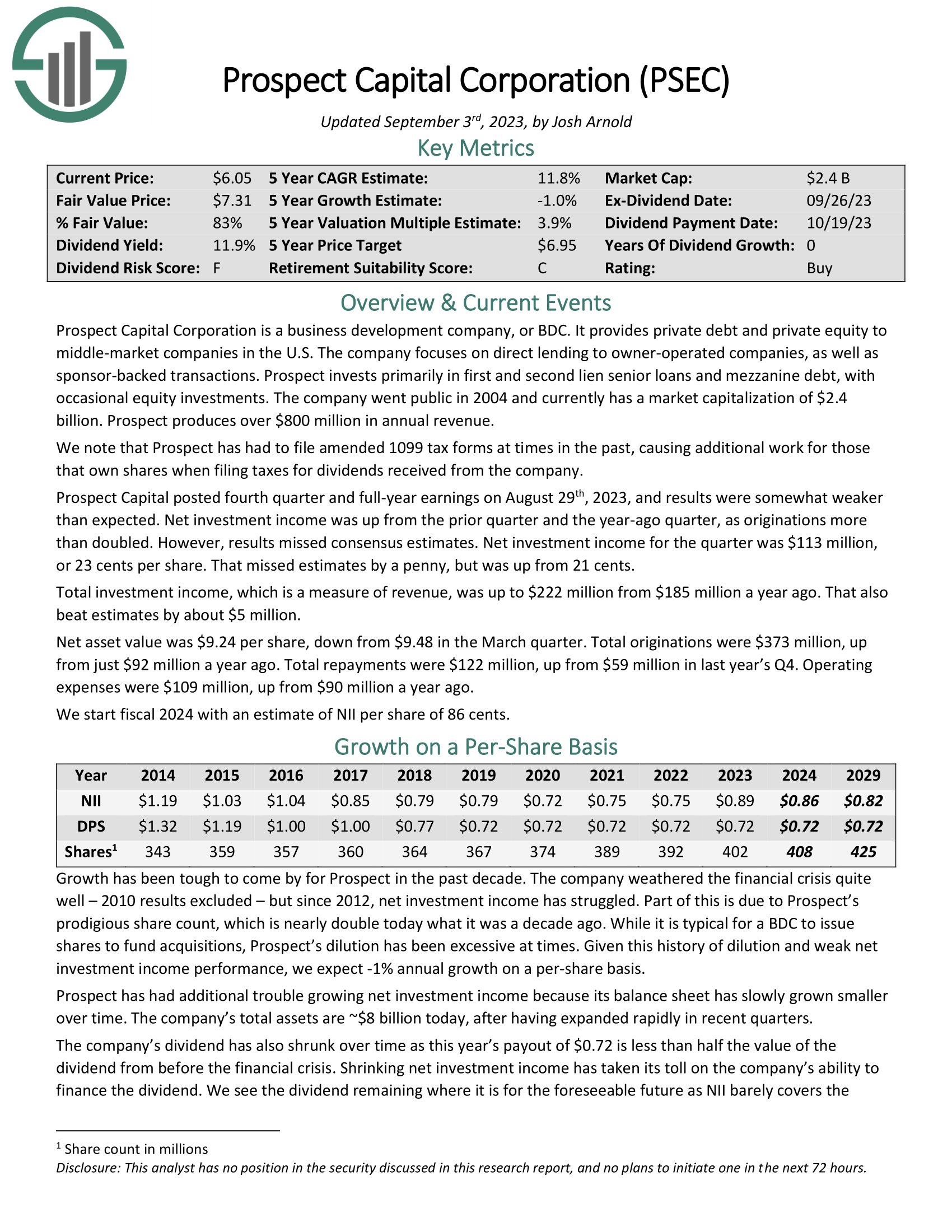

Prospect Capital (PSEC)

Value-to-book ratio: 0.63

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives personal debt and personal fairness to center–market firms within the U.S. The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect Capital posted fourth quarter and full-year earnings on August twenty ninth, 2023, and outcomes had been considerably weaker than anticipated. Web funding revenue was up from the prior quarter and the year-ago quarter, as originations greater than doubled. Nonetheless, outcomes missed consensus estimates. Web funding revenue for the quarter was $113 million, or 23 cents per share. That missed estimates by a penny, however was up from 21 cents.

Click on right here to obtain our most up-to-date Certain Evaluation report on PSEC (preview of web page 1 of three proven under):

