[ad_1]

Apple (AAPL) is encountering a turbulent begin to 2024, marked by downgrades and rising apprehensions about its progress trajectory. At present we are going to study each the technical and elementary points influencing Apple’s present market dynamics.

Apple (AAPL) is encountering a turbulent begin to 2024, marked by downgrades and rising apprehensions about its progress trajectory. At present we are going to study each the technical and elementary points influencing Apple’s present market dynamics.

Analyst Downgrades and Considerations:Apple just lately confronted its third downgrade in lower than two weeks, with Redburn Atlantic, Barclays, and Piper Sandler expressing considerations about slowing iPhone gross sales and potential regulatory challenges. Fears of weakening iPhone gross sales and regulatory headwinds prompted these downgrades, significantly specializing in the deteriorating macro atmosphere in China.

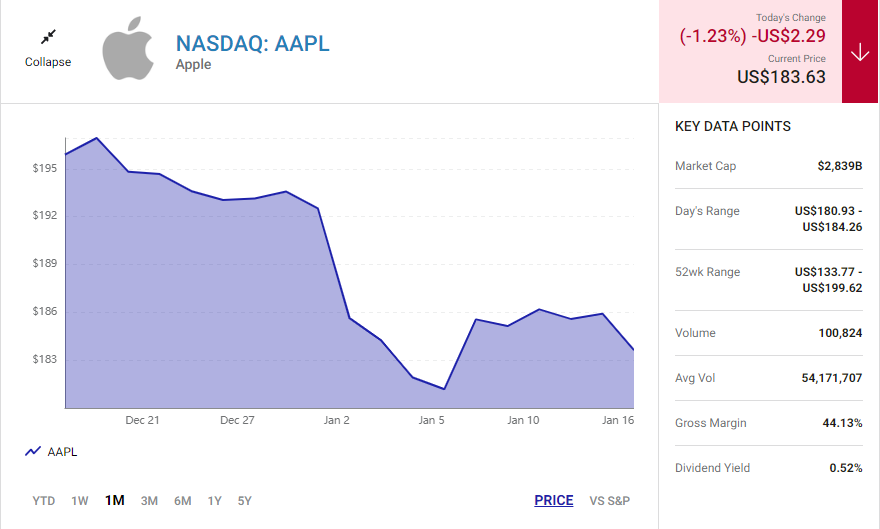

Blended Efficiency and Valuation Challenges:Within the preliminary days of 2024, Apple’s inventory dropped roughly 4%, in distinction to its Huge Tech friends exhibiting positive aspects. Considerations about its excessive valuation are on the rise, particularly amid worries about international financial downturns. Merchants are apprehensive about Apple’s progress price, significantly within the face of a possible international recession.

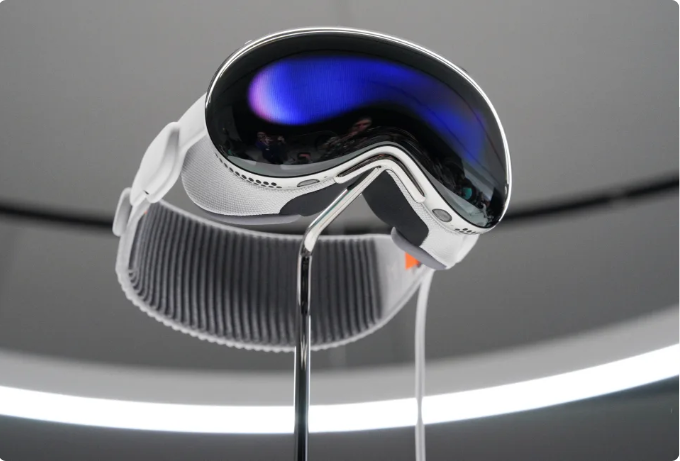

Optimistic Outlook and Catalysts:Regardless of downgrades, some preserve a optimistic outlook. Evercore ISI’s Amit Daryanani sees a possibility to purchase the dip, emphasizing Apple’s robust fundamentals and potential optimistic information circulate, particularly associated to Apple’s Imaginative and prescient Professional. Morgan Stanley’s Erik Woodring predicts a big raise for Apple in 2024, citing the potential for Apple’s ‘Edge AI’ alternative to materialize.

Challenges within the AI and Subsequent-Gen Know-how Sphere:Apple’s emphasis on synthetic intelligence (AI) and next-gen know-how, together with the high- priced Imaginative and prescient Professional headset, raises considerations. The success of the $3,499 Imaginative and prescient Professional spatial computing headset, set to launch in February, might considerably affect Apple’s inventory worth. Heavy investments in AI and next-gen headsets pose dangers, significantly if Apple’s progress price continues to say no.

priced Imaginative and prescient Professional headset, raises considerations. The success of the $3,499 Imaginative and prescient Professional spatial computing headset, set to launch in February, might considerably affect Apple’s inventory worth. Heavy investments in AI and next-gen headsets pose dangers, significantly if Apple’s progress price continues to say no.

