[ad_1]

US DOLLAR FORECAST – EUR/USD, GBP/USD, USD/JPY

This week’s point of interest on the U.S. financial calendar revolves across the eagerly awaited launch of January’s PCE information on FridayA stronger-than-expected report may propel the U.S. greenback upwards, whereas subdued outcomes might have a bearish affect on the American forexThis text rigorously examines the short-term technical outlook for 3 key FX pairs: EUR/USD, USD/JPY and GBP/USD

Most Learn: Japanese Yen Outlook – Turnaround Forward; Setups on USD/JPY, GBP/JPY, EUR/JPY

Wall Road will probably be on edge this week forward of a high-impact occasion on the U.S. calendar on Friday: the discharge of core PCE information, the Fed’s most well-liked inflation indicator. This report is prone to amplify volatility and should alter sentiment, so merchants ought to put together for the potential for wild value swings to be able to higher reply to sudden modifications in market circumstances.

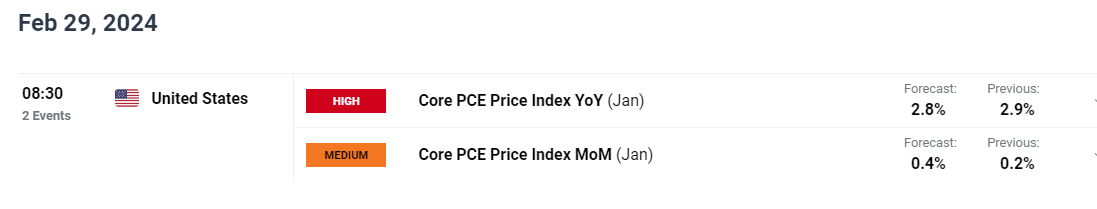

January’s core PCE is forecast to have elevated by 0.4% in comparison with the earlier month, leading to a slight decline within the yearly studying from 2.9% to 2.7% – a minor but encouraging directional adjustment. Nonetheless, merchants shouldn’t be caught off guard if official outcomes shock to the upside, mirroring the traits and patterns seen within the CPI and PPI surveys a few weeks in the past.

UPCOMING US DATA

Supply: DailyFX Financial Calendar

Sticky value pressures, coupled with strong job development and reaccelerating wages, might immediate the FOMC to delay the beginning of its easing cycle till the second half of the yr and to ship fewer cuts than anticipated. This state of affairs may shift rate of interest expectations in the direction of a extra hawkish course in comparison with their current outlook.

Greater rates of interest for longer might preserve U.S. Treasury yields tilted upwards within the close to time period, establishing a fertile floor for the U.S. greenback to construct upon its 2024 restoration. With the dollar displaying a constructive bias, the euro, pound and, to a lesser extent, the Japanese yen might encounter challenges transitioning into March.

Keen to realize readability on the euro’s future trajectory? Entry our quarterly buying and selling forecast for knowledgeable insights. Safe your free copy now!