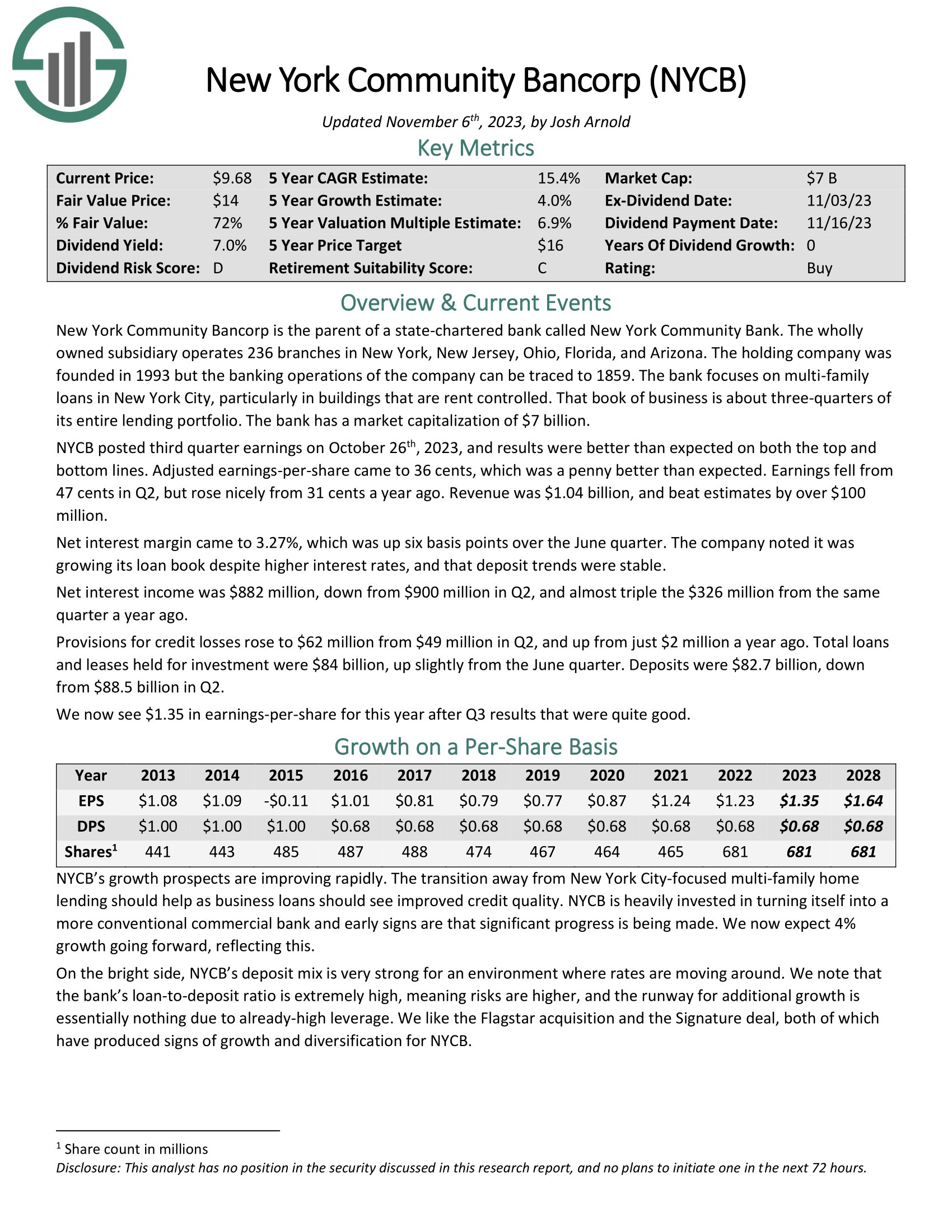

New York Group Bancorp (NYCB)

Value-to-book ratio: 0.63

New York Group Bancorp is the dad or mum of a state-chartered financial institution referred to as New York Group Financial institution. The wholly owned subsidiary operates 236 branches in New York, New Jersey, Ohio, Florida, and Arizona. The holding firm was based in 1993 however the banking operations of the corporate may be traced to 1859.

The financial institution focuses on multi-family loans in New York Metropolis, significantly in buildings which are lease managed. That ebook of enterprise is about three-quarters of its whole lending portfolio.

NYCB posted third quarter earnings on October twenty sixth, 2023, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 36 cents, which was a penny higher than anticipated. Earnings fell from 47 cents in Q2, however rose properly from 31 cents a yr in the past. Income was $1.04 billion, and beat estimates by over $100 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on NYCB (preview of web page 1 of three proven under):

NextEra Power Companions (NEP)

Value-to-book ratio: 0.63

NextEra Power Companions was fashioned in 2014 as Delaware Restricted Partnership by NextEra Power to personal, function, and purchase contracted clear power initiatives with steady, long-term money flows. The corporate’s technique is to capitalize on the power trade’s favorable tendencies in North America of fresh power initiatives changing uneconomic initiatives.

NextEra Power Companions operates 34 contracted renewable era property consisting of wind and photo voltaic initiatives in 12 states throughout the US. The corporate additionally operates contracted pure gasoline pipelines in Texas which accounts for a few fifth of NextEra Power Companions’ revenue.

