[ad_1]

Up to date on November 2nd, 2023 by Bob Ciura

Month-to-month dividend shares generally is a worthwhile funding choice for these looking for steady earnings since they supply a daily and steady stream of money stream.

Month-to-month dividends, versus quarterly or annual dividends, permit buyers to obtain funds extra usually, which may help to fund dwelling prices or complement different sources of earnings. Month-to-month dividend shares can even enhance returns as a result of buyers can reinvest dividends extra incessantly to extend their wealth over time.

You possibly can see all 80+ month-to-month dividend shares right here.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

On this article, we have a look at the ten month-to-month dividend shares from our Positive Evaluation Analysis Database, with the best 5-year anticipated complete returns.

The shares have been organized in ascending order primarily based on their 5-12 months Anticipated Complete Returns.

Desk of Contents

You possibly can immediately soar to any particular part of the article through the use of the hyperlinks under:

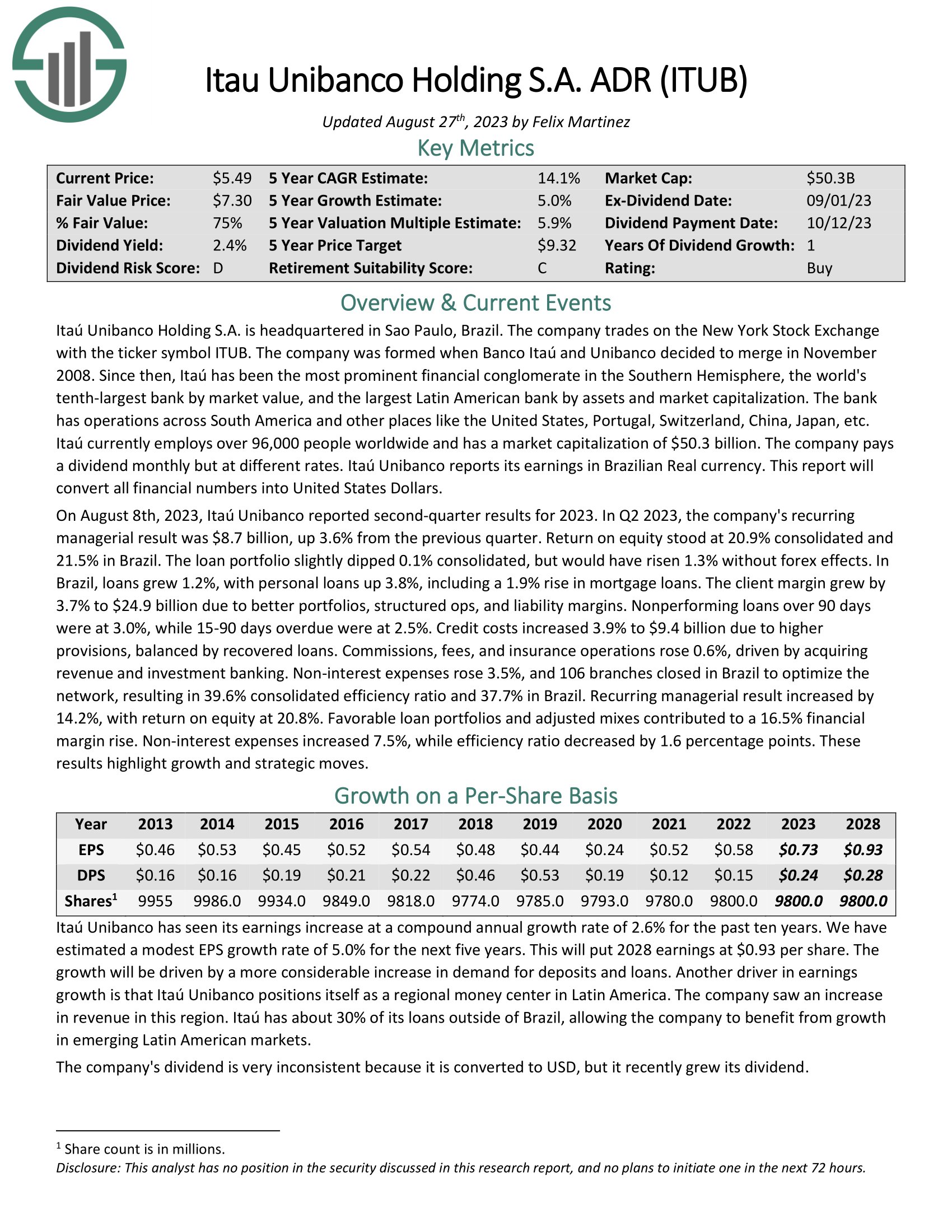

Month-to-month Dividend Inventory #10: Itau Unibanco Holding SA (ITUB)

5-12 months Anticipated Complete Return: 15.7%

Dividend Yield: 4.7%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. Itaú is essentially the most outstanding monetary conglomerate within the Southern Hemisphere, the world’s tenth-largest financial institution by market worth, and the biggest Latin American financial institution by belongings and market capitalization. The financial institution has operations throughout South America and america, Portugal, Switzerland, China, Japan, and extra.

