[ad_1]

Fox Enterprise

On Thursday, after final week’s podcast|videocast, I joined Kelly O’Grady on Fox Enterprise – The Claman Countdown. On this phase we mentioned 2024 market outlook, Small (and Mid Caps), why Fed Cuts (this spherical) are NOT bearish, Cooper Customary updates and extra. Due to Jake Mack and Kelly for having me on:

Bloomberg HT

Final week I joined Ali Cinar on Bloomberg HT Turkey. We mentioned Fed Cuts, Recession, Earnings, Company Effectivity, Margins, Vitality Costs, Inflation, (!), PYPL, CCI, Inventory Market Outlook, Presidential Election yr, Giant cap v. SMID, CPS, Company Credit score/Excessive Yield Markets, Refinancing theme, Message for 2024, Breadth, and much more. Due to Ali for having me on:

As I said within the media appearances above, whereas we did/do count on some consolidation/volatility in Q1 after a pleasant transfer in This autumn, we’d not get too cute with shorting or hedging because it’s powerful to quick new highs. There are nonetheless bargains to be discovered for those who look rigorously, however definitely an surroundings to HOLD. We don’t promote or hedge shares on the premise of market timing. We promote shares once they have reached our estimate of honest worth – which we decide BEFORE WE ENTER THE POSITION.

Solar Tzu: “Each battle is received earlier than it’s ever fought.”