On October 24, 2023, NextEra Power Companions launched its earnings report for the third quarter of 2023. The corporate reported quarterly earnings of $0.57 per share, surpassing the consensus estimate of $0.48 per share, however falling wanting the $0.93 per share reported a yr in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on NEP (preview of web page 1 of three proven under):

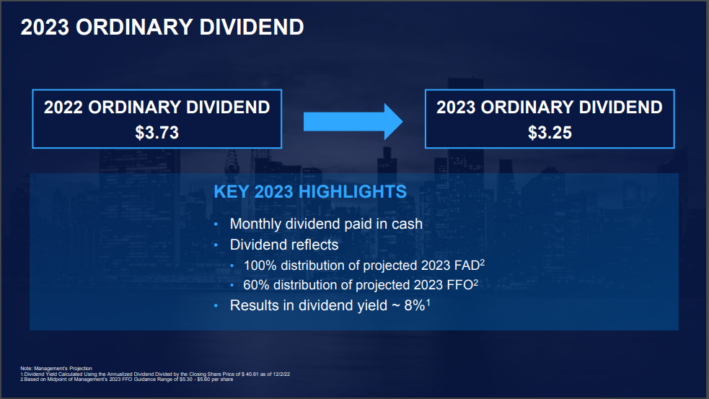

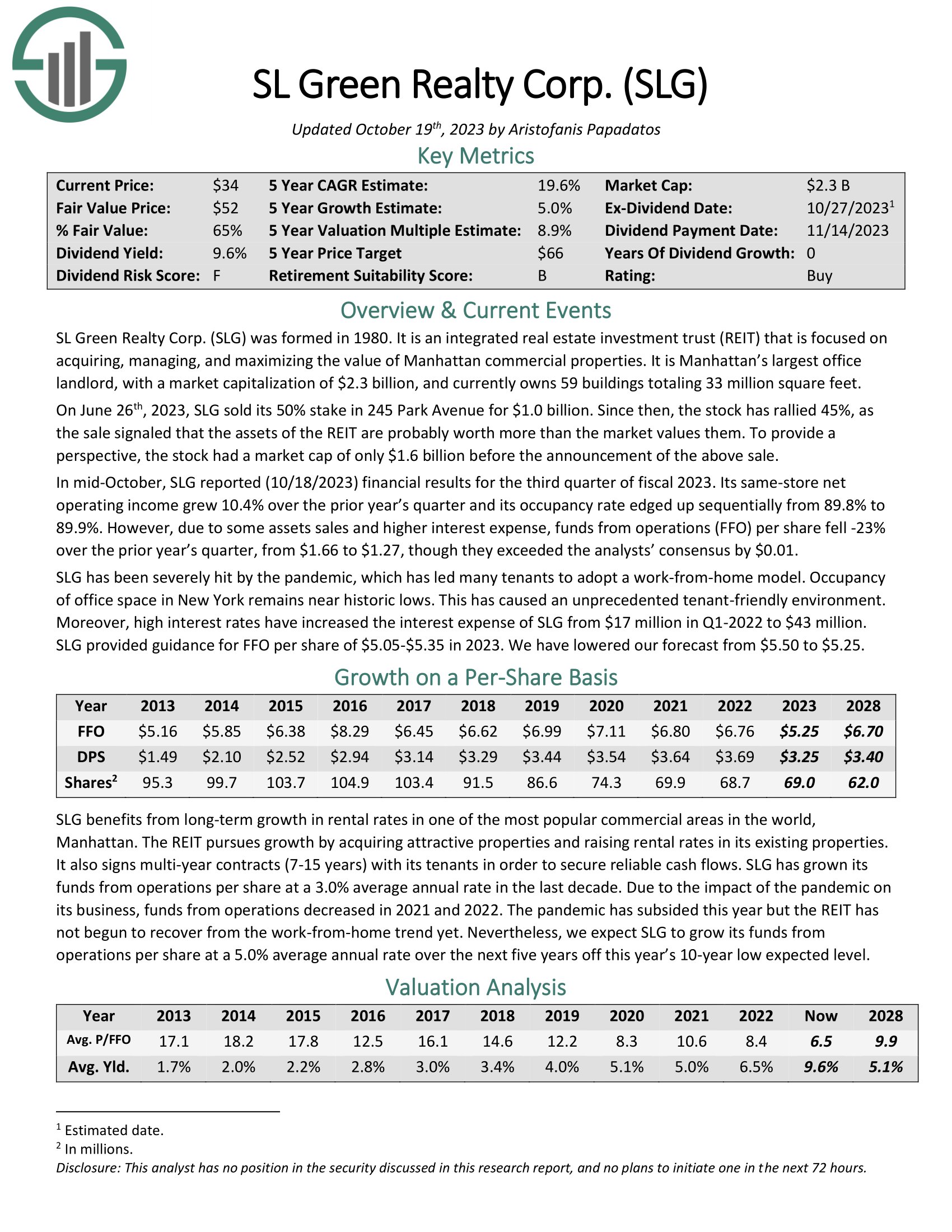

SL Inexperienced Realty (SLG)

Value-to-book ratio: 0.61

SL Inexperienced is a self-managed REIT that manages, acquires, develops, and leases New York Metropolis Metropolitan workplace properties. Actually, the belief is the biggest proprietor of workplace actual property in New York Metropolis, with the vast majority of its properties situated in midtown Manhattan. It’s Manhattan’s largest workplace landlord, with 60 buildings totaling about 33 million sq. ft.

