[ad_1]

PeopleImages

Introduction

DLocal (NASDAQ:DLO) is a cross-border cost processor that connects international retailers to rising markets. In my view, dLocal is a robust purchase advice on account of its aggressive benefits within the business and profitable development technique. Regardless of dangers related to political, regulatory, and forex fluctuations, the corporate has demonstrated a robust monitor file of innovation and growth. With over 900 native cost strategies, dLocal presents a easy, scalable, and safe answer for retailers to just accept and make funds in over 40 rising markets.

Enterprise Overview

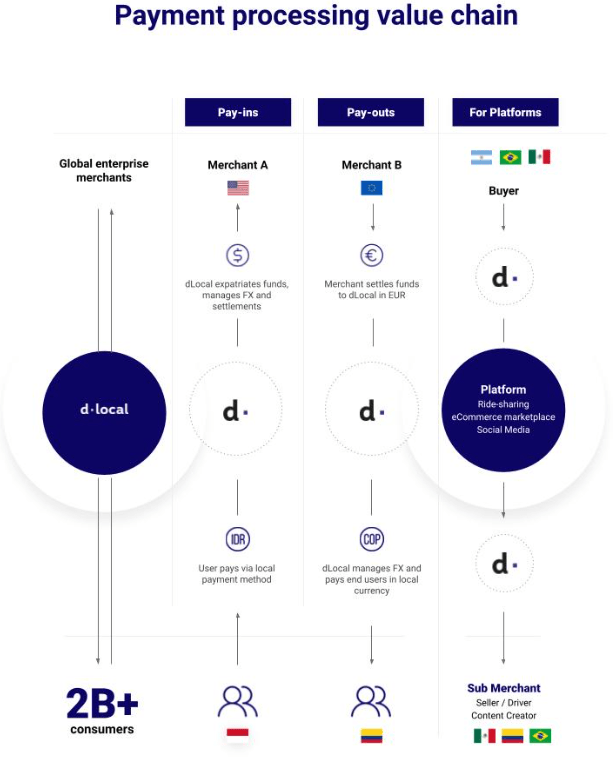

dLocal is a cross-border cost processor that connects international retailers to rising markets. It presents a one-stop-shop answer for retailers to just accept and make funds in over 40 rising markets, utilizing over 900 native cost strategies. dLocal’s platform is designed to be easy, scalable, and safe, making it ideally suited for international enterprise retailers working in rising markets. dLocal’s companies embody:

Pay-in: dLocal permits international retailers to just accept client funds in rising markets utilizing varied native cost strategies, together with credit score and debit playing cards, financial institution transfers, eWallets, and money funds.

Pay-out: dLocal permits international retailers to pay suppliers and contractors in rising markets utilizing varied native cost strategies.

Forex conversion: dLocal presents aggressive forex conversion charges and helps retailers handle international trade threat.

Fraud prevention: dLocal makes use of varied measures to guard retailers from fraud and chargebacks.

dLocal 10K Report

dLocal presents a number of crucial advantages to international enterprise retailers working in rising markets, together with:

Simplified funds: dLocal offers retailers with a single API and know-how platform to just accept and make funds in over 40 rising markets, utilizing over 900 native cost strategies. This simplifies the cost course of for retailers and reduces their operational prices.

Improved acceptance charges: dLocal has excessive acceptance charges for card funds and different cost strategies (APMs) in rising markets. This helps retailers to extend their gross sales and attain a broader buyer base.

Diminished friction: dLocal’s platform is designed to be user-friendly and seamless for each retailers and shoppers. This helps to scale back friction within the cost course of and enhance the general buyer expertise.

Enhanced fraud safety: dLocal makes use of varied fraud prevention measures to guard retailers from fraud and chargebacks. This provides retailers peace of thoughts and permits them to give attention to their enterprise.

dLocal is well-positioned to capitalize on the expansion of e-commerce and on-line funds in rising markets. The corporate has a robust monitor file of development and innovation, and main enterprise capital companies again it. dLocal can be increasing its presence into new rising markets and growing new services and products to satisfy the wants of its clients.

dLocal 10K Report

General, dLocal is a number one supplier of cross-border cost options for international enterprise retailers working in rising markets. The corporate presents a simplified, safe, and scalable platform that helps retailers improve their gross sales, attain a broader buyer base, and scale back their operational prices.

