[ad_1]

The Boeing-Airbus rivalry extends past enterprise into diplomatic realms, sparked by French Finance Minister Bruno Le Maire’s public choice for Airbus attributable to security issues.

Regardless of Airbus CEO Guillaume Faury’s assurances, Le Maire’s stance underscores ongoing unease with Boeing.

As traders weigh the implications, information from InvestingPro suggests Airbus has capitalized on Boeing’s challenges, however analysts foresee potential development for Boeing if it resolves issues of safety.

In 2024, make investments like the massive funds from the consolation of your private home with our AI-powered ProPicks inventory choice software. Study extra right here>>

The rivalry between Boeing (NYSE:) and Airbus Group (OTC:) (EPA:) is not nearly enterprise – it is also taking up diplomatic dimensions.

The spark was ignited by French Finance Minister Bruno Le Maire. Throughout a convention in Berlin, he made it clear that he and his household desire flying Airbus over Boeing saying ‘they prioritize security.’

The minister’s assertion was rooted in issues about Boeing’s most up-to-date debacles, together with incidents like defective doorways this yr and the tragic crashes of two 737 Max planes in 2018 and 2019, which claimed 346 lives.

However Boeing’s troubles aren’t essentially useful for Airbus both. CEO Guillaume Faury intervened to emphasise that technical points affecting Boeing harm the complete aerospace trade’s popularity, stressing that security and high quality are paramount.

Regardless of Faury’s reassurance, Le Maire stays steadfast in his choice for Airbus, particularly given the French authorities’s vital stake within the firm.

This backdrop raises traders a query: Are Airbus shares now a safer wager for traders than Boeing shares? Let’s analyze each shares utilizing information from InvestingPro to search out out.

Benefit from a particular low cost on InvestingPro+. Discover extra particulars on the backside of this text.

Boeing Vs. Airbus: Which Inventory Is the Higher Wager?

5 years in the past, Boeing confronted its greatest scandal ever, which drastically affected its standing out there. In the meantime, its European rival, Airbus, skilled a surge in its inventory worth.

Evaluating information from the previous 5 years, on March 23, 2019, shortly after the second airplane crash involving Ethiopian Airways Flight 302, Boeing’s inventory was priced at $353.69 per share, whereas Airbus shares have been at $124.10 every.

Since then, Boeing’s inventory has virtually halved in worth, dropping to $181 per share as of Monday, March 19. In distinction, Airbus shares have surged by practically 50%, reaching a considerable parity with Boeing at $182 per share.

5 years in the past, there was a stark distinction between the 2 corporations, however right now, Airbus has not solely closed the hole however surpassed Boeing, with a market capitalization of $142 billion in comparison with Boeing’s $110 billion.

Airbus’s inventory is now extra steady than Boeing’s, with current occasions having a considerably damaging impression on Boeing’s monetary well being.

