[ad_1]

da-kuk

It has been about 4 months since I wrote my dour article about Worth Line Inc. (NASDAQ:VALU), and in that point the shares have returned detrimental 11% in opposition to a achieve of about 5.6% for the S&P 500. A inventory buying and selling at $44.20 is extra compelling than one which’s buying and selling at $50, although, so I assumed I would evaluation the identify once more. I am going to decide whether or not or not it is smart to purchase by taking a look at the newest monetary outcomes from the agency and by trying on the valuation. After I decide the valuation, I am going to take action in opposition to the inventory’s personal historical past, and in opposition to alternate options out there to traders immediately, particularly the 10-12 months Treasury Notice.

I do know that my writing could be a bit “further” as a number of the younger folks apparently say. Some persons are pushed away by the tiresome jokes, some don’t love the truth that I am writing unhealthy issues about their most well-liked investments, and a few persons are turned off by all the correct spelling. Regardless of the cause, my stuff may be “a bit a lot.” For that cause, I write a “thesis assertion” paragraph in the beginning of every of my articles. This enables the investor to get in, get the gist of my considering, after which get out once more earlier than my writing induces vertigo or nausea. You are welcome.

I feel Worth Line is the canonical “money cow.” The enterprise would not develop very a lot, and over 60% of web earnings is spun out within the type of a dividend. Provided that, I feel we must always decide it as a money cow enterprise. Once we examine it to the 10-12 months Treasury Notice, issues do not look nice. The dividend would want to develop at a CAGR of better than 10% to easily earn the (a lot much less dangerous) money flows earned by the Treasury Notice holder. So, individuals who purchase this inventory are taking up extra danger, and getting a decrease return than a Treasury Notice holder. That makes little or no sense to me. Investing is a relativistic recreation, the place we’re all the time trying to find one of the best danger adjusted returns. The inventory presents decrease returns, and better danger in my opinion, and for that cause I see no level in proudly owning the inventory.

Monetary Snapshot

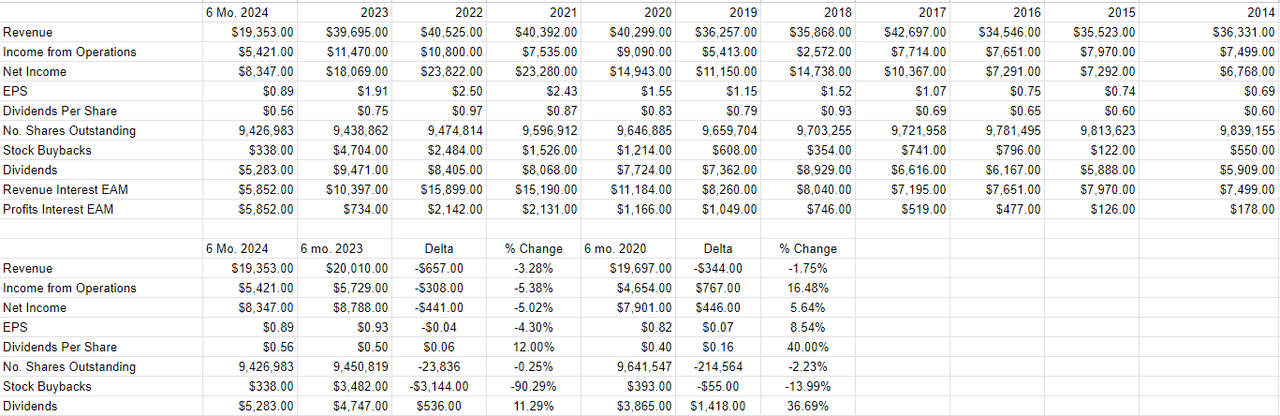

I would say that relative to the identical interval a yr in the past, the newest monetary outcomes may very well be described as “lackluster.” Particularly, income, earnings from operations, and web earnings are down by 3.3%, 5.4%, and 5% respectively. Moreover, the pattern right here is just not nice in my opinion, provided that income for the newest six months is definitely decrease (by 1.75%) relative to the identical interval in 2019. That is a type of firms that appears to be producing much less gross sales now than they did previous to the pandemic. Provided that the corporate pays out about 63.3% of its web earnings within the type of dividends, I feel we must always think about this to be the proverbial “money cow”, and I feel we must always worth the shares accordingly.

Whereas I do not suppose there’s something notably flawed with the enterprise, I do not suppose it is price a lot of a premium, and so I would solely be prepared to purchase it if the shares had been moderately priced.

