[ad_1]

Up to date on November twentieth, 2023 by Bob Ciura

Kevin O’Leary is Chairman of O’Shares Funding Advisors, however you in all probability know him as “Mr. Fantastic”.

He will be seen on CNBC in addition to the tv present Shark Tank. Traders who’ve seen him on TV have seemingly heard him talk about his funding philosophy.

Mr. Fantastic appears to be like for shares that exhibit three predominant traits:

First, they have to be high quality corporations with sturdy monetary efficiency and strong stability sheets.

Second, he believes a portfolio ought to be diversified throughout completely different market sectors.

Third, and maybe most vital, he calls for earnings—he insists the shares he invests in pay dividends to shareholders.

You’ll be able to obtain the entire checklist of all of O’Shares Funding Advisors inventory holdings by clicking the hyperlink beneath:

OUSA owns shares that show a mixture of all three qualities. They’re market leaders with sturdy earnings, diversified enterprise fashions, they usually pay dividends to shareholders. The checklist of OUSA portfolio holdings is an fascinating supply of high quality dividend development shares.

This text analyzes the fund’s largest holdings intimately.

Desk of Contents

The highest 10 holdings from the O’Shares FTSE U.S. High quality Dividend ETF are listed so as of their weighting within the fund, from lowest to highest.

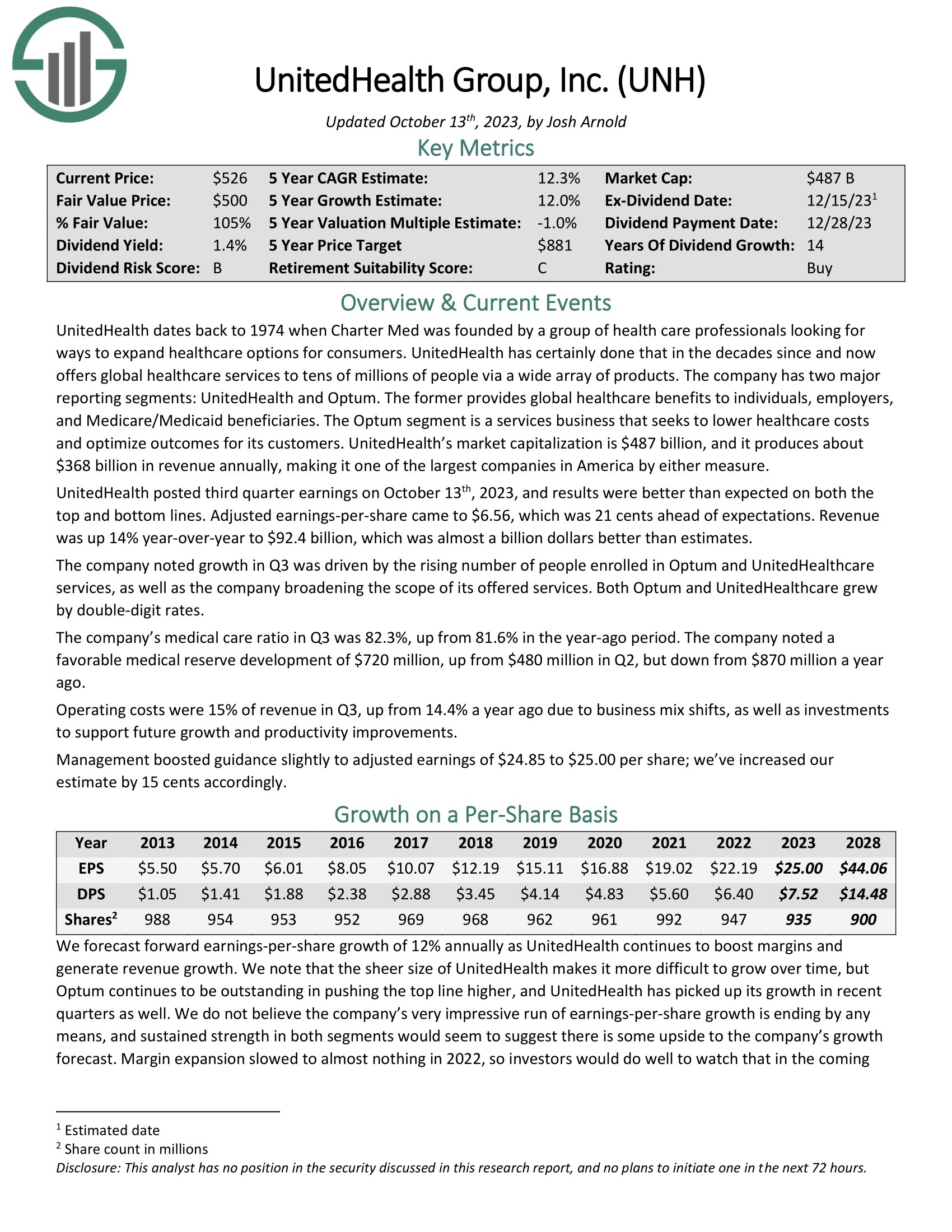

No. 10: UnitedHealth Group (UNH)

Dividend Yield: 1.4%

Proportion of OUSA Portfolio: 2.96%

UnitedHealth gives world healthcare companies to tens of hundreds of thousands of individuals through a wide selection of merchandise. The corporate has two main reporting segments: UnitedHealth and Optum. The previous offers world healthcare advantages to people, employers, and Medicare/Medicaid beneficiaries. The Optum section is a companies enterprise that seeks to decrease healthcare prices and optimize outcomes for its clients.

UnitedHealth posted third quarter earnings on October thirteenth, 2023, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $6.56, which was 21 cents forward of expectations. Income was up 14% year-over-year to $92.4 billion, which was virtually a billion {dollars} higher than estimates.

The corporate famous development in Q3 was pushed by the rising variety of individuals enrolled in Optum and UnitedHealthcare companies, in addition to the corporate broadening the scope of its provided companies. Each Optum and UnitedHealthcare grew by double-digit charges.

