[ad_1]

Dividend ETFs may be nice choices for these seeking to make investments for normal earnings.

Nonetheless, some buyers choose to spend money on particular person shares.

So on this article, we are going to check out some prime shares with upside potential together with one of the best ETFs.

Investing within the inventory market? Make the most of our InvestingPro reductions. Extra info on the finish of this text.

Traders usually discover dividends enticing, nevertheless it’s not sensible to base inventory purchases solely on excessive dividend yields. Whereas dividends is usually a bonus, they should not be the first motive for getting shares.

Earlier than shopping for shares for dividend yields, buyers ought to take into account facets like monetary well being together with the inventory’s upside potential.

For individuals who aren’t snug with investing in particular person shares, ETFs may be nice choices.

There are a number of well-known dividend ETFs to select from. Nonetheless, it is important to look at their efficiency over the previous few years earlier than you resolve to speculate.

Listed below are the highest dividend ETFs you possibly can take into account:

Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:)

Dividend yield: 4.99%

Focuses on Japanese dividend-paying corporations.

Schwab U.S. Dividend Fairness ETF (NYSE:)

Dividend yield: 3.81%

Manages 4.9B in property.

WisdomTree Japan Hedged Fairness Fund (NYSE:)

Dividend yield: 6.23%

Manages $8.4B in property.

Whereas ETFs is usually a nice alternative for some buyers, others choose to spend money on particular person shares.

Beneath, we are going to check out some shares with interesting dividend yields and bullish potential utilizing the InvestingPro device, which gives important information for our evaluation.

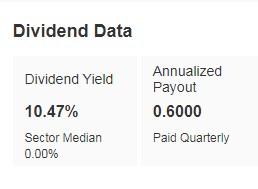

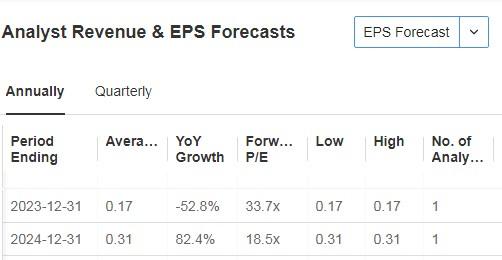

1. Uniti Group

Uniti Group (NASDAQ:) is engaged within the acquisition and development of communications infrastructure and is a number one supplier of fiber and different wi-fi options.

Its dividend yield is +10.47%.

Uniti Group Dividend Information

Supply: InvestingPro

On February 29 it presents its accounts. For 2024 the forecast is for a rise in earnings per share (EPS) of +82.4% and income of +3%.

Uniti Group Income and EPS Estimates

Supply: InvestingPro

Its scalable nationwide community has facilitated custom-made agreements with wi-fi service suppliers. The corporate expects progress in fiber initiatives and new community development.

It has 10 scores, of which 3 are purchase, 7 are maintain and 1 is promote.

The market sees a 12-month potential at $6.90.

Uniti Group Targets

Supply: InvestingPro

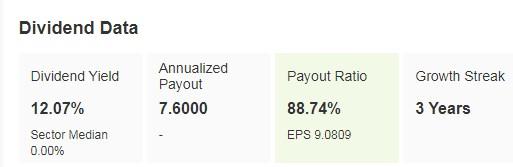

2. Civitas Assets

Civitas Assets (NYSE:) is an organization that focuses on the acquisition, improvement, and manufacturing of oil and within the Rocky Mountain area.

It was previously often called Bonanza Creek (NYSE:) Vitality. It was based in 1999 and is headquartered in Denver, Colorado.

Its dividend yield is +12.07%.

Civitas Assets Dividend Information

Supply: InvestingPro

On February twenty seventh we are going to know its accounts. For 2024 the forecast is for a rise in earnings per share (EPS) of +29.7% and income of +57.9%.

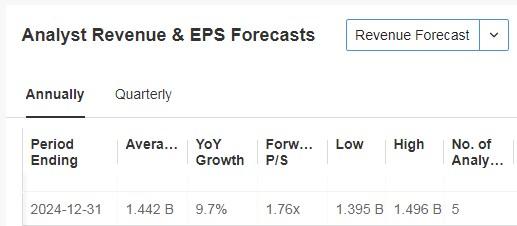

Civitas Assets Income and EPS Forecasts

Supply: InvestingPro

Taking a look at numerous metrics, we see that the inventory is undervalued.

