[ad_1]

SOPA Pictures/LightRocket through Getty Pictures

Introduction

Being a PayPal Holdings, Inc. (NASDAQ:PYPL) investor has been significantly irritating. Since its peak in July 2021, the inventory is down 80%. Moreover, the inventory has been bleeding slowly over the past twelve months, making decrease lows and decrease highs.

As traders attempt to look previous PayPal’s dismal years, many traders have excessive expectations for PayPal heading into 2024 given current administration modifications and the brand new CEO’s “we’ll shock the world” assertion.

Sadly, traders have been not too long ago slapped within the face as the corporate’s This autumn earnings dissatisfied – the precise outcomes have been nice, however 2024 steering was an actual get together pooper.

Administration overpromised after which underdelivered. Easy as that.

Hopefully, they’re simply sandbagging steering.

In the interim, PayPal nonetheless trades at depressed valuations, which nonetheless makes it a horny long-term funding alternative.

Development

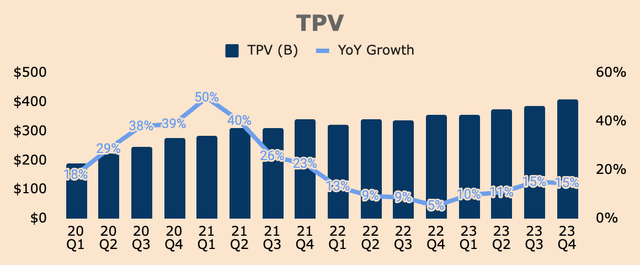

PayPal’s This autumn outcomes, Complete Fee Quantity (TPV) was $410B, up by 15% YoY. This sturdy progress was primarily pushed by:

Unbranded Processing TPV, which grew 29% YoY. Unbranded Processing now represents 35% of Complete TPV, up from 30% final yr. Worldwide TPV, which grew 22% YoY.

This was offset by:

Branded Checkout TPV, which grew 5% YoY. Branded Checkout now represents 29% of Complete TPV, down from 30% final yr. Venmo TPV, which grew 8% YoY. US TPV, which grew 11% YoY.

Writer’s Evaluation

Increased engagement additionally contributed to progress.

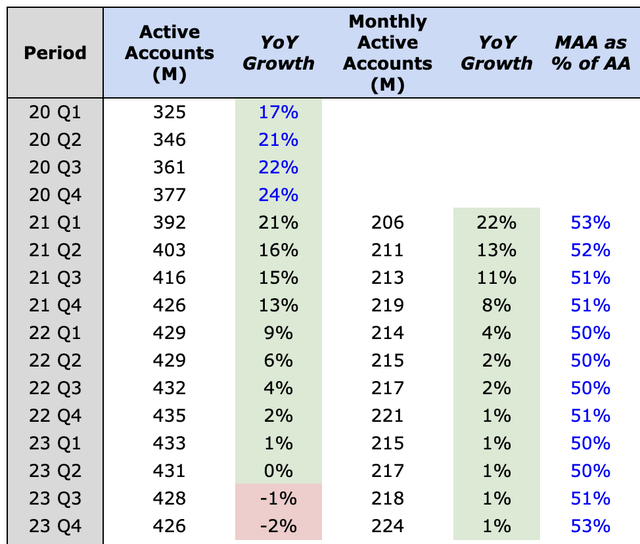

Energetic Accounts (AA) – that are accounts which have accomplished a transaction throughout the previous 12 months – have been down 2% YoY to 426M, reflecting churn of unengaged accounts.

Whereas this appears regarding, Month-to-month Energetic Accounts (MAA) – a brand new metric disclosed by administration – grew 1% YoY to 224M, exhibiting rising engagement throughout the platform.

Writer’s Evaluation

To trace the standard of PayPal’s account base, I additionally calculated MAA as a share of AA – the upper the proportion, the extra engaged PayPal’s account base is, which is what we need to see.

As you possibly can see, MAA as a share of AA was 53% as of This autumn, an enchancment of two share factors YoY. So whereas Energetic Accounts have been declining, PayPal is retaining extra “energetic” accounts.

In addition to, it is higher to have an account that transacts as soon as monthly than to have an account that transacts as soon as per yr.