Click on right here to obtain our most up-to-date Certain Evaluation report on UNH (preview of web page 1 of three proven beneath):

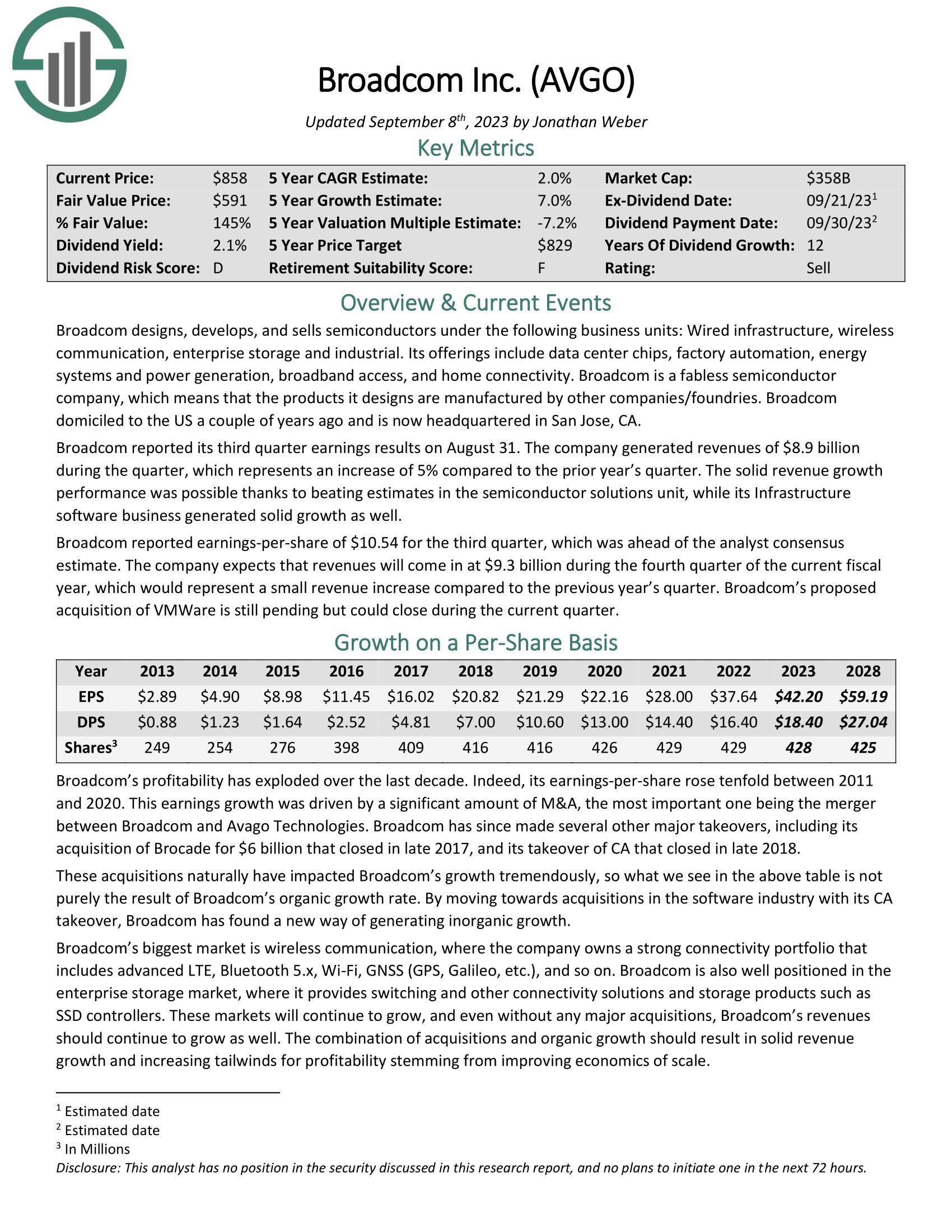

No. 9: Broadcom (AVGO)

Dividend Yield: 4.5%

Proportion of OUSA Portfolio: 3.13%

Broadcom designs, develops, and sells semiconductors below the next enterprise models: Wired infrastructure, wi-fi communication, enterprise storage and industrial. Its choices embrace information heart chips, manufacturing unit automation, vitality methods and energy era, broadband entry, and residential connectivity. Broadcom is a fabless semiconductor firm, which signifies that the merchandise it designs are manufactured by different corporations/foundries.

Broadcom reported its third quarter earnings outcomes on August 31. The corporate generated revenues of $8.9 billion in the course of the quarter, which represents a rise of 5% in comparison with the prior yr’s quarter. The strong income development efficiency was attainable due to beating estimates within the semiconductor options unit, whereas its Infrastructure software program enterprise generated strong development as properly.

Broadcom reported earnings-per-share of $10.54 for the third quarter, which was forward of the analyst consensus estimate. The corporate expects that revenues will are available at $9.3 billion in the course of the fourth quarter of the present fiscal yr, which might characterize a small income enhance in comparison with the earlier yr’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on AVGO (preview of web page 1 of three proven beneath):