Cross-Border Fee Trade and Aggressive Panorama

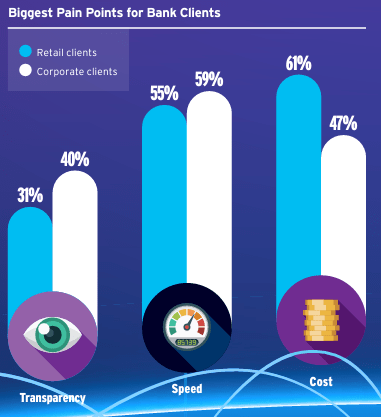

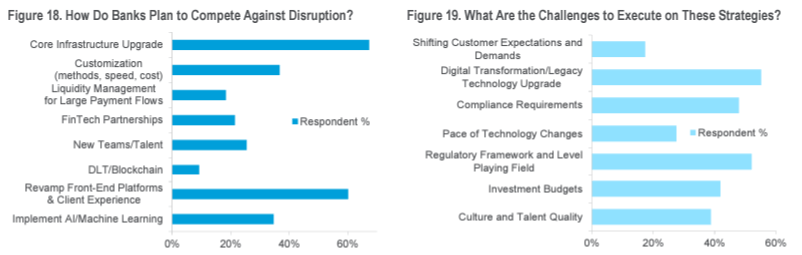

The outdated incumbents within the cross-border cost business (CBPI) have been banks. Nonetheless, within the earlier years, they’ve donated market share to disruptive fintech, corresponding to dLocal, D24, Astro Pay, Adyen (OTCPK:ADYEY), and so forth. In response to the Citigroup Report, over 40% of the banks have misplaced at the least 5% of the market share to fintech, and 89% of them anticipate to maintain being donors within the following 5-10 years. Fintech knew methods to enhance cross-border companies by specializing in transparency, prices, and velocity, the primary points skilled by company and retail shoppers working with banks.

