[ad_1]

BlackJack3D

At first look, Incyte (NASDAQ:INCY) is a superb worth inventory that enables shopping for into development at an affordable worth, GARP. 10-year revenues have clocked in a really enviable compound annual development price (CAGR) of 26.4% and are projected to develop over the following few years. Despite the fact that development is predicted to outpace the sector averages, the FY24 PE is 13.4x and beneath the sector common of 19.3x. PS is 3.3x, once more beneath the sector common of 4.0x. Is that this a superb GARP firm or a possible worth lure? 70% of its whole income is from one product, Jakafi (ruxolitinib), and that is dealing with a patent cliff in late 2028. We dig slightly deeper to search out that the corporate is on the precise path in diversifying its product choices and its income stream.

The Firm

Incyte is a biopharmaceutical firm that makes a speciality of the invention, growth, and commercialization of proprietary therapeutics hematology/oncology, the remedy of cancers of the blood, and Irritation and Autoimmunity. Incyte’s prescription drugs resembling Jakafi are used for the remedy of polycythemia vera, a kind of most cancers of the blood, and myelofibrosis, a bone marrow most cancers that disrupters the manufacturing of blood cells. Pemazyre treats adults with bile duct most cancers.

Incyte employs over 2,500 with over 1,000 concerned in analysis and medical growth. Science journal ranks Incyte at quantity 2 as the most effective employer in 2023.

Value Efficiency

The worth efficiency of Incyte has been disappointing as it’s buying and selling 22% down in comparison with the identical interval final yr, and 29% down in comparison with 5 years in the past. Traders haven’t been rewarded for holding the shares over an extended 10-year interval, as share costs are roughly on the identical ranges.

Financials

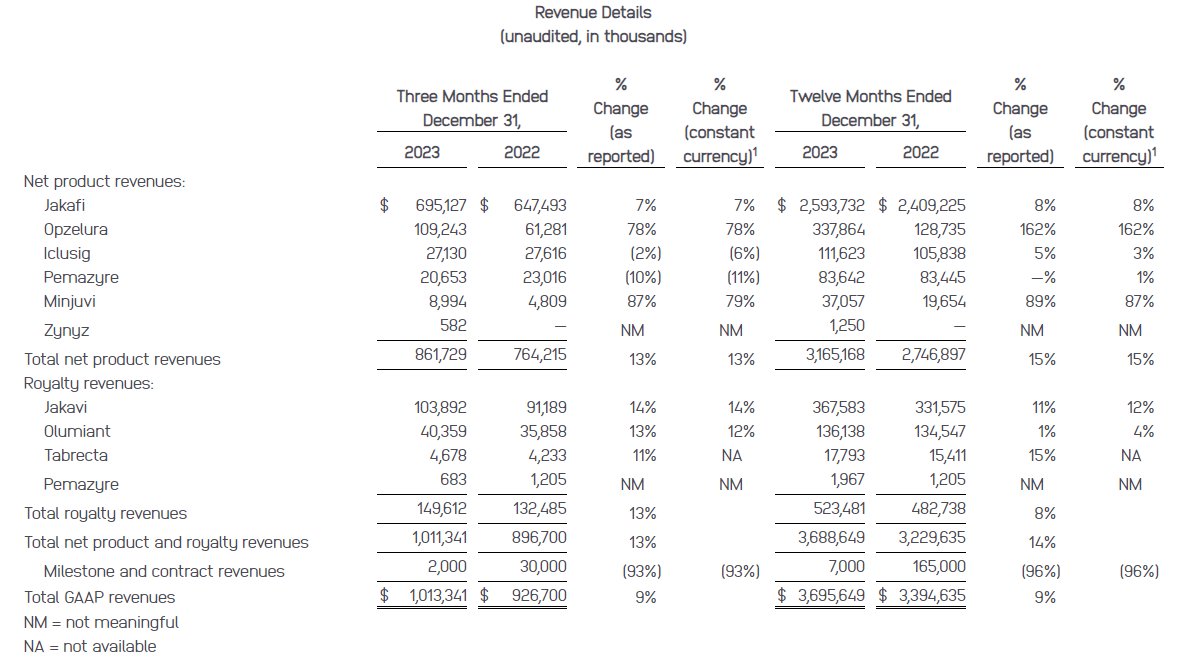

Incyte reported its FY23 outcomes earlier this month, the place revenues noticed a rise of 9% from $3.4bn to $ 3.7bn, and non-GAAP EPS elevated 27%, from $2.8 to $3.56. Its important product, Jakafi’s revenues elevated by 8%, Opzelura by a extra spectacular 162%.

