[ad_1]

Isaac Lee

Introduction

Within the present market, it appears that evidently “everybody” is bullish. I do not even know what a really steep down day looks like anymore.

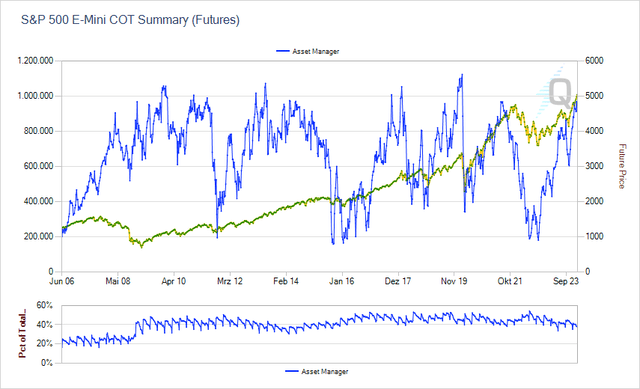

All kidding apart, taking a look at CME Group’s (CME) Dedication of Merchants report beneath, we see that asset managers are very lengthy the e-mini, essentially the most traded S&P 500 future.

CME Group

Though we aren’t at report ranges, the present positioning is akin to 2021, 2019, and a number of short-term inventory market peaks going again to 2006.

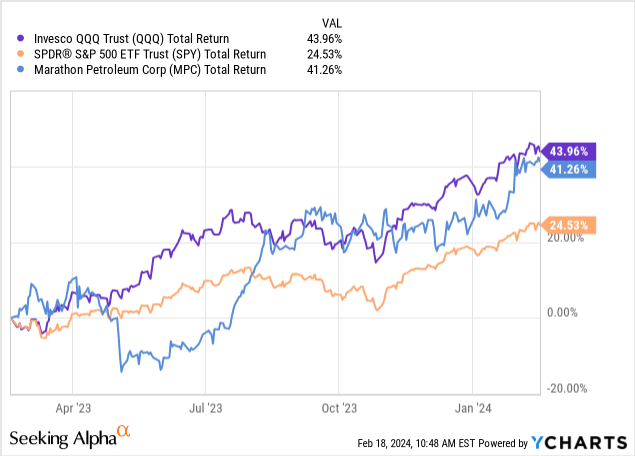

What’s fascinating about this inventory market rally is that it is primarily pushed by know-how. As we will see beneath, the tech-heavy ETF (QQQ) is up 44% over the previous 12 months, beating the S&P 500 by roughly 20 factors.

Nonetheless, it is not simply tech.

Because the chart above additionally reveals, there’s worth in sudden areas. One among them is refining!

This “soiled” business is dwelling to a number of the finest complete return stars in the marketplace, together with Marathon Petroleum (NYSE:MPC), which has returned 41% over the previous 12 months regardless of headwinds in cyclical industries.

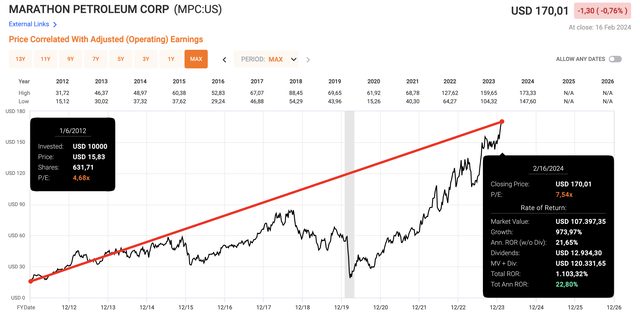

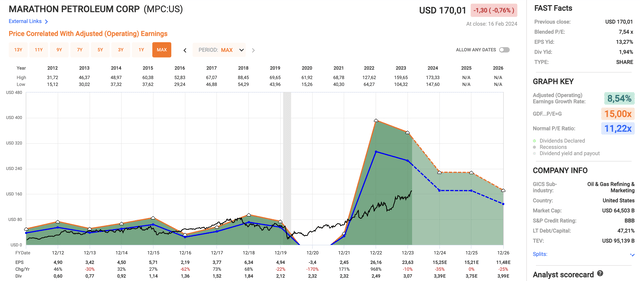

Even higher, since its spin-off from Marathon Oil (MRO), which produces oil as an alternative of refining it, the inventory has returned 22.8% per yr!