Citi Group Report

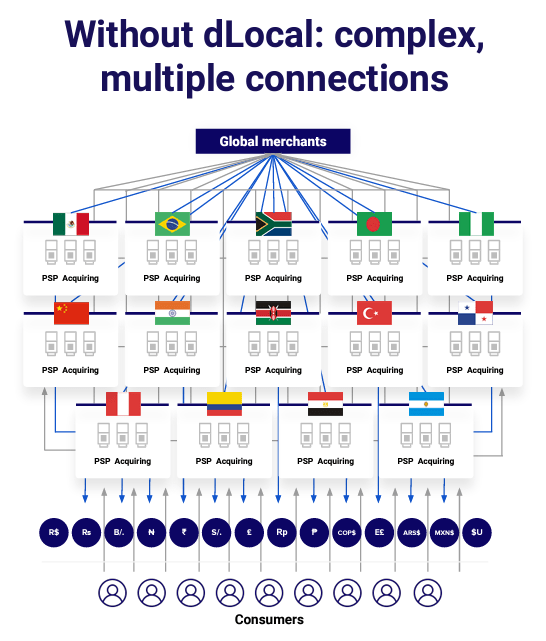

On this sense, a key determinant of success is the mixing of APIs of their networks in order that shoppers can handle all their funds extra effectively and thru a broad community of suppliers, bettering transparency and prices (choosing the right supplier and routing). dLocal founders noticed some great benefits of integrating all its companies right into a sole API and know-how platform, permitting retailers to handle all their funds and geographies in a single platform whereas fostering transparency and analyses of real-time cost information. Furthermore, dLocal retains integrating into its platform new cost strategies, geographies, initiatives (corresponding to Issuing-as-a-service and dLocal for Platforms), and monetary companions; the most recent allowed it to develop the Good Routing, which is a system that at all times selects probably the most cost-effective approach to course of funds in dLocal know-how platform. From my perspective, the entrepreneurial imaginative and prescient of its founders, Sergio Fogel and Andrés Bzurosvki, permits dLocal to quickly develop a robust community of service provider and monetary companions and substantial aggressive benefits. On this sense, I feel dLocal’s vast revenue margins are on account of a extremely scalable enterprise that advantages from a bigger Whole Fee Quantity (TPV), which in flip is pushed by dLocal’s give attention to transparency and adaptableness to service provider wants. For example, as quickly as dLocal has developed an answer for a service provider in a rustic (let’s say the acceptance of a brand new cost technique), the answer might be supplied to a different service provider with the identical drawback at a minimal incremental price, making it extremely scalable. In the meantime, banks should adjust to extra laws, slowing the discharge of latest services and products, and face larger prices on account of their bodily presence and fewer automation processes.

Citigroup Report

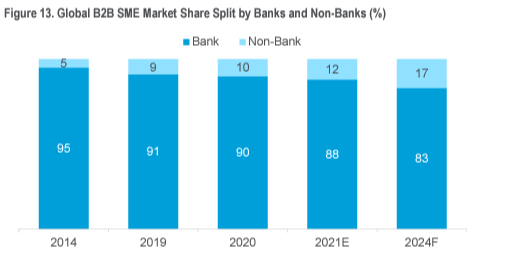

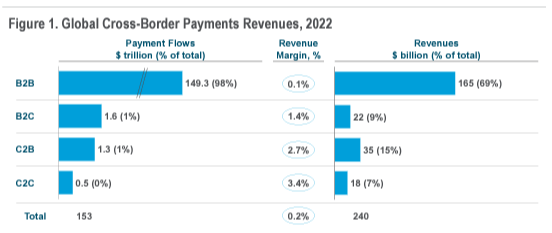

Persevering with with the business, the quantity of cross-border funds is anticipated to achieve $250 trillion by 2027, including $100 trillion in comparison with 2022. Furthermore, the entire business income is anticipated to extend at a excessive single digit, in accordance with Citigroup Report. Nevertheless, a lot of the market contains B2B transactions with the bottom margin; these transactions are usually not the primary enterprise of dLocal; as a substitute, they’re the B2C and C2B transactions (the most recent is anticipated to be the quicker rising section), which usually carry larger margins, in accordance with McKinsey Report.

Citigroup Report

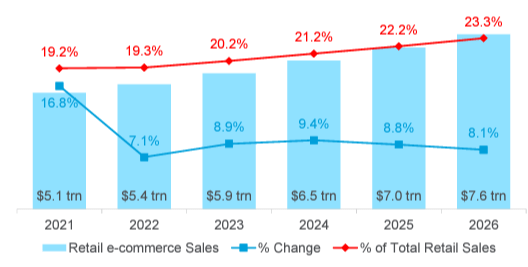

E-commerce will probably be an important driver within the development of cross-border funds, because the business is anticipated to develop at a CAGR of 9%, and the growth of worldwide logistics decreases transportation costs. Furthermore, Asia and Africa are anticipated to develop quicker than different markets (10-15%), reaching a $3.3 trillion quantity in e-commerce international funds by 2028. On this sense, e-commerce clients anticipate to have the ability to pay with a various of cost strategies at just about zero prices; thus, I imagine the worth proposition of dLocal adapts completely to the demand of finish shoppers within the e-commerce business, facilitating funds with any cost technique on the lowest prices attainable by means of sensible routing. As a affirmation of dLocal’s success in each markets, we are able to observe the three-digit-growth fee in international locations like Morocco, Egypt, Indonesia, and the Philippines, and an general income development of 152% YoY in 2Q23. E-commerce platforms can’t lag in implementing new cost strategies, so they are going to maintain partnering with Fintechs to enhance shoppers’ cost expertise.

