[ad_1]

Elen11

Introduction

I’ve to confess that I wasn’t planning on writing this text. Not solely have we talked so much about protection firms in 2023, however my most up-to-date article wasn’t that way back.

On November 19, I wrote an article titled With Vital Potential, L3Harris Stays My Favourite Deep Worth Dividend Inventory.

Since then, L3Harris Applied sciences, Inc. (NYSE:LHX) shares are up 13%, beating the S&P 500 by roughly 800 foundation factors. Shares are up virtually 25% since my summer time article after I wrote that LHX has greater than 50% room to run.

Having stated that, I am not writing this text to rejoice the latest surge. In spite of everything, a few of my prior calls at the moment are breakeven. It is nonetheless not a efficiency to jot down house about.

The explanation I am writing this text is as a result of now we have so much to debate.

Since my most up-to-date article, L3Harris Applied sciences has held its 2023 Investor Day, it has acquired upgrades and offered us with a longer-term outlook.

On prime of that, the corporate checks all marks relating to the factors I take advantage of when choosing shares for 2024 and past.

Within the 2024 outlook I wrote with In search of Alpha, I stated I am searching for three key factors:

Security- I need firms with sturdy steadiness sheets to resist intervals of extended elevated charges and inflation. High quality- I need firms with the flexibility to develop over time, ideally with secular development tailwinds. Deep value- In mild of elevated inventory market valuations, odds are we may encounter general subdued returns within the years forward (see the chart under). Therefore, I need firms which can be very attractively valued to supply me with a shot at outperforming the market.

With all of this stated, let’s dive into the small print, as now we have a lot to debate!

L3Harris Has Super Progress Potential

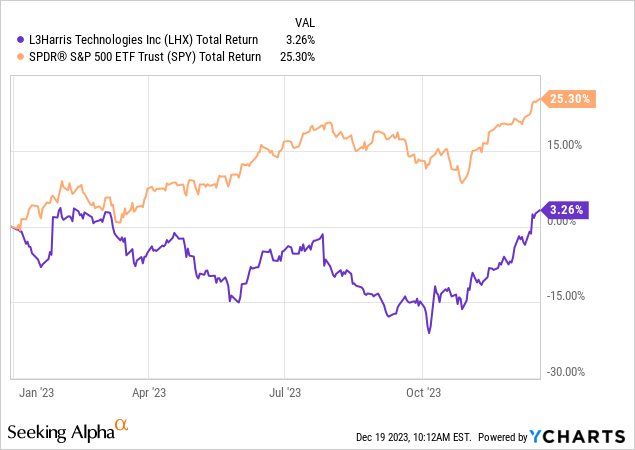

Regardless of the returns I simply listed, LHX shares are up simply 3% year-to-date, together with dividends, underperforming the S&P 500 by greater than 20 factors.

This yr, LHX suffered from investor mistrust. In mild of elevated charges and finances uncertainties, buyers did not look after this protection contractor, which closed the large acquisition of Aerojet Rocketdyne.

Whereas LHX is likely one of the the reason why my portfolio has didn’t outperform the market this yr, I couldn’t be happier with the shopping for alternatives this inventory offered for us (it is nonetheless enticing).

I’ve been aggressively shopping for L3Harris for my portfolio and the portfolios of my household, making it one in all our greatest long-term investments.

The reason being fairly easy: L3Harris has the whole lot we’re searching for in a long-term funding.

It has an anti-cyclical enterprise mannequin, primarily counting on home and worldwide authorities contracts. It’s a main provider of all main protection contractors, which lowers competitors dangers. It’s a dividend development inventory with an incredible observe report. It’s on the forefront of protection innovation. It has a wholesome steadiness sheet. It makes use of extra free money move to purchase again inventory, enhancing shareholder worth. It’s attractively valued.

With all of this in thoughts, the corporate’s latest Investor Day was very fascinating, because it was the primary Investor Day that included the “fashionable” L3Harris after the Aerojet deal.