Do not consider me?

This is proof:

FAST Graphs

For a few years, Marathon Petroleum has been on my radar attributable to its wonderful administration, in addition to its priceless insights into business developments.

My most up-to-date article was printed on November 9, titled “Marathon Petroleum Is A Buyback Monster.”

Since then, shares are up 21%, beating the spectacular 15% return of the S&P 500 by roughly 600 foundation factors.

On this article, we’ll dive into current developments, assess why MPC is doing so nicely, what this tells us concerning the economic system, and – much more importantly – what we could count on going ahead.

So, let’s get proper to it!

What’s Marathon Petroleum?

Marathon Petroleum is a significant participant within the downstream power sector, boasting a 135-year historical past and a presence throughout refining, advertising and marketing, and midstream operations.

In different phrases, they don’t produce oil and gasoline however flip oil into value-added merchandise. That is the core of the downstream business.

They maintain the title of the nation’s largest refiner, working a community of 13 refineries throughout the Gulf Coast, Mid-Continent, and West Coast areas, with a processing capability of two.9 million barrels of crude oil per day.

Past home consumption, Marathon Petroleum actively participates within the worldwide market, exporting gasoline, distillates, and asphalt primarily from their refineries in Garyville, Galveston Bay, Anacortes, and Los Angeles.

It additionally has midstream publicity by MPLX LP (MPLX), which is a publicly-traded firm. MPC owns greater than 60% of the Common Accomplice and advantages from MPLX by quarterly dividends.

I talk about MPLX on this article.

With that stated, whereas refiners are a part of the power sector, we can not make the case that rising oil costs are bullish for refiners. In any case, pure-play refiners like Marathon Petroleum don’t produce oil. They should purchase it from corporations like Marathon Oil.

Under are a number of drivers of profitability to remember.

Market-driven components:

Refined product costs: The promoting costs of gasoline, diesel, jet gas, and different merchandise straight impression profitability. Robust demand for these merchandise can result in larger costs and improved margins. Provide and demand dynamics: If the availability of refined merchandise exceeds demand, it places downward stress on costs and margins. Conversely, tight provide raises costs and improves margins. As the worldwide refinery market is advanced, this can be a robust issue to forecast. Crack spreads: That is the distinction between the value of crude oil and the mixed promoting costs of refined merchandise. Wider crack spreads point out larger profitability. It is associated to the “refined product costs” issue I began with.

Refinery and regulation-specific components:

Refining capability and utilization: Bigger refineries usually have economies of scale, however excessive capability utilization is essential for maximizing earnings. Authorities rules: Environmental rules, taxes, and commerce insurance policies can impression prices and demand for refined merchandise. Geopolitical occasions: Disruptions in main oil-producing areas can have an effect on crude oil costs and refining margins. Competitors: The aggressive panorama within the refining business can affect product costs and margins. Diversification: Refiners like MPC are more and more centered on merchandise like renewable diesel and associated to adjust to rules and stay aggressive in a world (slowly) transitioning to cleaner fuels.

This brings me to the core of this text.

Marathon Petroleum Is Doing Very Effectively

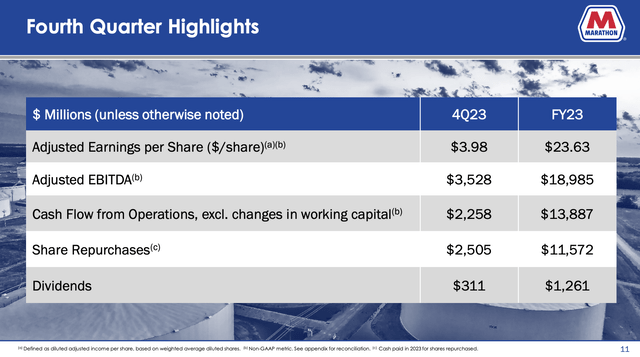

The most recent monetary outcomes mirror strong efficiency, with adjusted earnings per share reaching $3.98 for the fourth quarter and $23.63 (-10% year-over-year) for the complete yr.

