[ad_1]

Up to date on November ninth, 2023 by Bob CiuraSpreadsheet knowledge up to date each day

Actual property funding trusts – or REITs, for brief – may be improbable securities for producing significant portfolio earnings. REITs broadly provide increased dividend yields than the common inventory.

Whereas the S&P 500 Index on common yields lower than 2% proper now, it’s comparatively straightforward to search out REITs with dividend yields of 5% or increased.

The next downloadable REIT listing accommodates a complete listing of U.S. Actual Property Funding Trusts, together with metrics that matter together with:

Inventory value

Dividend yield

Market capitalization

5-year beta

You’ll be able to obtain your free 200+ REIT listing (together with necessary monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink under:

Along with the downloadable Excel sheet of all REITs, this text discusses why earnings buyers ought to pay notably shut consideration to this asset class. And, we additionally embody our prime 7 REITs at present primarily based on anticipated whole returns.

Desk Of Contents

Along with the total downloadable Excel spreadsheet, this text covers our prime 7 REITs at present, as ranked utilizing anticipated whole returns from The Positive Evaluation Analysis Database.

The desk of contents under permits for straightforward navigation.

How To Use The REIT Record To Discover Dividend Inventory Concepts

REITs give buyers the flexibility to expertise the financial advantages related to actual property possession with out the effort of being a landlord within the conventional sense.

Due to the month-to-month rental money flows generated by REITs, these securities are well-suited to buyers that purpose to generate earnings from their funding portfolios. Accordingly, dividend yield would be the main metric of curiosity for a lot of REIT buyers.

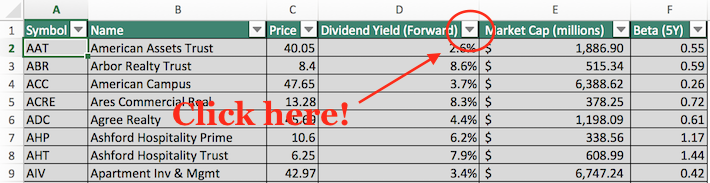

For these unfamiliar with Microsoft Excel, the next pictures present the way to filter for top dividend REITs with dividend yields between 5% and seven% utilizing the ‘filter’ perform of Excel.

Step 1: Obtain the Full REIT Excel Spreadsheet Record on the hyperlink above.

Step 2: Click on on the filter icon on the prime of the ‘Dividend Yield’ column within the Full REIT Excel Spreadsheet Record.

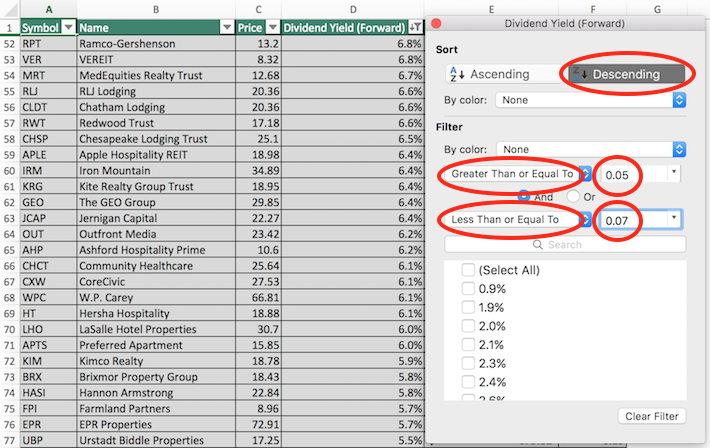

Step 3: Use the filter features ‘Larger Than or Equal To’ and ‘Much less Than or Equal To’ together with the numbers 0.05 advert 0.07 to show REITs with dividend yields between 5% and seven%.

It will assist to get rid of any REITs with exceptionally excessive (and maybe unsustainable) dividend yields.

Additionally, click on on ‘Descending’ on the prime of the filter window to listing the REITs with the best dividend yields on the prime of the spreadsheet.

Now that you’ve got the instruments to establish high-quality REITs, the subsequent part will present a number of the advantages of proudly owning this asset class in a diversified funding portfolio.

Why Put money into REITs?

REITs are, by design, a improbable asset class for buyers trying to generate earnings.

Thus, one of many main advantages of investing in these securities is their excessive dividend yields.

The at present excessive dividend yields of REITs shouldn’t be an remoted prevalence. In truth, this asset class has traded at the next dividend yield than the S&P 500 for many years.

Associated: Dividend investing versus actual property investing.

The excessive dividend yields of REITs are as a result of regulatory implications of doing enterprise as an actual property funding belief.

In change for itemizing as a REIT, these trusts should pay out a minimum of 90% of their internet earnings as dividend funds to their unitholders (REITs commerce as items, not shares).

Typically you will notice a payout ratio of lower than 90% for a REIT, and that’s probably as a result of they’re utilizing funds from operations, not internet earnings, within the denominator for REIT payout ratios (extra on that later).

