[ad_1]

US DOLLAR OUTLOOK – EUR/USD, GBP/USD, USD/JPY

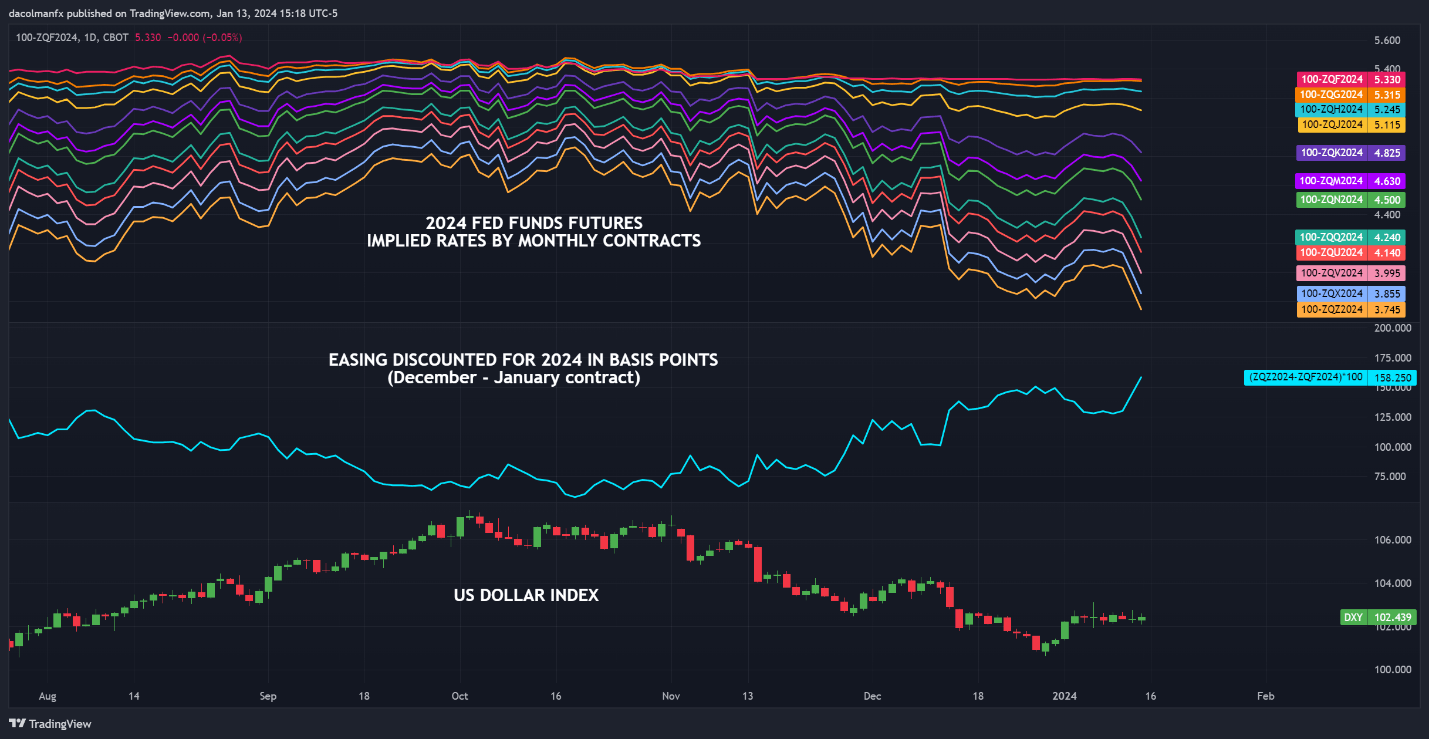

The U.S. greenback has largely stalled its rebound, consolidating across the 102.00 stage in latest daysU.S. rates of interest expectations shifted in a dovish course final week, with merchants pricing in almost 160 foundation factors of easing for the 12 monthsDovish wagers on the Fed’s path might be scaled again if central financial institution officers began pushing again in opposition to Wall Road’s projections – a scenario that would enhance yields and the U.S. greenback

Most Learn: US Greenback at Crucial Juncture after US CPI, Setups on EUR/USD, USD/JPY, GBP/USD

U.S. rate of interest expectations turned fairly dovish final week although December headline and core inflation figures stunned to the upside. The chart beneath reveals that merchants are actually discounting virtually 160 bp of easing for 2024, 30 bp larger than seven days in the past. On this context, the U.S. greenback (DXY) has stalled its restoration, consolidating barely above the 102.00 stage because the begin of the 12 months.

Supply: TradingView

Questioning in regards to the U.S. greenback’s technical and basic outlook? Achieve readability with our newest forecast. Obtain a free copy now!

