[ad_1]

As FOMC rides into the sundown till March, the is left to fend for itself amid the hawkish (or no less than not but dovish) echos of Jerome Powell’s assertion that the market mustn’t count on fee cuts in March. Effectively duh, we all know that already, sir.

The one profit the could be left with, assuming the ‘not but dovish’ coverage doesn’t flip hawkish once more, could be the potential for a counter-party bid.

An impulsive bid by risk-soaked on line casino patrons instantly jerking to a protected haven. Which USD absolutely is, very like . The distinction being that USD is a protected haven device so long as public confidence in debt paper stays. Gold is a protected ‘worth’ haven, long-term.

As a device and with the herd’s confidence implied to be intact, by advantage of its international reserve standing USD receives incoming (pressured) ‘funding’ when herds flee the asset racket, which has been arrange counter the US greenback by a long time of US and international inflationary financial coverage.

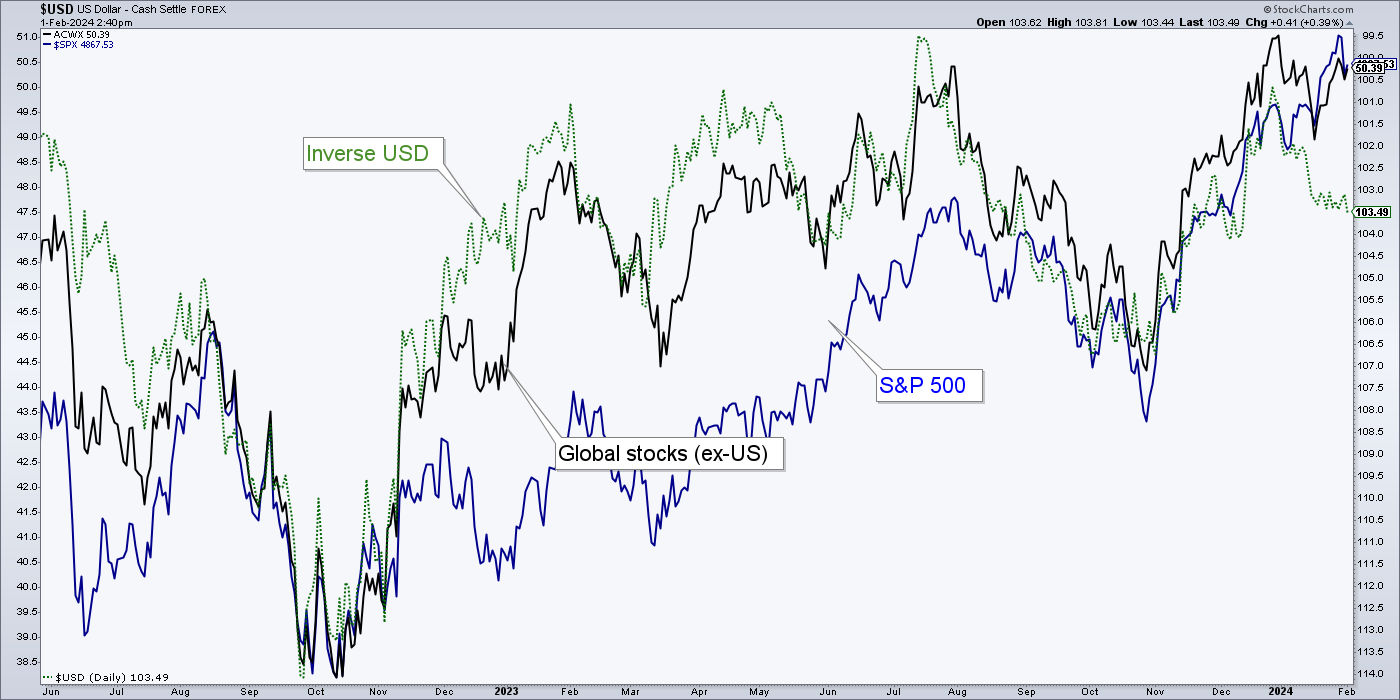

But right here we discover a latest disconnect between shares ( and international, ex-US) and inverse USD. Both USD goes to drop (inverse rise again according to shares) or simply possibly we’d have the beginning of one thing essential within the type of a basic change of character within the macro markets.

That would imply market rotation, a inventory bear market (SPX has lastly joined the ‘new all-time highs!’ contingent, in any case, a most popular ingredient to creating a sentiment-fueled high) or, if USD continues to bounce (inverse continues to drop) even a slippery slope right into a market liquidation (once more, reference all that ‘mushy touchdown’, ‘no touchdown’ Goldilocks consensus on the market within the mainstream monetary media for a possible opposite setup).

The Gold/Silver ratio (GSR) continues to be perched constructively to attend USD upward, in any case. If gold have been to rise impulsively vs. silver the inflation trades could be ‘off’ and the market liquidation trades might be ‘on’.

is much less financial, extra speculative, and extra cyclical/inflation-sensitive than gold. If the GSR breaks down from this constructive perch, the inflation trades would profit.