REIT Monetary Metrics

REITs run distinctive enterprise fashions. Greater than the overwhelming majority of different enterprise sorts, they’re primarily concerned within the possession of long-lived belongings.

From an accounting perspective, which means that REITs incur vital non-cash depreciation and amortization bills.

How does this have an effect on the underside line of REITs?

Depreciation and amortization bills cut back an organization’s internet earnings, which signifies that generally a REIT’s dividend will probably be increased than its internet earnings, though its dividends are secure primarily based on money stream.

Associated: How To Worth REITs

To offer a greater sense of monetary efficiency and dividend security, REITs finally developed the monetary metric funds from operations, or FFO.

Similar to earnings, FFO may be reported on a per-unit foundation, giving FFO/unit – the tough equal of earnings-per-share for a REIT.

FFO is decided by taking internet earnings and including again varied non-cash expenses which can be seen to artificially impair a REIT’s perceived potential to pay its dividend.

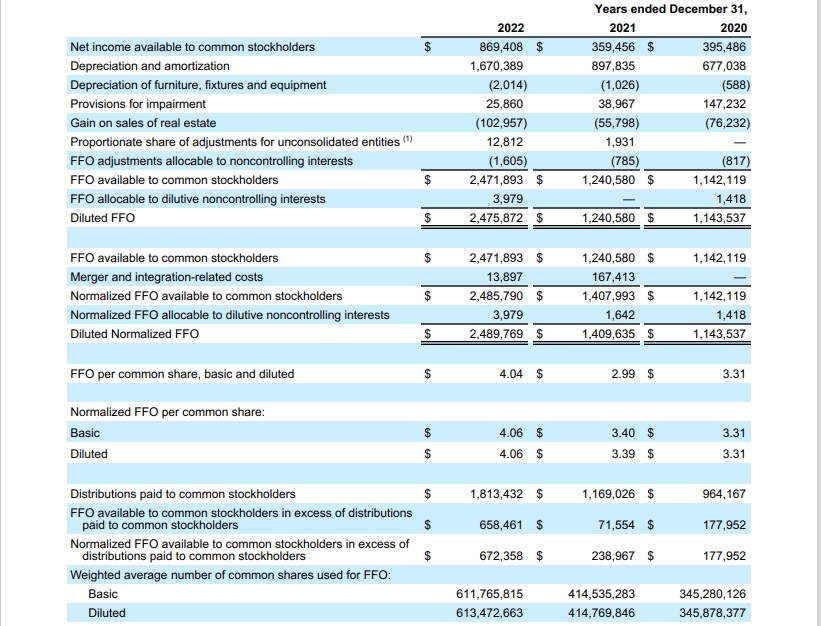

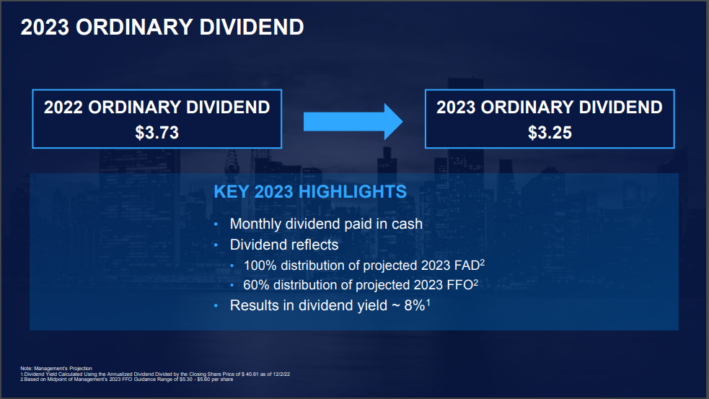

For an instance of how FFO is calculated, take into account the next internet income-to-FFO reconciliation from Realty Revenue (O), one of many largest and hottest REIT securities.

Supply: Realty Revenue Annual Report

In 2022, internet earnings was $869 million whereas FFO out there to stockholders was above $2.4 billion, a large distinction between the 2 metrics. This reveals the profound impact that depreciation and amortization can have on the GAAP monetary efficiency of actual property funding trusts.

The Prime 7 REITs At present

Beneath now we have ranked our prime 7 REITs at present primarily based on anticipated whole returns.

Anticipated whole returns are in flip made up from dividend yield, anticipated progress on a per unit foundation, and valuation a number of adjustments. Anticipated whole return investing takes under consideration earnings (dividend yield), progress, and worth.

Observe: The REITs under haven’t been vetted for security. These are excessive anticipated whole return securities, however they could include elevated dangers.

We encourage buyers to totally take into account the chance/reward profile of those investments.

For the Prime 10 REITs every month with 4%+ dividend yields, primarily based on anticipated whole returns and security, see our Prime 10 REITs service.