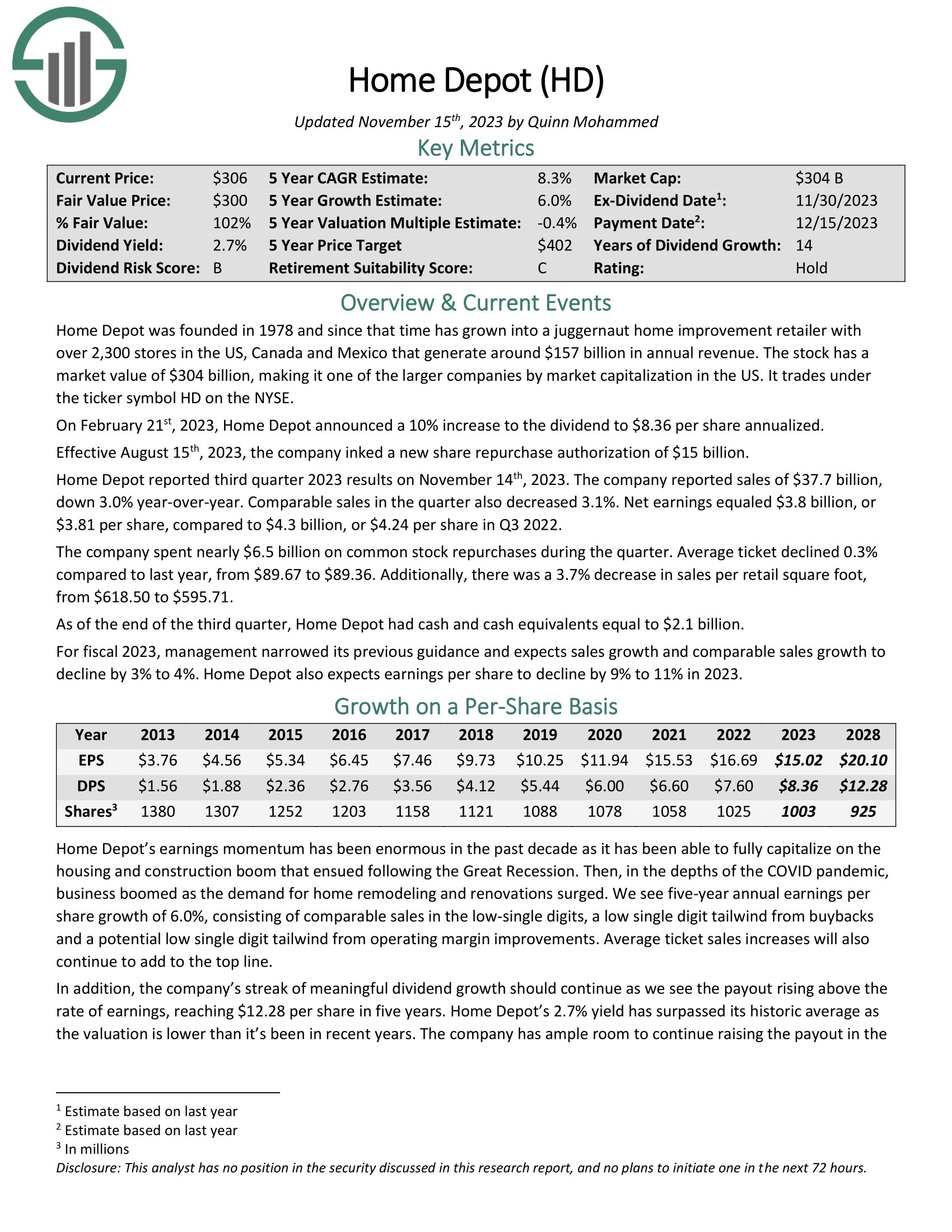

No. 8: Dwelling Depot (HD)

Dividend Yield: 2.7%

Proportion of OUSA Portfolio: 3.15%

Dwelling Depot is a juggernaut dwelling enchancment retailer with over 2,300 shops within the US, Canada and Mexico that generate round $157 billion in annual income. On February twenty first, 2023, Dwelling Depot introduced a ten% enhance to the dividend to $8.36 per share annualized.

Efficient August fifteenth, 2023, the corporate inked a brand new share repurchase authorization of $15 billion. Dwelling Depot reported third quarter 2023 outcomes on November 14th, 2023. The corporate reported gross sales of $37.7 billion, down 3.0% year-over-year. Comparable gross sales within the quarter additionally decreased 3.1%. Internet earnings equaled $3.8 billion, or $3.81 per share, in comparison with $4.3 billion, or $4.24 per share in Q3 2022.

The corporate spent almost $6.5 billion on widespread inventory repurchases in the course of the quarter. Common ticket declined 0.3% in comparison with final yr, from $89.67 to $89.36. Moreover, there was a 3.7% lower in gross sales per retail sq. foot, from $618.50 to $595.71.

Click on right here to obtain our most up-to-date Certain Evaluation report on HD (preview of web page 1 of three proven beneath):

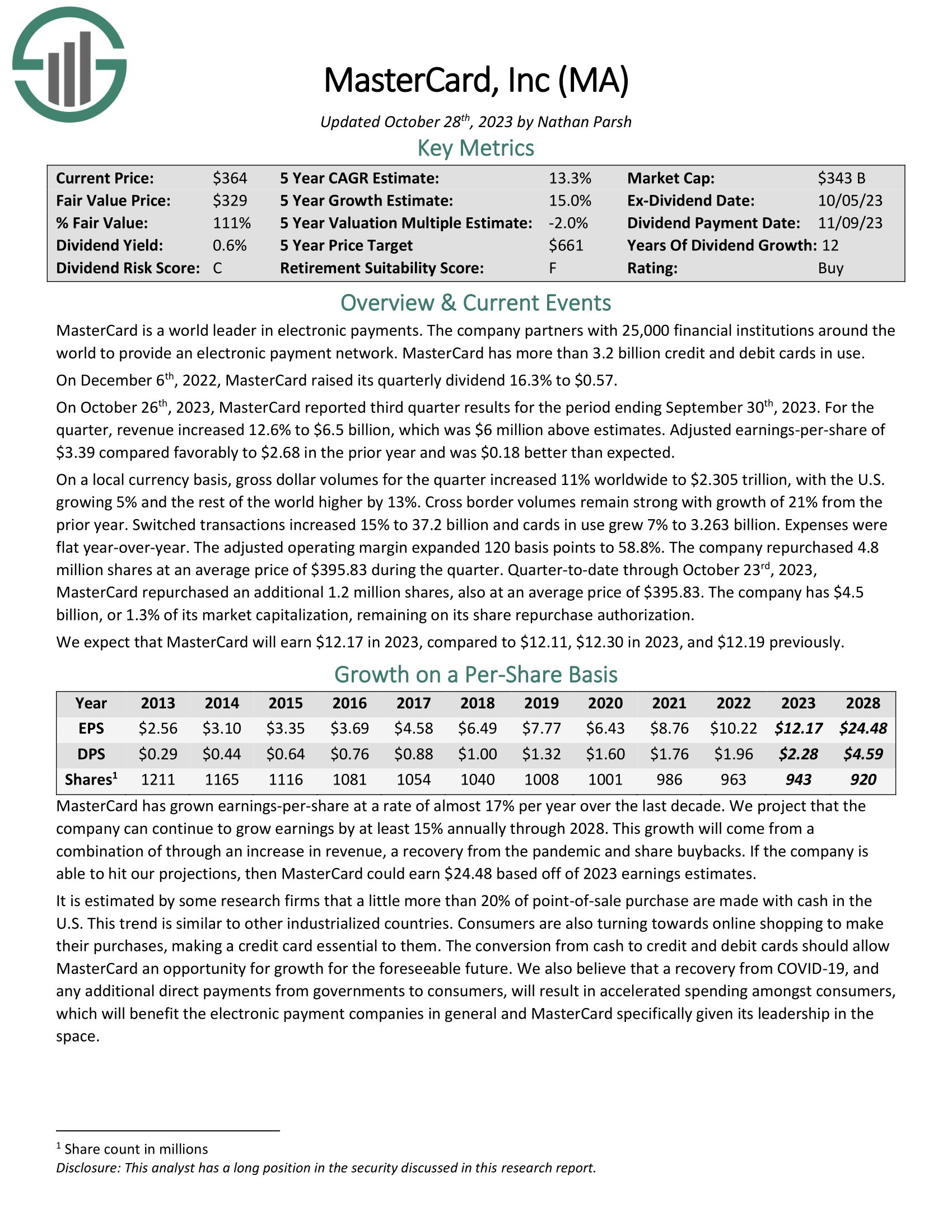

No. 7: Mastercard Inc. (MA)

Dividend Yield: 0.5%

Proportion of OUSA Portfolio: 3.20%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments around the globe to offer an digital cost community. MasterCard has greater than 3.2 billion credit score and debit playing cards in use.