On August eighth, 2023, Itaú Unibanco reported second-quarter outcomes for 2023. In Q2 2023, the corporate’s recurring managerial consequence was $8.7 billion, up 3.6% from the earlier quarter. Return on fairness stood at 20.9% consolidated and 21.5% in Brazil. The mortgage portfolio barely dipped 0.1% consolidated, however would have risen 1.3% with out foreign exchange results.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITUB (preview of web page 1 of three proven under):

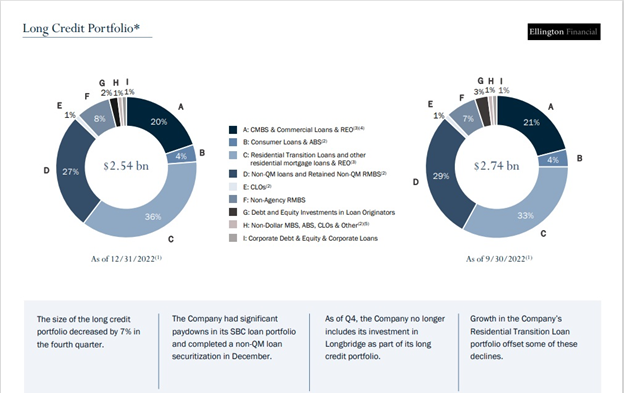

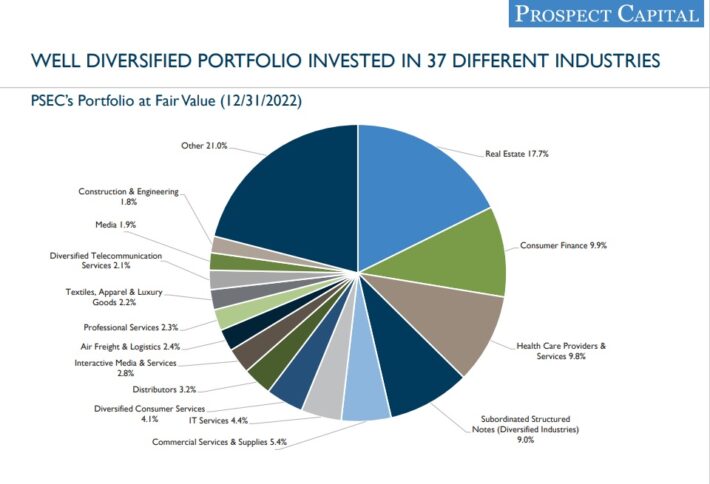

Month-to-month Dividend Inventory #9: Ellington Monetary (EFC)

5-12 months Anticipated Complete Return: 14.5%

Dividend Yield: 14.7%

Ellington Monetary Inc. acquires and manages mortgage, client, company, and different associated monetary belongings within the United States. The corporate acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Moreover, it manages RMBS, for which the U.S. authorities ensures the principal and curiosity funds. It additionally supplies collateralized mortgage obligations, mortgage–associated and non–mortgage–associated derivatives, fairness investments in mortgage originators and different strategic investments.

Supply: Investor Presentation

On August seventh, 2023, Ellington Monetary reported its Q2 outcomes for the interval ending June thirtieth, 2023. As a result of firm’s enterprise mannequin, Ellington doesn’t report any revenues. As an alternative, it information solely earnings. For the quarter, gross curiosity earnings got here in at $88.1 million, up 1% quarter-over-quarter. Adjusted (beforehand known as “core”) EPS got here in at $0.38, seven cents decrease versus Q1-2023.

The decline was primarily as a consequence of increased skilled charges. Ellington’s ebook worth per share fell from $15.10 to $14.70 over the past three months, with its dividends exceeding the underlying earnings. The month-to-month dividend stays at $0.15.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ellington Monetary Inc (EFC) (preview of web page 1 of three proven under):

Month-to-month Dividend Inventory #8: Permianville Royalty Belief (PVL)

5-12 months Anticipated Complete Return: 14.9%

Dividend Yield: 16.7%

Permianville Royalty Belief was integrated in 2011 and relies in Houston, Texas. It operates as a statutory belief and owns a web earnings curiosity representing the best to obtain 80% of the web earnings from the sale of oil and pure fuel manufacturing from properties positioned within the states of Texas, Louisiana and New Mexico.

Permianville Royalty Belief has proved extra susceptible than most royalty trusts to the downturns of the power market. During the last eight years, the entire manufacturing of Permianville Royalty Belief has declined at a mean annual price of 6%. Such a decline price weighs closely on future progress prospects. General, Permianville Royalty Belief is very dangerous and therefore buyers ought to contemplate buying it solely throughout extreme downturns.

Click on right here to obtain our most up-to-date Positive Evaluation report on Permianville Royalty Belief (PVL) (preview of web page 1 of three proven under):