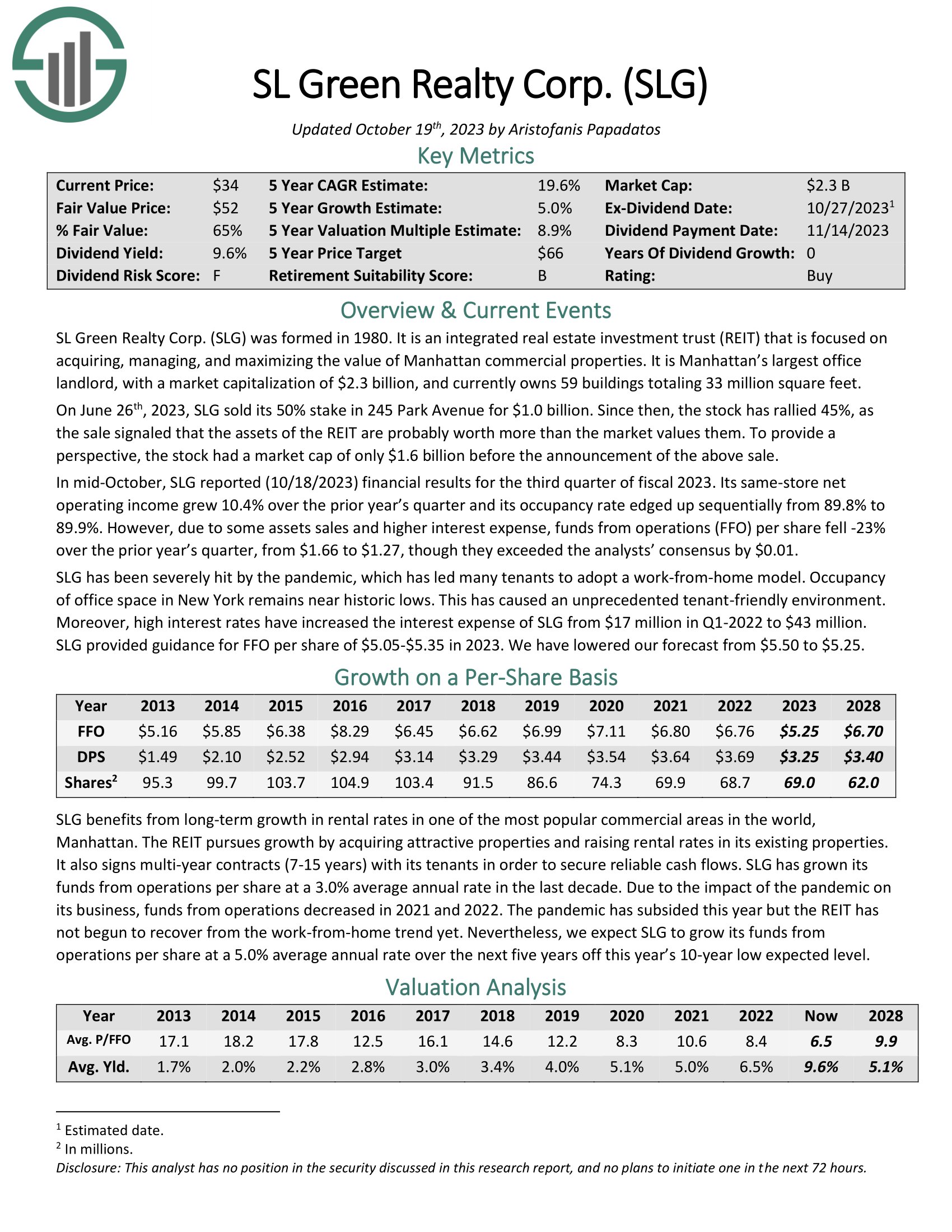

Prime REIT #7: SL Inexperienced Realty (SLG)

Anticipated Complete Return: 20.8%

Dividend Yield: 10.1%

SL Inexperienced is a self-managed REIT that manages, acquires, develops, and leases New York Metropolis Metropolitan workplace properties. In truth, the belief is the biggest proprietor of workplace actual property in New York Metropolis, with the vast majority of its properties situated in midtown Manhattan. It’s Manhattan’s largest workplace landlord, with 60 buildings totaling about 33 million sq. toes.

Supply: Investor Presentation

In mid-October, SLG reported (10/18/2023) monetary outcomes for the third quarter of fiscal 2023. Its same-store internet working earnings grew 10.4% over the prior yr’s quarter and its occupancy charge edged up sequentially from 89.8% to 89.9%. Nonetheless, because of some belongings gross sales and better curiosity expense, funds from operations (FFO) per share fell -23% over the prior yr’s quarter, from $1.66 to $1.27, although they exceeded the analysts’ consensus by $0.01.

