[ad_1]

Up to date on November twenty ninth, 2023 by Nikolaos Sismanis

Invoice Gates is the sixth-richest particular person on the earth, behind solely Bernard Arnault, Elon Musk, Jeff Bezos, Larry Ellison, and Warren Buffet. His internet value of ~$ 106 billion is a large sum of money. Not surprisingly, the Invoice & Melinda Gates Basis has an enormous funding portfolio of practically $39 billion, in line with a latest 13F submitting.

That type of wealth is one thing the overwhelming majority of us can solely dream of. Nonetheless, there may be one similarity between the on a regular basis investor and the wealthiest particular person on the planet.

We’re all in search of good shares to purchase and maintain for the long run. That’s the reason it’s helpful to overview the inventory holdings of the Invoice & Melinda Gates Basis.

You’ll be able to obtain our full record of all 70 Gates Basis shares (together with essential metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Word: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

The Invoice & Melinda Gates Basis owns a number of extremely worthwhile firms with sustainable aggressive benefits. Lots of the shares additionally pay dividends to shareholders and develop their dividend payouts over time.

This text will talk about the highest 22 shares held by the Invoice & Melinda Gates Basis.

Desk of Contents

You’ll be able to skip to the evaluation for every of the Gates Basis’s high 22 inventory holdings, with the desk of contents under. Shares are listed so as of the portfolio’s largest positions to smallest positions.

Microsoft (MSFT)

Berkshire Hathaway (BRK.B)

Canadian Nationwide Railway (CNI)

Waste Administration (WM)

Caterpillar Inc. (CAT)

Deere & Firm (DE)

Ecolab (ECL)

Coca-Cola FEMSA, S.A.B. de C.V. (KOF)

Walmart (WMT)

FedEx Corp. (FDX)

Waste Connections (WCN)

Schrodinger, Inc. (SDGR)

Coupang, Inc. (CPNG)

Crown Fortress Worldwide (CCI)

United Parcel Service, Inc. (UPS)

Anheuser-Busch InBev SA/NV (BUD)

Madison Sq. Backyard Sports activities Corp. (MSGS)

Kraft Heinz (KHC)

Danaher Company (DHR)

Hormel Meals (HRL)

Carvana Co. (CVNA)

On Holding AG (ONON)

You too can watch video evaluation of Gates’ inventory holdings under:

#1—Microsoft (MSFT)

Dividend Yield: 0.8%

Proportion of Invoice Gates’ Portfolio: 34.6%

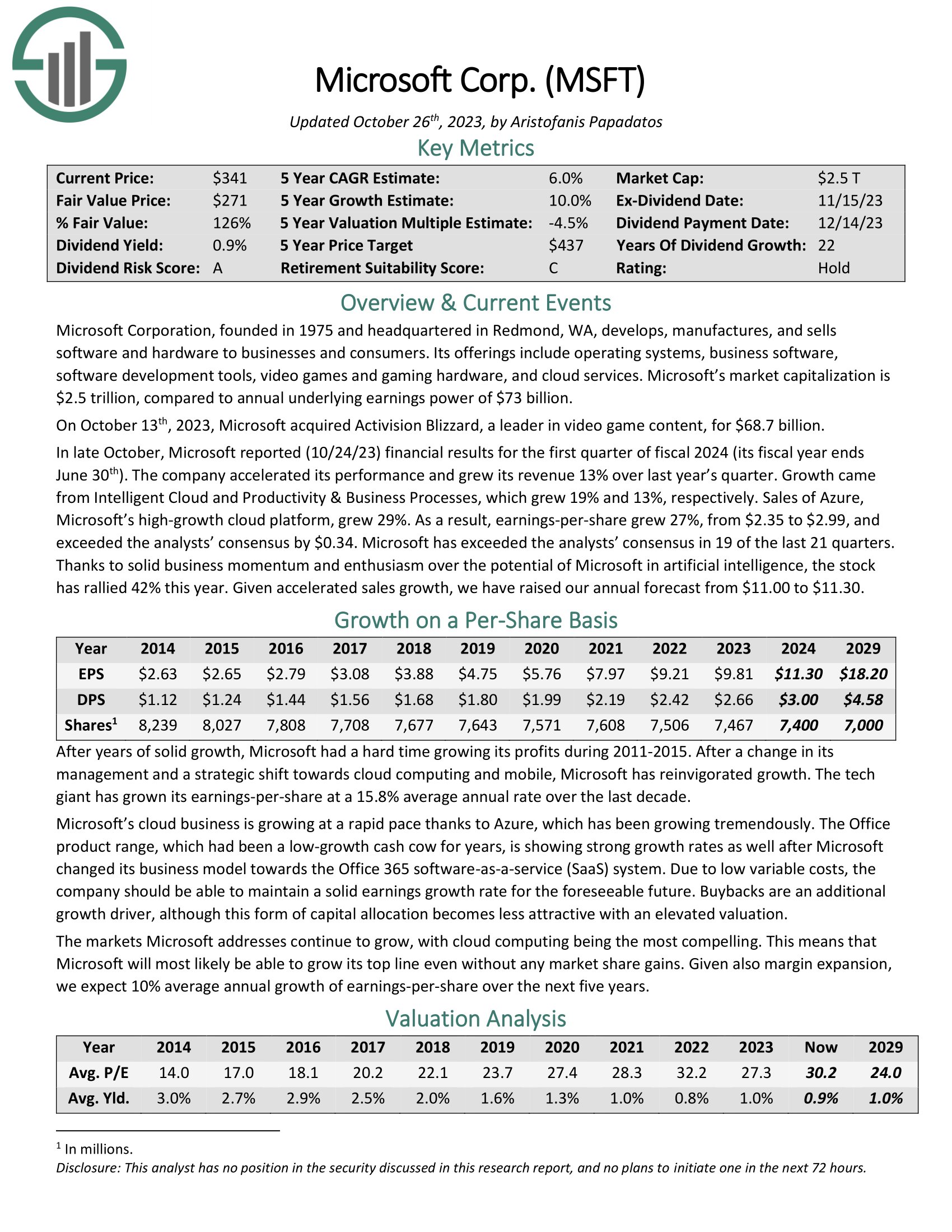

Microsoft Company, based in 1975 and headquartered in Redmond, WA, develops, manufactures, and sells each software program and {hardware} to companies and shoppers. Microsoft is a mega-cap inventory with a market capitalization of $2.8 trillion.

Its choices embody working techniques, enterprise software program, software program improvement instruments, video video games and gaming {hardware}, and cloud providers.

On October 13 th, 2023, Microsoft acquired Activision Blizzard, a frontrunner in online game content material, for $68.7 billion.

In late October, Microsoft reported (10/24/23) monetary outcomes for the primary quarter of fiscal 2024 (its fiscal 12 months ends June thirtieth). The corporate accelerated its efficiency and grew its income by 13% over final 12 months’s quarter. Development got here from Clever Cloud and Productiveness & Enterprise Processes, which grew 19% and 13%, respectively. Gross sales of Azure, Microsoft’s high-growth cloud platform, grew 29%.

In consequence, earnings-per-share grew 27%, from $2.35 to $2.99, and exceeded the analysts’ consensus by $0.34.

Click on right here to obtain our most up-to-date Positive Evaluation report on Microsoft (preview of web page 1 of three proven under):

#2—Berkshire Hathaway (BRK)

Dividend Yield: N/A (Berkshire Hathaway doesn’t at present pay a dividend)

Proportion of Invoice Gates’ Portfolio: 19.0%

Berkshire Hathaway inventory is the third-largest particular person holding of the Gates Basis’s funding portfolio, and it’s straightforward to see why. It’s protected to say the cash is in good fingers. Berkshire, underneath the stewardship of Warren Buffett, grew from a struggling textile producer into one of many largest conglomerates on the earth.

Right this moment, Berkshire is a world large. It owns and operates dozens of companies, with a hand in practically each main business, together with insurance coverage, railroads, power, finance, manufacturing, and retailing. It has a market capitalization of virtually $790 billion.

Berkshire might be considered in 5 elements: wholly-owned insurance coverage subsidiaries like GEICO, Basic Re, and Berkshire Reinsurance; wholly-owned non-insurance subsidiaries like Dairy Queen, BNSF Railway, Duracell, Fruit of the Loom, NetJets, Precision Forged Elements, and See’s Candies; shared management companies like Kraft Heinz (KHC) and Pilot Flying J; marketable publicly-traded securities together with vital stakes in firms like American Categorical (AXP), Apple (AAPL), Financial institution of America (BAC), Coca-Cola (KO) and Wells Fargo (WFC); and eventually the corporate’s large money place.

In Berkshire’s annual letters to shareholders, Buffett usually evaluates the corporate’s efficiency when it comes to guide worth. E-book worth is an accounting metric that measures an organization’s belongings minus its liabilities. The ensuing distinction is an organization’s guide worth. This can be a proxy for the intrinsic worth of a agency, which Buffett believes to be crucial monetary metric.

Berkshire doesn’t pay a dividend to shareholders. Buffett and his companion Charlie Munger have all the time contended that they’ll create wealth at the next charge than the dividend would supply to shareholders.