Supply: Investor Presentation

In mid-October, SLG reported (10/18/2023) monetary outcomes for the third quarter of fiscal 2023. Its same-store web working revenue grew 10.4% over the prior yr’s quarter and its occupancy price edged up sequentially from 89.8% to 89.9%. Nonetheless, attributable to some property gross sales and better curiosity expense, funds from operations (FFO) per share fell -23% over the prior yr’s quarter, from $1.66 to $1.27, although they exceeded the analysts’ consensus by $0.01.

Click on right here to obtain our most up-to-date Certain Evaluation report on SL Inexperienced Realty Corp. (SLG) (preview of web page 1 of three proven under):

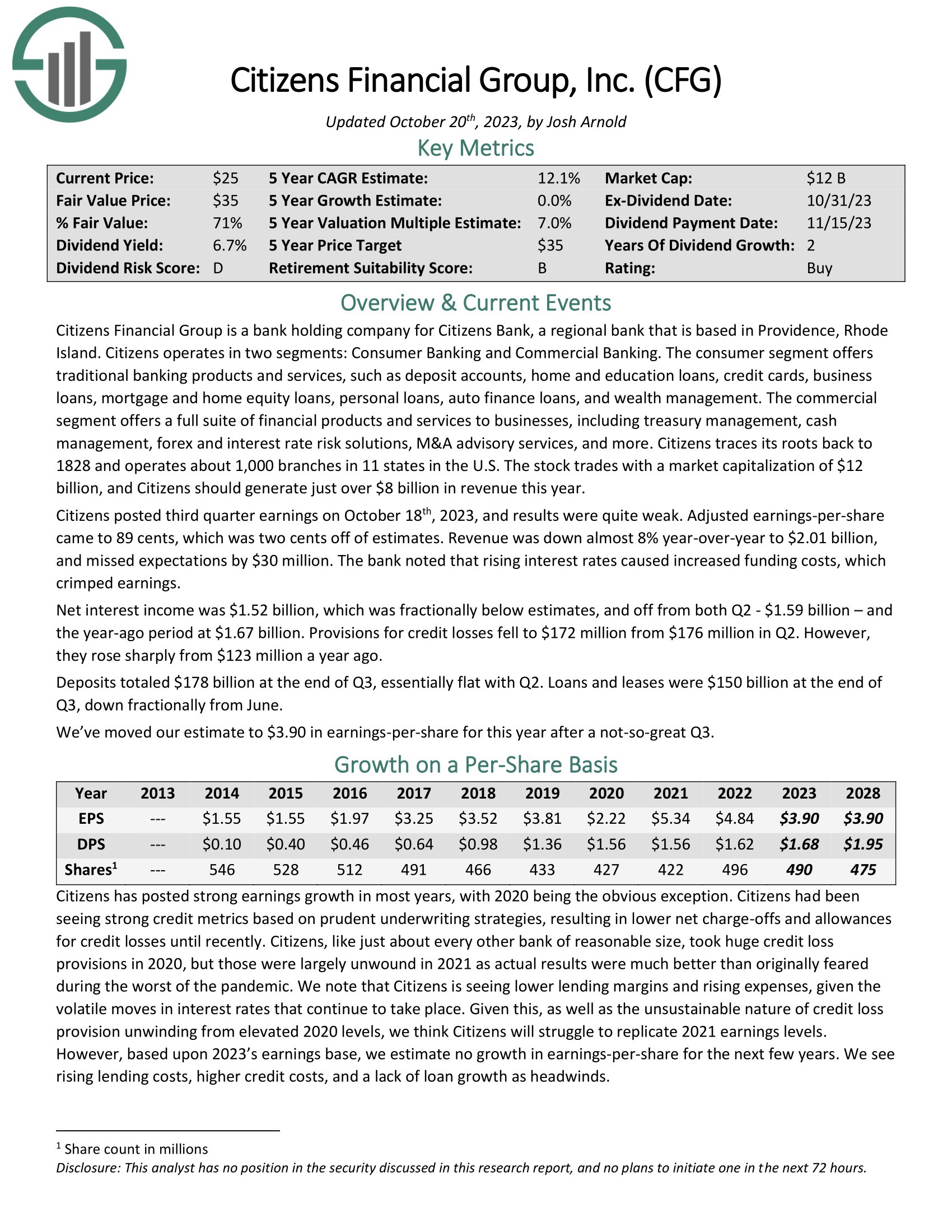

Residents Monetary Group (CFG)

Value-to-book ratio: 0.60

Residents Monetary Group is a financial institution holding firm for Residents Financial institution, a regional financial institution that’s primarily based in Windfall, Rhode Island. Residents operates in two segments: Client Banking and Business Banking. The buyer section affords conventional banking services and products, corresponding to deposit accounts, house and schooling loans, bank cards, enterprise loans, mortgage and residential fairness loans, private loans, auto finance loans, and wealth administration.

The industrial section affords a full suite of economic services and products to companies, together with treasury administration, money administration, foreign exchange and rate of interest threat options, M&A advisory companies, and extra. Residents traces its roots again to 1828 and operates about 1,000 branches in 11 states within the U.S.