As extra unengaged accounts churn off and PayPal drives extra engagement amongst present accounts, I anticipate this metric to enhance to 60% or extra.

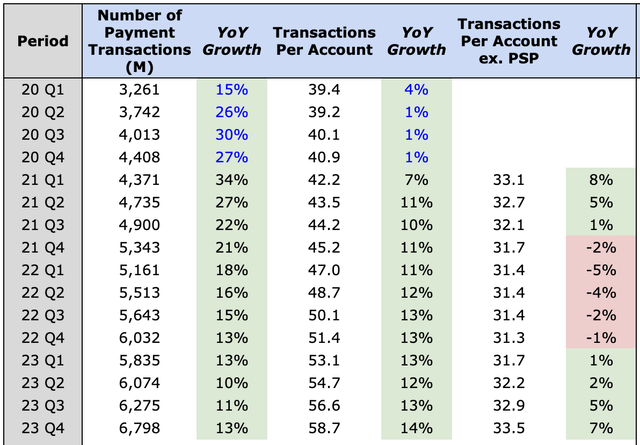

One other signal of rising engagement is PayPal’s growing Variety of Fee Transactions, which was 6.8B in This autumn, up by 13% YoY. As well as, Transactions Per Account (TPA) grew 14% YoY to 58.7, primarily as a result of Braintree (or Unbranded Processing). If we exclude Braintree, TPA ex. PSP – a brand new disclosure that assesses Branded Checkout exercise ranges – was 33.5 in This autumn, up by 7%.

Put merely, administration’s plan to drive increased engagement throughout the PayPal ecosystem appears to be working.

Writer’s Evaluation

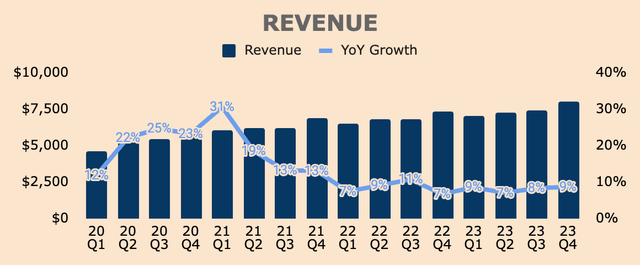

Altogether, increased TPV and better engagement drove a 9% progress in Income in This autumn, to $8.0B. This beat analyst estimates by $130M, or 2%. This additionally beat the excessive finish of administration’s steering by 2 share factors.

PayPal continues to be underestimated, to say the least.

Writer’s Evaluation

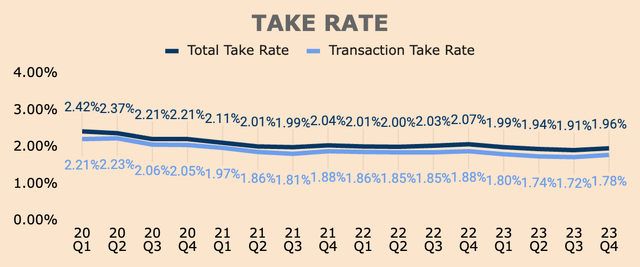

Regardless, Income remains to be rising slower than TPV, as a result of decrease Take Charges:

This autumn Complete Take Charge was 1.96%, down from 2.07% final yr. This autumn Transaction Take Charge was 1.78%, down from 1.88% final yr.

Nevertheless, evidently Take Charges have bottomed, as seen by the sequential enchancment in each metrics. It is too early to inform, however that is a promising signal – increased Take Charges sometimes result in improved profitability.

Writer’s Evaluation

All in all, PayPal confirmed sturdy progress in This autumn, regardless of the narrative that “PayPal is a dying model” or “competitors is consuming PayPal’s lunch”.

Sure, PayPal goes by way of some powerful challenges and transitions.

Nevertheless, PayPal continues to course of extra {dollars} and its account base is extra engaged than ever, which is a testomony to its scale and model moats.

Profitability

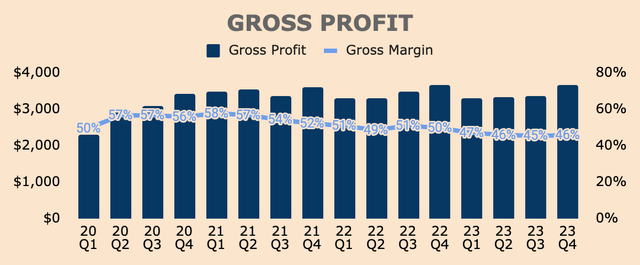

Turning to profitability, This autumn Gross Revenue was flat YoY at $3.7B, representing a Gross Margin of 46%.

