[ad_1]

Soulmemoria/iStock through Getty Pictures

Thesis Abstract

Tesla (NASDAQ:TSLA) has seen its inventory go nowhere within the final six months. Although there have been ups and downs, the inventory is now equally priced because it was again in August.

Over the final month, Tesla has really misplaced over 7%, because the market begins to cost in additional damaging information.

Not solely is Tesla now not the highest electrical car (“EV”) vendor over the past three month interval, however the firm has seen combined evaluations over its newly launched Cybertruck, has needed to recall over 2 million automobiles, and it continues to lose market share in China.

If ever there was a time to not be bullish on this EV maker, you may suppose it is now.

Nevertheless, my thesis is that, whereas the market is already pricing within the not insignificant points the firm is going through proper now, it’s failing to see the good long-term potential the corporate nonetheless possesses.

By historic requirements, Tesla’s inventory is arguably “low cost.” I discover this unusual at a time when Tesla has taken nice strides within the final 10 months to set itself up for the subsequent 10 years.

By this, I imply that Tesla has made nice strikes in its Vitality, full self-driving (“FSD”), and charging segments. Sooner or later, these segments will contribute rather more to the corporate’s income than automobile gross sales.

I dive deep into simply how a lot Tesla might stand to make from every of those ventures over the subsequent 7 years as a way to arrive at a attainable worth goal.

Briefly, it is a pullback value shopping for.

A Fast Replace

Regardless of contemplating myself a Tesla bull, my final two items on the corporate have had impartial rankings.

In the course of the 2023 Q2 earnings, I gave Tesla a impartial score after it had already run up near 50% within the months prior. This was primarily based totally on Technical Evaluation.

Earlier Tesla Article (Creator’s work on SA)

Extra not too long ago, I gave the corporate one other impartial score after Morgan Stanley (MS) upgraded its worth goal to $400.

Earlier Tesla Article (Creator’s work on SA)

The inventory had not too long ago had one other runup, and regardless of my long-term conviction, I argued that the financial institution analysts have been overly optimistic within the quick time period, as they have been neglecting to cost within the danger posed by China.

Effectively, over the previous few months, I’d argue that markets have certainly begun to cost in a number of the damaging.

Sentiment definitely appears to have shifted considerably. Out of the final 10 SA articles on Tesla, three price the corporate a Purchase, one a Robust Purchase, One a Robust Promote, three a Promote, and two a Maintain. Opinions are equally divided primarily based on this small pattern, however it does appear to me just like the mega-bulls are a bit much less vocal.

A lot Of Causes To Promote

There’s no scarcity of causes to be bearish on Tesla. Let’s start with the newest.

Provide Constraints

Tesla has been pressured to close down manufacturing in its largest manufacturing unit in Europe, the Berlin Gigafactory. This has been attributable to an absence of key parts, which have been delayed because of the disruptions triggered to transport within the Purple Sea.

It is projected that Tesla may need to pause a lot of the output for shut to 2 weeks. Tesla hasn’t been the one firm affected, as it appears that evidently Volvo is in the identical boat.

That is, in fact, unhealthy information for the EV producer, which has already confronted points in 2024, because the Cybertruck launch has maybe not triggered fairly the specified response.

Cybertruck and Different Points

Cybertruck deliveries started round November thirtieth, with a beginning worth near $60,000.

For starters, a few viral movies have already made their rounds via the Web, exhibiting Cybertrucks getting caught within the snow. Not a wholly unusual factor to occur to pickups, but additionally not an amazing search for a car marketed as the top of know-how on this area.

Moreover, in an unofficial check carried out by a YouTuber, it was proven that the Cybertruck’s precise vary was near 254 miles, which is round 79% of the marketed vary.

In all honesty, these points with the Cybertruck shouldn’t come as a shock, as Elon himself has talked about many occasions simply how advanced the manufacturing of this automobile has been.

…However first order approximation, there’s like 10,000 distinctive elements and processes within the Cybertruck. And if any one in every of — it’ll go as quick because the least fortunate, least well-executed factor of the ten,000. So, it’s all the time troublesome to foretell the ramp initially, however I feel we’ll be making them in excessive quantity subsequent 12 months, and we might be delivering the automobile this 12 months.”

