[ad_1]

November has seen notable developments for main Altcoins, with Ethereum, Avalanche, and Chainlink forming worth squeeze patterns.

Ethereum’s symmetrical triangle suggests a possible breakout above $2,060

In the meantime, Avalanche faces resistance at $21.5, and Chainlink’s restoration hinges on a every day shut above $15.

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

Cryptocurrencies confronted resistance of their upward trajectory all through the primary half of November, experiencing declines that have been met with progressively larger ranges of help.

Over the previous two weeks, this worth motion has given rise to a worth squeeze sample for sure altcoins, with being a outstanding instance.

After encountering resistance across the $2,100 mark, Ethereum entered a slim buying and selling vary, forming decrease lows within the quick time period. and , amongst cryptocurrencies with vital market capitalization, share an analogous outlook.

From a technical perspective, a swift worth motion is anticipated following such worth compression, contingent on the course of the breakout. Let’s assess the potential short-term worth actions by inspecting the present standing of ETH, AVAX, and LINK.

1. Ethereum: Watch Out for the Worth Staying Above $2000

Ethereum jumped as excessive as $2,100 within the first days of November. The cryptocurrency then started to fluctuate, forming a symmetrical triangle sample with decrease peaks and troughs all through the month.

It appears to have reached the final a part of the value squeeze that continued earlier than getting into December.

Accordingly, Ethereum can even break the higher line of the symmetrical triangle if it may possibly obtain a web day shut above a mean of $2,060 in its subsequent upward transfer.

Such a breakout may strengthen the purchase facet and Ethereum may shortly transfer in direction of the $2,300 band with a 12% improve in worth in proportion to the dimensions of the triangle.

The short-term worth goal for Ethereum additionally is sensible with Fibonacci ranges set relative to the current bearish momentum. ETH entered a fast restoration section after discovering help at $1,520 in October.

The cryptocurrency, which encountered resistance on the April peak at the start of the month, turned its course upwards once more after a partial correction.

Provided that the restoration development continues, breaking the final resistance at $ 2,100 reveals that there isn’t a impediment till the Fibonacci growth zone within the vary of $ 2,270 – $ 2,470.

Alternatively, every day closes under $2,000 can be a transfer that might disrupt the bullish setup for Ethereum. A potential bearish momentum may set off ETH to retreat to the $1,800 band.

Consequently, so long as Ethereum stays above $ 2,000 and might break above $ 2,060 and $ 2,100 resistances, we will see that the subsequent buying and selling vary may very well be within the vary of $ 2,270 – $ 2,470.

2. Avalanche: Search for a Break Above $21.5

After recording a steep accelerated rise in November, AVAX retreated barely after revenue gross sales within the $ 24 band.

Whereas the retreat was met with calls for within the common $ 20 band, the AVAX worth began to maneuver in a slim band within the final 2-week interval. Within the present state of affairs, we see that the $ 21.5 stage stays an necessary resistance level for AVAX.

With the formation of a transparent every day candle above this stage, the triangle sample shaped within the quick time period will break upwards and we will see that the subsequent transfer could proceed as much as the typical $ 27 band.

Within the decrease area, there’s a help line beginning at $ 20.8. If AVAX, which is caught in a really slim worth vary, as soon as once more sags under $ 20, the bullish situation could also be invalidated.

On this case, eyes shall be on the second help line extending to the $ 18 stage, whereas the lack of this help may set off a correction to under $ 15.