Advisable by Diego Colman

Get Your Free USD Forecast

Though the U.S. central financial institution is prone to cut back borrowing prices later this 12 months, the deep price cuts priced in by market individuals appear excessive for an economic system displaying exceptional resilience and nonetheless experiencing above-target and sticky inflation. Given present circumstances, it could not be stunning to see merchants cut back dovish wagers quickly, paving the way in which for a market reversal.

Waiting for subsequent week, the U.S. financial calendar is reasonably gentle, with markets closed on Monday for the Martin Luther King Jr. vacation. Nonetheless, a number of Fed officers may have public appearances, so you will need to watch whether or not policymakers begin pushing again in opposition to Wall Road’s dovish outlook. In the event that they do, yields and the U.S. greenback could head larger.

For a whole evaluation of the euro’s medium-term prospects, request a replica of our Q1 forecast!

Advisable by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL ANALYSIS

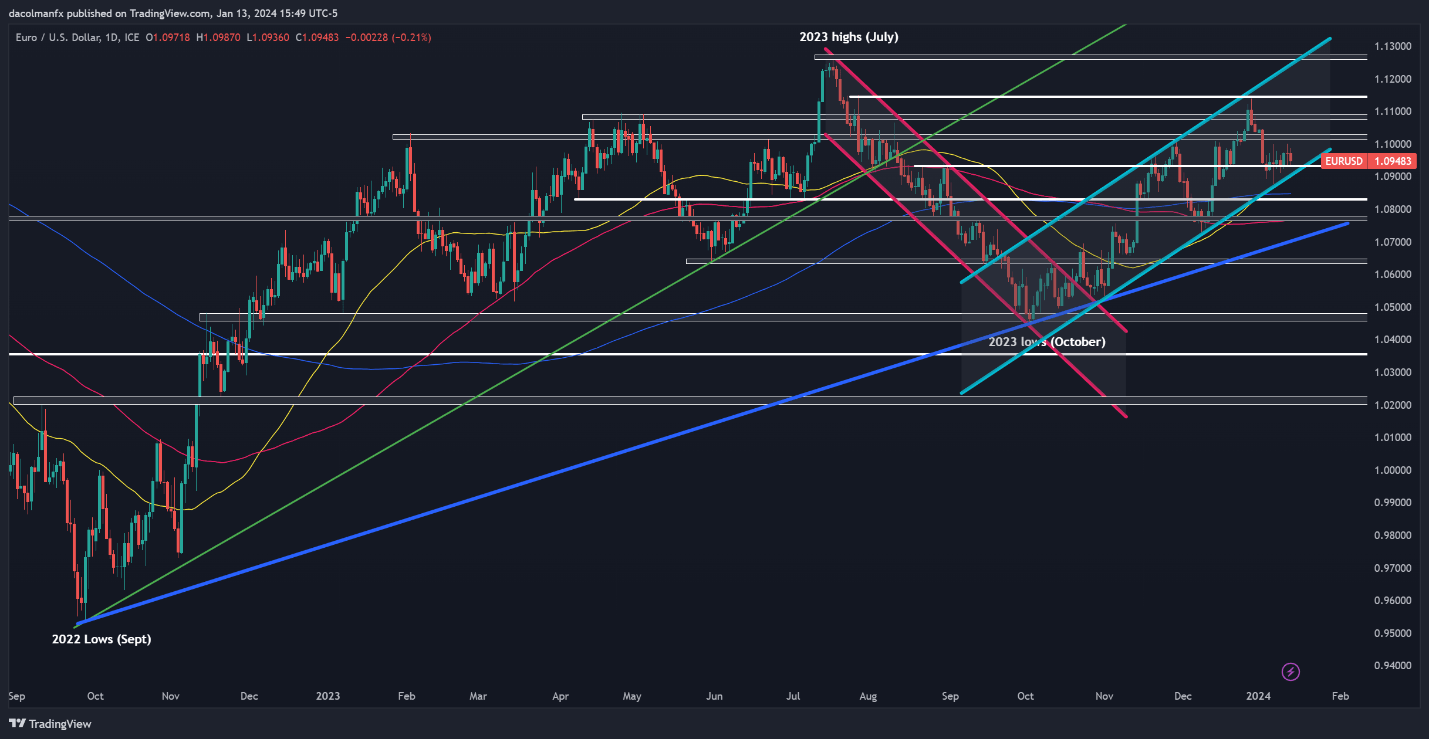

EUR/USD fell modestly on Friday, however remained above assist close to 1.0930. If this technical flooring holds, there may be potential for costs to renew their upward journey within the close to time period, during which case, we are able to’t rule out an advance in the direction of 1.1020. Continued power could then redirect consideration to 1.1075/1.1095, adopted by 1.1140.