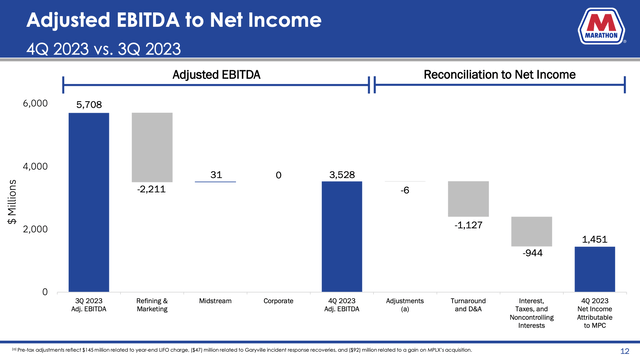

Adjusted EBITDA got here in sturdy at over $3.5 billion for the quarter and practically $19 billion for the yr, underscoring operational excellence and efficient price administration methods.

Marathon Petroleum Company

Money circulate from operations, excluding working capital adjustments, amounted to almost $2.3 billion for the quarter and $13.9 billion for the yr, highlighting the corporate’s capacity to generate substantial money circulate even amidst difficult market situations like margin headwinds.

Marathon Petroleum Company

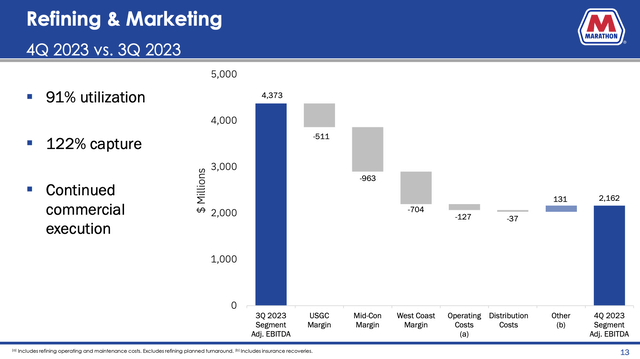

Digging a bit deeper, operational effectivity and resilience have been witnessed throughout each refining and advertising and marketing segments.

Refineries maintained a excessive utilization fee of 91%, processing practically 2.7 million barrels of crude per day.

Regardless of margin pressures impacting per-barrel margins, sturdy industrial execution resulted in a seize fee of 122% for the quarter. The seize fee refers to precise realized margins in comparison with market-based benchmarks.

Marathon Petroleum Company

Favorable “seize” was offered by what the corporate calls a stable industrial execution, tailwinds from mild product gross sales, and favorable relative pricing of secondary merchandise.

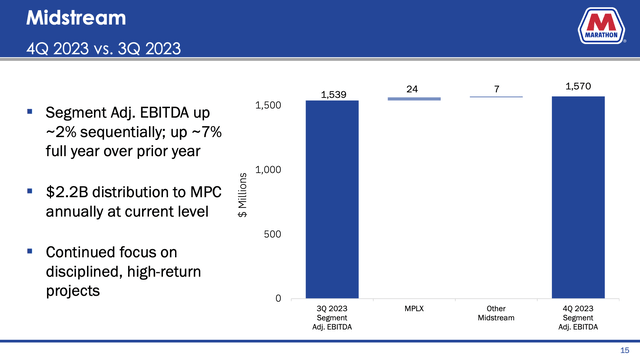

Within the midstream section, EBITDA development of seven% in comparison with the prior yr displays the section’s contribution to general monetary efficiency, pushed by high-return development initiatives in each the Marcellus and Permian basins.

Marathon Petroleum Company

To this point, so good.

Whereas the corporate is seeing earnings headwinds, that is primarily attributable to improbable ends in 2022, when your complete business benefited from huge post-pandemic provide shortages and war-related pricing advantages.

For instance, final yr, the corporate generated $26.16 in EPS. That quantity was virtually 1,000% above the 2021 results of $2.45!

With that stated, the sturdy efficiency was additionally useful for traders.