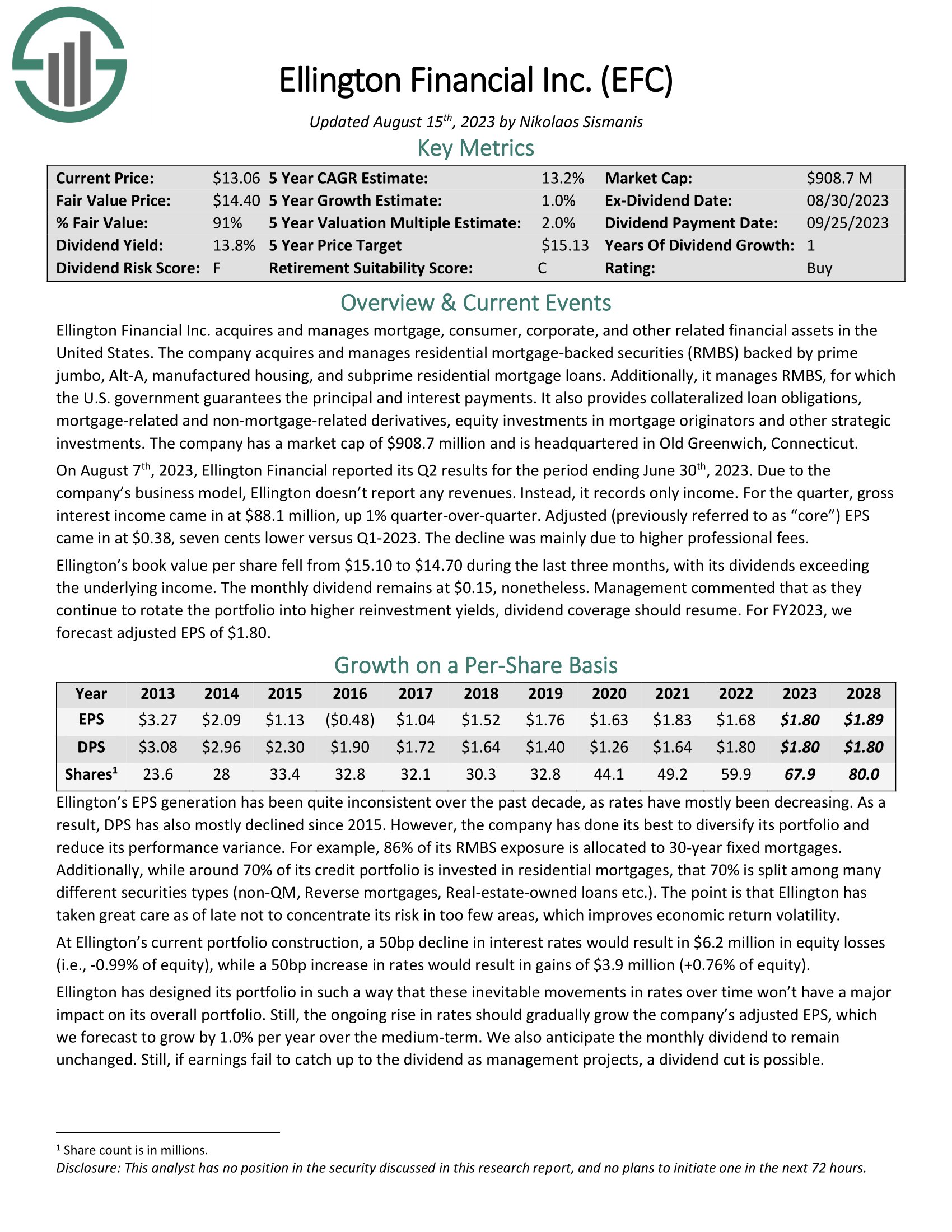

Month-to-month Dividend Inventory #7: Prospect Capital (PSEC)

