[ad_1]

HJBC

Funding Thesis

Amazon (NASDAQ:AMZN) remains to be one in every of my favourite long-term picks due to its steady innovation, nice progress avenues and elevated give attention to working effectivity.

A strong This fall report has helped the agency finish FY23 on a excessive, with the 12 months being characterised by stable topline progress and nice bottom-line enlargement.

However, shares seem pretty valued at the moment with a lot of the expansion for FY24 already being priced into the present inventory value.

When mixed with an advanced macroeconomic outlook, I consider an inadequate margin of security exists to proceed including shares at present ranges.

Subsequently, I fee Amazon a Maintain at the moment and welcome the 104% positive aspects made since my first bullish thesis on the inventory again in early 2023.

Firm Background

Amazon.com is likely one of the most influential companies of the twenty first century. Their huge presence in e-commerce, cloud computing and leisure has made the agency an important factor of the each day lives of just about all Western civilizations.

Steady improvement and enlargement of their core e-commerce platform’s capabilities have been mixed with a fantastic value-add service within the type of Amazon Prime.

The flexibility of the Prime service has additional boosted progress for the agency’s person base, and revenues, be it from shoppers seeking to watch reveals and films or get their parcels delivered faster.

Innovation essentially stays on the forefront of Amazon’s progress technique, with the agency quickly increasing into new markets and industries similar to healthcare, digital promoting and machine studying tasks such because the Amazon Q generative AI-powered assistant for AWS.

The immense scale and breadth of Amazon’s operations generates a real mega-moat standing for Amazon, with a number of aggressive benefits serving to to extend their return on invested capital and their alternatives for future progress.

I carried out a complete evaluation of Amazon’s financial moat final 12 months, which I nonetheless consider to be a fantastic deep dive into the agency’s enterprise operations construction.

You’ll be able to take a look at that article right here. I extremely suggest studying that piece to permit for a deeper understanding of the agency to be developed.

Monetary State of affairs – This fall & Full-Yr 2023 Replace

Amazon reported fairly stable This fall and full-year outcomes, with the quarter specifically being characterised by huge income progress, continued AWS energy and great profitability.

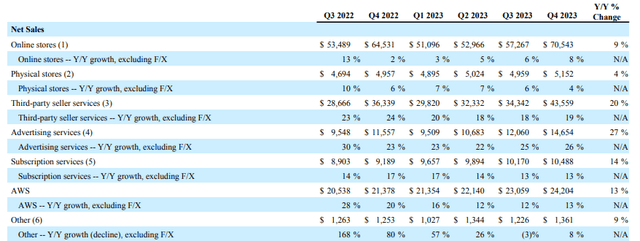

Internet gross sales grew 14% YoY to $170B in This fall due to nice efficiency by basically all of Amazon’s geographic section gross sales. AWS additionally posted nice efficiency in This fall with 13% YoY progress being achieved by the section.

AMZN This fall & Full-Yr 2023 Press Launch

I additionally favored the speed at which Amazon’s digital promoting enterprise grew within the ultimate quarter. The 27% progress witnessed in what may be thought of Amazon’s latest enterprise section illustrates simply how apt the agency is at extracting earnings from new ventures.

Amazon’s e-commerce platform is completely positioned to permit for vital promoting alternatives, with the addition of some adverts to Amazon’s Prime service additionally driving vital revenues for the agency.

What actually stood out to me from these This fall figures was the general energy of their core e-commerce enterprise, together with excessive charges of progress being achieved by AWS and their new promoting enterprise.

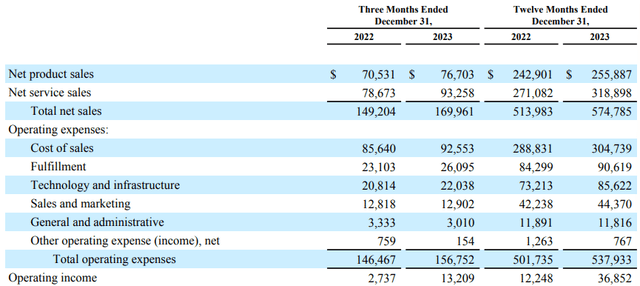

These successes culminated in huge working earnings for the agency which totaled simply over $13.2B for This fall in comparison with simply $2.7B the earlier 12 months.

AMZN This fall & Full-Yr 2023 Press Launch

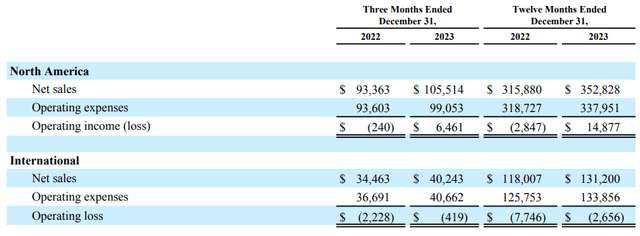

This huge soar in profitability got here due to Amazon’s North American section’s earnings leaping from a small loss on the finish of final 12 months to over $6.5B in earnings in FY23. An analogous reversal was achieved by the Worldwide section, which noticed a YoY working earnings enchancment of over $1.8B.

