[ad_1]

Uncover the ability of two mixed metrics (Honest Worth Development and International Rating) to seek for undervalued shares in any area or inventory market on this planet.

Learn how InvestingPro’s filtering system works: A easy and sensible device to search out one of the best choices for investing within the inventory market.

Know when to purchase or promote – be the primary to know with InvestingPro at 55% off this Black Friday!

In the event you want to improve your understanding of the inventory market or are searching for a easy methodology to establish undervalued shares, InvestingPro’s inventory screener is a invaluable device that ought to be in your radar.

In case you are not aware of InvestingPro, it is a premium device provided by Investing.com, designed to help small buyers such as you in making well-informed and worthwhile funding decisions.

It simplifies the method of figuring out whether or not a inventory is undervalued or overvalued, making your purchase and promote choices simple and clear.

However how do you uncover undervalued shares available in the market and get in on them earlier than they take off?

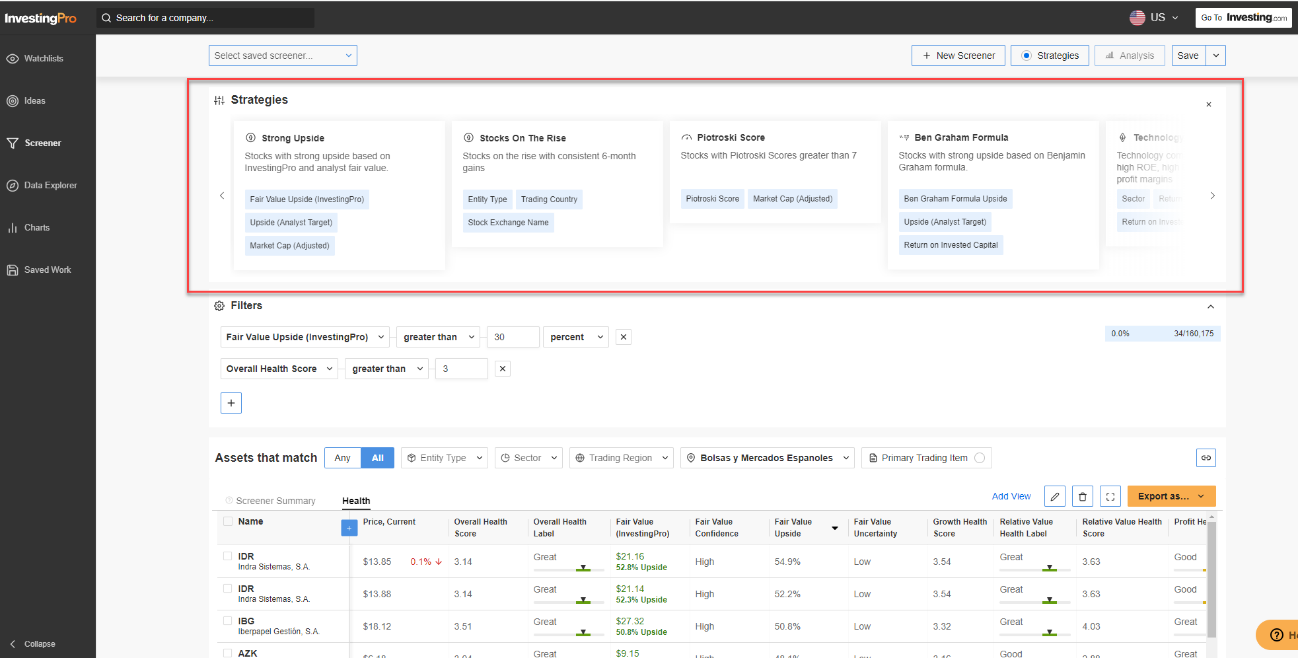

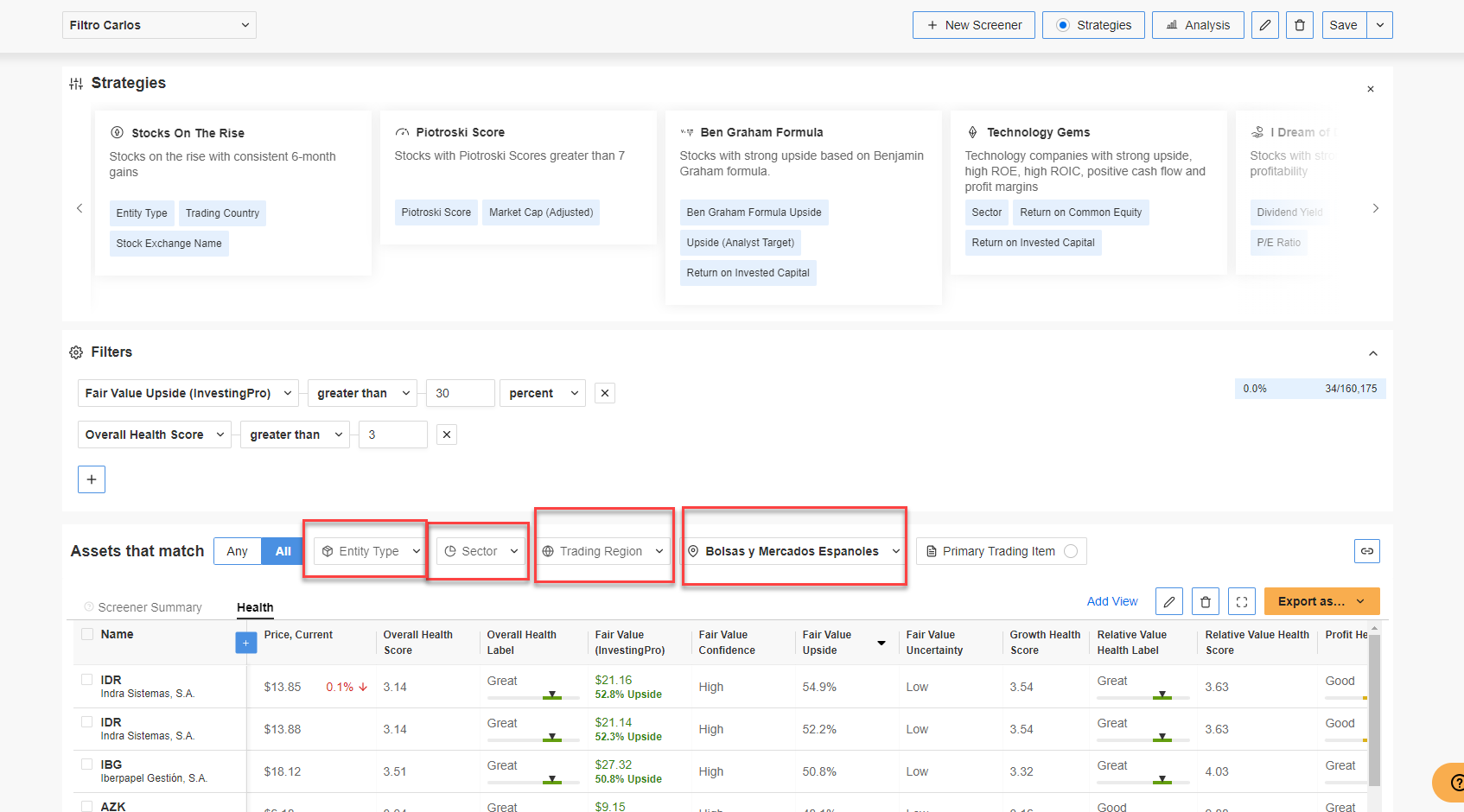

In InvestingPro’s ‘Filter’ part, you will discover a vary of predefined methods like Sturdy Upside, Bullish Shares, Piotroski Rating, Ben Graham Method, Tech Gems, Dividend Dream, 52-week Lows Discount Hunters, Money is King, and Altman Z Excessive Rating.

These methods are wonderful for uncovering hidden gems available in the market based mostly on numerous metrics, however they is likely to be a bit overwhelming when you’re a newbie investor.