On October twenty sixth, 2023, MasterCard reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income elevated 12.6% to $6.5 billion, which was $6 million above estimates. Adjusted earnings-per-share of $3.39 in contrast favorably to $2.68 within the prior yr and was $0.18 higher than anticipated.

On a neighborhood forex foundation, gross greenback volumes for the quarter elevated 11% worldwide to $2.305 trillion, with the U.S. rising 5% and the remainder of the world greater by 13%. Cross border volumes stay sturdy with development of 21% from the prior yr. Switched transactions elevated 15% to 37.2 billion and playing cards in use grew 7% to three.263 billion. Bills have been flat year-over-year. The adjusted working margin expanded 120 foundation factors to 58.8%.

The corporate repurchased 4.8 million shares at a mean value of $395.83 in the course of the quarter. Quarter-to-date by way of October twenty third, 2023, MasterCard repurchased a further 1.2 million shares, additionally at a mean value of $395.83. The corporate has $4.5 billion, or 1.3% of its market capitalization, remaining on its share repurchase authorization.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

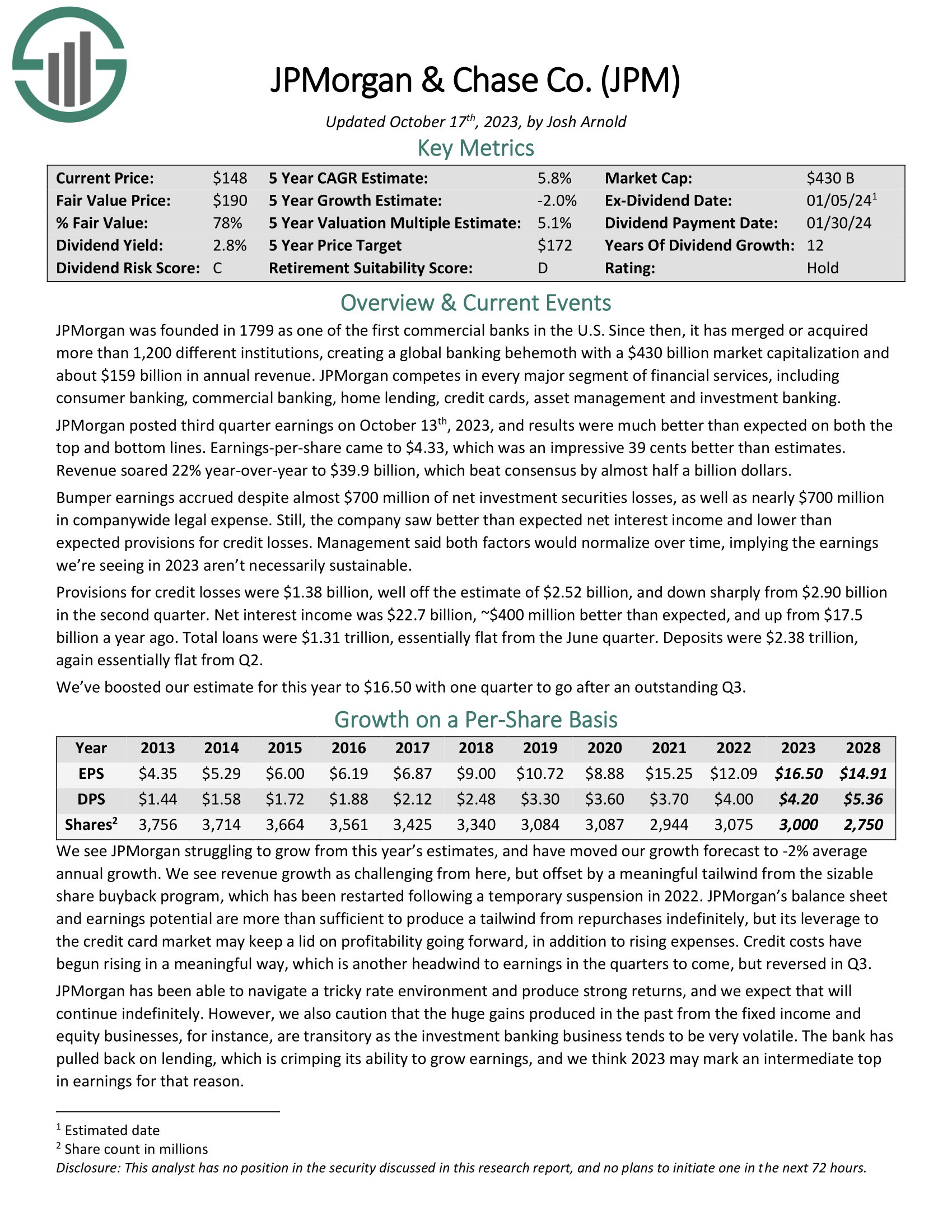

No. 6: J.P. Morgan Chase (JPM)

Dividend Yield: 2.7%

Proportion of OUSA Portfolio: 3.79%

JPMorgan was based in 1799 as one of many first business banks within the U.S. Since then, it has merged or acquired greater than 1,200 completely different establishments, creating a world banking behemoth with about $159 billion in annual income. JPMorgan competes in each main section of economic companies, together with client banking, business banking, dwelling lending, bank cards, asset administration and funding banking.

JPMorgan posted third quarter earnings on October thirteenth, 2023, and outcomes have been significantly better than anticipated on each the highest and backside traces. Earnings-per-share got here to $4.33, which was a powerful 39 cents higher than estimates. Income soared 22% year-over-year to $39.9 billion, which beat consensus by virtually half a billion {dollars}.