Incyte FY23 Income Breakdown (Incyte)

If we’re to exclude “milestone and contract revenues” and simply have a look at the product and royalties revenues, they elevated by a extra respectable 14%. Web earnings margins improved considerably from 18.3% to 21.5%.

Incyte has a powerful stability sheet with shareholders fairness of $5.2bn, of these solely $280m are intangibles. Shareholders fairness has grown considerably during the last 10 years from destructive $87m. As of December 2023, it has nearly no debt and a money pile of $3.7bn. The corporate can also be extremely cash-generative and over the following 4 years, it may have at its disposal as much as $5.5bn of extra retained earnings.

For pharm corporations, R&D is important in discovering new remedies, and much more very important for Incyte forward of 2028’s patent cliff for Jakafi. R&D expense for FY23 was $1.6bn, 44% of revenues. They at the moment have 8 accepted merchandise, 7 within the pivotal levels, and 19 with medical proof of idea.

Income And Development

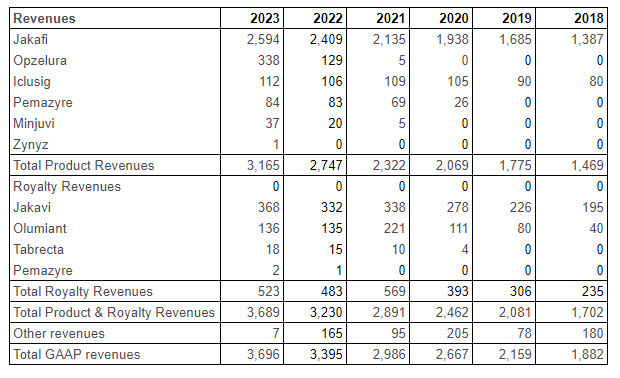

Earlier than we go on to development, allow us to take a look at how Incyte’s revenues have developed over the previous 5 years.

Incyte Income Breakdown (Writer & Incyte 10K Statements)

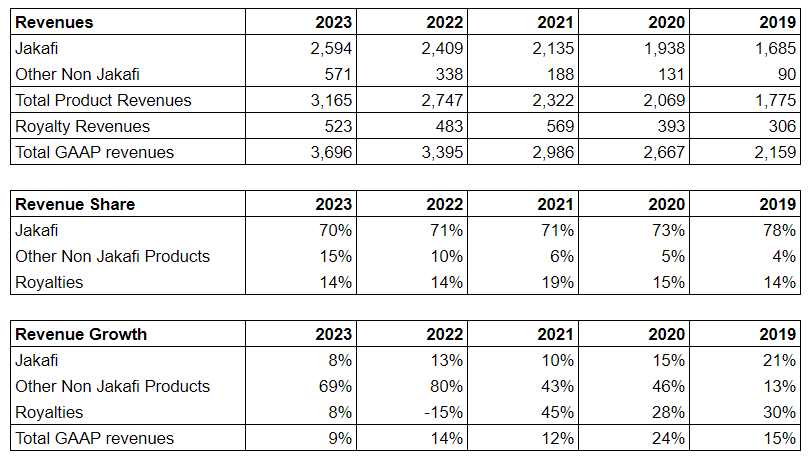

Other than Jakafi, Incyte has a number of different revenue-generating merchandise and revenues from royalties. We simplify this for a clearer image of the income share and development.

Incyte Income & Development Evaluation (Writer & Incyte 10K Statements)

Jakafi accounted for 70% of whole revenues in FY23, although excessive, that is decrease than FY19’s 78%. Royalties stay comparatively fixed and represented 14% in FY23. Different product share elevated from a low base of 4% in FY19 to fifteen% in FY23. That is the realm that has proven vital development. In FY20 solely Jakafi and Iclusig had been revenue-generating merchandise, and 4 new merchandise have begun contributing to revenues. These elevated from $90m in FY19 to $571m in FY23 which represents a powerful CAGR of over 45%. In FY23, different non-Jakafi product revenues elevated by a wide ranging 69%, primarily from Opzelura’s 162% enhance. Opzelura is an inhibitor ruxolitinib for the topical remedy of nonsegmental vitiligo and delicate to average atopic dermatitis.