Supply: InvestingPro

That is why from this level on I’ll present you how you can create a inventory screener with InvestingPro that’s easy, simple, and appropriate for every type of buyers (even in case you are a novice or newbie) and that additionally works to search out shares with nice revaluation potential. Here is how you can choose successful shares step-by-step:

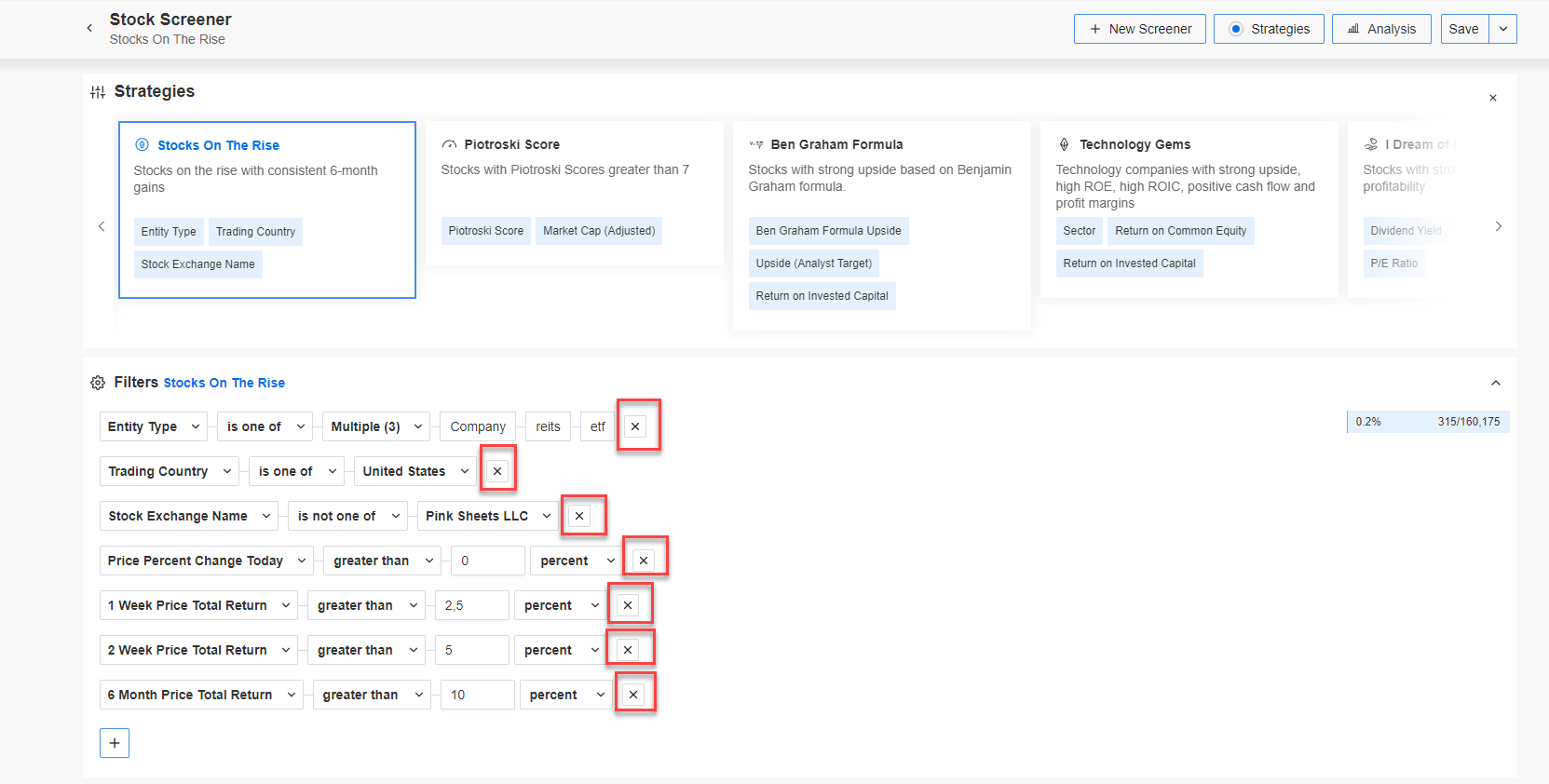

Step 1: Delete Current Filters

Step one is to delete all of the filters you’ve energetic by clicking on the X that seems to the fitting of every filter.

