[ad_1]

Daniel Grizelj

Warren Buffett famously stated, “It is solely when the tide goes out that you understand who’s been swimming bare.” Per ordinary, the Oracle of Omaha was right and over the previous two years, the REIT sector has been completely disrupted. REITs touted as “sleep effectively at night time” shares have lower their dividends and sector-wide development has been anemic. Right this moment, we’re going to dive into a very troubled web lease REIT that has been swimming bare.

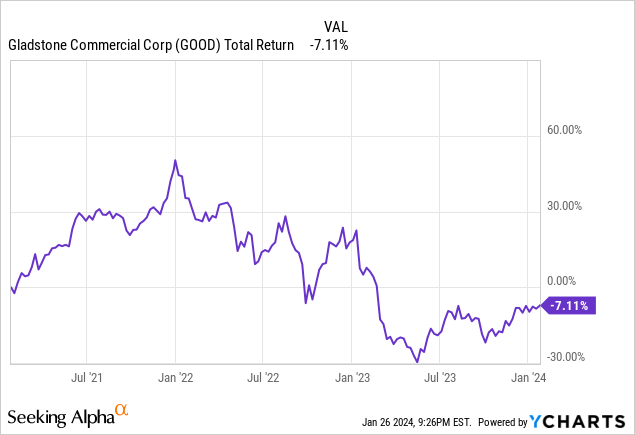

We coated Gladstone Business (NASDAQ:GOOD) a number of years in the past, earlier than their dividend lower. We highlighted issues within the firm’s portfolio, which precipitated the slash to shareholder money circulate. A spotlight of our earlier protection was predicting the affect of rising rates of interest on money flows and finally the distribution.

Rising charges pose a considerable danger to GOOD by way of the rise in value of debt. A substantive portion of GOOD’s capital stack stems from floating price debt which can really feel the rapid burden of rising charges. Given the already stretched payout ratio, an rising curiosity expense will definitely be difficult to navigate.

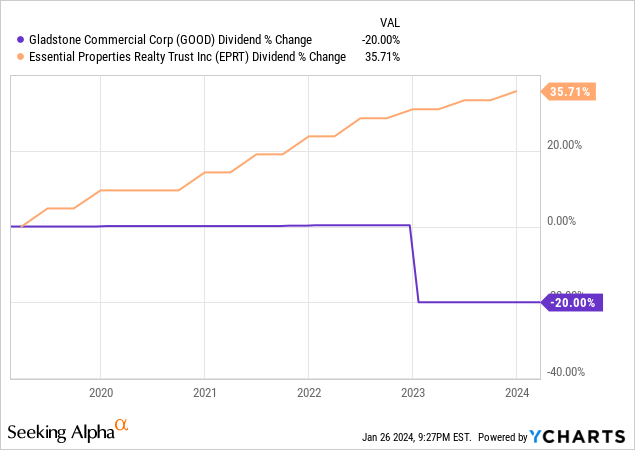

GOOD was compelled to chop the dividend by year-end. The discount got here as a shock to many buyers who depend on Gladstone’s stellar fame of constant month-to-month dividends to assist their revenue. Nonetheless, even a legendary supervisor reminiscent of Gladstone was unable to keep away from the tides of actual property chaos, notably throughout the workplace sector. Rising tenant concessions paired with headwinds stemming from work-from-home tendencies have troubled the workplace sector, which represents a big portion of Gladstone’s portfolio.

Right this moment, we’ll dive deeper into the dividend lower and the agency’s administration construction to establish underlying points. We’ll go additional to spotlight one among GOOD’s opponents who affords considerably higher long-term worth and alternative.

Dividend and Aggressive Disadvantages

REIT buyers are yield-hungry. We prioritize the dividend in making our funding choices. We have a look at money circulate because the underlying linchpin of what makes an actual property funding enticing. In a fancy and nuanced investing world, this method might be problematic as it may make poor alternatives seem extra enticing. Main as much as the dividend lower, there have been a wide range of analysts who touted GOOD as a top-tiered web lease REIT. Right here is one instance and one other.

So, what was missed? Extra importantly, have the circumstances that led to the dividend lower modified?