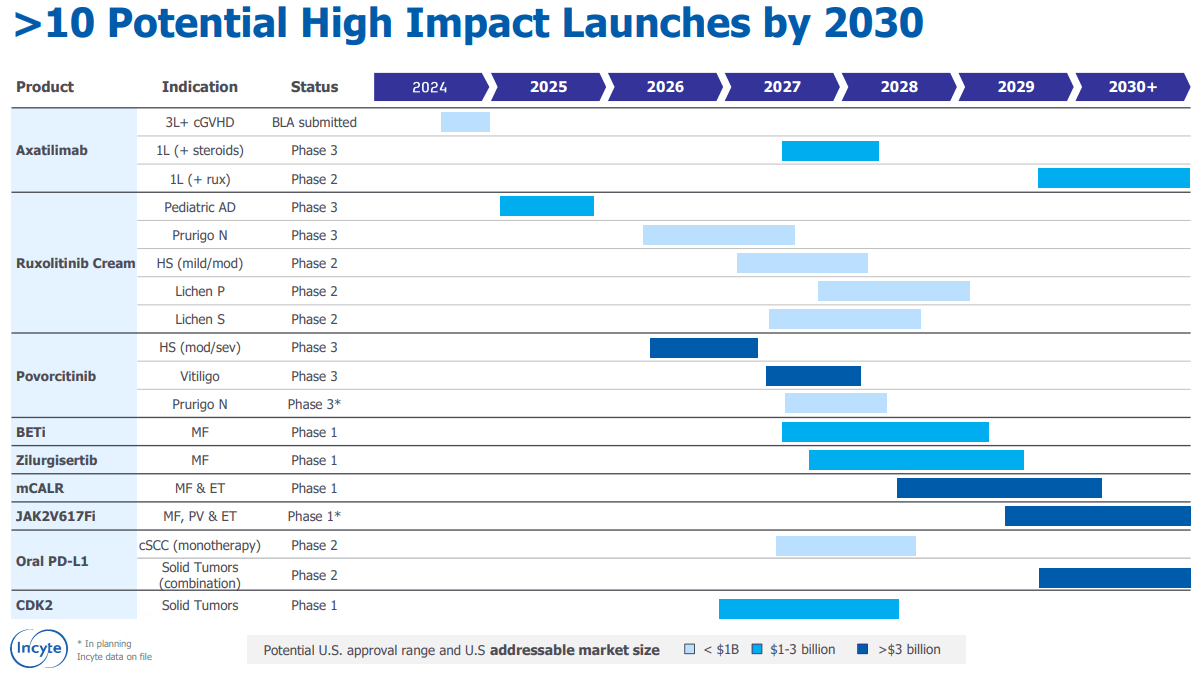

With Jakafi’s 2028 patent cliff approaching, administration is dedicated to supporting development drivers. They’ve plans for some promising and probably high-impact launches by 2030. In December 2023, Incyte introduced optimistic knowledge for its pivotal trial of axatilimab its remedy of graft-versus-host illness, and is at the moment filed with the FDA for approval. Share costs reacted positively to the information and had been up 17% over the following three buying and selling periods, from $54.7 to $64.2.

Incyte This fall 2023 Presentation (Incyte)

If Incyte can introduce new merchandise to the market and keep its development trajectory in non-Jakafi-related merchandise, the drop-off from the 2028 patent cliff could also be manageable.

The best danger confronted by Incyte just isn’t with the ability to introduce and get FDA approval for brand new merchandise shortly sufficient. The opposite danger just isn’t with the ability to keep revenues in its closely dependent product, Jakafi. On the optimistic facet, administration is devoted to diversifying revenues and so they even have an current conflict chest with $3.7bn of money on their stability sheet and a possible of as much as $5.5bn extra over the following 4 years from retained earnings. This might help pace up its R&D in addition to be used for acquisitions.

Valuation

Wanting on the conventional valuation matrix, Incyte is buying and selling a big low cost to the sector common on a number of fronts. It’s buying and selling at a ahead PE of 13.3x in comparison with the sector common of 19.3x and a PS of three.3x in comparison with the common of three.96x.

We may even use a singular Money Stream Returns on Investments primarily based DCF perspective to establish and study Incyte. Extra data on how Money Stream Returns on Investments are calculated, together with gross money, gross belongings, and returns could be present in Bartley Madden’s paper “The CFROI Life Cycle”. Bartley Madden is a big contributor to the Money Stream Returns on Funding methodology. Now we have used and expanded on this idea in our earlier articles.

Returns On Money Producing Belongings or ROCGA makes use of the identical methodology as Money Stream Returns On Investments and is a measure of financial returns. One other approach of corporations is the ratio of financial returns to the price of capital. This could straight correspond to the worth of an organization. The larger the unfold, the upper the share worth ought to be. This may be represented by the unfold between the EV and the belongings used to generate earnings.