Click on right here to obtain our most up-to-date Positive Evaluation report on SL Inexperienced Realty Corp. (SLG) (preview of web page 1 of three proven under):

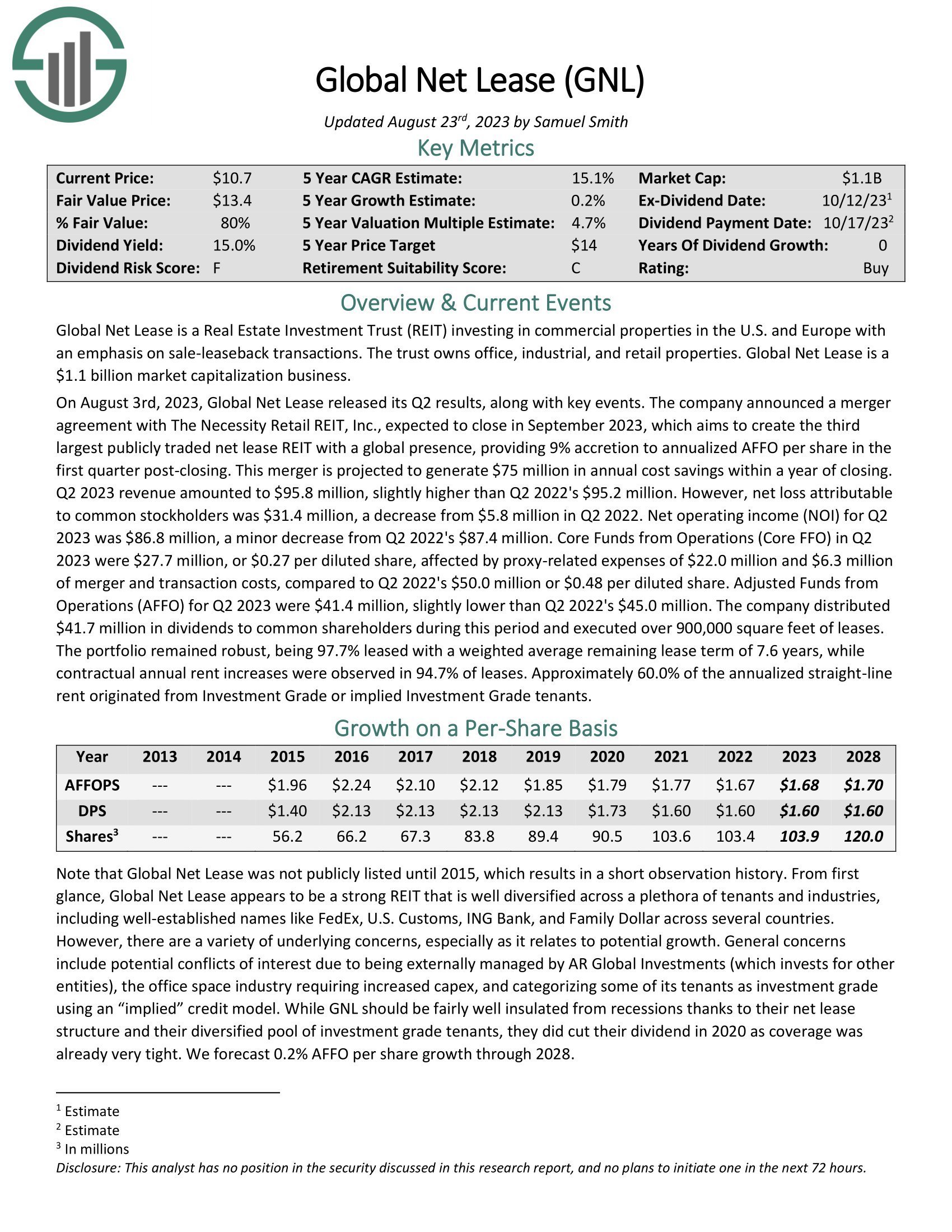

Prime REIT #6: International Web Lease (GNL)

Anticipated Complete Return: 21.0%

Dividend Yield: 19.3%

International Web Lease invests in business properties within the U.S. and Europe with an emphasis on sale-leaseback transactions. The belief owns properly in extra of 300 properties, of which workplace is the biggest sector, adopted by industrial and retail. International Web Lease is a $1.1 billion market capitalization enterprise.

On August third, 2023, International Web Lease launched its Q2 outcomes. The corporate introduced a merger settlement with The Necessity Retail REIT, Inc., anticipated to shut in September 2023, which goals to create the third largest publicly traded internet lease REIT with a world presence, offering 9% accretion to annualized AFFO per share within the first quarter post-closing. This merger is projected to generate $75 million in annual price financial savings inside a yr of closing.