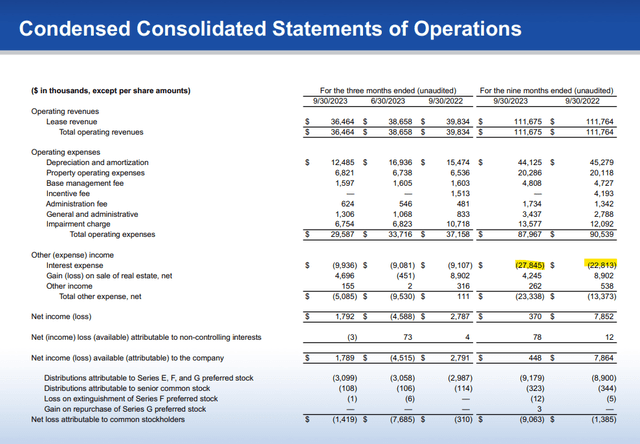

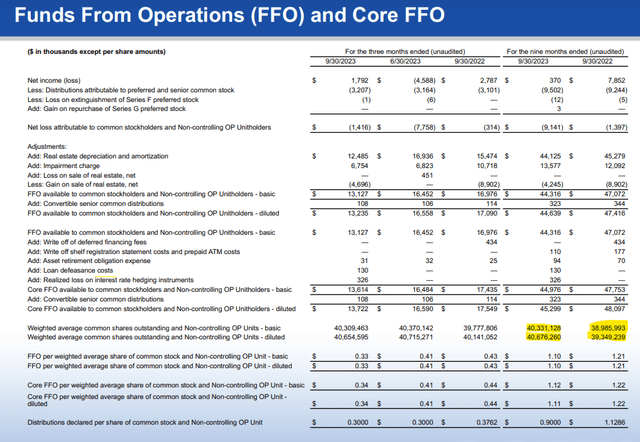

One purpose behind the lower lies within the agency’s value of capital. GOOD lacks the credit standing of blue-chip opponents reminiscent of Realty Earnings (O) which might allow GOOD to challenge debt at low rates of interest. Moreover, a big portion of GOOD’s debt is floating price, that means the agency has skilled rising curiosity expense strain with out even refinancing. The rising strain was apparent and contributed to a rise in curiosity expense of $5 million between the third quarter of 2023 and the identical quarter of the yr prior.

GOOD

Evaluate GOOD’s floating price debt to the low-interest, fixed-rate debt of huge opponents reminiscent of O. Merely put, GOOD’s stability sheet had nowhere to cover from rising charges and administration didn’t insulate itself appropriately.

Past the debt on GOOD’s stability sheet, the fairness issued by GOOD can be materially costlier than its opponents. Like all REITs, GOOD points shares to finance the acquisition of latest properties. For instance, GOOD not too long ago acquired a producing facility in Indiana. Nonetheless, not like opponents, GOOD’s widespread shares pay out a big dividend, that means the price of capital related to these shares is far greater. Though GOOD’s share issuance shouldn’t be notably aggressive, the REIT should make investments the proceeds of the issued fairness in a productive method, which is difficult given the yield.

GOOD

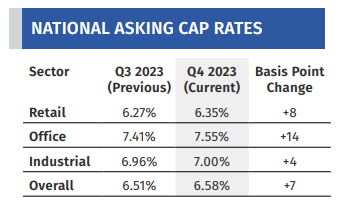

Based on the Boulder Group, a web lease brokerage and analysis agency, market capitalization charges for web lease belongings common 6.51%, that means GOOD can not pursue common at-market alternatives accretively. Whereas O and comparable extremely rated REITs can pursue low capitalization price belongings and earn a variety, GOOD is compelled to spend money on riskier belongings to earn the identical reward. In the newest studies, GOOD introduced investments in 4 markets at a 9.6% weighted common capitalization price. Can we realistically consider {that a} property with an in-place capitalization price of 9.6% matches a purchase and maintain investor like GOOD?

Boulder Group

Over time, the price of capital drawback led GOOD to pursue non-core belongings in secondary markets. GOOD’s portfolio of primarily workplace and industrial belongings is unfold throughout secondary and tertiary markets of the decrease 48 states. Positioning outdoors of core markets makes negotiating renewals or new leases a problem. GOOD is compelled to attract from a smaller tenant base which frequently results in further concessions from the owner. Right this moment, 37% of the portfolio remains to be workplace, which requires extra capital outlay from a landlord in comparison with retail or industrial. As GOOD retains money to assist its distribution and new acquisitions, it’s compelled to divert that capital to securing new tenants or negotiating with current tenants to resume, which is usually economically unproductive. Take note, that the workplace properties owned by GOOD are single-tenant, suburban places of work. These are utterly totally different than class-A places of work in main markets in all of the incorrect methods.

