[ad_1]

As a 2023 bullish attracts to an in depth, buyers are already setting their sights on shares to purchase for 2024.

The market offers these 3 shares greater than +32% development potential within the coming 12 months

Let’s check out these three shares intimately.

As 2023 attracts to an in depth, buyers are shifting their focus to the upcoming fiscal 12 months.

In right now’s evaluation, we’ll discover three shares which have captured the market’s consideration and are poised for substantial development of over 32% within the subsequent fiscal 12 months.

Moreover, we’ll delve into the underlying elements driving their respective potentials, leveraging knowledge from the InvestingPro skilled device.

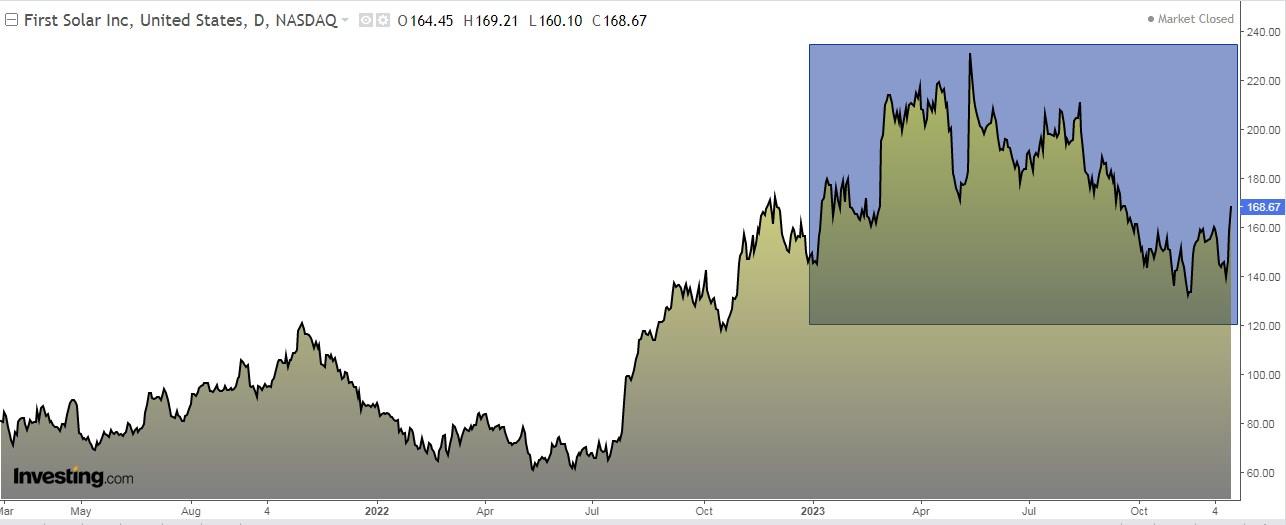

1. First Photo voltaic

First Photo voltaic (NASDAQ:) gives photo voltaic photovoltaic power options in the US, Japan, France, Canada, India, and Australia.

The corporate designs manufactures and sells photo voltaic modules that convert daylight into electrical energy.

It was previously generally known as First Photo voltaic Holdings and altered its identify to First Photo voltaic in 2006.

First Photo voltaic experiences its quarterly outcomes on February 22. Its earnings per share (EPS) are anticipated to extend by +60.34% and precise revenues by +22%.

Waiting for 2024, EPS forecasts are for a rise of +63.7% and income of +31.4%.

First Photo voltaic Upcoming Earnings

Supply: InvestingPro

First Photo voltaic has turn into a outstanding participant in its sector and has attracted the eye of Wall Avenue for its strategic positioning and monetary efficiency.

Along with the promising earnings forecasts for 2024, the inventory has a number of favorable elements in its nook.

These embody a sturdy order backlog extending till 2026, a strong stability sheet, and an anticipated development in gross margins from 18% in 2023 to 25% in 2025.

Supply: InvestingPro

As well as, its deal with utilities slightly than residential photo voltaic units it other than its rivals, insulating it from trade challenges reminiscent of weak residential demand and rate of interest volatility.

The utility-scale photo voltaic demand is ever-increasing rising within the U.S. market because the shift to carbon-neutral power sources takes maintain.

The corporate’s inventory is up +10.60% for the 12 months. The conservative facet of the market sees a 12-month potential of +36% at $229.63. In distinction, the extra aggressive facet believes the potential is +50-55%.

First Photo voltaic Analyst Targets

Supply: InvestingPro

2. Schlumberger

Schlumberger (NYSE:) is engaged within the provide of expertise for the power trade worldwide. Schlumberger was based in 1926 and is headquartered in Houston, Texas.

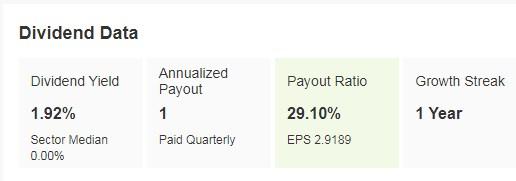

Its dividend yield is +1.92%.