On the flip aspect, ought to bearish momentum intensify and drive the change price beneath 1.0930, the opportunity of a retracement in the direction of 1.0875 emerges – a key space the place the 50-day easy shifting common converges with the decrease restrict of a short-term ascending channel. On additional weak point, sellers could provoke an assault on the 200-day SMA.

EUR/USD TECHNICAL CHART

EUR/USD Chart Ready Utilizing TradingView

For a complete view of the Japanese yen‘s basic and technical outlook, be certain to obtain our Q1 buying and selling forecast in the present day. It’s completely free!

Advisable by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL ANALYSIS

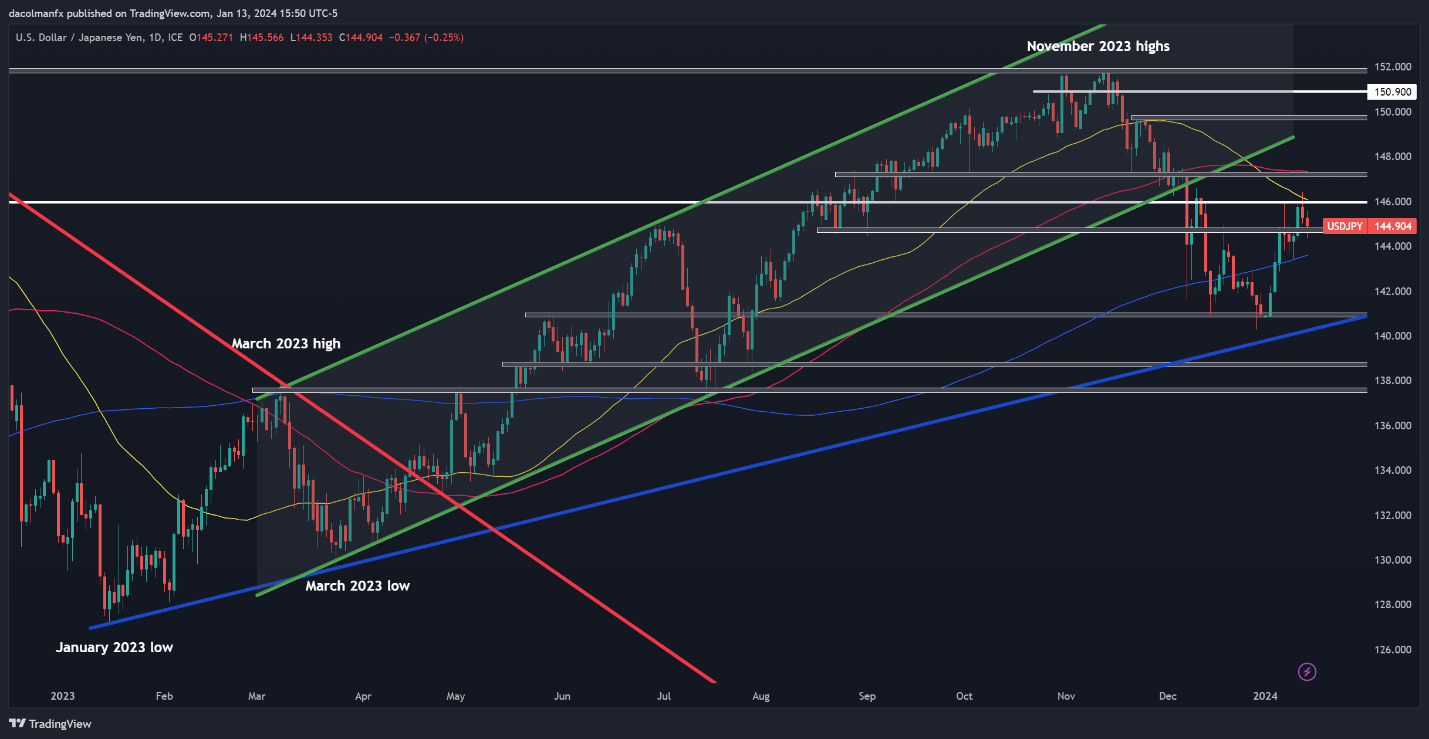

USD/JPY rallied early final week, however its upward momentum began fading when the pair did not push previous resistance close to 146.00, finally resulting in a pullback in the direction of assist at 144.65. Bulls should defend this flooring in any respect prices; failure to take action might expose the 200-day easy shifting common at 143.60. Continued losses from this level onward might draw consideration to the December lows beneath the 141.00 mark.

Within the occasion of bulls regaining management of the market, technical resistance seems at 146.00, proper across the 50-day easy shifting common. If historical past is a information, the pair might be rejected from this area on a retest, however a profitable breakout might set the stage for a rally in the direction of 147.25, barely beneath the 100-day easy shifting common.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

Keen on studying how retail positioning can provide clues about GBP/USD’s short-term course? Our sentiment information has all of the solutions you search. Get the complimentary information now!