5-12 months Anticipated Complete Return: 15.7%

Dividend Yield: 14.1%

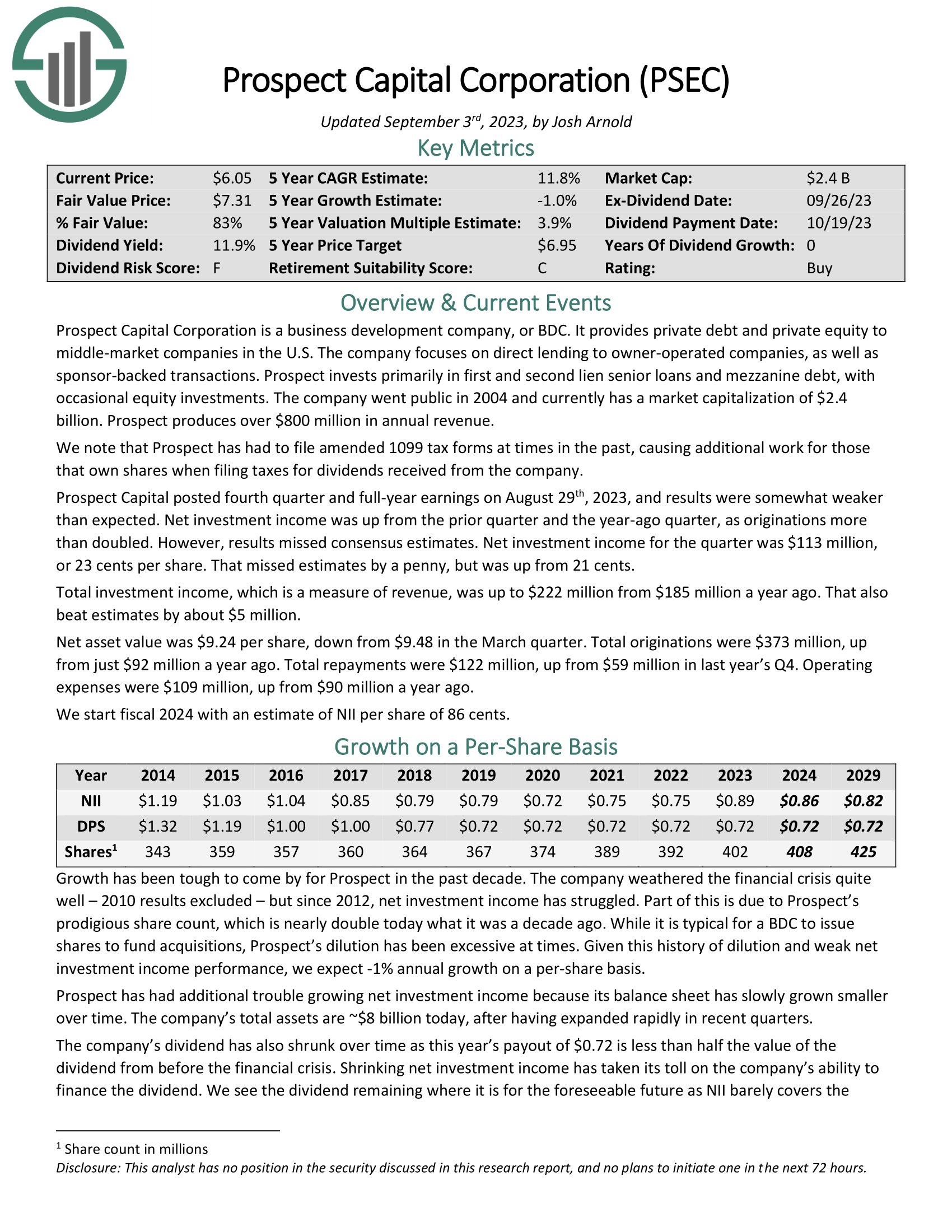

Prospect Capital Company is a Enterprise Improvement Firm, or BDC, that gives personal debt and personal fairness to center–market firms within the U.S. The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect Capital posted fourth quarter and full-year earnings on August twenty ninth, 2023, and outcomes have been considerably weaker than anticipated. Web funding earnings was up from the prior quarter and the year-ago quarter, as originations greater than doubled. Nonetheless, outcomes missed consensus estimates. Web funding earnings for the quarter was $113 million, or 23 cents per share. That missed estimates by a penny, however was up from 21 cents.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven under):

Month-to-month Dividend Inventory #6: Ellington Residential Mortgage REIT (EARN)

5-12 months Anticipated Complete Return: 17.4%

Dividend Yield: 17.8%

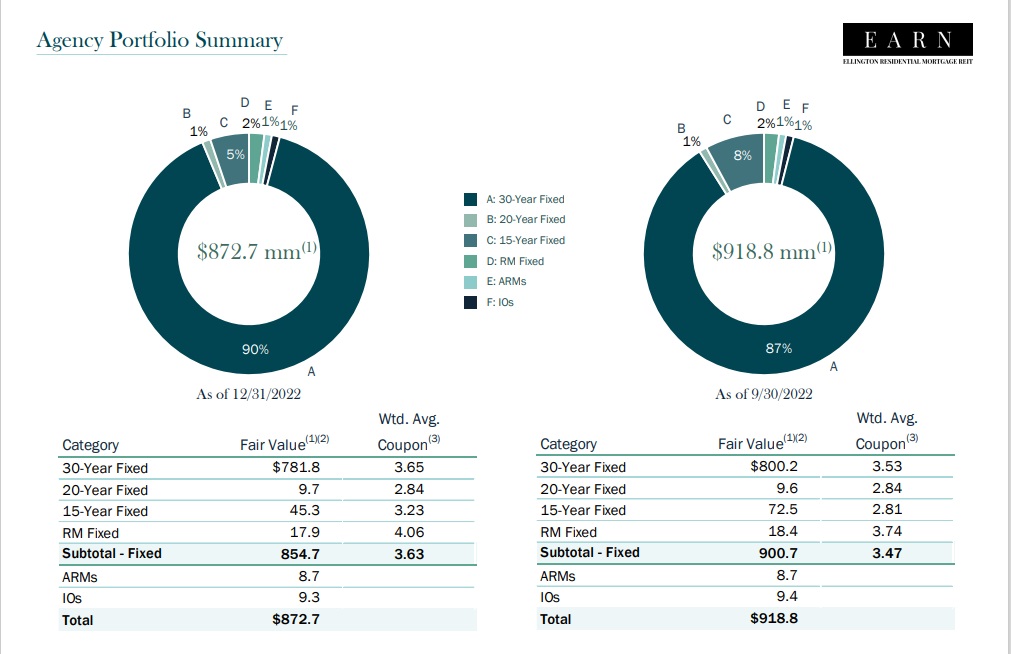

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

Supply: Investor Presentation

On August tenth, 2023, Ellington Residential reported its second quarter outcomes for the interval ending June thirtieth, 2023. The corporate generated web earnings of $1.2 million, or $0.09 per share. Ellington achieved adjusted distributable earnings of $2.4 million within the quarter, resulting in adjusted earnings of $0.17 per share, which doesn’t cowl the dividend paid within the interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

Month-to-month Dividend Inventory #5: AGNC Funding Corp (AGNC)

