[ad_1]

Most Learn: US Greenback Falls, Fed’s Resolve in Query; USD/JPY, USD/CAD Setups Earlier than NFP

The European Central Financial institution’s Thursday assembly is prone to be a subdued affair, with markets broadly anticipating rates of interest to stay unchanged for the fourth consecutive gathering. Because of this, traders ought to intently monitor President Lagarde’s press convention – her statements might present helpful insights into the financial coverage outlook.

Lagarde is prone to embrace a impartial stance, refraining from sending alerts that might inadvertently create unrealistic expectations in both course. Though disappointing development knowledge over the previous couple of months might argue for a extra dovish place, policymakers might go for warning within the face of stalled progress on disinflation.

To offer some context, January’s CPI within the Eurozone topped estimates, reinforcing the argument that client costs will not be but on a sustained downward pattern, with speedy wage development retaining service sector inflation stickier than anticipated. Towards this backdrop, the ECB will keep away from any dedication to a pre-set course that might increase untimely market hopes, stressing that selections shall be data-dependent.

By way of potential situations for the euro, any indication that the ECB’s easing measures will not be imminent and might be delayed to the latter half of the yr might spark a hawkish repricing of rate of interest expectations. This is able to be bullish for the widespread forex. Conversely, any trace of potential early fee cuts might elicit an reverse response, weighing on the euro.

Need to know the place the euro is headed over a longer-term horizon? Discover key insights in our quarterly forecast. Request your complimentary information immediately!

Really helpful by Diego Colman

Get Your Free EUR Forecast

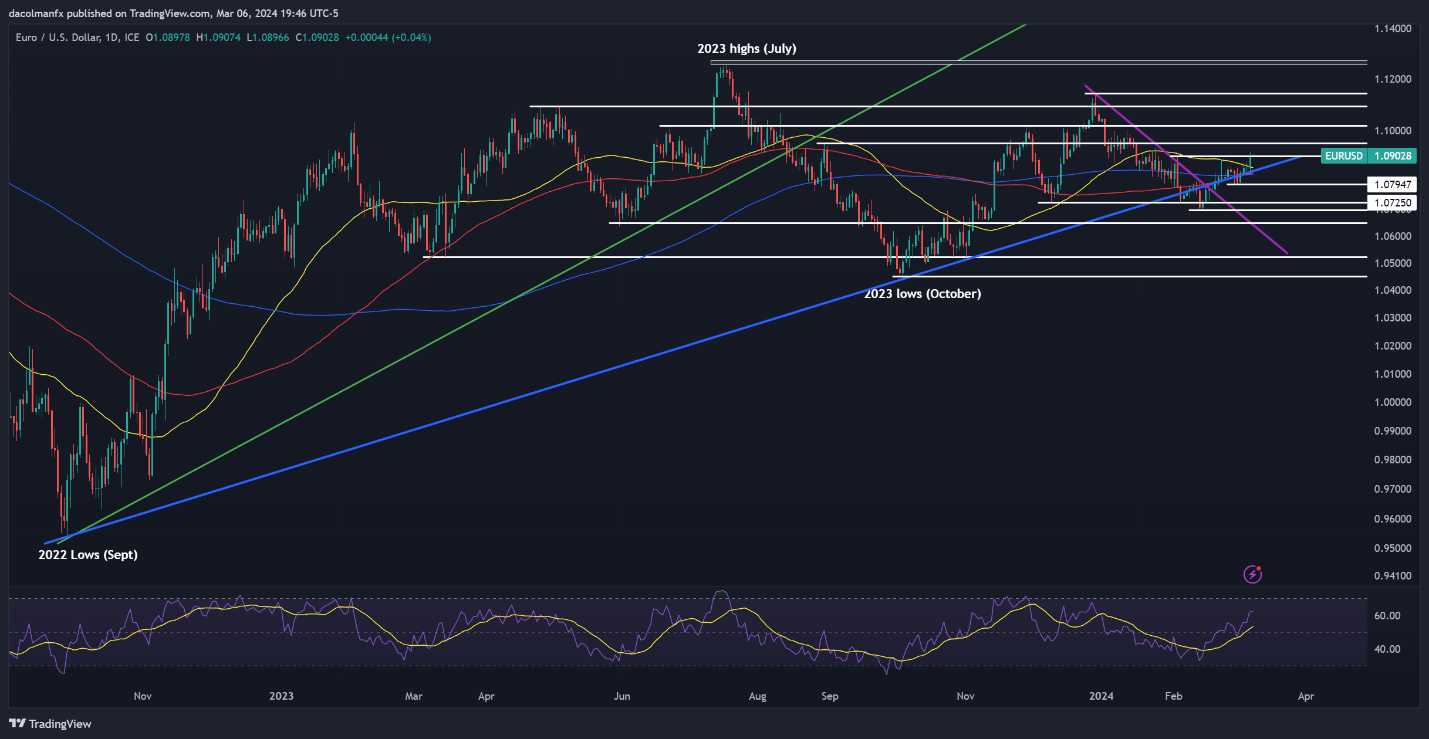

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD rallied on Wednesday, breaking above its 50-day easy transferring common, and reclaiming the 1.0900 deal with. If this bullish transfer is sustained within the coming days, consumers might achieve confidence to launch an assault on 1.0950, with a possible give attention to 1.1020 thereafter.