Schlumberger Dividend Information

Supply: InvestingPro

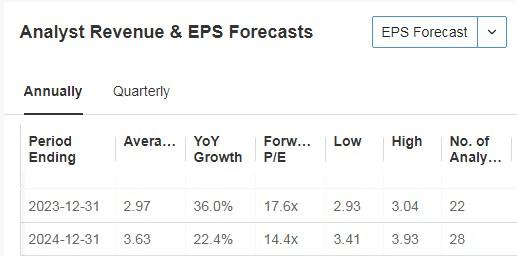

It’s going to report its numbers for the quarter on January 19 and its income might rise by virtually +4%.

The corporate’s earnings per share are anticipated to extend by +36% in 20234 and +22.4% in 2024. Relating to revenues, a rise of +17.9% this 12 months and +13.1% for the next fiscal 12 months.

Schlumberger Income and EPS Estimates

Supply: InvestingPro

Its shares are down 2% for the 12 months. It presents 31 rankings, of which 28 are purchase, 3 are maintain and none are promote.

Supply: InvestingPro

The market offers it a 12-month ahead potential of +32%.

Schlumberger Analyst Targets

Supply: InvestingPro

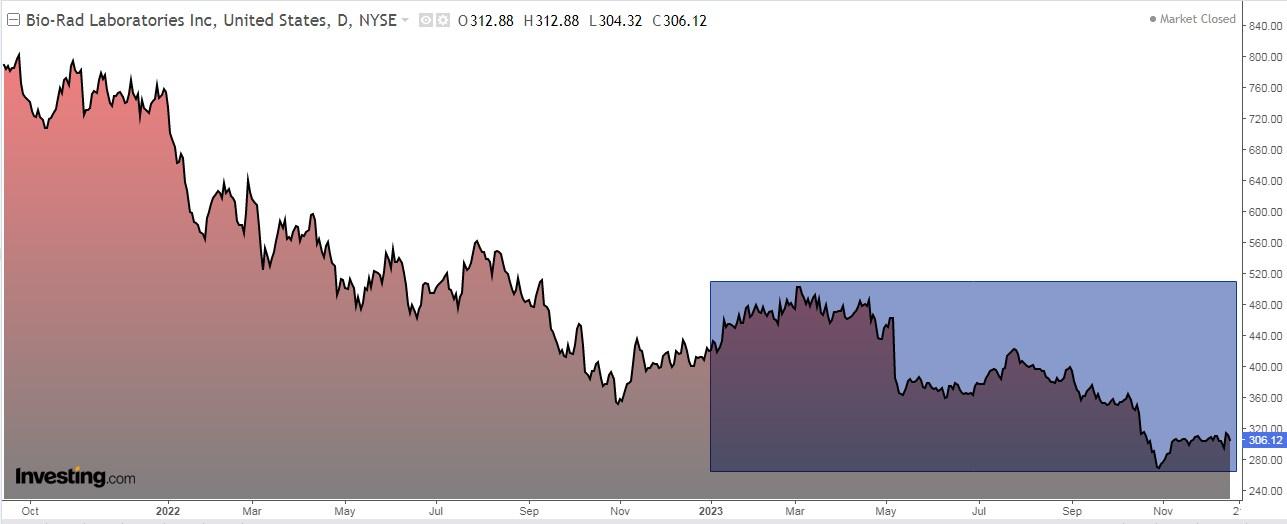

3. Bio Rad Laboratories

Bio-Rad Laboratories (NYSE:) manufactures and distributes scientific diagnostic merchandise and laboratory units and devices which can be utilized in analysis strategies in the US, Europe, Asia, Canada, and Latin America.

It was based in 1952 and is headquartered in Hercules, California.

On February 8 it presents its accounts for the quarter. For 2024, it forecasts a rise in earnings per share and income of +2.6% and +2.8%, respectively.

Bio Rad Laboratories Inventory Response After Earnings

Supply: InvestingPro

The corporate’s margin enlargement alternative is a optimistic. The unfold between lagging working margins and margins on quantity development is excessive, a truth that ought to place the corporate for a reasonably sturdy enlargement.

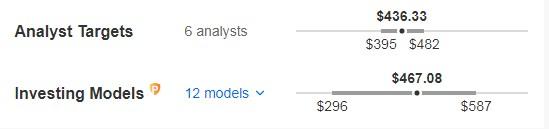

The market sees a 12-month +42.5% potential at $436.33. For his or her half, InvestingPro fashions elevate it to +52% (the $467.08).

Bio Rad Laboratories Analyst Targets

Supply: InvestingPro

Supply: InvestingPro

***

You’ll be able to simply decide whether or not an organization is appropriate on your threat profile by conducting an in depth basic evaluation on InvestingPro based on your standards. This manner, you’ll get extremely skilled assist in shaping your portfolio.

As well as, you’ll be able to join InvestingPro, probably the most complete platforms available in the market for portfolio administration and basic evaluation, less expensive with the largest low cost of the 12 months (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost Right this moment!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to speculate as such it isn’t supposed to incentivize the acquisition of property in any approach. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link