Whereas Berkshire inventory is probably not engaging for buyers who need dividend revenue, there are few firms which have a observe report practically as nice as Berkshire’s.

#3—Canadian Nationwide Railway (CNI)

Dividend Yield: 2.1%

Proportion of Invoice Gates’ Portfolio: 14.9%

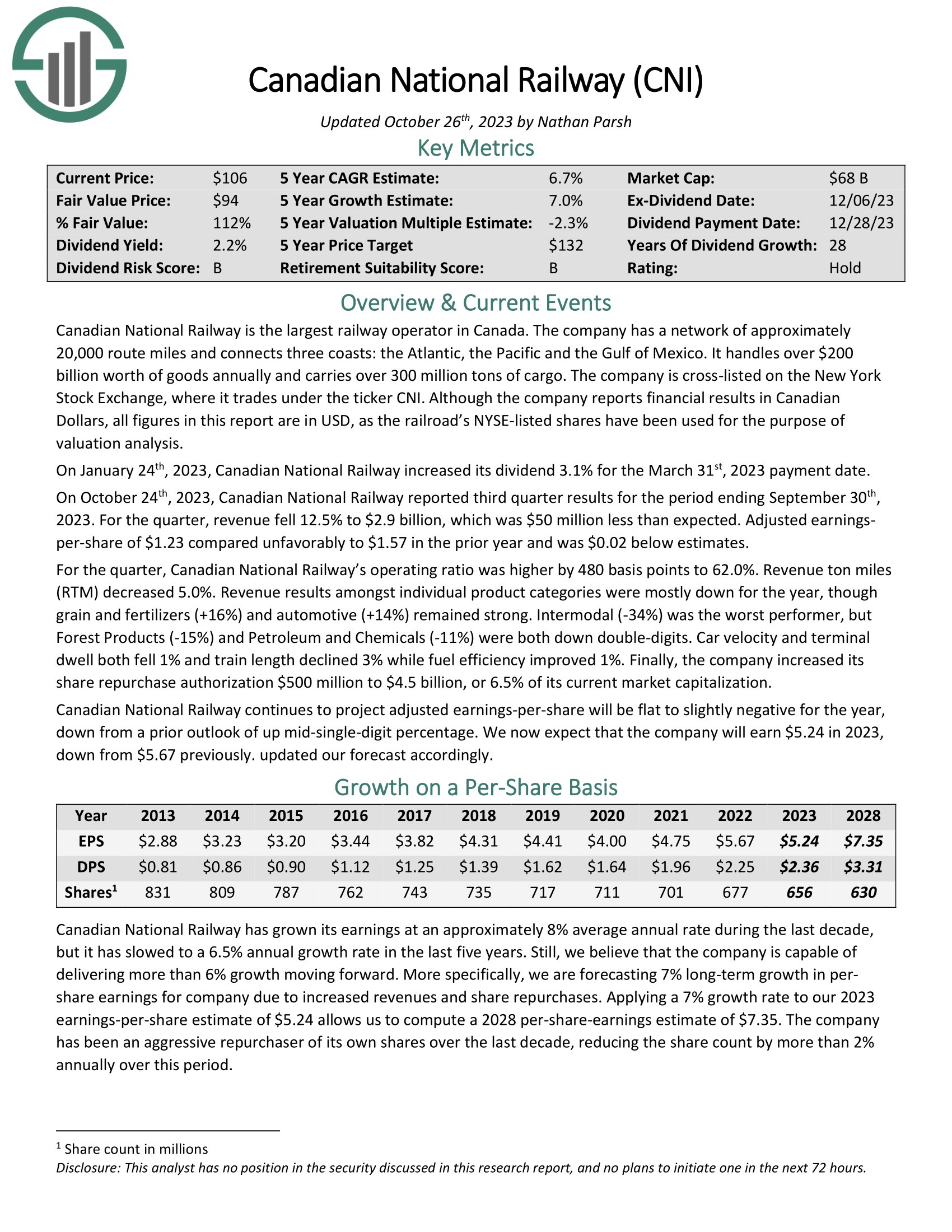

Canadian Nationwide Railway is the one transcontinental railroad in North America. It has a community of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific, and the Gulf of Mexico. It handles over $200 billion value of products yearly and carries over 300 million tons of cargo.

On January twenty fourth, 2023, Canadian Nationwide Railway elevated its dividend by 3.1% for the March thirty first, 2023 fee date.

On October twenty fourth, 2023, Canadian Nationwide Railway reported third-quarter outcomes for September thirtieth, 2023. For the quarter, income fell 12.5% to $2.9 billion, which was $50 million lower than anticipated.

Adjusted earnings per share of $1.23 in contrast unfavorably to $1.57 within the prior 12 months and was $0.02 under estimates.

For the quarter, Canadian Nationwide Railway’s working ratio was increased by 480 foundation factors to 62.0%. Income ton-miles (RTM) decreased 5.0%. Income outcomes amongst particular person product classes had been principally down for the 12 months, although grain and fertilizers (+16%) and automotive (+14%) remained robust. Intermodal (-34%) was the worst performer, however Forest Merchandise (-15%) and Petroleum and Chemical compounds (-11%) had been each down double-digits. Automotive velocity and terminal dwell each fell by 1%, and prepare size declined by 3% whereas gasoline effectivity improved by 1%.

Lastly, the corporate elevated its share repurchase authorization from $500 million to $4.5 billion, or 6.5% of its present market capitalization.

Canadian Nationwide Railway continues to mission adjusted earnings per share, which will probably be flat to barely adverse for the 12 months, down from a previous outlook of up mid-single-digit proportion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Canadian Nationwide Railway (preview of web page 1 of three proven under):

#4—Waste Administration (WM)

