[ad_1]

by Johanan Devanesan

January 11, 2024

Because the tech-driven financial panorama continues to evolve at a outstanding tempo, Singapore stays on the forefront of this transformation, notably within the realm of fintech. In 2024, a few of the most prevalent fintech tendencies in Singapore showcase how the city-state continues to cement its place as a hub for innovation and technological developments within the monetary sector.

This booming scene is pushed by supportive authorities insurance policies, a strong tech-savvy inhabitants, and an growing variety of fintech startups. With the Singapore fintech market dimension when it comes to transaction worth anticipated to develop from US$38.80 billion in 2024 to US$63.18 billion by 2029, as we speak we look at 5 of the highest fintech tendencies set to form the Singaporean monetary trade this 12 months.

From breakthroughs in digital banking to developments in blockchain know-how, we discover the cutting-edge developments that aren’t solely revolutionising the way in which monetary companies are delivered in Singapore but in addition setting benchmarks for the worldwide fintech panorama.

So what are the highest fintech tendencies in Singapore for 2024, and the way are these improvements paving the way in which for a extra environment friendly, inclusive, and forward-thinking monetary ecosystem? The highest fintech tendencies in Singapore shaping this progress embody prompt cross-border transactions, generative AI throughout monetary companies, rising digital foreign money makes use of, embedded finance “as-a-Service”, and elevated ESG reporting and information convergence.

Embracing these rising fintech tendencies can be essential for Singapore to remain forward on this rapidly-developing sector.

Proliferation of Actual-time, Cross-border Transactions

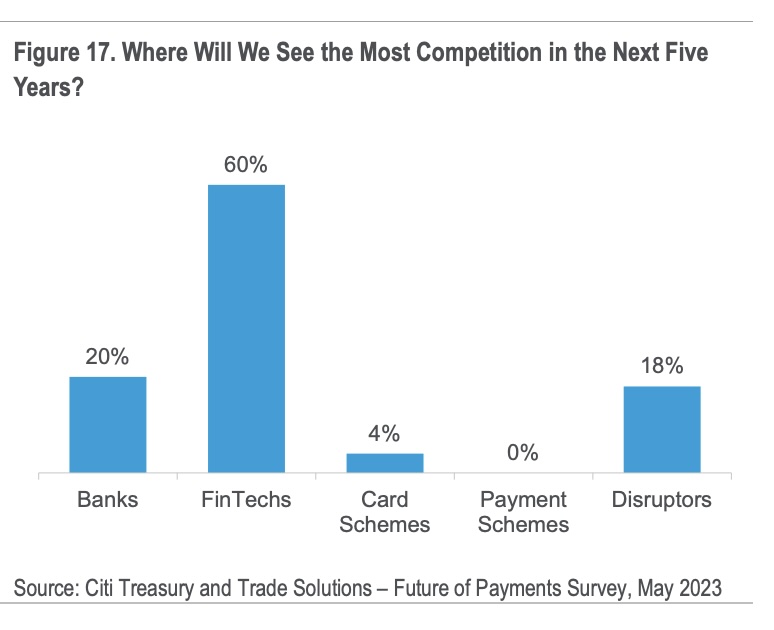

Banks’ largest competitors in cross-border funds within the subsequent 5 years, Supply: Way forward for Cross-Border Funds: Who Will Be Shifting $250 Trillion within the Subsequent 5 Years?, Citi GPS, Sep 2023

The 12 months 2023 marked a notable transition in direction of cross-border cost partnerships throughout Southeast Asia, fueled by financial growth, developments in digital infrastructure, and a burgeoning tourism trade. As a regional frontrunner, Singapore has been instrumental in shaping the event of cross-border cost techniques. Conventional challenges related to these transactions, similar to exorbitant prices, protracted processing occasions, opacity and safety considerations are being systematically addressed by means of collaborative efforts amongst regulators, monetary establishments, and trade gamers.

The 12 months 2024 is poised to witness a major enhancement in cross-border cost connectivity throughout Southeast Asia, underscored by the adoption of real-time funds. A neighborhood QR-code-based real-time funds ecosystem is established in Singapore, and now consists of cross-border QR cost collaborations with Indonesia and the mixing of Singapore’s PayNow with Malaysia’s DuitNow. These initiatives construct upon current linkages with Thailand’s PromptPay and India’s Unified Funds Interface, in addition to QR cost connections with China and Thailand.

In an effort to fortify its cost infrastructure, the Financial Authority of Singapore (MAS) is growing an interoperable SGQR+ scheme to spice up QR code cost interoperability. A proof-of-concept for this scheme, performed in November 2023, explored the feasibility of enabling Singaporean retailers to just accept QR funds from numerous cost schemes by means of a singular monetary establishment.