Gross Margin follows the identical sample as Take Charges: down YoY, however up QoQ.

Gross Margin was down YoY as a result of 1) decrease positive factors from international forex hedges and a couple of) increased volumes from bigger retailers, which generally have decrease take charges. The metric improved QoQ as a result of 1) decrease service provider contractual compensation and a couple of) a extra favorable combine between Braintree and Branded Checkout.

Regardless, it is nonetheless early days to name a backside on Gross Margins.

Writer’s Evaluation

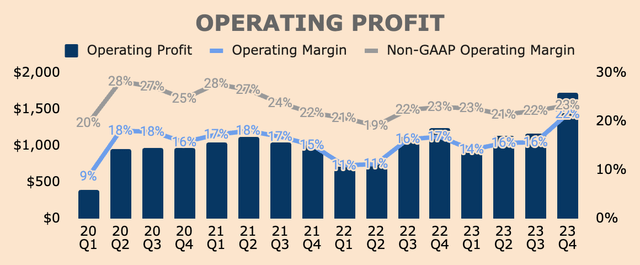

Transferring on, This autumn GAAP Working Revenue was $1.7B, up 39% YoY, representing a GAAP Working Margin of twenty-two%, which, as you possibly can see, improved considerably YoY and QoQ. Earlier than you get too enthusiastic about this enchancment, this was as a result of a one-time pre-tax achieve of $339M in This autumn, on account of the sale of Completely happy Returns.

Adjusting for this divestiture, This autumn Non-GAAP Working Revenue was $1.9B, up 11% YoY. This represents a Non-GAAP Working Margin of 23%, which is a 39 foundation level enchancment YoY.

Writer’s Evaluation

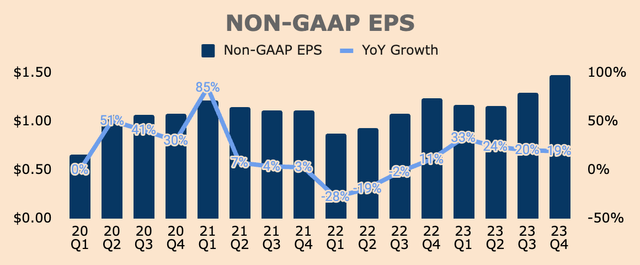

Lastly, Non-GAAP EPS was $1.48 in This autumn, up 19% YoY, pushed by working leverage and share buybacks. This beat each analyst estimates and administration’s steering of $1.36.

As you possibly can see, non-GAAP EPS reached an all-time excessive for the corporate.

Writer’s Evaluation

That being stated, PayPal’s backside line continues to enhance, which is encouraging to see, however the actual subject pertains to PayPal’s Gross Margin, which it’s too early to say – with full confidence – that it has bottomed.

If administration can reverse the downward spiral in Gross Margin, PayPal has a very good probability of increasing EPS meaningfully. If they can not, earnings progress may be muted, as there is a pure restrict to how a lot administration can reduce non-transaction-related bills.

Well being

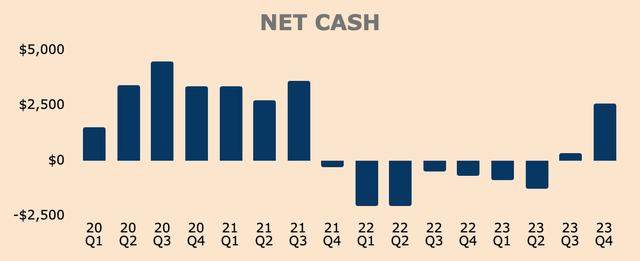

Development and profitability weren’t the one issues that improved – PayPal’s steadiness sheet improved as effectively.

In This autumn, PayPal’s Internet Money place expanded by $2.3B QoQ, to $2.6B. Since day one, the brand new CEO, Alex Chriss, has expressed his intent to create a leaner, meaner PayPal, and we’re already seeing that in motion as noticed by PayPal’s bettering steadiness sheet.

