[ad_1]

deepblue4you

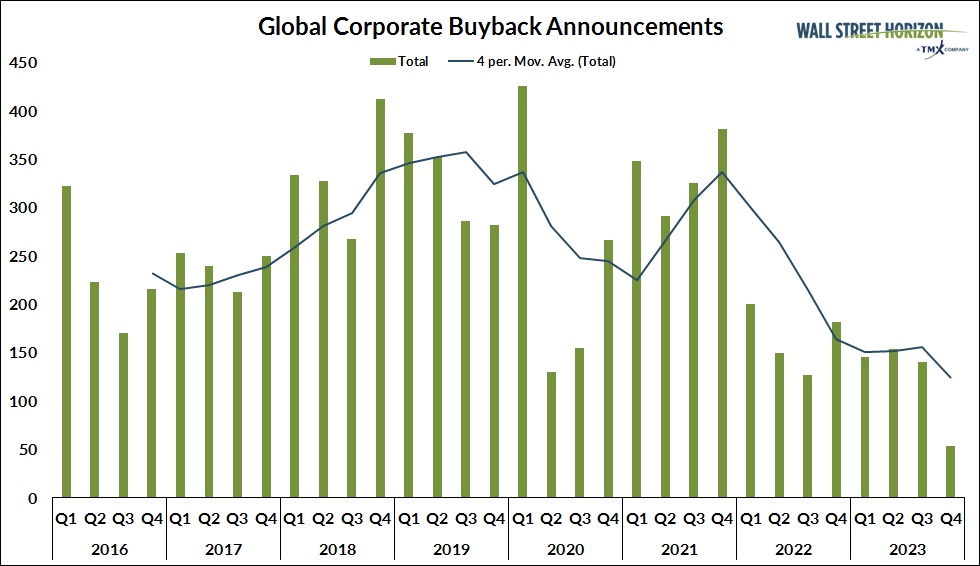

Wall Avenue Horizon has intently monitored the development in company buybacks all through 2023. It has been a bit like watching paint dry given the dearth of exercise, and the Q3 earnings season did not result in an entire lot of confidence for a direct turnaround.

Traders proceed to desire that firm executives shore up steadiness sheets, and the prices of fairness and debt capital are a lot increased in comparison with year-ago ranges.1

Is there hope on the horizon? Will subsequent yr mark a buyback bounceback? Perhaps all of it will depend on how the macro image unfolds. Strategists on Wall Avenue are publishing their 2024 outlooks, and the large query is whether or not a U.S. recession strikes.

To date, the roles market is hanging in there whereas strong, although slowing, retail spending is a wholesome signal. In the meantime, the speed of inflation is clearly coming nearer to the Fed’s goal.2

Some certainty that central banks are by means of with rate of interest hikes could be music to the ears of these within the C-suite, and that might enable for extra aggressive capital allocation plans within the coming quarters.

A Yr to Overlook

For now, 2023 is about to mark the weakest yr of world company buyback bulletins since we started monitoring this metric in 2016. Companies that executed share repurchases not too long ago might show to have been clever since we’re closing in on two years for the reason that S&P 500®’s all-time excessive and plenty of inventory costs are depressed.

Certainly, Financial institution of America famous final week that its company shoppers had been heavy consumers of the latest market dip – that is a minimum of one nugget of optimism.3

Apparently, our staff noticed three firms you may not contemplate to be in a powerful place to provoke and proceed buyback packages.

One other Weak Quarter of Share Repurchase Bulletins

Supply: Wall Avenue Horizon

Bullish Chats

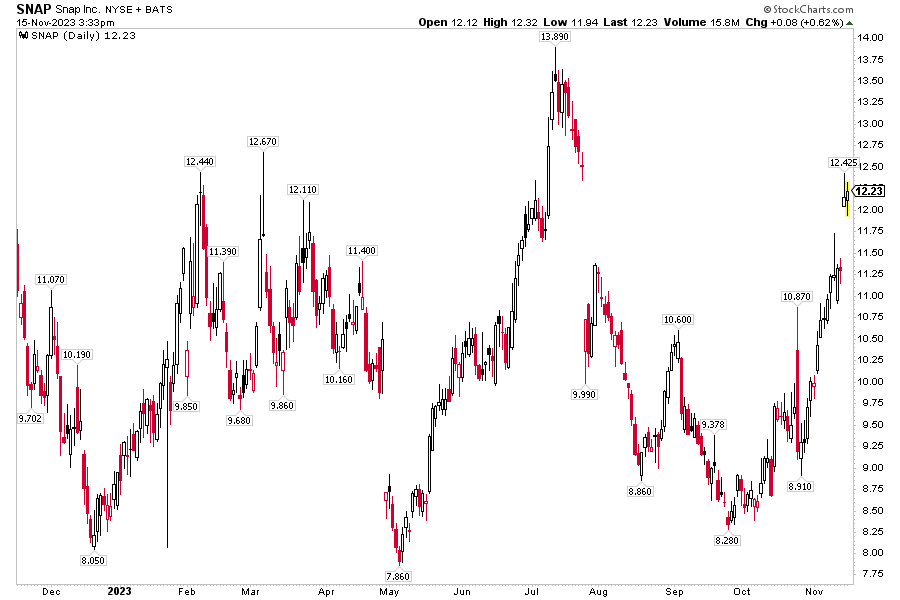

Snap Inc. (SNAP) has been on a heater recently. Shares had been beneath $10 upfront of the Communications Companies sector firm’s Q3 earnings report on October 24.