Amazon’s means to develop revenues at a a lot sooner tempo than whole working bills illustrates that the agency’s companies are nicely positioned to generate huge profitability for the agency, even regardless of an advanced macroeconomic surroundings.

AMZN This fall & Full-Yr 2023 Press Launch

Full-year outcomes for 2023 had been very encouraging, with whole revenues rising 12% YoY and working earnings increasing over 200% to $36.9B.

ROIC expanded to 9.82% for FY23 in comparison with 0% in FY22, whereas internet working margins elevated a fantastic 4pp to six.41%.

I consider the core drivers behind these quantitative successes in FY23 got here due to excellent qualitative developments throughout Amazon’s varied enterprise segments.

For instance, 2023 noticed the introduction of a brand new add-on well being care service being supplied to exiting Prime subscribers, which permits clients to buy healthcare merchandise and have consultations by way of Amazon’s platform.

Amazon additionally entered right into a partnership with Hyundai to promote their new autos by way of amazon.com in 2024. This might see a considerably elevated quantity of gross sales occurring by way of the location, together with one other alternative for cross-selling to happen.

I additionally actually just like the agency’s devotion to additional growing their fast supply providers, be it by way of including extra vans and depots to their infrastructure community in Europe or by way of the testing of recent autonomous supply drones in an excellent bigger variety of areas.

Integration of generative AI into AWS additionally presents the likelihood for the platform to return to even better ranges of progress, with their latest generative AI providing being able to doing huge quantities of AWS associated work within the blink of an eye fixed.

Whereas comparable generative AI integrations are being pursued by the likes of Microsoft (MSFT) and Alphabet’s Google (GOOG) (GOOGL), Amazon has begun a fast enlargement into the AI house with a number of new avenues of improvement for their very own giant language fashions.

New AWS Trainium2 chips ought to ship 4 instances sooner machine studying coaching for generative AI functions than the first-generation chips, whereas a partnership with Nvidia for the GH200 Grace Hopper superchips ought to allow extra superior AI infrastructure throughout Amazon’s tasks.

Whereas no actual figures have been given about Amazon’s funding into AI or R&D particularly, the agency continues to spend round 15% of whole revenues on “Expertise & Infrastructure”.

New AI options are being built-in into AWS, amazon.com, Prime Video and the digital promoting enterprise with a core goal of Amazon’s AI technique centered across the agency’s core ethos: enhancing the shopper expertise.

Total, Amazon has produced sturdy This fall and full-year outcomes which noticed the agency return to huge profitability, with nice topline income progress being complemented by great enhancements in working effectivity.

Administration forecasts Q1 FY24 income progress to be round 10% YoY, with working earnings anticipated to fall between $8B and $12B. These huge working incomes would signify even in probably the most conservative case, an 80% YoY improve, which might be nice to see.

I count on Amazon to have the ability to obtain these progress targets in Q1 due to the continued progress of their AWS and digital promoting segments specifically.

Whereas a repeatedly softening shopper spending surroundings could dampen the speed of core e-commerce gross sales, I consider these issues could materialize later within the 12 months nearer to the election.

Valuation – This fall & Full-Yr 2023 Replace

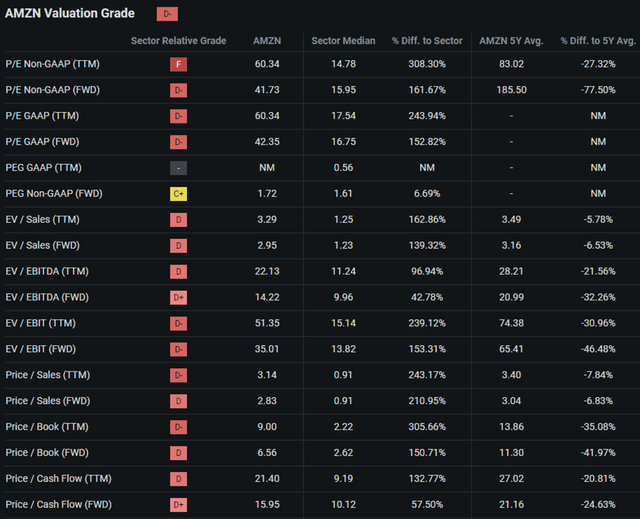

In search of Alpha | AMZN | Valuation

In search of Alpha’s Quant continues to assign Amazon with a “D-” Valuation score. I’m nonetheless inclined to disagree with this score, as I discover it to be an excessively pessimistic illustration of the worth current inside Amazon shares.

Present P/E GAAP and Value/Money Move TTM ratios of 60.34x and 21.40x are round 24% down from their respective 5Y averages.

The low cost steered by these metrics in AMZN inventory relative to historic averages most probably has arisen because of the considerably elevated earnings in FY23 and the accompanying progress in working earnings.

Whereas each of those metrics are nonetheless very elevated and never instantly consultant of a deep-value alternative with big upside, I view AMZN inventory extra as a GARP alternative given the corporate’s nonetheless vital progress prospects.