I’m within the means of evaluating our most worthwhile progress priorities and aligning our assets to these priorities. We are going to grow to be leaner, extra environment friendly and simpler, driving better velocity, innovation and influence for purchasers.

(CEO Alex Chriss – PayPal FY2023 Q3 Earnings Name).

Writer’s Evaluation

I anticipate Internet Money to proceed to construct up over the subsequent few quarters as PayPal maintains sturdy money flows.

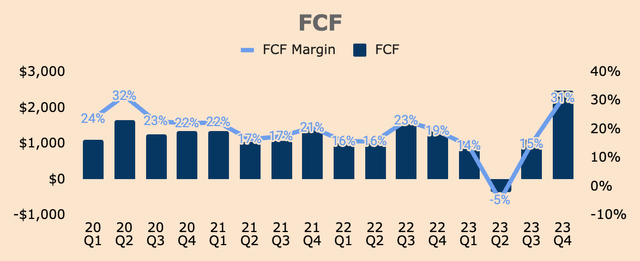

In This autumn, Free Money Circulation was $2.5B, at a 31% FCF Margin, which features a $1.7B web profit from the sale of European BNPL receivables to KKR.

With out the BNPL profit, This autumn Adjusted FCF would have been about $0.8B, representing an FCF Margin of simply 10%, which is sort of low in comparison with historic requirements. Per administration, “higher-than-expected modifications in working capital and money taxes” resulted in decrease FCF in This autumn.

Writer’s Evaluation

Adjusted FCF was $0.8B and $4.6B for This autumn and 2023, respectively, which was down 46% and 11% YoY, respectively. Possibly that is why administration slowed down the tempo of share buybacks in This autumn.

Regardless of a decrease common share worth, PayPal bought solely $0.6B of inventory in This autumn, as in comparison with $1.4B in Q3.

With a lot money in hand, why would not PayPal purchase again much more aggressively in This autumn?

The $0.6B share buyback in This autumn does not significantly scream administration’s confidence that the inventory is undervalued.

I believe this angered plenty of traders. Heck, I used to be a bit agitated too.

In any case, PayPal nonetheless has $10.9B of share buyback capability left. I want administration would take full benefit of it given PayPal’s underperforming inventory worth.

They should ship a message to the markets that claims: “Hey, when you do not need to purchase our shares at these costs, we’ll purchase them. Shares are low cost now, and we’re enjoying it for the lengthy haul”.

Sadly, they are not signaling that type of perspective.

Outlook

For 2024, administration guided for share buybacks of “a minimum of $5B” which is just about according to 2023 ranges. I used to be anticipating a extra aggressive method in direction of buybacks.

That is not all. Administration did three extra issues that destroyed investor confidence:

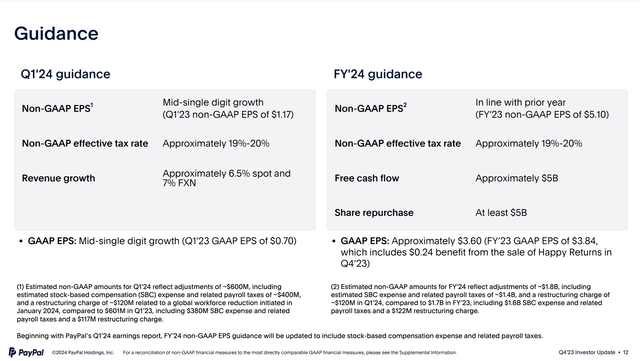

It guided for Q1 Income progress of 6.5%, a deceleration from This autumn’s progress of 9%. They stopped annual income steering. Most significantly, they guided for 2024 Non-GAAP EPS of $5.10, which is flat YoY. This missed analyst estimates by $0.43!

That is in all probability why the inventory offered off 11% following the earnings report.

PayPal FY2023 This autumn Investor Replace

And here is the place issues get complicated.

Trying on the footnotes of the slide above, administration guided for Non-GAAP EPS of $5.10, which incorporates the next:

Estimated non-GAAP quantities for FY’24 mirror changes of ~$1.8B, together with estimated SBC expense and associated payroll taxes of ~$1.4B, and a restructuring cost of ~$120M in Q1’24, in comparison with $1.7B in FY’23, together with $1.6B SBC expense and associated payroll taxes and a $122M restructuring cost.