The market sees 12-month potential at $88.91.

Civitas Assets Targets

Supply: InvestingPro

3. Organon

Organon & Co (NYSE:) sells its merchandise to hospitals, pharmacies, clinics, authorities companies and different establishments. The corporate was included in 2020 and is headquartered in Jersey Metropolis, New Jersey.

Its dividend yield is +6.95%.

Organon Dividend Information

Supply: InvestingPro

It’ll report its outcomes on Might 2. For 2024 the forecast is for a rise in earnings per share (EPS) of +3.3% and revenues of +2.2%. Its final identified outcomes 12 days in the past had been good.

Organon Final Earnings

Supply: InvestingPro

It has 10 scores, of which 5 are purchase, 3 are maintain and a couple of are promote.

Market expectations put the inventory at $21.38.

Organon Targets

Supply: InvestingPro

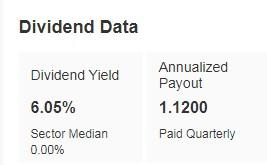

4. AT&T

AT&T Inc (NYSE:) was previously often called SBC Communications and adjusted its identify to AT&T in 2005. It was established in 1983 and is headquartered in Dallas, Texas.

It has a dividend yield of +6.61%.

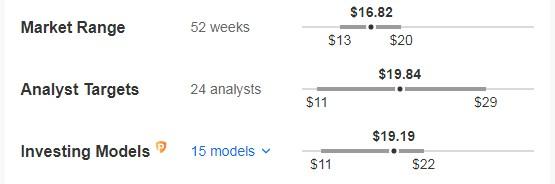

AT&T Dividend Information

Supply: InvestingPro

April 24 would be the time to take a look at its accounts. Revenues rose +1.8% within the final report and heading into 2024 one other +1.1% enhance can be anticipated.

AT&T Forecasts

Supply: InvestingPro

Each InvestingPro’s fashions and the market agree on the 12-month potential of its shares, particularly at $19.19 and $19.84 respectively.

AT&T Targets

Supply: InvestingPro

5. Guess

Guess (NYSE:) is an attire firm that additionally sells watches and jewellery. It was based in 1981 and is headquartered in Los Angeles, California.

Its dividend yield is +4.82%.

Guess Information

Supply: InvestingPro

It’ll report its numbers on March 20. Income is predicted to extend by +8.39% and earnings per share by +9.90%.

Guess Earnings

Supply: InvestingPro

Guess and WHP International have introduced a definitive settlement whereby Guess acquires the rag & bone trend model, which has turn into a distinguished identify within the US trend trade, with 34 shops within the US and a couple of within the UK.

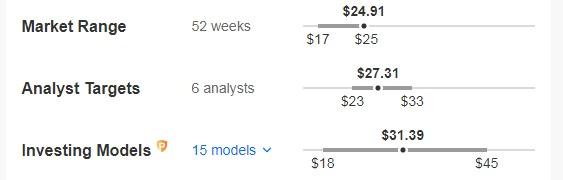

It has 5 scores, of which 3 are purchase, 2 are maintain and none are promote.

The market offers it a possible at $27.31, whereas InvestingPro fashions it at $31.39.