Step one entails modeling the corporate, back-testing the valuation for correlation with the historic share costs, and as soon as assured, utilizing that very same mannequin to forecast ahead. Worth is a perform of returns an organization achieves, the speed of fade of these returns to the price of capital, and development. The whole worth of the corporate is the current worth of current belongings and the current worth of development. For mature corporations, most of its worth is within the current belongings, and for high-growth corporations, the worth is within the current worth of development belongings.

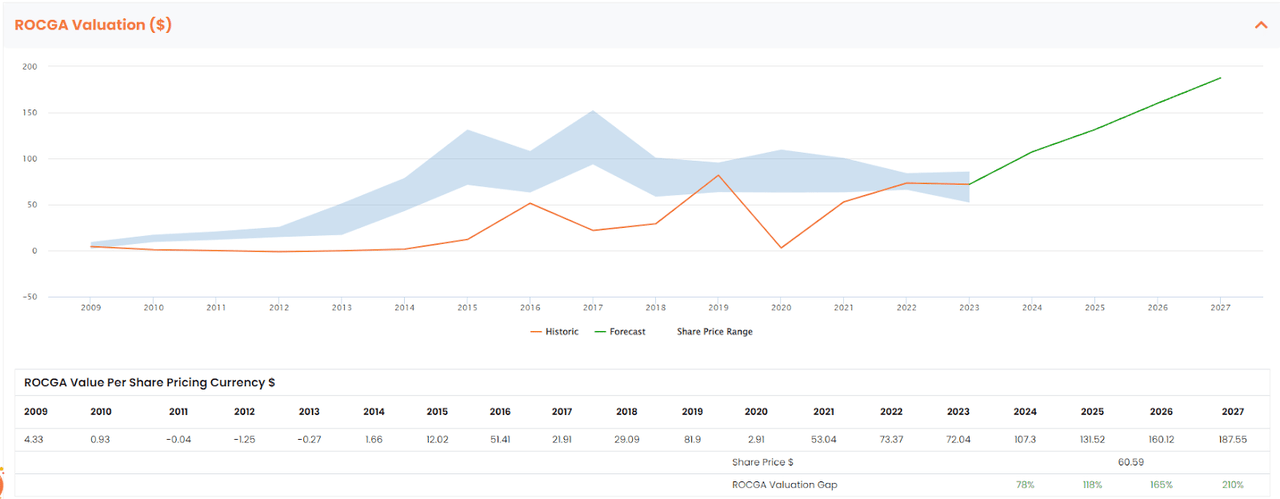

The blue band beneath represents the share worth highs and lows for the yr, and the orange line is the DCF model-driven historic valuation. The inexperienced line is the forecast warranted worth derived utilizing the identical mannequin together with consensus earnings and default self-sustainable natural development. Self-sustainable natural development is a ratio of investable free money to gross belongings.

Default ROCGA Valuation (Chart created by the creator utilizing ROCGA Analysis platform)

The imply reversion concept of returns reverting to the price of capital over time is utilized. An organization generates returns, and the upper the returns, in concept, the upper the valuation. The corporate will be unable to maintain its excessive returns over a protracted interval. Corporations with stronger aggressive benefit will keep these returns for slightly longer earlier than the fade begins. This means the power of the enterprise. A mature firm’s return will fade faster, and the sooner life cycle corporations will fade at a decrease price. The mannequin additionally ensures that the corporate just isn’t overvalued or undervalued throughout totally different levels of enterprise cycles.

Extra particulars of how the modeling and quantitative valuation work could be discovered right here.

