[ad_1]

YinYang

A stronger-than-expected December rise in nonfarm payrolls dominated the headlines this morning. However the markets reacted extra to an indicator that not often will get consideration.

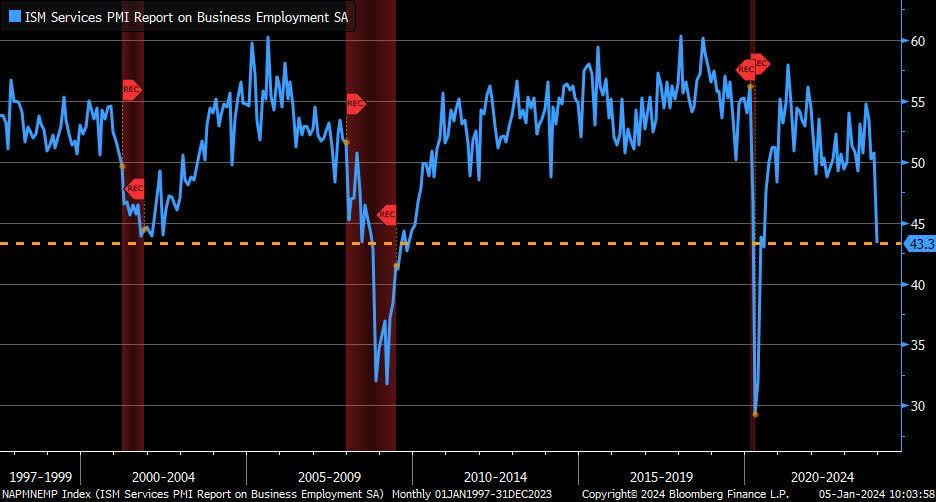

Within the December ISM non-manufacturing PMI, the place the headline fell greater than anticipated, the employment part plunged.

The roles part sank to 43.3, effectively into contraction territory and confounding expectations for a small rise to 51.

{That a} degree that hasn’t been seen exterior of crises like COVID and the Nice Recession. Shwab’s Liz Ann Sonders famous (tweeting the chart beneath) that the part did not sink that far through the 2001 recession.

“This feels out-of-step with the broader labor market given the robust hiring report we obtained earlier this morning,” Wells Fargo economists wrote. “That stated, we’re cautious to wave away this weak spot as purely seasonal noise.”

“Trying past the nonfarm payroll figures and unemployment fee, there are rising indicators of labor market moderation,” they stated.

“The chosen respondent feedback within the survey included: ‘Distant work is most well-liked for many, making it tough to recruit expert staff, and our expert staff are leaving for hybrid choices’, and ‘Layoffs have elevated within the skilled companies and staffing industries over the previous a number of months as corporations attempt to cut back price amid the local weather of financial uncertainty and reducing buyer demand.'”

“Taking these feedback at face worth suggests labor weak spot may nonetheless be partially provide associated, the place expert labor is difficult to search out, however that there is additionally some cost-reduction beginning to materialize in layoffs,” Wells Fargo stated.

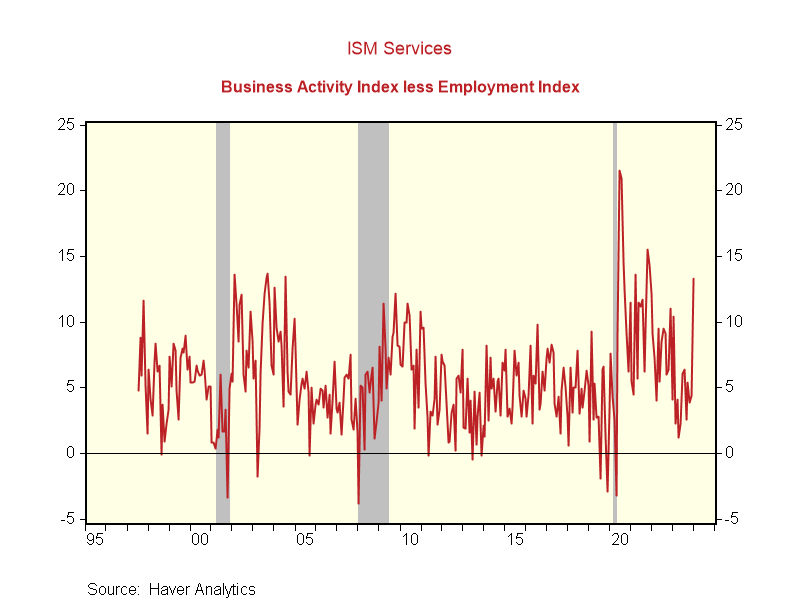

However Renaissance Macro notes that whereas “development pessimists latch onto ISM companies employment index (on a day precise companies employment rose), the ISM enterprise exercise index (proxy for service trade output) hit a 3 month excessive.”

“As determine reveals, the hole between the 2 swells AFTER a recession has ended!”

[ad_2]

Source link