[ad_1]

Up to date on March twentieth, 2024 by Bob Ciura

Nucor Company (NUE) is the biggest metal producer in North America. Regardless of working within the notoriously risky uncooked supplies sector, Nucor can also be a remarkably constant dividend progress inventory. The corporate is within the S&P 500 Index and has elevated its annual dividend for over 50 consecutive years, which qualifies it to be a member of the Dividend Aristocrats record.

The Dividend Aristocrats have lengthy histories of elevating their dividends annually, even throughout recessions, which makes them comparatively uncommon finds inside the broader S&P 500. With this in thoughts, we created a listing of all 68 Dividend Aristocrats, together with essential monetary metrics like price-to-earnings ratios and dividend yields.

You may obtain an Excel spreadsheet with the complete record of Dividend Aristocrats by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend will not be affiliated with S&P International in any method. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

Nucor’s dividend consistency permits it to face out in its trade. Metal is a very troublesome trade because of the cyclical nature of the enterprise mannequin, which makes Nucor’s streak of annual dividend will increase much more spectacular.

This text will analyze Nucor’s enterprise mannequin, progress prospects, and valuation to find out whether or not the inventory is a purchase proper now.

Enterprise Overview

Nucor is the biggest metal producer in North America after a long time of progress. The corporate is headquartered in Charlotte, North Carolina, and has a market capitalization of $39.5 billion.

Nucor was not all the time a frontrunner within the metal manufacturing trade. The corporate has a protracted and convoluted company historical past that may be traced again to the corporate’s founder, Ransom E. Olds (the creator of the Oldsmobile vehicle). Olds left his personal automotive firm over a disagreement with shareholders to type the REO Motor Firm, which finally reworked into the Nuclear Company of America – Nucor’s first predecessor.

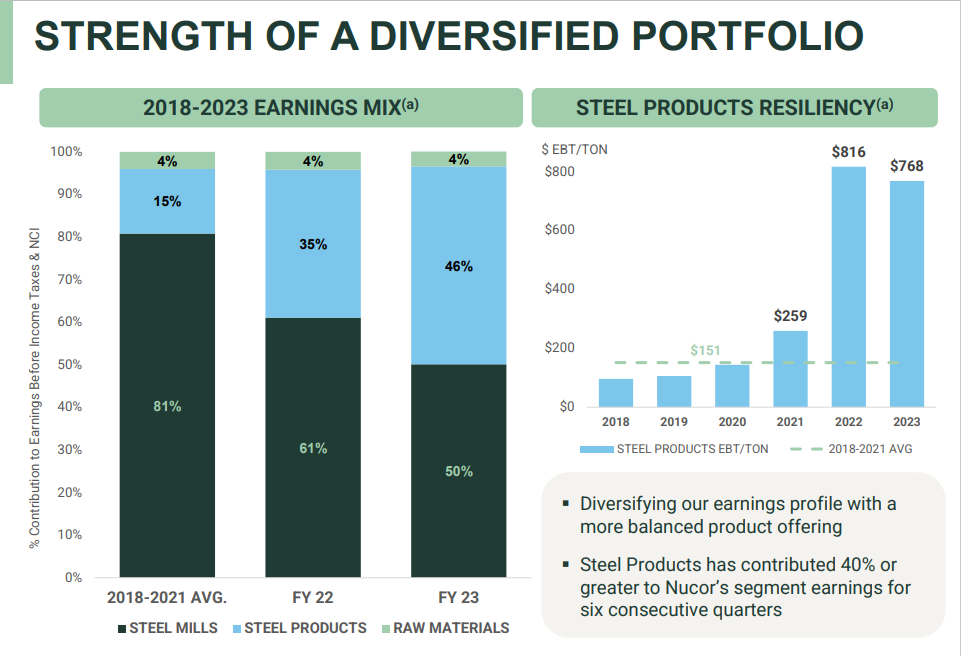

The corporate at the moment operates in three segments: Metal Mills (the biggest section by income), Metal Merchandise, and Uncooked Supplies.

Supply: Investor presentation

Nucor manufactures all kinds of fabric sorts, together with sheet metal, metal bars, structural formations, metal plates, downstream merchandise, and uncooked supplies. The vast majority of the corporate’s manufacturing comes from a mixture of sheet and bar metal, as has been the case for a few years.