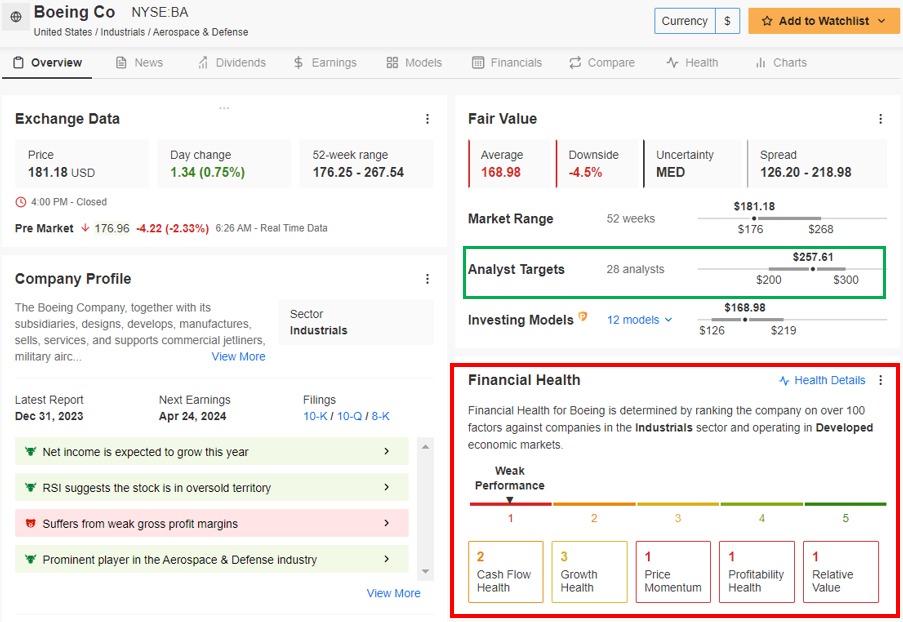

Supply: InvestingPro

The U.S. producer’s efficiency is weak, scoring just one out of 5. In distinction, the European competitor is presently stronger with a rating of three out of 5.

Nevertheless, the State of affairs May Change Going Ahead

Wanting forward, prospects matter extra to markets than previous efficiency.

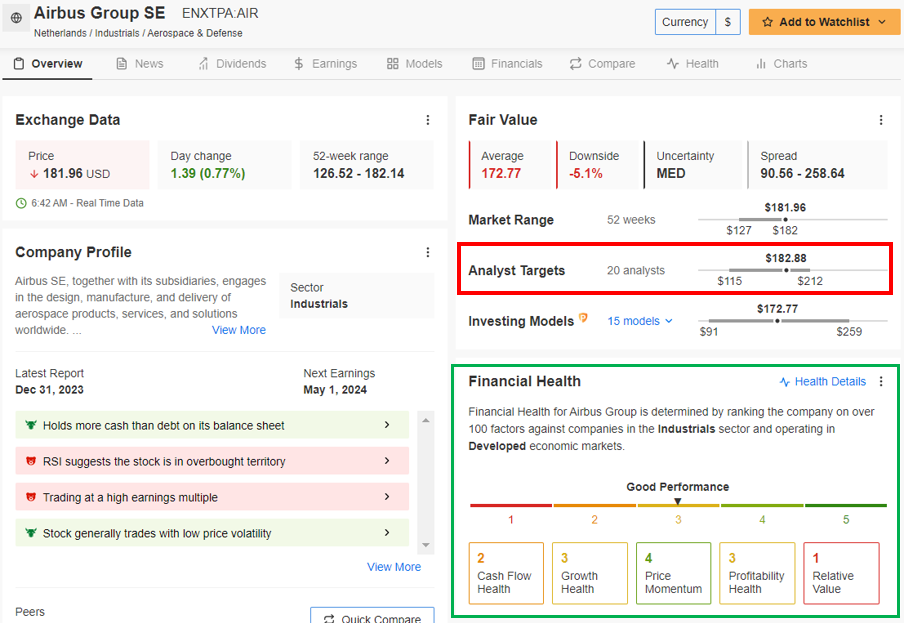

In accordance with 28 analysts surveyed by InvestingPro, Boeing’s shares are believed to be undervalued. The common goal worth is ready at $257.61, which is greater than 42% larger than the closing worth on March 19.

Then again, analysts surveyed by InvestingPro consider that Airbus’ inventory is sort of at its goal worth of $182.88, with solely a slight distinction from the present stage.

Supply: InvestingPro

In brief, InvestingPro’s information clearly reveals that Airbus has capitalized on Boeing’s challenges in recent times, placing it in a greater place than its rival.

Nevertheless, analysts counsel that Boeing’s inventory has better potential for development sooner or later, offered the U.S. firm resolves its issues of safety.

***

Take your investing recreation to the following stage in 2024 with ProPicks

Establishments and billionaire traders worldwide are already properly forward of the sport relating to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,485% over the past decade, traders have the perfect choice of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe At this time!

Keep in mind the ten% low cost on the annual Investingpro+ subscription with the code “proit2024.” Click on on the inexperienced banner above, and when paying, enter the code.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any manner. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link