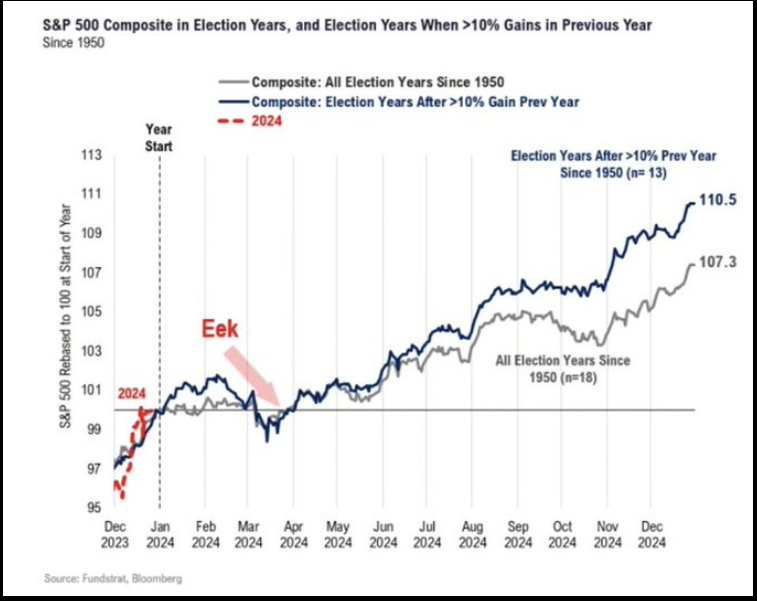

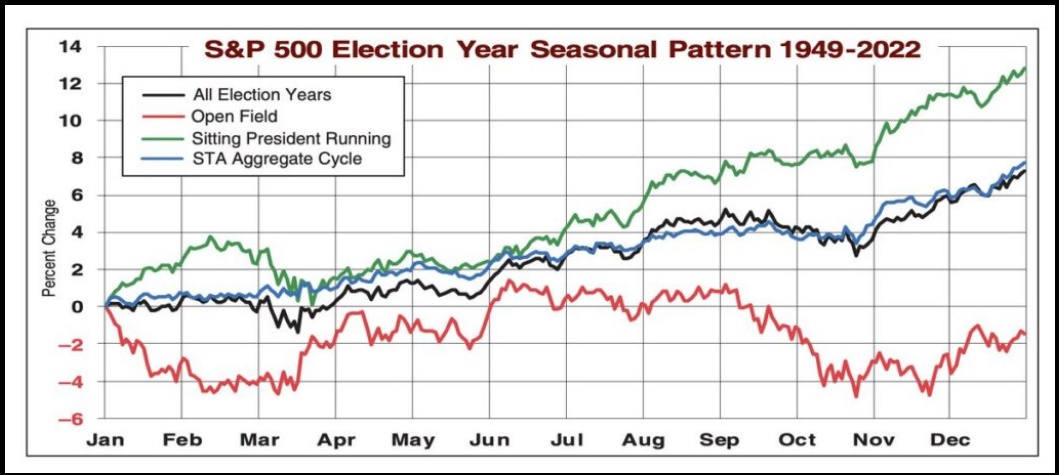

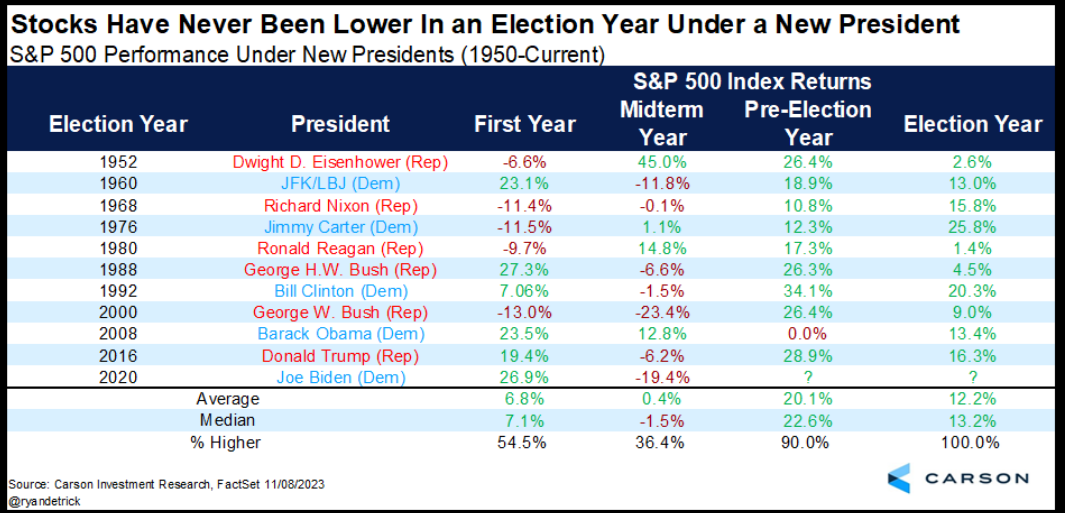

Election Yr Historic Efficiency:

supply: Fundstrat

supply: Almanac Dealer

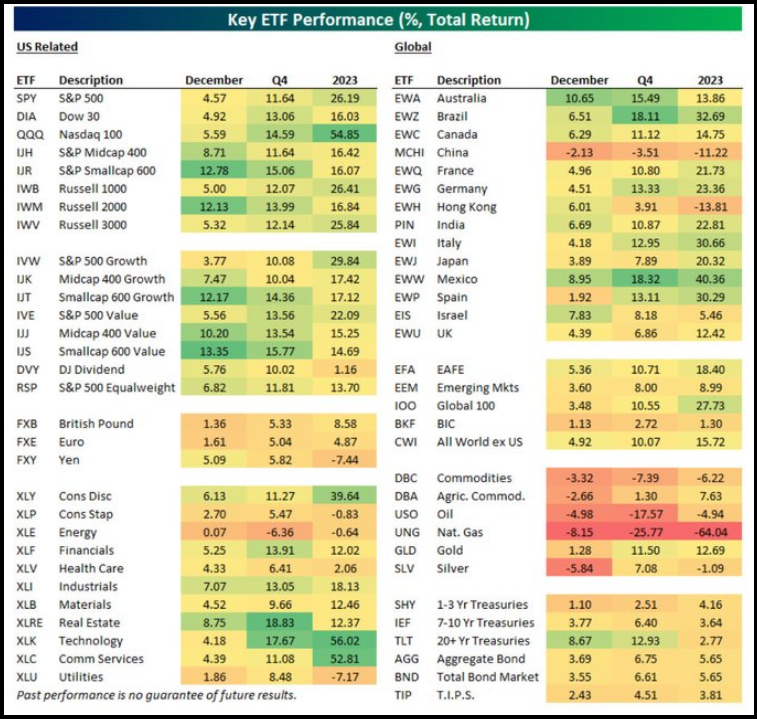

Final Shall Be First (half II)

Supply: Bespoke

Trying by way of these asset lessons, our eyes are skilled for alternatives in final yr’s laggards (most of which we now have already executed):

Nat Gasoline, Vitality, Commodities, Lengthy Bonds, Rising Markets, China, Hong Kong, Utilities, REITs, , Staples, Yen, Dividend Shares, Small Caps, and Mid-Caps.