5-12 months Anticipated Complete Return: 19.5%

Dividend Yield: 18.6%

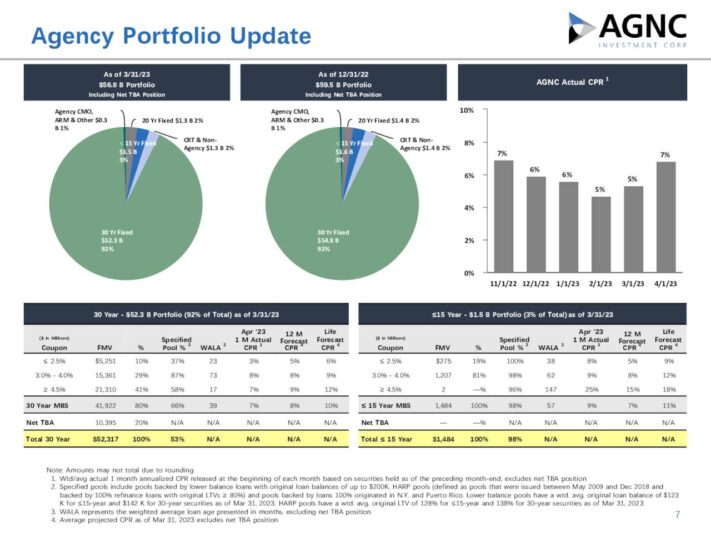

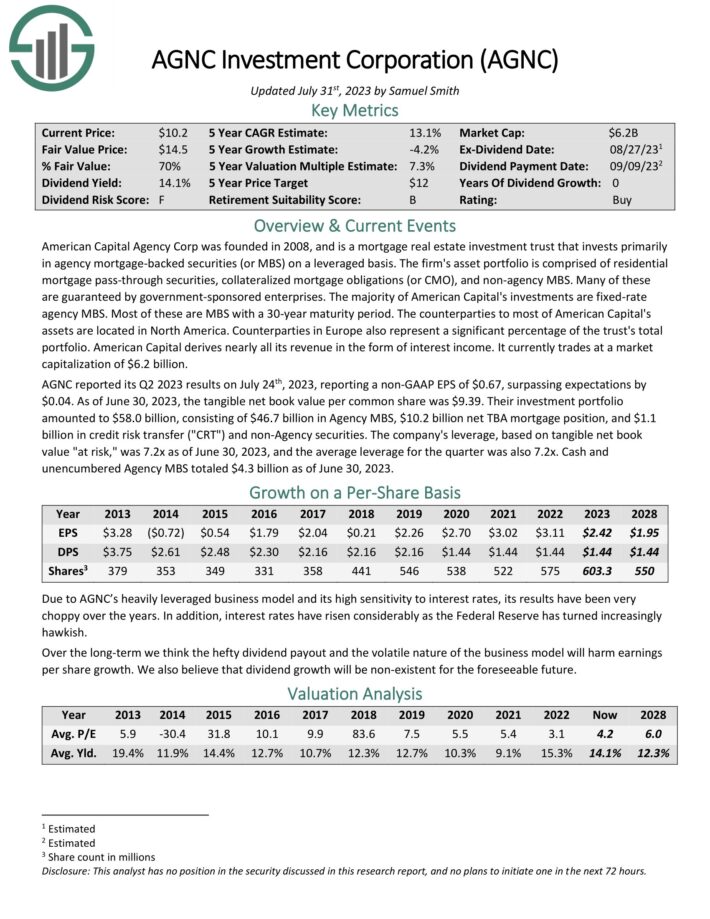

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage go–by way of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

Supply: Investor Presentation

AGNC reported its Q2 2023 outcomes on July twenty fourth, 2023, reporting a non-GAAP EPS of $0.67, surpassing expectations by $0.04. As of June 30, 2023, the tangible web ebook worth per widespread share was $9.39. Their funding portfolio amounted to $58.0 billion, consisting of $46.7 billion in Company MBS, $10.2 billion web TBA mortgage place, and $1.1 billion in credit score threat switch (“CRT”) and non-Company securities.

The corporate’s leverage, primarily based on tangible web ebook worth “in danger,” was 7.2x as of June 30, 2023, and the common leverage for the quarter was additionally 7.2x. Money and unencumbered Company MBS totaled $4.3 billion as of June 30, 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven under):

