[ad_1]

Spreadsheet information up to date each day

Up to date on January twenty fourth, 2024 by Bob Ciura

Particular person merchandise, companies, and even total industries (newspapers, typewriters, horse and buggy) exit of favor and turn into out of date.

Maybe greater than another business, agriculture is right here to remain. Agriculture began round 14,000 years in the past. It’s a protected guess we might be working towards agriculture far into the long run.

And, the expansion of the worldwide inhabitants is tied to rising agricultural effectivity. The agricultural revolution allowed better inhabitants development (and led to the commercial revolution).

As the worldwide inhabitants grows, so does the necessity for improved agricultural manufacturing. This creates a long-term demand driver for agriculture shares.

You’ll be able to obtain the entire record of all 40+ agriculture shares (together with necessary monetary metrics comparable to price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the hyperlink under:

The agriculture shares record was derived from two main exchange-traded funds. These are the AgTech & Meals Innovation ETF (KROP) and the iShares World Agriculture Index ETF (COW).

Investing in farm and agriculture shares means investing in an business that:

Has steady long-term demand

Has withstood the check of time, and is extraordinarily more likely to be round far into the long run

Advantages from advancing expertise

This text analyzes 7 of one of the best agriculture shares intimately. You’ll be able to shortly navigate the article utilizing the desk of contents under.

Desk of Contents

We now have ranked our 7 favourite agriculture shares under. The shares are ranked in accordance with anticipated returns over the subsequent 5 years, so as of lowest to highest.

Even higher, all 7 agriculture shares pay dividends to shareholders, making them engaging for earnings buyers. buyers ought to view this as a beginning off level to extra analysis.