(PayPal FY2023 This autumn Investor Replace).

So the information contains $1.4B of SBC and associated payroll taxes added again to EPS.

After which administration additionally talked about this:

Starting with PayPal’s Q1’24 earnings report, FY’24 non-GAAP EPS steering will probably be up to date to incorporate stock-based compensation expense and associated payroll taxes.

(PayPal FY2023 This autumn Investor Replace).

In different phrases, in Q1, PayPal will subject a brand new FY2024 Non-GAAP EPS steering with $1.4B of SBC and payroll taxes subtracted from its present steering of $5.10.

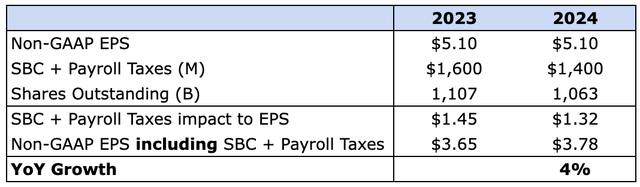

So, if we do the calculation:

$1.4B of SBC and payroll taxes equates to a $1.32 influence on EPS, assuming a 4% discount in shares excellent in 2024 (which is according to 2023). Subtracting that influence from its information of $5.10, we get an up to date FY2024 Non-GAAP EPS of about $3.78, which is simply a 4% improve YoY.

Writer’s Evaluation

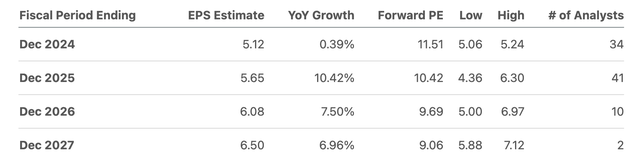

I am not even positive if analysts are conscious of those modifications, since, collectively, they nonetheless have an FY2024 EPS estimate of $5.12 for PayPal.

I really feel like administration didn’t make this clear sufficient, and I believe plenty of traders and analysts could also be unpleasantly shocked when PayPal experiences earnings that fall manner in need of analyst estimates, solely due to modifications in Non-GAAP EPS calculations.

In search of Alpha

My concern is that the inventory could dump as a result of miscommunication on administration’s half.

That being stated – nevertheless, you take a look at it – a 0% to 4% Non-GAAP EPS progress in 2024 is unquestionably an enormous disappointment for a lot of. It is a “shock-the-world” second, for positive.

The excellent news is that administration’s steering “features a minimal contribution from the improvements we not too long ago introduced”, extra particularly, the six new initiatives from its current First Look occasion:

Smarter, sooner checkout. Fastlane by PayPal. PayPal Sensible Receipts. PayPal CashPass. PayPal Superior Affords Platform. Venmo Enterprise Profiles.

Put in another way, PayPal seems to be sandbagging its steering, and thus, has a very good probability of beating its personal steering. Increased-than-expected FCF and share buybacks must also assist with EPS progress.

No matter it’s, administration touted 2024 because the yr of transformation and execution, with 4 key priorities:

Speed up Branded Checkout. Enhance total profitability. Leverage knowledge. Function extra effectively.

Simpler stated than completed. Solely time will inform if Alex Chriss and Co. can flip this firm round.

However one factor’s for positive, I did not significantly like how administration hyped the crowds, solely to flop their 2024 steering.

Valuation

Happily, shares stay attractively valued.

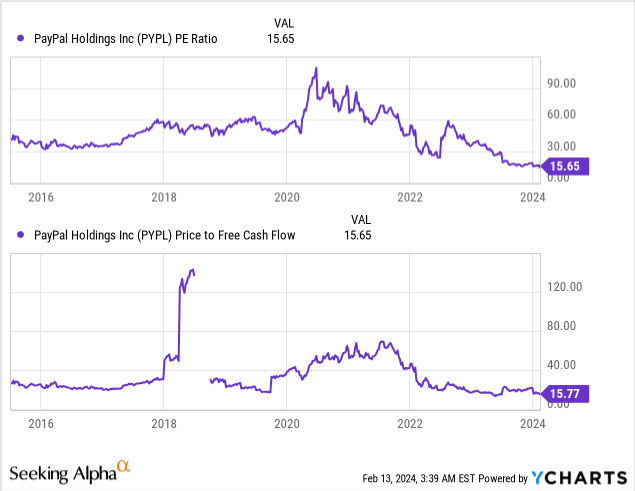

Primarily based on LTM EPS and FCF, PayPal trades at a PE and Worth to FCF ratios of about 15.7x, which is the bottom they’ve ever been for each metrics. So from a historic standpoint, PayPal appears considerably undervalued.