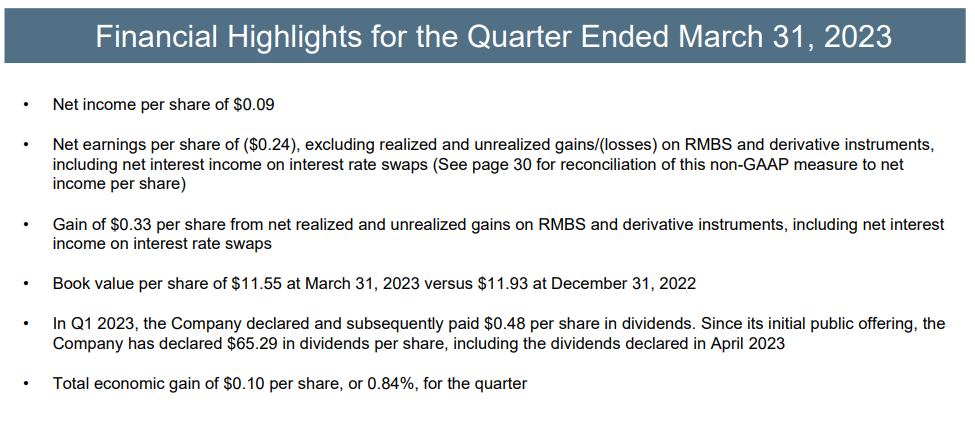

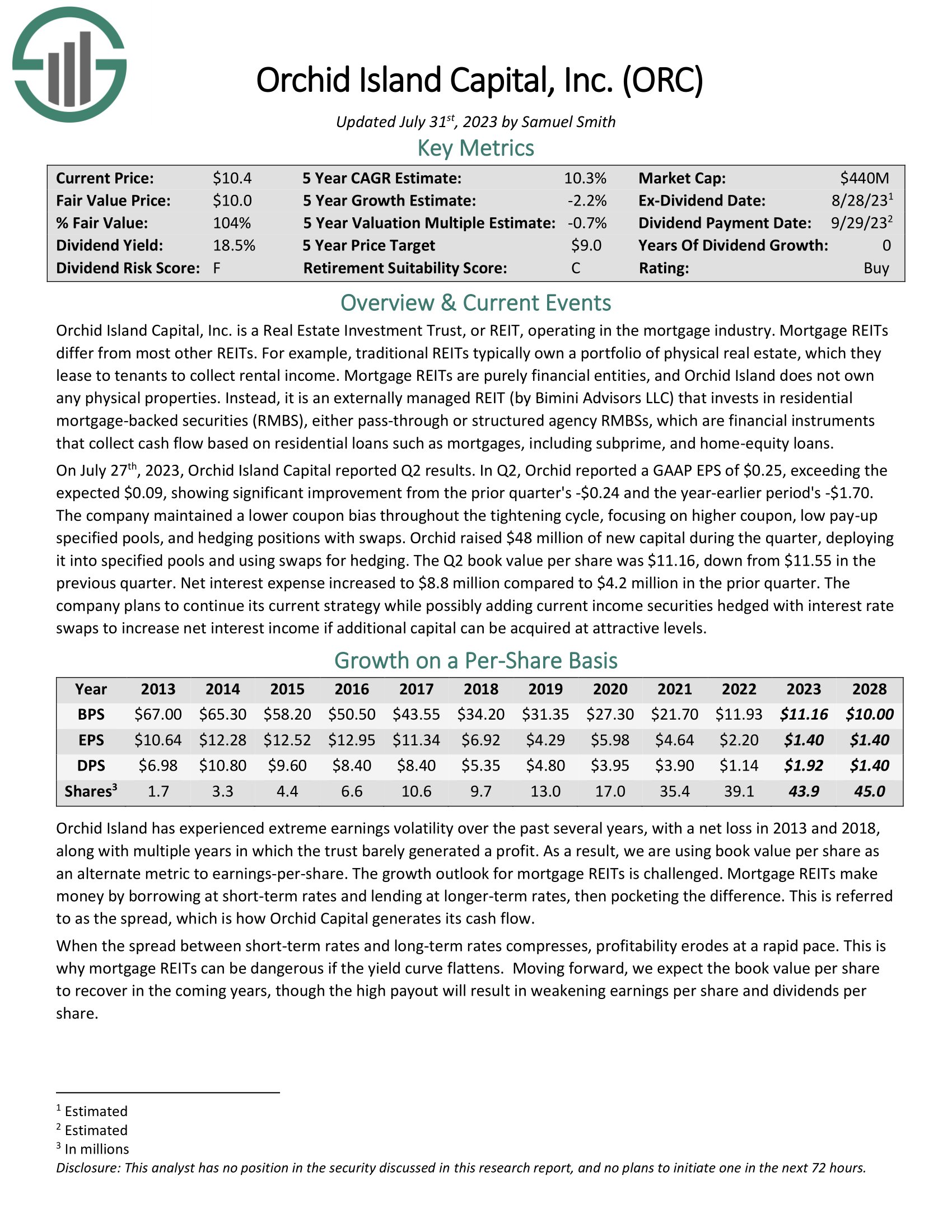

Month-to-month Dividend Inventory #4: Orchid Island Capital (ORC)

5-12 months Anticipated Complete Return: 19.8%

Dividend Yield: 22.2%

Orchid Island Capital, Inc. is an mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs. These monetary devices generate money stream primarily based on residential loans comparable to mortgages, subprime, and home-equity loans.

Supply: Investor Presentation

Orchid Island has skilled important earnings volatility not too long ago, with web losses in 2013 and 2018 and a number of other years the place earnings have been minimal. Wanting forward, the ebook worth per share of Orchid Island is predicted to get better, though the excessive payout will doubtless weaken earnings per share and dividends per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven under):