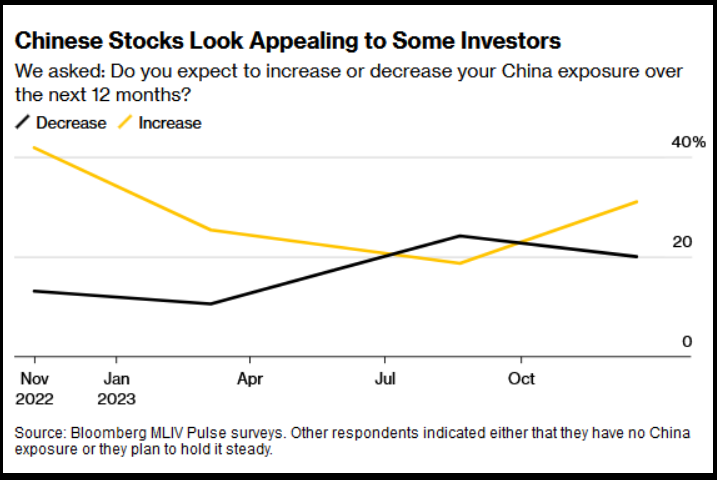

Sentiment altering in China for “Dragon Yr” 2024?

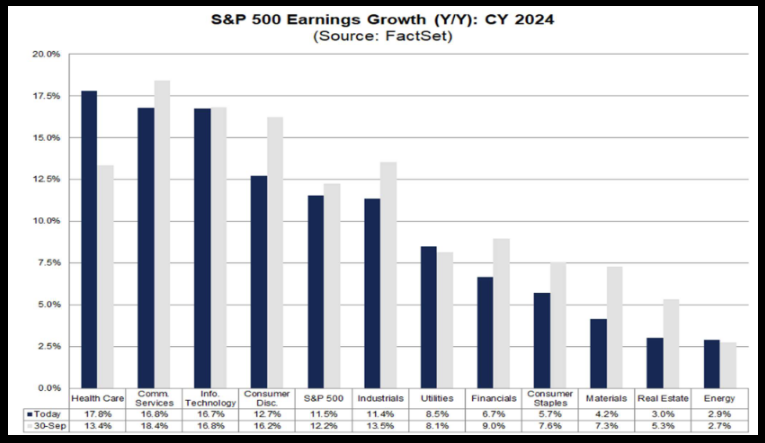

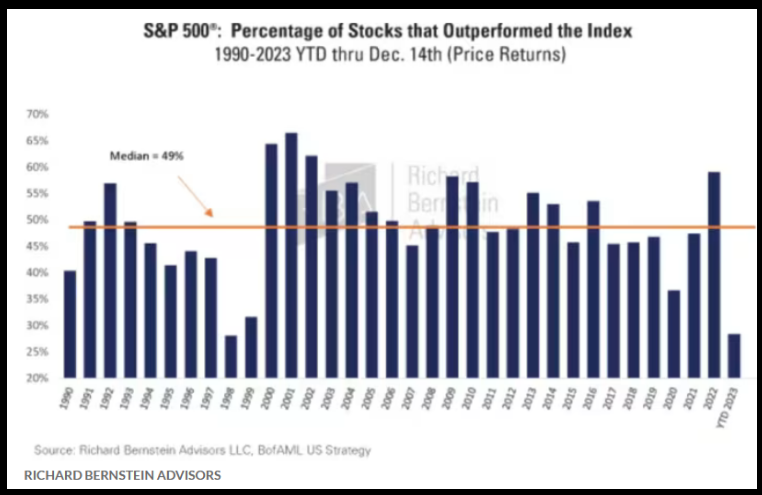

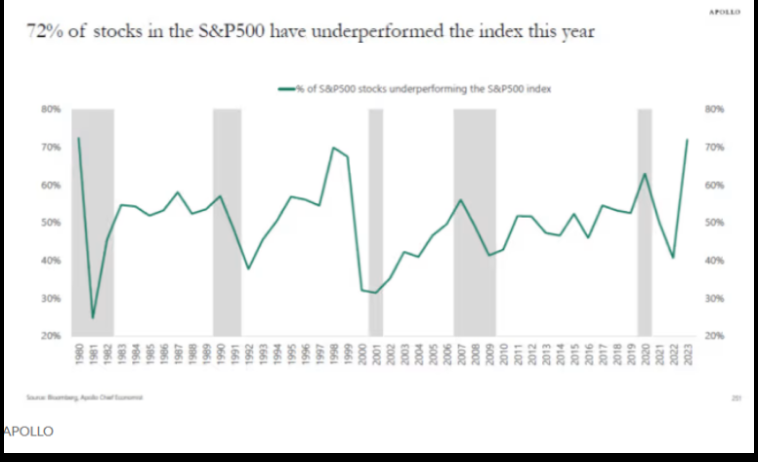

Additional room for Breadth Growth:

Fed Minutes:

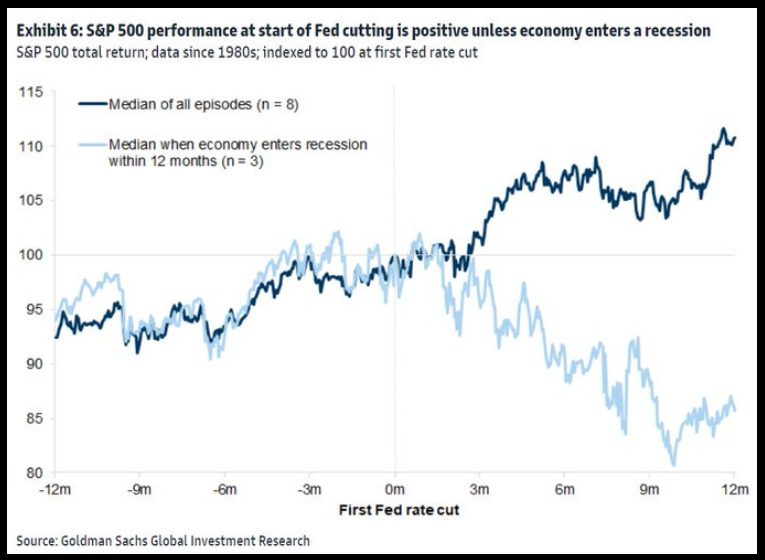

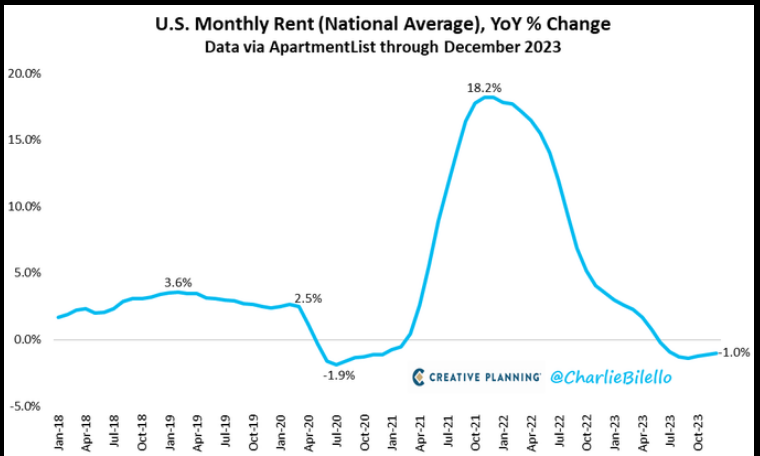

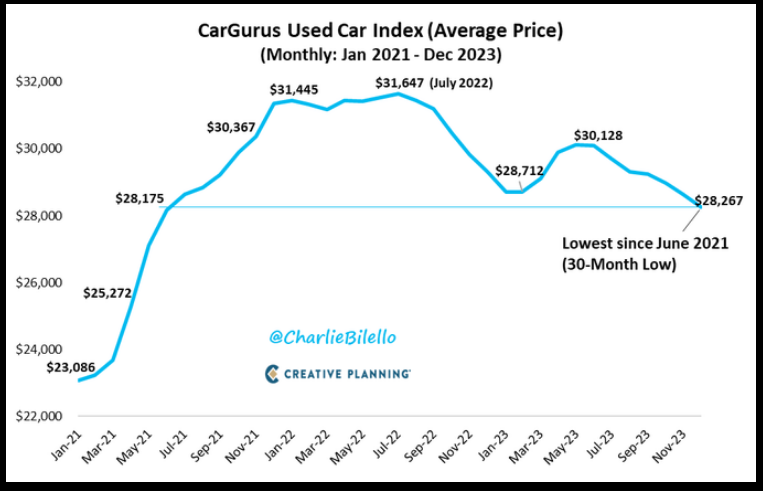

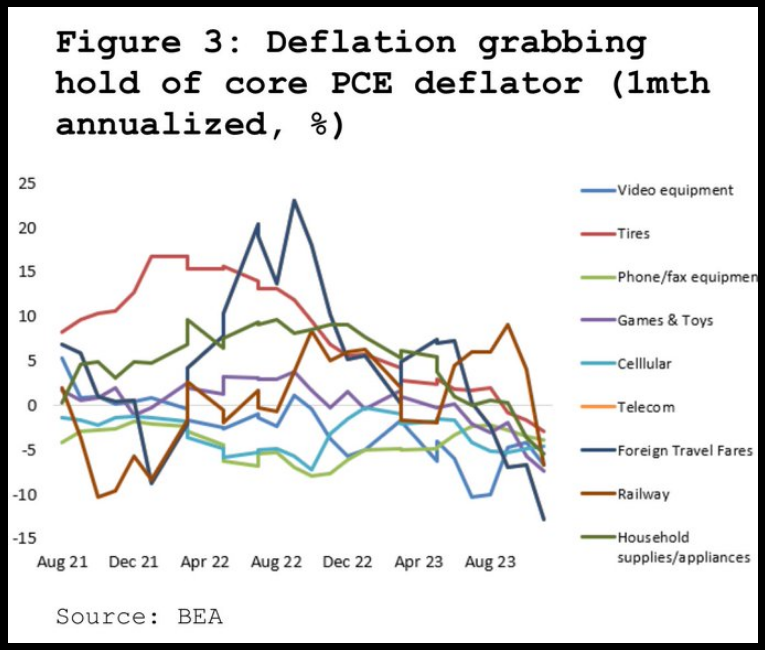

I’m beginning to lean on the facet of cuts coming in sooner slightly than later (1/11 CPI report essential forward of Jan 31 Fed Assembly). The large drop within the Fed’s most popular inflation gauge (Core PCE) now exhibits the avg. month-to-month change of the final half yr is BELOW the Fed’s goal of two%.

