[ad_1]

DoraZett

Foreword

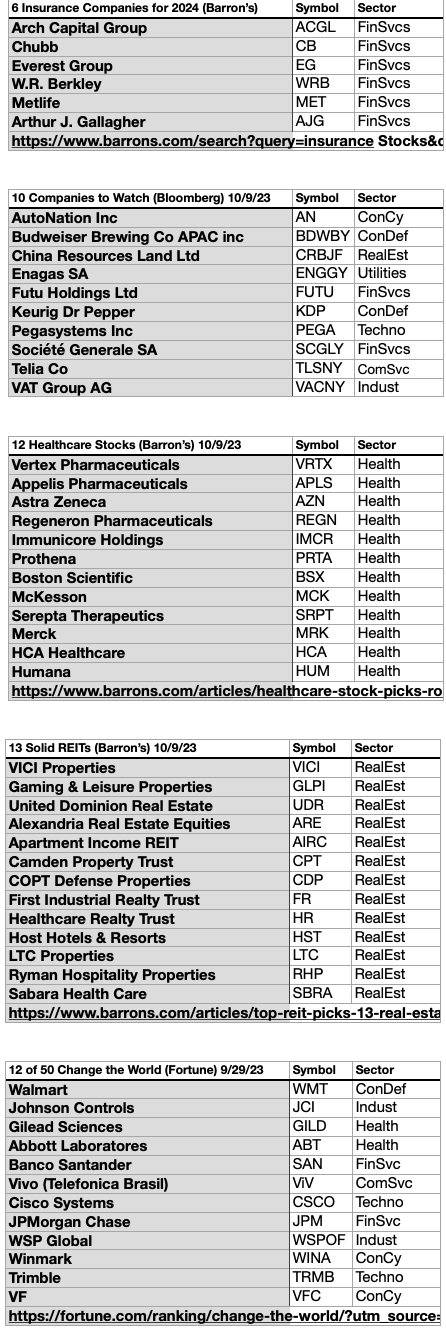

This text relies on 5 Barron’s, Bloomberg Enterprise-Week, and Fortune articles, geared toward discovering “Pre-Crash Restoration,” shares for 2023. The title and hyperlinks to the articles observe:

The Fortune Change the World listing

is rooted in the assumption that corporations can mobilize the inventive instruments of capitalism to assist clear up social issues—utilizing the revenue motive to realize objectives which are simply as essential as turning a revenue, and generally extra so. The 2023 listing, Fortune’s ninth, showcases 59 corporations chosen by reporters and editors from a brief listing of practically 250. A dozen from the 53 have been chosen by the writer at random for this put up.

REITs Have Room to Rebound.

By

Jack Hough, in Barron’s

Oct 06, 2023.

Rising charges have roughed up REITs. An MSCI index of U.S. ones has fallen 7% this yr, not counting dividends, versus an 11% rise for the S&P 500. Is it time to sound the rally horn or the warning kazoo?

Possibly each. Funding financial institution Wedbush says the group seems low cost and poised to shine subsequent yr and past, regardless of dangers.

12 Inventory Picks From Barron’s Healthcare Roundtable Professionals.

By Lauren R. Rublin in Barron’s

Up to date October 7, 2023.

4 panelists on Barron’s 2023 healthcare roundtable noticed engaging alternatives not solely in pharma, biotech, hospital, and medical-device shares that Wall Avenue has crushed down or ignored. Scientific breakthroughs, deal making, and a nimble response to regulation might brighten the business’s monetary prospects within the years forward, these consultants say, and reignite investor curiosity in one of many U.S. financial system’s most essential enterprise drivers.

Insurance coverage Shares Are on a Roll. 6 Picks for the Rally.

Insurers have been hit by a one-two punch of pure disasters and lackluster monetary markets. However there’s a silver lining: the income and surpluses that include rising premiums.

Nicholas Jasinski, in Barron’s Oct 15, 2023.