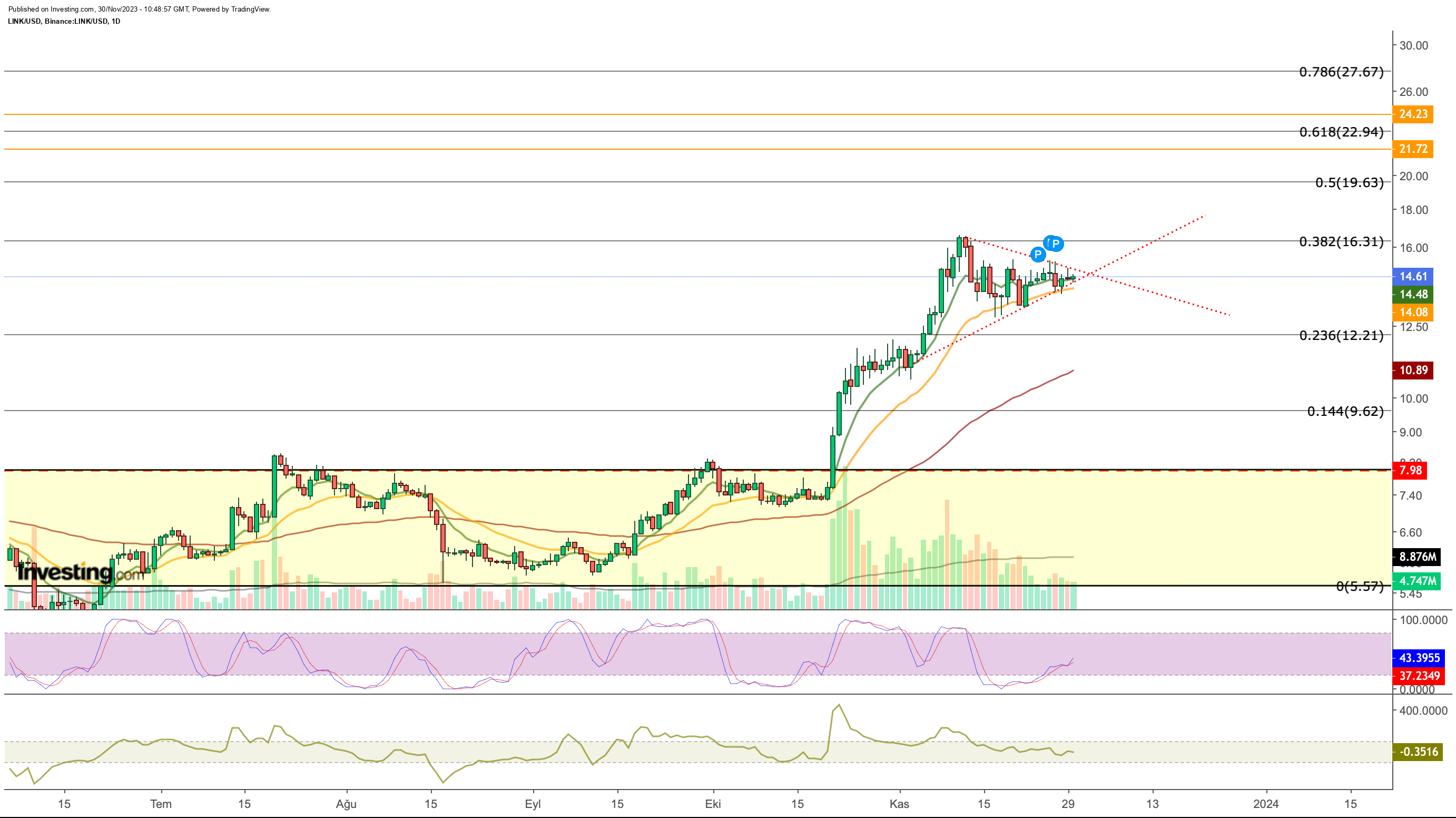

3. Chainlink: Preserve an Eye on a Day by day Shut Above $15

LINK continued its restoration development all through November after ending its long-term sideways motion in October.

LINK, which rose as excessive as $ 16.5 within the first half of November, encountered resistance of Fib 0.382 when measured in opposition to the long-term downtrend.

Within the final two weeks, after the rejection of this level, the correction development in crypto cash has been fairly restricted with the re-engagement of consumers at $ 13.7 ranges.

Within the LINK market, the place buying and selling volumes have decreased within the final week, it’s seen that the value has began to maneuver in a narrower band.

For the remainder of the week, day closures at $ 15 ranges may re-trigger purchaser quantity, and the cryptocurrency may break the short-term downtrend and make a fast transfer towards $ 20.

The 21-day EMA, which is at $14 right now, has been performing as dynamic help in current days. This worth stage additionally kinds the underside line of the short-term triangle.

This will trigger the LINK worth to speed up its downward momentum if it falls under $ 14. Thus, because the chance of a deepening correction will increase, LINK is prone to retreat to $10.

Consequently, it may be talked about that the course of exit from the $ 14 – $ 15 vary shall be decisive for the subsequent course of LINK.

***

You’ll be able to simply decide whether or not an organization is appropriate in your danger profile by conducting an in depth elementary evaluation on InvestingPro in response to your individual standards. This manner, you’re going to get extremely skilled assist in shaping your portfolio.

As well as, you’ll be able to join InvestingPro, one of the crucial complete platforms available in the market for portfolio administration and elementary evaluation, less expensive with the most important low cost of the yr (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost At this time!

Disclosure: The creator doesn’t personal any of the securities talked about on this report.

[ad_2]

Source link