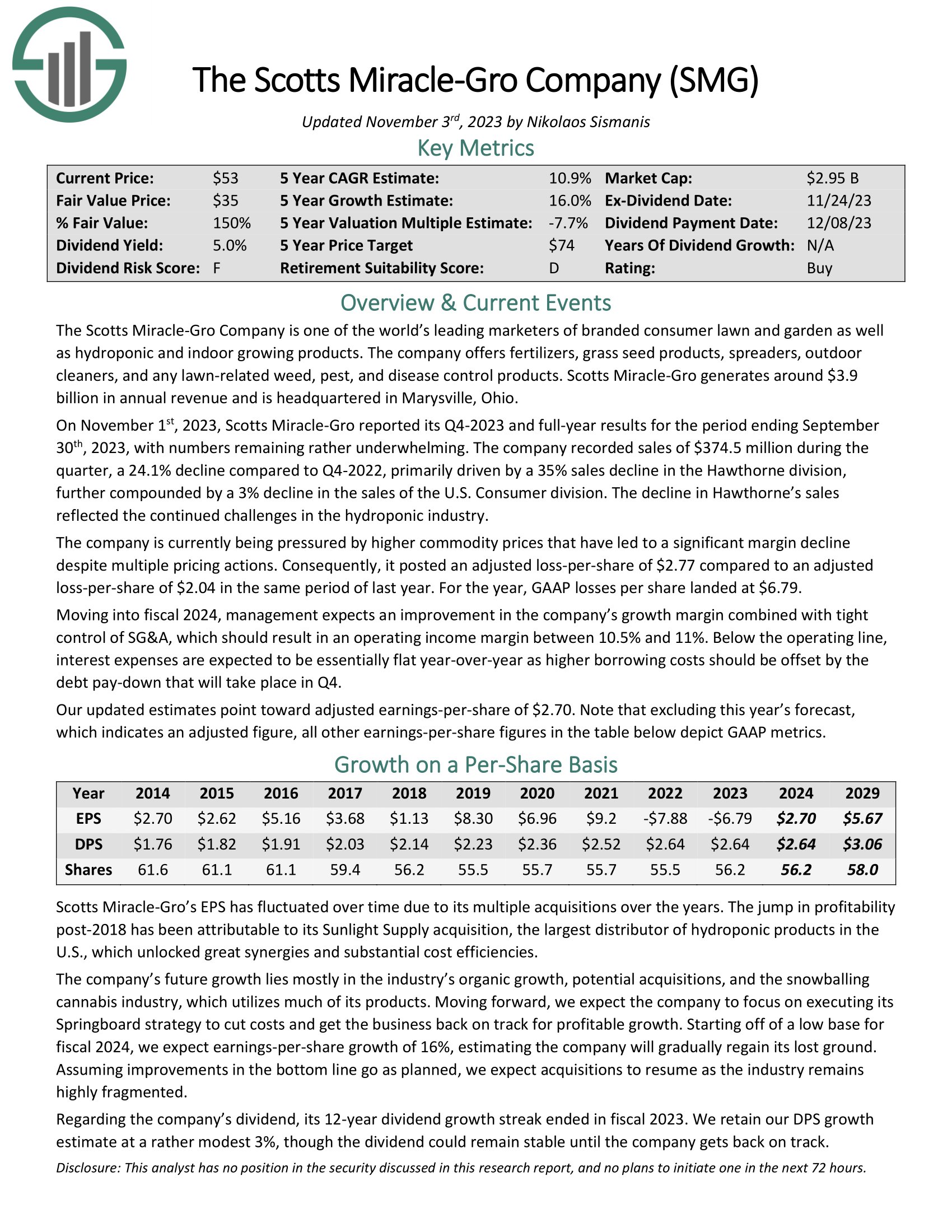

Agriculture Inventory #7: Scotts Miracle-Gro (SMG)

5-year anticipated annual returns: 8.1%

Scotts Miracle-Gro is without doubt one of the world’s main entrepreneurs of branded shopper garden and backyard in addition to hydroponic and indoor rising merchandise. The corporate presents fertilizers, grass seed merchandise, spreaders, out of doors cleaners, and any lawn-related weed, pest, and illness management merchandise. Scotts Miracle-Gro generates round $3.9 billion in annual income and is headquartered in Marysville, Ohio.

On November 1st, 2023, Scotts Miracle-Gro reported its This fall-2023 and full-year outcomes for the interval ending September thirtieth, 2023, with numbers remaining quite underwhelming.

The corporate recorded gross sales of $374.5 million throughout the quarter, a 24.1% decline in comparison with This fall-2022, primarily pushed by a 35% gross sales decline within the Hawthorne division, additional compounded by a 3% decline within the gross sales of the U.S. Client division. The decline in Hawthorne’s gross sales mirrored the continued challenges within the hydroponic business.

Click on right here to obtain our most up-to-date Positive Evaluation report on SMG (preview of web page 1 of three proven under):