Supply: InvestingPro

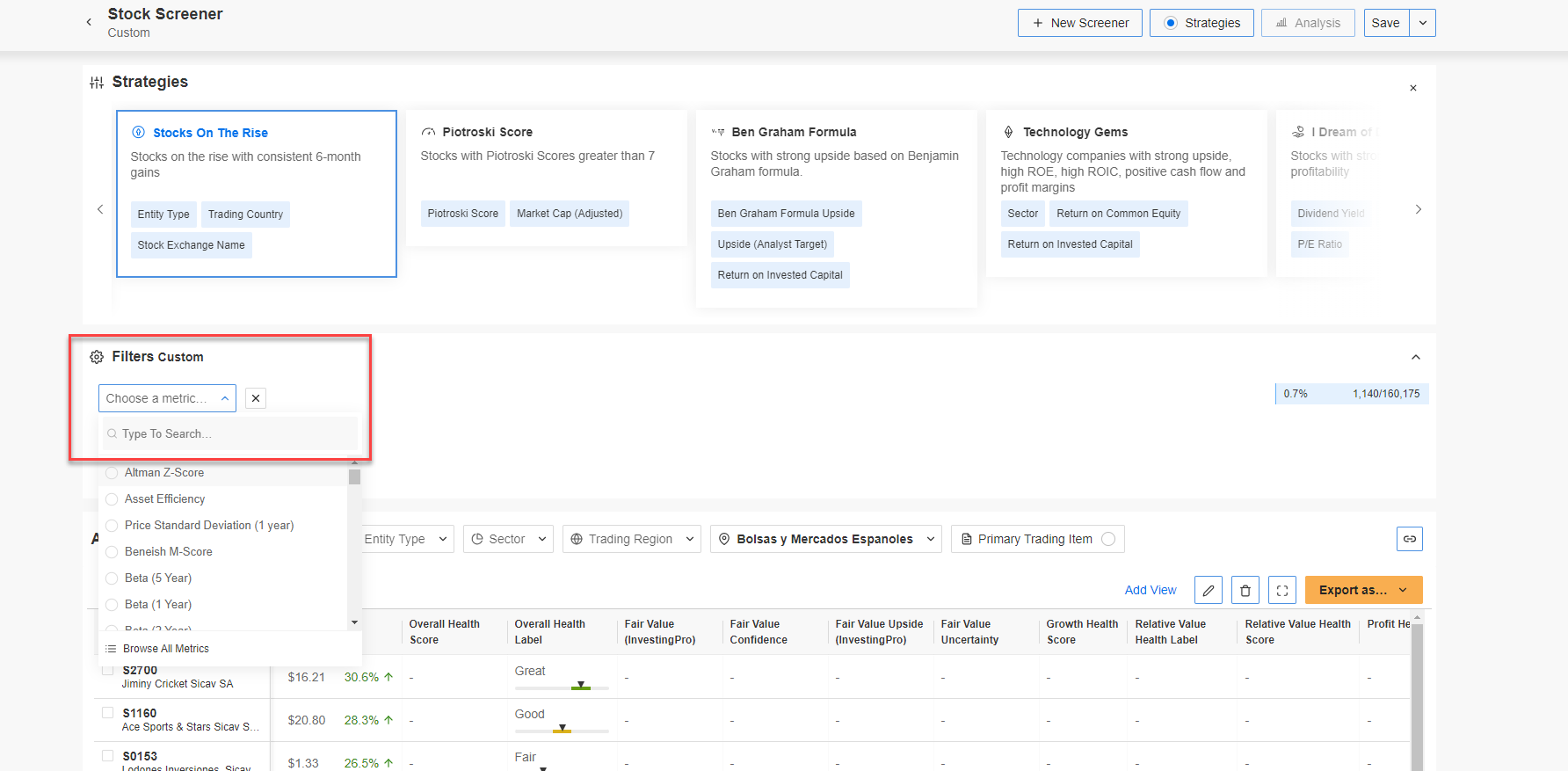

Step 2: Add New Filters

The second step is so as to add 2 filters. Solely two? Sure, solely two, however with an enormous search and choice potential.

Supply: InvestingPro

The primary metric so as to add could be the InvestingPro Honest Worth Enhance and the second is the General Rating.

What do these two metrics imply?

Market worth or InvestingPro Honest Worth in a nutshell means the worth a inventory ‘ought to’ have, not the precise value it holds within the inventory market. Thus, this metric assumes the increment of its precise or underlying intrinsic worth. It’s an unbiased estimate of the potential market value and is helpful in basic evaluation to estimate the worth of an organization based mostly on future money flows.

The General Rating, then again, refers back to the monetary well being of a inventory and represents the general power of an organization. In different phrases, the International Rating is a sign of an organization’s efficiency and monetary place based mostly on an evaluation of total market worth, calculation of particular monetary ratios and comparability with different corporations in the identical business. InvestingPro’s Monetary Well being makes use of a scale of 1 to five to attain shares bearing in mind 5 parameters based mostly on our well being checks: Relative Worth, Value Momentum, Money Move, Profitability and Development. Due to this fact, the Well being or Monetary Standing of an organization is proven as a weighted common of the well being checks.