Change in

Longs

Shorts

OI

Every day

2%

1%

2%

Weekly

7%

1%

4%

GBP/USD TECHNICAL ANALYSIS

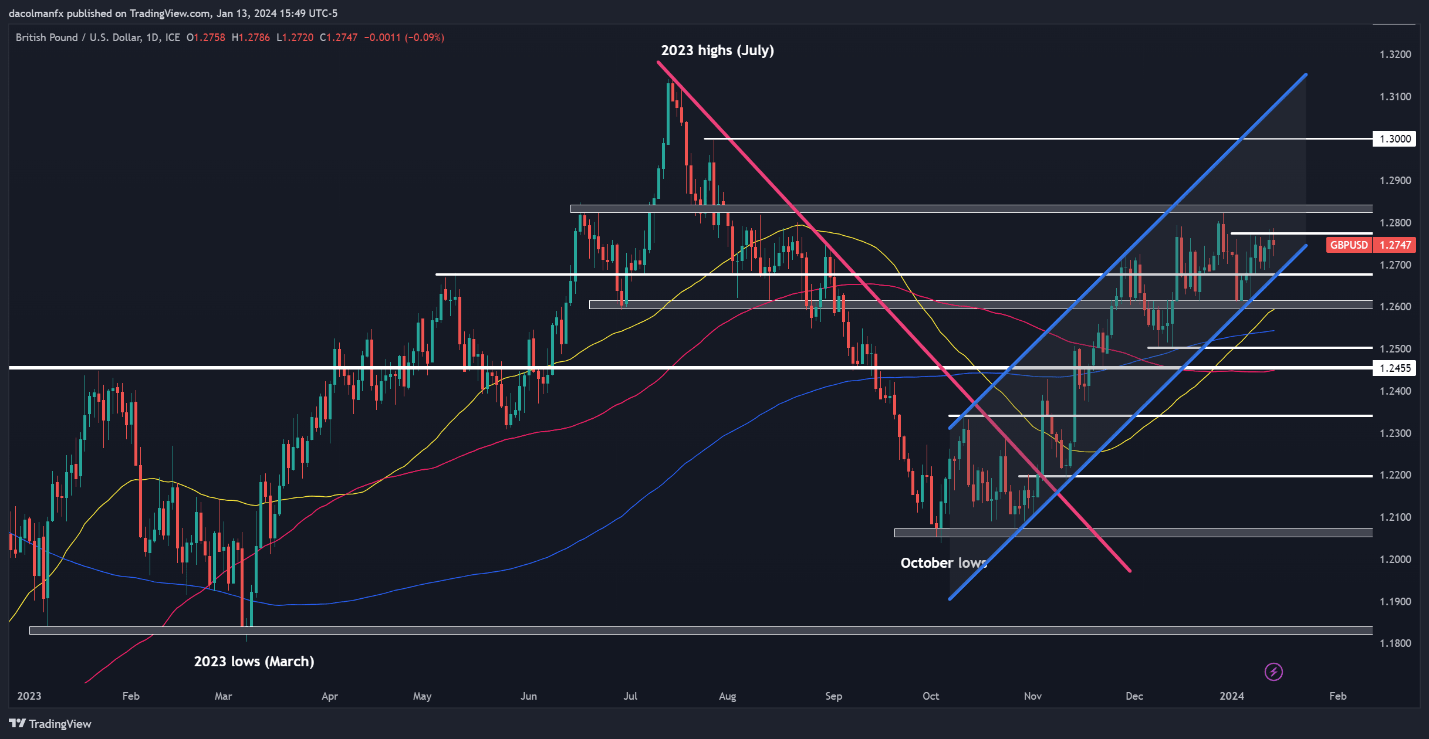

GBP/USD was largely directionless on Friday, fluctuating round overhead resistance within the 1.2765 space. Sellers should staunchly defend this technical ceiling; failure to take action might set off an upward transfer towards the December peak located above the 1.2800 stage. On additional power, the bulls may collect the boldness to mount an assault on the psychological 1.3000 threshold.

Conversely, if sellers regain the higher hand and set off a selloff, major assist looms at 1.2675, which represents the decrease boundary of a medium-term ascending channel in play since October. Whereas cable is prone to discover stability on this area throughout a pullback, a breakdown might open the door for a decline in the direction of 1.2600. Subsequent losses past this stage could immediate interplay with the 200-day SMA.

GBP/USD TECHNICAL CHART

GBP/USD Chart Ready Utilizing TradingView

aspect contained in the aspect. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the aspect as an alternative.

[ad_2]

Source link