This view seems to be supported by buyers at the moment, with the agency’s Value/Gross sales TTM of three.14x illustrating simply how a lot progress is already baked into the share value.

Subsequently, it’s tough to develop an actual understanding of any worth which will lie in Amazon’s inventory simply from these easy valuation metrics, given the complexities of valuing a progress inventory with out immediately contemplating future earnings.

In search of Alpha | AMZN | 5Y Superior Chart

Contemplating a working 5Y timeframe, Amazon’s shares have generated nice returns of round 104% for its shareholders. In comparison with the favored S&P 500 monitoring ETF SPY (SPY), AMZN inventory has outperformed the index by nearly 30%.

Nevertheless, it is very important notice that Amazon’s volatility has been considerably better, with the inventory at present having a beta worth of 1.14x.

In search of Alpha | AMZN | 1Y Superior Chart

A lot of Amazon’s current efficiency has come because of a 1Y bull run that has seen shares respect by over 86%.

This investor urge for food for AMZN shares has come on the heels of Amazon producing nice income progress and excellent working incomes as in comparison with the rapid post-pandemic interval.

The Worth Nook

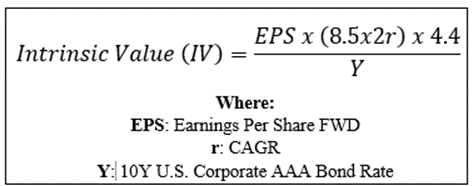

By using The Worth Nook’s Intrinsic Valuation Calculation, we will higher perceive what worth exists within the firm from an goal perspective.

As inputs, we are going to use Amazon’s present share value of $174.64, an estimated 2024 EPS of $4.19, a sensible “r” worth of 0.18 (18%) and the present Moody’s Seasoned AAA Company Bond Yield ratio of 4.87x. These values generate a base-case IV of $170, suggesting a good valuation at the moment.

When utilizing a extra pessimistic CAGR worth for r of 0.13 (13%) to replicate a extra recessionary macro surroundings the place Amazon struggles to fulfill its progress targets, shares are valued at $131, suggesting a considerable 33% overvaluation in shares.

Within the quick time period (3-12 months), I discover it tough to touch upon the route of the inventory.

The huge distinction between my base and bear case eventualities illustrates simply how a lot progress is already priced-in to the present inventory value for AMZN. Any underperformance within the quick time period relative to those expectations may ship shares downwards.

Macroeconomic shocks similar to a recession or new geopolitical battle may additionally bitter investor sentiment and the flexibility of shoppers to spend on the services and products bought by Amazon.

Within the long-term (2-10 years), I consider Amazon nonetheless presents itself as a compelling GARP alternative due to its huge scale, breadth of operations and steady drive for innovation.

Amazon.com Danger Profile

Amazon nonetheless faces actual danger from its publicity to a cyclical market surroundings together with some acute ESG issues.

Recessionary enterprise environments may see Amazon’s core e-commerce platform’s revenues fall as shoppers are much less prepared and capable of spend their disposable earnings.

Whereas I do see the AWS and digital promoting companies as being extra remoted from the cyclicality of the buyer discretionary markets, progress in these segments would nearly actually additionally decelerate throughout a recession.

Failed execution of recent improvements additionally generates danger for the agency. Whereas innovation and the creation of recent concepts will at all times have some failures, any future costly missteps similar to Amazon’s Fireplace cellphone may hurt profitability and investor sentiment in direction of the agency.

From an ESG perspective, Amazon nonetheless faces actual social danger arising from the allegations of anti-union habits from the agency together with substandard working situations being current on the agency’s warehouses.

Simply a few months in the past, Amazon witnessed firsthand the issues their huge scale may cause with regard to governance issues.

The EU’s threatened blockage of Amazon’s acquisition of iRobot illustrates the issue most of the present mega-caps could face when seeking to additional increase their enterprise operations into new areas.

Contemplating these ESG issues, I consider Amazon has extreme danger to be thought of a stable choose for a extra ESG aware buyers.

In fact, I implore you to conduct your individual analysis into Amazon’s distinctive danger construction and publicity to ESG issues, ought to these points be of concern to you.

Abstract

A powerful This fall earnings report rounds off what has been a reasonably spectacular 12 months for Amazon. The agency has proven its means to extract actual earnings from its operations whereas concurrently persevering with to innovate and develop its a number of enterprise divisions.

Whereas the present outlook for Q1 FY24 is stable, I discover the present inventory valuation to have already priced within the majority of positive aspects anticipated to be earned by the agency in 2024.

Given this honest valuation in shares, I consider there may be inadequate upside alternative and margin of security to warrant including publicity to AMZN inventory at the moment.

Subsequently, I fee Amazon shares a Maintain at the moment. Whereas I can’t be promoting any of my shares at the moment and stay optimistic concerning the long-term way forward for the inventory, I don’t assume now is an efficient alternative so as to add extra shares to the e-commerce big.

[ad_2]

Source link