[ad_1]

by Fintechnews Switzerland

January 31, 2024

Fintech is experiencing fast progress in Uzbekistan, enjoying a pivotal position in bettering monetary inclusion, driving digital transformation, and contributing to financial growth. However regardless of the expansion, the home fintech sector stays small and nascent, presenting alternatives for gamers to faucet into, a brand new report by Mastercard says.

The report, titled “Fintech Market Uzbekistan” and launched in December 2023, offers a complete evaluation of the Uzbekistan fintech market, providing insights into the developments, challenges, regulatory setting, key ecosystem gamers and rising fintech startups.

Based on the report, fintech adoption in Uzbekistan has accelerated over the previous years, owing to the event of digital infrastructure within the nation, together with web and cellular companies. This pattern accelerated on the COVID-19 pandemic, which fueled demand for distant entry to monetary and banking.

Proof of that is the numerous enlargement of digital funds and the event of digital wallets. Between 2020 and 2022, the amount of transactions by way of QR-online techniques grew by a outstanding 119% common annual progress charge. Whole worth skyrocketed by a staggering 1,500% throughout the interval.

Transactions by way of QR-online system, Supply: Fintech Market Uzbekistan, Mastercard, Dec 2023

Distant banking has additionally skilled vital progress, revealing untapped alternatives for enhancing monetary companies. In 2018, solely 8 million folks in another country’s 32 million inhabitants used distant transactions, a quantity that rose to 30 million in 2022 and which suggests an annual progress charge of 30% between 2018 and 2022. Whole POS transaction worth, in the meantime, grew by 56% between 2021 and 2022, reaching US$14 billion, reflecting the shift to digital funds and cashless transactions.

Distant and POS-terminal transactions, Supply: Fintech Market Uzbekistan, Mastercard, Dec 2023

The Mastercard report identifies a number of crucial developments driving the expansion of fintech in Uzbekistan. It notes that the federal government is actively selling monetary inclusion and dealing on establishing a conducive basis for fintech to attempt. Latest developments on this regard embody a banking reform technique for 2020-2025 which has spurred the entry of international entities and prompted native banks to diversify their mortgage and deposit portfolios, and develop newl merchandise, deposits, loans and different commission-based merchandise to draw new prospects and improve experiences.