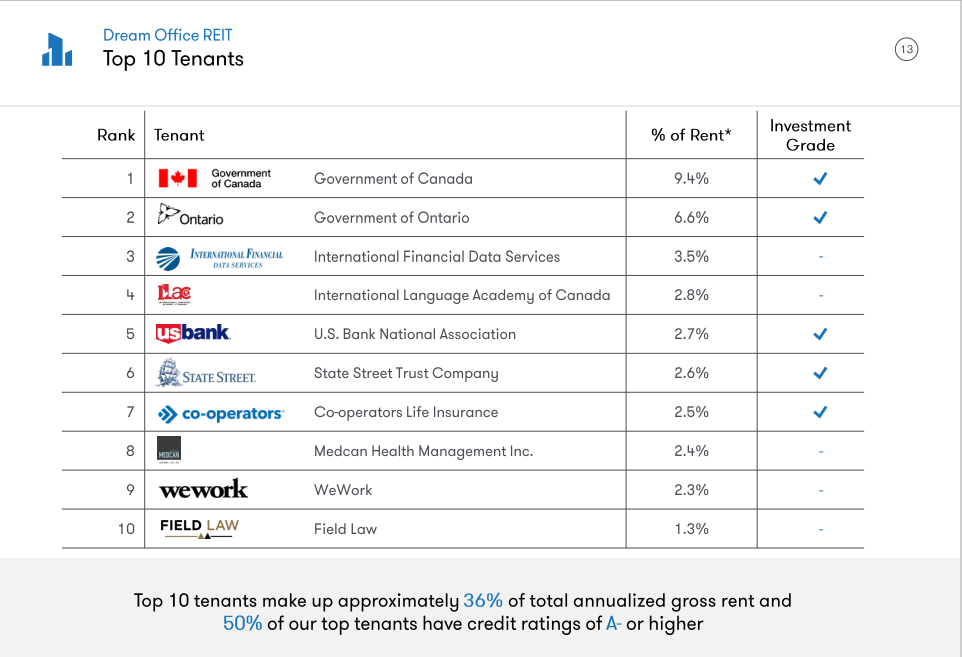

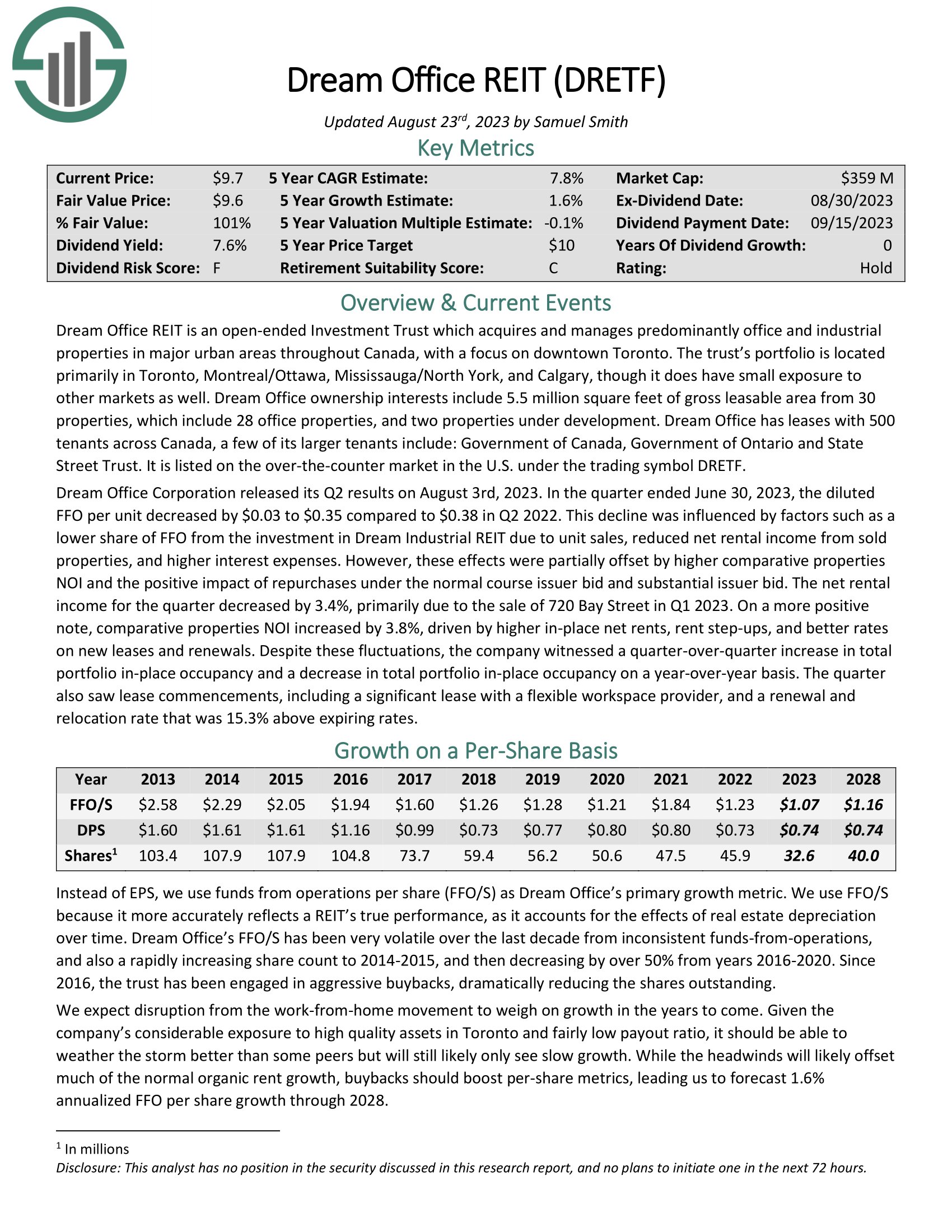

Month-to-month Dividend Inventory #3: Dream Workplace REIT (DRETF)

5-12 months Anticipated Complete Return: 21.1%

Dividend Yield: 13.7%

Dream Workplace REIT acquires and manages predominantly workplace and industrial properties in main city areas all through Canada, with a concentrate on downtown Toronto. The belief’s portfolio is positioned primarily in Toronto, Montreal/Ottawa, Mississauga/North York, and Calgary, although it does have small publicity to different markets as effectively.

Dream Workplace possession pursuits embrace 5.5 million sq. ft of gross leasable space from 30 properties, which embrace 28 workplace properties, and two properties beneath improvement. Dream Workplace has leases with 500 tenants throughout Canada, a couple of of its bigger tenants embrace: Authorities of Canada, Authorities of Ontario and State Avenue Belief.

Supply: Investor Presentation

Dream Workplace Company launched its Q2 outcomes on August third, 2023. Within the quarter ended June 30, 2023, the diluted FFO per unit decreased by $0.03 to $0.35 in comparison with $0.38 in Q2 2022. This decline was influenced by a decrease share of FFO from the funding in Dream Industrial REIT as a consequence of unit gross sales, lowered web rental earnings from bought properties, and better curiosity bills.