As we mentioned a number of occasions final yr within the podcast|videocast if actual charges (FFR – inflation) keep too restrictive we may have DEFLATIONARY dangers forward – that are a lot more durable to repair than inflation. A weaker and a few commodity stability might maintain this threat at bay, however the Fed might must step in sooner than anticipated – or fall BEHIND THE CURVE as soon as once more. An earlier reduce will result in additional weakening within the greenback and a possible rebound in commodity costs within the coming yr.

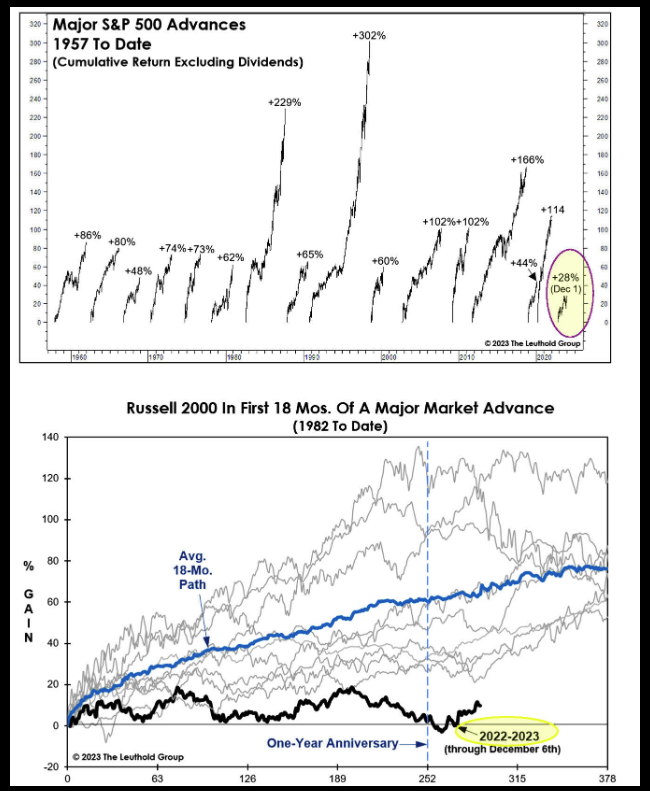

New Bull Market in early levels:

