[ad_1]

NASDAQ 100 FORECAST:

The Nasdaq 100 rebounds off technical assist heading into the weekend following a selloff within the earlier buying and selling periodsAmazon leads the cost increased due to strong company earningsRegardless of the optimistic temper on Wall Avenue, market dangers stay elevated forward of the Fed resolution subsequent Wednesday

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

Most Learn: USD Breaking Information – Greenback Index Slides as PCE Information Declines in Line with Estimates

The Nasdaq 100 staged a average comeback on Friday after a big selloff in earlier buying and selling periods, with the tech index bouncing off cluster assist within the 14,150/13,930 area, propelled increased by Amazon’s spectacular rally within the aftermath of the corporate’s quarterly outcomes.

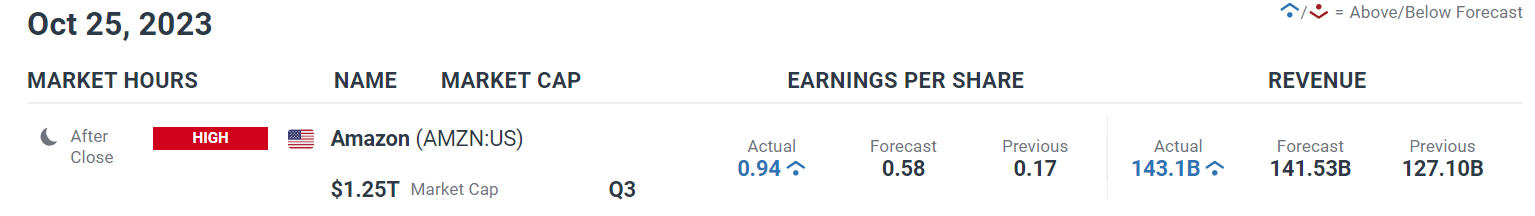

For context, shares of the e-commerce large (AMZN) superior greater than 7% following better-than-expected Q3 earnings and constructive steerage for its cloud companies enterprise, which accelerated late within the quarter, with “shocking” uptake for its generative AI merchandise.

AMAZON EARNINGS

Supply: DailyFX Earnings Calendar

For these searching for a extra complete view of U.S. fairness indices, our This autumn inventory market buying and selling information is the important thing to priceless insights. Seize your copy now!

Really useful by Diego Colman

Get Your Free Equities Forecast

Whereas sentiment seems to be on the mend, a one-day aid rally is not going to considerably erase what has transpired because the center of July: the tech index has fallen sharply, getting into correction territory earlier this week after posting a ten% drop from the 2023 excessive.

For clues on market trajectory, merchants ought to carefully observe the Federal Reserve’s financial coverage announcement subsequent week and, extra importantly, its ahead steerage. Whereas no change in rates of interest is predicted, the central financial institution may supply perception into its subsequent steps by way of its climbing marketing campaign.

With Fedspeak blended in latest weeks, it is very important watch what Fed Chair Powell has to say. Within the occasion that the FOMC reveals an inclination to hike borrowing prices once more in 2023, tech shares may come below strain. Conversely, any sign that the tightening cycle has ended ought to favor danger belongings.

The U.S. financial system has been extraordinarily resilient this 12 months, thanks partly to robust shopper spending. Towards this backdrop, inflation may stay sticky, pushing policymakers to maintain their choices open in case additional financial coverage tightening is important. This might weigh on the Nasdaq 100.

In case you’ve been discouraged by buying and selling losses, take into account taking a proactive strategy to spice up your expertise. Obtain our information, “Traits of Profitable Merchants,” and uncover a priceless assortment of insights that can assist you keep away from frequent buying and selling pitfalls.