Dividend Yield: 1.6%

Proportion of Invoice Gates’ Portfolio: 14.4%

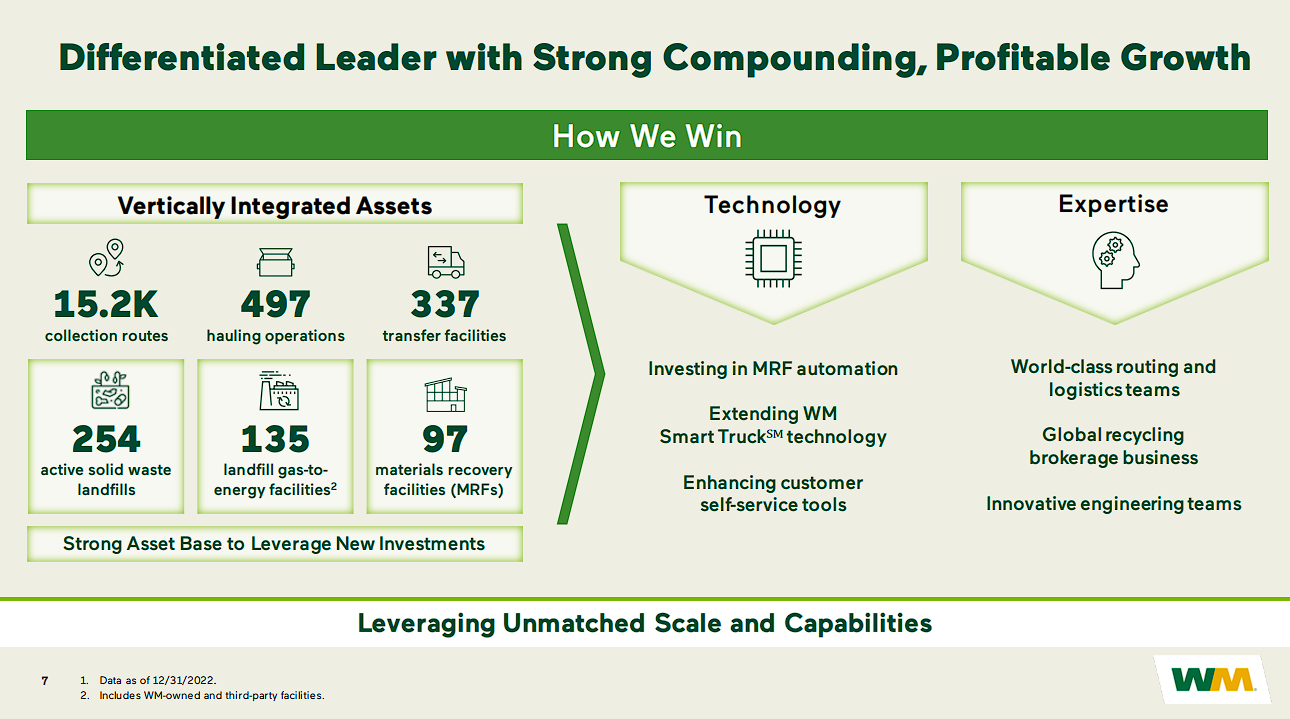

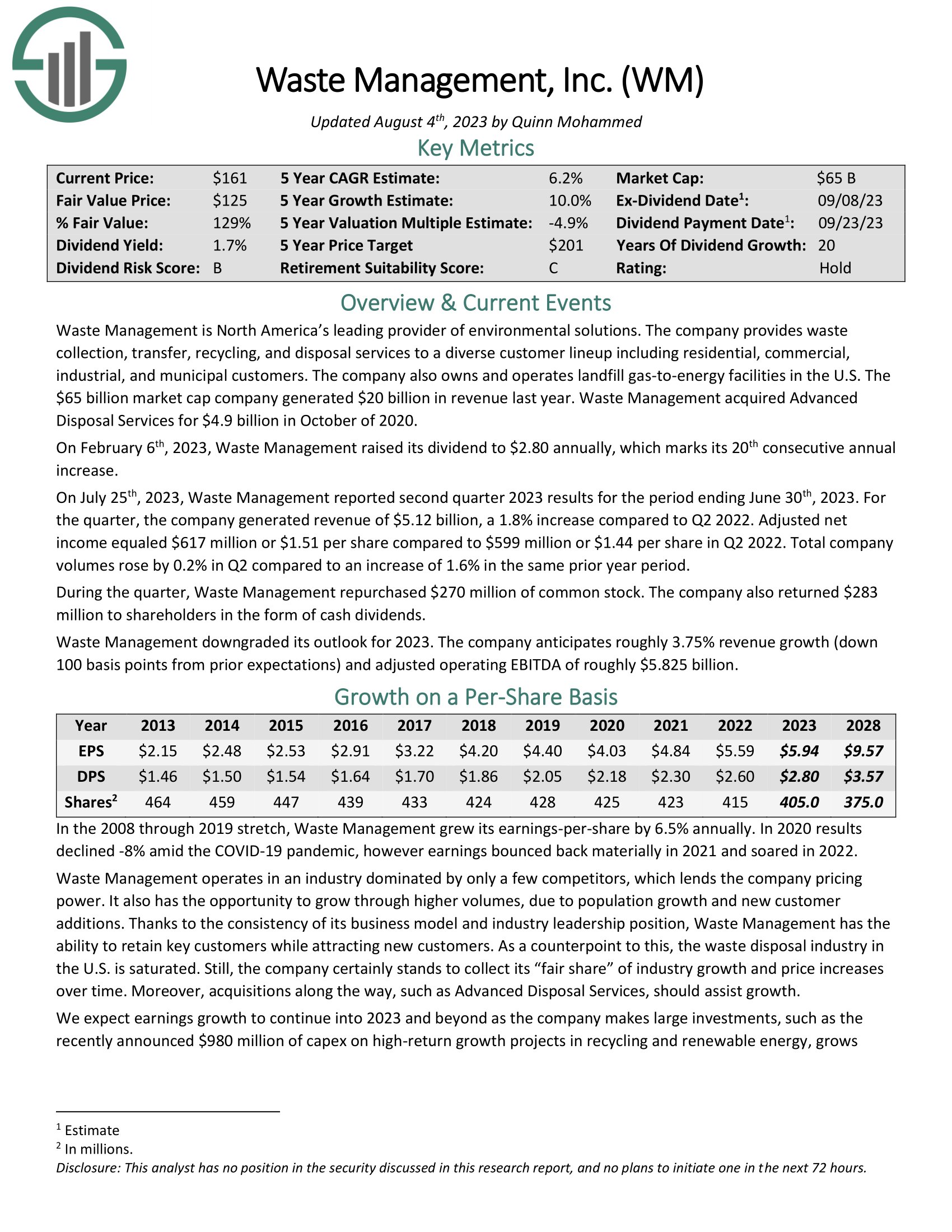

Waste Administration is the embodiment of an organization with a large financial “moat”, a time period popularized by Warren Buffett to explain a robust aggressive benefit that protects an organization from the total ravages of market competitors. Waste Administration operates in waste elimination and recycling providers. This can be a extremely concentrated business, with just a few firms controlling the vast majority of the market.

Supply: 2023 Investor Day Presentation

On October twenty fourth, 2023, Waste Administration reported third quarter 2023 outcomes for the interval ending September thirtieth, 2023.

For the quarter, the corporate generated income of $5.2 billion, a 2.4% enhance in comparison with Q3 2022. Adjusted internet revenue equaled $664 million or $1.63 per share in comparison with $645 million or $1.56 per share in Q3 2022.

Complete firm volumes rose by 0.5% in Q3 in comparison with a rise of 1.0% in the identical prior 12 months interval. Throughout the quarter, Waste Administration repurchased $370 million of widespread inventory. The corporate additionally returned $283 million to shareholders within the type of money dividends.

Waste Administration expects 2023 free money circulate of $1.825 billion to $1.925 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Waste Administration (preview of web page 1 of three proven under):

#5—Caterpillar (CAT)

Dividend Yield: 2.1%

Proportion of Invoice Gates’ Portfolio: 4.3%

Caterpillar is the worldwide chief in heavy equipment. It has a robust model with a dominant business place. Caterpillar manufactures and markets heavy equipment, principally for the development and mining sectors.

The company operates in three main segments: Building Industries, Useful resource Industries, and Vitality & Transportation, together with ancillary financing and associated providers by way of its Monetary Merchandise section.

Supply: Newest Investor Day Presentation

On October thirty first, 2023, Caterpillar reported its Q3 outcomes for the interval ending September thirtieth, 2023. For the quarter, the corporate generated revenues of $16.8 billion, a 12% enhance in comparison with the $15.0 billion posted within the third quarter of 2022.

Building Industries, Useful resource Industries, and Vitality & Transportation posted development of 12%, 9%, and 11%, respectively. These will increase had been primarily as a consequence of favorable worth realization and better gross sales quantity. The rise in gross sales quantity was pushed by increased gross sales of apparatus to finish customers, partially offset by the affect of adjustments in vendor inventories and decrease providers gross sales quantity.

Caterpillar’s adjusted working revenue margin was 20.5%, in comparison with 16.2% final 12 months. Margin enlargement mixed with income development resulted in adjusted earnings-per-share touchdown at $5.52 in opposition to $3.95 within the comparable interval final 12 months. A decrease share rely additionally boosted the outcome.

Caterpillar returned $1.0 billion to shareholders by way of dividends and share repurchases through the quarter, ending with $6.5 billion of enterprise money.

Click on right here to obtain our most up-to-date Positive Evaluation report on Caterpillar (preview of web page 1 of three proven under):

#6—Deere & Firm (DE)

Dividend Yield: 1.5%

Proportion of Invoice Gates’ Portfolio: 3.5%

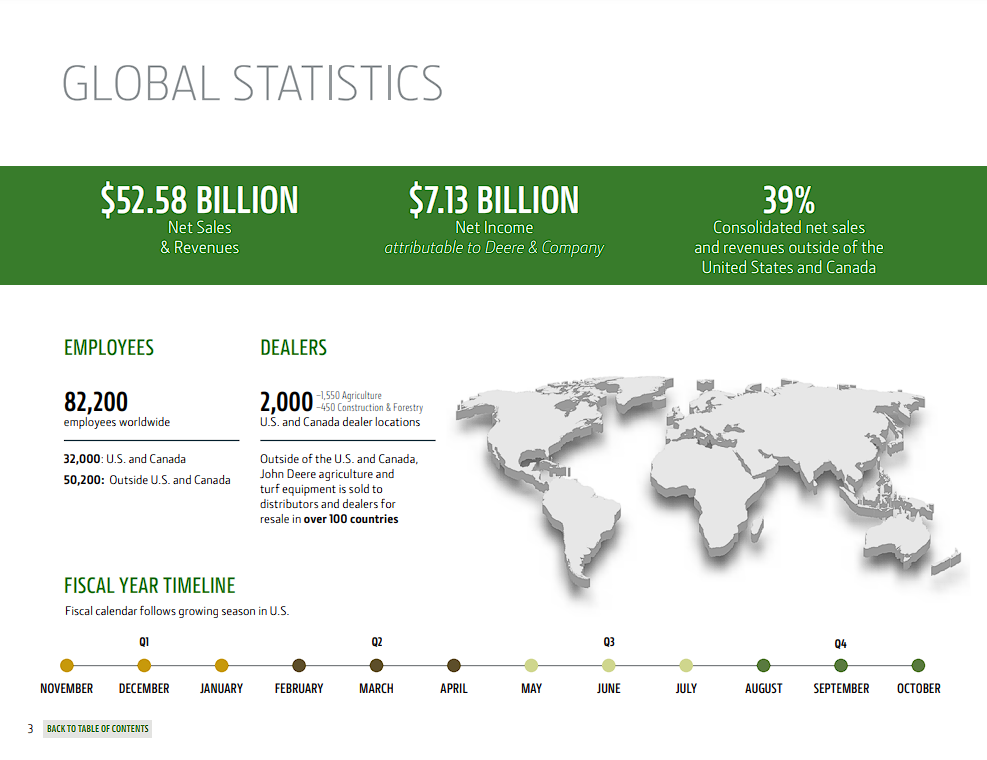

Deere & Firm is the biggest producer of farm tools on the earth. The corporate additionally makes tools utilized in development, forestry & turf care, produces engines, and supplies monetary options to its prospects. Deere was based in 1837.

Supply: Investor Truth E-book

In late November, Deere reported (11/22/23) monetary outcomes for the fourth quarter of fiscal 2023. Gross sales slipped -1% over the prior 12 months’s quarter because the profit from robust demand for farm and development tools was offset by a lower within the gross sales of the Manufacturing & Precision Ag and Small Ag & Turf segments.