Regulatory Dangers and Competitors:Regulatory dangers are surfacing, significantly regarding Apple’s providers enterprise, particularly the app retailer, as antitrust investigations intensify. Apple’s profitable settlement with Google because the default search engine in Safari faces uncertainty, including one other layer of complexity. Apple’s progress price and competitors within the AI and next-gen know-how sectors stay pivotal elements influencing its inventory efficiency.

Technical Evaluation

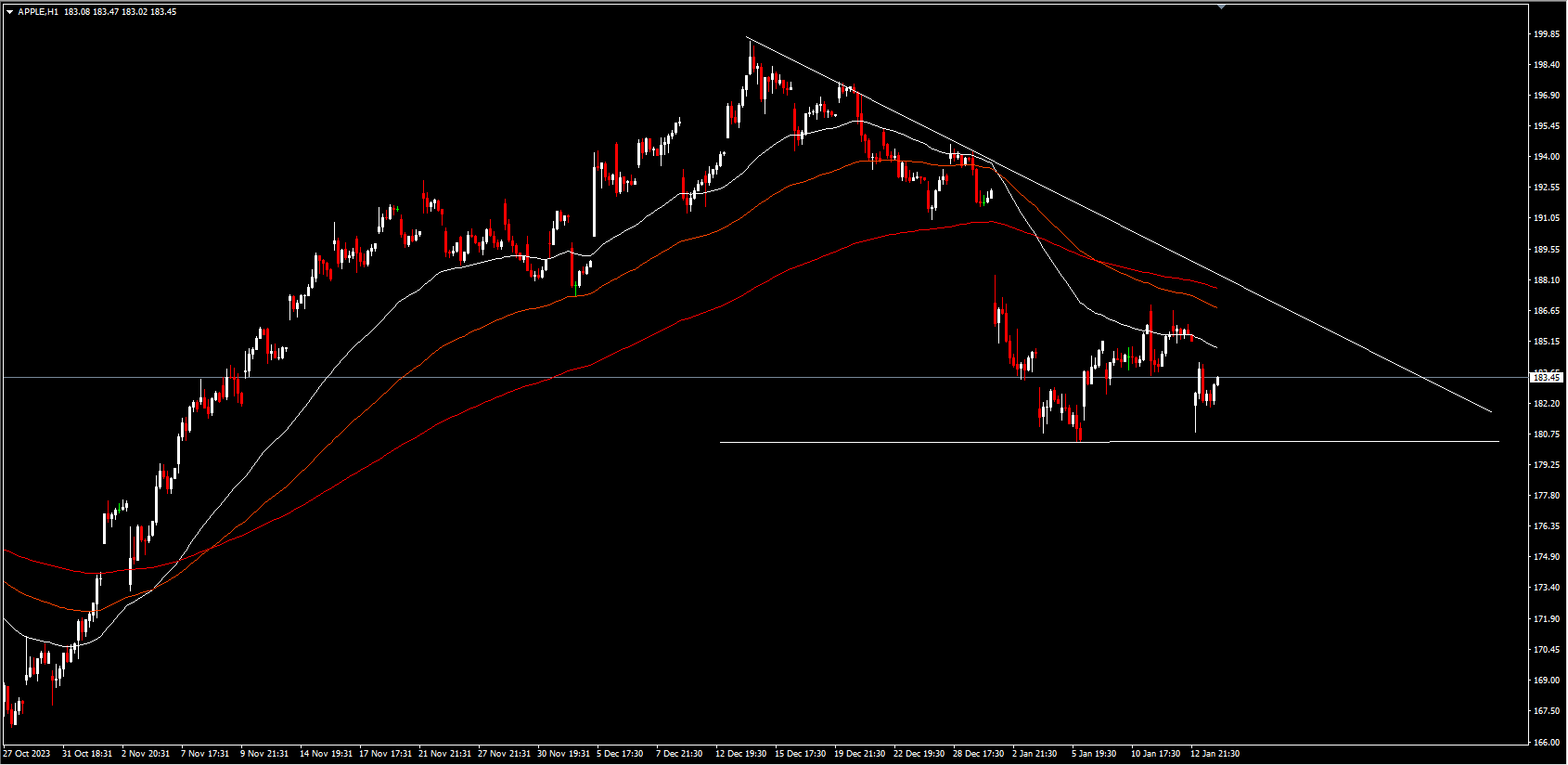

On the each day timeframe, Apple is positioned beneath the vital 100-day Exponential Transferring Common (EMA), presently standing at $184.45. This placement suggests a possible bearish pattern, because the EMA features as a dynamic resistance degree. Conversely, the inventory maintains its place above the 200-day EMA, standing at $178.54, appearing as an important dynamic help degree.

Moreover, a discernible descending triangle sample is observable on the 1-hour timeframe, signalling a bearish continuation sample that hints at a possible additional draw back breakout. The decrease threshold of the triangle, located at $180.30, serves as a pivotal help degree. A breach beneath this level may pave the best way for a considerable decline, concentrating on subsequent help ranges at $174.00 and $167.Conversely, if the inventory rebounds from the $180.30 degree, it might encounter resistance on the higher boundary of the triangle, marked at $184.45, aligning with the 100-day EMA. A breakthrough above this juncture might signify a reversal of the bearish pattern, probably triggering a rally in the direction of subsequent resistance ranges at $189 and $196.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link