Really useful by Diego Colman

Traits of Profitable Merchants

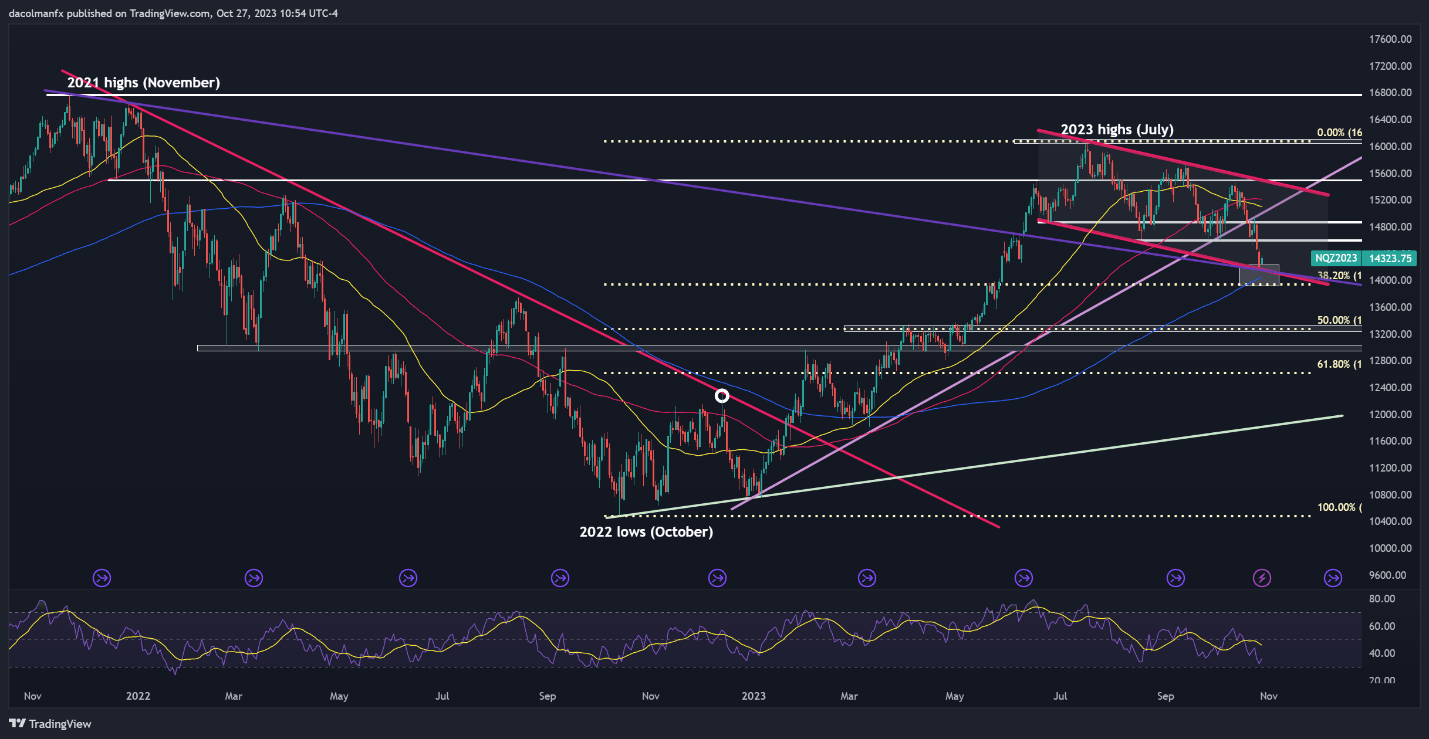

NASDAQ 100 TECHNICAL ANALYSIS

From a technical standpoint, the Nasdaq 100 is at the moment sitting close to an space of cluster assist that stretches from 14,150 to 13,930, the place the decrease restrict of the short-term descending channel converges with the 200-day SMA and the 38.2% Fibonacci retracement of the October 2022/July 2023 leg increased.

To create a pathway for a possible bullish resurgence, it’s important for confluence assist within the 14,150/13,930 vary to carry. Any breach of this zone may spark a steep retrenchment, doubtlessly taking costs in the direction of 13,270, which aligns with the 50% Fib retracement.

Within the occasion that the bulls handle to drive the index increased, preliminary resistance is positioned at 14,600. Upside clearance of this barrier may rekindle upward impetus and pave the way in which for a transfer to 14,860. On additional power, the eye will flip to fifteen,100.

Searching for actionable buying and selling insights? Obtain our high buying and selling alternatives information full of attention-grabbing technical and elementary buying and selling setups!

Really useful by Diego Colman

Get Your Free Prime Buying and selling Alternatives Forecast

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Futures Chart Created Utilizing TradingView

aspect contained in the aspect. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the aspect as a substitute.

[ad_2]

Source link