[ad_1]

Dividend kings are these corporations which have distributed and elevated their dividend for no less than 50 consecutive years.

Because the market grows more and more costly, holding on to secure, incoming-paying corporations is a good way to guard your positive factors.

Immediately we are going to have a look at 5 such shares with wonderful prospects for the rest of the yr.

In 2024, make investments like the massive funds from the consolation of your own home with our AI-powered ProPicks inventory choice instrument. Be taught extra right here>>

Dividend kings are distinguished by their exceptional monitor file of persistently paying dividends to shareholders for a formidable span of no less than 50 consecutive years. These corporations not solely distribute dividends often but additionally exhibit a commendable development of persistently growing them.

The important thing benefits of investing in dividend kings might be succinctly enumerated as follows:

Stable and Dependable Firms: Dividend kings are famend for his or her stability and reliability, making them reliable investments.

Constant Dividend Payouts: These corporations have a confirmed historical past of paying dividends for quite a few consecutive years, demonstrating a dedication to shareholder returns.

Common Dividend Will increase: Buyers profit from the reassurance that dividend kings often increase their dividend payouts, offering a dependable supply of earnings progress. It will are available significantly in useful when there’s inflation.

Stability and Peace of Thoughts: Investing in dividend kings provides buyers a way of stability and peace of thoughts. Figuring out that dividends will probably be acquired periodically contributes to a safer funding expertise.

Resilient Efficiency: Dividend kings exhibit steady efficiency unbiased of financial cycles, showcasing constant progress over time.

Due to this fact, selecting to put money into dividend kings means aligning with sturdy, reliable, extremely liquid, and sizable corporations. These entities boast a notable historical past of consecutively distributing dividends over a few years, additional enhancing their attraction to buyers.

The attractiveness of those investments lies within the mixture of a constant file of dividend will increase and the general stability exhibited by these corporations.

See beneath all of the dividend kings within the US inventory market, together with the variety of consecutive years of accelerating dividends and the corresponding dividend yield:

Emerson (NYSE:) Electrical: 67 / +2.2%.

Parker-Hannifin (NYSE:): 67 / +1.3%.

Procter & Gamble (NYSE:): 67 / +2.5%.

3M Firm (NYSE:): 65 / +5,5%

Cincinnati Monetary (NASDAQ:): 63 / +2.8%

Lowe’s (NYSE:): 62 / +2%.

Coca-Cola (NYSE:): 61 / +3.1%

Colgate-Palmolive (NYSE:): 61 / +2.4%

Johnson & Johnson (NYSE:): 61 /+2.9%

Nordson (NASDAQ:): 60 /+1,1%

Northwest Pure Gasoline (NYSE:): 68 / +5.13%

American States Water Firm (NYSE:): 69 / +2.24%

Dover Company (NYSE:): 68 / +1.40%

Real Elements (NYSE:): 67 / +2.67%

Lancaster Colony (NASDAQ:): 61 / +2.10%

Beneath, we’ll discover a collection of 5 dividend kings that seem able to maintain outperforming the market. To boost our evaluation, I’ll leverage the InvestingPro instrument, knowledgeable useful resource that provides worthwhile knowledge and knowledge for complete analysis on this area.

1. Northwest Pure Holding

The corporate gives distribution companies to residential, industrial and industrial clients in Oregon and Washington. It was based in 1859 and is headquartered in Portland, Oregon.

It has been growing its dividend for 68 consecutive years. Its dividend yield is +5.13%. It is going to distribute it on February 15 and with a view to obtain it it’s essential to personal shares earlier than January 30.

Northwest Pure Holding

Supply: InvestingPro

On February 23 it would current its quarterly outcomes and is anticipated to extend revenues by +7.40%.

Northwest Pure Holding

Supply: InvestingPro

It has 6 rankings, of which 2 are purchase, 4 are maintain and none are promote.

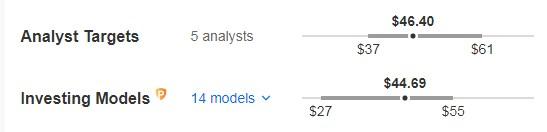

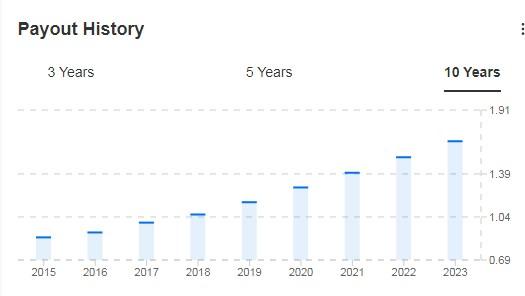

The market offers it potential at $46.40 and InvestingPro fashions at $44.69.