Beneficial by Diego Colman

Get Your Free EUR Forecast

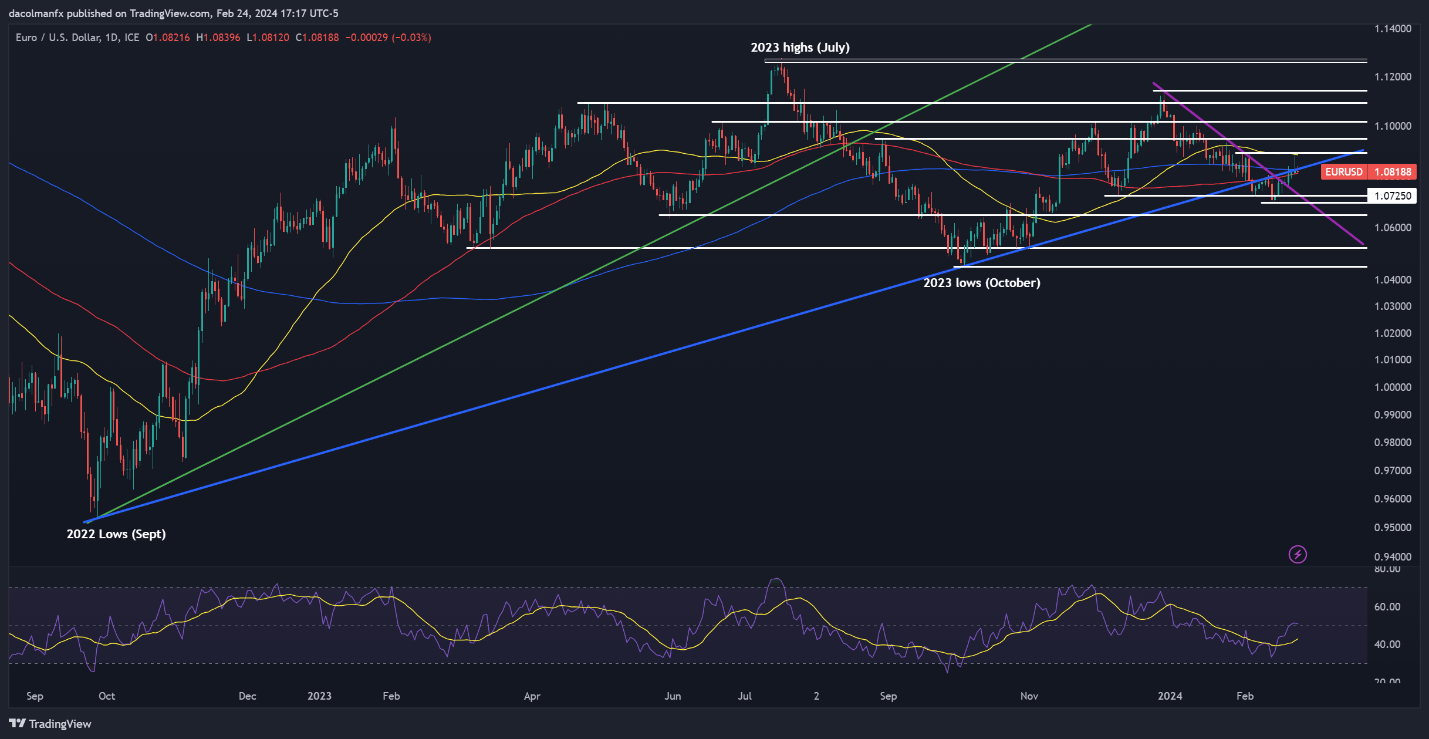

EUR/USD TECHNICAL ANALYSIS

EUR/USD rebounded this previous week, however didn’t decisively recapture its 200-day easy transferring common at 1.0825. It is crucial to intently monitor this indicator within the coming days, as a push above it might set off a rally in the direction of 1.0890. On additional power, consideration will flip to 1.0950.

Alternatively, if the pair will get rejected downwards from its present place and heads decrease, technical assist fist seems at 1.0725, adopted by 1.0700. Past this threshold, further weak point may immediate a retracement in the direction of 1.0650.

EUR/USD TECHNICAL ANALYSIS CHART

EUR/USD Chart Created Utilizing TradingView

Curious to uncover the connection between FX retail positioning and GBP/USD’s value motion dynamics? Take a look at our sentiment information for key findings. Obtain now!