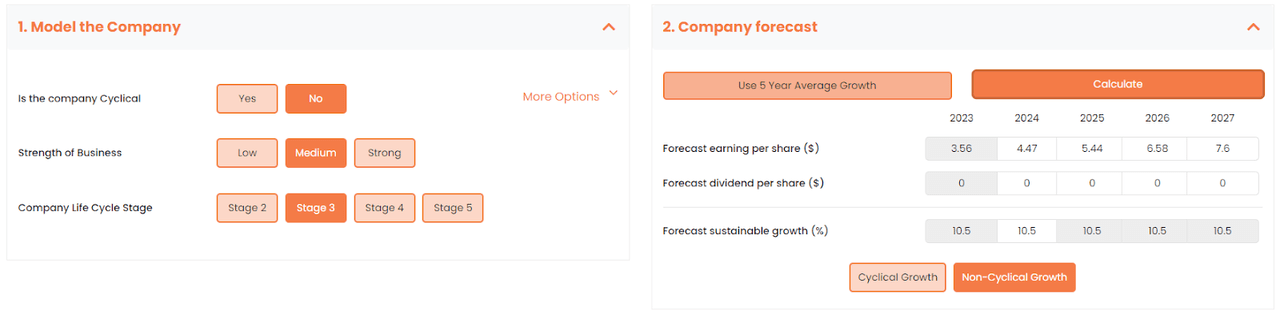

The assumptions used for this specific mannequin are that the corporate returns usually are not cyclical, have average enterprise power (aggressive benefit), and are within the early enterprise cycle life cycle levels.

Monetary Modelling Assumptions (ROCGA Analysis & Writer)

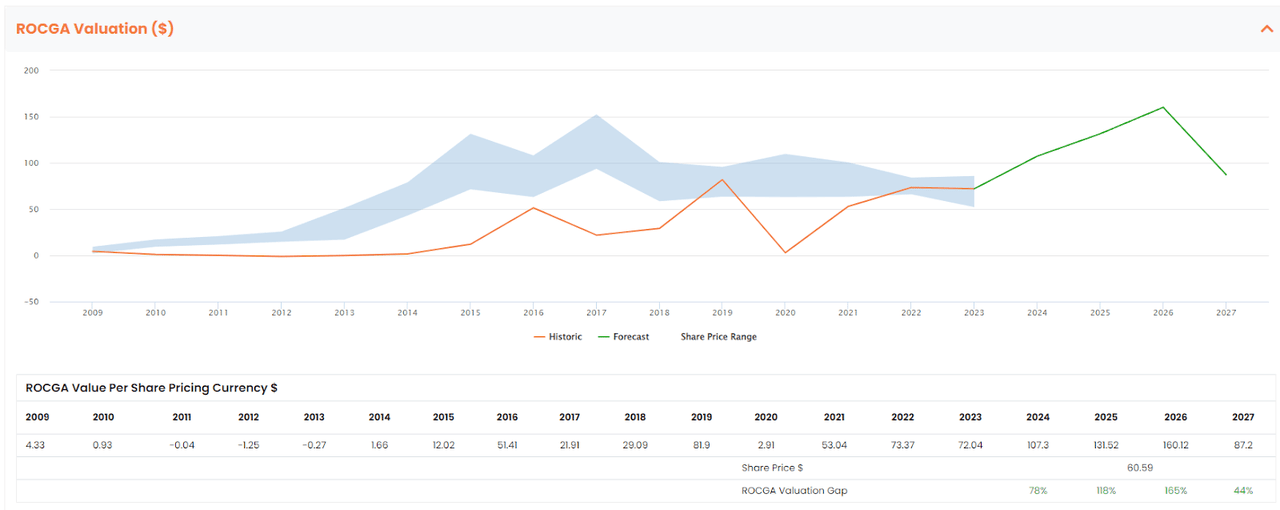

Within the valuation graph above, it’s only not too long ago that Incyte is trying low cost, and given the default mode, it has a possible 78% upside for FY24. We all know that there’s a patent cliff pending in 2028. Our mannequin doesn’t lengthen that far so we’ll assume that earnings drop in FY27 and use a conservative EPS of $2.5.

Adjusted ROCGA Valuation (Chart created by the creator utilizing ROCGA Analysis platform)

This offers us an adjusted warranted worth of $87 in FY27.

We are able to additionally have a look at Incyte as separate elements, the primary because the extremely cash-generative Jakafi. However its patent is about to run out in 2028 and we are able to count on a big drop in revenues and earnings after that. We are able to worth this half at a really primary $3.7bn in money and $5.5bn in retained earnings over 4 years. The second is its non-Jakafi associated merchandise revenues which grew at a wide ranging price of 69% in FY23. We apply a conservative 10x PS for this half giving us roughly $5.5bn. The third could be royalties-related revenues that’s $0.5bn however rising reasonably. A sector common of 4x PS provides us $2bn. Collectively they add as much as $16.7bn, lower than our DCF valuation above, however nonetheless a possible upside of 23%.

Conclusion

There are dangers concerned however given the low share costs, robust monetary place, and a powerful pipeline of promising merchandise, we consider Incyte warrants to be buying and selling at greater multiples. All valuation methodologies we used level to Incyte being undervalued. We provoke with a purchase ranking.

[ad_2]

Source link