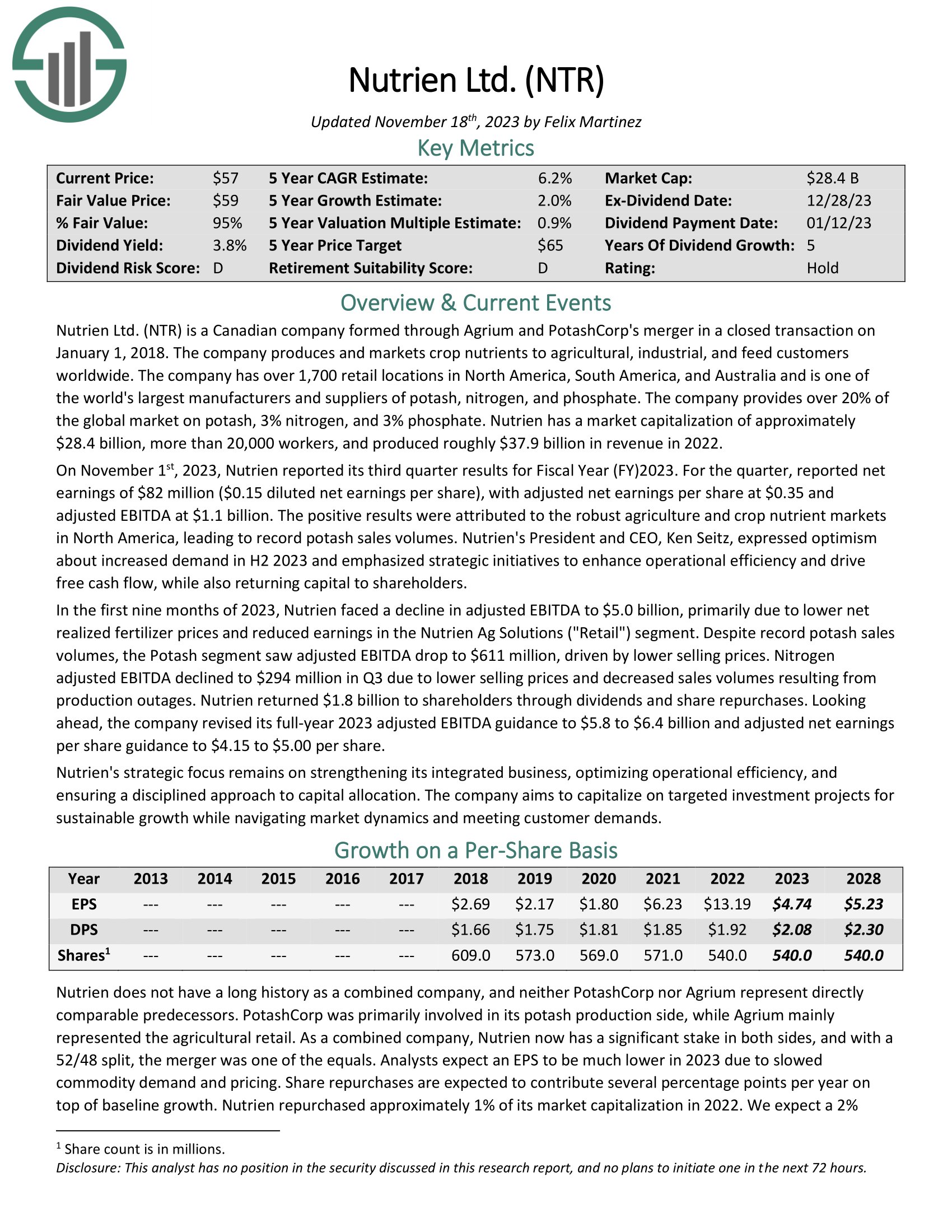

Agriculture Inventory #6: Nutrien Ltd. (NTR)

5-year anticipated annual returns: 8.2%

Nutrien is a Canadian firm shaped via Agrium and PotashCorp’s merger in a closed transaction on January 1, 2018. The corporate produces and markets crop vitamins to agricultural, industrial, and feed clients worldwide.

The corporate has over 1,700 retail places in North America, South America, and Australia and is without doubt one of the world’s largest producers and suppliers of potash, nitrogen, and phosphate. The corporate offers over 20% of the worldwide market on potash, 3% nitrogen, and three% phosphate.

On November 1st, 2023, Nutrien reported its third quarter outcomes for Fiscal Yr (FY) 2023. For the quarter, reported web earnings of $82 million ($0.15 diluted web earnings per share), with adjusted web earnings per share at $0.35 and adjusted EBITDA at $1.1 billion. The constructive outcomes had been attributed to the strong agriculture and crop nutrient markets in North America, resulting in document potash gross sales volumes.

Click on right here to obtain our most up-to-date Positive Evaluation report on NTR (preview of web page 1 of three proven under):