GOOD

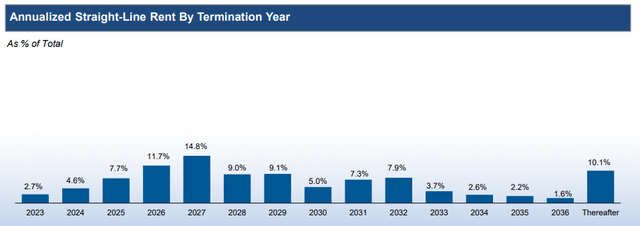

GOOD might be renegotiating roughly 25% of the portfolio’s leases over the subsequent three years. Whereas there is a chance to earn significant spreads on the re-leasing of the commercial portfolio, it’ll doubtless be overshadowed by the impacts of workplace leasing. GOOD is compelled to shell out tenant enhancements, free lease, and different concessions to draw or retain tenants, all of which come from the corporate’s rental income or newly issued shares/debt. The outgoing capital will put strain on retained earnings, which can once more improve the online value of capital for GOOD.

Exterior Administration

GOOD is externally managed that means it compensates an exterior advisor for companies rendered. The agency is managed by Gladstone Firms, a well-liked asset supervisor of month-to-month paying dividend shares. GOOD is one among 5 externally managed investments from Gladstone Firms. Gladstone additionally managed Gladstone Capital (GLAD), Gladstone Land (LAND), and Gladstone Funding (GAIN).

With exterior administration comes administration and advisory charges versus salaries and compensation as acknowledged by an inner board of administrators. In some instances, exterior administration can result in conflicts of curiosity. The most typical occasion is incentivizing portfolio development with no regard for enchancment to share metrics. For instance, a administration charge primarily based on belongings beneath administration or AUM incentivizes a rising portfolio even at the price of high quality. This would possibly add perspective to GOOD’s continued development regardless of financing dangers.

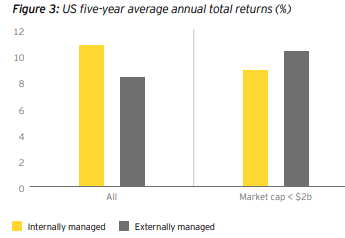

Ernst & Younger

Whereas smaller REITs might profit from an exterior supervisor, information helps the concept internally managed REITs are typically a greater possibility. Over time, internally managed REITs generate higher returns attributable to economies of scale and inner efficiencies.

GOOD’s market capitalization of $538 million is just too small to realistically set up an inner administration construction. The corporate merely lacks the size to rent a crew to internally handle an actual property funding belief. This isn’t a difficulty that may realistically be mounted within the brief time period given REIT should develop prudently. So, what does the scenario imply for the corporate?

GOOD is left in a quite precarious place. The portfolio realistically has an excessive amount of workplace to be an acquisition goal of one other REIT. It’s not doubtless {that a} competitor reminiscent of Realty Earnings can be thinking about buying GOOD as it’s constructed as we speak.

Let’s dive right into a viable different to GOOD with a greater stability sheet and outlook.

The Various

Important Properties Realty Belief (EPRT) has been the discuss of the online lease world for a number of years. Capitalizing on a well-established enterprise mannequin, EPRT acquires, owns, and operates single-tenant, web lease properties throughout the USA. The corporate leases its properties to middle-market tenants, reminiscent of eating places, automotive washes, automotive companies, C shops, health facilities, and childhood schooling facilities on a long-term, NNN leases. The mannequin is aligned with opponents reminiscent of Realty Earnings or Agree Realty (ADC). Capitalizing on the center market is even paying homage to STORE Capital, which was not too long ago taken personal by GIC and Oak Road.