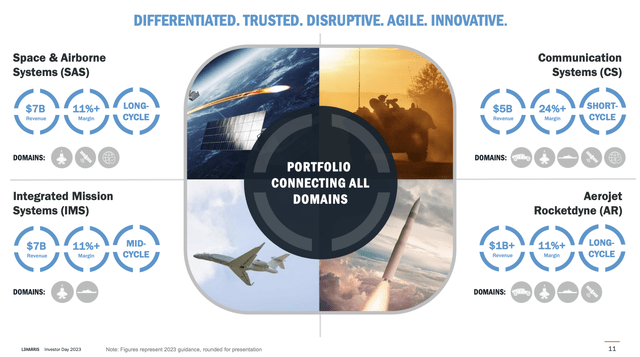

As we are able to see under, L3Harris at the moment operates in all 5 domains, emphasizing a industrial enterprise mannequin that yields increased margins in 4 key areas:

Area & Airborne Methods (“SAS”). Built-in Mission Methods (“IMS”). Communication Methods (“CS”). Aerojet Rocketdyne (“AR”).

Every of those companies generates greater than $1 billion in income. Simply one in all these companies is a short-cycle enterprise.

L3Harris Applied sciences

Unsurprisingly, L3Harris is all about innovation. That is the primary cause why I really like protection firms. I’m not rooting for conflict, however I am betting on the necessity for superior applied sciences to maintain us secure.

On the whole, I might make the case that peace is extra bullish for LHX than conflict.

Throughout peace, protection firms aren’t rushed to provide, authorities involvement is much less seemingly, and potential weaknesses in provide chains stay hidden.

Basically, *if* protection firms needed to “rip off” the federal government, doing it throughout peacetime could be a lot simpler.

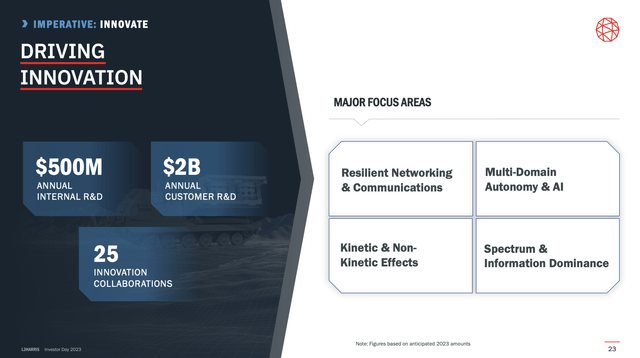

With that stated, L3Harris has been actively pursuing analysis and improvement (“R&D”), with a notable improve in customer-funded R&D contracts.

Whereas this will likely affect short-term margins, the emphasis is on positioning the corporate for long-term energy and innovation. The objective is to bridge the $2.5 billion R&D hole and develop capabilities for future challenges.

L3Harris Applied sciences

The corporate can also be altering its Board of Administrators to replicate numerous experiences from industrial entities, authorities, mid-tier firms, and primes, with trade veterans like Invoice Swanson and Kirk Hachigian becoming a member of.

Invoice Swanson, for instance, is the previous CEO of the Raytheon Firm, now a part of the RTX Company (RTX).

That is additionally a part of a enterprise assessment with hedge fund D.E. Shaw, as reported by In search of Alpha.

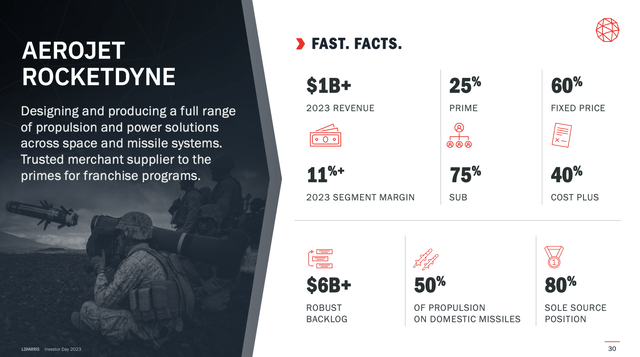

As I already talked about, the acquisition of Aerojet Rocketdyne was (and nonetheless is) a serious deal, because it provides a complete new layer of capabilities to L3Harris.