Click on right here to obtain our most up-to-date Positive Evaluation report on International Web Lease (GNL) (preview of web page 1 of three proven under):

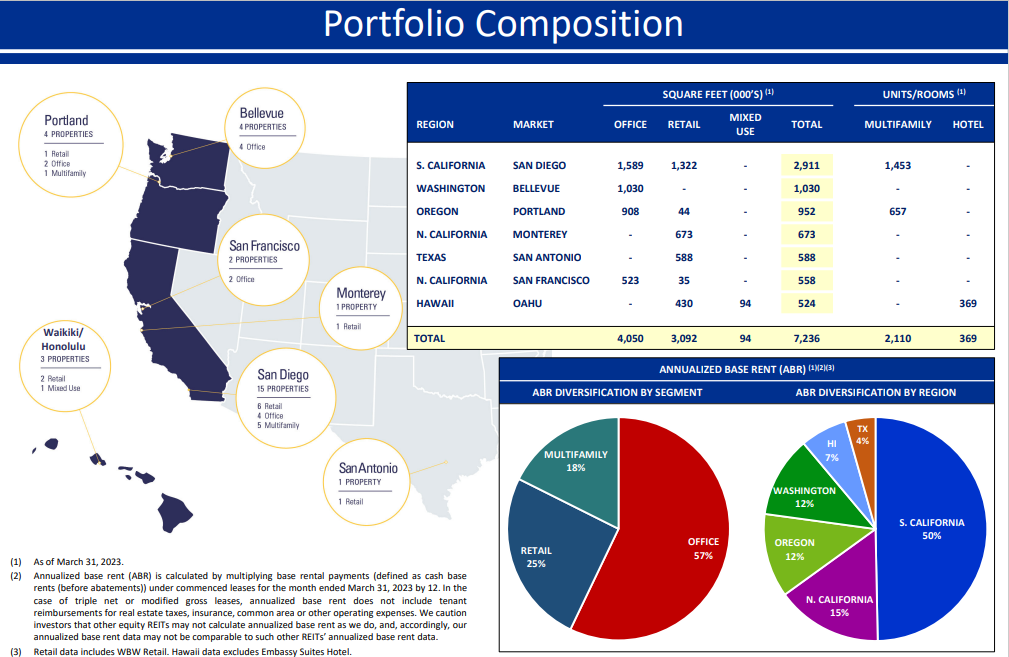

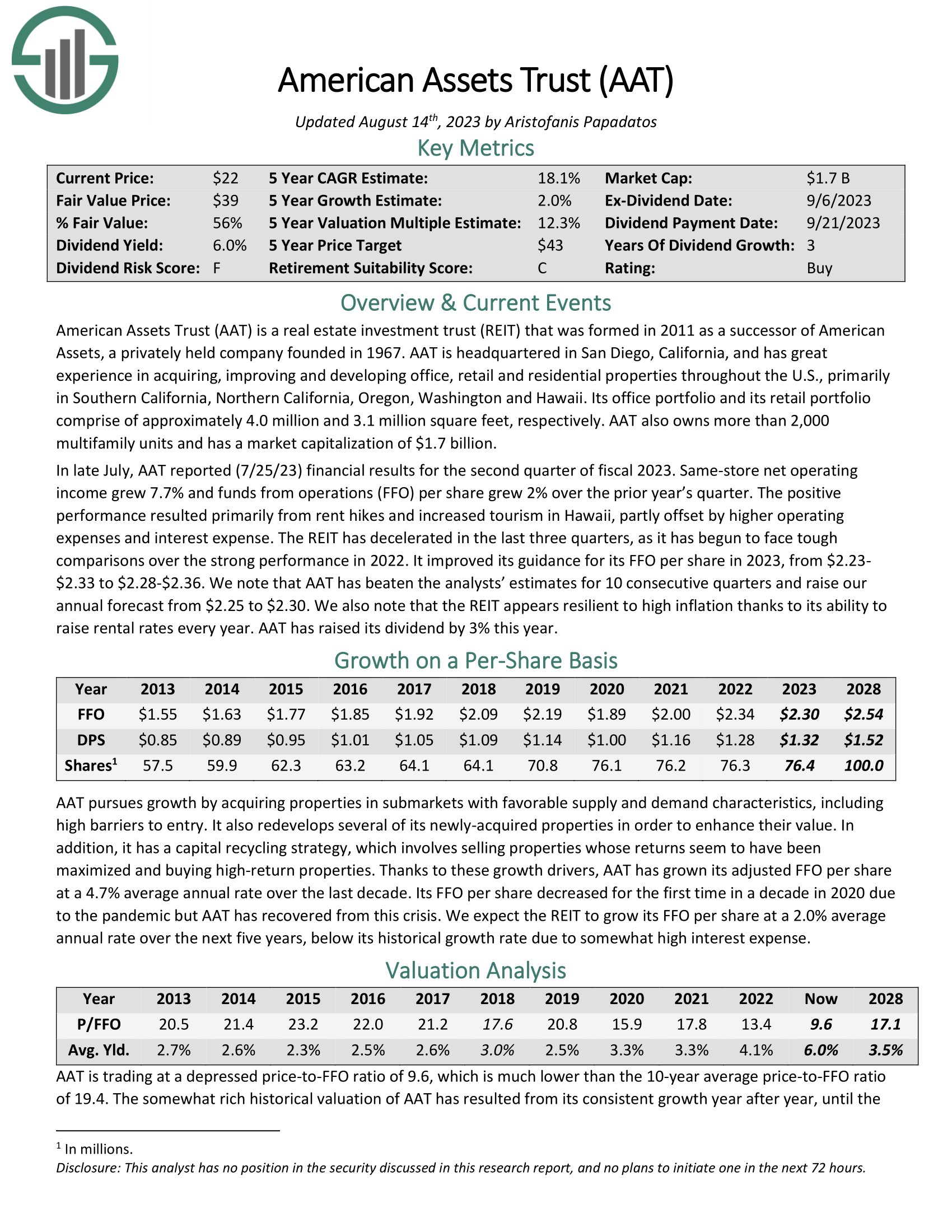

Prime REIT #5: American Belongings Belief (AAT)