Citigroup report dLocal 2Q23 presentation

From my perspective, the B2B market might be a big marketplace for dLocal sooner or later as most of those transactions are made by banks (by means of SWIFT), which, even with enhancements, generally is a sluggish and expensive technique on account of capital controls, regulatory boundaries and antiquate banking infrastructure. Nonetheless, fintech might want to achieve extra belief from company shoppers in the event that they need to compete towards the safety given by SWIFT.

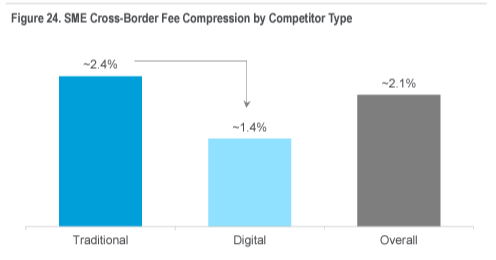

At present, the aggressive panorama within the C2B and B2C segments is outlined by specializing in clients’ cost expertise and reducing charges as banks and fintech attempt to achieve market share by bringing extra transparency and cost choices at a decrease price for finish customers.

Citigroup Report

*SME: corporations with 50-100 staff.

Moreover, banks are evaluating methods to keep aggressive on this setting, and most of them imagine that their infrastructures want a considerable change and that they should revamp front-platforms and shoppers’ expertise. Nonetheless, they face some challenges, corresponding to compliance necessities, regulatory framework, and legacy know-how. Furthermore, Swift Go is an initiative anticipated to extend transparency in cross-border funds and decrease transaction prices, particularly for small quantity transactions; nonetheless, it faces the identical challenges named under.

Citigroup Report

Due to this fact, banks will probably maintain giving up market share to FinTech corporations. On this sense, it’s essential to grasp how dLocal can outplay different fintech and maintain gaining market share in a fast-growing business. First, the worldwide funds business is more likely to expertise the introduction of disruptive applied sciences, corresponding to cryptocurrency, AI, tokenization, and central financial institution digital currencies; thus, the diploma of uncertainty is excessive about how the long run will probably be within the subsequent 5-10 years. Second, dLocal faces stiff competitors from different fintech with comparable companies, corresponding to D24 and Astro Pay in Latam and lots of others in Africa and Asia. For instance, greater than 12 gamers are much like dLocal in international locations like Malaysia.

inai

Nonetheless, dLocal’s shoppers make me suppose dLocal presents one of the best worth for all retailers within the business. Firms corresponding to Amazon, Uber, Google, Tencent, Microsoft, Shopify, Shein, Nike, and Salesforce, amongst others, inform us the standard of the service supplied by dLocal. For example, Amazon evaluated the corporate for 2 years to confirm its safety, reliability, and effectivity in processing funds. Furthermore, Amazon will not be the one service provider doing its due diligence earlier than selecting up a cross-border fintech, in accordance with its 10K Report. Therefore, for my part, there are switching prices within the business as a result of retailers want to hold out lengthy due diligence processes to find out which supplier is one of the best and since altering from one to a different is more likely to disrupt the cost processes for shoppers, affecting the service provider’s gross sales in rising markets. Furthermore, as extra retailers use dLocal in a couple of nation (on common, each service provider makes use of it in almost eight international locations) and for a couple of sort of cost technique (on common, each service provider makes use of it for nearly 79 completely different cost strategies), it’s difficult to seek out one other firm that integrates all these funds in only one platform, so native or regional corporations play with an incredible drawback in comparison with dLocal.

Moreover, dLocal’s tradition focuses on creating new options for shoppers and fixed innovation. It is sensible as an answer for a consumer might be supplied to a different enterprise just about at no incremental prices. As dLocal has entry to the wants of probably the most prestigious shoppers, it has an data benefit over different corporations. It may well generate options tailor-made to clients’ wants, rising the switching prices.

As well as, dLocal staff’ data about each rising market and its partnerships with monetary establishments permits the corporate to supply a wide selection of cost strategies (900) in several international locations, adapting to the most-used cost strategies in each rising market and permitting the corporate to vary and adapt to new laws quicker than retailers might do it by themself.