New Bull Market

Supply: Leuthold Group

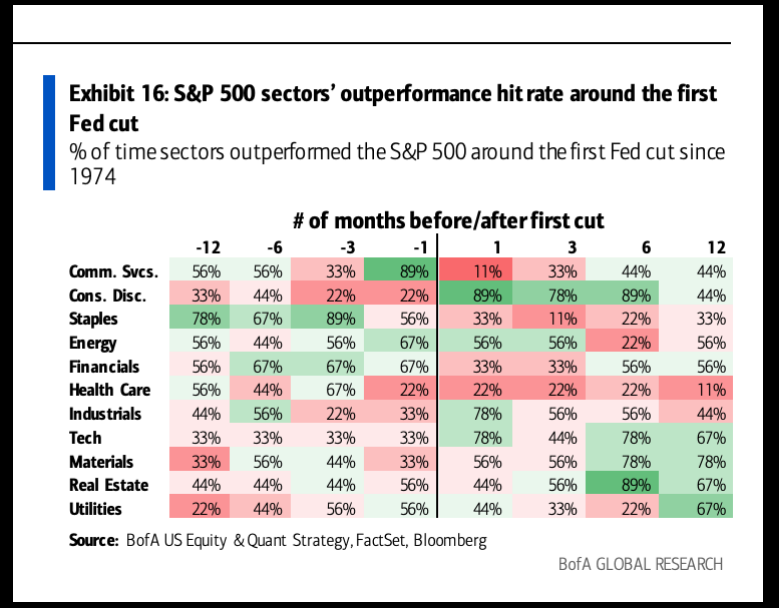

The Goose Is Unfastened?

On the Saturday earlier than Christmas, Kaitlyn introduced the women into NYC to hitch me after certainly one of my hits. We determined to soak within the Vacation Spirit for a few days earlier than heading again out to CT to host Christmas. As we walked up fifth avenue, the women visited their favourite shops and I did channel checks on mine: North Face, Vans (VFC) and some others. I used to be fascinated with surveying the “client discretionary” panorama – as that group tends to have the very best likelihood of sector out-performance following the primary Fed reduce (see above).

As the women and Kaitlyn took a flip into Coach, I observed a retailer known as Canada Goose (TSX:) throughout the road. I used to be curious as a result of the inventory had popped up a number of occasions in the previous couple of months – however I all the time handed – till I noticed the road out the door. You needed to wait on the road within the chilly as a result of there have been too many individuals within the retailer and safety would solely let in a sure variety of individuals at a time. I waited for ~half-hour till the women got here out of Coach after which I simply left as a result of there have been too many individuals in entrance of me.

It jogged my memory of Yeti – which additionally got here up numerous occasions in the course of the Summer time. The inventory received all the way down to ~$35 from $108 and I took a fast look. I noticed a little bit of development deceleration, nevertheless it was nonetheless a money generative, top quality enterprise with some degree of runway forward. What I couldn’t perceive was who was shopping for $500-$1000 coolers to retailer their beer at a tailgate? Isn’t a cooler a cooler?

On the way in which to attending the Cowboys sport in Dallas (in opposition to the Jets) – at first of this season (with an excellent good friend and shopper) – I spoke with one other fairness supervisor who had additionally observed the inventory and never completed something – however had a greater grasp of the buyer who bought this stuff. It was a luxurious spend for individuals who wished to indicate they might afford an costly cooler. Sure, the standard and sturdiness was most likely higher on the margins, however this was the Starbucks (NASDAQ:) (of espresso), Apple (NASDAQ:) (of Electronics), Nike/Air Jordans (of sneakers), BMW (ETR:) (of automobiles), Rolex (of watches) and Coach (of Purses).