Supply: Elon Musk.

Nonetheless, it stays to be seen simply how properly the market will react to this product. Musk estimated annual gross sales of as much as half one million, however it’s nonetheless unclear simply how this can contribute to the underside line.

On prime of this, Tesla was additionally made to recall 2 million automobiles final month, because the U.S. Nationwide Freeway Visitors Security Administration claimed that the automobiles have been inadequately monitoring drivers utilizing self-driving capabilities. Their report claims, amongst different issues, that the Tesla automobiles weren’t aptly checking that each palms have been nonetheless on the steering wheel.

Fall in Demand

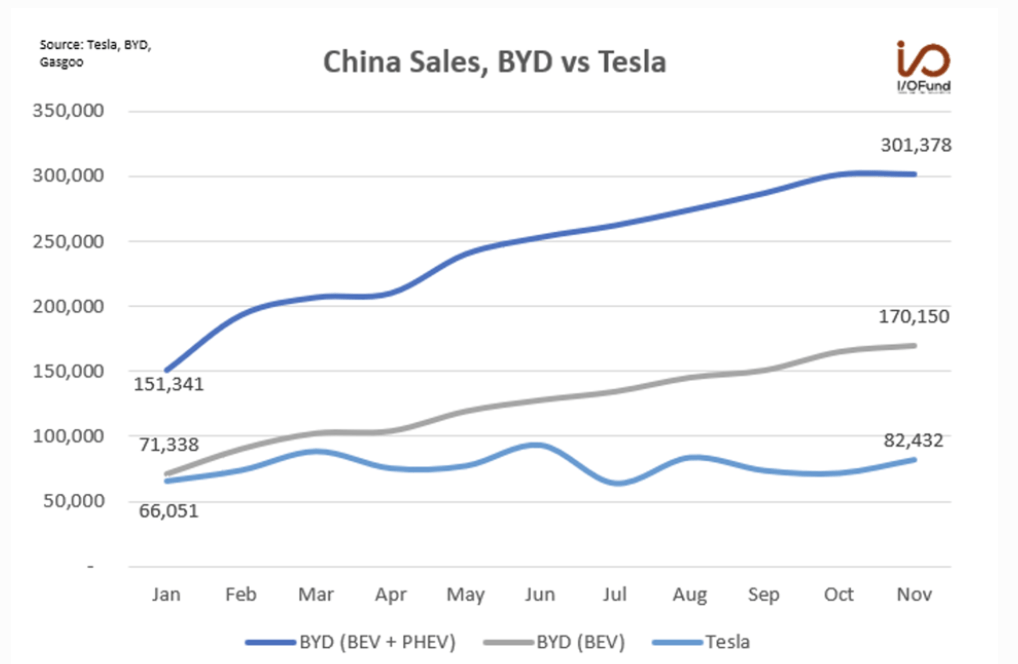

All of this occurred as Tesla was dethroned by BYD Firm Restricted (OTCPK:BYDDF) as the most important EV vendor within the final quarter. Tesla is promoting fewer automobiles than its competitors and has been dropping market share in China for fairly a while.

BYD vs TSLA (IQ Fund)

Tesla is going through extra intense competitors than ever this 12 months from each different EV corporations in addition to conventional automobile corporations that are actually promoting Electrical and hybrid fashions.

Higher Causes To Purchase

However all of the noise surrounding Tesla in the previous few months is simply that: noise. These are, at most, short-term issues that can affect share costs within the speedy future. Nevertheless, I’m a long-term investor with a long-term horizon.

Over the subsequent few years, Tesla stands to turn into a really completely different beast. The truth is, its present revenues, most of which come from EV gross sales, will doubtless turn into smaller in proportion to its different segments as these notice their potential.

And, maybe extra importantly, these new sources of income will supply a lot greater margins than auto manufacturing.

The present auto manufacturing and gross sales are merely laying the groundwork for what’s to come back.

Vitality Storage

Sure, vitality storage could possibly be on monitor to turn into a really vital addition to revenues and, maybe extra importantly, earnings.