Deere grew its earnings-per-share 11%, from $7.44 to $8.26, and beat the analysts’ consensus by $0.85. Nonetheless, the quarter marked a pointy deceleration over the earlier quarters.

Attributable to this deceleration and its expectation for quantity gross sales to revert to mid-cycle ranges, Deere supplied lackluster steerage for the brand new fiscal 12 months, anticipating earnings of $7.75-$8.25 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Deere (preview of web page 1 of three proven under):

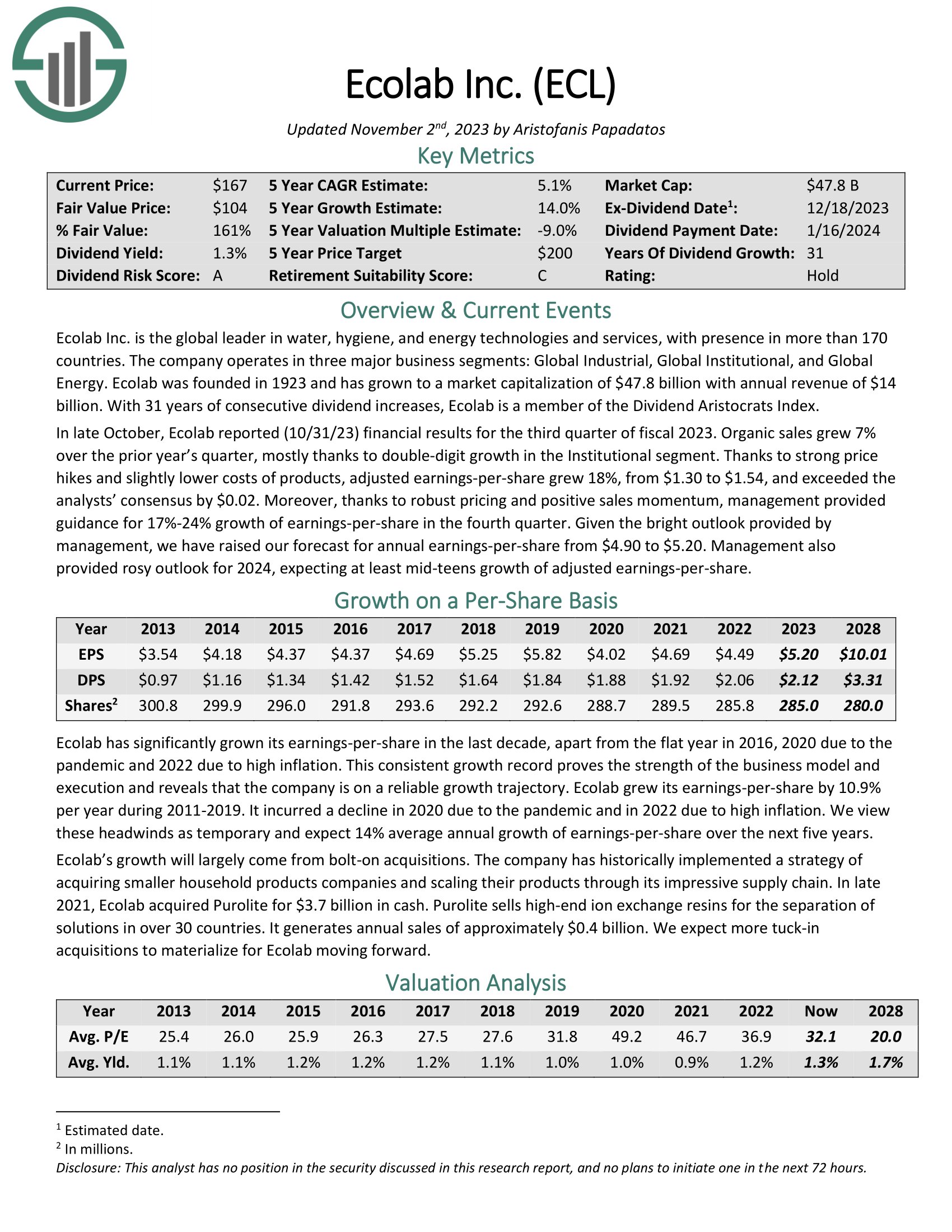

#7—Ecolab (ECL)

Dividend Yield: 1.1%

Proportion of Invoice Gates’ Portfolio: 2.3%

Ecolab was created in 1923 when its founder Merritt J. Osborn invented a brand new cleansing product known as “Absorbit”. This product cleaned carpets with out the necessity for companies to close down operations to conduct carpet cleansing. Osborn created an organization revolving across the product known as Economics Laboratory, or Ecolab.

Supply: Investor Presentation

In late October, Ecolab reported (10/31/23) monetary outcomes for the third quarter of fiscal 2023. Natural gross sales grew 7% over the prior 12 months’s quarter, principally because of double-digit development within the Institutional section.

Because of robust worth hikes and barely decrease prices of merchandise, adjusted earnings-per-share grew 18%, from $1.30 to $1.54, and exceeded the analysts’ consensus by $0.02. Furthermore, because of sturdy pricing and optimistic gross sales momentum, administration supplied steerage for a 17%-24% development of earnings-per-share within the fourth quarter.

Given the brilliant outlook supplied by administration, we’ve got raised our forecast for annual earnings-per-share from $4.90 to $5.20. Administration additionally supplied a rosy outlook for 2024, anticipating at the least mid-teens development of adjusted earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ecolab (preview of web page 1 of three proven under):

#8—Coca-Cola FEMSA SAB (KOF)

Dividend Yield: 3.9%

Proportion of Invoice Gates’ Portfolio: 1.3%

Coca-Cola FEMSA produces, markets, and distributes Coca-Cola (KO) drinks. It affords a full line of glowing and nonetheless drinks. It sells its merchandise by way of distribution facilities and retailers in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and the Philippines.

Coca-Cola FEMSA is the biggest franchise bottler on the earth. The inventory is an fascinating solution to achieve publicity to 2 very engaging rising markets: Latin America and South Asia.

#9—Walmart Inc. (WMT)

Dividend Yield: 1.5%

Proportion of Invoice Gates’ Portfolio: 1.2%

Walmart is one other nice instance of an organization with sturdy aggressive benefits. It’s the largest retailer within the U.S., with annual income above $600 billion. The corporate got here to dominate the retail business by retaining a laser-like give attention to lowering prices in all places, significantly within the provide chain and distribution.

Customers are likely to scale all the way down to low cost retail when instances are tight, which is why Walmart continued to develop, even through the Nice Recession. In consequence, Walmart is arguably essentially the most recession-resistant inventory within the Gates Basis’s portfolio.

This enables Walmart the power to lift its dividend every year like clockwork, even throughout recessions. Walmart has raised its dividend for over 40 years in a row.

Walmart posted third-quarter earnings on November sixteenth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $1.53, which was a penny forward of estimates.

Income was up 5.2% year-over-year to $160.8 billion and was $2.26 billion higher than anticipated. US comparable gross sales had been up 4.9% year-over-year, which was 150bps higher than anticipated. Transactions rose 3.4%, whereas aWalmart’s common ticket rose 1.5%. Ecommerce contribution to comparable gross sales was down 300bps.

Gross margins had been up fractionally, rising 32bps. Consolidated working bills as a proportion of gross sales rose 37bps, offsetting the rise in gross margins. Working revenue was up 3% year-over-year on an adjusted foundation.

Walmart ended the quarter with internet money of $12.2 billion and whole debt of $55.4 billion. Free money circulate was $4.3 billion, up from $3.6 billion a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walmart (preview of web page 1 of three proven under):