Nucor has been profitable over the long-term due to a concentrate on low-cost manufacturing. This enables it to keep up profitability throughout downturns, in addition to to supply vital working leverage throughout higher instances. As well as, it has labored to increase its product choices to new markets, and preserve and develop its market management in present channels.

Development Prospects

The previous a number of years have been risky for Nucor and its opponents across the globe. Metal costs have been fluctuating wildly, pushed primarily by a provide glut popping out of worldwide markets, particularly China. Nevertheless, the trade outlook has been fairly favorable these days.

Nucor Company disclosed its This fall 2023 earnings on January 30, 2024, demonstrating resilience amid difficult market situations. The corporate reported earnings of $3.16 per share for the quarter, a lower from the earlier yr’s $4.89 per share however surpassing the consensus estimate of $2.83.

Nucor’s web gross sales for the quarter amounted to $7.70 billion, marking an 11.7% lower year-over-year, but exceeding the consensus estimates. The decline in earnings throughout the fourth quarter was primarily attributed to decrease costs, reflecting the risky metal market situations.

For the complete yr 2023, Nucor reported web earnings of $4.52 billion or $18 per share, a lower from 2022’s web earnings of $7.61 billion or $28.79 per share. The whole web gross sales for the yr stood at $34.71 billion, exhibiting a 16% lower from the earlier yr.

General, we anticipate Nucor’s earnings-per-share to say no by 0.9% per yr over the subsequent 5 years, as the corporate is coming off a multi-year interval of file earnings.

Aggressive Benefits & Recession Efficiency

Nucor is a producer and distributor of uncooked supplies and metal. Accordingly, the corporate is a ‘commodity enterprise’ – one wherein the one largest differentiator between opponents is value.

Warren Buffett has the next to say about commodity companies:

“Shares of corporations promoting commodity-like merchandise ought to include a warning label: ‘Competitors could show hazardous to human wealth.’” – Warren Buffett

Actually, commodity companies should not essentially the most defensive companies, due to their cyclicality. This may be seen by Nucor’s efficiency throughout the 2007-2009 monetary disaster:

2007 adjusted earnings-per-share: $4.98

2008 adjusted earnings-per-share: $6.01

2009 adjusted earnings-per-share: web lack of ($0.94)

2010 adjusted earnings-per-share: $0.42

2011 adjusted earnings-per-share: $2.45

Nucor’s earnings-per-share had been decimated by the monetary disaster. The corporate is one among few Dividend Aristocrats whose earnings truly turned adverse throughout this tumultuous time interval. Earnings have solely just lately caught as much as their pre-recession ranges, though Nucor has continued to steadily enhance its dividend funds.

Valuation & Anticipated Returns

Nucor is anticipated to report adjusted earnings-per-share of about $13.60 in fiscal 2024. That places the price-to-earnings ratio at ~14.1, which is above our truthful worth estimate of 12.0. For metal producers, we stay extra cautious than the overall market, partly because of the volatility of commodity costs.

We see truthful worth at 12 instances earnings, which means Nucor is overvalued as we speak. If the P/E a number of contracts from 14.1 to 12, it will scale back annual returns by -3.2% over the subsequent 5 years.

The present yield is 1.1%, and we anticipate EPS to say no by 0.9% annually over the subsequent 5 years. We see adverse complete annual returns of -3% within the subsequent 5 years.

Nucor has a extremely spectacular dividend historical past. It has elevated its dividend for 51 consecutive years. It has paid over 200 consecutive quarterly dividends. That stated, the speed of dividend progress has lagged common over the past decade, with most annual will increase within the low single-digits on a proportion foundation.

Closing Ideas

Nucor’s standing as a Dividend Aristocrat and, following its most up-to-date dividend enhance as a Dividend King, helps it to face out among the many extremely risky supplies sector. There are a handful of uncooked supplies companies which have multi-decade monitor data of compounding their adjusted earnings-per-share.

Regardless of Nucor that includes a protracted historical past of annual dividend will increase and having a robust trade place and a wholesome steadiness sheet, Nucor now has a decrease dividend yield than the S&P 500 Index common attributable to its rising share value in recent times.

The share value rally has additionally elevated Nucor’s valuation, and we now see the inventory as considerably overvalued. General, the inventory has a promote advice on the present value.

Moreover, the next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

In case you’re on the lookout for shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link