[ad_1]

Some shares are backed by Wall Avenue to rally in 2024.

On the flip aspect, some shares repel traders due to poor prospects.

On this piece, we’ll focus on 5 shares which can be primed for a poor 2024.

Trying to beat the market in 2024? Let our AI-powered ProPicks do the leg give you the results you want, and by no means miss one other bull market once more. Study extra right here

As we close to the conclusion of 2023, it is price noting that December 21 has traditionally been a bullish day for the previous 35 years, showcasing the best every day beneficial properties throughout all main US indexes. The typical rise on at the present time is as follows:

: +0.18%

: +0.15%

: +0.34%

This means that the rally can resume right now after the current pullback.

Nonetheless, let’s shift our focus to 2024. Whereas it is unusual on Wall Avenue to dwell on underperforming shares, monitoring them can present priceless insights.

On this spirit, let’s discover some shares that the market anticipates to carry out poorly in 2024 and delve into the explanations behind these expectations.

1. Seagate Expertise

Seagate Expertise (NASDAQ:) provides information storage know-how and options in Singapore, the USA and the Netherlands.

It sells its merchandise primarily to tools producers, distributors, and retailers. It was based in 1978 and is headquartered in Dublin, Eire.

It paid a dividend of $0.70 on January 9 and its dividend yield is +3.32%.

Outcomes for the quarter will probably be introduced on January 24 and are anticipated to be poor with earnings per share (EPS) down -106.69% and income down -36.07%. For 2024 the forecast is for a fall in actual revenues of -13.1%.

Its shares are up +55% within the final yr and +25% within the final 3 months.

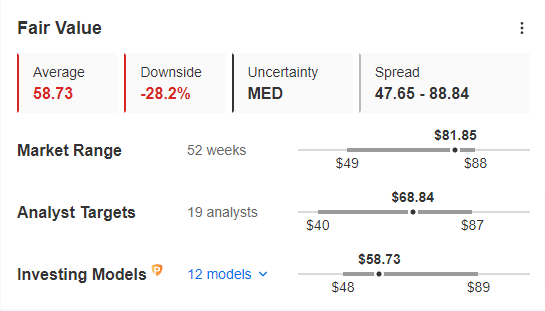

STX Truthful Worth

Supply: InvestingPro

The market doesn’t bode nicely for 2024, giving it a possible draw back of -18% to $68.84. InvestingPro Truthful Worth sees the inventory falling even additional, with a 28.2% draw back threat over the subsequent 12 months.

2. Robert Half (RHI)

Robert Half (NYSE:) gives enterprise consulting options and companies in North America, South America, Europe, Asia and Australia.

The corporate’s dividend yield is +2.2%.

On January 30 it should launch its accounts for the quarter and earnings per share are anticipated to fall by -39.96% and income by -13.36%. Looking forward to 2024, revenues are anticipated to fall -1.7%.

Its shares are up +24.90% within the final yr and +18.21% within the final 3 months.

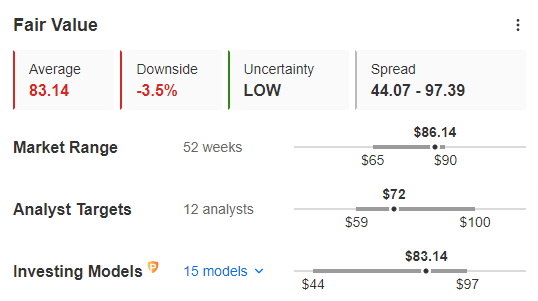

Truthful Worth

Supply: InvestingPro

The market offers it a possible draw back of -17.50% at $72, whereas InvestingPro units its Truthful Worth at $83, implying a 3.5% draw back from present ranges.

3. Intel

Intel (NASDAQ:) was included in 1968 and is headquartered in Santa Clara, California.

Its dividend yield is +1.08%.

Outcomes for the quarter will probably be launched on June 25 and it expects earnings per share to fall -31.50% and precise income to fall -8.40%.

Its shares are up +80.59% within the final yr and +34.95% within the final 3 months.

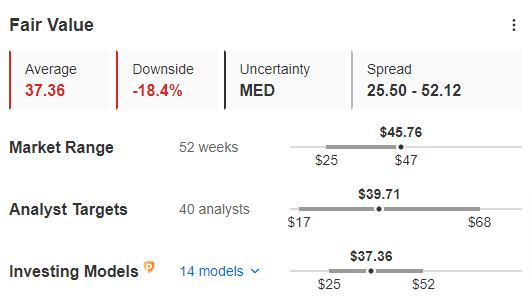

Truthful Worth

Supply: InvestingPro

The market sees a draw back potential of -19% at $37.34. Accordingly, InvestingPro sees the inventory falling by 18.4% over the subsequent 12 months.

4. Southwest Airways

Southwest Airways Firm (NYSE:) was included in 1967 and is headquartered in Dallas, Texas.

It pays a dividend on January 11 of $0.18 and the yield is +2.48%.

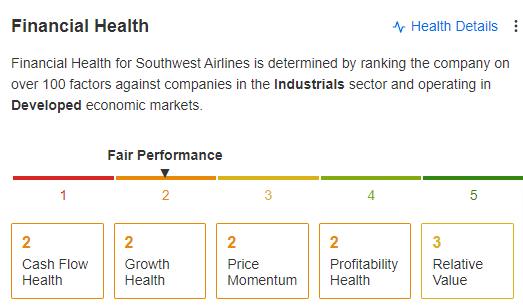

On January 25 we’ll know its numbers for the quarter and earnings per share are anticipated to fall by -83.19% and precise income by -3.27%. That is maybe why InvestingPro offers is a meager “Truthful” monetary well being rating.

src=

Supply: InvestingPro

Its shares are down -17.14% within the final yr.

The market believes it may fall by -9.8% in 2024.

5. Expedia Group

Expedia (NASDAQ:) is an internet journey firm that operates primarily in the USA but additionally in different international locations.

The corporate was previously referred to as Expedia and adjusted its identify to Expedia Group in March 2018. It was based in 1996 and is headquartered in Seattle, Washington.

We are going to study its quarterly accounts on February 8, with earnings per share anticipated to fall by 18% and precise income by -0.80%, in response to InvestingPro.

Upcoming Earnings

Supply: InvestingPro

Its shares are up +76.99% within the final yr and +45.29% within the final 3 months.

The market sees a draw back potential of -8.3% by 2024.

***

In 2024, let laborious choices change into straightforward with our AI-powered stock-picking instrument.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers.

Utilizing state-of-the-art AI know-how, ProPicks gives six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% over the past decade.

Be part of now and by no means miss one other bull market by not figuring out which shares to purchase!

Declare Your Low cost Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related threat stays with the investor.

[ad_2]

Source link