Northwest Pure Holding

Supply: InvestingPro

2. American States Water

The corporate gives water and electrical companies to residential, industrial and industrial clients in america. It was integrated in 1929 and is headquartered in San Dimas, California.

It has been growing its dividend for 69 consecutive years. Its dividend yield is +2.24%.

American States Water

Supply: InvestingPro

It is going to report its quarterly outcomes on February 20 and is anticipated to report a +9.09% enhance in income.

American States Water

Supply: InvestingPro

It presents 7 rankings, of which 4 are purchase, 2 are maintain and 1 is promote. The market offers it potential at $85.33 and InvestingPro fashions at $83.49.

American States Water

Supply: InvestingPro

3. Dover Company

It’s an American conglomerate producer of commercial merchandise. The Downers Grove, Illinois-based firm was based in 1955.

It has been growing its dividend for 68 consecutive years. Its dividend yield is +1.40%.

Dover Company

Supply: InvestingPro

It experiences its financials on February 1, and earnings per share (EPS) are anticipated to extend by +7.88%.

Dover Company

Supply: InvestingPro

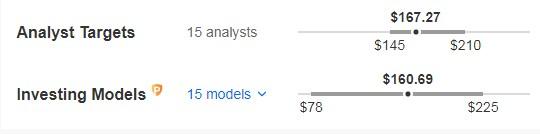

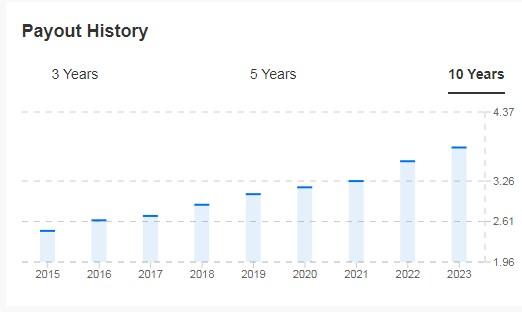

The 12-month potential seen by the market is at $167.27, whereas InvestingPro’s fashions decrease it to $160.69.

Dover Company

Supply: InvestingPro

4. Real Elements

The corporate distributes automotive components and industrial components and supplies. It was integrated in 1928 and is headquartered in Atlanta, Georgia.

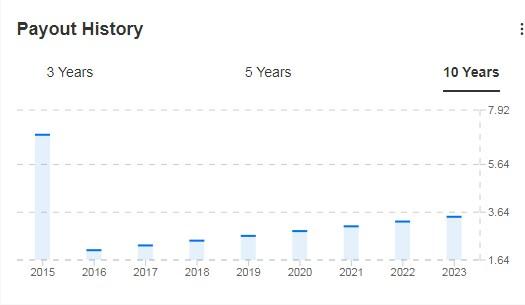

It has been growing its dividend for 67 consecutive years. Its dividend yield is +2.67%.

Real Elements

Supply: InvestingPro

It experiences its financials on February 20, and earnings per share (EPS) are anticipated to extend by +8.49%.

Real Elements

Supply: InvestingPro

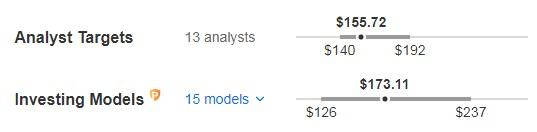

It presents 16 rankings, of which 6 are purchase, 10 are maintain and none are promote. The market offers it potential at $155.72 and InvestingPro fashions at $173.11.

Real Elements

Supply: InvestingPro

5. Lancaster Colony

The corporate is engaged within the manufacturing and advertising of meals merchandise for retail channels in america. It was integrated in 1961 and is headquartered in Westerville, Ohio.

It has been growing its dividend for 61 consecutive years. Its dividend yield is +2.10%.

Lancaster Colony

Supply: InvestingPro

It experiences its quarterly experiences on February 1. Earnings per share (EPS) is anticipated to extend by +22.6% in 2024.

Lancaster Colony

Supply: InvestingPro

It presents 6 rankings, of which 2 are purchase, 4 are maintain and none are promote. InvestingPro fashions see potential at $188.80.

Lancaster Colony

Supply: InvestingPro

***

Take your investing sport to the subsequent degree in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already effectively forward of the sport in the case of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and reduce losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 952% during the last decade, buyers have one of the best collection of shares out there on the tip of their fingers each month.

Subscribe right here for as much as 50% off as a part of our year-end sale and by no means miss a bull market once more!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to speculate as such it isn’t supposed to incentivize the acquisition of property in any manner. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related threat stays with the investor.

[ad_2]

Source link