10 Corporations to Watch (Bloomberg Businessweek) 10/9/23

It’s not solely excellent news within the company world. There are three or extra cautions among the many Bloomberg number of watchable mid to massive cap market worth shares. They got here up with ten. —By Kevin Tynan, Ada Li, Patrick Wong, Patricio Alvarez, Sharnie Wong, Ken Shea, Tamlin Bason, Philip Richards, Tom Ward, Omid Vaziri, Up to date September 29, 2023. Revealed October 9 (Sorry no net hyperlinks for Bloomberg Businessweek)

Any assortment of shares is extra clearly understood when subjected to yield-based (dogcatcher) evaluation, this assortment ofBarron’s, Bloomberg, and

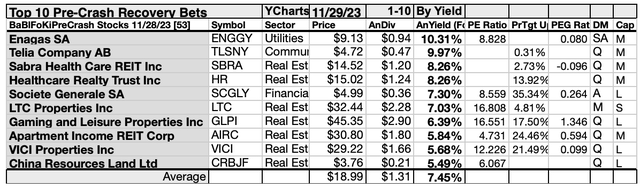

Fortune articles, geared toward figuring out “Pre-Crash Restoration”, shares is ideal for the dogcatcher course of. Under are the 53 November 29, 2023 Pre-Crash “Restoration” candidates as parsed by YCharts.

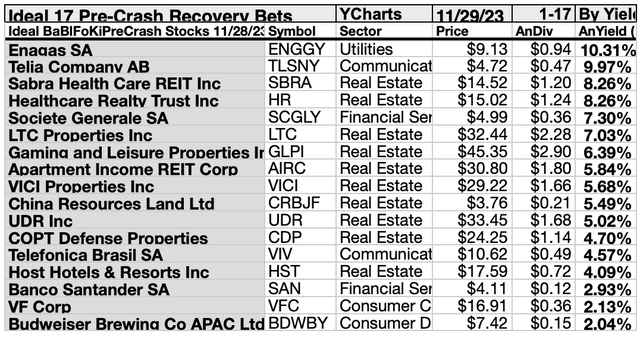

The costs and yields of 17 of those 53 made the opportunity of proudly owning productive dividend shares from this assortment extra viable for first-time buyers.

These 17 Dogcatcher Splendid “Pre-Crash Restoration” shares for December are: Enagas SA (OTCPK:ENGGY); Telia Firm AB (OTCPK:TLSNY); Sabra Healthcare REIT Inc (SBRA); Slociete Generale SA (OTCPK:SCGLY); LTC Properties Inc (LTC); Gaming and Leisure Properties Inc (GLPI); Condo Revenue REIT Corp (AIRC); VICI Properties Inc (VICI); China Sources land Ltd (OTCPK:CRBJF); UDR Inc (UDR); COPT Protection Properties (CDP); Telefonica Brasil SA (VIV); Host Motels & Resorts Inc (HST); Banco Santander SA (SAN); VF Corp (VFC); Budweiser Brewing Co APAC LTD (OTCPK:BDWBY).

These seventeen all reside as much as the perfect of annual dividends from $1K invested exceeding their single share costs. Many buyers see this situation as “look nearer to possibly purchase” alternative.

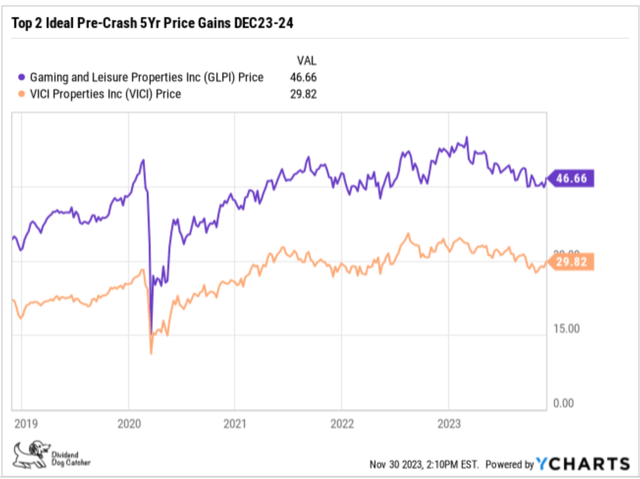

In a rating of five-year worth positive factors of the highest 17 “Pre-Crash Restoration” shares by yield, two of the Splendid alternatives stood out: Gaming and Leisure Properties Inc; VICI Properties Inc.