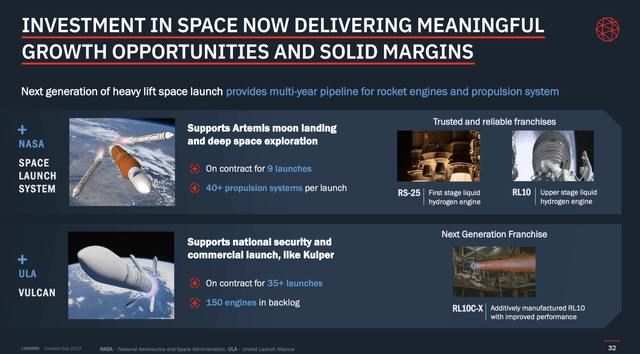

Throughout its Investor Day, the corporate made clear that Aerojet’s involvement in house propulsion and missile applied sciences is pivotal for L3Harris’ technique.

The house enterprise, constituting about one-third of Aerojet Rocketdyne’s income, is marked by stability, strong backlog, and elevated margins.

L3Harris Applied sciences

Vital franchises, akin to NASA’s house launch system and United Launch Alliance’s Vulcan Rocket, contribute to this stability.

Furthermore, the corporate’s forward-thinking strategy is obvious within the modernization efforts, akin to upgrading the RL10 engine utilizing additive manufacturing to reinforce effectivity and scale back prices.

L3Harris Applied sciences

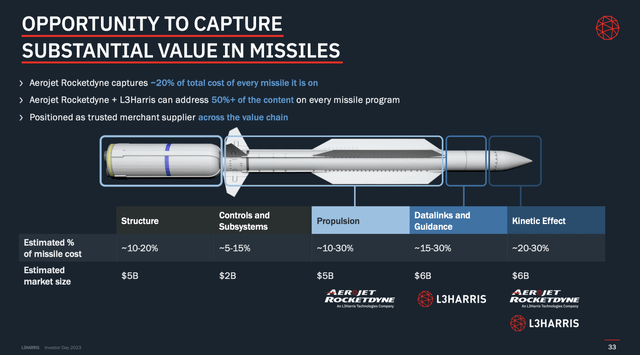

Within the missile enterprise, Aerojet Rocketdyne’s function in offering propulsion and kinetic results (warheads) positions it uniquely available in the market.

The corporate highlighted that Aerojet Rocketdyne’s elements account for about 20% of the price of any given missile, and, when mixed with L3Harris’ capabilities, the businesses have entry to over 50% of the overall missile price.

Take into consideration that for a second.

Basically, this built-in strategy helps L3Harris’ imaginative and prescient to be a one-stop store for all points of missile improvement.

L3Harris Applied sciences

Furthermore:

The corporate has merchandise in additional than 75% of all home missiles at the moment fielded! It has provided each single surface-to-surface and air-to-air missile. Half of all air-to-surface and strategic deterrence missiles have LHX elements. 80% of all surface-to-air rockets have elements from LHX.

Sadly, Aerojet has struggled with some provide points itself.

L3Harris has addressed this by spending more cash.

For the reason that acquisition, R&D spending has elevated fourfold, and capital funding has doubled, exhibiting a dedication to supporting innovation and manufacturing efficiencies, that are key to rising margins on a long-term foundation.

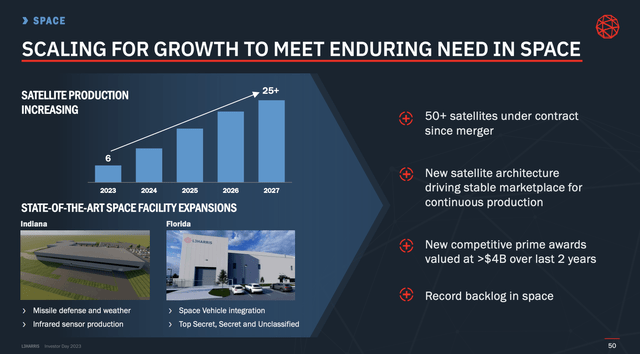

The identical applies to its house enterprise, which the corporate is trying to develop.