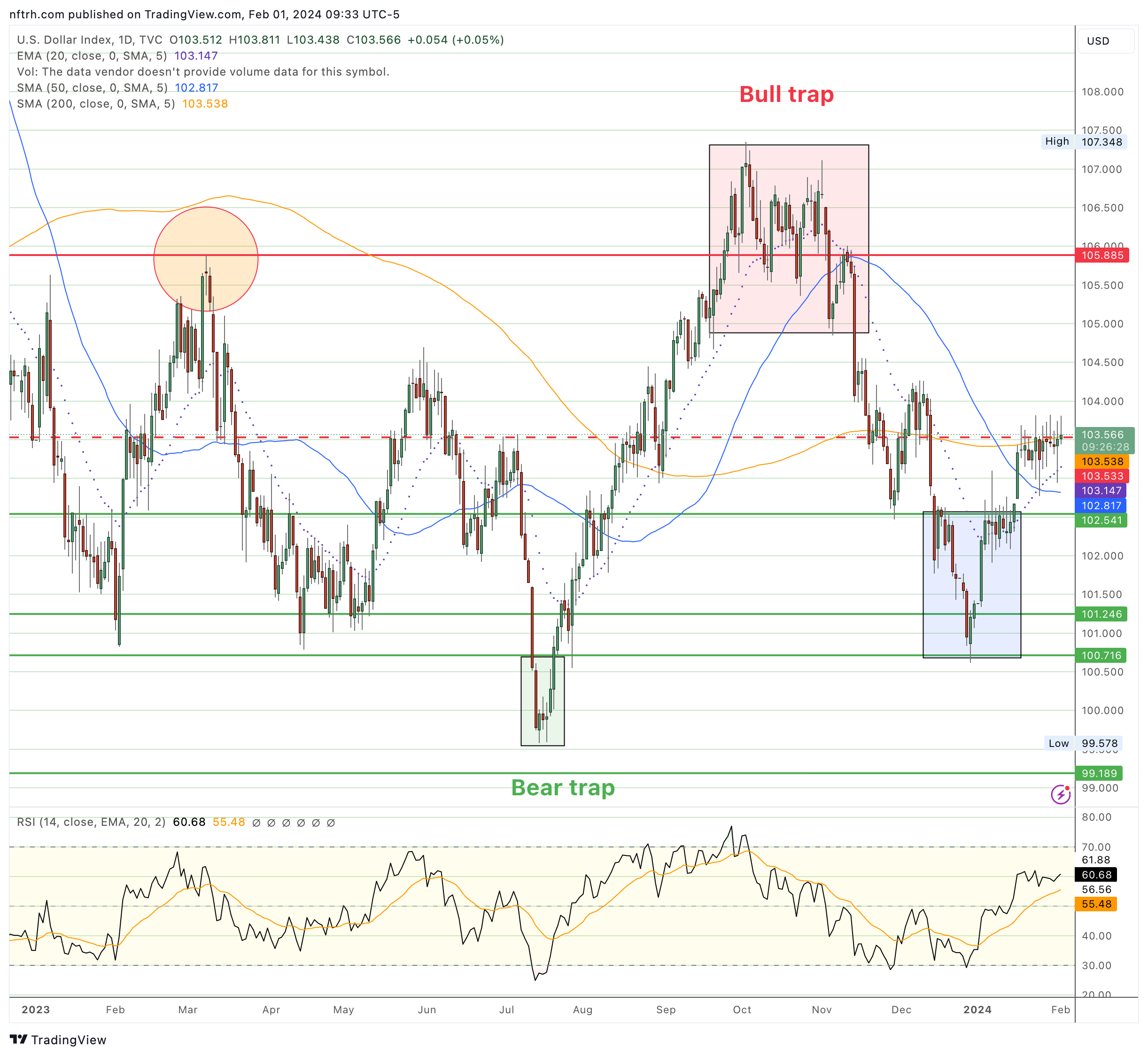

Shifting on, let’s take a quick have a look at the technical standing of the anti-market, the US greenback index (DXY). Very similar to the bull entice from September to November felt prefer it took endlessly and a day to resolve, right this moment’s assembly with resistance is a persistent little bugger.

Grinding, chewing, and instigating to take out resistance at 103.50. As suggested to my subscribers a number of weeks in the past, the important thing stage to exceed and maintain (for USD to go bullish) is the December excessive at 104.27. However first USD is buzz-sawing the resistance space and the essential every day SMA 200.

The weekly chart offers the angle {that a} stage of warning, for inflation merchants, is supplied by the truth that the index held a better low to the ‘bear entice’ low with the bounce ranging from clear long-term assist.

Backside Line

If the US greenback index fails to make a better excessive to the December excessive and as a substitute turns down (and silver leads gold upward), then the broad rally can proceed, particularly within the extra conventional ‘inflation trades’ like commodities and equities that produce commodities/assets, and resource-rich areas inside Rising Markets.

If the US greenback index takes out the December excessive and holds it, and the Gold/Silver ratio follows its present constructive sample upward, you may wish to do a radical test of the funding pool. The is likely to be a turd in there!

So as to add a 3rd dynamic, there was a blessed part from 2001 to 2004 when the Gold/Silver ratio rose (non-impulsively), the US greenback declined and the gold mining sector had its most basically pure macro backdrop for years earlier and now 20 years since. After that commodities and inventory markets rallied as properly and the gold miners entered a bubble amid degrading fundamentals. However even a 2 to 3-year part could be fairly worthwhile.

[ad_2]

Source link