Provisions for credit score losses have been $1.38 billion, properly off the estimate of $2.52 billion, and down sharply from $2.90 billion within the second quarter. Internet curiosity earnings was $22.7 billion, ~$400 million higher than anticipated, and up from $17.5 billion a yr in the past. Whole loans have been $1.31 trillion, primarily flat from the June quarter. Deposits have been $2.38 trillion, once more primarily flat from Q2.

Click on right here to obtain our most up-to-date Certain Evaluation report on JPM (preview of web page 1 of three proven beneath):

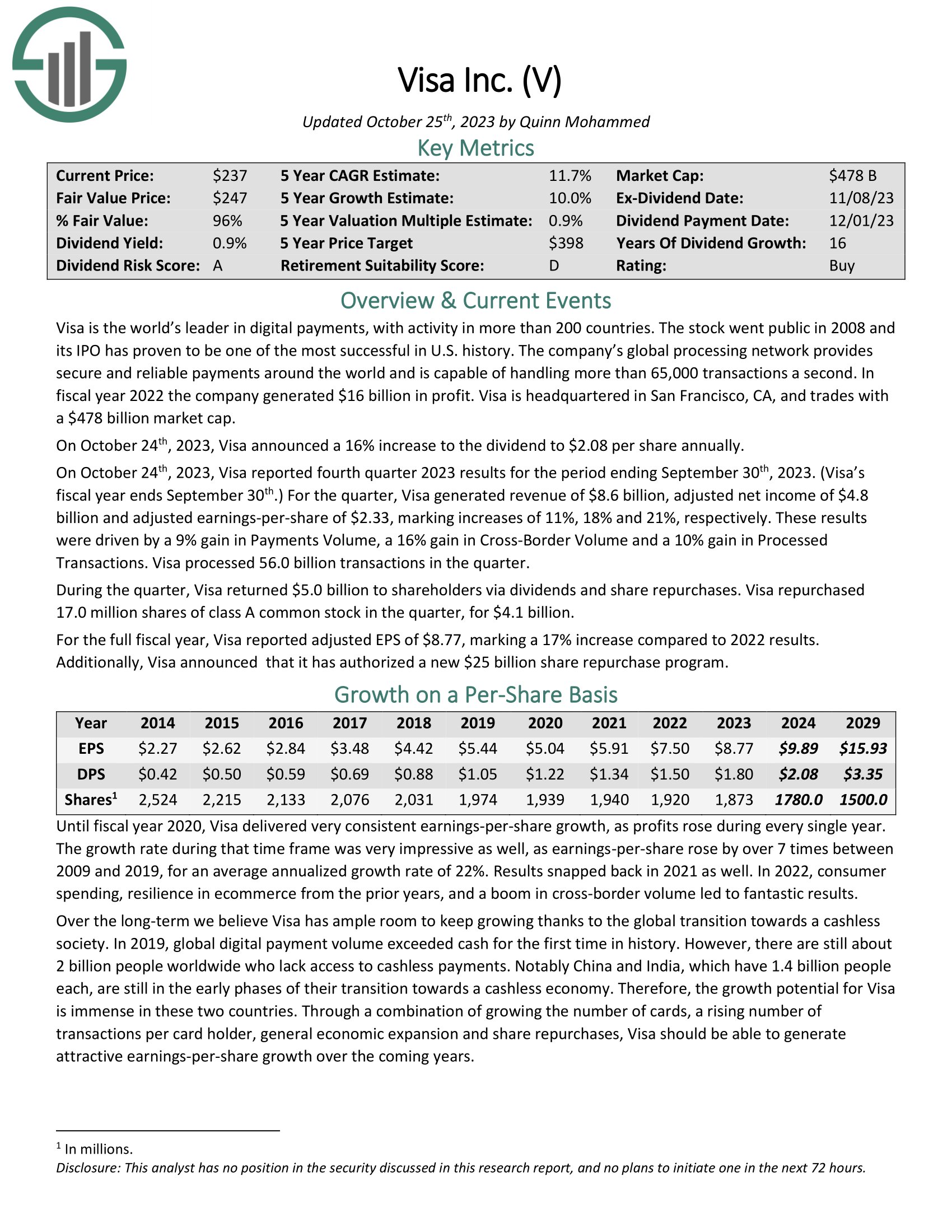

No. 5: Visa Inc. (V)

Dividend Yield: 0.8%

Proportion of OUSA Portfolio: 3.97%

Visa is the world’s chief in digital funds, with exercise in additional than 200 international locations. The corporate’s world processing community offers safe and dependable funds around the globe and is able to dealing with greater than 65,000 transactions a second. In fiscal yr 2022 the corporate generated $16 billion in revenue.

On October twenty fourth, 2023, Visa introduced a 16% enhance to the dividend to $2.08 per share yearly.

On October twenty fourth, 2023, Visa reported fourth quarter 2023 outcomes for the interval ending September thirtieth, 2023. (Visa’s fiscal yr ends September thirtieth.) For the quarter, Visa generated income of $8.6 billion, adjusted internet earnings of $4.8 billion and adjusted earnings-per-share of $2.33, marking will increase of 11%, 18% and 21%, respectively.

These outcomes have been pushed by a 9% acquire in Funds Quantity, a 16% acquire in Cross-Border Quantity and a ten% acquire in Processed Transactions. Visa processed 56.0 billion transactions within the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on Visa (preview of web page 1 of three proven beneath):