Anticipated Complete Return: 21.5%

Dividend Yield: 7.0%

American Belongings Belief acquires and develops workplace, retail and residential properties all through the U.S., primarily in Southern California, Northern California, Oregon, Washington and Hawaii.

Its workplace portfolio and its retail portfolio comprise of roughly 4.0 million and three.1 million sq. toes, respectively. AAT additionally owns greater than 2,000 multifamily items.

Supply: Investor Presentation

In late July, AAT reported (7/25/23) monetary outcomes for the second quarter of fiscal 2023. Identical-store internet working earnings grew 7.7% and funds from operations (FFO) per share grew 2% over the prior yr’s quarter.

The optimistic efficiency resulted primarily from lease hikes and elevated tourism in Hawaii, partly offset by increased working bills and curiosity expense. It improved its steering for its FFO per share in 2023, from $2.23- $2.33 to $2.28-$2.36.

Click on right here to obtain our most up-to-date Positive Evaluation report on AAT (preview of web page 1 of three proven under):

Prime REIT #4: Douglas Emmett Realty (DEI)

Anticipated Complete Return: 21.5%

Dividend Yield: 6.3%

Douglas Emmett is an actual property funding belief (REIT) that was based in 1971. It’s the largest workplace landlord in Los Angeles and Honolulu, with a 38% common market share of workplace house in its submarkets. The REIT generates 80% of its income from its workplace portfolio and 20% of its income from its multifamily portfolio. It has roughly 2,700 workplace leases in its portfolio, annual income of $1 billion and a market capitalization of $2.2 billion.

In late October, Douglas Emmett reported (10/31/23) monetary outcomes for the third quarter of fiscal 2023. Income grew 0.7% due to increased tenant recoveries however adjusted funds from operations (FFO) per share dipped -15% over the prior yr’s quarter because of elevated curiosity expense. Administration reiterated its steering for FFO per share of $1.81-$1.85 in 2023, as excessive rates of interest will proceed weighing on curiosity expense..

Click on right here to obtain our most up-to-date Positive Evaluation report on DEI (preview of web page 1 of three proven under):

Prime REIT #3: Clipper Properties (CLPR)

Anticipated Complete Return: 22.1%

Dividend Yield: 7.6%

Clipper Properties owns business (primarily multifamily and workplace with a small sliver of retail) actual property throughout New York Metropolis.

On August third, Clipper Properties launched its second-quarter outcomes. The corporate achieved file quarterly revenues of $34.5 million and earnings from operations of $8.0 million in the course of the second quarter of 2023. Notably, there was additionally a file internet working earnings (“NOI”) of $19.2 million for a similar interval.

Nonetheless, the corporate reported a internet lack of $3.3 million for the second quarter. Moreover, the quarterly adjusted funds from operations (“AFFO”) amounted to $5.5 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on CLPR (preview of web page 1 of three proven under):