Analysts anticipated a damaging EPS print, however SNAP printed constructive per-share income and year-on-year income development of higher than 5%.4 Together with reporting a 12% leap in every day lively customers, the administration staff licensed a brand new $500 million buyback plan.5

SNAP was unstable the next buying and selling day, maybe on the heels of what appeared to be vital warning urged by the agency relating to the onset of the battle within the Center East. One other unknown was (and is) how company advert spending may very well be impaired ought to an financial slowdown happen.

Nonetheless, possibly it was extra of a ‘watch what we do, not what we are saying’ method taken by traders. The spectacular share repurchase plan could have overshadowed the geopolitical jitters. $3.6 billion of money added improved the standard of the favored messaging firm’s steadiness sheet.6 The inventory rallied to above $12 by mid-November.

SNAP 1-Yr Inventory Worth Historical past: A Main This autumn Rally

Supply: Chart courtesy of StockCharts.com7

Swiping Proper

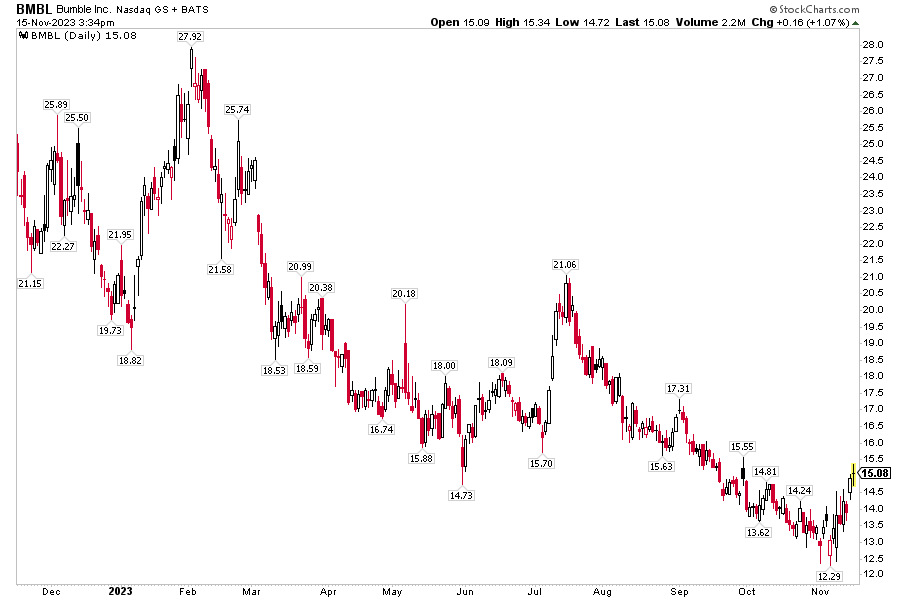

SNAP is likely to be turning round what has been a irritating yr amongst traders within the inventory, however one in all its sector friends has not held up as nicely amid tighter monetary circumstances.

Shares of Bumble Inc. (BMBL) are down greater than 40% from a yr in the past. The inventory wavered after a blended third quarter report earlier this month, however finally BMBL bulls defended the $12 to $13 vary, and it now flirts with breaking a multi-month downtrend.

Q3 GAAP EPS of $0.12 was higher than anticipated, whereas income got here in barely under the consensus estimate.8 App Paying Customers, an vital metric for the favored relationship app firm, elevated 25% to 2.6 million from year-ago ranges and 147,000 sequentially.9

Together with strong development figures, the Austin-based social community firm introduced a $300 share repurchase program. “Our conviction within the long-term trajectory of our enterprise is mirrored within the elevated share repurchase authorization and our dedication to return capital to shareholders,” stated Anu Subramanian, CFO of Bumble.10

Take note of the corporate’s This autumn 2023 outcomes due out (date unconfirmed) on Wednesday, February 21 AMC as, in keeping with a survey carried out by Courting.com, the November by means of February interval is the seasonal peak in on-line and app-based relationship.11