GenAI: Enhancing Buyer Service and Tackling Id Fraud

An worker utilizing OCBC GPT. Supply: OCBC

The acceleration of real-time funds brings with it an escalated danger of fraud, necessitating the mixing of subtle fraud companies able to screening and, if wanted, blocking transactions nearly instantaneously. Generative AI (GenAI) is predicted to play a pivotal position in advancing the battle in opposition to id fraud, notably within the context of the rising menace posed by deep fakes. Monetary companies’ Chief Data Safety Officers (CISOs) are, subsequently, integrating this know-how into their cybersecurity arsenals.

Giant Language Fashions (LLMs) are anticipated to bolster investigation processes, enhancing the consistency of choices throughout information volumes beforehand unmanageable by people. These fashions can be instrumental in transaction critiques, adept at extracting pertinent info, recognising transaction patterns, and flagging anomalous actions.

Native banks have begun to combine GenAI throughout their operations, with OCBC recognising GenAI’s potential to deal with duties similar to writing job descriptions, doing funding analysis experiences, drafting responses to buyer complaints, doing translation of paperwork, onboard OCBC inside employees, and to personalise buyer experiences.

OCBC’s Head of Group Knowledge Workplace, Donald MacDonald, advised Fintech Information Singapore that AI makes over 4 million day by day choices for the financial institution throughout danger administration, customer support, and gross sales, with OCBC projecting this quantity to succeed in 10 million by 2025. AI delivers personalised suggestions and insights by means of the cellular banking app, sending 250 million suggestions per 12 months in direction of helping clients

The Emergence of Stablecoins and CBDCs

Venture Guardian, spearheaded by MAS at the side of trade stakeholders, is on the vanguard of tokenising varied asset lessons similar to international alternate, bonds, and funds. This initiative goals to unlock liquidity, streamline operational effectivity, and lengthen investor entry. MAS is collaborating with world regulators, together with the Worldwide Financial Fund (IMF), to ascertain worldwide requirements and frameworks for asset tokenisation, thereby fostering world belief and cooperation.

In 2024, MAS is about to provoke a pilot program for the issuance of wholesale Central Financial institution Digital Currencies (CBDCs), surpassing earlier simulations to precise functions in collaboration with native banks. This initiative underscores the potential of digital currencies in facilitating home funds. Concurrently, the provisional approval of stablecoins, aligning with MAS’ regulatory framework, highlights the potential of well-regulated stablecoins in broadening the functions of digital cash.

MAS is collaborating with policymakers and monetary establishments to discover the design of an open digital infrastructure that may host tokenized monetary property and functions, known as International Layer One (GL1). This method will facilitates tokenised property to be traded throughout world liquidity swimming pools, whereas assembly related regulatory necessities and pointers.