Which of the 17 are “safer” dividend canine? To search out the reply, discover my “Safer” December Dividend Dogcatcher follow-up detailing these Barron’s, Bloomberg, and Fortune alternatives, geared toward figuring out “Pre-Crash Restoration,” shares in our Investing Group showing on or about December 8.

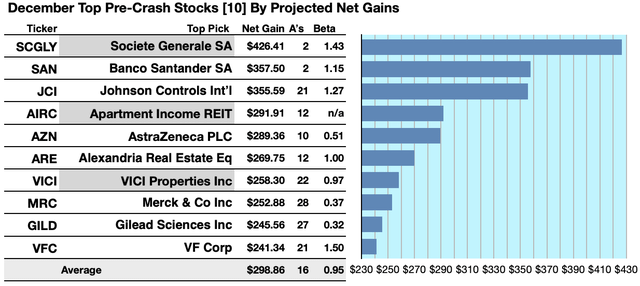

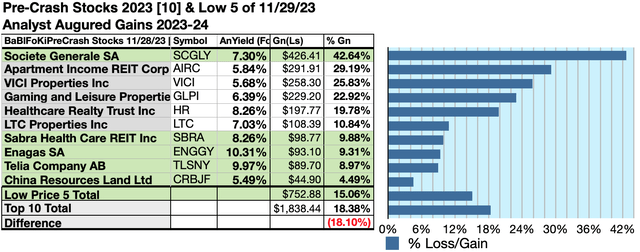

Actionable Conclusions (1-10): Analysts Estimated 24.13% To 42.64% ‘Pre-Crash Restoration’ Dividend High 10 Internet Features By December, 2024

Three of ten prime “Pre-Crash Restoration” dividend shares by yield have been additionally among the many top-ten gainers for the approaching yr primarily based on analyst 1-year goal costs. (They’re tinted grey within the chart under). Thus, the yield-based forecast for these December canine was graded by Wall St. Wizards as 30% correct.

Supply: YCharts.com

Estimated dividends from $1000 invested in every of the very best yielding “Pre-Crash Restoration” shares, added to the median of combination one-year goal costs from analysts (as reported by YCharts), generated the next outcomes. Observe: one-year goal costs by lone analysts weren’t included. Ten possible profit-generating trades projected to December 2024 have been:

Society Generale SA was projected to web $426.41, primarily based on dividends, plus the median of goal worth estimates from 2 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 43% larger than the market as a complete.

Banco Santander SA was projected to web $357.50 primarily based on dividends, plus the median of goal estimates from 2 brokers, much less transaction charges. The Beta quantity confirmed this estimate topic to threat/volatility 15% larger than the market as a complete.

Johnson Controls Worldwide PLC (JCI) was projected to web $355.59, primarily based on dividends, plus the median of goal worth estimates from 21 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 27% over the market as a complete.

Condo Revenue REIT Corp was projected to web $291.91, primarily based on dividends, plus the median of goal worth estimates from 12 analysts, much less dealer charges. A Beta quantity was not out there for AIRC.

AstraZeneca PLC (AZN) was projected to web $289.36, primarily based on the median of goal worth estimates from 10 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 49% lower than the market as a complete.

Alexandria Actual Property Equities Inc (ARE) was projected to web $269.75, primarily based on the median of estimates from 12 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility equal to the market as a complete.

VICI Properties Inc was projected to web $258.30, primarily based on dividends, plus the median of goal worth estimates from 22 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 3% underneath the market as a complete.

Merck & Co Inc (MRK) was projected to web $252.88 primarily based on the median of goal worth estimates from 28 analysts, plus annual dividend, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 63% underneath the market as a complete.