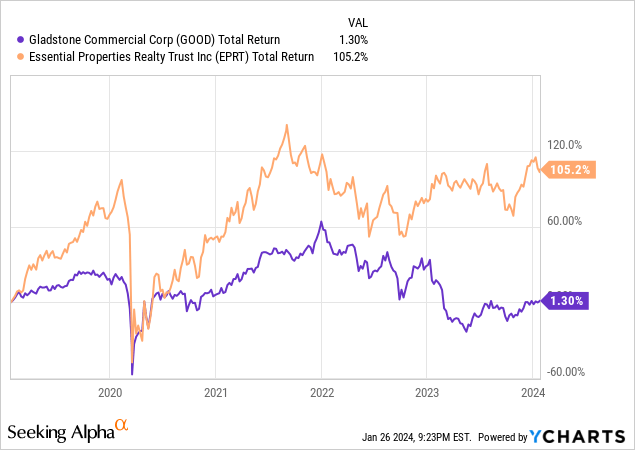

Since EPRT’s IPO, the online lease REIT has outperformed GOOD considerably. Leaving EPRT’s vastly superior portfolio apart, EPRT is a greater possibility than GOOD for 2 causes, the debt profile and price of capital. Let’s discover these two in better element.

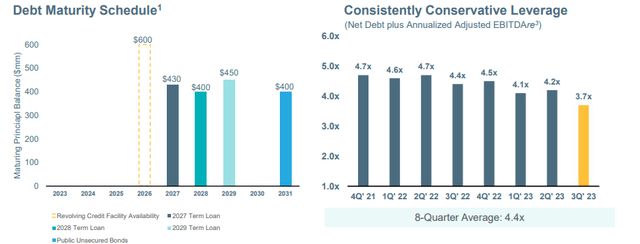

First, EPRT is conservatively managed. Like all REITs, EPRT makes use of leverage to fund property acquisitions. Nonetheless, the REIT has differentiated itself from different web lease opponents attributable to a decrease leverage profile which continues to enhance over time. As of the third quarter, EPRT’s web debt to EBITDA ratio was 3.7x, in comparison with 4.4x for a similar quarter within the prior yr. Moreover, given EPRT is a comparatively new firm, there are few upcoming debt maturities. The agency has no long-term refinancing obligations till 2027 that means EPRT can journey by way of the tumultuous rate of interest setting with a weighted common rate of interest of simply 3.6%. In distinction, different REITs are being compelled to refinance or challenge their debt at considerably greater charges, straight impacting the underside line.

EPRT

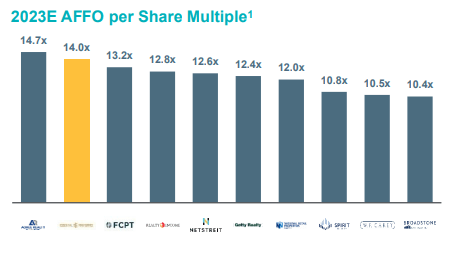

Second, EPRT is buying and selling at a market main valuation relative to web lease friends. Presently, EPRT is buying and selling at a 14.26x FFO a number of primarily based on present share costs of roughly $25. Throughout this market, this implies EPRT’s valuation is overshadowed solely by Agree Realty. A part of the premium valuation pertains to EPRT’s debt profile as outlined above. Nonetheless, one other essential part pertains to EPRT’s scale relative to opponents. The REIT is far smaller than opponents reminiscent of O, that means particular person acquisitions can drive superior accretion on the share degree.

EPRT

The expensive a number of is supported by a number one AFFO per share development projection. EPRT estimated 7.2% AFFO per share development for 2023, main their web lease opponents by a big margin. Over time, EPRT will proceed to outperform GOOD as their stability sheet improves and the agency leverages its value of capital benefits to develop. With a superior portfolio, stability sheet, and outlook, EPRT is a greater funding than GOOD, plain and easy.

Conclusion

REIT buyers are inherently yield hungry. We’re motivated by the attract of actual property’s excellent mixture of development and revenue that has pushed generational wealth for tons of of years. Nonetheless, yield alone can not inform the entire story. Diving deeper into the financials of REITs, we perceive that not all landlords are created equal. Usually, we will transcend the dividend and discover alternatives for superior complete return. Progress issues and it turns into paramount over very long time horizons.

With a adequate runway, EPRT’s development can return extra capital to shareholders by way of a rising dividend than can be acquired by the upper, however flat yield of a REIT like GOOD. Traders ought to take into consideration the large image and purchase high quality. Your portfolio will thanks.

[ad_2]

Source link