Residents posted third quarter earnings on October 18th, 2023, and outcomes had been fairly weak. Adjusted earnings-per sharecame to 89 cents, which was two cents off of estimates. Income was down virtually 8% year-over-year to $2.01 billion, and missed expectations by $30 million. The financial institution famous that rising rates of interest precipitated elevated funding prices, which crimped earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on CFG (preview of web page 1 of three proven under):

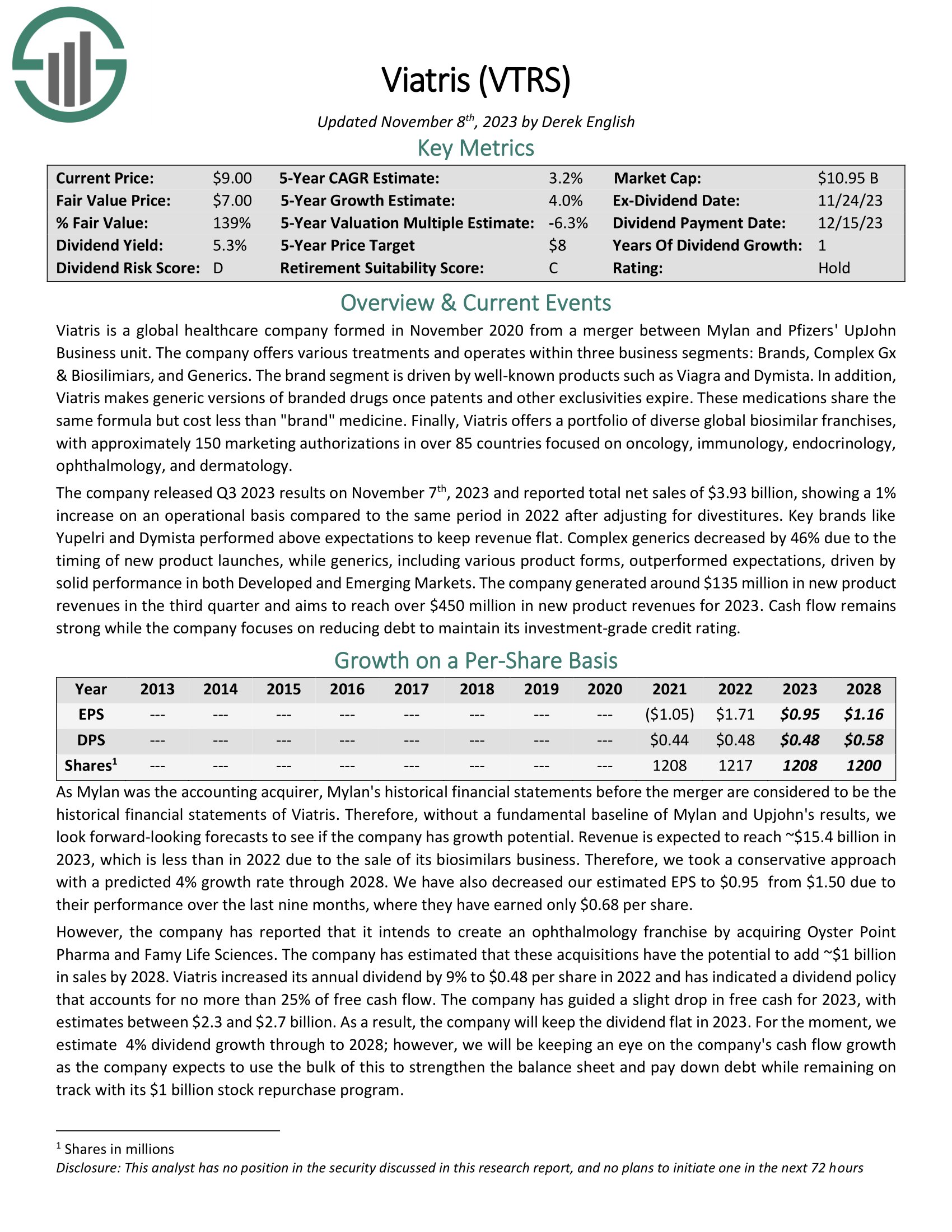

Viatris (VTRS)

Value-to-book ratio: 0.55

Viatris is a world healthcare firm fashioned in November 2020 from a merger between Mylan and Pfizers’ UpJohn Enterprise unit. The corporate affords varied remedies and operates inside three enterprise segments: Manufacturers, Advanced Gx & Biosilimiars, and Generics.

The model section is pushed by well-known merchandise corresponding to Viagra and Dymista. As well as, Viatris makes generic variations of branded medicine as soon as patents and different exclusivities expire. These drugs share the identical method however price lower than “model” drugs.

Lastly, Viatris affords a portfolio of various world biosimilar franchises, with roughly 150 advertising authorizations in over 85 nations targeted on oncology, immunology, endocrinology, ophthalmology, and dermatology.

The corporate launched Q3 2023 outcomes on November seventh, 2023 and reported whole web gross sales of $3.93 billion, displaying a 1% enhance on an operational foundation in comparison with the identical interval in 2022 after adjusting for divestitures. Key manufacturers like Yupelri and Dymista carried out above expectations to maintain income flat.

