[ad_1]

The ten largest shares account for 33% of the S&P 500’s market capitalization, up from 27% on the peak of the tech bubble in 2000.

In the meantime, the S&P 400 has been performing higher than the opposite indexes this 12 months and has a extra diversified inventory weightage.

On this piece, we’ll check out 4 shares that would make an ideal addition to your portfolio.

Investing within the inventory market and trying to get probably the most out of your portfolio? Attempt InvestingPro+! Join HERE and make the most of as much as 38% off your 1-year plan for a restricted time!

Final 12 months and in 2024, the media has primarily centered on large firms that seize a lot of the headlines. However there’s extra to the inventory market than simply these giants.

At present, I need to introduce you to a set of shares from the . This index consists of 400 mid-sized firms.

Mid-cap firms fall within the vary of market cap between $2 billion and $10 billion.

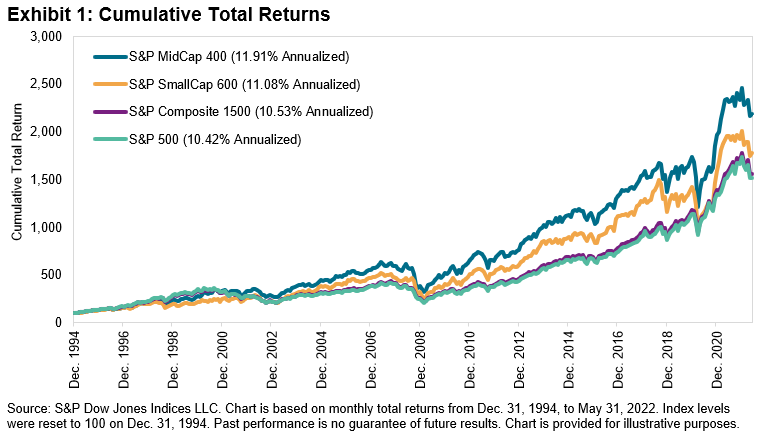

In keeping with information obtainable from 1994 to 2020, it has outperformed each the and the .

And right here we are able to see the latest comparability between the S&P 500 and the S&P 400.

The S&P 500 has a extra intense focus of shares in comparison with the S&P 400.

Nvidia (NASDAQ:)’s market worth makes up nearly 5% of the S&P 500. At the moment, the highest 10 shares contribute to 33% of the index’s complete market worth, which is greater than the 27% noticed through the peak of the tech bubble in 2000.

Now, let’s discover some intriguing shares within the S&P 400 MidCap. I am going to make the most of InvestingPro to assemble important data and information about these firms.

