[ad_1]

Dennis Garrels/iStock Editorial through Getty Photographs

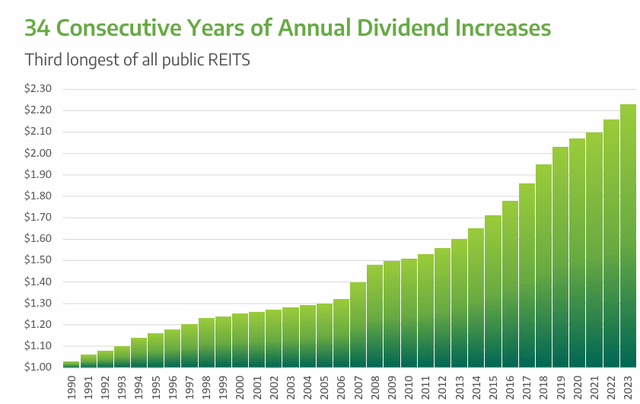

NNN REIT (NYSE:NNN) is a single tenant web lease REIT that develops and acquires retail properties throughout america. Like many web lease REITs, NNN emerged from humble beginnings. NNN was based in 1984 as Golden Corral Realty Company. At that time, the corporate served as a landlord for the restaurant chain, very like Realty Earnings (O) started as a Taco Bell landlord. Over the previous a number of many years, NNN has steadily grown to turn out to be a high tier web lease REIT. NNN has even turn out to be a dividend aristocrat and maintains the third longest streak of annual dividend will increase in the true property sector. As of 2024, NNN has raised its dividend for 34 consecutive years.

NNN REIT

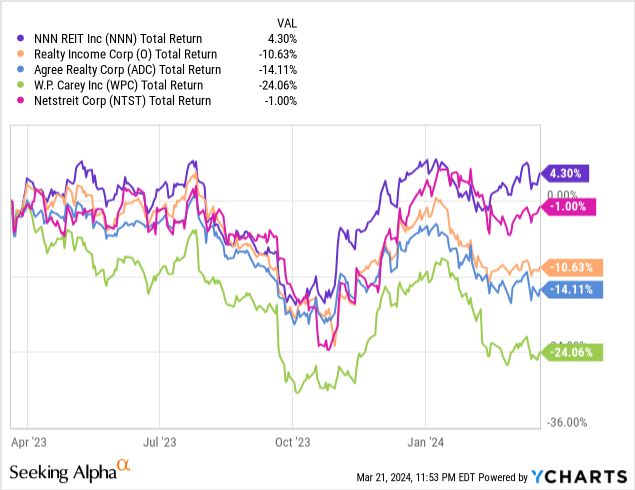

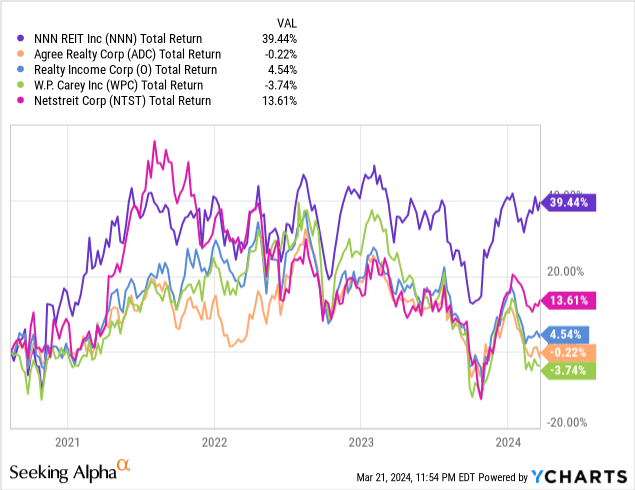

Nonetheless, extra spectacular is NNN’s latest efficiency. NNN has been a sector chief which has earned reward for many years, however solely just lately has NNN begun to outperform friends meaningfully. We’ve mentioned NNN beforehand, cueing in on administration’s dedication to their mission and constant development. Our final protection of NNN was dated December 2021, near the beginning of the rising price setting. In truth, as of our final protection, NNN REIT was known as Nationwide Retail Properties. As we speak, we’ll stack up NNN’s key metrics in opposition to Agree Realty (ADC), Realty Earnings (O), W.P. Carey (WPC), and NETSTREIT (NTST). NNN has outperformed every of those companies over the previous twelve months.

