[ad_1]

Not too long ago, a number of Brazilian fintech firms selected to go public on Wall Avenue, opting to commerce on both the NYSE or Nasdaq for causes like liquidity, visibility, safety, and low volatility.

Utilizing InvestingPro’s superior instruments, we analyzed these firms to find out which one stands out probably the most. We centered on the highest 5 when it comes to market cap.

1. Nubank

Truthful Worth: $10.02 (-13.2%)

Analyst Goal: $12.15

Monetary Well being Rating: 4

Market Cap: $55.05 billion

Nubank (NYSE:) stands out as a widely known Brazilian firm internationally, largely as a consequence of its investments from Warren Buffet. It has additionally established itself as certainly one of Brazil’s hottest banks.

Whereas its P/L ratio of 55x could seem excessive, it is really favorable in comparison with the sector’s short-term revenue progress. Furthermore, income are anticipated to proceed rising this yr.

Notably, the financial institution’s Leveraged Free Money Circulation and Working Income present robust progress, indicating strong monetary well being.

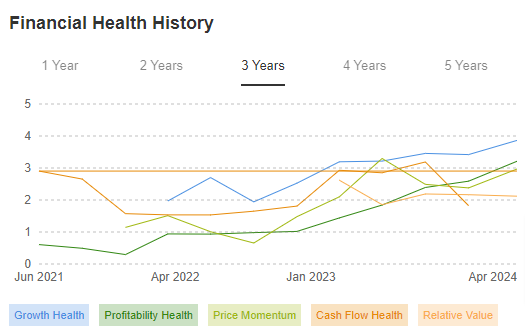

Supply: InvestingPro

Nevertheless, two analysts have not too long ago lowered their projections for the corporate. Moreover, Nubank’s short-term debt surpasses its web belongings. Among the many 5 fintechs listed right here, Nubank is the one one thought of costly by InvestingPro.

2. StoneCo

Truthful Worth: $24.75 (+48.7%)

Analyst Goal: $19.51

Monetary Well being Rating: 4

Market Cap: $5.14 billion

StoneCo (NASDAQ:) recognized for its card machines, boasts a number of constructive features. These embrace an ideal Piotroski rating of 9 out of 9 and projected revenue will increase for the yr.

Stone has additionally been actively repurchasing shares, a transfer sometimes properly acquired by the market. Nevertheless, it doesn’t pay dividends to shareholders.

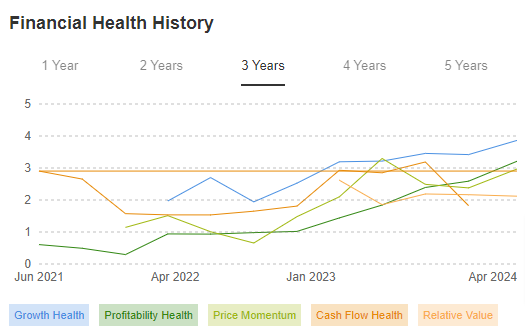

Supply: InvestingPro

Relating to monetary well being, Stone’s latest developments in revenue, debt, and income have been constructive, with efficiency barely above common.

The Return on Invested Capital over the previous two years stands at a positive 17.5%, with a exceptional progress price of 101.0% throughout the identical interval. Moreover, InvestingPro suggests there’s potential for greater than a 40% improve within the share worth.

3. XP

Truthful Worth: $34.41 (+42.8%)

Analyst Goal: $30.51

Monetary Well being: 2.69 (C)

Market Cap: $13.2 billion

Xp Inc (NASDAQ:), a number one dealer in Brazil, was a pioneer in making investments in style right here. Profitability has remained robust in latest instances, and the corporate is actively shopping for again shares out there.

Nevertheless, the excessive P/L ratio of 17x in relation to short-term outcomes is value noting, and they don’t pay dividends to shareholders.

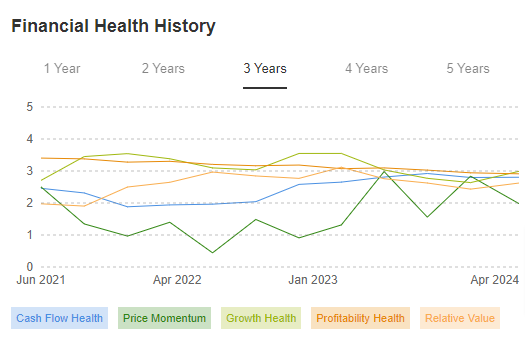

Supply: InvestingPro

Monetary well being is barely under common, however not a trigger for concern. The corporate has been constantly producing excessive income, sustaining web revenue, and experiencing cumulative money movement progress lately.

Furthermore, there’s over 40% upside potential on the honest worth.

4. PagSeguro

Truthful Worth: $22.52 (+74.6%)

Analyst Goal: $16.20

Monetary Well being Rating: 4

Market Cap: $4.07 billion

PagSeguro (NYSE:), a big participant in fee administration and card machine companies, shines with the strongest Monetary Well being amongst all firms listed.

With an ROIC above 30.0%, it stands out within the sector, each presently and over latest years.

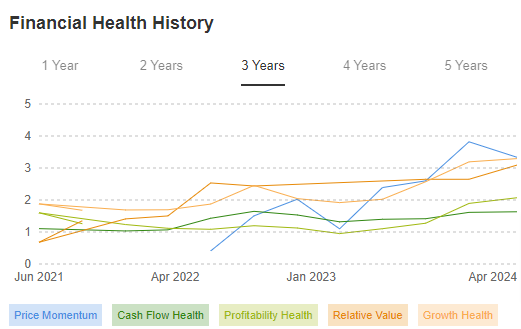

Supply: InvestingPro

The corporate scores excellently throughout Money Circulation (3.08), Development (3.25), Profitability (3.59), and Relative Worth (3.47), contributing to its constructive outlook.

Analysts are revising their projections upward for the subsequent outcomes, anticipating increased income as the corporate additionally engages in share repurchases. Moreover, PagSeguro boasts the best upside potential on the record, practically 70.0%.

5. Inter

Truthful Worth: $7.28 (+30%)

Analyst Goal: $5.70

Monetary Well being Rating: 3

Market Cap: $2.25 billion

Inter (NASDAQ:) initially went public on B3 however shifted to buying and selling solely on Nasdaq in 2022. Main analysts predict elevated gross sales and income for the corporate in 2024.

Supply: InvestingPro

Regardless of delivering excessive returns in latest months, Inter doesn’t distribute dividends. Nevertheless, it faces challenges reminiscent of low-profit margins and excessive valuation multiples.

One among Inter’s monetary strengths lies in its progress in earnings per share and working revenue over latest years. Analysts recommend that the financial institution nonetheless has an upside potential of greater than 20% within the medium time period.

***

Keep in mind to benefit from the InvestingPro+ low cost on the annual plan (click on HERE), the place you’ll be able to uncover undervalued and overvalued shares utilizing unique instruments: ProPicks, AI-managed inventory portfolios, and skilled evaluation.

Make the most of ProTips for simplified info and knowledge, Truthful Worth and Monetary Well being indicators for fast insights into inventory potential and danger, inventory screeners, Historic Monetary Information on 1000’s of shares, and extra!

For a restricted time, readers can get a ten% low cost on 1 and 2-year Professional and Professional+ subscriptions with promo code “INVESTIR”. Subscribe now!

Disclaimer: The creator holds lengthy positions in Paypal, S&P 500, and Nasdaq. This text was written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or advice to speculate as such it isn’t supposed to incentivize the acquisition of belongings in any means. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding choice and the related danger stays with the investoR.

[ad_2]

Source link