All perceived as “luxurious” however any aspirational center class particular person may stretch their budgets to indicate that they had “made it.” I couldn’t get there, so I handed. The inventory closed the yr ~$54. Error of omission. I can take care of that! Perhaps I’ll get one other look (nonetheless unsure if I’d pull the set off). Perhaps not…

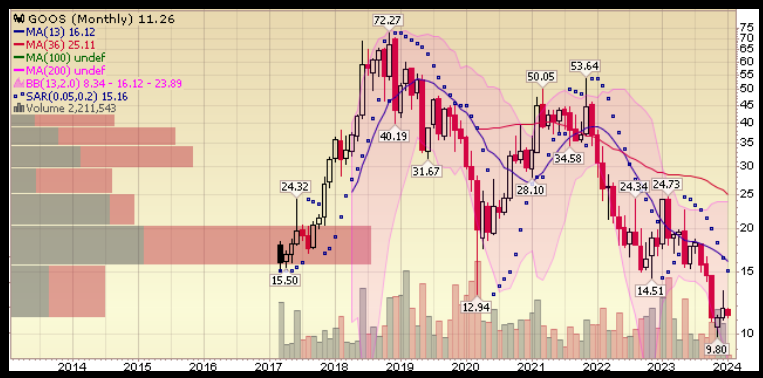

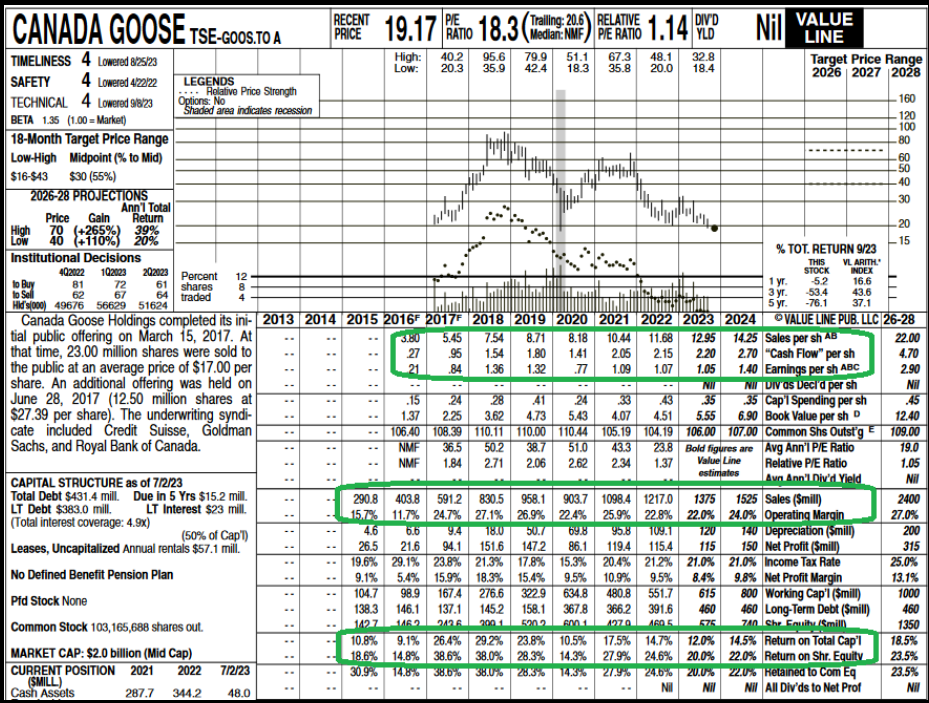

GOOS

We have now now established a brand new starter place in GOOS, throughout accounts the place there may be capability. We’re doubtless a bit early on this one and may have time so as to add extra over time.

The primary factor that stood our for me on GOOS was the truth that gross margins are EXPANDING. You’d by no means guess that by wanting on the inventory!

They proceed to develop revenues and compound shareholder wealth.

Most up-to-date earnings outcomes:

Inventory is down on account of lowered steerage. Inventory down considerably greater than steerage!