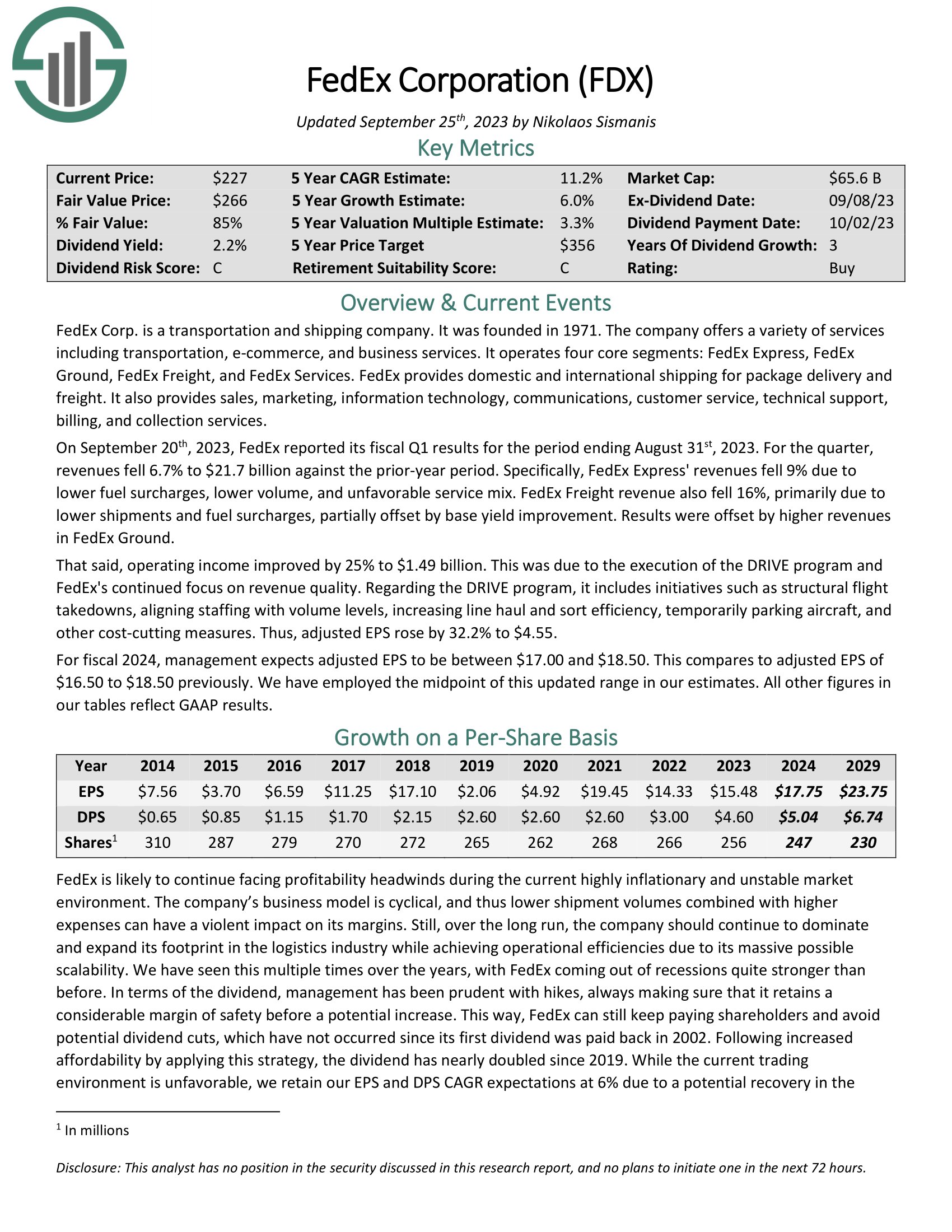

#10—FedEx (FDX)

Dividend Yield: 2.0%

Proportion of Invoice Gates’ Portfolio: 0.9%

FedEx Corp. is a transportation and transport firm. The corporate affords quite a lot of providers, together with transportation, e-commerce, and enterprise providers. It operates 4 core segments: FedEx Categorical, FedEx Floor, FedEx Freight, and FedEx Companies.

On September twentieth, 2023, FedEx reported its fiscal Q1 outcomes for the interval ending August thirty first, 2023. For the quarter, revenues fell 6.7% to $21.7 billion in opposition to the prior-year interval. Particularly, FedEx Categorical’ revenues fell 9% as a consequence of decrease gasoline surcharges, decrease quantity, and unfavorable service combine.

FedEx Freight income additionally fell 16%, primarily as a consequence of decrease shipments and gasoline surcharges, partially offset by base yield enchancment. Outcomes had been offset by increased revenues in FedEx Floor. That stated, working revenue improved by 25% to $1.49 billion. This was as a result of execution of the DRIVE program and FedEx’s continued give attention to income high quality.

Supply: Investor Presentation

The DRIVE program contains initiatives comparable to structural flight takedowns, aligning staffing with quantity ranges, growing line haul and kind effectivity, quickly parking plane, and different cost-cutting measures.

Thus, adjusted EPS rose by 32.2% to $4.55. For fiscal 2024, administration expects adjusted EPS to be between $17.00 and $18.50. This compares to adjusted EPS of $16.50 to $18.50 beforehand.

Click on right here to obtain our most up-to-date Positive Evaluation report on FedEx (preview of web page 1 of three proven under):

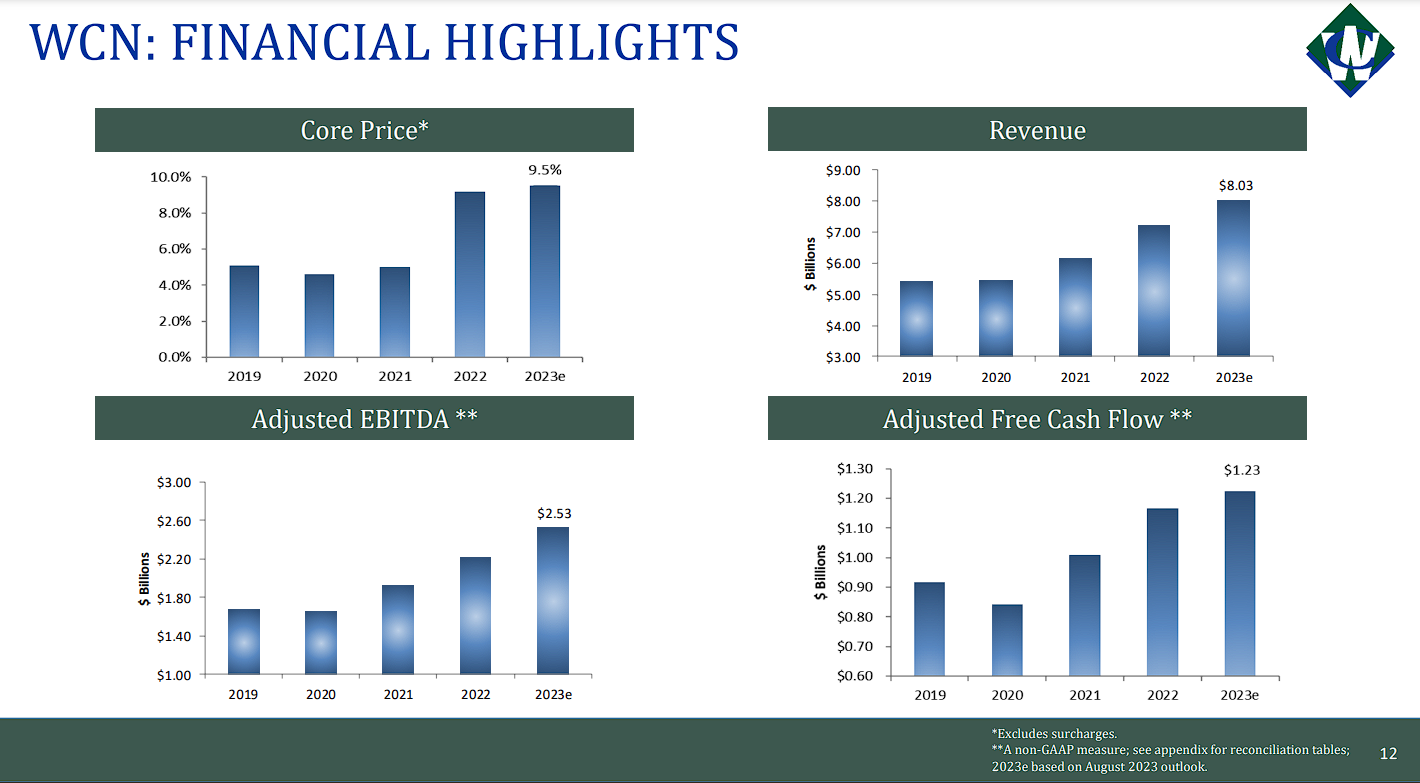

#11—Waste Connections (WCN)

Dividend Yield: 0.9%

Proportion of Invoice Gates’ Portfolio: 0.7%

Waste Connections is a waste assortment, switch, disposal, and useful resource restoration enterprise within the U.S. and Canada. It affords varied recycling providers, together with strong waste in addition to fluids used within the oil and fuel drilling business, serving to to extend the sustainability of these sectors.

The corporate was based in 1997 and is predicated in Canada, with $7.2 billion in annual income and a market cap of $34.4 billion.

Supply: Investor presentation

As we will see, Waste Connections has set sturdy targets for fiscal 2023, as it’s trying to enhance its personal sustainability, in addition to these of its prospects.

Waste Connections has boosted its dividend for 14 consecutive years, however the robust efficiency of the inventory means the yield is low at simply 0.7%. Nonetheless, we see robust dividend development prospects for the inventory within the years to come back.

#12—Schrodinger Inc. (SDGR)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.5%

Schrodinger, Inc. is a healthcare expertise firm. It operates a computational platform that goals to speed up drug supply, each for exterior purchasers and the corporate’s personal inner drug applications. Schrodinger performed its preliminary public providing in February 2020. The inventory at present has a market capitalization of about $ 2.3 billion.

Schrodinger has thrilling development potential as a result of success of its drug supply platform and its giant and diversified buyer base.

Schrodinger has an extended runway of development due to the excessive diploma of worth that its services and products present to prospects. Designing medicine is extraordinarily tough, is advanced, prolonged, capital-intensive, and vulnerable to excessive failure charges. This implies many purchasers will proceed to outsource this work to Schrodinger.

#13—Coupang, Inc. (CPNG)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.3%

Coupang is an e-commerce platform by way of its cell apps and web sites, primarily in South Korea. It sells varied services and products within the classes of residence items, attire, magnificence merchandise, recent meals and groceries, sporting items, electronics, consumables, and extra.