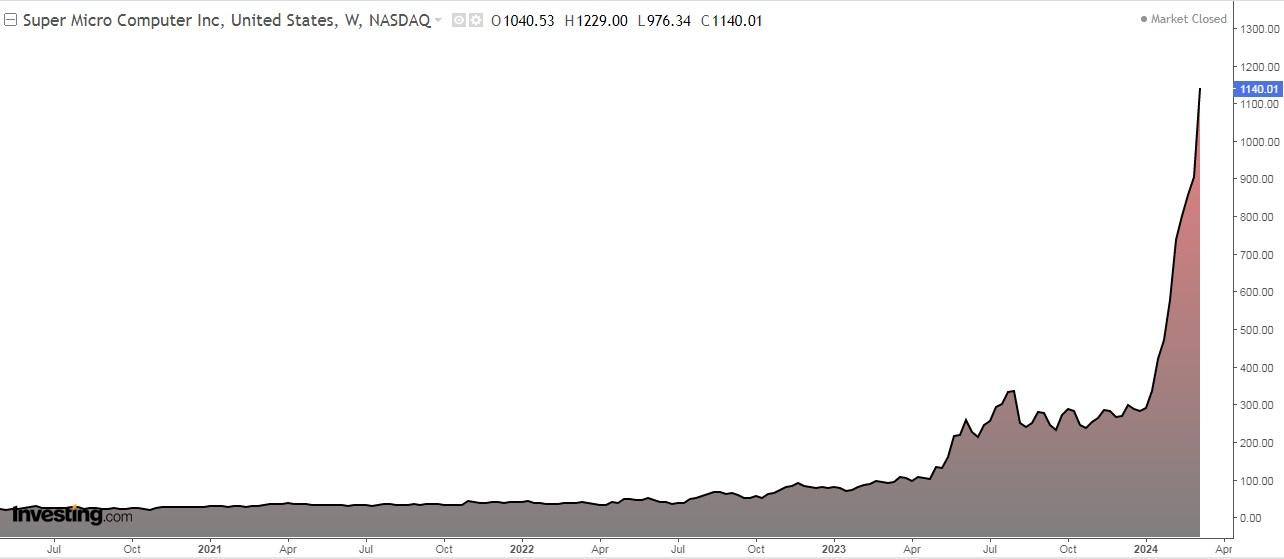

1. Tremendous Micro Pc

Tremendous Micro Pc (NASDAQ:) is a expertise firm specializing in high-end servers, networking gadgets, and workstations. The corporate was integrated in 1993 and relies in San Jose, California.

On April 30 we’ll know its accounts. Earnings per share (EPS) are anticipated to extend by +146.22% and income by +104%.

Tremendous Micro Pc Earnings

Supply: InvestingPro

Tremendous Micro is experiencing accelerating income and, specifically, earnings progress as demand for its servers and computing options expands quickly. It has been rising earnings at a median annual fee of +53% lately.

Be aware additionally the working leverage that’s contributing to margin enlargement and quickly accelerating earnings per share.

The market is aware of its shares will not be low-cost, however believes the near- and long-term progress prospects justify the funding at present ranges.

Supply: InvestingPro

With information on the shut of the week, over the past 12 months, its shares are up +1056%, and over the past three months +334%.

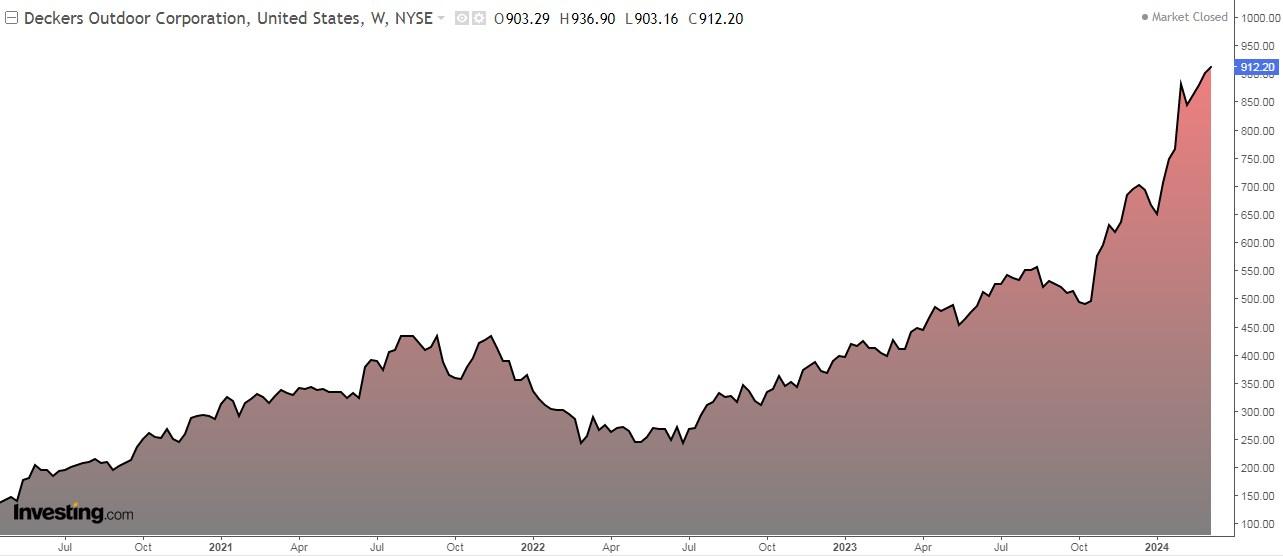

2. Deckers Out of doors

Deckers Out of doors Company (NYSE:) designs and markets footwear, attire and equipment in the US and internationally. It was based in 1973 and is headquartered in Goleta, California.

It is going to launch its numbers on Could 23 and is anticipated to extend revenues by +7.81%.

Deckers Out of doors Earnings

Supply: InvestingPro

Deckers’ manufacturers are experiencing important good points, which contrasts with the loss for instance Nike (NYSE:).