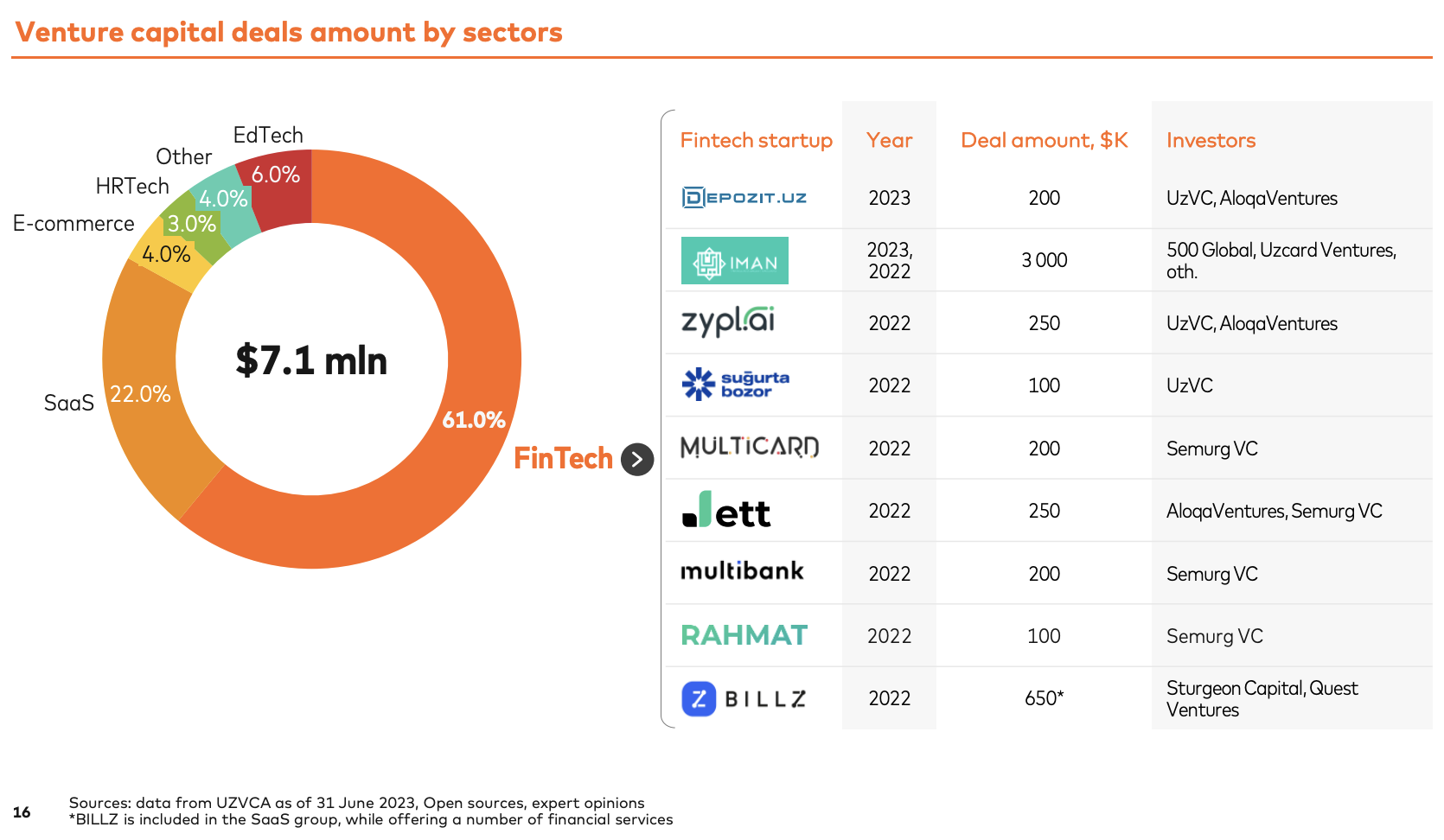

The rise of fintech in Uzbekistan has additionally been fueled by elevated funding within the nation’s startup ecosystem. From 2022 to 2023, enterprise capital (VC) funding in home startups totaled US$7.1 million, with 61% of that quantity going in direction of fintech corporations.

Based on the report, notable fintech rounds secured throughout that interval embody a US$3 million spherical raised by banking infrastructure supplier Iman, US$650,000 secured by Billz, a startup that gives easy-to-use instruments for retail administration; and US$250,000 secured by Zypl.ai, a credit score scoring startup.

Uzbekistan enterprise capital offers by sectors, Supply: Fintech Market Uzbekistan, Mastercard, Dec 2023

Uzbekistan’s fintech ecosystem

A fintech panorama map produced by Mastercard as a part of the report reveals a dynamic and numerous Uzbek fintech ecosystem. This ecosystem contains quite a lot of segments together with cost, cellular banking, purchase now, pay later (BNPL), wealthtech and blockchain, in addition to varied stakeholders comparable to trade commerce teams, worldwide organizations, startup applications and VC companies.

Uzbekistan fintech ecosystem map, Supply: Fintech Market Uzbekistan, Mastercard, Dec 2023

The report additionally delves into particular fintech developments shaping the panorama in Uzbekistan. Notably, the rise of digital funds is pushed by the federal government’s dedication to monetary inclusion and is being fueled by the gradual tempo of financial institution digitalization. Notable gamers within the house embody cost firm Click on, digital companies ecosystem Uzum, and on-line cost service Payme.

Concurrently, neobanking is experiencing vital progress, serving each people and companies. Digital financial institution Anorbank, for instance, presents a cellular app that facilitates a various vary of on-line funds for varied companies together with on-line card ordering, on-line credit score utility and approval, and on-line deposit account opening. Multibank, a neobanking firm, offers a digital answer for micro, small and medium-sized enterprises (SMEs) encompassing banking companies, digital doc administration and invoicing.

One other key pattern outlined within the report is the rising recognition of BNPL companies which have change into a big catalyst for e-commerce, providing Sharia-compliant choices and swift on-line installment approvals. Common choices in Uzbekistan embody halal installment service Uzum Nasiya, which boasted greater than 350,000 prospects in April 2023, and ZoodPay BNPL, a product launched in 2019 as a part of the Zood digital ecosystem.

Lastly, within the digital lending section, corporations like ZoodPay are filling the hole left by conventional establishments, providing digital client lending companies, whereas Oasis Microcredit is contributing to the fintech ecosystem by offering SME lending alternatives.

The report additionally places the highlight on rising Uzbek fintech stars, emphasizing the expansion of Zood, an ecosystem that mixes an e-commerce lending platform (ZoodPay), a market (ZoodMall), supply and logistics companies (ZoodShip), and a digital financial institution; Marta, a startup that gives cellular buying companies for small companies; Billz, an all-in-one retailer administration automatization options for corporations in retail enterprise; Iman, a digital funding and financing startup; and Sug’urta Bozor, an insurance coverage market.

The Mastercard report concludes that whereas the Uzbek fintech sector remains to be small and nascent, the panorama presents quite a few alternatives for each native and worldwide gamers to contribute to the evolution of the nation’s monetary companies sector. This progress might be supported by strategic authorities initiatives, a conducive regulatory setting and the presence of a burgeoning ecosystem of startups.

Featured picture credit score: edited from Unsplash

[ad_2]

Source link