[ad_1]

audioundwerbung/iStock through Getty Photographs

The Industrial Choose Sector (XLI) rose +1.90% for the week ending Feb. 2, whereas the SPDR S&P 500 Belief ETF (SPY) climbed +1.42%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +14% every this week.

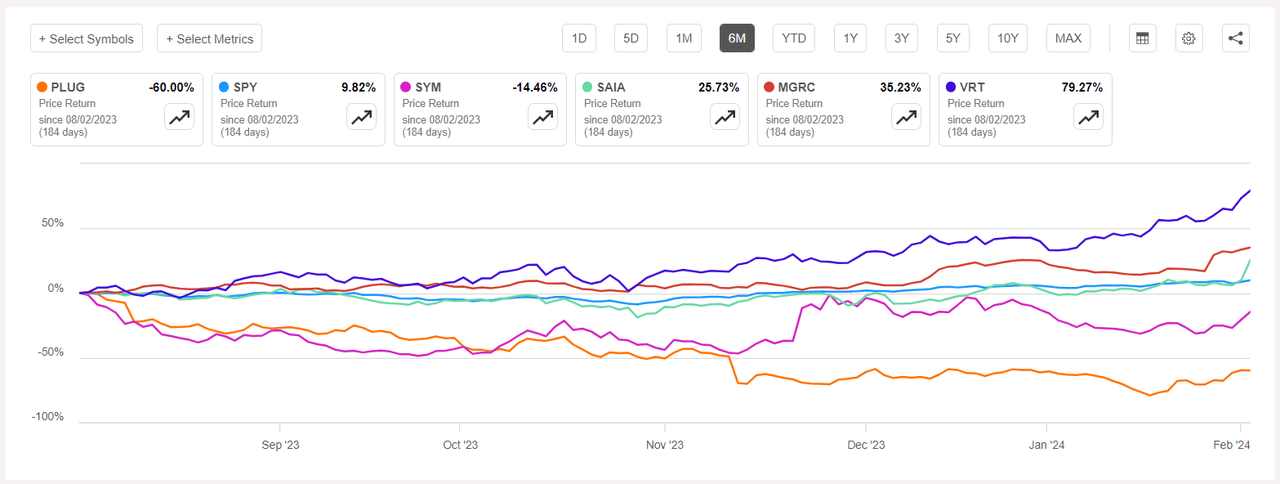

Plug Energy (NASDAQ:PLUG) +37.06%. The Latham, N.Y.-based firm’s shares surged essentially the most on Wednesday (+19.30%) after Roth MKM upgraded the inventory to Purchase from Impartial citing confidence that the ramp-up of the corporate’s Georgia inexperienced hydrogen plant goes easily.

Plug has a SA Quant Ranking — which takes into consideration components corresponding to Momentum, Profitability, and Valuation amongst others — of Robust Promote. The inventory has an element grade of F for Profitability and C+ for Development. The typical Wall Avenue Analysts’ Ranking disagrees and has Purchase score, whereby 9 out of 29 analysts tag the inventory as Robust Purchase.

Symbotic (SYM) +23.05%. Shares of the corporate, which offers warehouse automation techniques, shot up essentially the most on Thursday +8.81%. Prior to now one yr the inventory has surged about 230%. The SA Quant Ranking on SYM is Promote with rating of B- for Momentum and C for Valuation. The typical Wall Avenue Analysts’ Ranking has a extra constructive view with a Purchase score, whereby 9 out of 15 analysts see the inventory as Robust Purchase.

The chart beneath reveals 6-month price-return efficiency of the highest 5 gainers and SPY:

Saia (SAIA) +18.74%. The trucking firm’s shares jumped +14.35% on Friday after fourth quarter outcomes beat estimates. The SA Quant Ranking on SAIA is Maintain with rating of B for Profitability and D for Valuation. The typical Wall Avenue Analysts’ Ranking differs and has Purchase score, whereby 21 out of 21 analysts view the inventory as Robust Purchase.

McGrath RentCorp (MGRC) +15.69%. WillScot Cell Mini (WSC) stated on Monday that it was buying McGrath in a cash-and-stock deal value $3.8B which despatched the McGrath’s shares surging +10.74% on the day. The SA Quant Ranking and the typical Wall Avenue Analysts’ Ranking, each, for MGRC is Robust Purchase.