Click on right here to obtain our most up-to-date Certain Evaluation report on VTRS (preview of web page 1 of three proven under):

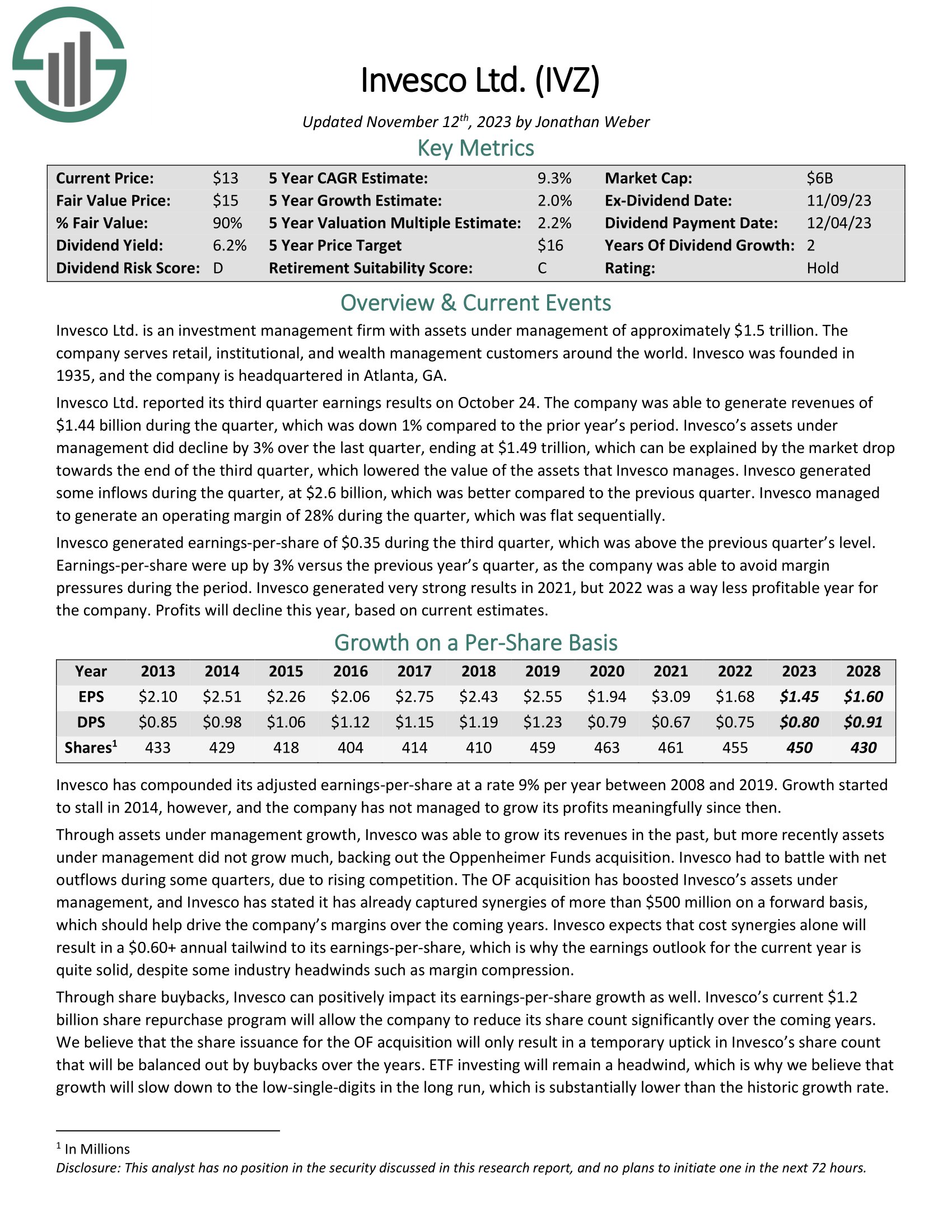

Invesco Ltd. (IVZ)

Value-to-book ratio: 0.55

Our subsequent inventory is Invesco, a publicly-owned funding supervisor. The corporate gives funding services and products to establishments, people, funds, and pension funds. Invesco affords all kinds of shares, bonds, and associated funds for patrons to select from.

Invesco Ltd. reported its third quarter earnings outcomes on October 24. The corporate was capable of generate revenues of $1.44 billion throughout the quarter, which was down 1% in comparison with the prior yr’s interval. Invesco’s property beneath administration did decline by 3% during the last quarter, ending at $1.49 trillion, which may be defined by the market drop in direction of the top of the third quarter, which lowered the worth of the property that Invesco manages.

Invesco generated inflows throughout the quarter, at $2.6 billion, which was higher in comparison with the earlier quarter. Invesco managed to generate an working margin of 28% throughout the quarter, which was flat sequentially.

