[ad_1]

Latest bullish momentum on Wall Road aided by a dovish Fed suggests the rally may proceed in 2024.

Nvidia has continued its bullish pattern with a 240% annual return. Nonetheless, the technical and basic elements point out extra upside subsequent yr.

In the meantime, Financial institution of New York Mellon and Procter & Gamble may check and even break above all-time highs subsequent yr.

In latest days, the bullish momentum on Wall Road has sustained, marked by the hitting new all-time highs, and an analogous breakthrough for the is imminent.

The Federal Reserve’s newest , additional fueled optimism with its dovish tone. Regardless of conserving rates of interest unchanged, the assertion means that the US is on the finish of the rate of interest hike cycle.

Although not formally confirmed by Jerome Powell, the chance of a pivot beginning round March with attainable price reductions all through subsequent yr is gaining traction.

Towards this backdrop, the inventory market has retained the potential for a continued rally. On this piece, we’ll attempt to analyze the shares that would feed off this optimistic momentum and hold rallying in 2024.

1. Nvidia: Chipmaker’s Bullish Pattern May Maintain Subsequent 12 months

The previous yr has been large for Nvidia Company (NASDAQ:), as evidenced by an annual return of virtually 240%.

Regardless of such a dynamic northward motion, there are nonetheless no indications suggesting that the pattern may finish.

One potential sign is the present technical state of affairs, which factors to a attainable high breakout from the consolidation that has been happening roughly since early July.

Nvidia Inventory Value Chart

The prospects for additional improvement of synthetic intelligence initiatives look fascinating.

In line with CEO Jensen Huang, the corporate is anticipated to spend money on the vary of $1 trillion in information facilities over the following 4 years to improve basic computing to accelerated computing infrastructure.

On high of that, the Nvidia-Amazon cooperation on revolutionary buyer options utilizing generative synthetic intelligence is intensifying.

This cooperation can take the AI section to even greater ranges by offering the businesses with synergies and management positions within the not too long ago launched race for supremacy within the synthetic intelligence trade.

2. Can Financial institution of New York Mellon Inventory Check All-Time Highs in 2024?

Financial institution of New York Mellon (NYSE:), which was shaped by the merger of Financial institution of New York and Mellon Monetary Company in 2007, is at the moment the most important depository financial institution on the planet.

The mixture of a world return in threat urge for food and really robust Q3 2023 outcomes has resulted in a dynamic upward momentum that’s at the moment testing an necessary resistance space situated within the $52 per share value area.

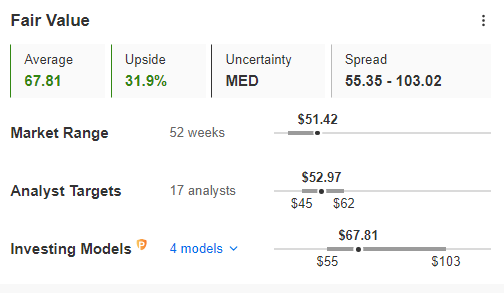

Nonetheless, regardless of the near-vertical upward motion, BNYM maintains a excessive honest worth index, which suggests the potential for an upside of greater than 30%.

Honest Worth

Supply: InvestingPro

The conclusion of this state of affairs would imply breaking out of latest all-time highs, thus piercing the earlier peaks of late 2021 and early 2022.

3. Procter & Gamble Inventory Stays a Gem for Dividend Hunters

Procter & Gamble (NYSE:) is an organization that wants no additional introduction to buyers targeted on typical dividend firms.

Suffice it to level out that the U.S. shopper items big has persistently paid dividends for 67 years in a row, so it is onerous to imagine that subsequent yr can be any completely different.

For a number of months, the corporate’s value has been caught inside a consolidation, the decrease restrict of which is being examined once more, and to this point consumers are managing to defend it.

P&G Inventory Value Chart

Assuming the worth stays throughout the sideways pattern, the goal for consumers is the higher band falling within the value space of $158 per share. Whether it is damaged, then the best way is opened for an assault on the historic excessive within the space of $165 per share.

***

You may simply decide whether or not an organization is appropriate to your threat profile by conducting an in depth basic evaluation on InvestingPro in response to your standards. This manner, you’re going to get extremely skilled assist in shaping your portfolio.

As well as, you may join InvestingPro, one of the complete platforms out there for portfolio administration and basic evaluation, less expensive with the largest low cost of the yr (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to speculate as such it isn’t supposed to incentivize the acquisition of belongings in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link