The corporate has gained immense recognition nationwide as a consequence of its give attention to quick and dependable supply providers. Coupang has constructed an in depth logistics community, together with its personal supply fleet and warehouses, to make sure fast and environment friendly supply to its prospects. It has pioneered the idea of “rocket supply,” promising next-day and even same-day supply for a overwhelming majority of its merchandise.

Coupang has additionally invested closely in expertise and innovation to reinforce its buyer expertise. Its cell app and web site present a seamless and user-friendly interface, making it handy for patrons to browse and buy merchandise. The corporate has additionally applied varied options comparable to buyer opinions, customized suggestions, and straightforward returns, additional enhancing its general purchasing expertise.

#14—Crown Fortress Worldwide (CCI)

Dividend Yield: 5.9%

Proportion of Invoice Gates’ Portfolio: 0.3%

Crown Fortress Worldwide is structured as an actual property funding belief or REIT. You’ll be able to see our full REIT record right here.

Crown Fortress owns cellular phone towers with small cells the place bigger towers will not be possible and fiber connections for knowledge transmission. The belief owns, operates, and leases greater than 40,000 cell towers and 85,000 route miles of fiber throughout each main US market, serving to it to help knowledge infrastructure throughout the nation.

Supply: Investor Presentation

Crown Fortress posted third-quarter earnings on October 18th, 2023, and outcomes had been worse than anticipated on each the highest and backside strains. The REIT posted funds-from-operations of $1.77, which missed estimates by three cents.

Income was down about 5% year-over-year to $1.67 billion, which missed estimates by $20 million. Steerage for income and FFO had been additionally under consensus as soon as once more, as weak point continues for Crown Fortress. Website rental income was $1.58 billion, down from $1.73 billion in Q2 however flat to the year-ago interval.

Adjusted EBITDA got here to $1.05 billion, which was barely wanting the consensus. It was additionally down from the year-ago interval and sharply down from $1.19 billion in Q2.

Steerage was lowered barely, and we’ve minimize our estimate once more, this time to $7.40 per share. The REIT minimize income steerage in addition to EBITDA, and we proceed to see weak point on the horizon as Crown Fortress struggles to generate each income and margins.

Click on right here to obtain our most up-to-date Positive Evaluation report on Crown Fortress Worldwide (preview of web page 1 of three proven under):

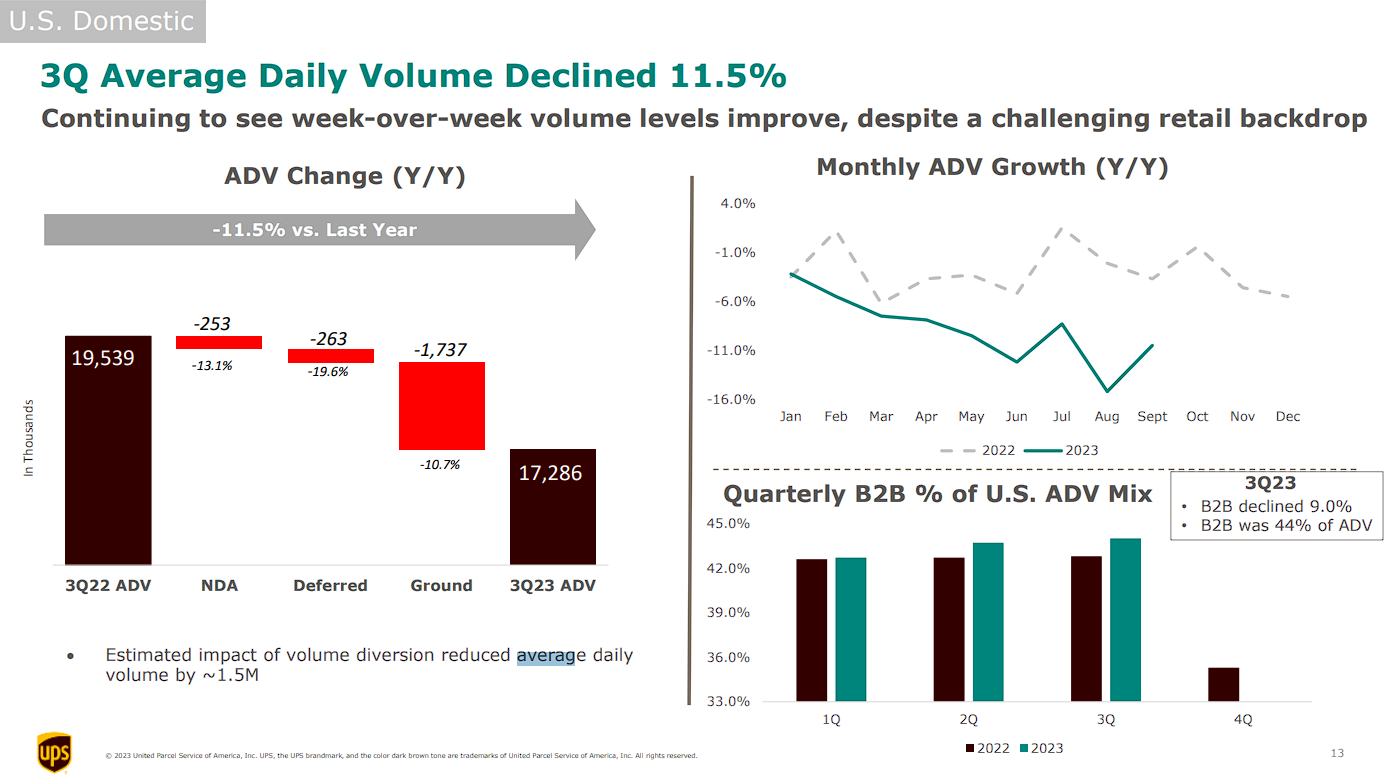

#15—United Parcel Service (UPS)

Dividend Yield: 4.3%

Proportion of Invoice Gates’ Portfolio: 0.3%

United Parcel Service is a logistics and bundle supply firm that gives providers, together with transportation, distribution, floor freight, ocean freight, insurance coverage, and financing. Its operations are break up into three segments: U.S. Home Bundle, Worldwide Bundle, and Provide Chain & Freight.

The corporate’s continued development within the face of potential world financial headwinds is due largely to its aggressive benefits. UPS is the biggest logistics/bundle supply firm within the U.S.

It operates in a close to duopoly, as its solely main competitor up to now is FedEx. To make sure, Amazon (AMZN) is increasing its personal logistics enterprise, nevertheless it nonetheless stays a buyer of UPS as properly.

On October twenty sixth, 2023, UPS reported third quarter 2023 outcomes for the interval ending September thirtieth, 2023. For the quarter, the corporate generated income of $21.1 billion, a 12.8% year-over-year lower. The U.S. Home section (making up 65% of gross sales) noticed an 11.1% income lower, with Worldwide additionally posting an 11% income lower, and Provide Chain Options seeing a 21% lower. Adjusted internet revenue equaled $1.57 per share, down 48% year-over-year.

Supply: Investor Presentation

UPS now expects income of about $91.8 billion (down from $93.0 billion beforehand), together with a consolidated adjusted working margin of 11.1% (down from 11.8% beforehand).

Moreover, management expects capex of $5.3 billion, in addition to $5.4 billion in dividend funds and $2.25 billion (in comparison with 3.0 billion earlier than) in share repurchases.

Click on right here to obtain our most up-to-date Positive Evaluation report on UPS (preview of web page 1 of three proven under):