Invesco generated earnings-per-share of $0.35 throughout the third quarter, which was above the earlier quarter’s stage. Earnings-per-share had been up by 3% versus the earlier yr’s quarter, as the corporate was capable of keep away from marginpressures throughout the interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on Invesco Ltd. (preview of web page 1 of three proven under):

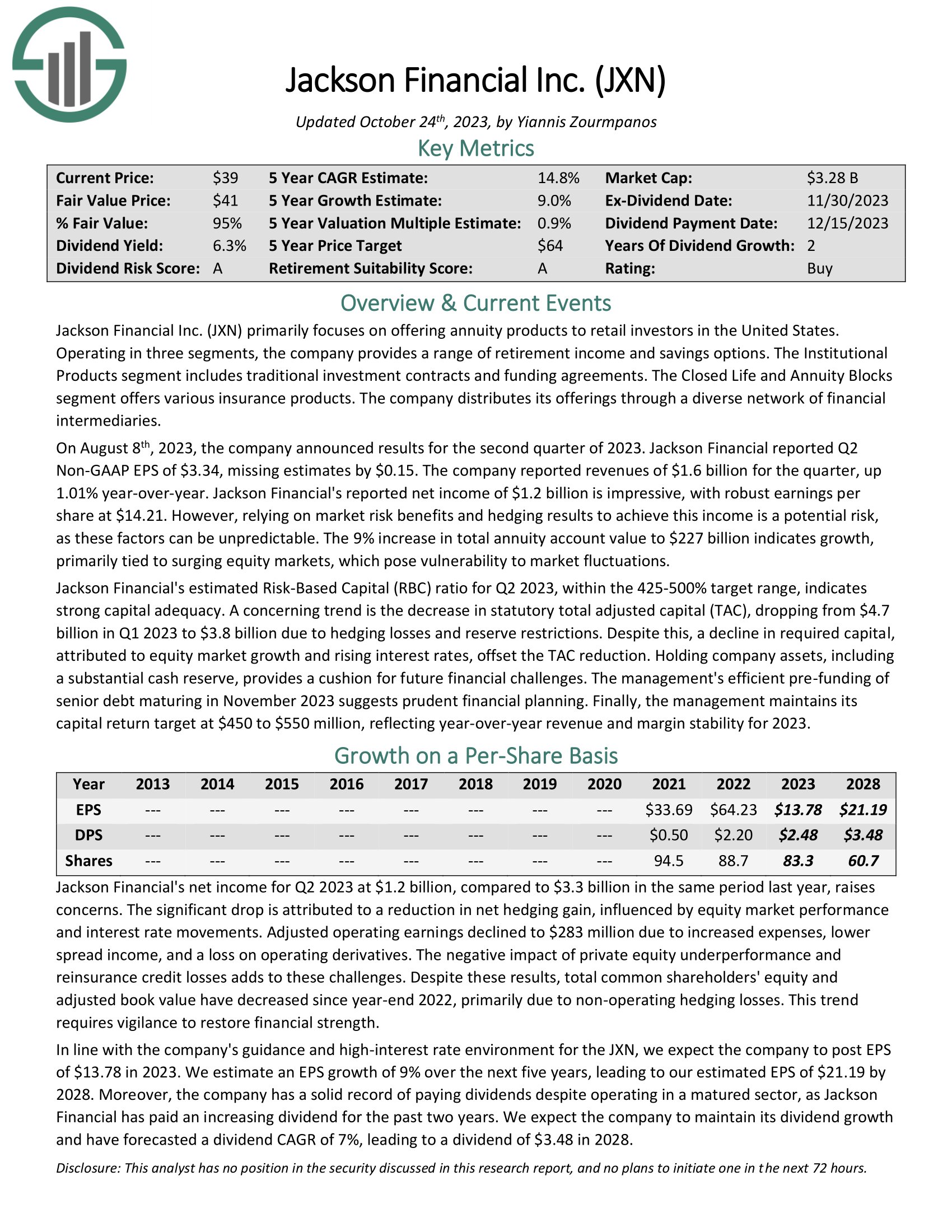

Jackson Monetary (JXN)

Value-to-book ratio: 0.42

Jackson Monetary Inc. primarily focuses on providing annuity merchandise to retail buyers in the US. Working in three segments, the corporate gives a variety of retirement revenue and financial savings choices. The Institutional Merchandise section contains conventional funding contracts and funding agreements. The Closed Life and Annuity Blocks section affords varied insurance coverage merchandise. The corporate distributes its choices by a various community of economic intermediaries.

On August eighth, 2023, the corporate introduced outcomes for the second quarter of 2023. Jackson Monetary reported Q2 Non-GAAP EPS of $3.34, lacking estimates by $0.15. The corporate reported revenues of $1.6 billion for the quarter, up 1.01% year-over-year. Jackson Monetary’s reported web revenue of $1.2 billion is spectacular, with strong earnings per share at $14.21. The 9% enhance in whole annuity account worth to $227 billion signifies development, primarily tied to surging fairness markets, which pose vulnerability to market fluctuations.

