[ad_1]

Seiya Tabuchi

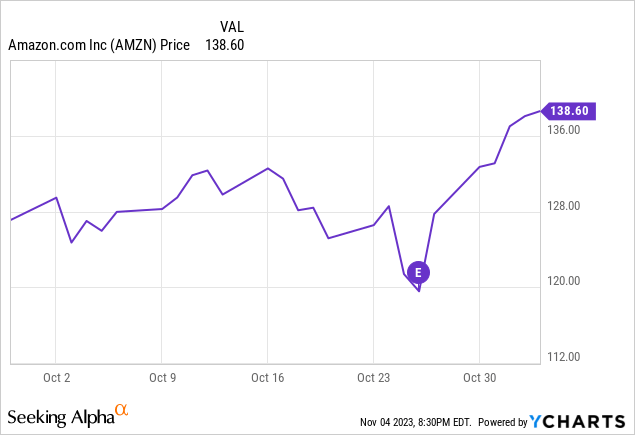

Traders had a proper to be nervous heading into Amazon’s (NASDAQ:AMZN) Q3 earnings announcement on October twenty sixth. The Nasdaq and S&P 500 had dipped into correction territory (outlined as a ten% decline from current highs), and Alphabet (GOOG)(GOOGL) inventory dropped 10% following its earnings announcement earlier that week. However Amazon confirmed why it is among the hottest shares and a terrific funding. The inventory has skyrocketed 15% off of earnings, as proven beneath.

Listed below are three causes I’m upgrading to Sturdy Purchase.

Free money circulate is again in an enormous approach.

2022 was a troublesome yr for Amazon for a lot of causes. Challenges like logistics, labor, and inflation added considerably to bills. Amazon’s money circulate was additionally a sufferer of the success of AWS. After almost doubling AWS income, from $45 billion in 2020 to $80 billion in 2022, Amazon needed to spend billions on property and gear (capital expenditures, or “CapEx”) to extend capability sufficient to maintain up with demand.

CapEx does not seem as an expense on the revenue assertion, but it surely reduces

free money circulate (FCF) – the cash left over after an organization funds its operations and purchases gear. Amazon spent simply $17 billion on CapEx in 2019, then $40 billion in 2020, and greater than $60 billion every in 2021 and 2022.

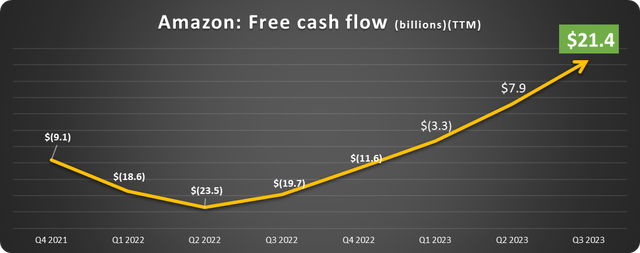

Elevated bills plus elevated CapEx equaled decimated free money circulate, which fell from a peak of $31 billion in This fall 2020 to a trough of -$23.5 billion in Q2 2022 on a trailing-twelve month (TTM) foundation.

In reality, FCF was underwater for six straight quarters earlier than breaking by in Q2 2023, as proven beneath.

Knowledge supply: Amazon. Chart by the writer.

The renaissance in free money circulate accelerated impressively in Q3. Since FCF is a number one indicator, it’s no shock that working revenue jumped 103% to $26.4 billion.

Promoting is on fireplace.

One income stream that does not get the eye it deserves is Amazon’s digital promoting. The phase has continued steamrolling regardless of an economywide promoting spending slowdown. The reason being that Amazon’s ads, like featured merchandise and pay-per-click, are very environment friendly for manufacturers. Folks looking for merchandise are already lively patrons, so reaching them is a wonderful technique to improve gross sales with out breaking the financial institution.

Promoting gross sales grew 26% yr over yr (YOY) to $12.1 billion in Q3. It now makes up 8% of whole gross sales and 15% of non-product gross sales. Search for this phase to turn into much more vital to Amazon sooner or later.

Has AWS turned the nook?

AWS progress considerations have plagued Amazon this yr. When firms budgeted for information utilization for 2023, many had been betting on a recession and appeared to chop prices. This hurts AWS as a result of it operates very similar to a utility, the place customers web page primarily based on how a lot information they use. Amazon made the smart determination to actively help clients in decreasing their prices. This harm AWS gross sales this yr however will maintain these clients with Amazon for the lengthy haul.

After years of prolific progress, AWS gross sales elevated solely 15.8% and 12.2% YOY in Q1 and Q2, respectively. A few of us had been bracing for the downtrend to proceed in Q3; nevertheless, gross sales progress was barely increased than in Q2, coming in at 12.5%. For the primary time since 2021, the phase added extra income on a YOY greenback foundation than the prior quarter ($2.4 billion in Q2 to $2.6 billion in Q3).

This might sign a stabilization that would quickly flip into acceleration.

One more reason to anticipate AWS to show the nook is the rise of synthetic intelligence (AI). AI applications require oodles of information to be processed within the cloud.

These writing off AWS as a progress phase are lacking the massive image.

Is Amazon inventory a robust purchase?

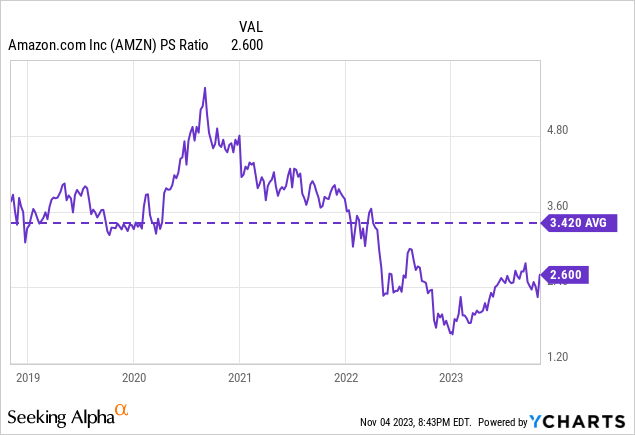

Amazon inventory is hard to worth. The corporate is exclusive, and price-to-earnings (P/E) is not too useful since ((a)) income are simply ramping again up and ((b)) there isn’t any correct comparability. These of us who’ve adopted the corporate carefully will inform you that Amazon inventory trades on gross sales progress greater than something, so I desire the price-to-sales (P/S) ratio.

As proven beneath, the inventory would wish to extend 32% to achieve its common over the previous 5 years.

The 5-year common simply occurs to be proper round the place it traded earlier than the pandemic induced inventory market pandemonium.

I wrote many occasions over the past couple of years to not rely out Amazon due to short-term headwinds, despite the fact that they had been extreme. The longer term appears good once more after Amazon’s Q3.

[ad_2]

Source link