Change in

Longs

Shorts

OI

Every day

-12%

12%

1%

Weekly

-15%

14%

0%

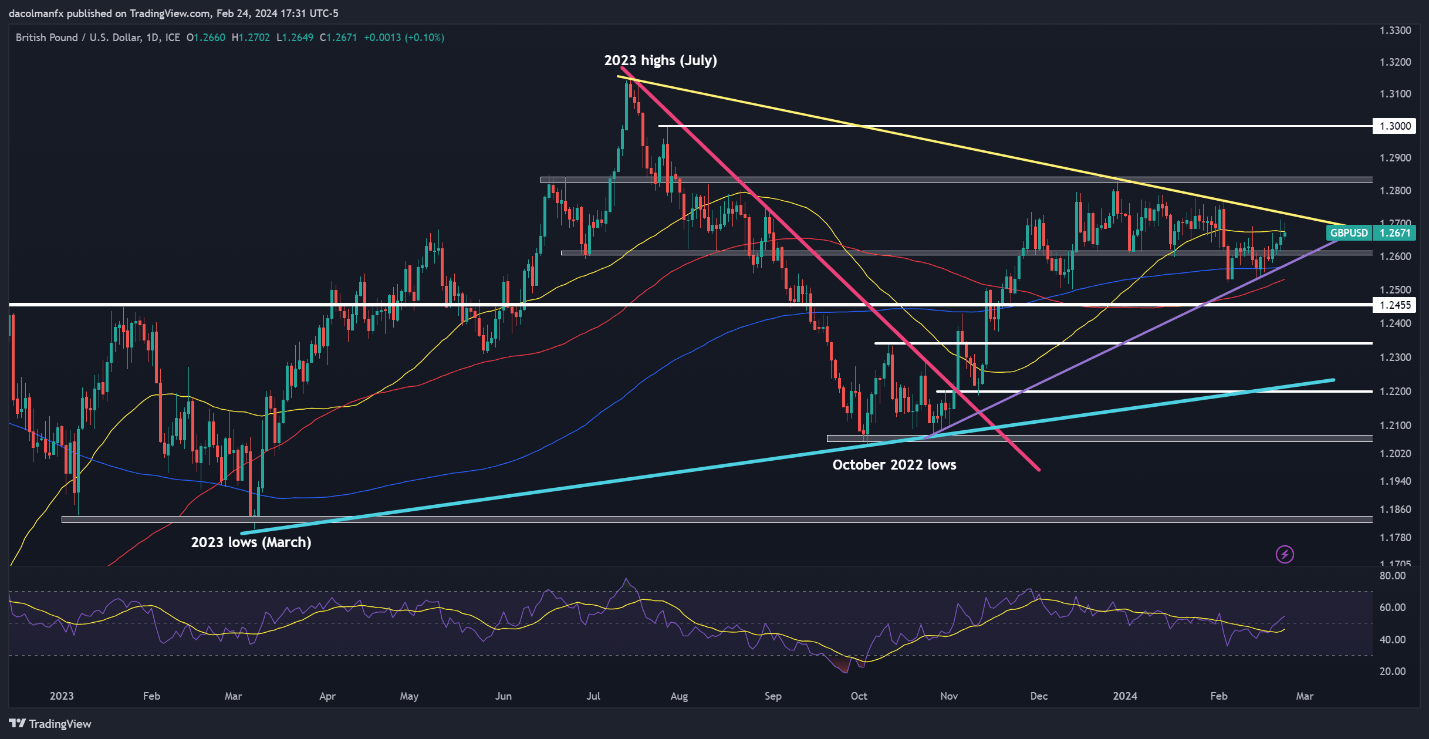

GBP/USD TECHNICAL ANALYSIS

GBP/USD superior throughout the week however didn’t take out its 50-day easy transferring common at 1.2680. Surpassing this technical impediment might be a tricky process for bulls, although a breakout would possibly usher in a transfer in the direction of trendline resistance at 1.2725. Above this barrier, all eyes will probably be on 1.2830.

Within the state of affairs of sellers reasserting management and kickstarting a pullback, the primary potential assist space arises across the 1.2600 deal with. Additional losses previous this juncture may pave the way in which for a decline in the direction of trendline assist and the 200-day easy transferring common, situated at 1.2570.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Utilizing TradingView

Questioning in regards to the yen’s prospects – will it proceed to weaken or mount a bullish comeback? Uncover all the small print in our quarterly forecast. Do not miss out – request your complimentary information at this time!