Shareholder Worth

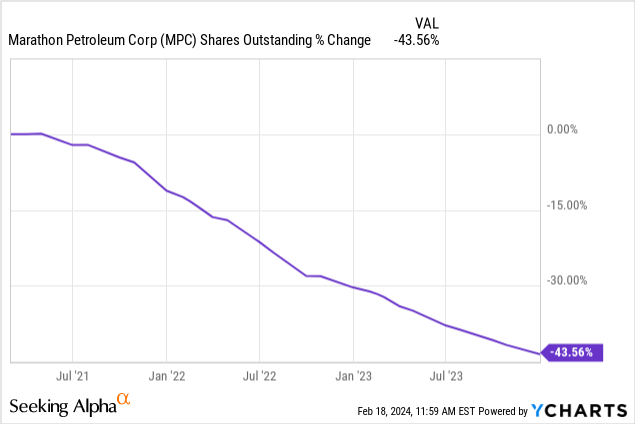

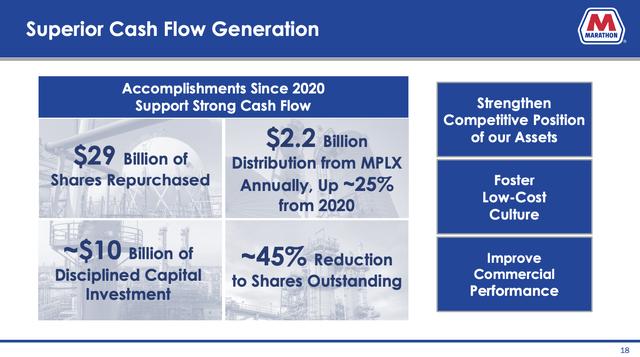

Because of a powerful monetary efficiency, the corporate returned $11.6 billion by share repurchases in 2023, bringing the entire repurchases to over $29 billion since Could 2021.

These numbers make MPC one of the vital aggressive buyback corporations in the marketplace, because it has diminished its shares by 44% over the previous 12 quarters!

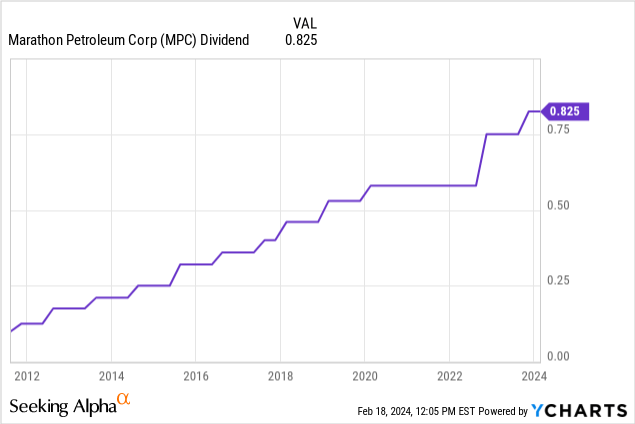

Furthermore, shareholders benefitted from a ten% enhance within the firm’s quarterly dividend within the fourth quarter of 2023, leading to a compounded annual development fee of over 12% in dividend development over the previous 5 years.

Marathon Petroleum Company

This dedication to returning extra capital is highlighted by a payout of 92% of working money circulate for the complete yr 2023.

The corporate at present pays $0.825 per share per quarter, leading to a yield of 1.9%, protected by a 22% 2024E payout ratio and the corporate’s BBB-rated stability sheet, which ended 2023 with a sub-1x leverage ratio.

To this point, so good.

Now What?

Looking forward to the refining macro surroundings, the corporate expects continued strong demand for oil, with world oil consumption hitting report highs in 2023 and projections indicating additional development in 2024.

This optimistic outlook is supported by regular demand for gasoline, diesel, and jet gas each domestically and within the export market.

Moreover, tight inventories globally, coupled with slower-than-expected progress in world capability additions, are anticipated to assist refining margins.

Even higher, the corporate foresees an enhanced mid-cycle surroundings for the U.S. refining business attributable to favorable world supply-demand fundamentals and comparative benefits over worldwide sources, together with power prices, feedstock acquisition prices, and refinery complexity.

