[ad_1]

AI shares have rallied this 12 months, posting vital YTD beneficial properties

However regardless of the rally, there are nonetheless some undervalued gems ready to be snapped up

On this piece, we’ll check out 3 such shares recognized by Morningstar

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

The surge in AI shares gained momentum with the introduction of ChatGPT, intensifying the competitors amongst firms to combine AI into their merchandise and platforms.

Regardless of the general surge in AI, there are particular shares that Morningstar identifies as undervalued, holding substantial potential within the medium- to long-term.

On this piece, we’ll delve into the main points of the three undervalued synthetic intelligence shares, as highlighted by Morningstar.

1. Snowflake

Snowflake (NYSE:) has nice medium to long-term upside potential, as future progress can flip it into an information chief within the coming years.

As well as, the corporate expects the results of synthetic intelligence to unfold step by step, with incremental workload utilization and consumption progress.

Snowflake has demonstrated vital income progress of +40.87% over the past twelve months with a gross revenue margin of +67.09%. This progress is a testomony to the corporate’s capacity to scale successfully and keep profitability.

The corporate has more money than debt on its stability sheet and expects gross sales progress. This monetary stability, coupled with anticipated gross sales progress, can present a stable basis for future enlargement and innovation.

It presents its quarterly outcomes on February 29 (in 2024 the month of February is 29, not 28 days). The earlier earnings in November have been excellent, including 35 $1 million+ clients within the quarter.

It additionally launched new applied sciences reminiscent of Snowflake Cortex for synthetic intelligence and forecasts that product revenues might originate within the fourth quarter between $716 million and $721 million.

By 2024, EPS is predicted to develop by +216% and precise income by +35%.

The corporate is specializing in enabling synthetic intelligence and machine studying applied sciences, with a shift in gross sales focus in direction of higher specialization and specialist groups.

As well as, it has acknowledged that the partnership with Microsoft (NASDAQ:) has had a optimistic impression on its enterprise.

It has 46 rankings, of which 31 are purchase, 14 are maintain and 1 is promote.

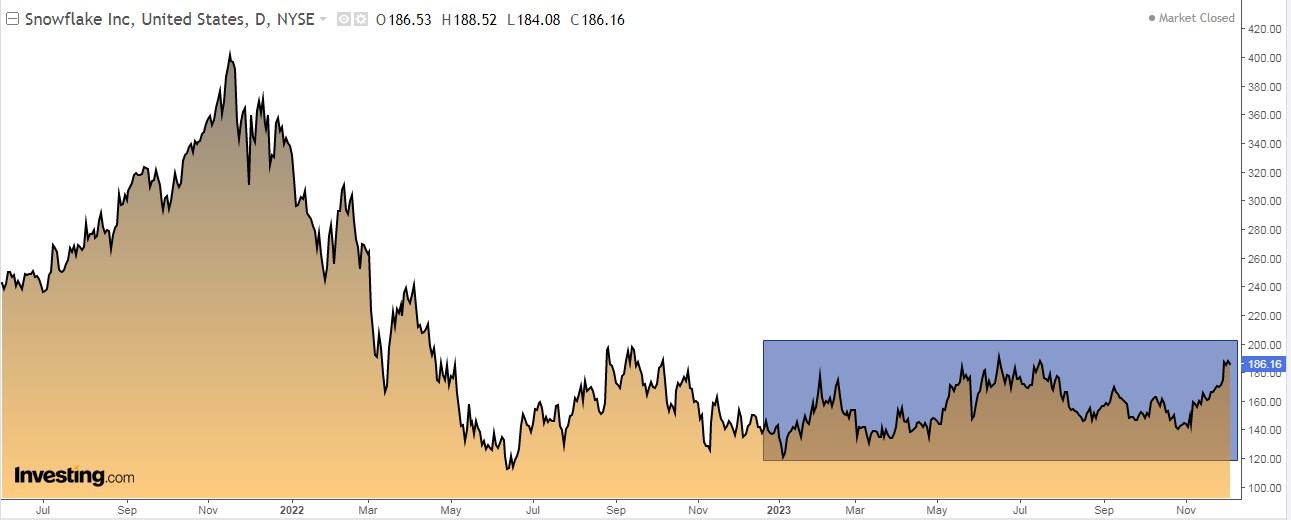

Its shares are up +36.17% within the final 12 months and +18.22% within the final 3 months. The market offers it a 12-month potential at $214.12 and Morningstar at $231.

2. Cognizant Know-how Options

Cognizant Know-how Options (NASDAQ:) inventory yields a dividend of +1.65%.

It can report its quarterly outcomes on February 1 and is anticipating revenues for the quarter to be between $4.69 billion and $4.82 billion.