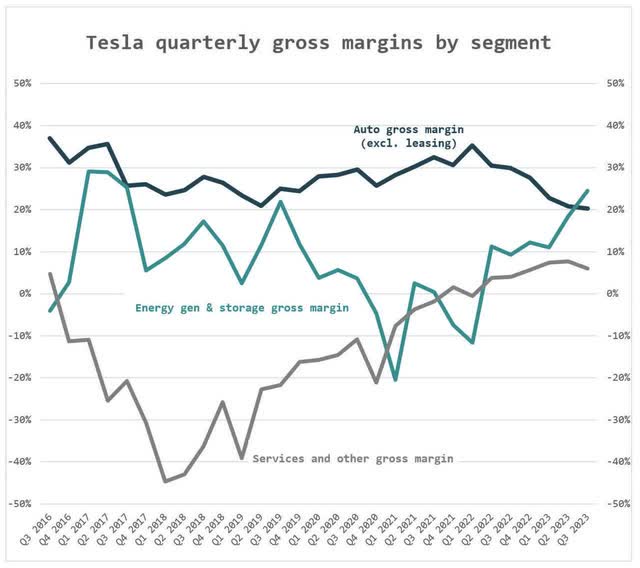

Certainly, auto manufacturing is a low-margin enterprise, however that in all probability gained’t be the case with vitality storage, which, even in its latest toddler state, has already surpassed auto margins.

Tesla gross margin by section (Heller Home)

Fellow SA contributor Luis Stevens not too long ago in contrast the Megapack enterprise (vitality storage) to Amazon (AMZN) Net Companies, or AWS. It looks like an apt comparability, because it holds each the promise of excessive development and adoption whereas additionally carrying a lot bigger margins than Tesla’s “important” enterprise.

Final month, Tesla secured a 1.6 GWh Megapack mission with the Melbourne Renewable Vitality Hub (MREH), and that is solely an indication of issues to come back.

Based on Verified Market Analysis, the vitality storage market might develop to $32.5 billion globally by 2030, rising at a CAGR of 16.3%.

Nevertheless, Tesla has a way more bold development goal, estimating it will probably present 1,500 GWh in annual vitality storage deployment, which suggests near a 90% CAGR of its enterprise.

