[ad_1]

Smaller shares provide alternatives past the massive tech firms and the Magnificent 7.

Many small-cap shares have surged by greater than +30% year-to-date.

On this piece, we are going to check out 4 such shares you possibly can contemplate including to your portfolio.

Investing within the inventory market, wish to get probably the most out of your portfolio? Attempt InvestingPro+! Enroll HERE, and benefit from as much as 38% off your 1-year plan for a restricted time!

Since final 12 months, all the eye has been on massive tech firms, particularly these within the Magnificent 7. That is comprehensible given their sturdy efficiency.

However there’s extra to the market than simply these giants. Right this moment, let’s shift our focus to smaller firms.

The S&P 600 Small Cap ETF (NYSE:) gained ‘solely’ +14% in 2023 in comparison with the ‘s +24.2%, and it is also trailing behind this 12 months.

That does not imply there aren’t particular person shares performing exceptionally nicely (up greater than +30% this 12 months) and price contemplating.

Established in 1994, the consists of small-cap firms carefully tied to the home market. These firms will need to have a market capitalization of no less than $750 million and have demonstrated stable monetary efficiency over the past 4 quarters.

In comparison with different small inventory indexes just like the , the S&P 600 has traditionally delivered larger returns.

Let’s delve into a few of these firms with the help of InvestingPro, which can present us with important knowledge and insights.

These shares share a number of widespread traits:

They’ve surged greater than +30% up to now this 12 months.

Their earnings outlook for 2024 and past is promising.

The market sees important upside potential for them for the rest of the 12 months.

1. Kaman (KAMN)

Kaman (NYSE:) is an American aerospace firm, headquartered in Bloomfield, Connecticut.

It was based in 1945 and for the primary ten years was devoted solely to designing and manufacturing helicopters and now manufactures all sorts of plane elements.

It’s going to pay a dividend of $0.20 per share on April 11, and to obtain it, shares have to be held by March 18. The annual dividend yield is +1.74%.

Kaman Upcoming Dividends

Supply: InvestingPro

On April 30, it presents its outcomes, and income is anticipated to extend by +5.43%. Waiting for 2024, the EPS (earnings per share) forecast is for a rise of +70.4%, and in 2025 one other improve of +61.9%.

Kaman Upcoming Earnings

Supply: InvestingPro

The corporate has a valuation of $1.3 billion. Its shares are up +112.24% within the final 12 months and +96.83% within the final 3 months.

The market sees potential for it at $51.50.

Kaman Targets

Supply: InvestingPro

2. AdaptHealth

Adapthealth (NASDAQ:) relies in Plymouth Assembly, Pennsylvania. It’s a community of firms that provide custom-made services to empower sufferers to reside higher lives, out of the hospital and of their properties.

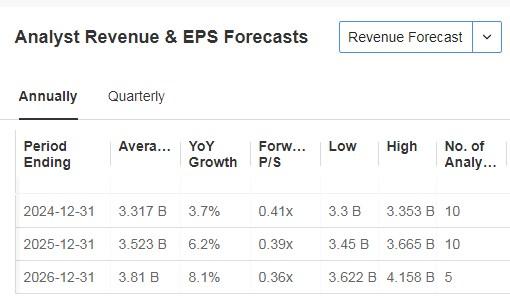

On Might 7, we are going to find out about their backside line. For the 2024 computation, income progress is anticipated to be +3.7% and for 2025 +6.2%.

Forecast

Supply: InvestingPro

Its shares within the final 12 months are down -24.50% and within the final 3 months are up +33.33%.

It has 10 rankings, of which 6 are purchase, 4 are maintain and none are promote.

Investing fashions give it a possible at $15.64.

Targets

Supply: InvestingPro

3. Extremely Clear Holdings

Extremely Clear Holdings (NASDAQ:) develops and provides ultrahigh-purity cleansing parts, elements and providers for trade. It was based in 1991 and relies in Hayward, California.

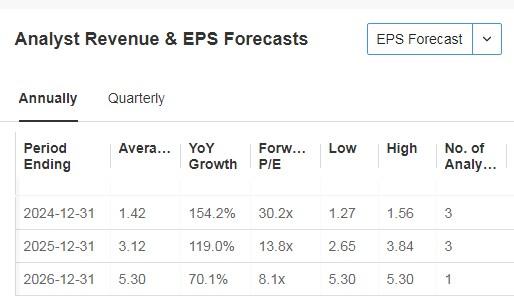

Its accounts will likely be launched on April 24. Waiting for 2024, EPS is anticipated to extend by +154.2% and in 2025 by +119%.

Extremely Clear Holdings Forecasts

Supply: InvestingPro

Its shares within the final 12 months are down -38.72% and within the final 3 months are up +36.82%.

It has 3 rankings and all of them are purchase.

Supply: InvestingPro

InvestingPro fashions give it potential at $52.36.

Extremely Clear Holdings Targets

Supply: InvestingPro

4. DXP Enterprises

DXP Enterprises (NASDAQ:) was based in 1908 and is headquartered in Houston, Texas.

The corporate for greater than 100 years has served as a number one industrial distribution knowledgeable specializing in bearings and energy transmission, metalworking, industrial provides.

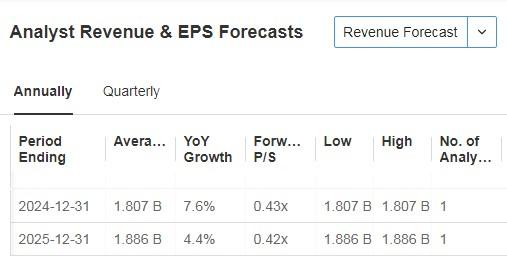

It’s going to report its numbers on Might 7, with income and EPS anticipated to extend. Waiting for the present fiscal 12 months, expectations are for income progress of +7.6% and in 2025 +4.4%.

DXP Enterprises Forecasts

Supply: InvestingPro

The corporate, which has diversified its finish markets, attributes its progress to strategic acquisitions.

The dedication to double the dimensions of its enterprise over the subsequent few years stays agency because it continues to generate substantial free money circulation and spend money on its workforce.

Its shares over the past 12 months are down -86.02% and over the past 3 months are up +45.94%.

The market assigns it a possible of $65.

DXP Enterprises Targets

Supply: InvestingPro

***

Investing within the inventory market? Decide when and how one can get in or out, strive InvestingPro.

Take benefit HERE & NOW! Click on HERE, select the plan you need for 1 or 2 years, and benefit from your DISCOUNTS.

Get from 10% to 50% by making use of the code INVESTINGPRO1. Do not wait any longer!

With it, you’ll get:

ProPicks: AI-managed portfolios of shares with confirmed efficiency.

ProTips: digestible info to simplify a considerable amount of advanced monetary knowledge into just a few phrases.

Superior Inventory Finder: Seek for the most effective shares primarily based in your expectations, making an allowance for a whole lot of monetary metrics.

Historic monetary knowledge for hundreds of shares: In order that basic evaluation professionals can delve into all the small print themselves.

And lots of different providers, to not point out these we plan so as to add within the close to future.

Act quick and be a part of the funding revolution – get your OFFER HERE!

Subscribe Right this moment!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought of as funding recommendation.

[ad_2]

Source link