With that stated, If there’s one factor I can’t cease speaking about, it is the alternatives that include the fast-growing house trade.

To learn from this, L3Harris is actively scaling its house enterprise to construct a dependable market for steady satellite tv for pc and sensor manufacturing.

The transition from a bespoke mannequin to a steady move mannequin displays an adaptive strategy to trade developments, whereas investments in amenities in Fort Wayne, Indiana, and Palm Bay, Florida, underscore the dedication to increasing manufacturing capabilities.

With a brand new constructing in Fort Wayne, L3Harris is gearing as much as produce one infrared sensor per week, marking a considerable improve in effectivity and output.

L3Harris Applied sciences

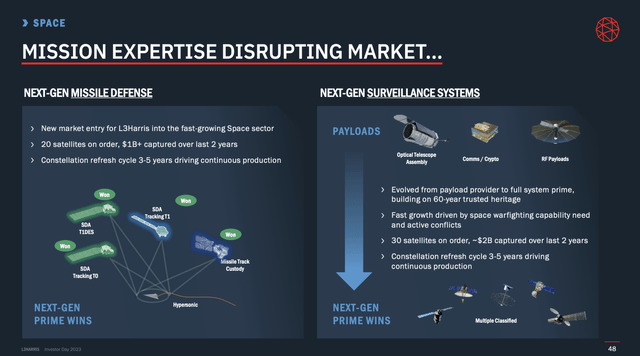

In the meantime, the corporate’s involvement in next-generation architectures, particularly in missile warning, missile protection, and categorised surveillance, aligns with the evolving wants of the protection and intelligence communities.

By profitable prime contracts and securing a report backlog, L3Harris is establishing itself as a key participant in shaping the way forward for space-based options.

L3Harris Applied sciences

However wait, there’s extra!

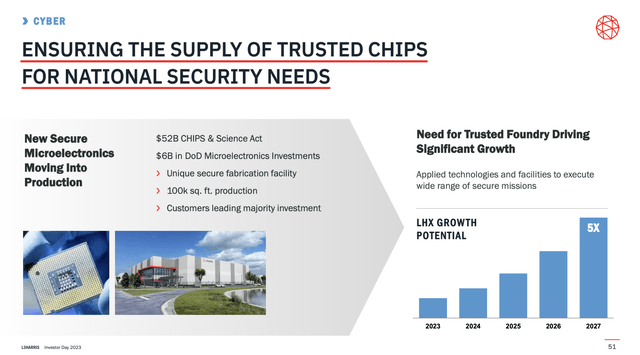

I imagine the transfer into trusted microelectronics is fascinating.

The corporate is recognizing the important significance of a safe and dependable supply of high-performance electronics, particularly in occasions of potential provide chain disruptions.

With over $600 million in backlog and plans for a state-of-the-art semiconductor manufacturing facility in Palm Bay, L3Harris is on the forefront of offering options for the protection sector’s digital wants.

L3Harris Applied sciences

In the meantime, within the cyber area, the deal with getting into the trusted microelectronics market provides a layer of resilience and flexibility to rising cyber threats.

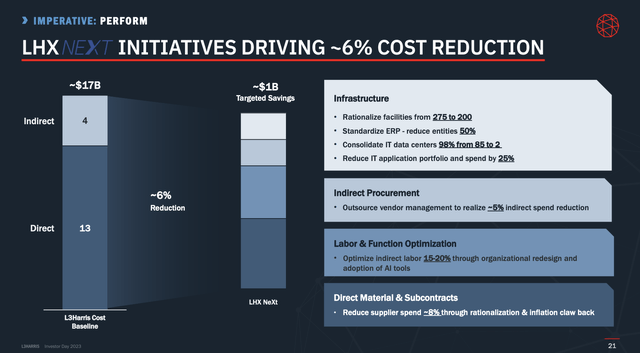

On prime of that, the corporate is chopping prices, because it has introduced the E3 initiative, concentrating on $500 million yearly for price takeout to offset headwinds. The brand new LHX NeXt initiative, an enterprise-wide effort, goals for a $1 billion run fee in three years, contributing to margin enchancment.