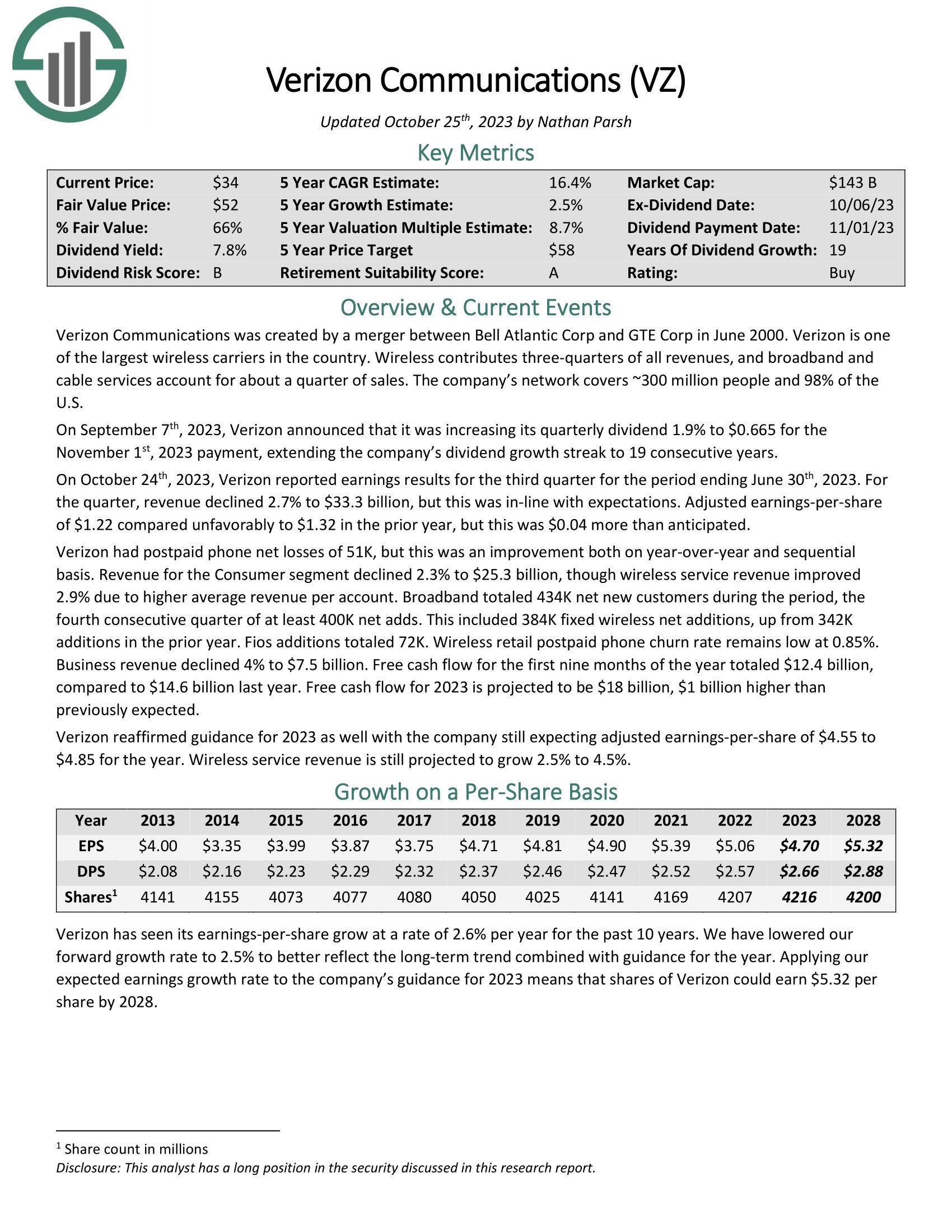

No. 4: Verizon Communications (VZ)

Dividend Yield: 7.3%

Proportion of OUSA Portfolio: 4.23%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is without doubt one of the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On September seventh, 2023, Verizon introduced that it was growing its quarterly dividend 1.9% to $0.665 for the November 1st, 2023 cost, extending the corporate’s dividend development streak to 19 consecutive years. On October twenty fourth, 2023, Verizon reported earnings outcomes for the third quarter for the interval ending June thirtieth, 2023. For the quarter, income declined 2.7% to $33.3 billion, however this was in-line with expectations. Adjusted earnings-per-share of $1.22 in contrast unfavorably to $1.32 within the prior yr, however this was $0.04 greater than anticipated.

Verizon had postpaid telephone internet losses of 51K, however this was an enchancment each on year-over-year and sequential foundation. Income for the Shopper section declined 2.3% to $25.3 billion, although wi-fi service income improved 2.9% as a result of greater common income per account. Broadband totaled 434K internet new clients in the course of the interval, the fourth consecutive quarter of not less than 400K internet provides.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

