[ad_1]

The labor market stays sturdy regardless of downward revision in latest months.

Disinflation dynamics could decelerate put up Thursday’s knowledge.

In the meantime, the EUR/USD pair is consolidating in an upward pattern.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Be taught Extra »

The start of the yr has seen minimal modifications within the general power of the US labor market.

Preliminary readings for the brand new yr exceeded expectations for each new and the .

Regardless of this optimistic outlook, latest alerts from the Federal Reserve make it clear {that a} cycle of rate of interest cuts is imminent; the one uncertainty lies within the timing of the primary transfer.

A pivotal indicator to observe this week is the knowledge for December within the U.S. If, according to forecasts, it should possible point out a slowdown in disinflation, struggling to breach the three% year-on-year barrier.

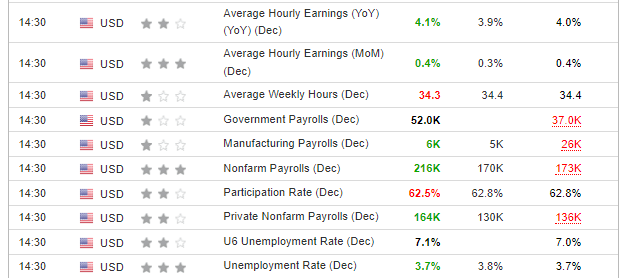

The U.S. labor market stays a supply of optimism for the Federal Reserve, with the most recent knowledge, launched on Friday, revealing a rise in new nonfarm payrolls to 216,000 and the unemployment price sustaining ranges under 4%.

Financial Calendar

Supply: Investing.com

Nevertheless, this optimistic image is disturbed by additional downward revisions of all months within the August-November interval. It’s because the information are coming in steadily, even with a delay of a number of months.

Regardless of this, the power of the labor market might be thought of extraordinarily stunning for the biggest financial tightening within the US in lots of many years.

Optimistic knowledge from the labor market, mixed with optimistic readings of financial progress dynamics measured via , make the so-called tender touchdown state of affairs an actual risk.

Nevertheless, we’re nonetheless a great distance from declaring full success, though if subsequent quarters affirm this growth it is going to be a really optimistic long-term sign for inventory markets.

In the meanwhile, the likelihood of rate of interest cuts in March has fallen considerably, nonetheless, it’s nonetheless barely above 60%.

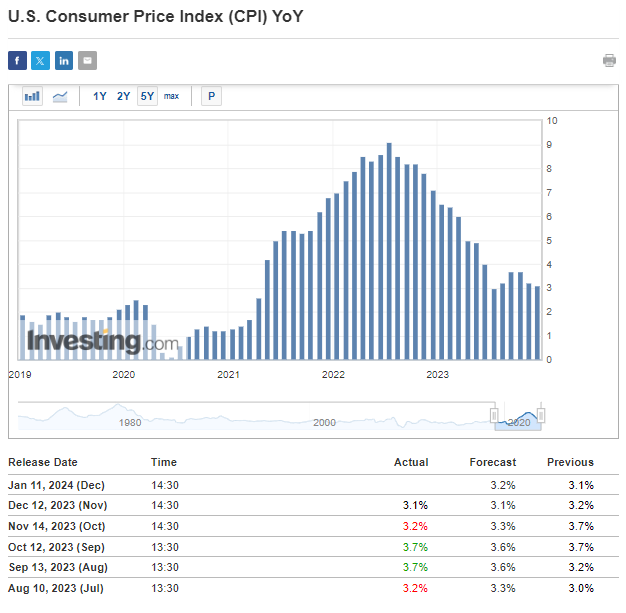

Inflation within the US caught above 3%

Since final July, when the y/y inflation price reached 3%, we now have seen a stabilization of the speed within the vary of 3-4%.

The readings for December indicate a continuation of this sideways pattern, which confirms that the final stage of reaching the inflation goal is essentially the most tough when the excessive base effect-based enhance is now not obtainable.

US Inflation Knowledge

Primarily based on the Fed , Because the cycle of rate of interest cuts begins, it turns into obvious that the main focus is shifting away from the battle in opposition to inflation.

The first goal now appears to be steering away from pushing the financial system right into a recession.

Which means that the labor market, industrial manufacturing dynamics, and GDP ought to turn out to be more and more vital, and relying on the following readings the tempo of financial easing might be adjusted.

EUR/USD consolidates: A pause earlier than the following push upward?

After the discharge of Friday’s knowledge from the US labor market, failed to find out a selected path and is caught in an area consolidation.

A potential upside breakout might be a vital pro-growth sign indicating the potential for initiating one other demand wave.

EUR/USD Each day Chart

The potential breakout aligns with the continuing pattern and is a mirrored image of the continued depreciation of the , pushed by the diminishing risk of the Federal Reserve initiating rate of interest cuts as early as March.

Consumers’ preliminary goal lies throughout the provide zone across the value degree of 1.12, established based mostly on this yr’s highs. Conversely, a break of the native pattern line is anticipated to increase the unwinding, reaching at the least the neighborhood of 1.0750.

***

In 2024, let exhausting choices turn out to be straightforward with our AI-powered stock-picking device.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI expertise, ProPicks gives six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Declare Your Low cost In the present day!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or advice to take a position as such it’s not meant to incentivize the acquisition of belongings in any manner. As a reminder, any sort of asset is evaluated from a number of views and is extremely dangerous, and subsequently, any funding choice and the related danger stays with the investor.

[ad_2]

Source link