[ad_1]

As 2024 approaches, the inventory market’s course hangs within the stability, formed by components akin to rates of interest, inflation, and earnings.

Making right predictions is almost not possible, as demonstrated by the improper predictions made for 2023.

Even then, being ready for dangers is part of sound monetary planning. So let’s check out just a few dangers markets may face subsequent 12 months.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg give you the results you want, and by no means miss one other bull market once more. Study Extra »

The query on everybody’s thoughts proper now’s: What does 2024 have in retailer for markets?

Whereas it’d seem mundane, the trajectory of the inventory market within the upcoming 12 months is something however sure.

It might persist in its upward pattern or pivot downward, contingent on components like rates of interest, , financial development in main areas, company earnings, investor sentiment, or any unexpected occasions.

Up up to now, essentially the most substantial threat may be presuming a predetermined course for the market.

I am not suggesting that forecasting is unwarranted; it is essential for future monetary planning. Nonetheless, we ought to be ready for unexpected developments and issue them into our plans.

In essence, absolute certainty usually carries the chance of being confirmed improper—a phenomenon not unusual in our each day lives.

Do not imagine predictions; they’re usually improper

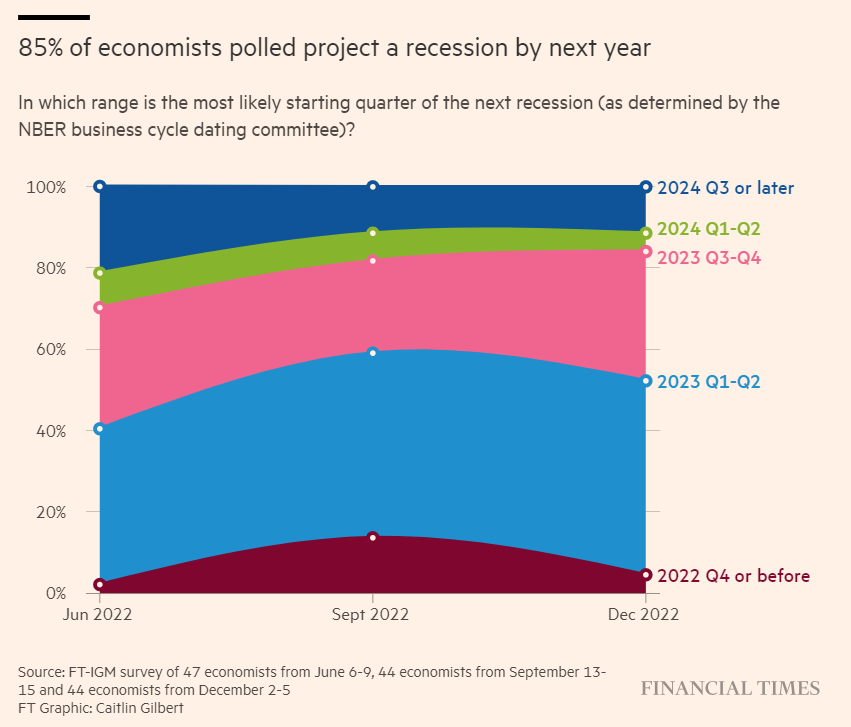

Final 12 months, concurrently we’re immediately, the Monetary Instances printed a survey that greater than 80% of economists had been sure, thus predicting with certainty, a recession in 2023.

Do you continue to assume a recession is coming? Folks, on the whole, are sometimes sure to be improper, and as I stated earlier than, it’s acceptable to anticipate something.

I feel, as with 2023, we must attempt to experience the market moderately than outperform it, and if predicting the longer term is troublesome maybe it might be wiser to begin with what we all know.