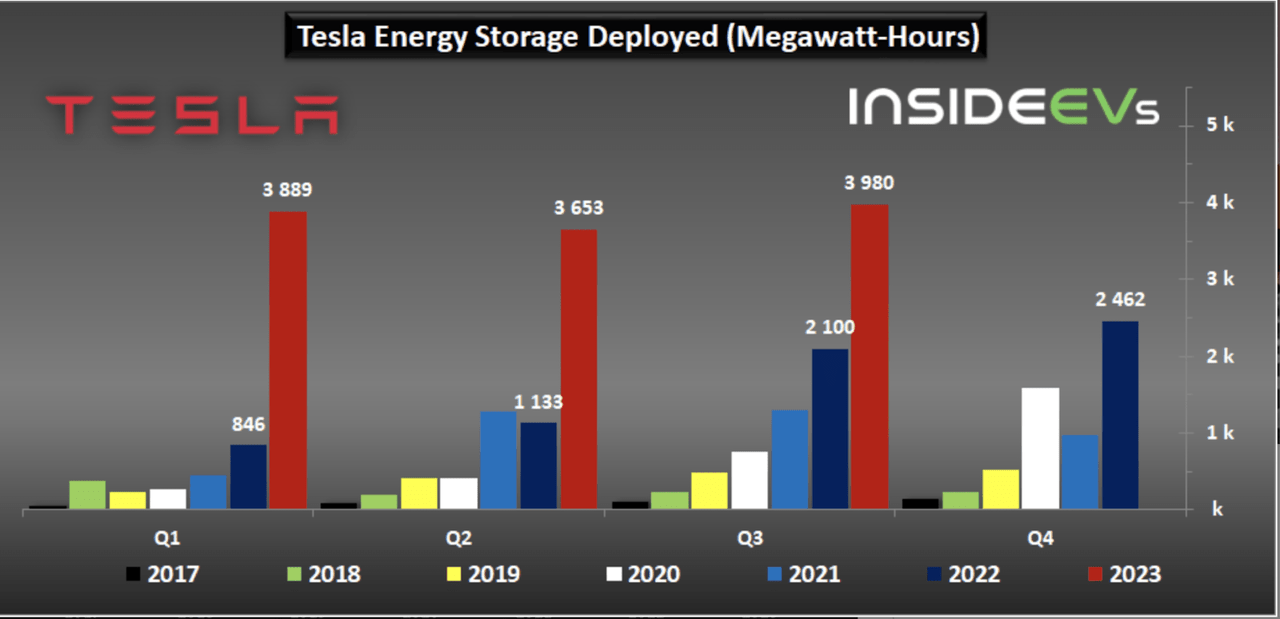

Formidable as it might appear, the corporate did handle to virtually double its Vitality Storage deployment YoY within the final quarter.

Tesla Vitality Storage Deployed (insideevs)

Full Self-Driving

Tesla’s full self-driving (“FSD”) isn’t just a dream pipe, however is definitely a enterprise section that’s already arguably contributing $1-3 billion to gross sales. Regardless that that is nonetheless in beta mode, Tesla says it fees an upfront payment of $12,000 for FSD, or round $199 for a month-to-month subscription.

Based on Goldman Sachs, FSD might contribute as a lot as $75 billion in revenues by 2030.

We consider that Tesla’s software-related income could possibly be tens of billions of {dollars} per 12 months by 2030 (largely from FSD),” Delaney wrote. “These eventualities recommend that in an upside case FSD might account for tens of billions of income per 12 months (and extra if we take into account licensing of Dojo or promoting FSD to different OEMs).

Supply: Delaney, GS.

We’ll attain our estimates for FSD revenues under.

Charging

Lastly, charging must also be an enormous tailwind for Tesla in 2024. I wrote about supercharging some time again when Tesla first reached agreements with main automobile makers to lease out their superchargers.

Within the final month, now we have seen some vital strikes on this regard. Firstly, in December, we simply noticed Volkswagen, Porsche and Audi undertake Tesla’s chargers. And, on prime of that, the White Home has additionally proven help to the thought of standardizing Tesla’s chargers.

Tesla’s supercharger community has all the time been a promoting level for customers, and now it’s one for traders. That is the pick-and-shovel play of EVs. Everybody must cost their EV, and the corporate that dominates this market will do very properly. Not solely as a result of it will probably make extra revenues but additionally as a result of it will probably achieve this with a better margin.

Piecing It Collectively

Let’s piece all of it collectively to estimate first how a lot yearly the corporate might make by 2030 and, secondly, how a lot gross revenue the corporate might generate from every of its segments.

Vitality Storage Forecast

Beginning with vitality storage, we’ll take a middle-of-the-road strategy between Tesla’s bold 90% development and our market estimates.

Within the final 12 months, Tesla generated $6.2 billion of their Vitality manufacturing and storage section, deploying round 14 GWh. Based on Elon, the corporate can take this to 1,500 GWh by 2030.