Gilead Sciences Inc (GILD) was projected to web $245.56, primarily based on dividends, plus median goal worth estimates from 27 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 68% underneath the market as a complete.

VFC Corp was projected to web $241.34, primarily based on the median of goal estimates from 21 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 50% larger than the market as a complete.

The common web acquire in dividend and worth was estimated at 29.89% on $10k invested as $1k in every of those ten shares. These acquire estimates have been topic to common threat/volatility 5% underneath the market as a complete.

Supply: Open supply canine artwork from dividenddogcatcher.com

The Dividend Canines Rule

Shares earned the “canine” moniker by exhibiting three traits: (1) paying dependable, repeating dividends, (2) their costs fell to the place (3) yield (dividend/worth) grew greater than their friends. Thus, the very best yielding shares in any assortment grew to become referred to as “canine.” Extra exactly, these are, actually, finest known as, “underdogs.”

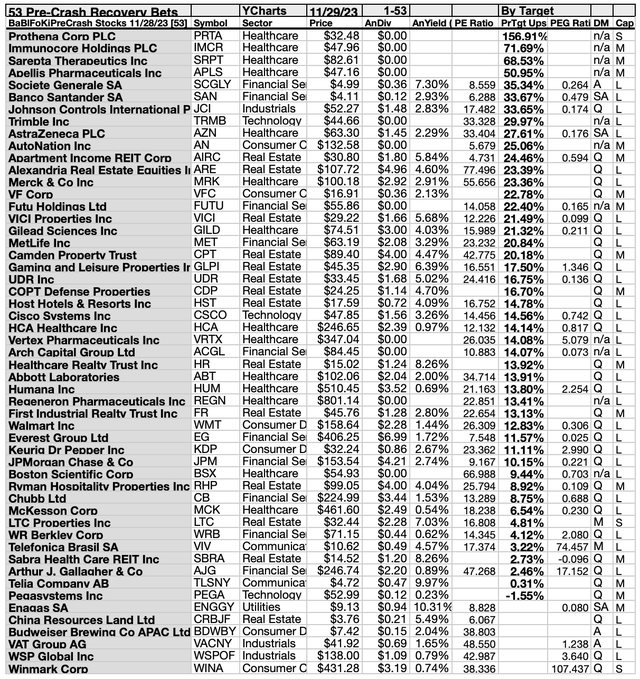

53 “Pre-Crash Restoration” Equities For 2023-24 Per December Analyst Goal Knowledge