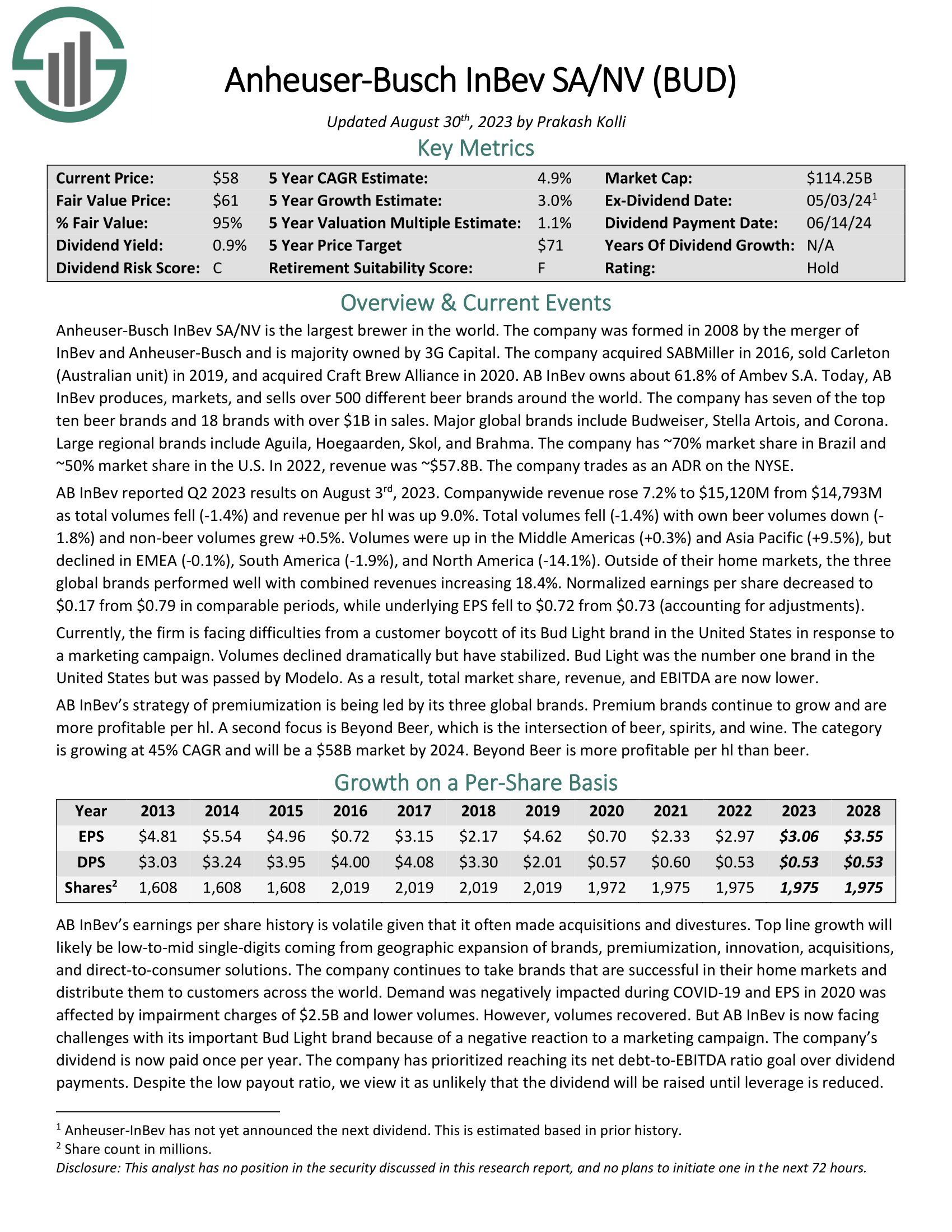

#16—Anheuser-Busch InBev SA/NV (BUD)

Dividend Yield: 1.3%

Proportion of Invoice Gates’ Portfolio: 0.2%

Anheuser-Busch InBev is a multinational beverage and brewing firm headquartered in Leuven, Belgium. It is among the largest and most distinguished beer firms on the earth. The corporate was fashioned by way of a sequence of mergers and acquisitions, together with the merger of Anheuser-Busch and InBev in 2008.

Right this moment, AB InBev produces, markets, and sells over 500 totally different beer manufacturers world wide. The corporate has seven of the highest ten beer manufacturers and 18 manufacturers with over $1B in gross sales. Main world manufacturers embody Budweiser, Stella Artois, and Corona. Massive regional manufacturers embody Aguila, Hoegaarden, Skol, and Brahma.

AB InBev reported Q3 2023 outcomes on October thirty first, 2023. Income rose 5.0% to $15,574M from $15,091M as whole volumes fell (-3.4%) and income per hl was up 9.0%. Complete volumes fell (-3.4%), with personal beer volumes down (-4.0%), and non-beer volumes grew +1.4%. Volumes had been up within the Center Americas (+1.7%) and Asia Pacific (+0.2%) however declined in EMEA (-1.5%), South America (-2.2%), and North America (-17.1%).

Exterior of their residence markets, the 4 world manufacturers carried out properly, with mixed revenues growing 15.1%. Normalized earnings per share elevated to $0.73 from $0.71 in comparable intervals, whereas underlying EPS rose to $0.86 from $0.84 (accounting for changes).

At present, the agency is going through difficulties from a buyer boycott of its Bud Mild model in the USA in response to a advertising and marketing marketing campaign. Volumes declined dramatically however have stabilized. Bud Mild was the primary model in the USA however was handed by Modelo. In consequence, whole market share, income, and EBITDA are actually decrease.

AB InBev’s premiumization technique is led by its 4 world manufacturers. Premium manufacturers proceed to develop and are extra worthwhile per hl. A second focus is Past Beer, which is the intersection of beer, spirits, and wine. The class is rising at 45% CAGR and will probably be a $58B market by 2024. Past Beer is extra worthwhile per hl than beer.

Click on right here to obtain our most up-to-date Positive Evaluation report on BUD (preview of web page 1 of three proven under):

#17—Madison Sq. Backyard Sports activities Corp. (MSGS)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.2%

Madison Sq. Backyard Sports activities Corp. is a diversified sports activities firm. It owns a number of sports activities franchises, together with the New York Knicks and the New York Rangers. It additionally owns improvement league groups such because the Hartford Wolf Pack and the Westchester Knicks of the NBA G League. It additionally owns e-sports properties, together with Knicks Gaming, and a controlling curiosity in Counter Logic Gaming (CLG).

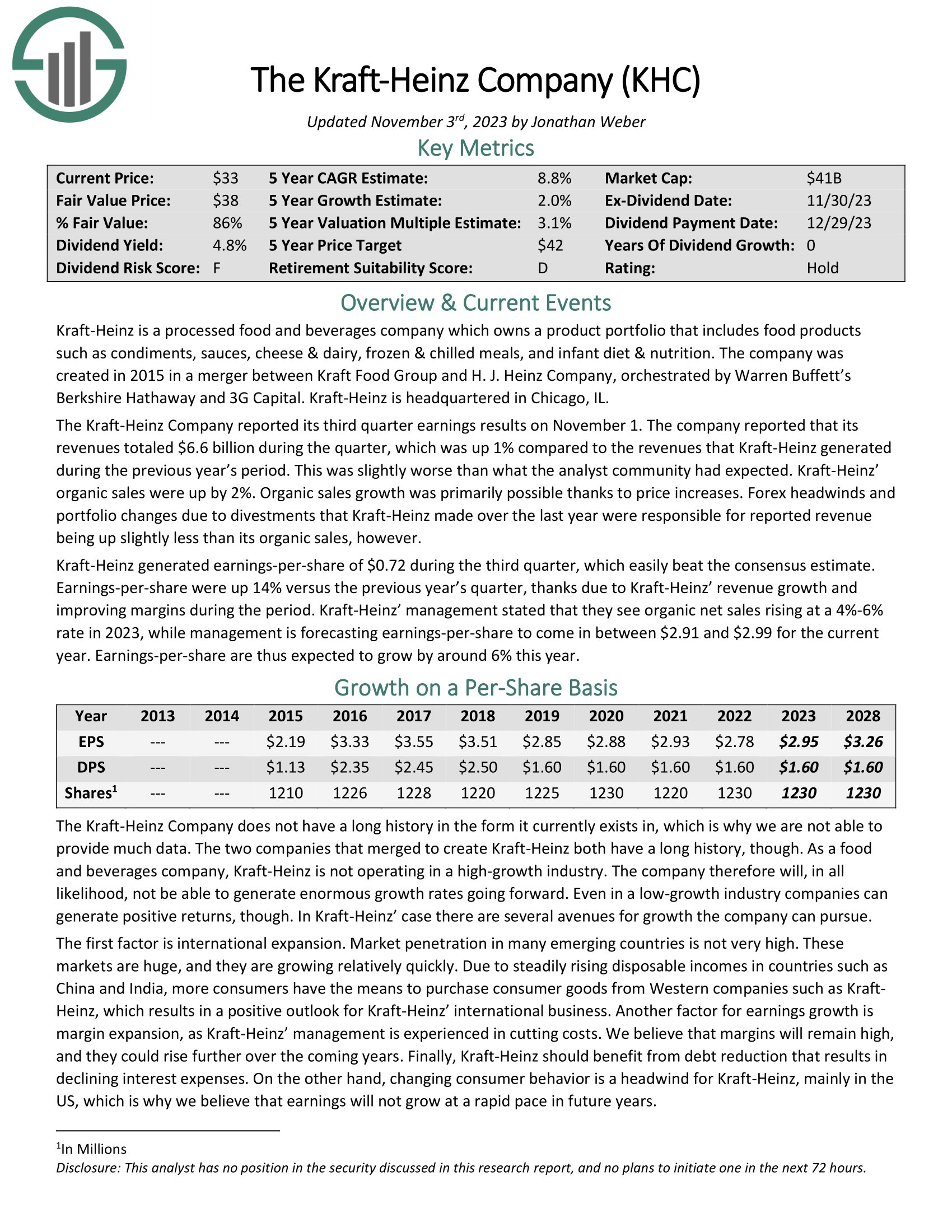

#18—Kraft Heinz (KHC)

Dividend Yield: 4.6%

Proportion of Invoice Gates’ Portfolio: 0.2%

Kraft–Heinz is a processed meals and drinks firm that owns a product portfolio that contains meals merchandise comparable to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler food regimen & nutrition. The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Berkshire Hathaway and 3G Capital.

The Kraft-Heinz Firm reported its third-quarter earnings outcomes on November 1. The corporate reported that its revenues totaled $6.6 billion through the quarter, which was up 1% in comparison with the revenues that Kraft-Heinz generated through the earlier 12 months’s interval. This was barely worse than what the analyst group had anticipated. Kraft-Heinz’s natural gross sales had been up by 2%.