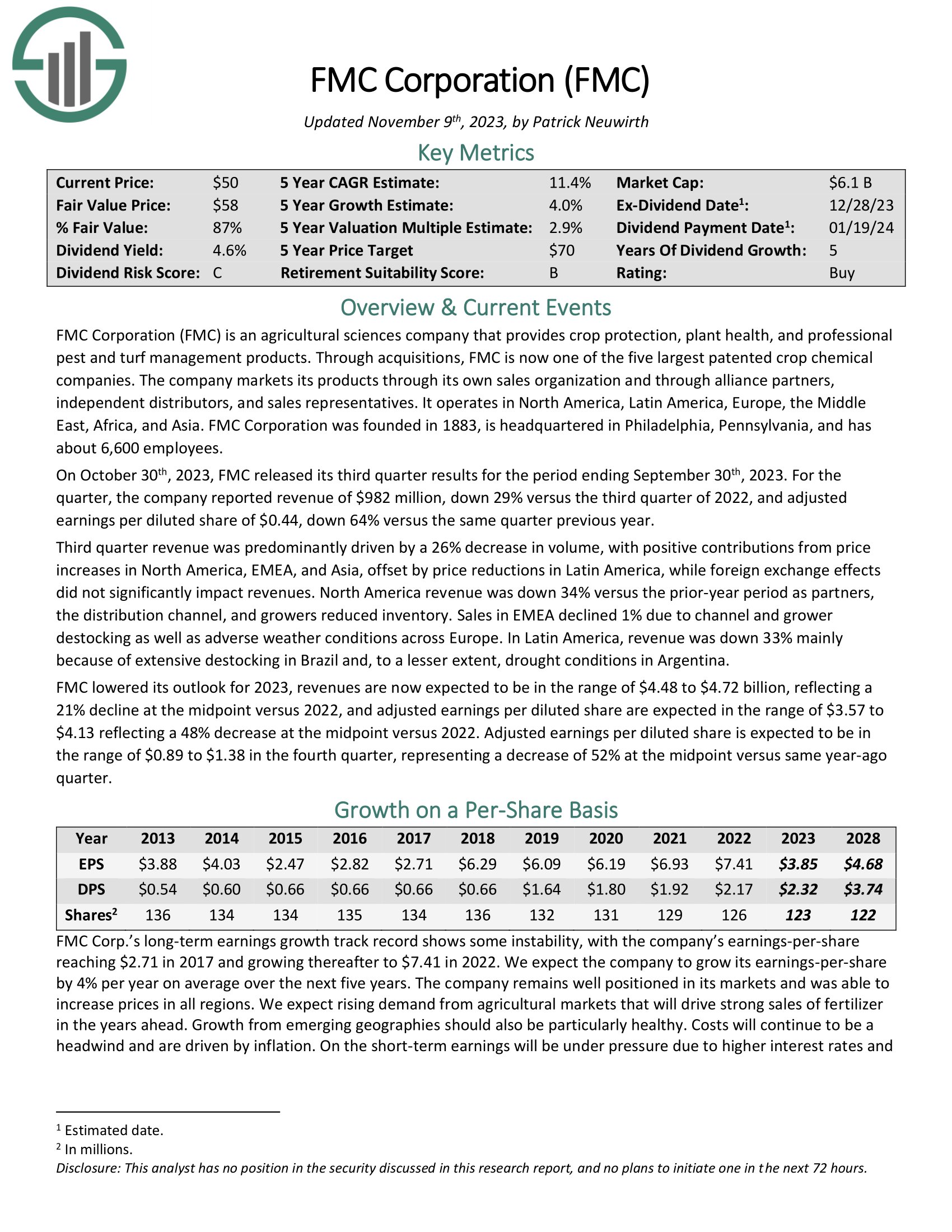

Agriculture Inventory #5: FMC Company (FMC)

5-year anticipated annual returns: 8.3%

FMC Company is an agricultural sciences firm that gives crop safety, plant well being, {and professional} pest and turf administration merchandise. Via acquisitions, FMC is now one of many 5 largest patented crop chemical firms.

The corporate markets its merchandise via its personal gross sales group and thru alliance companions, unbiased distributors, and gross sales representatives. It operates in North America, Latin America, Europe, the Center East, Africa, and Asia.

On October thirtieth, 2023, FMC launched its third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, the corporate reported income of $982 million, down 29% versus the third quarter of 2022, and adjusted earnings per diluted share of $0.44, down 64% versus the identical quarter earlier 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMC (preview of web page 1 of three proven under):