Click on right here to obtain our most up-to-date Certain Evaluation report on JXN (preview of web page 1 of three proven under):

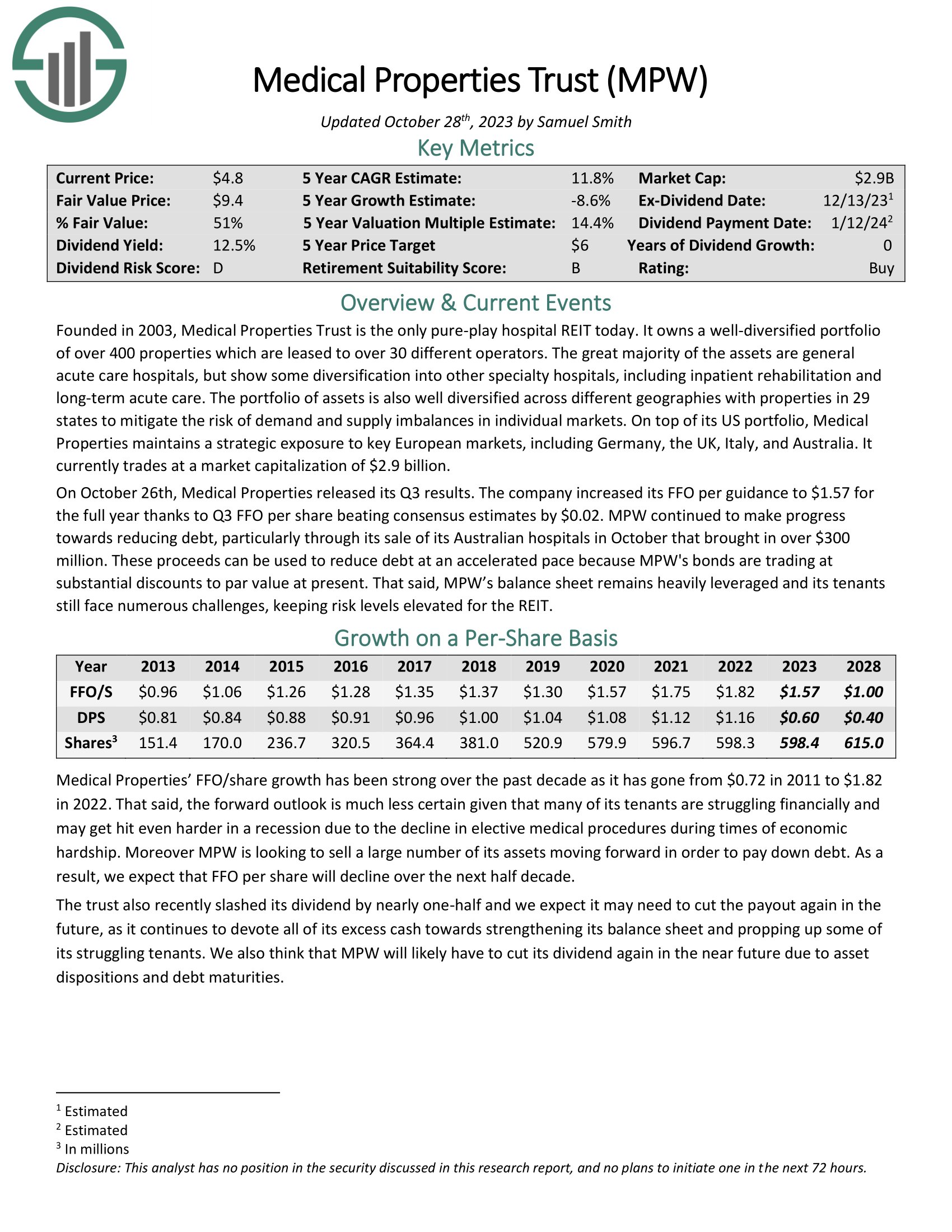

Medical Properties Belief (MPW)

Value-to-book ratio: 0.34

Medical Properties Belief is the one pure-play hospital REIT right this moment. It owns a well-diversified portfolio of over 400 properties that are leased to over 30 completely different operators. The nice majority of the property are normal acute care hospitals, however present some diversification into different specialty hospitals, together with inpatient rehabilitation and long-term acute care.

The portfolio of property can also be nicely diversified throughout completely different geographies with properties in 29 states to mitigate the danger of demand and provide imbalances in particular person markets. On prime of its US portfolio, Medical Properties maintains a strategic publicity to key European markets, together with Germany, the UK, Italy, and Australia.

On October twenty sixth, Medical Properties launched its Q3 outcomes. The corporate elevated its FFO per steerage to $1.57 for the complete yr due to Q3 FFO per share beating consensus estimates by $0.02. MPW continued to make progress in direction of decreasing debt, significantly by its sale of its Australian hospitals in October that introduced in over $300 million.

These proceeds can be utilized to cut back debt at an accelerated tempo as a result of MPW’s bonds are buying and selling at substantial reductions to par worth at current. That mentioned, MPW’s stability sheet stays closely leveraged and its tenants nonetheless face quite a few challenges, holding threat ranges elevated for the REIT.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPW (preview of web page 1 of three proven under):

Ultimate Ideas

Whereas there may be all kinds of how to worth shares, a technique we like is to think about the corporate’s market worth towards its ebook worth. This helps guard towards overpaying for costly shares, and above, we famous ten shares we like beneath ebook worth right this moment that additionally pay robust dividends.

Every has its distinctive mixture of worth, dividend yield, and development; most are buy-rated primarily based on whole return potential.

If you’re thinking about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link