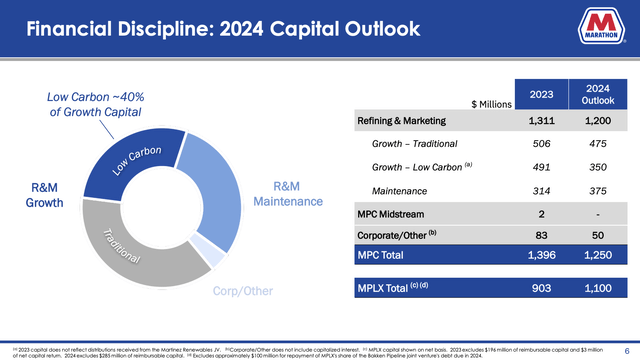

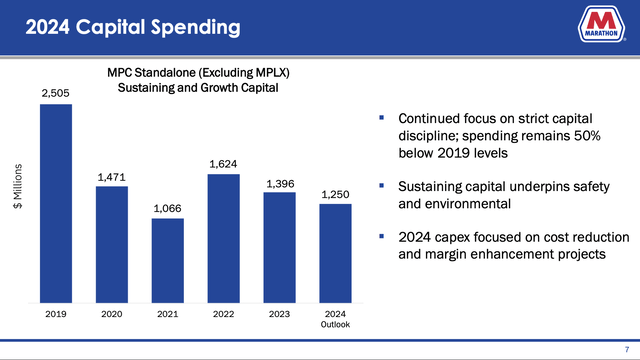

With that in thoughts, trying ahead to 2024, the overview beneath outlines its funding plans, with a stand-alone capital funding totaling $1.25 billion.

Marathon Petroleum Company

This funding will primarily give attention to initiatives aimed toward enhancing margin and lowering prices, with a specific emphasis on security and environmental efficiency.

As we will see beneath, the corporate’s capital plan is roughly half of what it was in 2019, which bodes nicely at no cost money circulate technology.

Marathon Petroleum Company

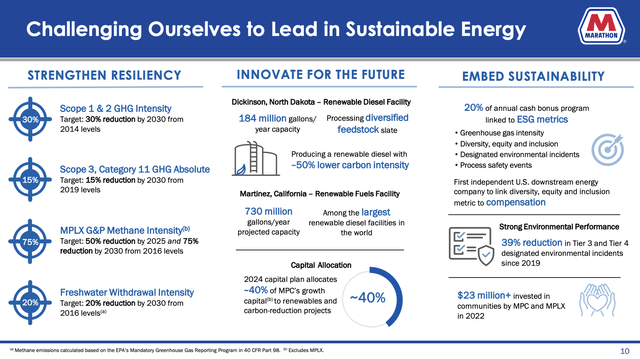

Notably, throughout its earnings name, the corporate highlighted its investments in low-carbon initiatives, which supply enticing returns, decrease prices, elevated reliability, and diminished emissions.

Actually, roughly $0.40 of each $1.00 invested in development will go in the direction of renewables and carbon-reduction initiatives.

Marathon Petroleum Company

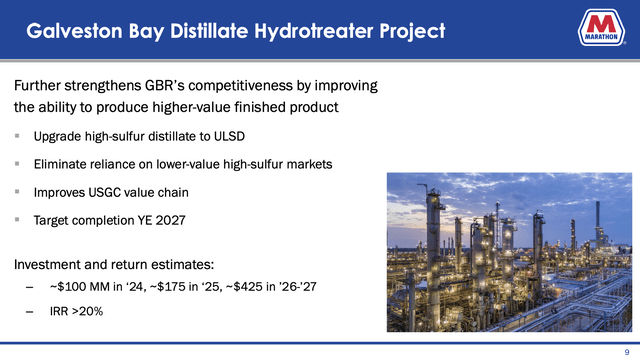

Based on the corporate:

As soon as in service, the brand new distillate hydrotreater will improve high-sulfur distillate to ultra-low sulfur diesel, eliminating the necessity for third-party processing or gross sales into shrinking lower-value high-sulfur export market. This strategic funding ensures we offer the clear burning gas of the world demand and additional enhances the aggressive place of our U.S. Gulf Coast worth chain. The venture is anticipated to be full by year-end 2027 and generate a return of over 20%. – MPC 4Q23 Earnings Name

Marathon Petroleum Company

Moreover, the corporate earmarks funds for exploring rising alternatives comparable to Renewable Pure Fuel, signaling its proactive stance in the direction of addressing local weather change considerations and fostering a greener operational footprint.