L3Harris Applied sciences

Key areas embody direct and oblique spend optimization, workforce and labor restructuring, and leveraging AI and automation for operational effectivity.

The Lengthy-Time period Outlook

An important a part of its 2023 Investor Day was its longer-term outlook.

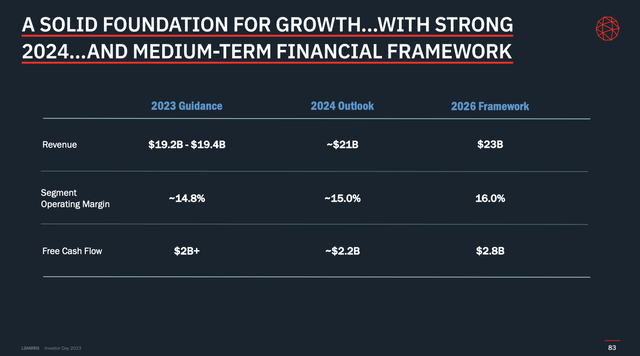

L3Harris outlined a compelling longer-term outlook, specializing in key monetary metrics and strategic initiatives by means of 2026.

The corporate’s imaginative and prescient contains reaching $23 billion in top-line income, a good portion of which is predicted to be pushed by natural development, as the corporate made the case that it’s seemingly performed with M&A in the intervening time.

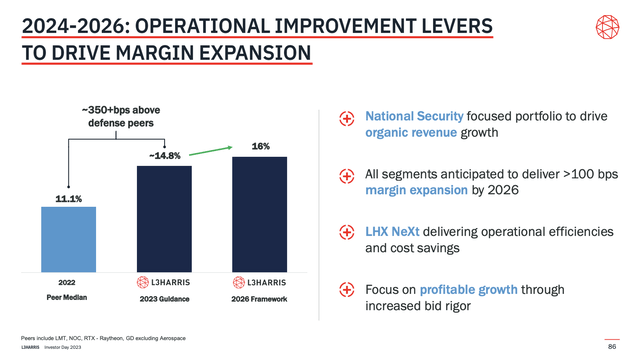

Moreover, the dedication to reaching at the very least 16% margins by 2026 demonstrates a robust emphasis on operational effectivity and profitability, which may increase free money move to virtually $3 billion in 2026.

It might be a rise of roughly 40% to 50% in comparison with 2023 expectations and indicate a free money move yield of 7-8%, which is a unbelievable quantity, because it opens up a lot room for shareholder distributions.

L3Harris Applied sciences

The roadmap for reaching these monetary milestones contains the execution of the aforementioned LHX NeXt program, concentrating on $3 billion in gross financial savings by the tip of 2026.

This program is positioned as a key driver for margin growth and operational excellence, whereas the emphasis on program execution, higher contract negotiations, and threat mitigation showcases the corporate’s dedication to bettering general effectivity and profitability in an surroundings that has seen a whole lot of cost-related headwinds for the reason that pandemic.

L3Harris Applied sciences

The longer-term outlook is complemented by a strong backlog of $32 billion, offering visibility and confidence in assembly the outlined monetary commitments.

So, what does this imply for shareholders?

The place’s The Shareholder Worth?