Portfolio

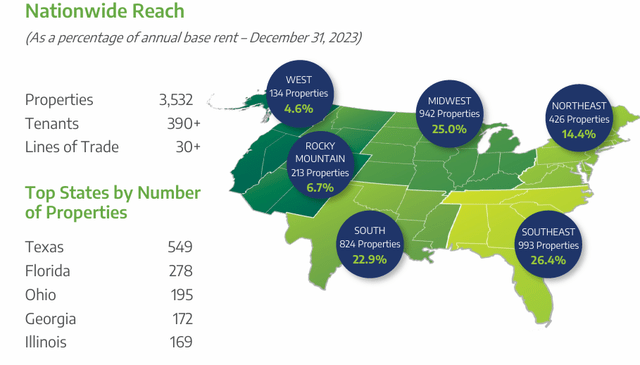

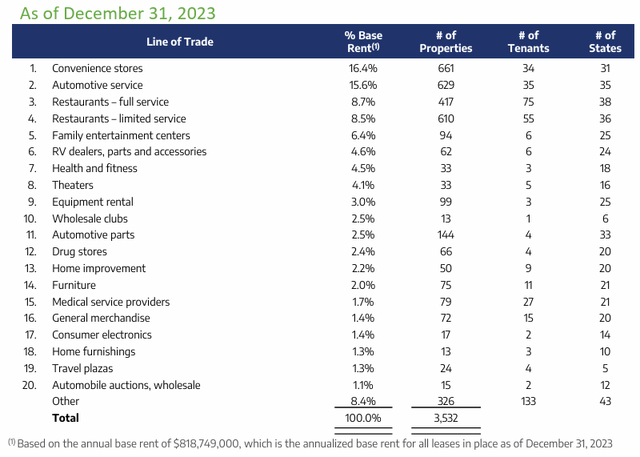

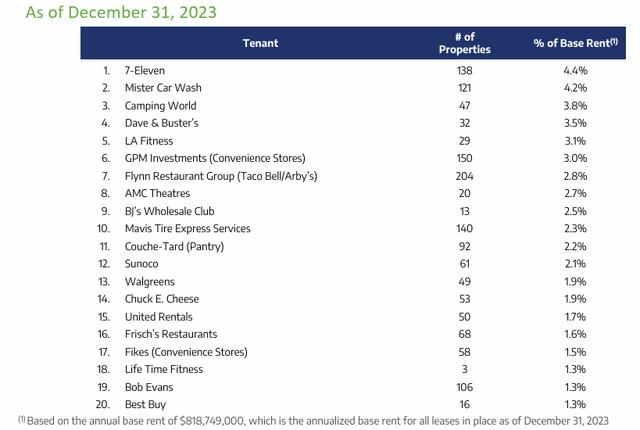

NNN manages a formidable STNL portfolio which has been extensively diversified throughout america and the broad retail sector. As of year-end, NNN owned 3,532 properties positioned in 49 states. These properties are leased to 390 tenants, the highest 20 of which account for practically 50% of portfolio hire.

NNN REIT

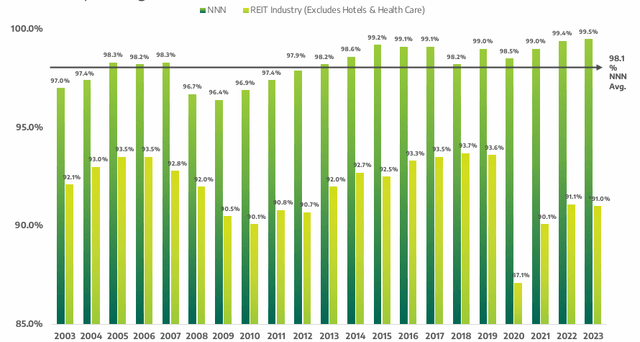

Occupancy has been a historic strongpoint for NNN. The REIT has been in a position to preserve a 98.1% common portfolio occupancy over the previous twenty years, together with the pandemic and the Nice Recession. As we speak, occupancy is even stronger at 99.5%.