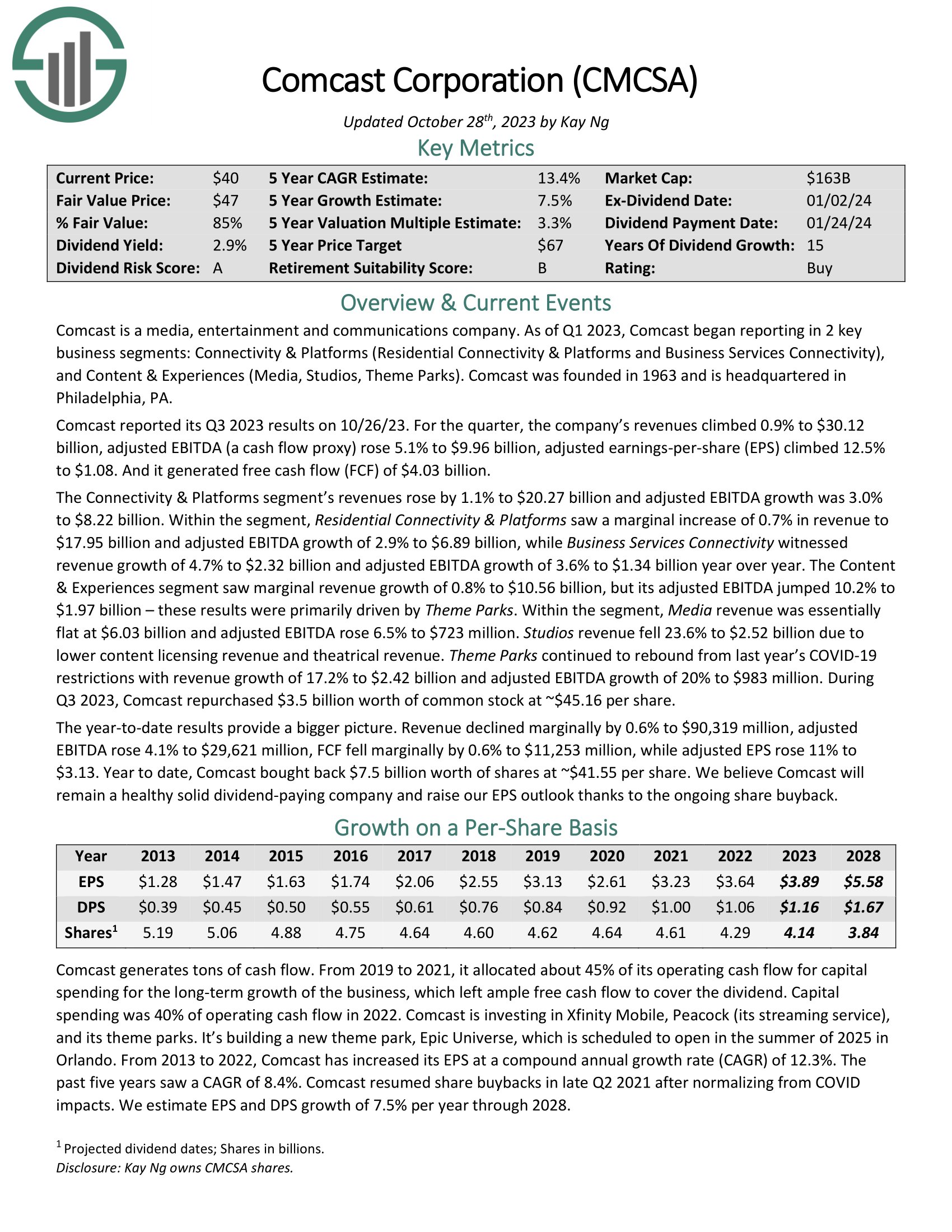

No. 3: Comcast Company (CMCSA)

Dividend Yield: 2.7%

Proportion of Portfolio: 4.46%

Comcast is a media, leisure and communications firm. As of Q1 2023, Comcast started reporting in 2 key enterprise segments: Connectivity & Platforms (Residential Connectivity & Platforms and Enterprise Companies Connectivity), and Content material & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q3 2023 outcomes on 10/26/23. For the quarter, the corporate’s revenues climbed 0.9% to $30.12 billion, adjusted EBITDA (a money movement proxy) rose 5.1% to $9.96 billion, adjusted earnings-per-share (EPS) climbed 12.5% to $1.08. And it generated free money movement (FCF) of $4.03 billion.

The Connectivity & Platforms section’s revenues rose by 1.1% to $20.27 billion and adjusted EBITDA development was 3.0% to $8.22 billion. Inside the section, Residential Connectivity & Platforms noticed a marginal enhance of 0.7% in income to $17.95 billion and adjusted EBITDA development of two.9% to $6.89 billion, whereas Enterprise Companies Connectivity witnessed income development of 4.7% to $2.32 billion and adjusted EBITDA development of three.6% to $1.34 billion yr over yr.

The Content material & Experiences section noticed marginal income development of 0.8% to $10.56 billion, however its adjusted EBITDA jumped 10.2% to $1.97 billion – these outcomes have been primarily pushed by Theme Parks. Throughout Q3 2023, Comcast repurchased $3.5 billion value of widespread inventory at ~$45.16 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on CMCSA (preview of web page 1 of three proven beneath):

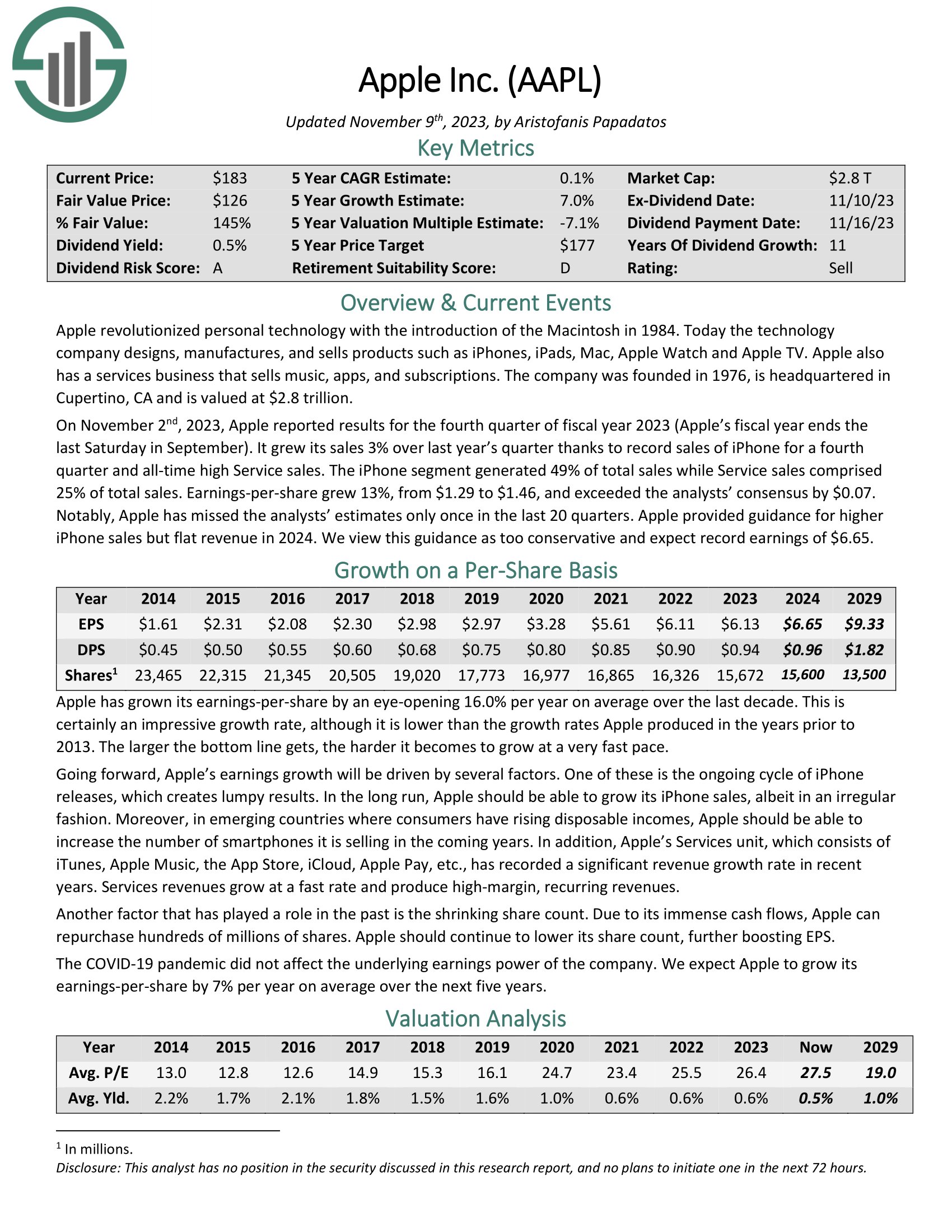

No. 2: Apple (AAPL)

Dividend Yield: 0.51%

Proportion of OUSA Portfolio: 5.30%

Apple designs, manufactures and sells know-how merchandise resembling iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a companies enterprise that sells music, apps, and subscriptions.