Supply: YCharts.com

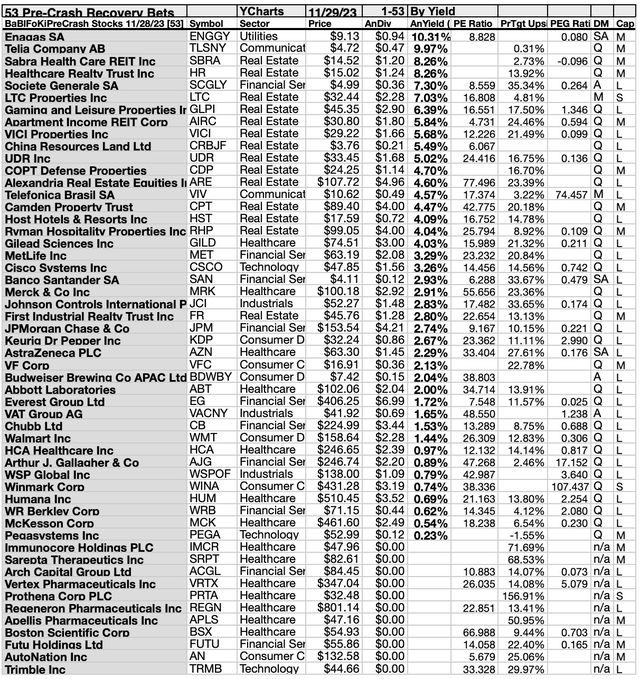

53 “Pre-Crash Restoration” Equities 2023-24 By December Yields

Supply: YCharts.com

Actionable Conclusions (11-20): Ten High “Pre-Crash Restoration” Equities

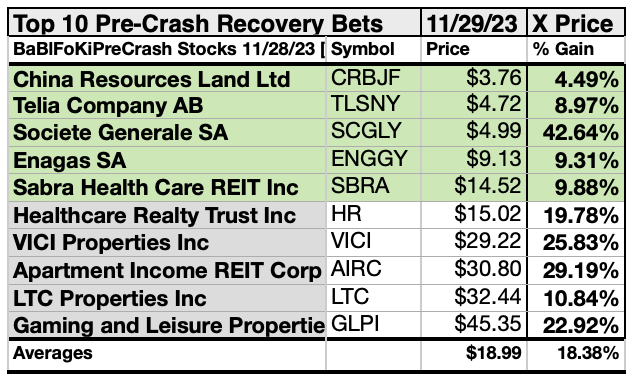

High ten 2023-24 “Pre-Crash Restoration” Equities by yield for December represented 4 of 11 Morningstar sectors. First place went to at least one utilities member, Enagas SA [1]. Whereas second place was captured by communication companies as represented by Telia Firm AB [2],

The primary of seven actual property sector representatives positioned third, Sabra Well being Care REIT Inc [3]. The opposite 5 positioned fourth, and sixth by tenth: Healthcare Realty Belief Inc (HR) [4]; LTC Properties Inc [6], and Gaming and Leisure Properties Inc [7]; Condo Revenue REIT Corp [8]; VICI Properties Inc [9]; China Sources Land.

The fifth slot was claimed by the lone monetary companies sector member: Society Generale SA [5] to finish the highest ten ‘Pre-Crash Restoration’ Equities by yield for 2023-24 as of November 29.

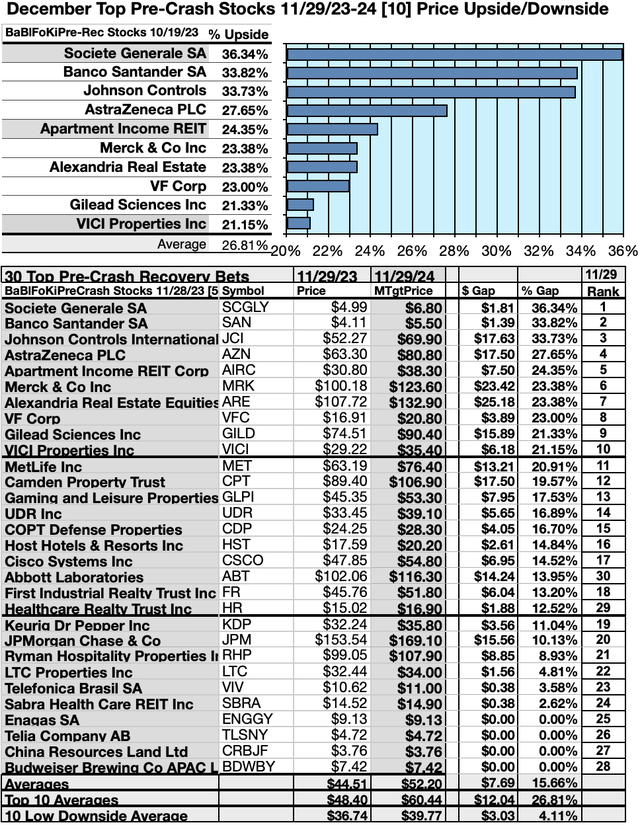

Actionable Conclusions: (21-30) Ten High “Pre-Crash Restoration” Dividend Payers For 2023-24 Confirmed 21.15%-36.34% Upsides Whereas (31) No Down-siders Had been Recorded For December

Supply: YCharts.com

To quantify prime canine rankings, analyst median worth goal estimates supplied a “market sentiment” gauge of upside potential. Added to the straightforward high-yield metrics, median analyst goal worth estimates grew to become one other software to dig out bargains.