NNN REIT

From a sector standpoint, NNN is diversified throughout fashionable retail sectors together with comfort shops (16.4%), automotive service (15.6%), and eating places (17.2% mixed). Collectively, these three sectors account for roughly half of NNN’s annual base hire.

NNN REIT

Lots of NNN’s high tenants are nationally acknowledged manufacturers together with 7-Eleven and LA Health. Given NNN maintains a powerful retail focus, all the high 20 tenants are throughout the retail sector.

NNN REIT

A standard level of criticism is the agency’s low funding in funding grade tenants. NNN invests in what is taken into account “Primary Avenue” actual property. This implies specializing in buildings which have robust elementary features akin to alternative value, location, entry, fungibility, and site visitors counts. The rationale behind this technique being that the tenant shall be simply changed ought to they vacate the property.

In most markets, retail actual property is positioned effectively, that means a alternative tenant would possible be throughout the similar trade. For NNN’s fungible area, this implies fast releasing and minimal concessions for incoming tenants. NNN has confirmed their capacity to handle their portfolio. Between 2007 and 2023, 83% of leases had been renewed with the present tenant. The leasing spreads had been 67% above, 8% at, and 25% beneath in place hire. Moreover, NNN notes hesitancy to capitalize tenant enhancements into future hire funds. Preserving hire decrease within the close to time period results in more healthy leasing spreads down the road.

NNN additionally capitalizes largely on the event and sale leaseback segments. Most of the tenants that NNN targets are sponsored. Given the rise in debt prices, many of those buyers have turned to different financing mechanisms to lift capital or recapitalize their targets. Sale leasebacks have remained considerably disconnected from actions within the treasury, rising slower than the danger free price. This implies sponsors can unlock worth by both promoting property to pay down floating price debt or extract capital. For NNN, this implies a wholesome pipeline of recent alternatives and potential companions.

NNN can also be conservatively capitalized. The agency’s stability sheet consists of unsecured debt (42%) and customary inventory (58%). With a complete enterprise worth of over $10 billion, NNN is significantly smaller than O or WPC, that means particular person acquisitions have a bigger impression on share degree earnings. NNN is rated funding grade by each Moody’s, Baa1, and S&P, BBB+.

Efficiency

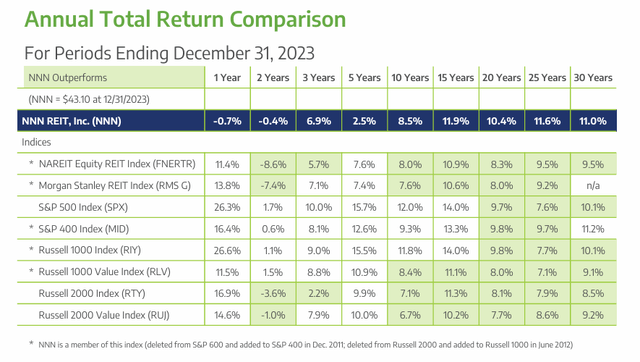

NNN has been an excellent funding for shareholders over the course of many years. By administration’s practically flawless long run execution, NNN has outperformed REIT indices and normal benchmarks over a interval of 20 years. Over the previous 25 years, NNN has outperformed the S&P 500 by 4% yearly.