Apple inventory is the #1 holding of Berkshire Hathaway (BRK.B), making the know-how large one of many high Warren Buffett shares.

On November 2nd, 2023, Apple reported outcomes for the fourth quarter of fiscal yr 2023 (Apple’s fiscal yr ends the final Saturday in September). It grew its gross sales 3% over final yr’s quarter due to file gross sales of iPhone for a fourth quarter and all-time excessive Service gross sales. The iPhone section generated 49% of complete gross sales whereas Service gross sales comprised 25% of complete gross sales. Earnings-per-share grew 13%, from $1.29 to $1.46, and exceeded the analysts’ consensus by $0.07.

Click on right here to obtain our most up-to-date Certain Evaluation report on AAPL (preview of web page 1 of three proven beneath):

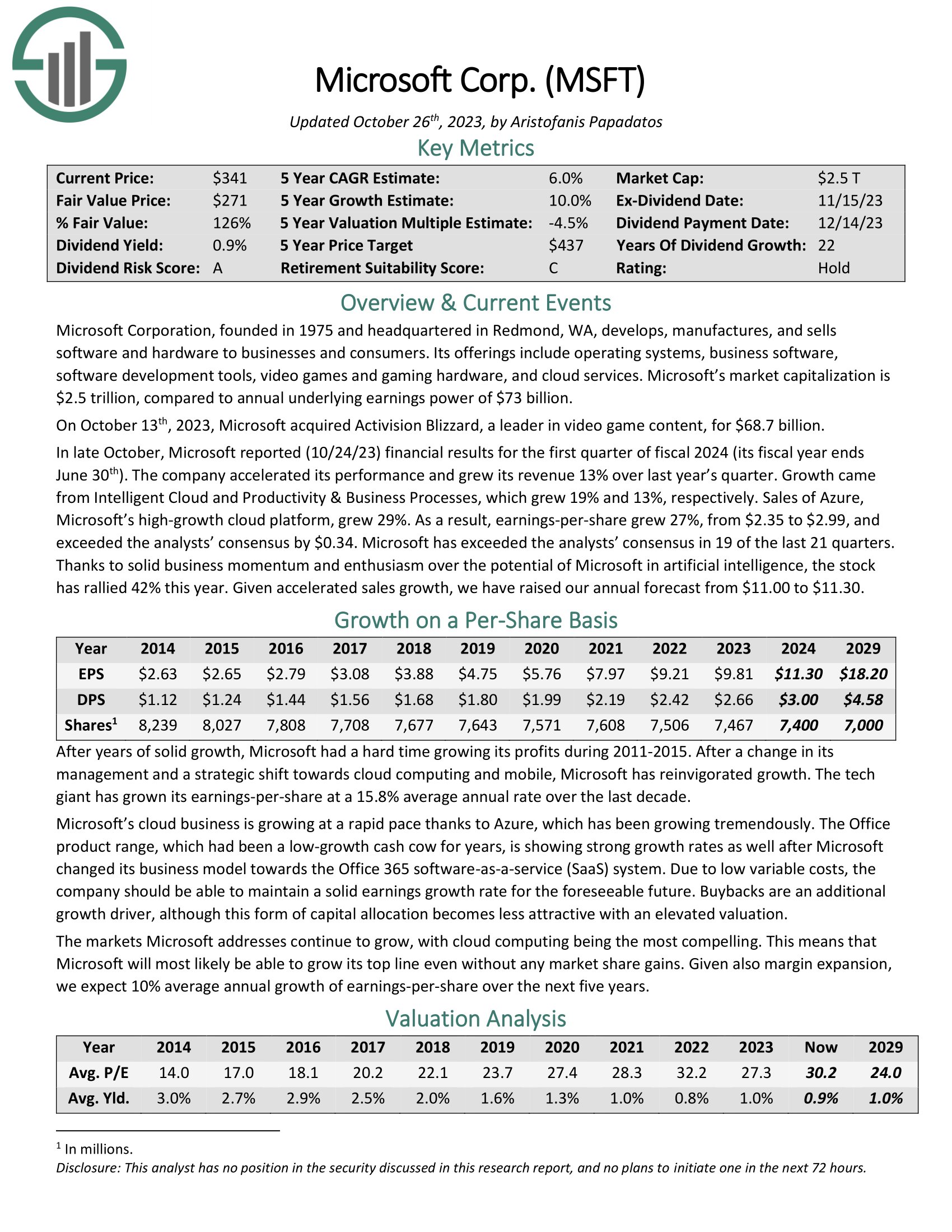

No. 1: Microsoft Company (MSFT)

Dividend Yield: 0.81%

Proportion of OUSA Portfolio: 5.56%

Microsoft Company, based in 1975 and headquartered in Redmond, WA, develops, manufactures and sells each software program and {hardware} to companies and customers.

Its choices embrace working methods, enterprise software program, software program growth instruments, video video games and gaming {hardware}, and cloud companies.

In late October, Microsoft reported (10/24/23) monetary outcomes for the primary quarter of fiscal 2024 (its fiscal yr ends June thirtieth). The corporate accelerated its efficiency and grew its income 13% over final yr’s quarter. Development got here from Clever Cloud and Productiveness & Enterprise Processes, which grew 19% and 13%, respectively.

Gross sales of Azure, Microsoft’s high-growth cloud platform, grew 29%. In consequence, earnings-per-share grew 27%, from $2.35 to $2.99, and exceeded the analysts’ consensus by $0.34.

Click on right here to obtain our most up-to-date Certain Evaluation report on Microsoft (preview of web page 1 of three proven beneath):

Ultimate Ideas

Kevin O’Leary has grow to be a family title as a result of his appearances on the TV present Shark Tank. However he’s additionally a widely known asset supervisor, and his funding philosophy largely aligns with Certain Dividend’s. Particularly, Mr. Fantastic usually invests in shares with massive and worthwhile companies, with sturdy stability sheets and constant dividend development yearly.

Not all of those shares are at present rated as buys within the Certain Evaluation Analysis Database, which ranks shares based mostly on anticipated complete return as a result of a mix of earnings per share development, dividends, and modifications within the price-to-earnings a number of.

Nevertheless, a number of of those 10 shares are beneficial holdings for a long-term dividend development portfolio.

Extra Assets

See the articles beneath for evaluation on different main funding corporations/asset managers/gurus:

In case you are concerned with discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The most important home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link