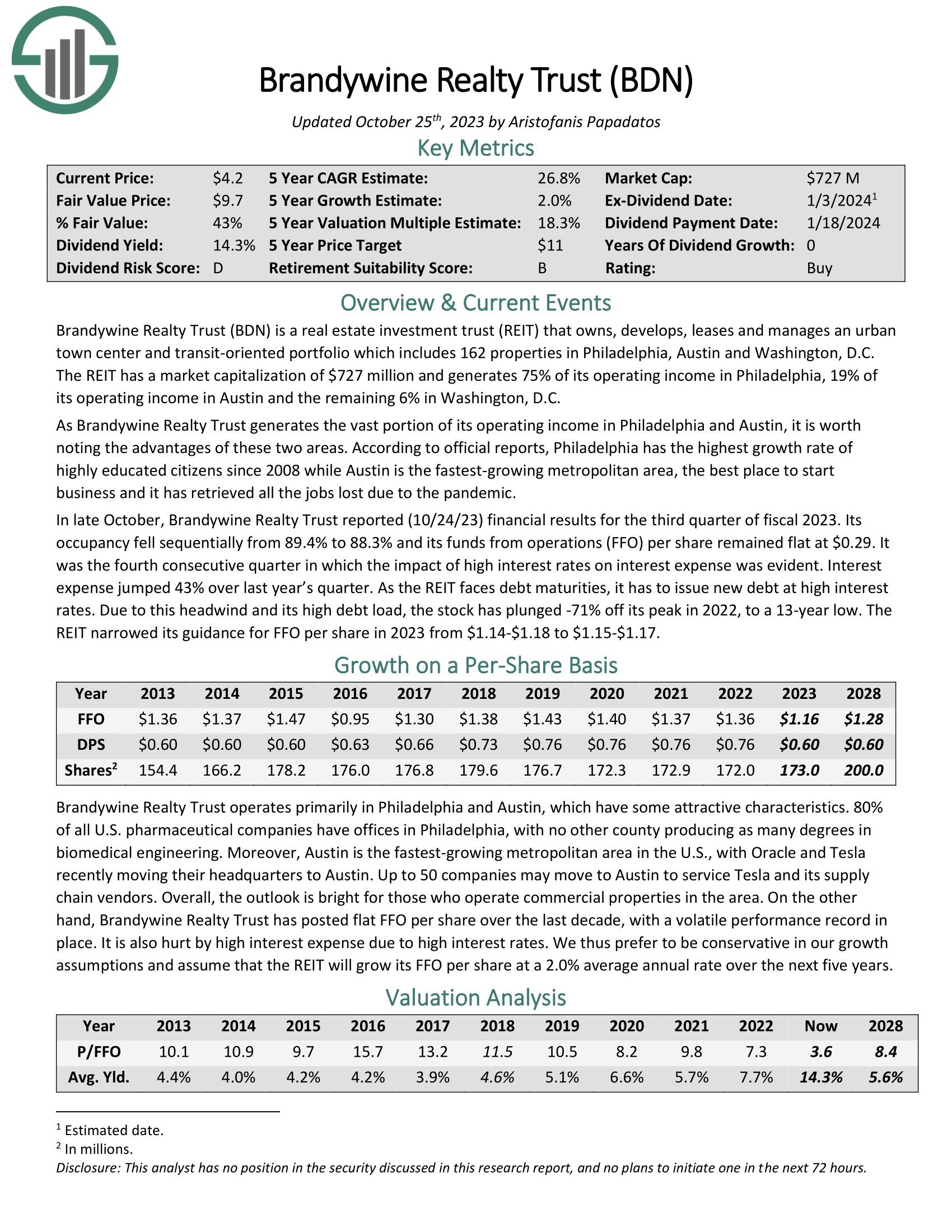

Prime REIT #2: Brandywine Realty Belief (BDN)

Anticipated Complete Return: 28.3%

Dividend Yield: 15.2%

Brandywine Realty owns, develops, leases and manages an city city middle and transit-oriented portfolio which incorporates 163 properties in Philadelphia, Austin and Washington, D.C. The REIT has a market capitalization of $1.1 billion and generates 74% of its working earnings in Philadelphia, 22% of its working earnings in Austin and the remaining 4% in Washington, D.C.

In late October, Brandywine Realty Belief reported (10/24/23) monetary outcomes for the third quarter of fiscal 2023. Its occupancy fell sequentially from 89.4% to 88.3% and its funds from operations (FFO) per share remained flat at $0.29. It was the fourth consecutive quarter by which the impression of excessive rates of interest on curiosity expense was evident.

Curiosity expense jumped 43% over final yr’s quarter. Because the REIT faces debt maturities, it has to challenge new debt at excessive rates of interest. As a result of this headwind and its excessive debt load, the inventory has plunged -71% off its peak in 2022, to a 13-year low. The REIT narrowed its steering for FFO per share in 2023 from $1.14-$1.18 to $1.15-$1.17.

Click on right here to obtain our most up-to-date Positive Evaluation report on BDN (preview of web page 1 of three proven under):