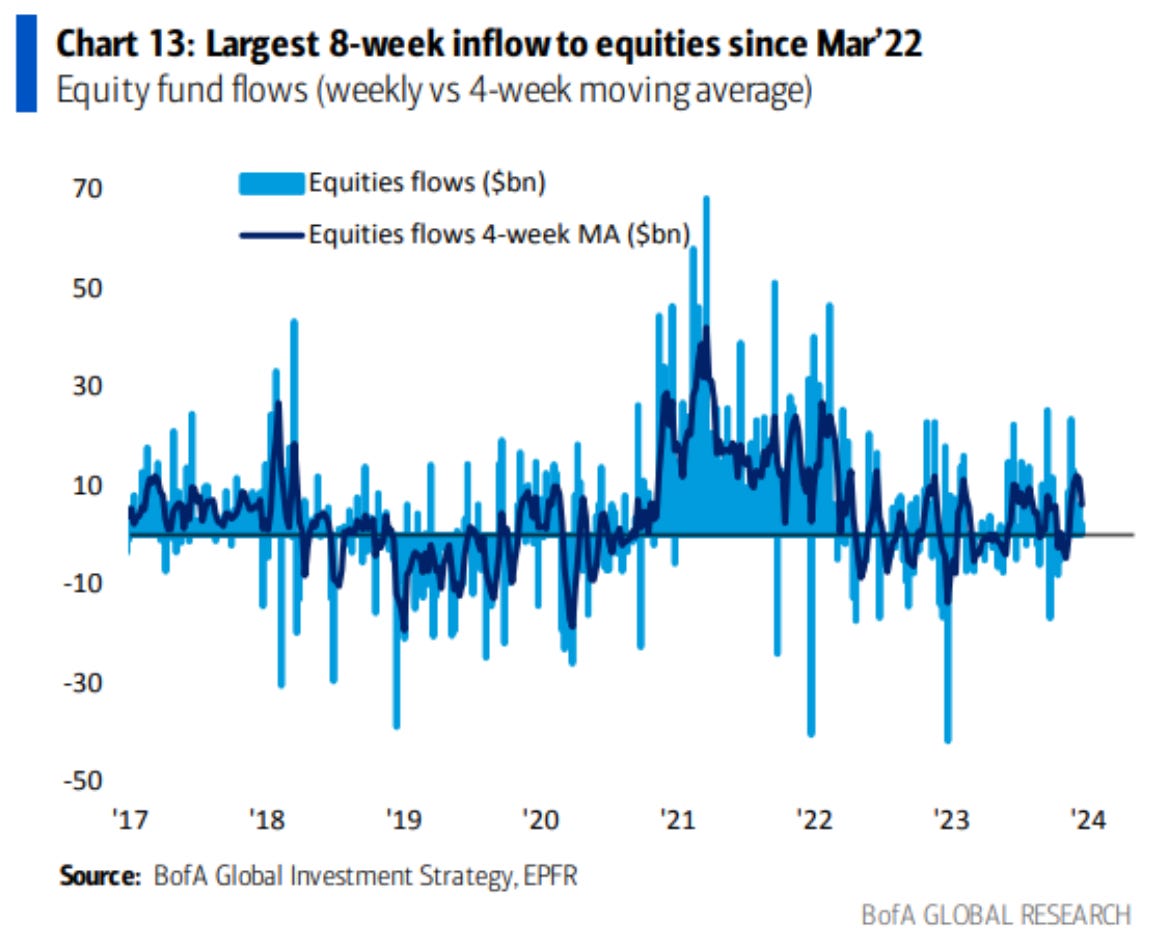

For a lot of 2023, we noticed traders’ cash stream into Treasuries, then we noticed the most important outflow from Treasuries since June 2020 into equities.

Flows into fairness funds have seen the most important inflows in 2 months since March 2022, and increasingly more persons are chasing the rally.

Equities, up to now, have merely adopted their seasonal tendencies. There’s nothing to fret about (for the time being).

It’s when markets ignore their seasonal tendencies that we have to listen; the onset of weak point throughout a seasonally sturdy interval of the 12 months, akin to late December and January, may very well be an indication that the pattern is worsening.

One knowledge level value monitoring is the which have modified their pattern because the continues to rise.

This isn’t the standard state of affairs; inspecting the information from 2000 onwards reveals a constant sample the place every decline within the knowledge is reliably succeeded by the reversal of the S&P 500.

What’s really driving shares?

One vital issue is a weak . Curiously, when the greenback is robust, inventory costs have a tendency to say no.

After the height in September 2022, the greenback went down whereas there was a reversal for the S&P 500, from there on, shares went upward.

We are able to say that so long as there’s a greenback with a bearish pattern, the inventory rally might proceed. That is supported by investor sentiment towards dangerous, non-defensive shares.

We’re seeing the precise reverse of what ought to be obvious within the case of a bearish market-there isn’t any rotation towards defensive shares with low volatility and on shopper items.

Ought to we proceed to assume that issues shall be high quality?

In line with a Bloomberg article, the S&P 500 has created the third wave of the “Elliott idea,” which is mostly essentially the most highly effective and in depth.

The index has approached all-time highs that may very well be damaged within the coming days with the opportunity of touching 4900 within the coming weeks.

As soon as the energy of the third wave is over, nevertheless, the index will are inclined to create the fourth, which as you properly know represents a correction.

The previous wave 2 of correction, began in January 2022 and lasted about 10 months with a drop of 20-25%.

Will the rally final for much longer? we will see.

Till then, pleased holidays!

***

In 2024, let onerous selections grow to be simple with our AI-powered stock-picking device.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI expertise, ProPicks supplies six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not realizing which shares to purchase!

Declare Your Low cost In the present day!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or advice to speculate as such it’s not meant to incentivize the acquisition of property in any approach. As a reminder, any kind of asset, is evaluated from a number of views and is very dangerous, and due to this fact, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link