[ad_1]

So, it was one other somewhat boring day, with the ending flat, charges up, the up, and implied volatility considerably increased. This has been a really odd earnings season.

Final night time, I famous a rising wedge within the S&P 500, and as of yesterday’s shut, the index is just about out of room.

There could be a little bit bit extra time it may purchase, however not a lot. As I discussed yesterday, these patterns are bearish by definition.

Nevertheless, simply because one thing is bearish doesn’t imply it has to interrupt decrease.

Usually, I’d have way more confidence on this sample, however given how troublesome the final 4 months have been for my S&P 500 views, I’m fairly hesitant about it.

If the sample breaks decrease, then it may retrace again to its origin at 4850. The place it goes from there, I must see.

If it reaches 4,850, so much can begin to occur as a result of I’ve quite a few development traces converging in that area. If these development traces start to interrupt, issues may begin to occur.

I famous earlier that implied volatility considerably elevated yesterday, and that’s as a result of the was basically flat, however the VVIX rose by 3% to 83, marking a rise for 2 consecutive days.

Generally, when the VVIX begins to rise, the VIX isn’t too far behind.

The VVIX measures the implied volatility of the VIX, and when the implied volatility of the VIX begins to rise, it suggests to me that one thing is occurring beneath the floor to trigger this.

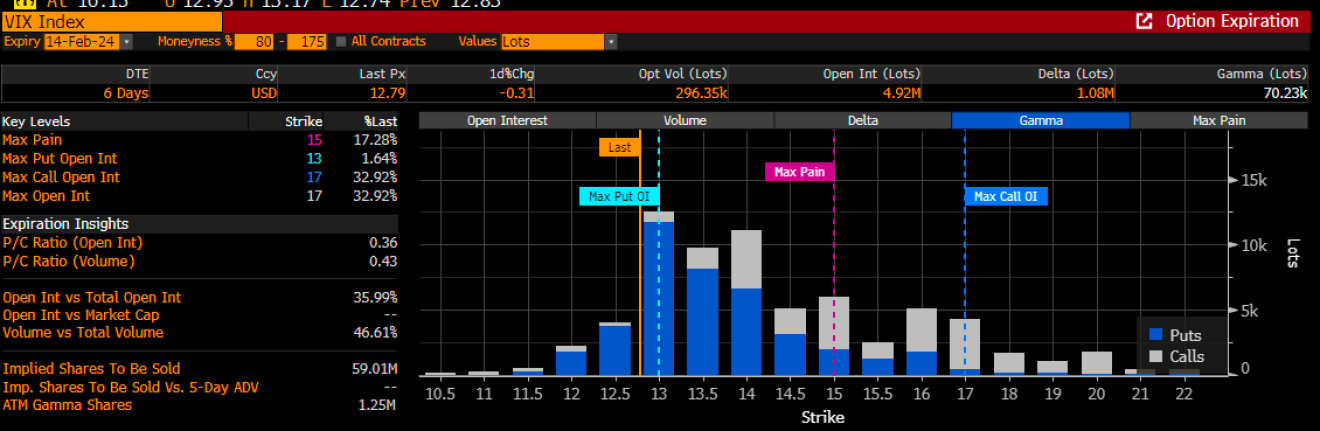

A part of the explanation why we see the VIX stay beneath 13 to 14 is because of the important gamma buildup across the choices expiration subsequent Wednesday, sure, February 14th.

It’s uncommon to see the VIX choices expiration (OPEX) happen on the second Wednesday of the month, however that’s what the calendar signifies.

I carry this up as a result of it’s fascinating to watch implied volatility ranges rising from beneath, whereas choices flows are serving to to maintain the VIX contained.

In the meantime, the public sale yesterday went wonderful, but we nonetheless noticed the 30-year and the charges transfer increased.

The ten-year could be very near breaking out and rising above the 4.20% area. If that occurs, I feel we may see it rise to round 4.35% to start out with.

I’m additionally maintaining a tally of the , of all issues, as a result of it appears like a double backside is within the technique of forming, blended in with a diamond reversal sample.

There’s strong momentum forming on the RSI, which has been pushing increased since June.

If you invert the peso, it turns into simpler to see the connection between the Peso and the S&P 500.

These relationships between the S&P 500 and currencies appear to exist extensively and are a perform of the greenback’s weakening and strengthening.

This emphasizes how a lot of the market actions should do with modifications in monetary situations. Additionally it is evident that the S&P 500 and the peso are diverging.

Apple (NASDAQ:) can be diverging from the S&P 500 and seems to be in a extra bearish formation than the S&P 500. An in depth beneath $186 seemingly units up a drop again to round $167.

It nearly appears like Tesla (NASDAQ:) has damaged the neckline of a head and shoulders sample.

It’s not clear at this level, however I can simply get the impression that if that is certainly the affirmation of the sample, then the losses within the inventory aren’t over but.

Nvidia (NASDAQ:) exhibited a notable reversal candle yesterday, after transferring above yesterday’s excessive after which closing beneath yesterday’s shut.

Nevertheless, given how overbought it’s, and the truth that the decision wall for the inventory for this week and subsequent week is at $700, there’s most likely motive why the inventory has struggled on this area during the last 4 days.

Anyway…

YouTube Video –

Unique Publish

[ad_2]

Source link