Lastly, I feel dLocal is well-prepared in case the fee charges maintain reducing, because it has the dimensions to endure pricing competitors due to its comparatively mounted price construction and vast revenue margins. Furthermore, because it retains rising at excessive double-digit development charges, the scalability of the enterprise ought to improve the revenue margins until competitors turns more durable.

Monetary Efficiency

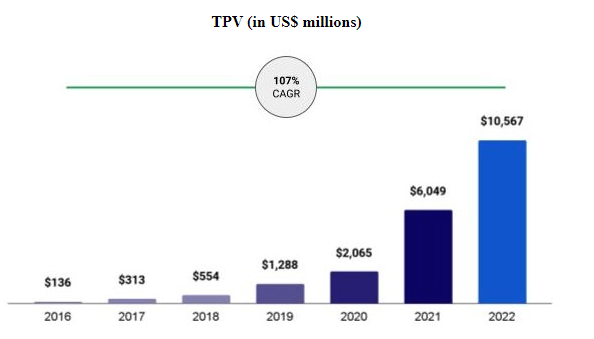

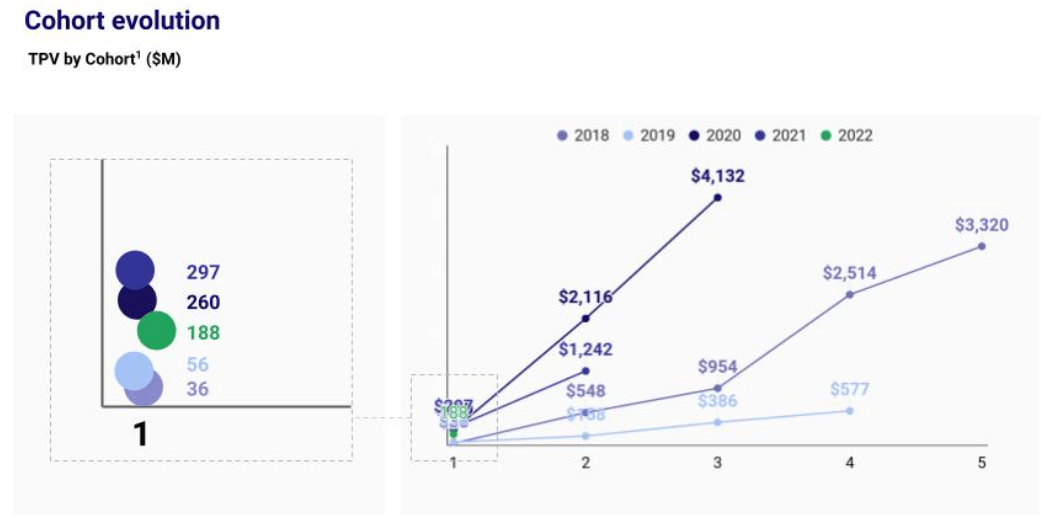

dLocal’s aggressive benefits within the business are mirrored in an impressive monetary efficiency since 2016. First, the Whole Fee Quantity (TPV) by means of dLocal elevated at a CAGR of 107% from 2016 till 2022.

dLocal 10K Report

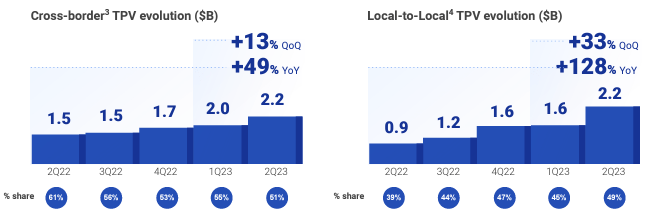

Furthermore, in 2Q23, TPV elevated by roughly 83.33% YoY. Consequently, the expansion fee is reducing however slowly.