Embedded Monetary Companies: A Sport Changer

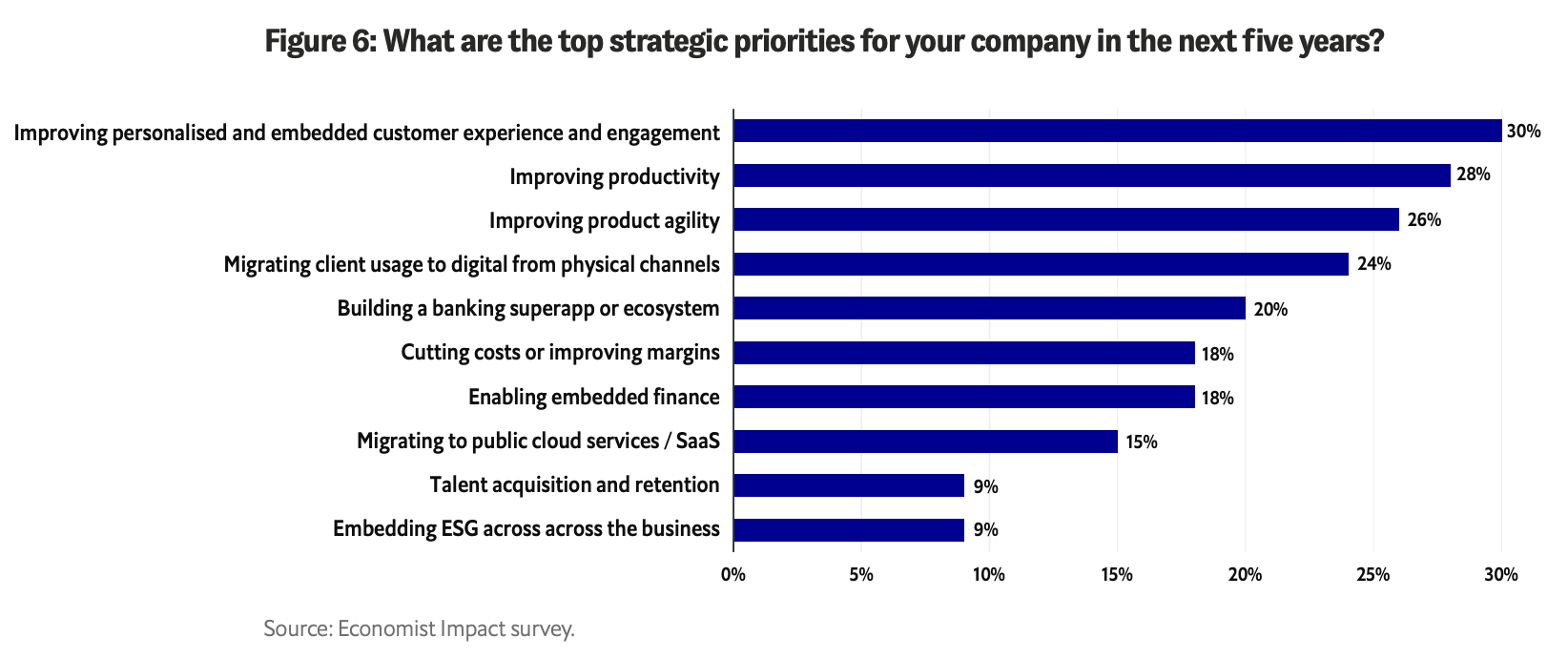

What are the highest strategic priorities to your firm within the subsequent 5 years?, Supply: Byte-sized banking: Can banks create a real ecosystem with embedded finance?, Economist Influence/Temenos, Sep 2023

Embedded finance (EmFi) is revolutionising the way in which non-financial service corporations incorporate monetary companies into their core choices. This 12 months, we’re more likely to witness a major surge in cross-sector convergence, as monetary parts are seamlessly built-in into buyer buying experiences. Conventional retail banks could quickly supply brokerage companies as an added worth for purchasers with financial savings accounts. Equally, monetary well being platforms are anticipated to broaden their companies to incorporate funding choices.

EmFi presents conventional monetary establishments with alternatives to discover new markets and reinvent their core companies by partnering with third-party platforms to supply interoperable monetary companies. For example, Commonplace Chartered spinoff audax gives Banking-as-a-Service options to energy embedded finance options for non-banks.

Insurance coverage and lending are anticipated to dominate the EmFi product spectrum, usually being bundled collectively. Singapore and regional super-app Seize gives a plethora of embedded choices, from GrabFinance micro loans to quite a lot of insurance coverage merchandise together with for journey, medical and private accident protection — all from inside its single, unified app.

For insurance coverage corporations, adopting daring embedded insurance coverage methods might be key to avoiding disintermediation. Insurance coverage-as-a-Service is more likely to be built-in into cellular apps and web sites, enabling the acquisition of insurance coverage with a single click on on the level of sale. In distinction, wealth and asset managers may face challenges on account of their slower adoption of AI and know-how. To stay aggressive, they might want to quickly embrace technological developments by partnering with fintechs.

In Southeast Asia, notably in rising markets the place entry to conventional credit score may be difficult, essentially the most prevalent type of embedded lending is predicted to be purchase now, pay later (BNPL) schemes. These schemes, built-in into retail platforms, are set to supply a monetary lifeline to a good portion of the inhabitants.

Taking ESG Knowledge Reporting to the Subsequent Degree

Supply: MAS

On the Singapore Fintech Pageant 2023, Ravi Menon, the Managing Director of MAS, launched the subsequent section of Venture Greenprint, which incorporates the launch of a brand new built-in platform named “Gprnt” (additionally pronounced “Greenprint”). This initiative, backed by trade giants similar to HSBC, KPMG, MUFG, and Microsoft, is designed to revolutionise the monetary ecosystem with superior capabilities for national-level sustainability reporting and information necessities.

A key facet of Gprnt.ai is its user-friendly ESG reporting software, particularly tailor-made for SMEs. This software is predicted to simplify the reporting course of, making it extra accessible and cost-effective. It should consolidate information from varied digital techniques, together with utility meters and enterprise accounting software program. In circumstances the place supply information is unavailable, AI instruments will allow customers to add paperwork and extract vital information. A Microsoft GPT-4 powered chatbot will help in bridging information gaps and crafting sustainability narratives.

Venture Greenprint is about to increase its impression past Singapore, participating in worldwide collaborations to collect information important for local weather danger administration and supporting the transition to a net-zero future.

These 5 fintech tendencies in Singapore for 2024 underscore the nation’s dedication to establishing a extra environment friendly, inclusive, and forward-thinking monetary ecosystem. The developments in real-time funds, the adoption of GenAI in combating fraud, the event of digital currencies, the mixing of economic companies into non-financial sectors, and the development in ESG reporting spotlight Singapore’s position as a pacesetter in monetary innovation, setting benchmarks not solely regionally but in addition on a world scale.

[ad_2]

Source link