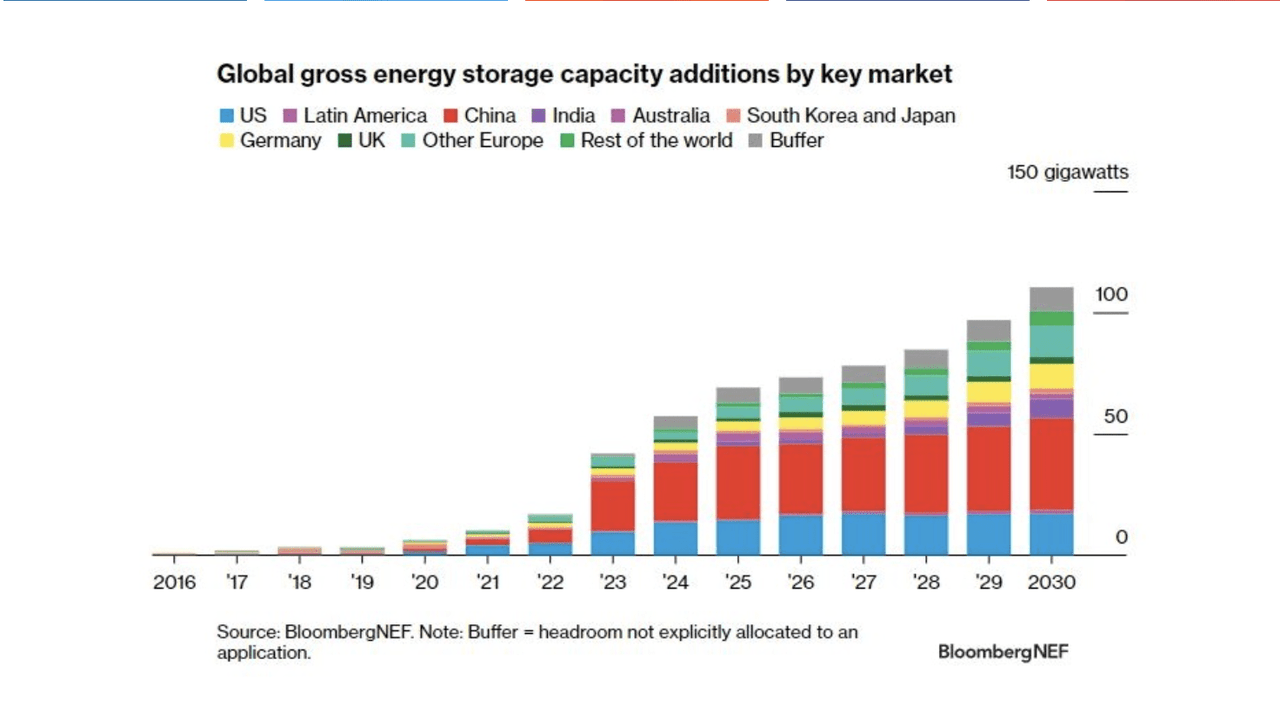

I discover that very troublesome to consider, sadly, and Elon has a monitor file of overpromising. The truth is, 1,500 GWh, is 1.5 TWh, which is a bit over what BloombergNEF estimates the entire world would want when it comes to vitality storage.

Vitality storage capability (BloombergNEF)

Being beneficiant, I consider Tesla might be able to turn into a key participant and take a 3rd of the market. Let’s additionally assume that these estimates are conservative and complete demand reaches round 1,500 GWh.

Subsequently, we will conclude that Tesla might maybe be chargeable for deploying and sustaining 500 GWh.

That’s nonetheless a 35x improve from at present’s capability. Making use of this to revenues, we might count on $217 billion in revenues. Making use of comparable gross margins to at present, round 25% in keeping with the graph proven earlier than, now we have a gross revenue of $54.24 billion in gross income.

FSD Valuation

For full self-driving, we might take Goldman’s estimates at face worth, that are as much as $70 billion in revenues, or we might make our personal calculations.