For 2023 annual income is within the vary of $19.3 billion to $19.4 billion and adjusted annual earnings per share are within the vary of $4.39 to $4.42 per share.

Rising borrowing prices and fears of a slowdown are main most firms within the sector to regulate their spending.

Whereas all the sector is benefiting from the bogus intelligence theme, Cognizant is considerably undervalued attributable to a reduction for errors the corporate made previously when it was slower to develop cloud options.

It presents 28 rankings, of which 6 are purchase, 20 are maintain and a pair of are promote.

Within the final 12 months, its shares are up +19.65% and within the final 3 months, they’re down -1.23%. InvestingPro fashions give it a possible at $90.54 and Morningstar at $94.

3. Salesforce

Salesforce’s (NYSE:) strategic deal with synthetic intelligence and cloud knowledge companies has fueled its progress.

The corporate’s knowledge cloud, which incorporates Mulesoft and Tableau, has proven spectacular progress, indicating sturdy demand for its built-in companies.

As well as, the corporate’s emphasis on synthetic intelligence integration positions it properly in opposition to its opponents.

Not solely that but in addition stable demand for its Mulesoft and Knowledge Cloud companies, strategic deal with progress, increased working margin steerage, and free money movement exceeding internet revenue.

On paper, it is without doubt one of the finest long-term alternatives in software program. Though income progress has slowed, a brand new deal with margin enlargement ought to proceed to compound sturdy earnings progress within the coming years.

Morningstar estimates that the five-year annual progress fee for complete income shall be +12% by means of fiscal 2028 and shall be pushed by platform energy together with innovation in synthetic intelligence.

On February 28 it presents its accounts for the quarter and earnings per share are anticipated to extend by +47.43%. By 2024 it could be up +56.3% and precise income +11%.

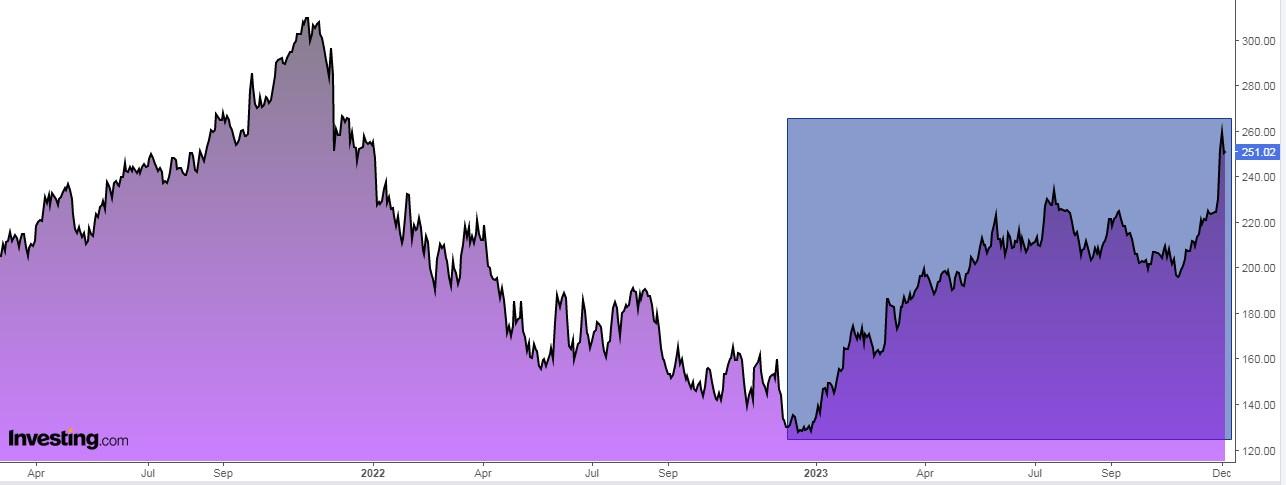

Its shares are up +88.35% within the final 12 months and +13.26% within the final 3 months. InvestingPro fashions see potential at $310.

***

You’ll be able to simply decide whether or not an organization is appropriate to your threat profile by conducting an in depth elementary evaluation on InvestingPro in keeping with your standards. This fashion, you’ll get extremely skilled assist in shaping your portfolio.

As well as, you may join InvestingPro, one of the vital complete platforms available in the market for portfolio administration and elementary evaluation, less expensive with the most important low cost of the 12 months (as much as 60%), by profiting from our prolonged Cyber Monday deal.

Declare Your Low cost Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to speculate as such it’s not supposed to incentivize the acquisition of property in any approach. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding determination and the related threat stays with the investor.

[ad_2]

Source link