NNN REIT

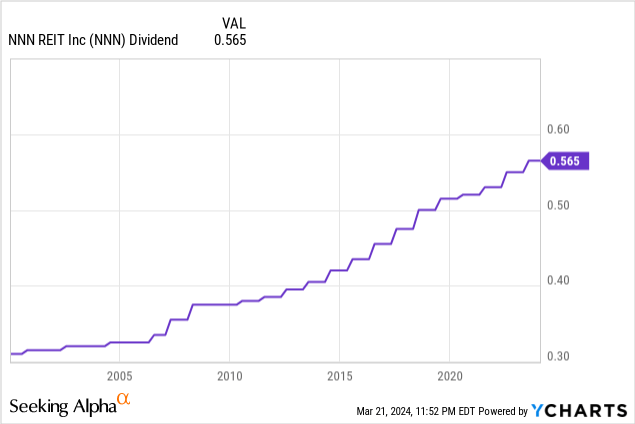

A big part of the success comes from NNN’s steadily rising dividend. As talked about earlier, NNN has efficiently grown the dividend for the previous 34 years, incomes probably the most spectacular dividend histories in actual property. Over many years, NNN has been in a position to compound its dividend in keeping with long run inflation charges of roughly 3%. Since 2004, NNN has averaged 2.92% annual dividend development.

NNN maintains a conservative dividend, leaving important capital contained in the enterprise for future funding. As of 12 months finish, the dividend payout ratio was 68%, that means NNN retains practically one third of capital.

AFFO per share got here in at $3.26 for 2023, a modest 1.6% improve over 2022. Whereas the expansion is anemic, it shines in opposition to a tough setting for web lease REITs the place financing prices have been closely impacted by rate of interest actions.

NNN actively manages their portfolio with an acquisition and disposition platform. Final 12 months, NNN invested $819.7 million in retail properties together with buying 165 new properties. NNN notes a entering into yield of seven.3% on these new acquisitions. On the different finish of the pipeline, NNN disposed of $115.7 million in belongings at a capitalization price of 5.9%. It’s price noting that NNN maintains monetary productiveness by reinvesting proceeds from tendencies at greater yields.

Competitor Comparability

With NNN’s robust efficiency in opposition to the broader sector, let’s open the hood of a number of opponents and examine some key metrics.

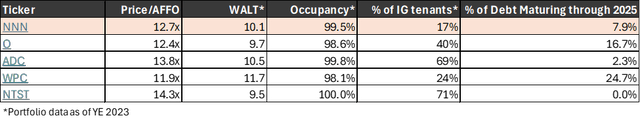

REITer’s Digest, Information from Annual Reviews

AFFO A number of: Primarily based on present share costs, NNN’s AFFO a number of is 12.7x, in direction of the decrease finish of the online lease ecosystem. Over the long run, NNN has maintained a slower development price than opponents akin to O, ADC, or newer NTST. In the course of the prior period of low financing prices, this was a detractor for NNN. As different companies grew aggressively, issuing inventory and debt to fund acquisitions, NNN maintained a extra conservative strategy. Whereas it accounts for NNN’s slower dividend development, it resulted in a extra conservative a number of for NNN. Over the previous two years the place web lease REITs have suffered, NNN exhibited much less room for a number of compression. For shareholders, this meant higher long run efficiency as NNN’s AFFO a number of caught nearer to long run ranges. As of 2021, NNN’s AFFO was $3.06 akin to an AFFO a number of of 15.7x based mostly on year-end share costs. Evaluate this to O’s a number of at that very same time of 17.8x. The larger they’re, the tougher they fall. The conservative valuation offered cowl for NNN’s share value as soon as charges started to rise.

Weighted Common Lease Time period: Web lease REITs sometimes goal long run leases. Accordingly, their weighted common lease phrases are usually lengthy. As a rule of thumb, a WALT over 10 years is usually a constructive signal for a balanced web lease REIT with a wholesome development trajectory. Apparently, every of the 5 REITs in contrast have a WALT of roughly 10 years. Whereas longer is often higher, there isn’t a clear winner amongst the 5.