On the flip facet, if the pair loses vigor and retreats again under the 1.0900 mark, consideration is prone to shift to confluence assist at 1.0850. Bulls have to vigorously defend this ground; failure to take action would possibly precipitate a pullback in the direction of 1.0790. On additional weak point, all eyes shall be on 1.0725.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Keen to find how retail positioning can affect EUR/GBP’s short-term trajectory? Our sentiment information has helpful insights about this subject. Seize a free copy now!

Change in

Longs

Shorts

OI

Day by day

-13%

12%

-6%

Weekly

-11%

-6%

-9%

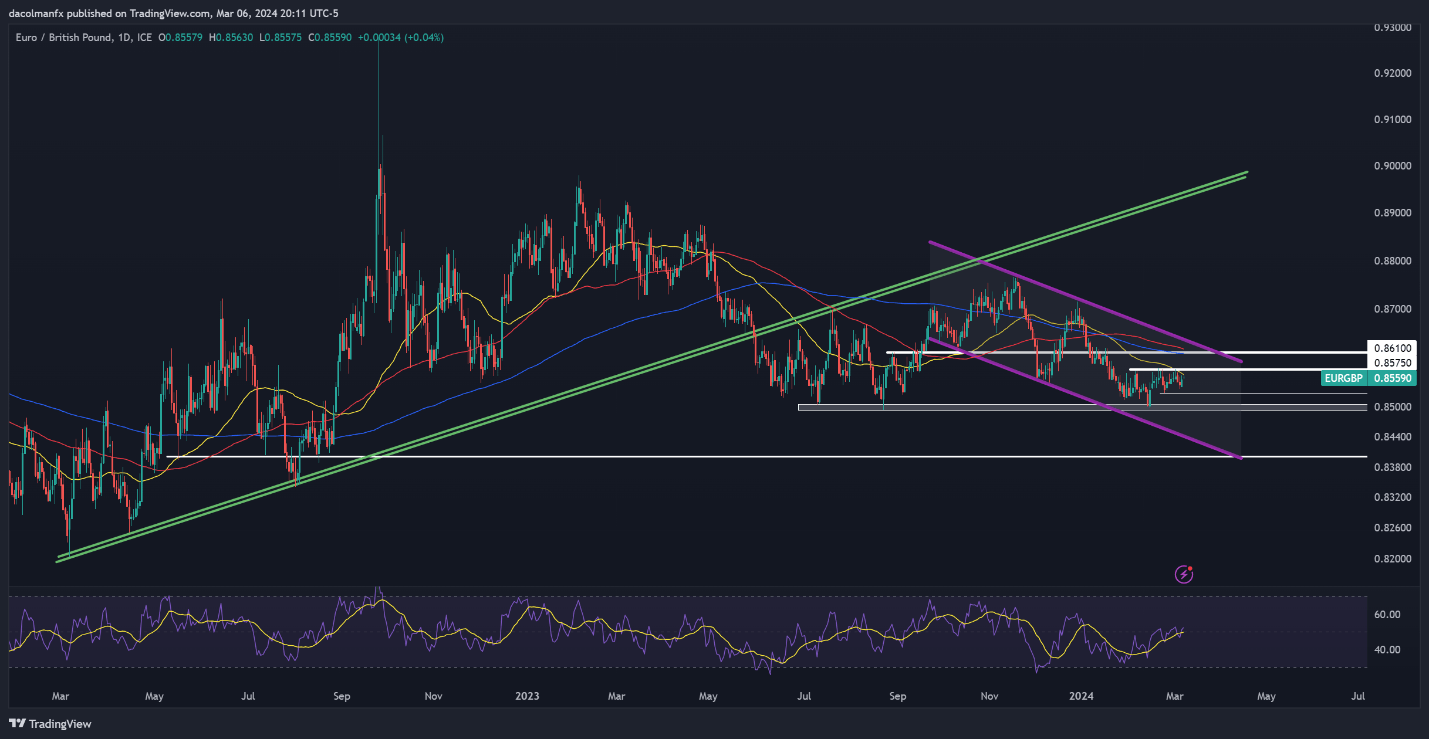

EUR/GBP FORECAST – TECHNICAL ANALYSIS

EUR/GBP has been in a downtrend since November, however the depth of the selloff has eased, with costs perking up and approaching resistance close to 0.8575. To reinforce sentiment in the direction of the euro, bulls have to convincingly breach this barrier – attaining this might set off a rally in the direction of 0.8610, adopted by 0.8640.