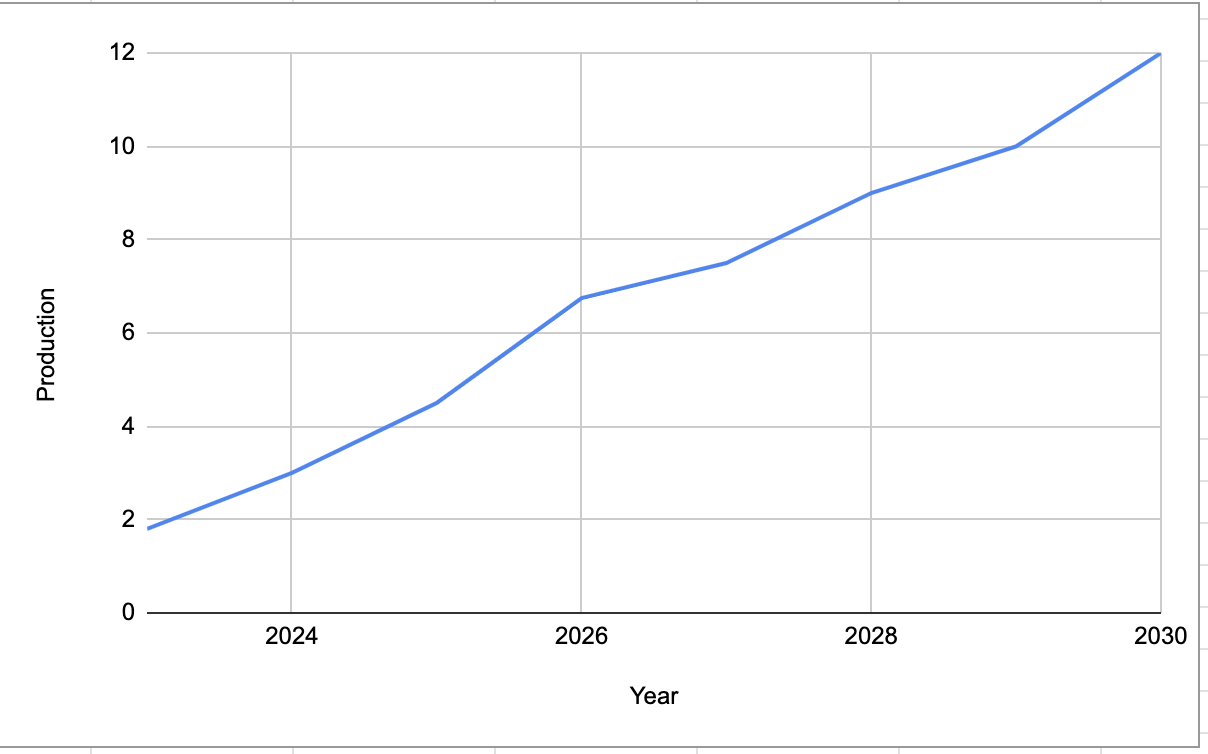

Once more, we will take Musk’s lofty targets and take them again to actuality. Musk has publicly mentioned he expects the corporate to achieve a $20 million manufacturing stage by 2030.

That’s a really bold goal, which might suggest round 40% CAGR over the subsequent seven years. As a substitute, making use of a extra modest CAGR of 30%, we will attain a goal for 2030 of 12 million.

Tesla Manufacturing Forecast (Creator’s work)

Now, let’s assume beginning round 2025, Tesla can supply FSD on 1/4 of each new mannequin it sells.

That might be virtually 12.5 million automobiles utilizing FSD. At $12,000 a bit, that’s $150 billion. Taking the low finish of the software program business common gross revenue margin, 75%, that suggests $115 billion in gross revenue.

That’s a bit greater than the GS estimate however not too far off, and I’m struggling to search out how precisely they reached this calculation.

Charging

Shifting on to charging, if Tesla can certainly set up itself as a normal for international EVs, then it definitely stands to make very substantial revenues.

The typical automobile wants maybe three fees per week, which is equal to round 225 Kw/h (75Kw/h per full cost.)

Multiply that by 52 weeks in a 12 months, and that’s a yearly “charging consumption” per EV of 11,700Kw/h.

Based on the IEA, there could possibly be 350 million EVs roaming the streets by 2030.

And one final piece of necessary data:

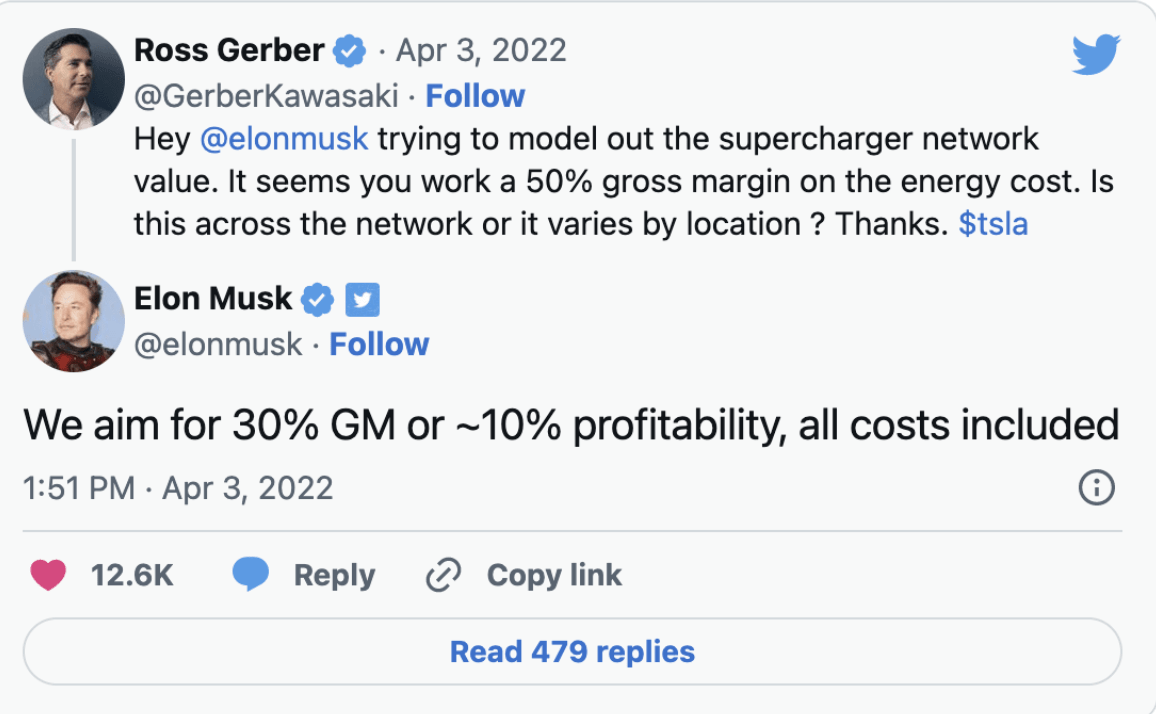

Musk Tweet (X)

Musk said that the Supercharger community goals for a 30% Gross Margin, and we all know Tesla fees customers round $0.40 per KWh.

Meaning if the Supercharger community could possibly be utilized by 10% of the worldwide fleet, that may be 35 million automobiles, charging 11,700Kw/h yearly.

This, in flip, means every automobile generates Tesla $4,680 in revenues. $163 billion yearly in revenues and $48.9 billion in gross revenue of we multiply that by 35 million automobiles.