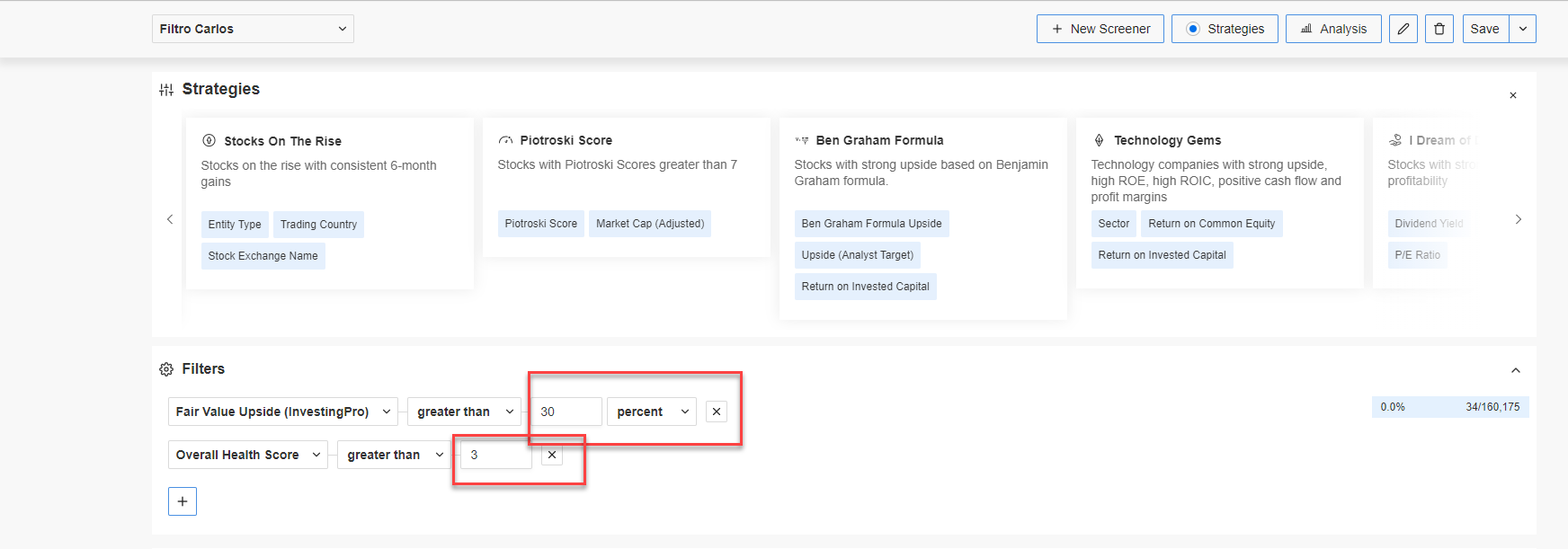

Step 3: Refine Your Search

As soon as we have now established the 2 metrics in our filter we are going to attempt ‘tightening’ the information to search out an optimum choice of shares (greater than 5 and fewer than 20, for instance) that meet these standards.

Supply: InvestingPro

From right here on (and at any time when you have an interest) you may add extra metrics following your data and your inventory choice course of.

Furthermore, when you choose to maintain issues easy, these two metrics might help you uncover interesting shares with out the necessity to fear concerning the inventory market, index, or area you select.

You may obtain this by making use of filters within the Buying and selling Area or Inventory Market sections.