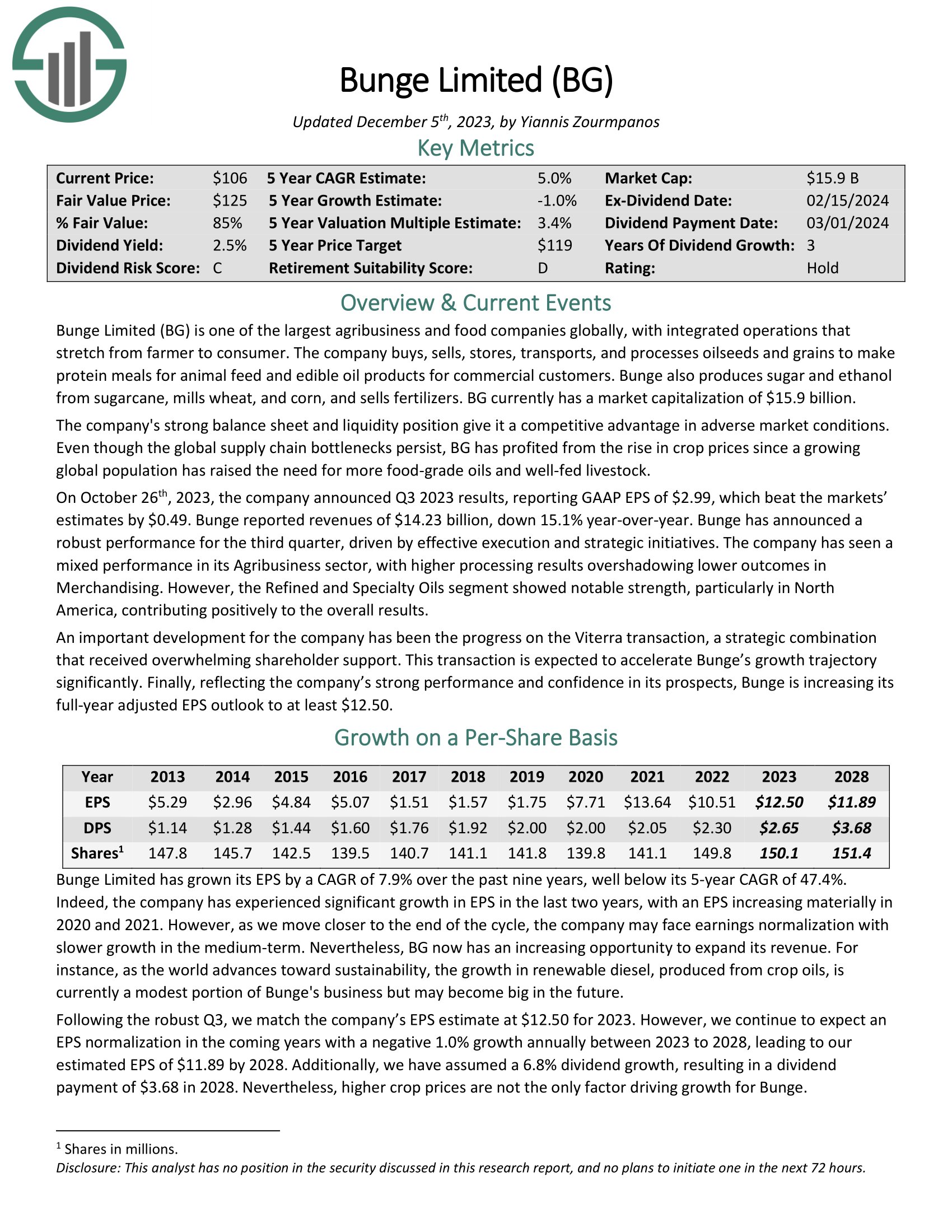

Agriculture Inventory #4: Bunge World SA (BG)

5-year anticipated annual returns: 8.4%

Bunge Restricted is without doubt one of the largest agribusiness and meals firms globally, with built-in operations that stretch from farmer to shopper. The corporate buys, sells, shops, transports, and processes oilseeds and grains to take protein meals for animal feed and edible oil merchandise for business clients. Bunge additionally produces sugar and ethanol from sugarcane, mills wheat, and corn, and sells fertilizers.

The corporate’s sturdy steadiness sheet and liquidity place give it a aggressive benefit in adversarial market circumstances. Although the worldwide provide chain bottlenecks persist, BG has profited from the rise in crop costs since a rising world inhabitants has raised the necessity for extra food-grade oils and well-fed livestock.

On October twenty sixth, 2023, the corporate introduced Q3 2023 outcomes, reporting GAAP EPS of $2.99, which beat the markets’ estimates by $0.49. Bunge reported revenues of $14.23 billion, down 15.1% year-over-year. Bunge has introduced a strong efficiency for the third quarter, pushed by efficient execution and strategic initiatives.

Click on right here to obtain our most up-to-date Positive Evaluation report on BG (preview of web page 1 of three proven under):