dLocal 2Q23 presentation

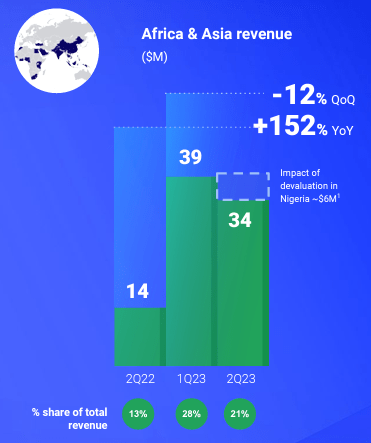

In the meantime, income has grown 101% yearly since 2020, and in 2Q23, it elevated by 59% YoY and 17% QoQ. Throughout 2020-2022, TPV elevated by 126% yearly, which I feel is an indicator of decrease charges charged by dLocal over TPV. Africa and Asia proceed to be the markets with the quicker development as they grew 259% in 2022 and 152% YoY in 2Q23, even after accounting for the devaluation of Nigerian Naira. In the meantime, the Latam market grew by 45% in 2Q23 and 54% in 2022. In each markets, the income development is decelerating, as we are able to anticipate after a interval of explosive development.

Nonetheless, I don’t anticipate the corporate to develop slower than 20% within the subsequent three years as a result of dLocal goals to extend the TPV of its present retailers and appeal to new retailers each month. Analyzing the expansion of the TPV of various cohorts and the Internet Retention Income Fee (NRR), retailers have elevated their TPV yearly after they began utilizing dLocal. Furthermore, the NRR has been larger than 100%, which means the corporate is increasing the income per service provider and doesn’t rely solely on new retailers to extend income.

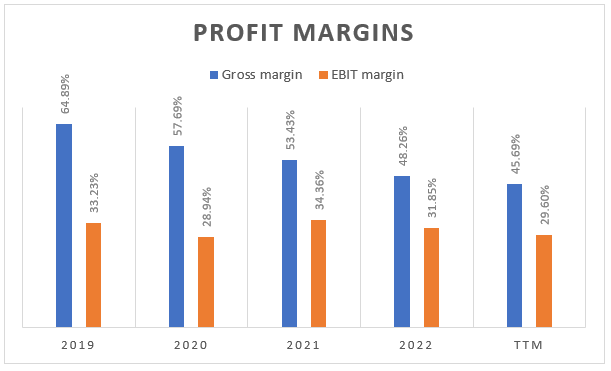

dLocal 10K Report

Nonetheless, gross revenue and EBIT have grown slower than income and TPV, owing primarily to quicker price development than income development. Even so, I feel the corporate advantages from working leverage because the EBIT margin stays near historic ranges, even when the gross margin plummeted to 45.69% in 2022. The corporate has skilled larger processing prices and international trade losses as its TPV skyrocketed. Following this pattern, in 2Q23, the gross margin stood at 44.1%. I feel this pattern is worrisome as, in some unspecified time in the future, the working leverage received’t be sufficient to carry a compressing contribution margin; furthermore, there might be an opportunity that the highest 10 clients (which accounted for 50% of FY22 income) are utilizing its bargaining energy to get higher companies on the identical value.

Writer’s Elaboration with information from QuickFS

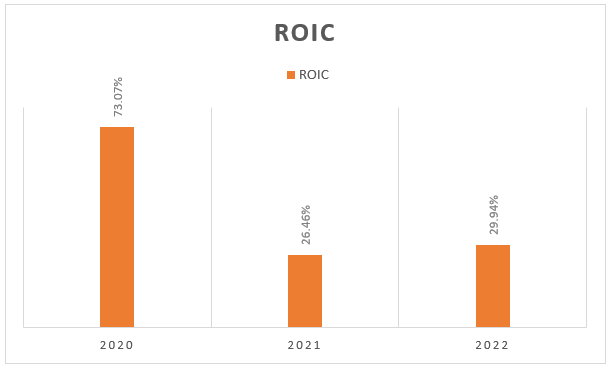

Lastly, dLocal is an asset-light mannequin enterprise which, together with its aggressive benefits, permits it to take pleasure in excessive returns on capital. Nevertheless, the ROIC has been reducing since 2020, and it’s too quickly to state if the corporate can preserve this excessive ROIC through the years. Even so, given its present aggressive benefits, I imagine it can retain its ROIC at the least within the subsequent couple of years, however additional decreases in gross margin might scale back it.