Now onto the shorter time period view for the Common Market:

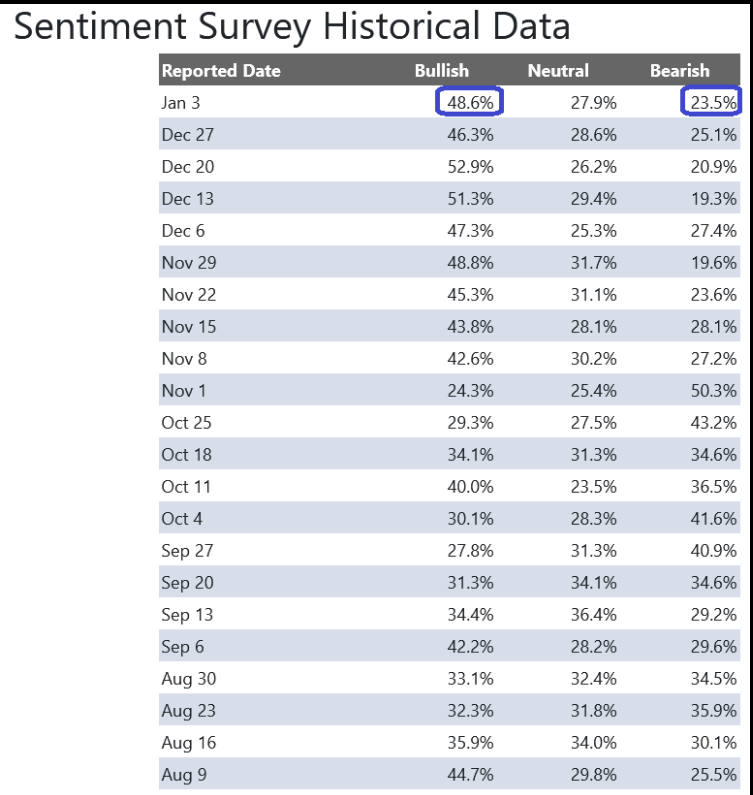

On this week’s AAII Sentiment Survey outcome, Bullish P.c (Video Rationalization) ticked as much as 48.6% from 46.3% the earlier week. Bearish P.c ticked all the way down to 23.5% from 25.1%. Retail traders are ebullient.

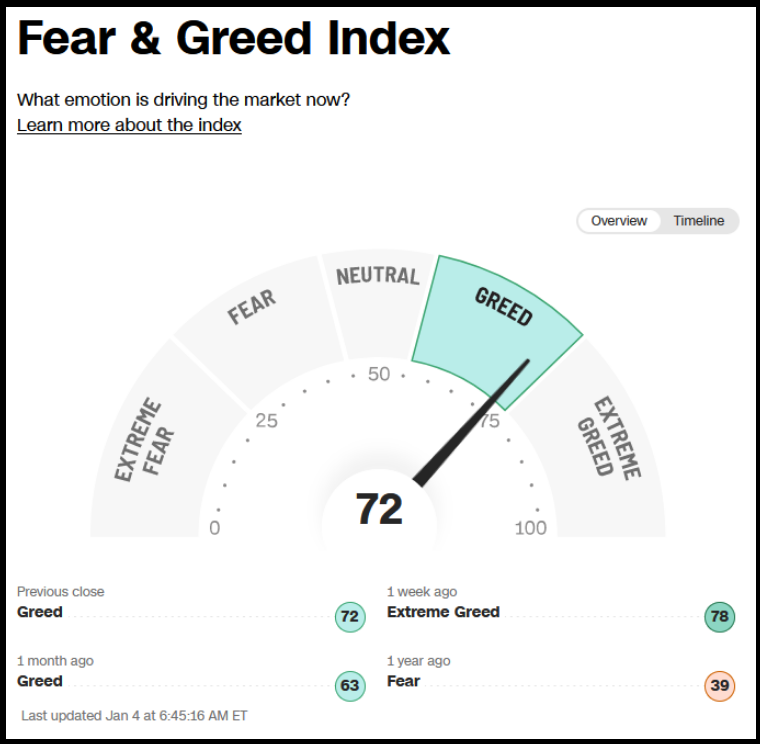

The CNN “Worry and Greed” ticked down from 78 final week to 72 this week. By this metric, traders are giddy, however not but totally euphoric. You possibly can find out how this indicator is calculated and the way it works right here: (Video Rationalization)

And eventually, the NAAIM (Nationwide Affiliation of Lively Funding Managers Index) (Video Rationalization) moved as much as 102.71% this week from 97.32% fairness publicity final week in the past. Managers have been “panic chasing” the rally into yr finish.

This content material was initially printed on Hedgefundtips.com

[ad_2]

Source link