Beneficial by Diego Colman

Get Your Free JPY Forecast

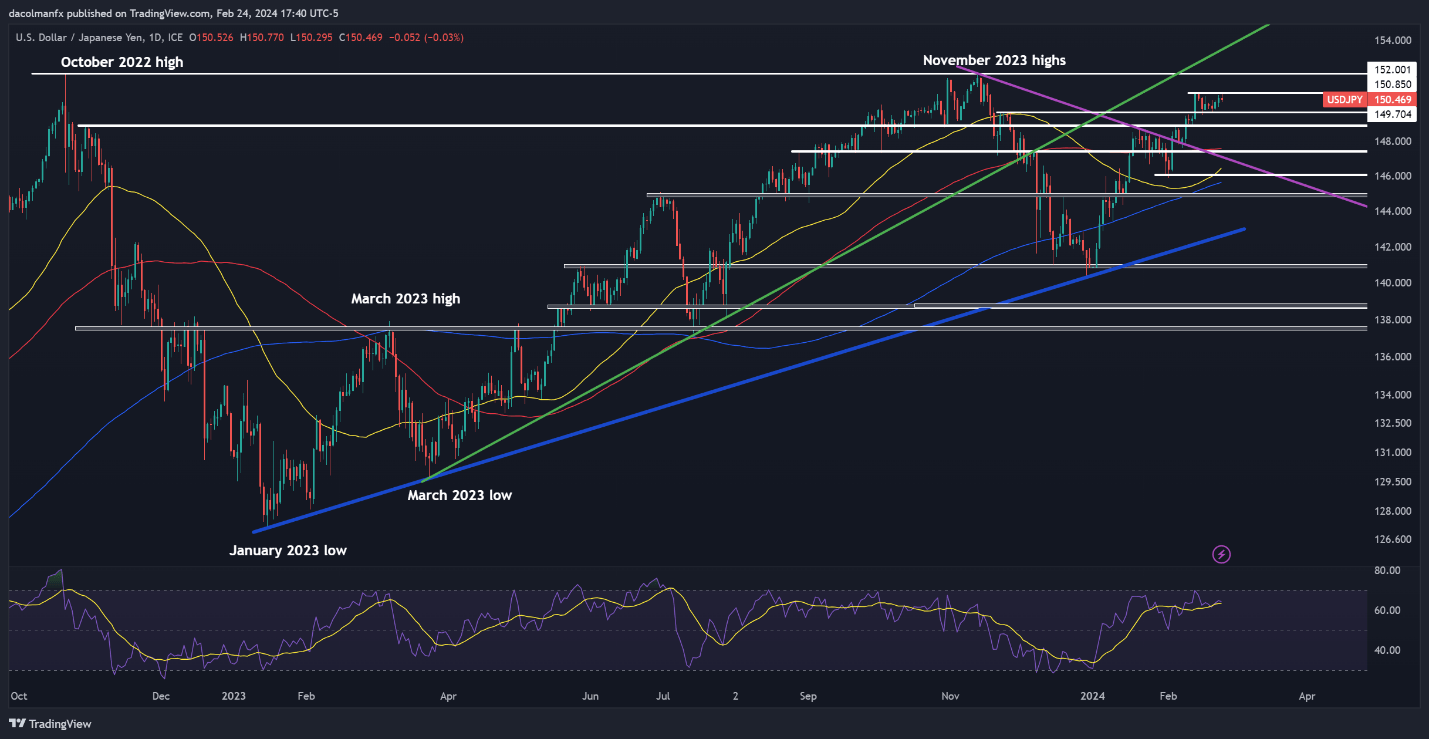

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY made additional progress to the upside this week, coming inside hanging distance from breaching resistance at 150.85. Merchants want to observe this technical barrier rigorously, as a profitable breakout may energize shopping for momentum, doubtlessly fueling a rally in the direction of final yr’s highs close to 152.00.

On the flip aspect, if sellers unexpectedly reclaim dominance and spark a bearish reversal, the primary technical ground to observe lies at 149.70 and 148.90 subsequently. Sustained losses past these key assist ranges may set off a retreat in the direction of the 100-day easy transferring common within the neighborhood of 147.50.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

ingredient contained in the ingredient. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the ingredient as a substitute.

[ad_2]

Source link