Analysts Forecast A 18.1% Drawback For five Highest Yield, Lowest Priced, of 10 “Pre-Crash Restoration” Shares for December 2023-24

Ten prime Barron’s, Bloomberg, and Fortune dividend alternatives, geared toward discovering the “Pre-Crash Restoration” equities for 2023-24 have been culled by yield 11/29/23 for this replace. Yield (dividend / worth) outcomes supplied by YCharts did the rating.

Supply: YCharts.com

As famous above, prime ten Barron’s, Bloomberg, and Fortune dividend alternatives, geared toward discovering the perfect “Pre-Crash Restoration” shares, as screened 11/29/23, exhibiting the very best dividend yields, represented 5 of 11 within the Morningstar sector scheme.

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The High Ten Highest-Yield “Pre-Crash Restoration” Dividend Shares for 2023-24 (32) Delivering 15.06% Vs. (33) 18.38% Internet Features by All Ten Come December 2024

Supply: YCharts.com

$5000 invested as $1k in every of the 5 lowest-priced shares within the prime ten Barron’s, Bloomberg, and Fortune dividend alternatives, geared toward discovering the “Pre-Crash Restoration” Dividend Shares for 2022-23 by yield, have been predicted, by analyst 1-year targets, to ship 18.1% LESS acquire than $5,000 invested as $.5k in all ten. The very lowest-priced choice, Society Generale SA, was projected to ship the perfect web acquire of 42.64%.

Supply: YCharts.com

The 5 lowest-priced top-yield Barron’s, Bloomberg, and Fortune dividend alternatives, geared toward discovering “Pre-Crash Restoration” Shares as of November 29 have been: China Sources Land Ltd; Telia Firm AB; Society Generale SA; Enegas SA; Sabara Well being Care REIT, with costs starting from $3.76 to $14.52.

5 higher-priced Barron’s, Bloomberg, and Fortune dividend alternatives, geared toward discovering “Pre-Crash Restoration” Shares as of October 19 have been: Healthcare Realty Belief Inc; VICI Properties Inc; Condo Revenue REIT Corp; LTC Properties Inc; Gaming and Leisure Properties Inc, whose costs ranged from $15.02 to $45.35.

The excellence between 5 low-priced dividend canine and the overall area of ten projected Michael B. O’Higgins’ “fundamental methodology” for beating the Dow. The size of anticipated positive factors, primarily based on analyst targets, added a singular factor of “market sentiment” gauging upside potential. It supplied a here-and-now equal of ready a yr to search out out what would possibly occur available in the market. Warning is suggested, since analysts are traditionally solely 15% to 85% correct on the route of change and simply 0% to fifteen% correct on the diploma of change.

The online acquire/loss estimates above didn’t factor-in any overseas or home tax issues ensuing from distributions. Seek the advice of your tax advisor concerning the supply and penalties of “dividends” from any funding.

Afterword

This text options 53 Barron’s, Bloomberg, and Fortune dividend alternatives, geared toward discovering “Pre-Crash Restoration” alternatives for 2023-24. The article focuses on the highest 30, or so, dividend payers. Thus, practically one-half of the unique listing of corporations is uncared for. Due to this fact, under is the entire listing of 53 shares grouped by supply.

Sources: Kiplinger.com, Barrons.com, Fortune.com, YCharts.com

If one way or the other you missed the suggestion of which shares are ripe for choosing in the beginning of this text, here’s a reprise of the listing on the finish:

The costs of 17 of those 53 Kiplinger, and Barron’s “Pre-Crash Restoration” alternatives for 2023-24 made the opportunity of proudly owning productive dividend shares from this assortment extra viable for first-time buyers.

These 17 Dogcatcher perfect “inflation Busting” dividend shares for October are:

Supply: YCharts.com

These 17 all reside as much as the perfect of getting their annual dividends from a $1K funding exceed their single share costs. Many buyers see this situation as “look nearer to possibly purchase” alternative.

In a rating of three-year worth positive factors of the highest 17 “Pre-Crash Restoration” shares by yield, two of the Splendid alternatives stood out: Gaming and Leisure Properties Inc; VICI Properties Inc.