It presents a strong monetary profile. Capitalization stands at $23.43 billion, reflecting its important trade presence.

It has a price-to-earnings ratio of 32.75, suggesting that traders are keen to pay a premium for its earnings potential.

That is supported by the corporate’s robust income progress. The gross revenue margin is +54.43%, indicating environment friendly price administration and a strong pricing technique.

Supply: InvestingPro

With information on the shut of the week, over the past 12 months, its shares are up +115.34%, and over the past three months +30.71%.

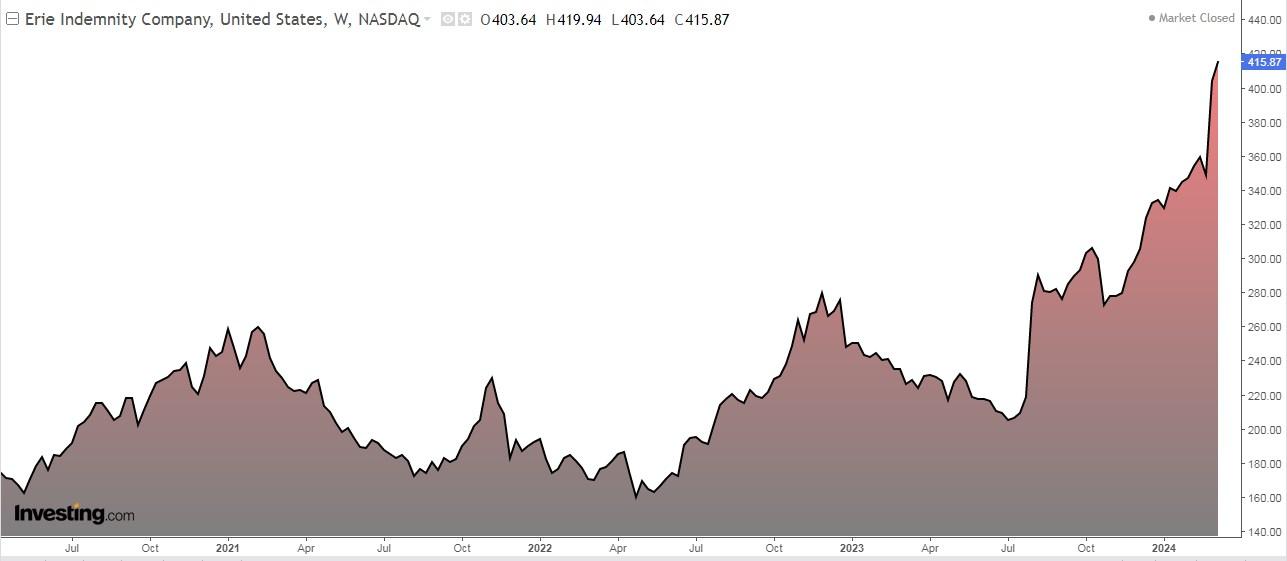

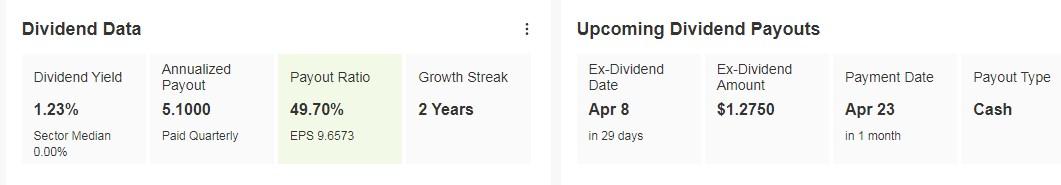

3. Erie Indemnity

Erie Indemnity Firm (NASDAQ:) is a house, accident, automobile, and life insurance coverage firm. The corporate was integrated in 1925 and is headquartered in Erie, Pennsylvania.

It distributes a dividend of $1.27 on April 23 and to be eligible to obtain it you have to personal shares earlier than April 8.

Supply: InvestingPro

It releases its earnings launch on April 25 and earnings per share (EPS) is anticipated to extend by +42.94%.

Erie Indemnity Earnings

Supply: InvestingPro

The corporate’s robust quarterly and year-over-year efficiency was pushed by premium progress, in addition to elevated administration payment revenue.

Buyers like the corporate’s bullish earnings outlook for this 12 months. The corporate is forecast to earn $10.09 per share in 2024, up +15% from 2023.

