[ad_1]

America’s financial institution conglomerates – JPMorgan and Citigroup – shall ship their This autumn 2023 earnings outcome this Friday (12h January) earlier than market open.

Final 12 months, the Dow Jones US Banks Index was seen falling behind the S&P500 since early March, primarily triggered by the failure of an inventory of home banks. The index gained floor within the final quarter of the 12 months, closing the 12 months at an annual return of 5.61%, in distinction to 23.03% generated by the S&P500, primarily boosted by excellent efficiency of mega-cap know-how shares (with the Magnificent Seven contributing almost half of the general beneficial properties), elevated expectation for the shift in Fed coverage in close to time period and the hopes of soppy touchdown. For the banking sector, greater borrowing price helped to spice up curiosity earnings for the massive lenders. Shifting ahead, a price reduce could alleviate debtors’ strain, whereas improved capital ranges may additionally be sufficient to regain traders.

JPMorgan

JPMorgan is the world’s largest financial institution by market capitalization (over $495B). It presents a spread of monetary and funding banking providers and merchandise in all capital markets, together with advising on company technique and construction, capital elevating in fairness and debt markets, threat administration, market making in money securities and by-product devices, brokerage and analysis.

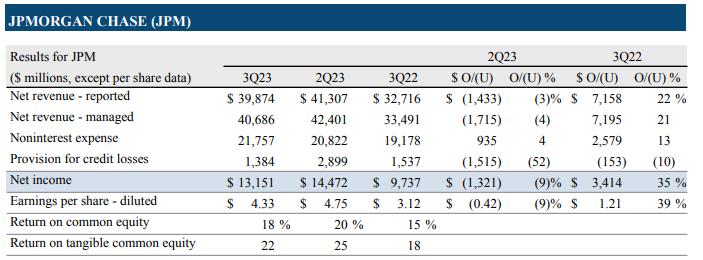

In Q3 2023, JPMorgan delivered $40.7B in web income, down -4% from the earlier quarter, however up over 21% from the prior 12 months interval. Excluding First Republic, web earnings was $13.2B, down -9% from the earlier quarter, however up 35% from the identical interval final 12 months.

By enterprise phase, Shopper & Neighborhood Banking contributed probably the most to the banks’ income ($18.4B, with steady enchancment in Banking and Wealth Administration, Residence Lending, Card Providers and Auto and provision for credit score losses, barely offset by a rise in non curiosity expense), adopted by Company & Funding Banking ($11.7B, with income of each banking and markets & securities providers down -2%), Asset & Wealth Administration ($5B, comparatively flat following greater administration charges and better common market ranges, offset by decrease efficiency charges and decrease web curiosity earnings), Business Banking ($4.03B, pushed by greater web curiosity earnings, partially offset by decrease balances, in addition to enhance in non-interest expense), and at last Company ($1.6B).

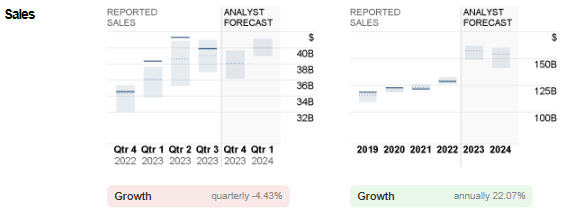

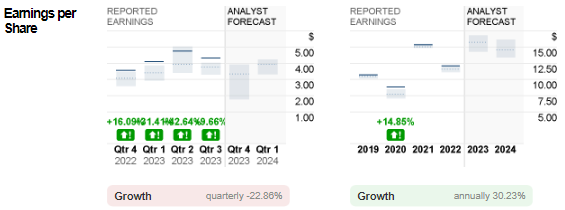

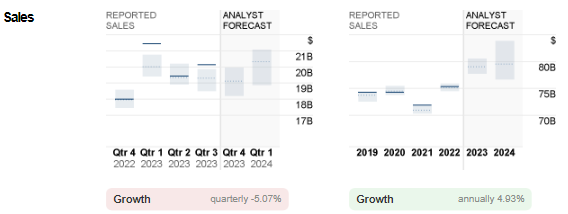

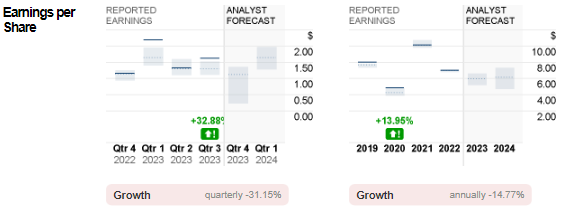

Consensus estimates for JPMorgan gross sales within the upcoming announcement stood at $38.1B. If reported figures hit expectations, this might deliver the entire gross sales income of FY 2023 to $157.1B, up over 22% from the earlier 12 months.

EPS, however, is anticipated to hit $3.34, down almost -23% from the earlier quarter. It was $3.57 within the fourth quarter final 12 months. Analysts forecast the ultimate EPS for FY 2023 to succeed in $15.75, up over 30% from the earlier 12 months.

Citigroup

Citigroup, fashioned by the merger of banking big Citicorp and monetary conglomerate Vacationers Group in 1998, has a market capitalization over $102B. It operates by International Shopper Banking (conventional banking providers for retail clients), Institutional Shoppers Group (fastened earnings and fairness analysis, gross sales and buying and selling, international trade, prime brokerage, by-product providers, funding banking and advisory providers, personal banking, commerce finance and securities providers), and Company and Different (embrace un-allocated prices of worldwide employees features, different company bills, un-allocated international operations and know-how bills).