Occupancy: Occupancy is a important measure of success for a web lease REIT. Occupancy is a marker of the asset administration workforce’s functionality to maintain the portfolio shifting. On this planet of web lease investments, occupancy is an much more important marker. As is widespread data, triple web leases offload the accountability of the three nets (property taxes, upkeep, and insurance coverage) onto the tenant. Nonetheless, if there isn’t a tenant in place, these duties (monetary and in any other case) are returned to the owner. This compounds the impression of a emptiness, because the property is now not producing hire and the tenant is now not overlaying these bills. Portfolio occupancy is usually an underappreciated metric for web lease REITs. NNN’s occupancy price of 99.5% is stellar for a protracted working web lease REIT. Bested solely by ADC as one other long run REIT who has maintained an distinctive occupancy share. NTST has reached 100% occupancy, however the firm is lower than ten years outdated, that means lots of the properties are nonetheless on their unique leases. In distinction, WPC’s occupancy is 98.1% which whereas solely modestly decrease, nonetheless negatively impacts earnings. The upper occupancy for NNN has been a driving power for his or her robust efficiency.

Proportion of Hire from Funding Grade Tenants: IG tenancy is one other important success marker for web lease REITs. Funding grade scores are usually a bellwether for the standard of an organization’s stability sheet and monetary well being. For a web lease REIT, IG tenancy is a straightforward method to peer into the credit score high quality of a portfolio. Within the easiest phrases, extra income from tenants with stronger credit score is healthier. Backing up, web lease REITs are a hybrid funding of credit score and actual property. Web lease REITs put money into properties encumbered by long run leases. These leases are usually assured by the company entity of the tenant or a creditworthy subsidiary. This implies the leases are solely pretty much as good because the creditworthiness of the occupying tenant. NNN clearly trails the pack with solely 17% of annual hire coming from funding grade tenants. Nonetheless, NNN’s give attention to extremely fungible, nicely positioned belongings mitigates the danger of decrease credit score high quality tenants. NNN’s long run occupancy common of 98.1% reveals administration can clearly mitigate credit score dangers and maintain the buildings occupied. Whereas the decrease share of hire coming from funding grade tenants is a threat for NNN, administration’s capacity to mitigate the danger is confirmed. ADC has maintained a considerably greater portion of hire coming from funding grade tenants than NNN or O.

Proportion of Debt Maturing in 2024/2025: Web lease REITs finance their acquisitions with long run, mounted price debt. NNN isn’t any exception, capitalizing their stability sheet with solely two elements, unsecured debt and customary inventory. The simplicity is gorgeous and reduces threat versus extra complicated stability sheets. Will increase to the federal funds price have created important headwinds for web lease REITs. These landlords are starting to refinance into considerably greater rates of interest, inflicting curiosity bills to rise. Nonetheless, some REITs are higher insulated with debt maturities pushed out additional and additional. NNN has solely 8% of debt maturing over the subsequent two years, that means most of their debt will stay in low price debt. ADC and NTST have much less debt maturing over the subsequent two years at 2% and 0%, respectively. Alternatively, O and WPC have considerably extra debt to refinance within the close to time period with 17% and 25%, respectively. NNN stays in the midst of the pack, however general nicely protected. Moreover, NNN was distinctive in inserting a big quantity of debt at lengthy maturities. NN has roughly 15% of debt maturing after 2048.

Conclusion

Having checked out every of those 5 key metrics, we’ll be aware that NNN falls quick in none. Whereas the IG tenancy share lags the sector, it’s in step with NNN’s long run technique and objectives. Shareholders have benefitted strongly from the administration’s give attention to producing long run worth constantly. NNN’s conservative valuation has helped defend shareholder from rising charges and different close to time period threat elements which have adversely impacts REITs.

Whereas O stays sweetheart of most web lease buyers, NNN is an distinctive REIT with an unparalleled monitor report. NNN’s elementary power is on par with ADC, making it one of many high web lease REITs. Sustaining the third longest streak of dividend will increase, NNN has outperformed opponents within the sectors by way of reliability. A conservative payout ratio leaves room for development. Wholesome acquisition and disposition exercise constantly produces worth for shareholders. The conservative valuation has resulted in NNN outperforming friends over the previous twelve months. There’s a lot to love and NNN stays nicely positioned as among the finest managed, however least acknowledged REITs throughout the true property sector.

[ad_2]

Source link