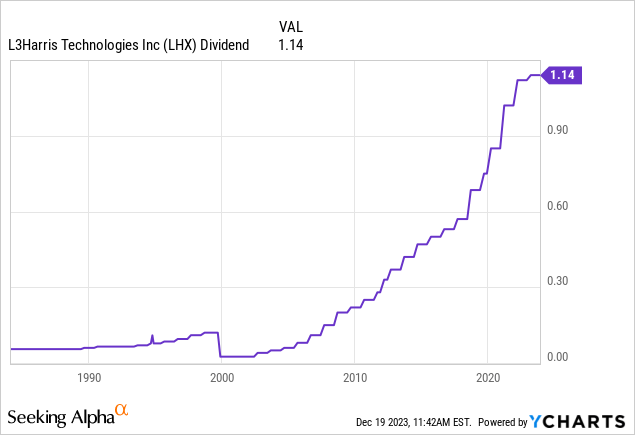

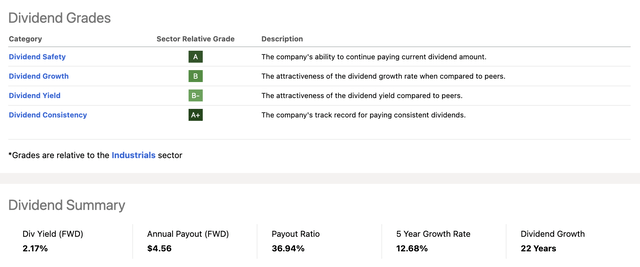

Even earlier than the 2019 merger between L3 and Harris, buyers in L3 benefited from an extended historical past of constant dividend development.

The corporate has 22 consecutive years of dividend hikes.

Presently, LHX pays $1.14 per share per quarter. This interprets to a yield of two.2%.

This yield is protected by a sub-40% payout ratio. The five-year dividend CAGR is 12.7%.

Because of this, it has among the best dividend scorecards in its sector.

In search of Alpha

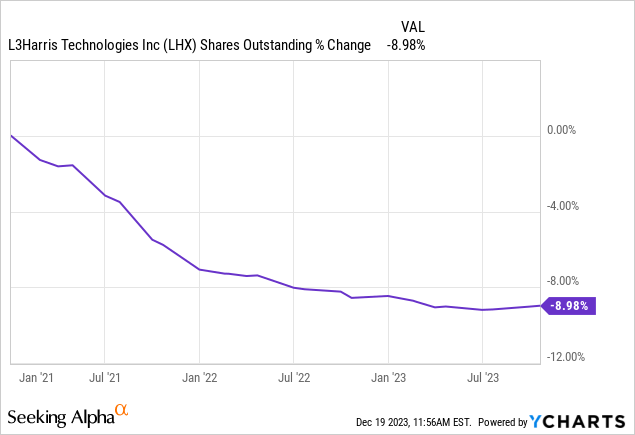

The corporate can also be an enormous fan of shopping for again inventory.

Over the previous three years alone, L3Harris has purchased again 9% of its shares. Most of it occurred shortly after the 2019 merger when the corporate used the proceeds from divestitures to purchase again inventory.

With that stated, the charts above clearly present that buybacks and dividend development have slowed.

That is as a result of firm’s deal with post-merger debt discount.

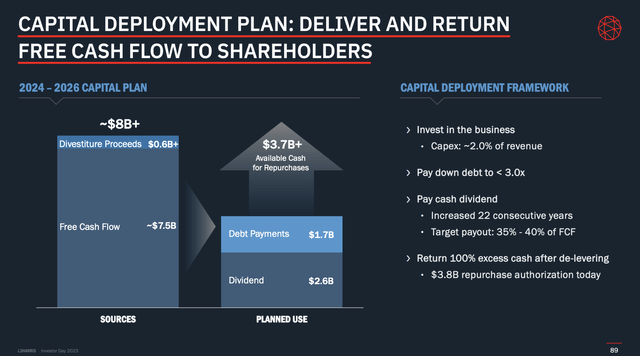

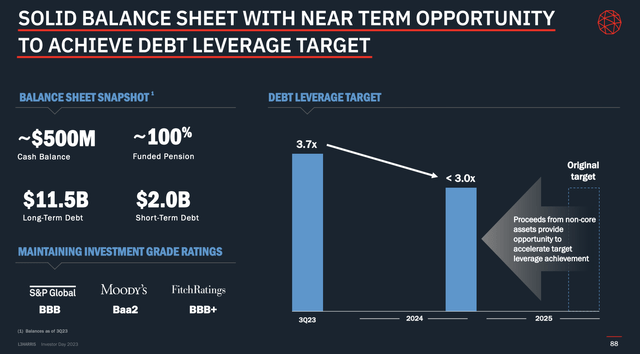

Presently, a good portion of the free money move is earmarked for debt discount. Attaining a debt-to-EBITDA ratio of three.0x or decrease is a precedence, making certain a wholesome steadiness sheet.