Conversely, if EUR/GBP is rejected at present ranges and begins to reverse, assist thresholds will come into play at 0.8530 and subsequently at 0.8500. Costs are anticipated to stabilize round this space throughout a downturn earlier than a possible reversal, however a breakdown might result in a decline towards 0.8450.

EUR/GBP PRICE ACTION CHART

EUR/GBP Char Creating Utilizing TradingView

Upset by buying and selling losses? Equip your self with information to enhance your technique with our “Traits of Profitable Merchants” information. Unlock essential insights to keep away from widespread pitfalls & expensive errors.

Really helpful by Diego Colman

Traits of Profitable Merchants

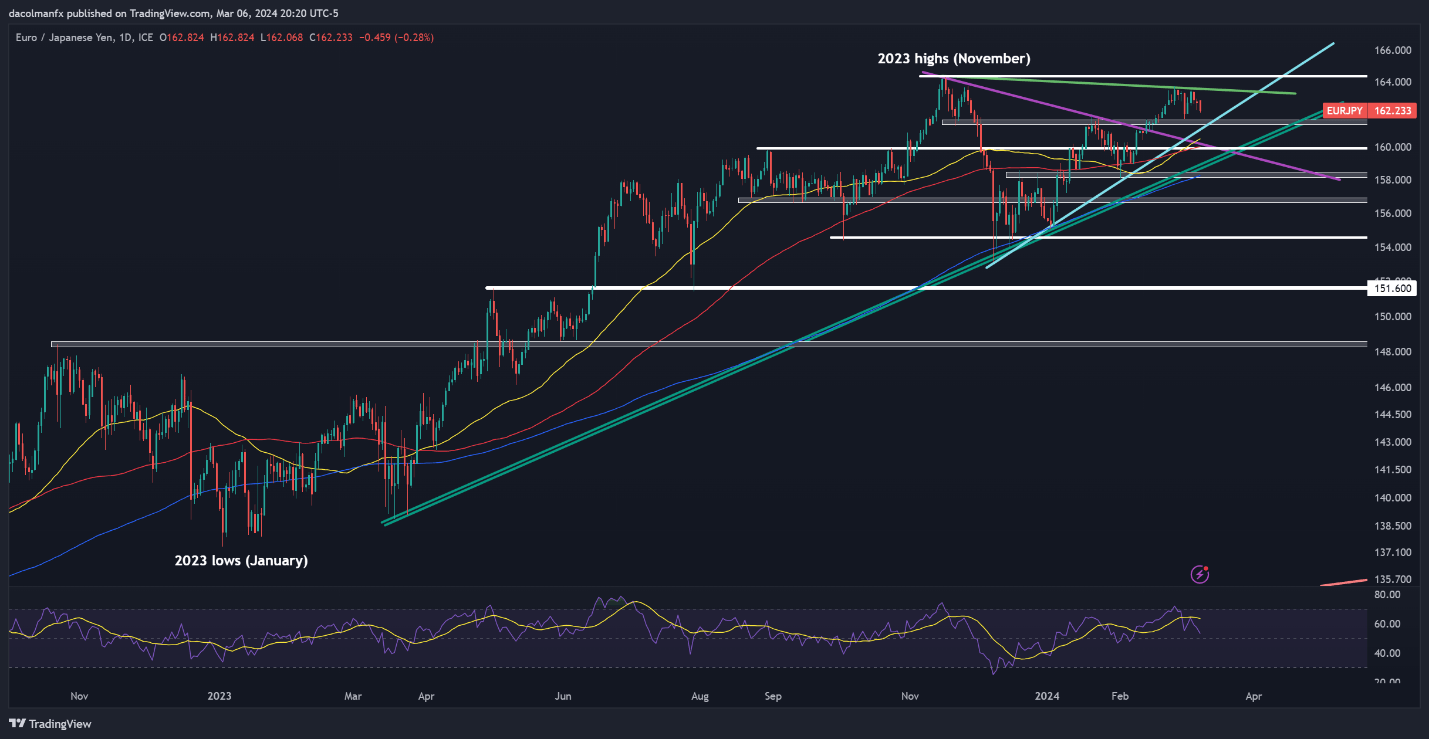

EUR/JPY FORECAST – TECHNICAL ANALYSIS

EUR/JPY has misplaced floor in current days after failing to clear trendline resistance at 163.50 earlier within the week. If losses speed up within the coming buying and selling classes, confluence assist emerges round 161.50. Ought to this technical ground fail, the highlight shall be on the 160.40-160.00 vary, adopted by 159.00.

Alternatively, if consumers regain management and set off a significant rebound, major resistance might be recognized at 163.50, as beforehand famous. It is too early to find out if bulls will collect the power to take out this barrier, but when they do, a possible transfer in the direction of final yr’s peak close to 164.30 might be within the playing cards.

EUR/JPY PRICE ACTION CHART

EUR/JPY Chart Created Utilizing TradingView

ingredient contained in the ingredient. That is most likely not what you meant to do!

Load your software’s JavaScript bundle contained in the ingredient as a substitute.

[ad_2]

Source link