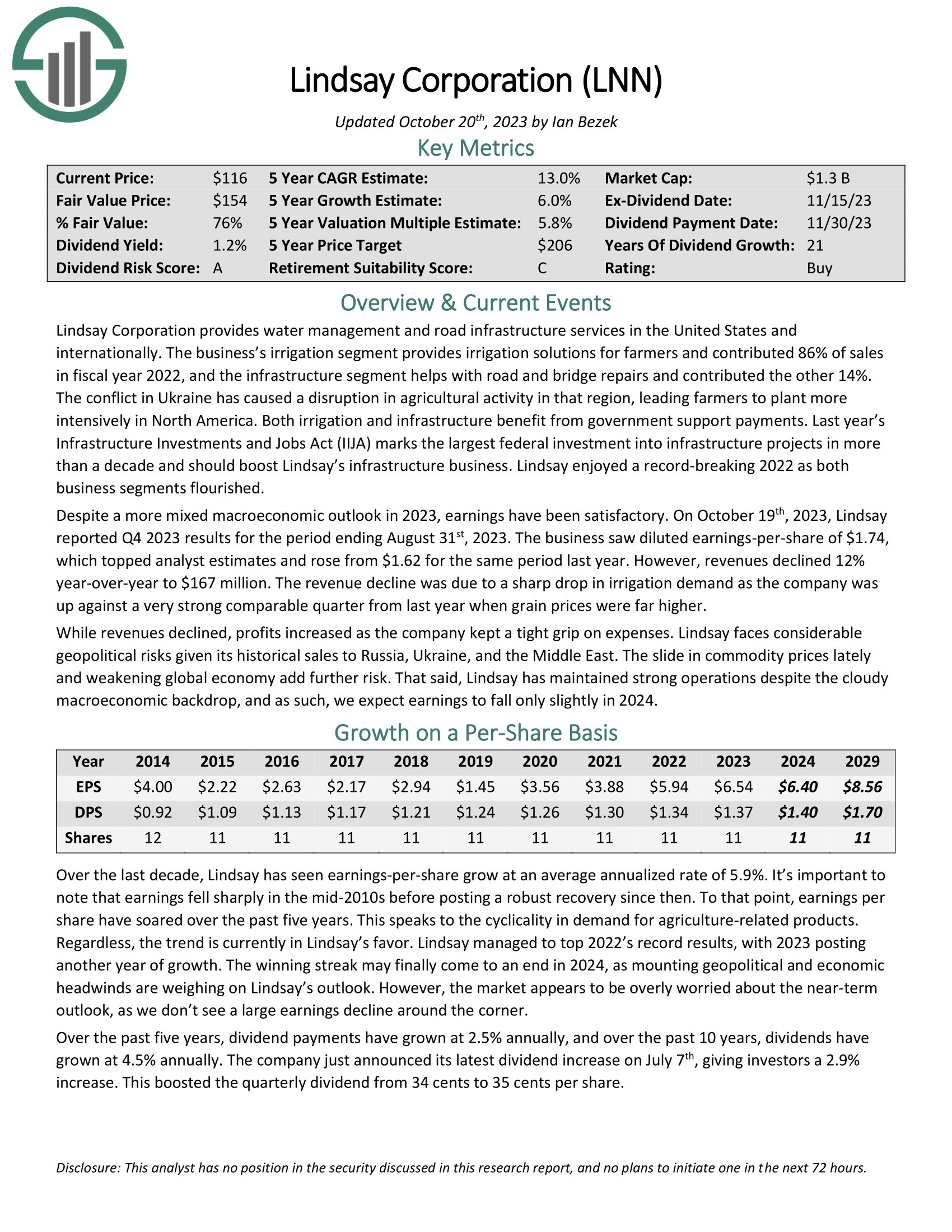

Agriculture Inventory #3: Lindsay Company (LNN)

5-year anticipated annual returns: 10.1%

Lindsay Company offers water administration and highway infrastructure providers in the US and internationally. The irrigation phase offers irrigation options for farmers and contributed 86% of gross sales in fiscal 12 months 2022. The infrastructure phase helps with highway and bridge repairs and contributed the opposite 14%.

On October nineteenth, 2023, Lindsay reported This fall 2023 outcomes for the interval ending August thirty first, 2023. The enterprise noticed diluted earnings-per-share of $1.74, which topped analyst estimates and rose from $1.62 for a similar interval final 12 months. Nonetheless, revenues declined 12% year-over-year to $167 million. The income decline was attributable to a pointy drop in irrigation demand as the corporate was up in opposition to a really sturdy comparable quarter from final 12 months when grain costs had been far greater.

Click on right here to obtain our most up-to-date Positive Evaluation report on Lindsay (preview of web page 1 of three proven under):