Vertiv (VRT) +14.98%. The corporate — which offers services and products for knowledge facilities and communication networks — noticed its shares climb all through the week, barring Wednesday. The SA Quant Ranking on VRT is Maintain, whereas the typical Wall Avenue Analysts’ Ranking is Robust Purchase.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -7% every.

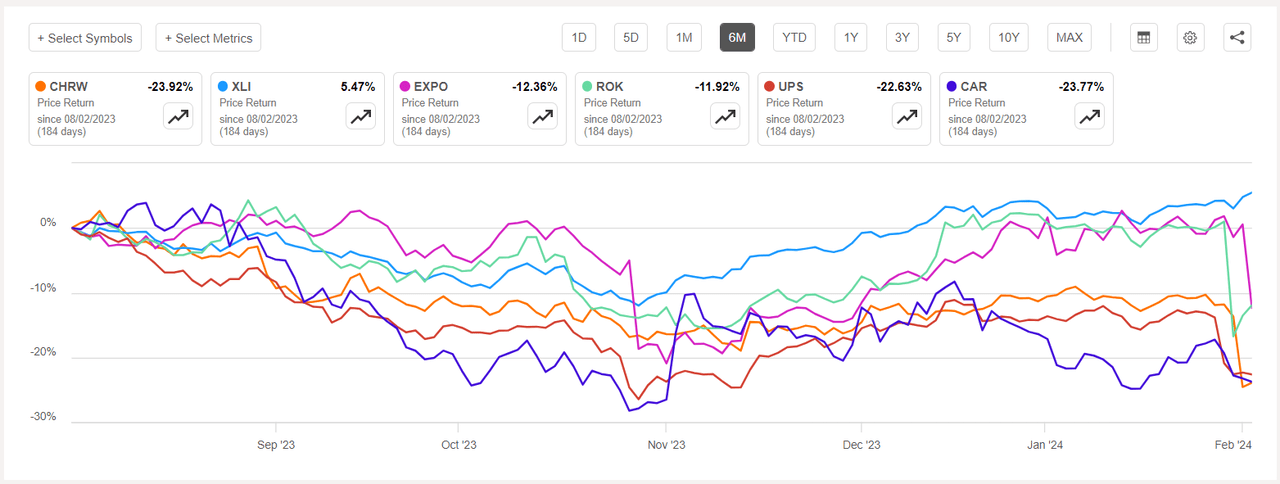

C.H. Robinson Worldwide (NASDAQ:CHRW) -15.17%. The trucking companies supplier’s inventory fell -12.59% on Thursday after fourth quarter adjusted earnings missed estimates by a large margin. The SA Quant Ranking on CHRW is Maintain with an element grade of B- for Profitability and D for Momentum. The typical Wall Avenue Analysts’ Ranking agrees and has a Maintain score too, whereby 17 out of 26 analysts view the inventory as Maintain.

Exponent (EXPO) -11.55%. The engineering consulting firm noticed its shares tumble -12.83% on Friday after its combined fourth quarter outcomes on Thursday (submit market). The SA Quant Ranking on EXPO is Promote with rating of D+ for Development and B for Momentum. The typical Wall Avenue Analysts’ Ranking differs and has a Purchase score, whereby 1 out of the three analysts tags the inventory as Robust Purchase.

The chart beneath reveals 6-month price-return efficiency of the worst 5 decliners and XLI:

Rockwell Automation (ROK) -11.55%. Shares of the industrial-technology firm fell -17.56% on Wednesday after first-quarter outcomes confirmed the detrimental results of supply-chain constraints and excessive inventories at prospects. The SA Quant Ranking on ROK is Maintain with an element grade of B for Profitability and A for Development. The score is in distinction to the typical Wall Avenue Analysts’ Ranking of Purchase score, whereby 9 out of 26 analysts view the inventory as Robust Purchase.

United Parcel Service (UPS) -10.95%. The inventory fell -8.20% on Tuesday after the corporate posted a combined This fall earnings report and set full-year steerage beneath expectations. The SA Quant Ranking on UPS is Maintain which differs from the typical Wall Avenue Analysts’ Ranking of Purchase.

Avis Funds (CAR) -7.21%. The shares of the automotive rental firm dipped essentially the most on Wednesday -4.26%. The SA Quant Ranking on CAR is Maintain, whereas the typical Wall Avenue Analysts’ Ranking is Purchase.

Extra on C.H. Robinson and Plug Energy

[ad_2]

Source link