Bumble 1-Yr Inventory Worth Historical past: Not A lot to Love

Supply: Chart courtesy of StockCharts.com12

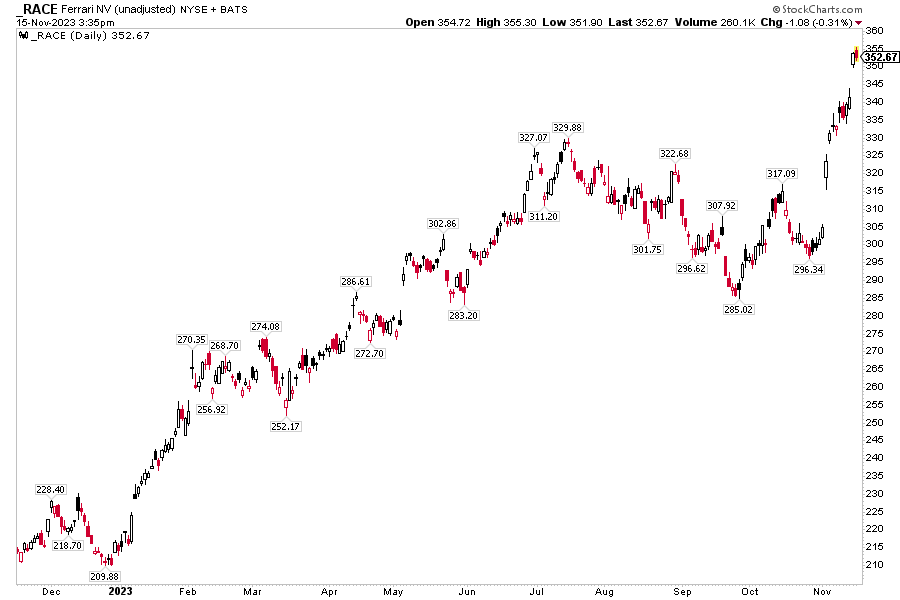

A Bull Market on Wheels

Citing the rear on this third-quarter earnings season buyback evaluation is a inventory accelerating to the 2023 end line. Ferrari N.V. (RACE) is increased by greater than 60% on the yr because the ultra-high-end luxurious car producer inside the Client Discretionary sector has trounced earnings expectations for a number of quarters in a row.

The $64 billion market cap agency was within the highlight this month on CNBC13, and final weekend’s Las Vegas Grand Prix was undoubtedly constructive media publicity.

Ferrari shifted into excessive gear within the quarter simply accomplished. Q3 working EPS of Є1.82 beat the Є1.66 consensus forecast whereas revenues powered increased by 23% year-on-year. Complete shipments of three,459 models had been up 8.5% in comparison with Q3 202214 because the richest sliver of the worldwide shopper market reveals few indicators of a spending slowdown.

Throughout the report revenue report, RACE introduced the fourth tranche of a multi-year share buyback plan. It intends to repurchase roughly Є2 billion of inventory by 2026 in combination, with the fourth tranche’s capability being Є350 million, which started on November 8.15

Ferrari 1-Yr Inventory Worth Historical past: A Thrilling Trip

Supply: Chart courtesy of StockCharts.com16

The Backside Line

Company buyback bulletins proceed to be comparatively sparse amongst firms throughout sectors internationally. Executing share repurchases over latest months might need been well-timed, however increased prices of capital and the specter of a potential Fed-induced 2024 recession seemingly go away firms uneasy about aggressively decreasing share counts.

1 World Fund Supervisor Survey, BofA World Analysis, Michael Hartnett, November 14, 2023, Entry – HTML Report

2 US inflation has steadily cooled. Getting it all the way down to the Fed’s goal fee would be the hardest mile, The Related Press, Christopher Rugabear, August 8, 2023

3 BofA Securities Fairness Consumer Movement Tendencies, BofA World Analysis, Jim Carey Corridor, November 14, 2023, Entry – HTML Report

4 Snap Non-GAAP EPS of $0.02 beats by $0.07, income of $1.19B beats by $80M, Searching for Alpha, Gaurav Batavia, October 24, 2023

5 Snap shares seesaw amid considerations concerning the battle’s impact on promoting, CNBC, Jonathan Vanian, October 24, 2023

6 Snap Inc. Broadcasts Third Quarter 2023 Monetary Outcomes, Snap Inc., October 24, 2023

7 Snap Inc., StockCharts, November 16, 2023

8 Bumble experiences blended Q3 earnings; initiates This autumn outlook; initiates This autumn outlook, Searching for Alpha, Meghavi Singh, November 7, 2023

9 Bumble experiences blended Q3 earnings; initiates This autumn outlook, Searching for Alpha, Meghavi Singh, November 7, 2023

10 Bumble Inc. Broadcasts Third Quarter 2023 Outcomes, Bumble Inc., November 7, 2023

11 Courting.com Discovered That On-line Exercise Hits Peak Season Throughout Chilly Winter Months, PR Newswire, Courting.com, September 26, 2019

12 BMBL Bumble Inc., StockCharts, November 16, 2023

13 Ferrari once more raises steerage as prospects go for high-priced, personalised sports activities vehicles, CNBC, John Rosevear, November 2, 2023,

14 One other report quarter sustaining upward revised year-end outlook, Ferrari N.V, November 2, 2023

15 Ferrari N.V.: Announcement of the Fourth Tranche of the Multi-Yr Share Repurchase Program, World Information Wire, Ferrari N.V., November 7, 2023

16 RACE Ferrari NV, StockCharts, November 16, 2023

Authentic Submit

[ad_2]

Source link