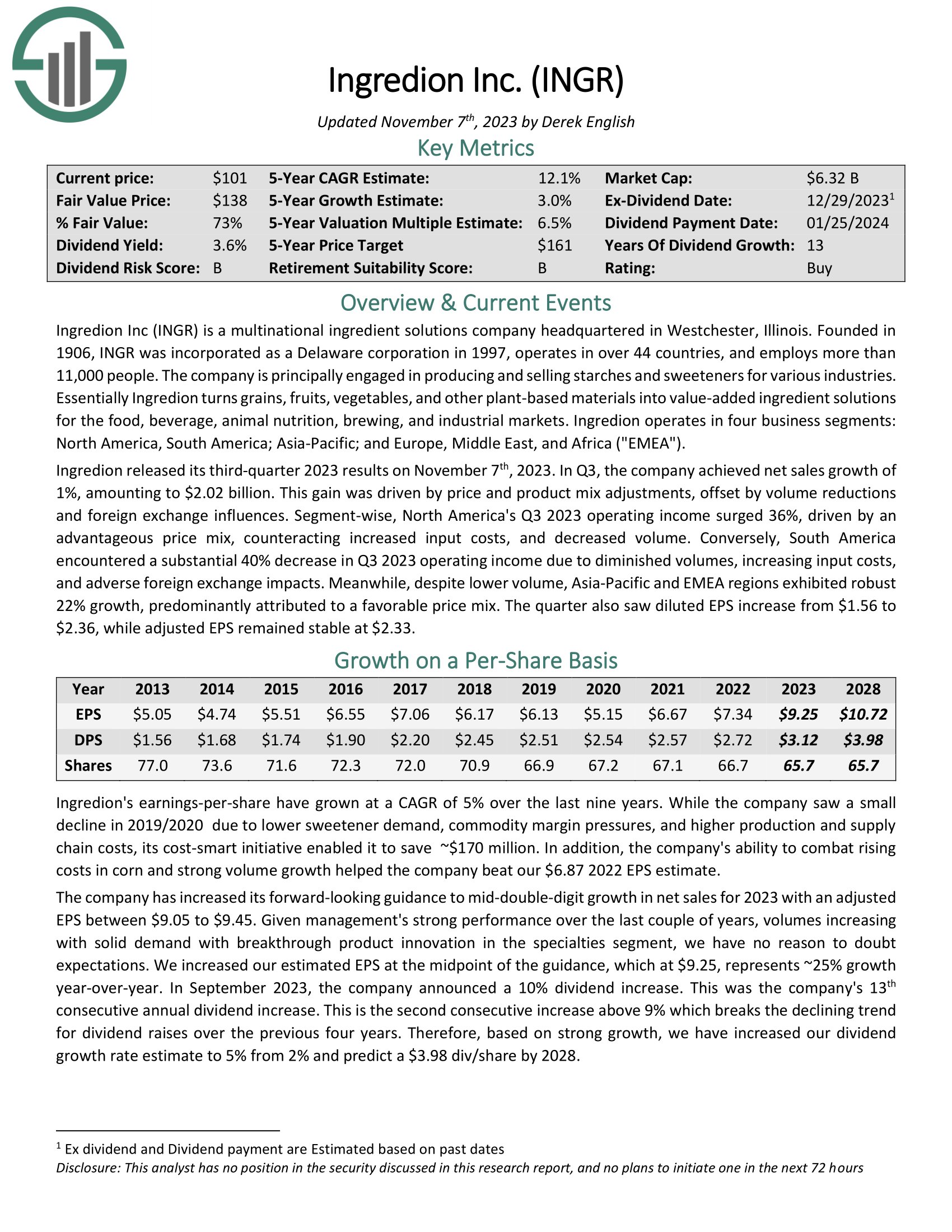

Agriculture Inventory #2: Ingredion Inc. (INGR)

5-year anticipated annual returns: 10.3%

Ingredion Inc is a multinational ingredient options firm engaged in producing and promoting starches and sweeteners for numerous industries. Ingredion turns grains, fruits, greens, and different plant-based supplies into value-added ingredient options for the meals, beverage, animal vitamin, brewing, and industrial markets.

Ingredion operates in 4 enterprise segments: North America, South America; Asia-Pacific; and Europe, Center East, and Africa (“EMEA”).

Ingredion launched its third-quarter 2023 outcomes on November seventh, 2023. In Q3, the corporate achieved web gross sales development of 1%, amounting to $2.02 billion. This achieve was pushed by value and product combine changes, offset by quantity reductions and overseas change influences. North America’s Q3 2023 working earnings surged 36%, pushed by an advantageous value combine, counteracting elevated enter prices, and decreased quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on INGR (preview of web page 1 of three proven under):