Writer’s Elaboration with information from QuickFS

Dangers

Argentina Lawsuit

A category motion lawsuit has been filed towards dLocal. The lawsuit alleges that dLocal made “materially false and deceptive statements” about its enterprise and operations, together with compliance with Argentine legislation. Particularly, the lawsuit alleges that dLocal engaged in improper forex trade transactions violating Argentine legislation, made false statements about its compliance with Argentine legislation, and didn’t disclose that it was beneath investigation by Argentine authorities.

The lawsuit seeks damages for buyers who bought dLocal shares between Could 2, 2022, and Could 25, 2023. The lawsuit remains to be ongoing, and it’s not but clear what the result will probably be. Along with the allegations within the lawsuit, dLocal has additionally confronted scrutiny from Argentine regulators. In June 2023, the Argentine customs company raided the places of work of Academiland LLC, suspected of utilizing dLocal’s cost community to commit fraud. The Argentine authorities alleges that Academiland LLC was utilizing dLocal to illegally entry US {dollars} and switch them in another country. dLocal has denied all the allegations towards it. The corporate has said that it’s cooperating with the Argentine authorities and is assured that it will likely be capable of clear its title.

It’s unclear what the long-term affect of the lawsuit and the regulatory scrutiny will probably be on dLocal. Nevertheless, the corporate’s inventory value has fallen considerably because the allegations have been first made public. Furthermore, the corporate has an open lawsuit towards a category motion owing to misrepresentation and omission in its IPO paperwork.

Competitors

Though dLocal has strong aggressive benefits and the business will develop at a excessive single-digit fee, the competitors stays. It might take actions to develop quicker than opponents by means of a steady lower in charges (which is a vital issue for finish shoppers) or a broader partnership community. Furthermore, the lack of belief by retailers on account of lawsuits, a weak compliance system, or safety points could result in the lack of shoppers, as they understand their funds are in danger. Nonetheless, I feel dLocal is a dependable companion because it’s the primary selection for the largest corporations on the earth. Moreover, stealing clients within the business is hard, as retailers could also be reluctant to vary from a supplier as they should perform all of the due diligence processes, could lose the present stage of customization, and should expertise disruptions.

Banking Menace

Even when banks have lagged within the cross-border cost business, they’re unwilling to permit Fintech to dominate the market. Company shoppers are inclined to have extra belief in banks in the case of giant enterprise transactions. As well as, they’ve higher entry to FX markets and the SWIFT system, which is implementing bettering options for cross-border funds, corresponding to SWIFT gpi and SWIFT Go.

Governance Threat

dLocal has a dual-class inventory construction during which the founders focus 80.51% of the voting energy whereas they’ve an financial curiosity of 45.26%. This construction offers them an excessive amount of energy relative to minority shareholders. As a consequence, minority shareholders can’t have a necessary affect on the principal firm choices, which makes it tougher to steer the corporate to a brand new technique in case the present one doesn’t work. Nonetheless, for my part, the founders even have pores and skin within the recreation, and their development technique and administration group choice have been ideally suited for dLocal as the corporate continues to develop and increase to new geographies. As well as, the quantity of associated occasion transactions is sort of negligible.

Forex Threat

The agency operates in a multi-currency setting, and adjustments within the trade regimes have affected the gross sales in 2Q23. In reality, the devaluation of Nigerian Naira generated a detrimental affect of ~$6 million in income. Furthermore, the corporate has to adapt shortly to adjustments within the laws of FX markets in all its geographies.

Political Threat

dLocal is a funds firm that operates in rising markets, primarily Brazil, Mexico, Argentina, and Chile. The corporate is uncovered to political, regulatory, financial, and social dangers in these international locations. For instance, the Argentine economic system has traditionally skilled excessive inflation charges, which might adversely have an effect on dLocal’s enterprise. As well as, Brazil has skilled latest financial and political instability, which might additionally adversely have an effect on dLocal. The Mexican authorities workouts appreciable affect over many elements of its economic system, which might additionally affect dLocal’s enterprise. Lastly, in Chile, political, authorized, regulatory, and financial uncertainty arising from social unrest and the ensuing social reforms and the enactment of Chile’s new structure might adversely affect dLocal’s enterprise.