With information on the shut of the week, over the past 12 months, its shares are up +84.51%, and over the past three months +30.80%.

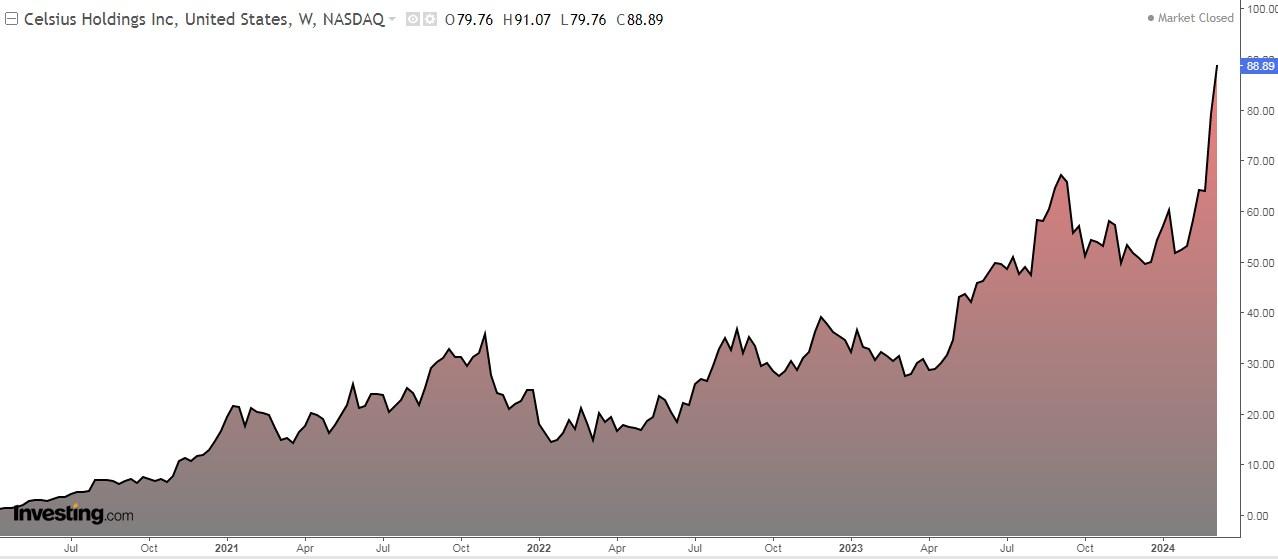

4. Celsius Holdings

Celsius Holdings (NASDAQ:) develops and markets power drinks in the US, Canada, Europe, and Asia-Pacific.

It was previously referred to as Vector Ventures and altered its title in January 2007. It was based in 2004 and relies in Boca Raton, Florida.

It is going to report its outcomes on Could 9 and is anticipated to report earnings per share (EPS) up +71.13% and income up +29.67%.

Celsius Holdings Earnings

Supply: InvestingPro

The market applauds that progress is supported by the nationwide launch of ‘Necessities’, a brand new product extension, which will likely be absolutely rolled out in Could.

The corporate’s gross revenue margin of +48.04% signifies a powerful skill to translate gross sales into earnings, a key consider sustaining its progress trajectory.

With information on the shut of the week, over the past 12 months, its shares are up +206.52%, and over the past three months +78.89%.

***

Do you spend money on the inventory market? When and methods to enter or exit? Attempt InvestingPro!

Make the most of it HERE AND NOW! Click on HERE, select the plan you need for 1 or 2 years, and make the most of your DISCOUNTS. Get from 10% to 50% by making use of the code INVESTINGPRO1. Do not wait any longer!

With it, you’ll get:

ProPicks: AI-managed portfolios of shares with confirmed efficiency.

ProTips: digestible data to simplify a considerable amount of complicated monetary information into a couple of phrases.

Superior Inventory Finder: Seek for the most effective shares primarily based in your expectations, taking into consideration lots of of monetary metrics.

Historic monetary information for 1000’s of shares: In order that elementary evaluation professionals can delve into all the small print themselves.

And lots of different providers, to not point out these we plan so as to add within the close to future.

Act quick and be part of the funding revolution – get your OFFER HERE!

Subscribe At present!

Act quick and be part of the funding revolution – get your OFFER HERE!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link