Worth Line Financials (Worth Line investor relations)

The Inventory

Those that have some familiarity with my stuff know that I decide the enterprise and the inventory that supposedly represents the enterprise as two distinct “issues.” It is because the inventory is commonly a poor proxy for what is going on on on the enterprise, or what is going to ultimately occur to the enterprise. Acknowledging the disconnect between the 2 is the explanation {that a} website like this one exists, for example, so I really feel like I am on fairly stable mental footing right here.

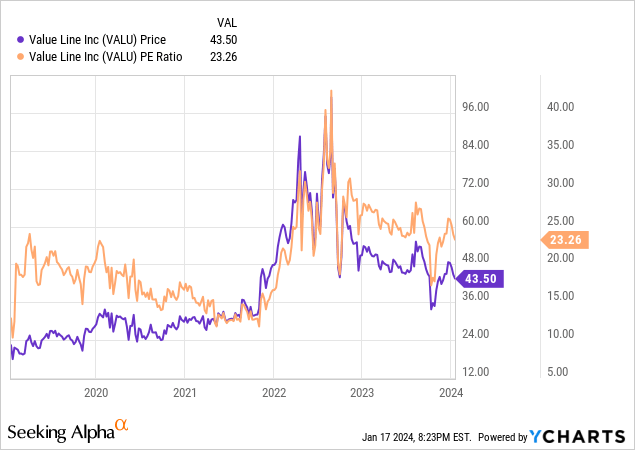

Anyway, I feel the inventory of even essentially the most sclerotic enterprise corresponding to this could be a nice funding in case you get it on the proper value. On this context, “proper value” means “adequate low cost relative to the general market and the inventory’s personal historical past.” We see from the chart beneath that the inventory is definitely buying and selling at a reasonably hefty premium relative to what it had when income was truly larger than immediately.

Along with taking a look at easy ratios, I need to examine the attractiveness of the inventory to the chance free investments that an investor may purchase. So, I additionally think about the inventory relative to a 10-12 months Treasury Notice. In any case, if an investor can obtain the identical, or better, money flows from a Treasury Notice than from a inventory, why purchase the extra dangerous inventory? This will get to the concept that we want a danger premium after we purchase shares, and absent an affordable danger premium, it makes little sense to purchase.

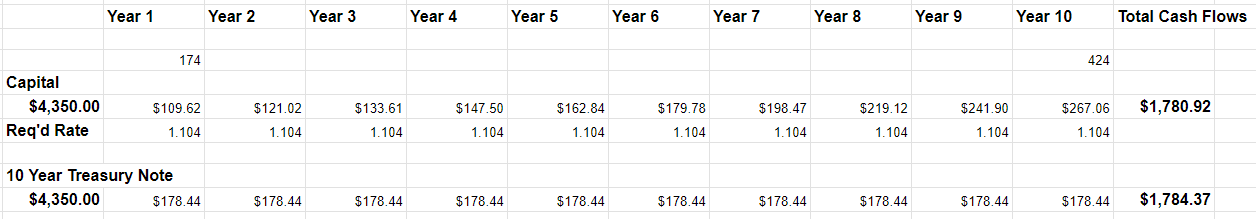

Provided that the yield on the 10-12 months Treasury Notice is presently about 4.1%, and provided that Worth Line’s dividend yield is just about 2.5%, the dividend would want to develop from present ranges to match the extent of earnings earned by the holder of the Treasury Notice. You might be questioning “at what charge would the Worth Line dividend must develop to match the money flows earned by the proprietor of the Treasury Notice?” I am glad you requested me that my rhetorically handy buddy. I am glad you requested as a result of answering the query will give me the chance to indicate off certainly one of my favorite funding instruments: the “all the things relative to Treasury Notes” desk.

We see from that desk, reprinted right here on your enjoyment and edification, that the dividend would want to develop at a CAGR of about 10.4% over the following decade to match the money flows from the Treasury Notice.

Worth Line v. Treasury Notice (Writer calculations)

It is at this level that I really feel compelled to remind all of you that income is decrease immediately than it was in 2019. I additionally really feel compelled to remind you that the payout ratio for this inventory is sitting round 63%. These two details counsel that the holder of this inventory over the following decade could not earn the identical degree of money because the Treasury Notice holder. This prompts the query: why would you purchase the comparatively extra dangerous inventory to earn much less cash than you’ll on the comparatively much less dangerous Treasury Notice? In some unspecified time in the future predictability turns into a pretty high quality, and in some unspecified time in the future we have to think about the relative deserves of funding A to funding B. On these deserves, Worth Line is just much less compelling an funding than the Treasury Notice in my opinion. For that cause, I might suggest eschewing this inventory till some mixture of decrease yield on the Treasury Notice, or larger dividend yield on the inventory transfer in favour of the fairness.

[ad_2]

Source link