Guess Targets

Supply: InvestingPro

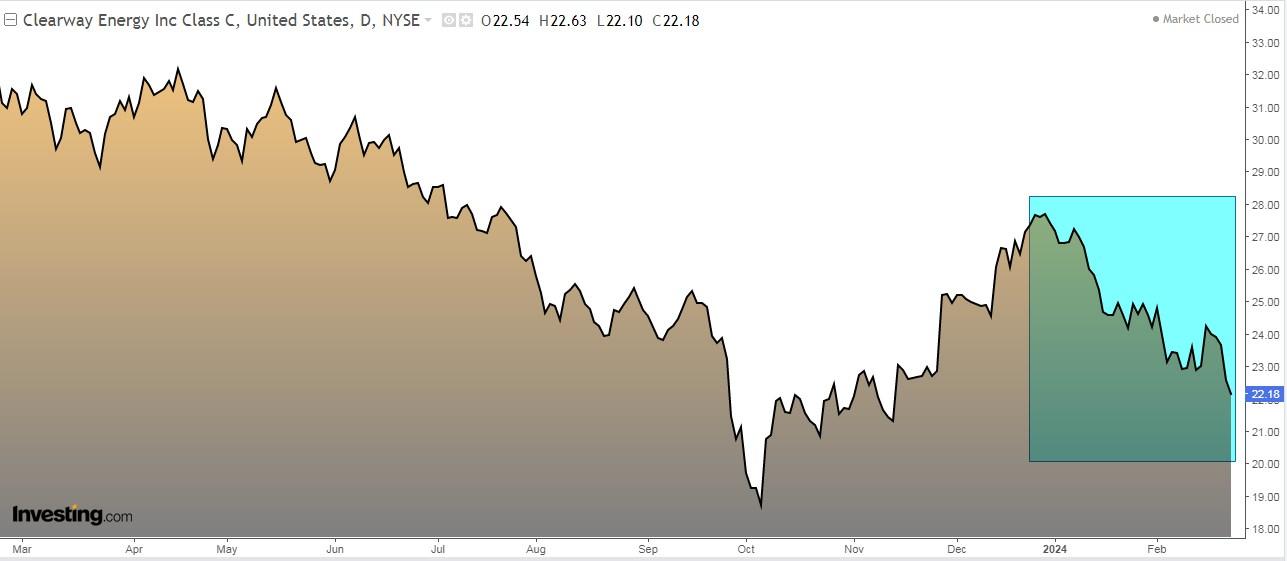

6. Clearway Vitality)

Clearway Vitality (NYSE:) operates within the renewable vitality enterprise in the USA. It was previously often called NRG Yield and adjusted its identify to Clearway Vitality in August 2018.

It was based in 2012 and is headquartered in Princeton, New Jersey.

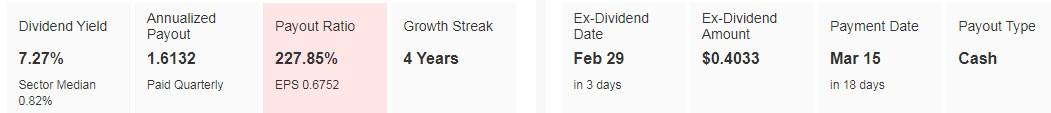

The dividend yield is +7.27%. It’ll ship $0.40 per share to shareholders on March 15, and to obtain it, shares should be held by February 29.

Supply: InvestingPro

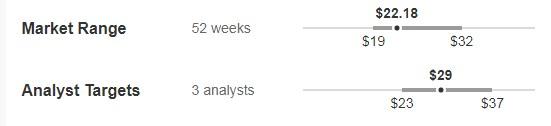

Might 2 is the time to publish its accounts. For 2024 it expects a rise in income of +9.7%.

Clearway Vitality Class C

Supply: InvestingPro

The potential the market sees for it in 12 months can be round $29.

Clearway Vitality Class C

Supply: InvestingPro

***

Do you spend money on the inventory market? Arrange your most worthwhile portfolio HERE with InvestingPro!

Take benefit HERE AND NOW! Use code INVESTINGPRO1 and get 40% off your 2-year subscription. With it, you’re going to get:

ProPicks: AI-managed portfolios of shares with confirmed efficiency.

ProTips: digestible info to simplify quite a lot of complicated monetary information into a couple of phrases.

Superior Inventory Finder: Seek for one of the best shares based mostly in your expectations, making an allowance for a whole lot of monetary metrics.

Historic monetary information for hundreds of shares: In order that basic evaluation professionals can delve into all the main points themselves.

And plenty of different companies, to not point out these we plan so as to add shortly.

Act quick and be part of the funding revolution – get your OFFER HERE!

Declare Your Low cost At the moment!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought of as funding recommendation.

[ad_2]

Source link