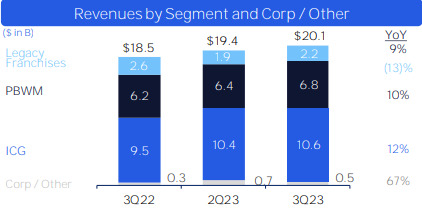

In Q3 2023, Citigroup bagged $20.1B in gross sales income, up 4% from the earlier quarter, and up 9% from the identical interval final 12 months. Inside Private Banking and Wealth Administration (PBWM), its US Private Banking phase achieved double digit income development (y/y) for the fifth consecutive quarter, whereas the Wealth phase was up 2% (y/y) in income supported by sturdy underlying enterprise drivers. Additionally, its Institutional Shoppers Group (ICG) phase delivered satisfying outcomes, with Providers recording its highest income quarter within the final decade, Markets reaching one of the best quarter in final decade when it comes to charges and currencies revenues, and Banking reporting funding up 34% from the prior 12 months interval. Web earnings was up 2% (y/y) to $3.5B.

Citigroup: Reported Gross sales versus Analyst Forecast. Supply: CNN Enterprise

Anticipated gross sales income for the ultimate quarter of 2023 stood at $19.1B, barely down almost -5% from the earlier quarter, however up over 6% from the identical interval final 12 months. Complete gross sales income for FY 2023 shall hit $79.1B, if the reported determine aligns with forecasts. In keeping with the administration’s steerage, the determine is anticipated to be between $78B and $79B.

EPS for This autumn 2023 is estimated to be down from $1.63 to $1.12. In the identical quarter final 12 months, the financial institution’s EPS was recorded at $1.16.

Technical Evaluation:

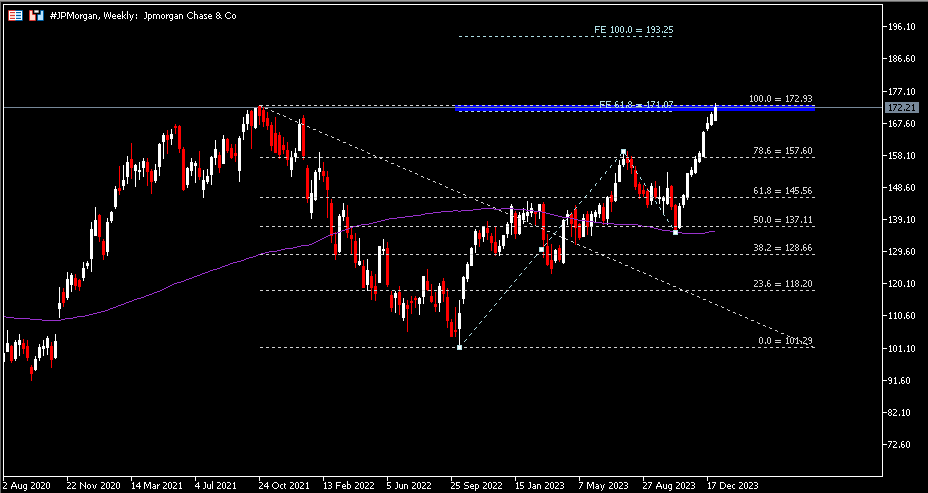

The #JPMorgan share value had a powerful bullish streak for ten consecutive weeks. The asset refreshed its ATH final seen in October 2021 ($172.93), at $173.37, earlier than closing the week at $172.21. The realm between $171 and $173 stays the closest resistance zone, adopted by $193 and $209 as projected by Fibonacci Enlargement. Alternatively, $159.36 (July 2023’s excessive) and $157.60 (FR 78.6%, expanded from the earlier ATH to lows in Oct 2022) function the closest assist. Breaking beneath this stage could point out value correction to increase in the direction of the following assist at $145.60 (FR 61.8%) and $137 (FR 50.0%).

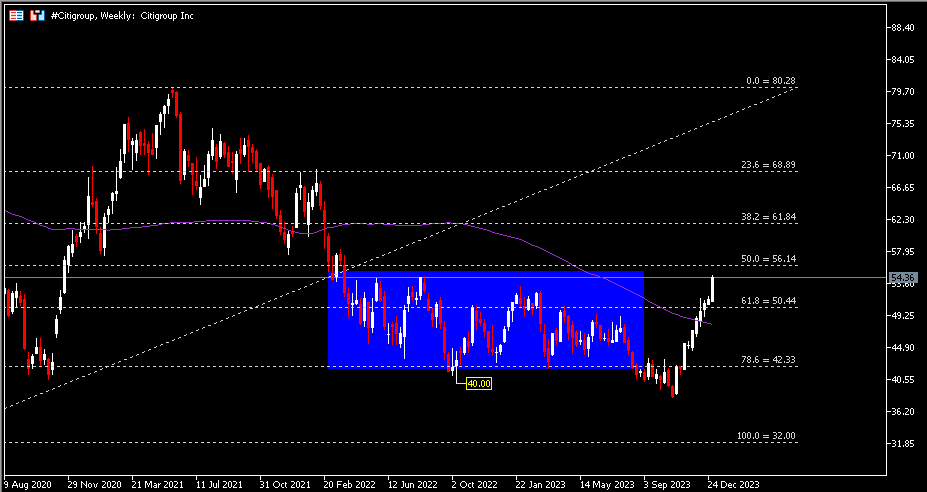

The #Citigroup share value noticed a vigorous rebound within the final two months of 2023, leaving the 12 months low at $38.16. Moving into 2024, the asset continued to surge greater, final closing at $54.36. The FR 50.0%, or $56 serves as the closest resistance, and in addition a necessary indicator for a correction in pattern path. R2 and R3 every stood at $61.85 (FR 38.2%) and $68.90 (FR 23.6%). Quite the opposite, $50.45 (FR 61.8%) would be the nearest assist, adopted by the 100-week SMA and $42.30 (FR 78.6%).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link