Automobile Gross sales

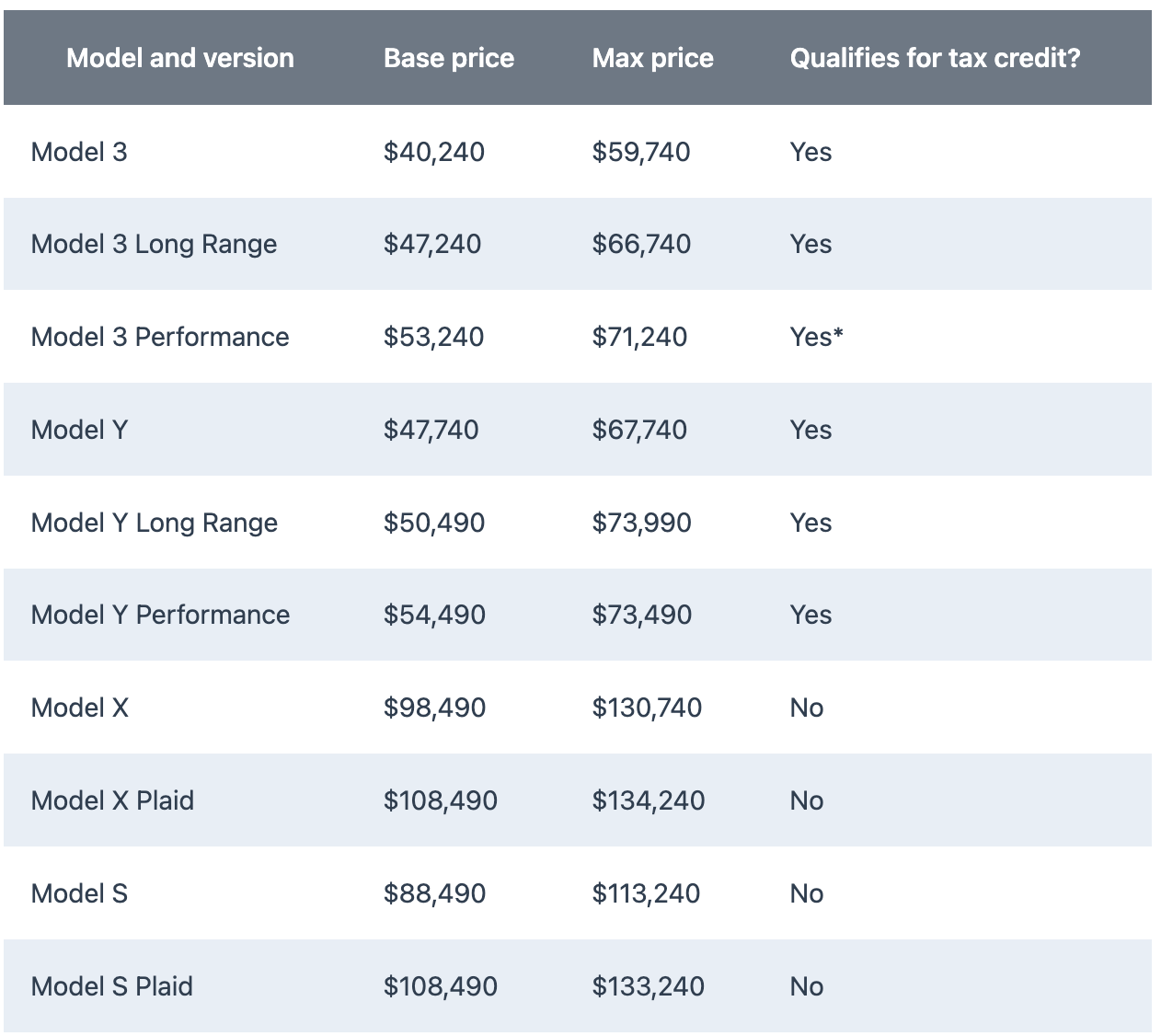

And, lastly, automobile gross sales. Now we have already projected 12 million manufacturing in 2030. Under are listed all the present worth ranges for Tesla’s automobiles.

Tesla Costs (Solarreviews)

Based mostly on these costs, a conservative common worth would doubtless be round $60,000.

At 12 million models, that may be $720 billion in income. With an auto margin of round 20%, that’s $144 billion in gross revenue.

Valuation

So, to sum up:

2030 Forecast

Income

Gross Revenue

Vitality Storage

$217,00

$54,40

FSD

$150,00

$115,00

Charging

$163,00

$48,90

Automobile Gross sales

$720,00

$144,00

Complete

$1.250,00

$362,30

Click on to enlarge

That’s $1.2 trillion in revenues and $362 billion in gross income.

However what does this imply when it comes to valuation? The most effective factor we will do right here is take the gross revenue, and apply a Worth/GP ratio.

Presently, Tesla’s Gross Revenue stands at just below $19 billion. With complete shares excellent of three.176 billion, which means gross revenue per share of slightly below $6, and a P/GP of round 36, given at present’s worth of $218.

Now, if we have been to use the a number of to our 2030 forecast, then we’d have a gross revenue of $114 a share, and a goal worth of $4100.

Nevertheless, this appears very bold, and one would count on this ratio to be a lot smaller.

Since we made the Amazon/Aws comparability, possibly this might function a sign of how the gross revenue for Tesla might evaluate to its worth as the corporate matures.

Amazon has a gross revenue of $225.152 billion and 10.3 billion shares excellent. Meaning round $22,5 GP per share and a P/GP ratio of 6.8.

Making use of a 6.8 ratio to our 2030 Tesla forecast yields a maybe extra real looking worth goal of $775.

Last Ideas

Whereas the market is trying on the damaging short-term information, it’s overlooking the entire nice enhancements to the long-term thesis which can be happening. Tesla, Inc. is killing it in vitality storage, charging and FSD, and that is going to be an even bigger a part of the pie yearly.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link