As soon as it has achieved this goal, it plans to distribute each penny of extra money to shareholders!

L3Harris Applied sciences

The corporate, which at the moment has an investment-grade BBB credit standing, is predicted to realize this goal subsequent yr.

L3Harris Applied sciences

As beforehand talked about, the corporate is on a path to generate a +7% free money move yield in 2026. Because of this subsequent yr (or early 2025), it might begin to aggressively hike its dividend once more and purchase again inventory, which may end in large shareholder worth on a protracted foundation.

This additionally makes for a gorgeous valuation.

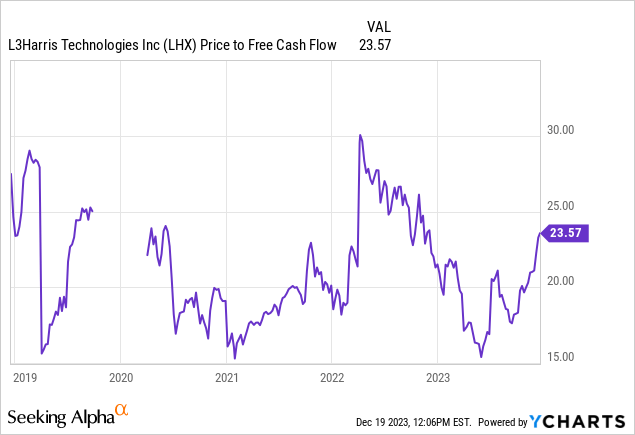

Over the previous few years, LHX has traded near 22x free money move, which I imagine is a good valuation.

Ignoring buybacks and different advantages, $2.8 billion in 2026 free money move would point out a good market cap of $62 billion ($2.8×22), which is roughly 50% above the present worth.

This is able to indicate roughly 14% returns per yr by means of 2026, excluding dividends, buybacks, and debt discount.

This return is backed by the worth/earnings a number of forecast.

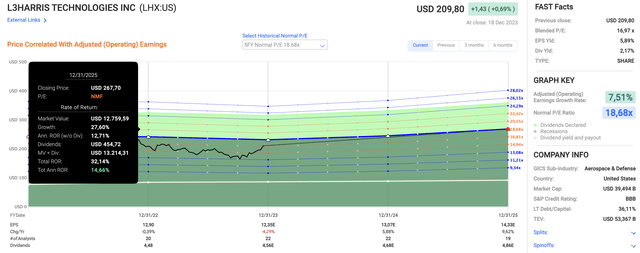

Utilizing the information within the chart under:

LHX is buying and selling at a blended P/E ratio of 17.0x. Its normalized valuation is eighteen.7x. This yr, EPS is predicted to contract by 4%, adopted by 6% development in 2024 and 10% development in 2025. An 18.6x a number of and anticipated development charges counsel between 14% and 15% in annual complete return potential.

FAST Graphs

On December 15, the corporate received an improve from Deutsche Financial institution, which upgraded the worth goal from $184 to $240.

That is 14% above the present worth.

All issues thought of, LHX stays a favourite of mine.

If I may purchase only one inventory going into 2024, it will be L3Harris.

Takeaway

Regardless of latest market fluctuations, L3Harris’ distinctive strengths place it as a compelling alternative for long-term buyers.

From its anti-cyclical enterprise mannequin to a dedication to innovation, L3Harris ticks all of the packing containers.

The latest Aerojet Rocketdyne acquisition has not solely broadened capabilities but in addition opened doorways to profitable alternatives within the house trade.

With a transparent imaginative and prescient outlined in its 2023 Investor Day, together with a strong roadmap and shareholder-friendly initiatives, L3Harris seems poised for sustained development.

The longer term seems promising with a transparent imaginative and prescient, doubtlessly reaching $23 billion in income and 16% margins by 2026.

Shareholders can anticipate not simply dividends however substantial worth as LHX navigates a path of sustained development and profitability.

[ad_2]

Source link