Natural gross sales development was primarily potential thanks to cost will increase. Foreign exchange headwinds and portfolio adjustments as a consequence of divestments that Kraft-Heinz made during the last 12 months had been chargeable for reported income being up barely lower than its natural gross sales, nevertheless.

Kraft-Heinz generated earnings-per-share of $0.72 through the third quarter, which simply beat the consensus estimate. Earnings-per-share had been up 14% versus the earlier 12 months’s quarter, because of Kraft-Heinz’s income development and enhancing margins through the interval.

Kraft-Heinz’s administration acknowledged that they see natural internet gross sales rising at a 4%-6% charge in 2023, whereas administration is forecasting earnings-per-share to come back in between $2.91 and $2.99 for the present 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Kraft-Heinz (preview of web page 1 of three proven under):

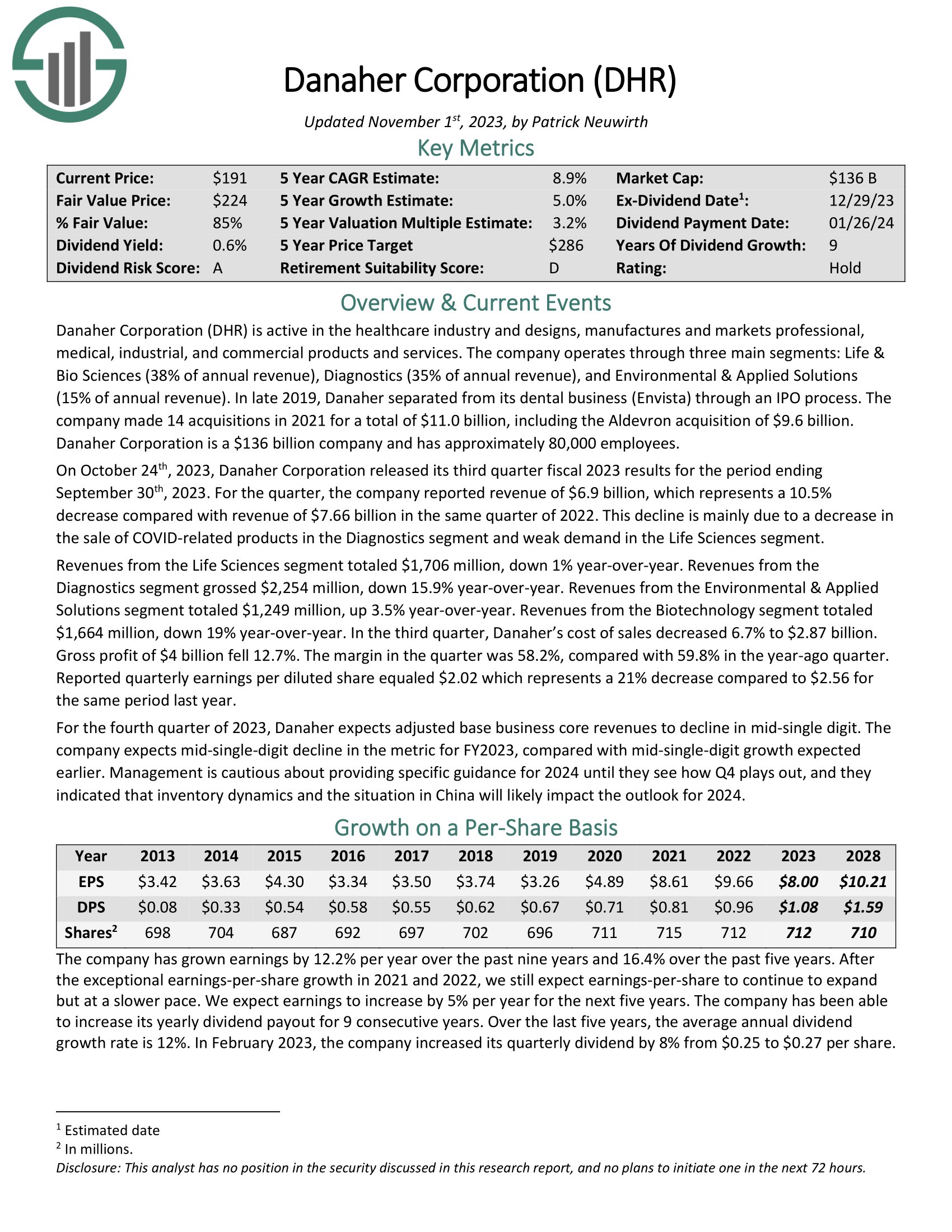

#19—Danaher Company (DHR)

Dividend Yield: 0.5%

Proportion of Invoice Gates’ Portfolio: 0.2%

Danaher Company is energetic within the healthcare business and designs, manufactures, and markets skilled, medical, industrial, and industrial services and products. The corporate operates by way of three essential segments: Life & Bio Sciences (38% of annual income – finish of 2022), Diagnostics (35% of annual income), and Environmental & Utilized Options (15% of annual income). The corporate made 14 acquisitions in 2021 for a complete of $11.0 billion, together with the Aldevron acquisition of $9.6 billion.

On October twenty fourth, 2023, Danaher Company launched its third quarter fiscal 2023 outcomes for the interval ending September thirtieth, 2023.

For the quarter, the corporate reported income of $6.9 billion, which represents a ten.5% lower in contrast with income of $7.66 billion in the identical quarter of 2022. This decline is especially as a consequence of a lower within the sale of COVID-related merchandise within the Diagnostics section and weak demand within the Life Sciences section.

Revenues from the Life Sciences section totaled $1,706 million, down 1% year-over-year.

Revenues from the Diagnostics section grossed $2,254 million, down 15.9% year-over-year.

Revenues from the Environmental & Utilized Options section totaled $1,249 million, up 3.5% year-over-year.

Revenues from the Biotechnology section totaled $1,664 million, down 19% year-over-year.

Within the third quarter, Danaher’s price of gross sales decreased 6.7% to $2.87 billion. Gross revenue of $4 billion fell 12.7%. The margin within the quarter was 58.2%, in contrast with 59.8% within the year-ago quarter. Reported quarterly earnings per diluted share equaled $2.02 which represents a 21% lower in comparison with $2.56 for a similar interval final 12 months.

For the fourth quarter of 2023, Danaher expects adjusted base enterprise core revenues to say no in mid-single digits. The corporate expects a mid-single-digit decline within the metric for FY2023, in contrast with the mid-single-digit development anticipated earlier. Administration is cautious about offering particular steerage for 2024 till they see how This fall performs out, they usually indicated that stock dynamics and the state of affairs in China will doubtless affect the outlook for 2024

Click on right here to obtain our most up-to-date Positive Evaluation report on Danaher (preview of web page 1 of three proven under):

#20—Hormel Meals (HRL)

Dividend Yield: 3.5%

Proportion of Invoice Gates’ Portfolio: 0.2%

Hormel Meals was based in 1891. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with practically $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for properly over 100 years however has additionally grown into different enterprise strains by way of acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its high manufacturers embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

As well as, Hormel is a member of the Dividend Kings, having elevated its dividend for 57 consecutive years.

Hormel posted third-quarter earnings on August thirty first, 2023, and outcomes had been weaker than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 40 cents, which missed estimates by a penny. Income fell 2.3% year-over-year to $2.96 billion, which missed consensus by $90 million.

Retail section quantity was up 1%, whereas internet gross sales fell 2%, and section revenue was down 7%. Foodservice quantity was up 2%, whereas internet gross sales fell 3%, however section revenue rose 14%. The worldwide section noticed quantity decline 10%, whereas internet gross sales fell 6%, and section revenue was minimize in half.

The corporate stated quantity development was pushed by stronger outcomes from turkey, broad demand for meals service merchandise, and energy in SPAM, Black Label, Planters, and pepperoni. A few of this was offset by provide chain disruptions within the firm’s worldwide section. We now see $1.65 in earnings-per-share for this 12 months after weaker-than-expected Q3 earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on Hormel (preview of web page 1 of three proven under):

#21—Carvana Co. (CVNA)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.04%

Carvana is an e-commerce platform for purchasing and promoting used vehicles in the USA. The corporate’s platform permits prospects to analysis, examine, acquire financing for, and buy autos from their desktop or cell units.

#22—On Holding AG (ON)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.03%

On Holding is predicated in Switzerland, and it develops and distributes sports activities merchandise worldwide. It affords its merchandise by way of impartial retailers and distributors, on-line, and shops.

On has shortly gained recognition amongst athletes and operating lovers worldwide for its dedication to delivering distinctive consolation, efficiency, and elegance. The corporate has skilled fast development since its inception and has established a robust presence within the world sports activities market.

The product portfolio of On contains a variety of trainers tailor-made for various terrains, comparable to street operating, path operating, and all-terrain operating. They’ve additionally expanded their choices to incorporate attire and equipment like jackets, shirts, shorts, socks, and backpacks, which counterpoint their footwear line.

Extra Sources

See the articles under for evaluation on different main funding companies/asset managers/gurus:

In case you are interested by discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link