Supply: YCharts.com

Which of the 17 are “safer” dividend canine? To search out the reply discover my ‘Safer’ October Dividend Dogcatcher follow-up detailing these Barron’s, Bloomberg, and Fortune alternatives, geared toward figuring out “Pre-Crash Restoration”, shares in our Investing Group showing on or about December 8.

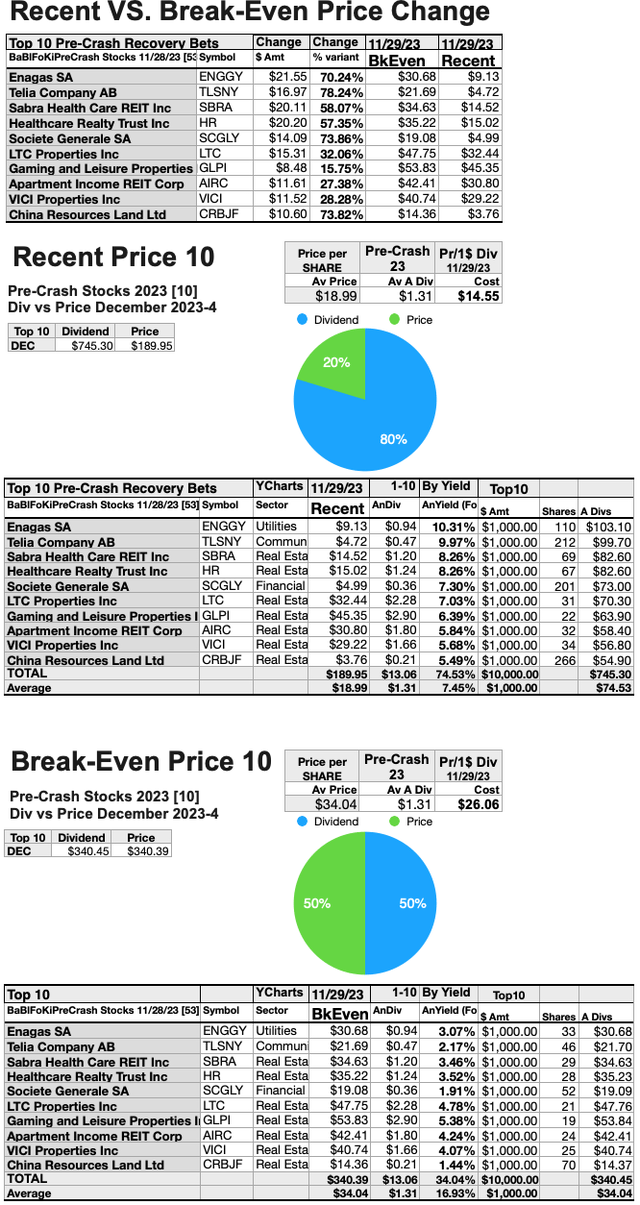

How Ten High “Pre-Crash Restoration” 2023-24 Shares Might Change into Splendid Honest Priced Canines

Supply: YCharts.com

Since the entire top-ten Barron’s, Bloomberg, and Fortune “Pre-Crash Restoration” shares for 2023 shares are actually priced lower than the annual dividends paid out from a $1K funding, the above charts examine these ten towards break-even costs.

The greenback and proportion variations between latest and break-even costs are detailed within the prime chart. The latest costs are proven within the center chart with the break-even pricing of all ten prime canine conforming to the dogcatcher perfect are detailed within the backside chart.

With out draw back market strain all ten highest-yield Barron’s, Bloomberg & Fortune Pre-Crash Restoration Dividend shares, are better-than fair-priced with their annual yield (from $1K invested) exceeding their single share costs. The comparability exhibits how a lot the latest inventory costs might go up earlier than exceeding the (arbitrary however logical) worth restrict.

Shares listed above have been steered solely as doable reference factors in your buy or sale analysis course of. These weren’t suggestions.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link