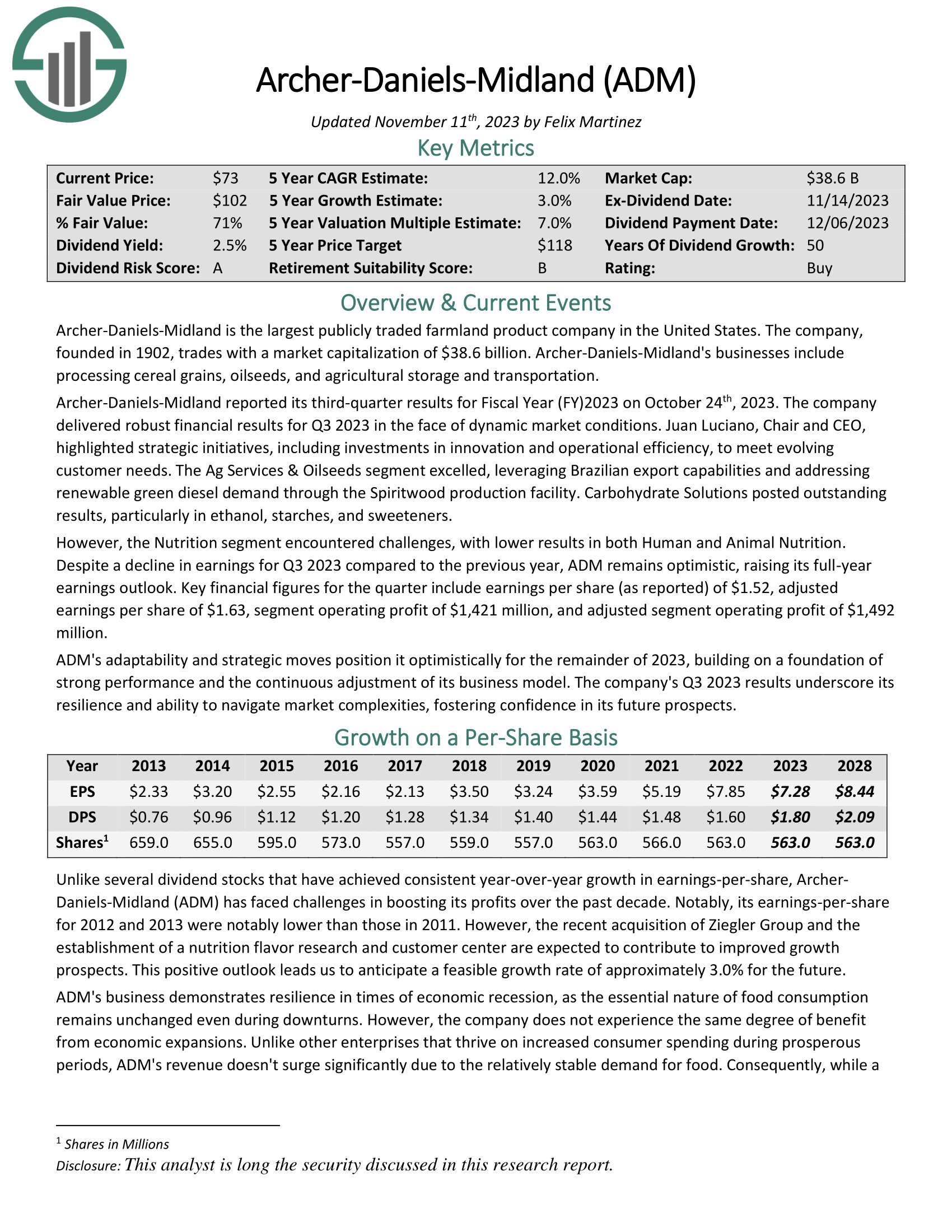

Agriculture Inventory #1: Archer-Daniels-Midland (ADM)

5-year anticipated annual returns: 19.6%

Archer-Daniels-Midland is the most important publicly traded farmland product firm in the US. The corporate, based in 1902, trades with a market capitalization of $38.6 billion. Archer-Daniels-Midland’s companies embrace processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal Yr (FY)2023 on October twenty fourth, 2023. The corporate delivered strong monetary outcomes for Q3 2023 within the face of dynamic market circumstances. Juan Luciano, Chair and CEO, highlighted strategic initiatives, together with investments in innovation and operational effectivity, to fulfill evolving buyer wants.

The Ag Providers & Oilseeds phase excelled, leveraging Brazilian export capabilities and addressing renewable inexperienced diesel demand via the Spiritwood manufacturing facility. Carbohydrate Options posted excellent outcomes, significantly in ethanol, starches, and sweeteners.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADM (preview of web page 1 of three proven under):

Remaining Ideas

Agriculture shares are a compelling place to search for long-term inventory investments. That’s as a result of the demand drivers of the business make it extraordinarily more likely to be round far into the long run.

We imagine the 7 agriculture shares examined on this article are one of the best throughout the business.

At Positive Dividend, we frequently advocate for investing in firms with a excessive chance of accelerating their dividends each 12 months.

If that technique appeals to you, it could be helpful to flick thru the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link