Valuation

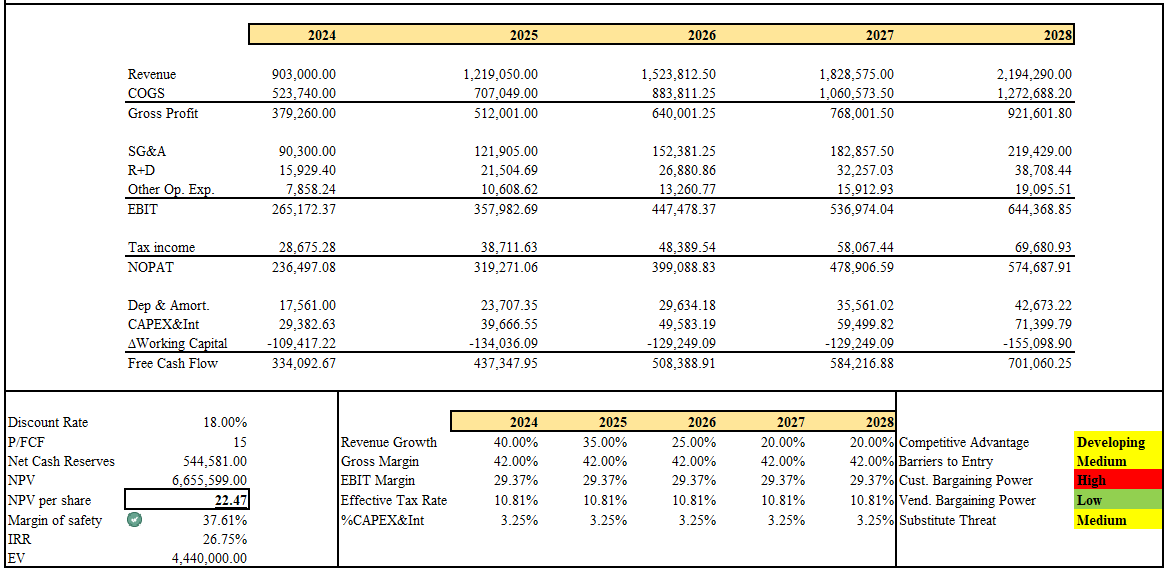

For my DCF evaluation, I’ll assume that the corporate could have income equal to $645 million in 2023. The income development fee will lower as the corporate ends its hypergrowth section and consolidates in present rising markets. Given the gross margin compression, I’ll use a decrease gross margin than 2Q23. The EBIT margin will probably be decrease than 30%; nonetheless, it could enhance if the corporate continues to depend on working leverage. To mirror the present dangers, I feel a reduction fee of 18% is acceptable for the case, particularly given the lawsuits and a attainable lack of belief from retailers. Lastly, the terminal worth will probably be a P/FCF of 15, so I’ll anticipate a big a number of compression within the coming years.

Writer’s Elaboration

dLocal is a ‘Purchase’ with a margin of security larger than 30, given the premises of my DCF evaluation. Nonetheless, a good portion of the FCF generated will come from adjustments within the working working capital, as the corporate has a detrimental working capital. Consequently, the mannequin is extremely delicate to adjustments within the exercise ratios sooner or later. Nonetheless, decrease revenue margins, along with a low a number of and a large margin of security, shield towards draw back threat, for my part.

Conclusion

dLocal is a cross-border cost processor with a robust aggressive benefit in rising markets. Regardless of dangers related to political, regulatory, and forex fluctuations, the corporate has demonstrated a profitable development technique and administration group choice. Our knowledgeable recommends a “Purchase” score with a margin of security larger than 30%, given the premises of the DCF evaluation. With over 900 native cost strategies, dLocal presents a easy, scalable, and safe answer for retailers to just accept and make funds in over 40 rising markets.

[ad_2]

Source link