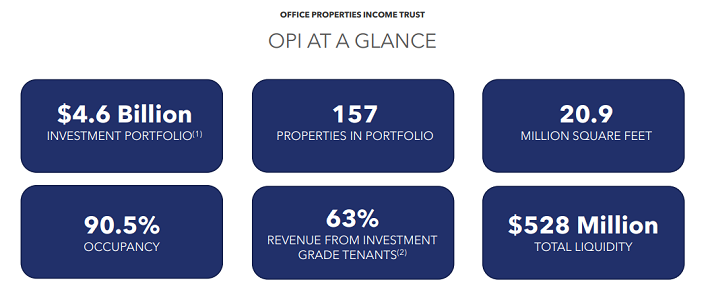

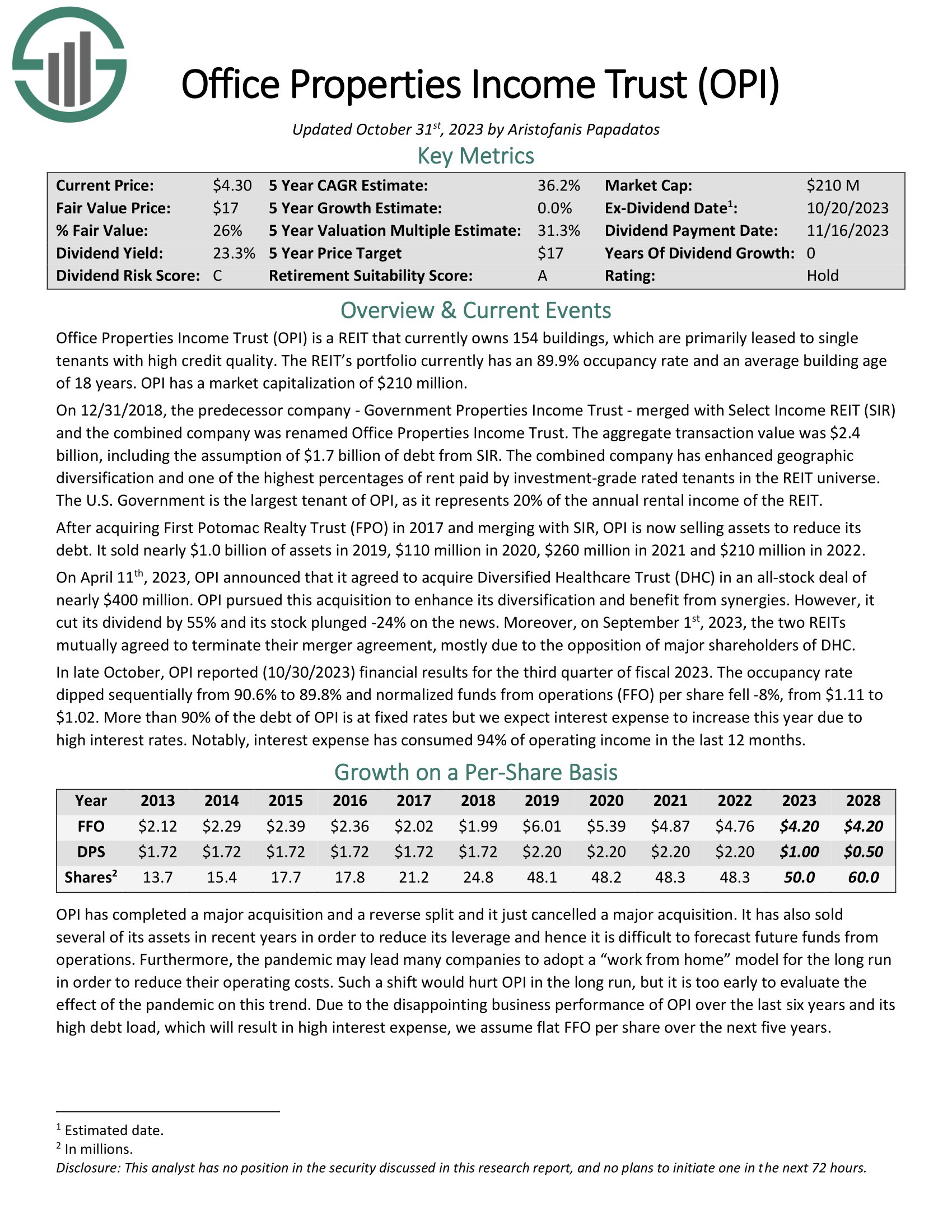

Prime REIT #1: Workplace Properties Revenue Belief (OPI)

Anticipated Complete Return: 32.3%

Dividend Yield: 19.9%

Workplace Properties Revenue Belief is a REIT that at present owns 157 buildings, that are primarily leased to single tenants with excessive credit score high quality. The REIT’s portfolio at present has a 90.5% occupancy charge.

In late October, OPI reported (10/30/2023) monetary outcomes for the third quarter of fiscal 2023. The occupancy charge dipped sequentially from 90.6% to 89.8% and normalized funds from operations (FFO) per share fell -8%, from $1.11 to $1.02.

Greater than 90% of the debt of OPI is at fastened charges however we count on curiosity expense to extend this yr because of excessive rates of interest. Notably, curiosity expense has consumed 94% of working earnings within the final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on OPI (preview of web page 1 of three proven under):

Last Ideas

The REIT Spreadsheet listing on this article accommodates a listing of publicly-traded Actual Property Funding Trusts.

Nonetheless, this database is actually not the one place to search out high-quality dividend shares buying and selling at honest or higher costs.

In truth, among the best strategies to search out high-quality dividend shares is searching for shares with lengthy histories of steadily rising dividend funds. Corporations which have elevated their payouts by means of many market cycles are extremely prone to proceed doing so for a very long time to return.

You’ll be able to see extra high-quality dividend shares within the following Positive Dividend databases, every primarily based on lengthy streaks of steadily rising dividend funds:

You may additionally be trying to create a extremely custom-made dividend earnings stream to pay for all times’s bills.

The next lists present helpful info on excessive dividend shares and shares that pay month-to-month dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link