Valuation

That is the difficult half for one main motive: analysts expect a protracted normalization in business fundamentals.

Utilizing the info within the chart beneath:

Analysts count on 2024 EPS to say no by 35%, adopted by 0% development in 2025 and 25% contraction in 2026. MPC, which at present trades at a blended P/E ratio of seven.5, would have a good value goal of $128 in 2026 utilizing its longer-term normalized P/E ratio of 11.2. That is 25% beneath the present value.

FAST Graphs

The present consensus value goal is $173, which is 2% above the present value.

Whereas there is no such thing as a denying that the unusually good years of 2022 and 2023 are over, I don’t count on the corporate to enter a long-term downtrend, with EPS falling beneath $12 in 2026.

I stick with what I wrote in my prior article, which is that the inventory ought to have room to run to $190 per share, which is predicated on $17 in EPS and a good a number of of 11.2x earnings.

The corporate’s feedback concerning the business are just too bullish for a protracted EPS downtrend, and I are inclined to agree with the corporate’s view.

Nonetheless, whereas I’ll stick with a Purchase score, I consider ready for a correction earlier than shopping for could also be a sensible transfer after the current rally.

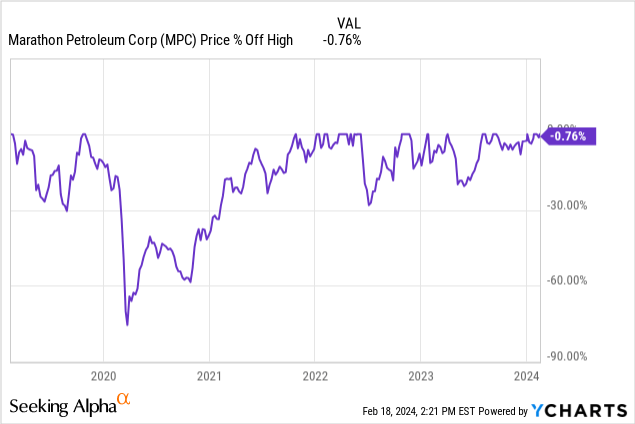

Whereas this technique all the time comes with dangers, it must be stated that refinery shares are unstable. As we will see beneath, ignoring bigger sell-offs, MPC’s inventory value tends to fall 10-15% on a slightly common foundation.

In different phrases, on the subject of cyclical shares, I are inclined to chorus from chasing rallies – particularly when “everybody” is bullish in the marketplace regardless of elevated financial dangers, as we mentioned within the first a part of this text.

Evidently, this doesn’t in any respect change the longer-term bull case, which stays sturdy for MPC.

Takeaway

In a market dominated by bullish sentiment, Marathon Petroleum stands out as a strong performer within the downstream power sector.

With a give attention to operational excellence, price administration, and shareholder worth, MPC demonstrates resilience amidst difficult market situations.

Whereas analysts venture a protracted decline in earnings, the corporate’s long-term prospects stay promising, supported by its strategic investments in low-carbon initiatives and rising alternatives.

Whereas I keep a Purchase score, exercising warning and ready for a possible correction might be prudent, given the inventory’s historic volatility.

Regardless of short-term fluctuations, MPC’s sturdy fundamentals place it for sustained development and worth creation sooner or later.

Professionals and Cons

Professionals:

Robust Operational Efficiency: MPC confirmed a strong efficiency, with spectacular earnings and EBITDA, reflecting operational excellence and efficient price administration methods. Shareholder Worth: The corporate’s aggressive buyback program and constant dividend development underscore its dedication to delivering worth to shareholders. Strategic Investments in Low-Carbon Initiatives: MPC’s give attention to renewable power initiatives bodes nicely for margins and competitiveness within the renewables business.

Cons:

Trade Fundamentals: Analysts anticipate a protracted normalization in business fundamentals, probably impacting MPC’s earnings development trajectory. Market Volatility: Refinery shares like MPC may be unstable, with inventory costs experiencing common fluctuations, posing dangers for traders.

[ad_2]

Source link

Add comment