However my concern lies with PayPal’s dwindling turnaround story, which, given administration’s remarks not too long ago, turned out to be tougher than anticipated.

Moreover, the decrease multiples are justified given PayPal’s slowing prime line and backside line progress. What’s extra, PayPal could not see any earnings progress in 2024, which can result in the inventory buying and selling sideways for the rest of the yr.

As well as, there appears to be no actual optimistic catalyst within the close to time period, which can result in weak worth motion.

Fundamentals must get higher – whether or not it’s progress, profitability, or earnings – for PayPal to see significant worth appreciation. Moreover, administration must do one thing above and past to instill confidence amongst PayPal traders – maybe accelerated share buybacks, dividend initiation, or insider buys might do the trick.

In any other case, the inventory could proceed to battle.

Sure, the inventory appears low cost. However the low cost can at all times get cheaper.

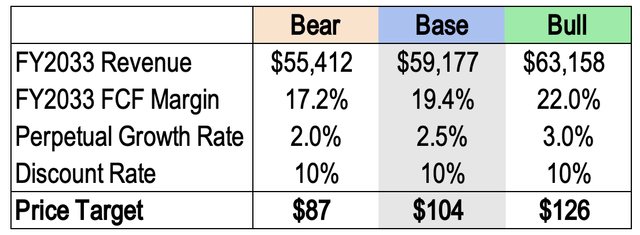

As for me, I preserve my worth goal of $104 a share for PayPal inventory, primarily based on the next assumptions:

FY2033 Income of $59B. Development follows analyst estimates for the primary three years after which stored steady at 7% for the remaining years. FY2033 FCF Margin at 19.4% with gradual enchancment as a result of working leverage. As a reference, PayPal’s FY2023 Adjusted FCF Margin was 15.3% Perpetual Development Charge of two.5%. Low cost Charge of 10%.

My worth goal of $104 represents an upside potential of 73% primarily based on the present worth of $60. As well as, my worth goal is increased than the typical analyst worth goal of $72.

I’ve additionally included my bear and bull instances beneath, which each present that PayPal is undervalued.

Writer’s Evaluation

Dangers

Competitors: the fintech business is extremely aggressive with gamers akin to Apple Inc.’s (AAPL) Apple Pay, Adyen N.V. (OTCPK:ADYEY), Block, Inc. (SQ), Fiserv, Inc. (FI), and SoFi Applied sciences, Inc. (SOFI). The commoditization of digital wallets and cost processing providers is an actual risk to PayPal, which can erode Gross Margins, and subsequently earnings potential for traders. Steerage Replace: As I’ve defined earlier, administration will subject an up to date FY2024 Non-GAAP EPS steering, decrease than its present steering, which can come as a (destructive) shock to many traders. Administration Adjustments: A number of modifications are taking place within the govt suite – it is too early to inform if they’ll reach turning the corporate or not.

Thesis

This autumn outcomes have been sturdy – but it surely was utterly eclipsed by weak steering.

PayPal’s traders did not significantly approve of administration’s steering, given CEO Alex Chriss’ promise that the corporate will “shock the world”.

Administration definitely overpromised over the previous few months constructing as much as its This autumn earnings launch and underdelivered on its steering – there isn’t any purpose to set excessive expectations after which come out guiding for nearly no earnings progress in 2024.

Nicely, I hope they do the alternative shifting ahead. I hope they’re going to underpromise and overdeliver all through 2024 as a result of that is the one strategy to flip across the inventory for good.

In the meantime, shares stay undervalued and the basics of the enterprise stay sturdy, which can provide some worth for traders.

For me, I nonetheless think about PayPal in deep worth territory – though I’ve to confess that it has been irritating holding PayPal inventory.

2024 is the yr of transformation and execution for PayPal. Solely time will inform if PayPal comes out stronger on the opposite aspect.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link