Supply: InvestingPro

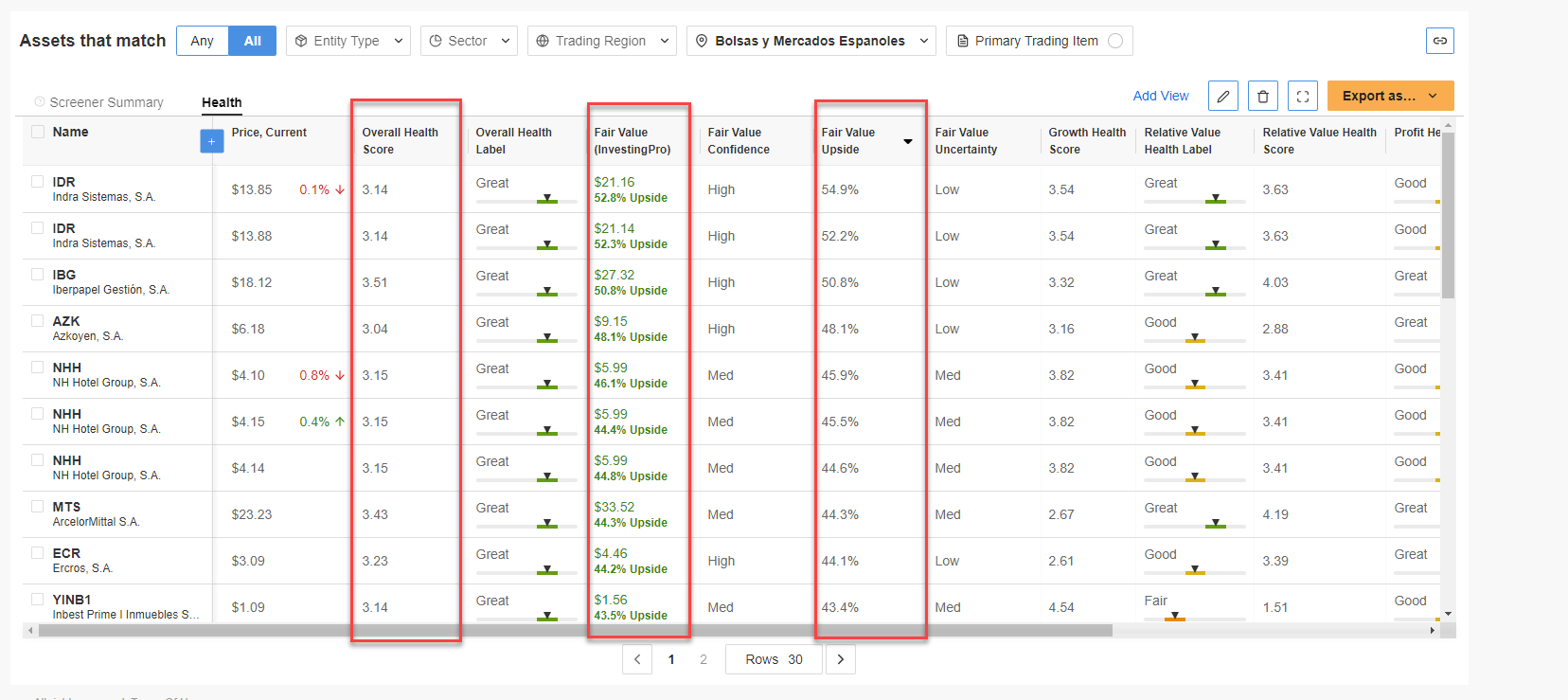

Step 4: Type Your Remaining Outcomes

So for the instance, I’ve created a filter with these two metrics based mostly on the Spanish Inventory Exchanges and Markets.

Thus for a good worth improve larger than 30% and with an total rating of three (out of 5) I get 16 corporations, all with a revaluation potential larger than 35% (even reaching 45 or 50% in a few of them) and with an excellent monetary rating that assures me that they’re robust, dependable corporations with low uncertainty.

As demonstrated by this instance, the one limits to figuring out shares with substantial progress potential are your obtainable time and your artistic pondering.

As an example, when you swap the buying and selling zone to the US, you may uncover a broader choice of shares and your complete course of is nearly the identical.

Moreover, by incorporating a selected sector into your filter standards, you may unearth hidden gems throughout the huge sea of obtainable shares.

In abstract, InvestingPro’s inventory finder proves to be a extremely sensible and user-friendly device for pinpointing probably the most promising funding alternatives within the inventory market.

I encourage you to offer it a attempt to share your insights and experiences with fellow customers. I hope you’ve got discovered this text informative!

***

Beat the Market with InvestingPro’s Unique Black Friday Deal!

This Black Friday, do not miss out on the chance to make your investments work more durable for you. Subscribe to InvestingPro now with an as much as 55% low cost and safe your place among the many savviest merchants available in the market.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation or advice to take a position as such and is by no means supposed to encourage the acquisition of property. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding choice and related danger stays with the investor.

[ad_2]

Source link