Comparative properties NOI elevated by 3.8%, pushed by increased in-place web rents, hire step-ups, and higher charges on new leases and renewals.

Click on right here to obtain our most up-to-date Positive Evaluation report on DRETF (preview of web page 1 of three proven under):

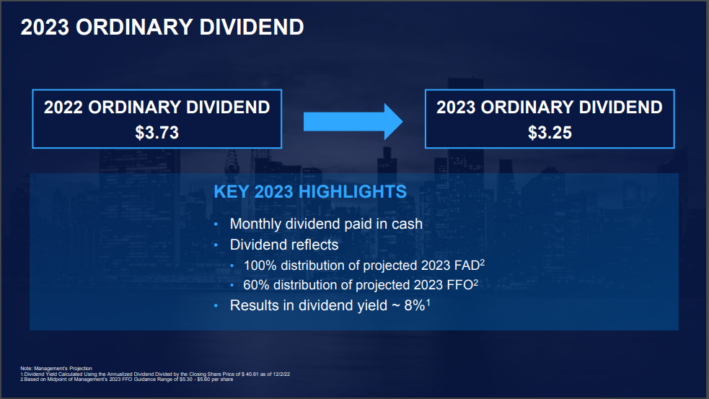

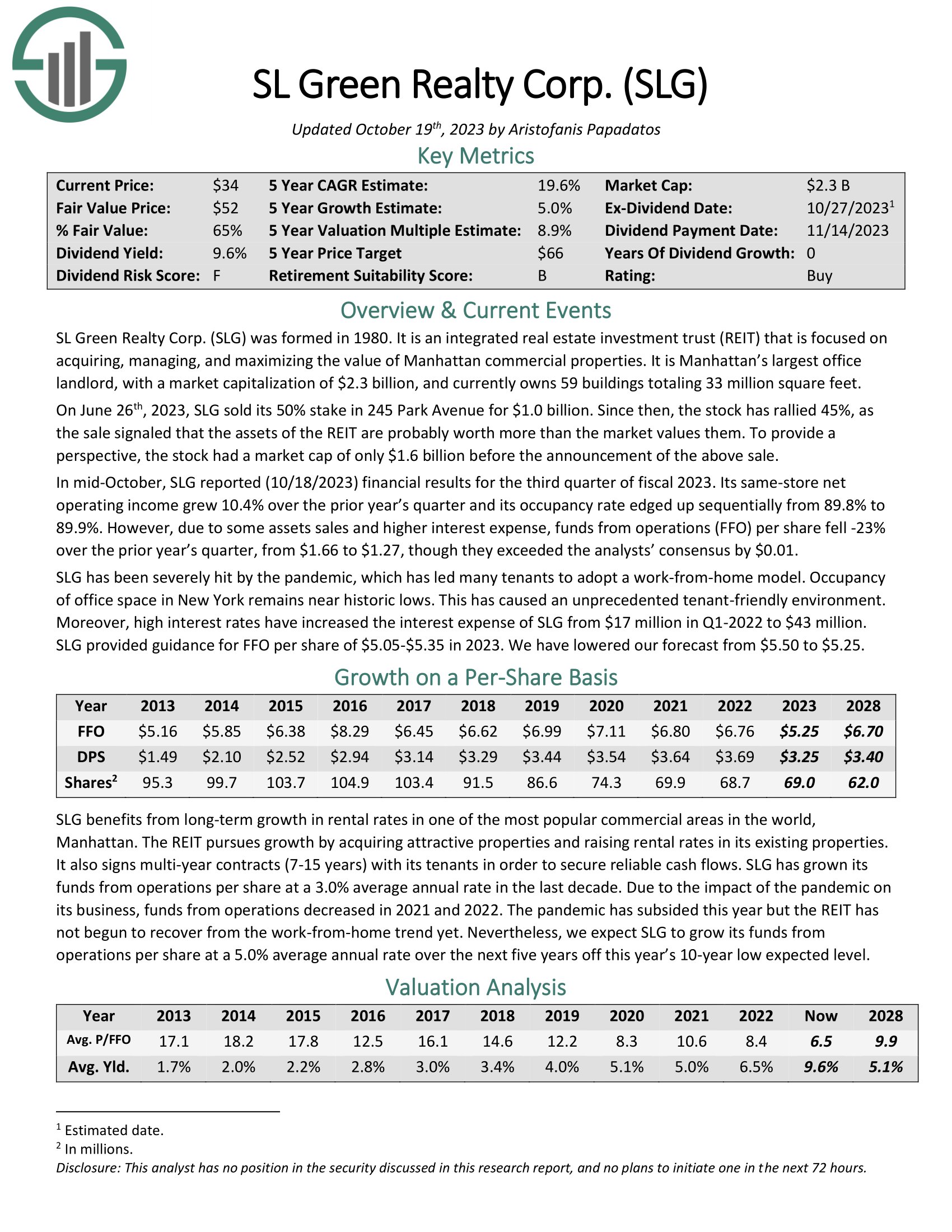

Month-to-month Dividend Inventory #2: SL Inexperienced Realty Corp. (SLG)

5-12 months Anticipated Complete Return: 23.1%

Dividend Yield: 11.1%

SL Inexperienced is a self-managed REIT that manages, acquires, develops, and leases New York Metropolis Metropolitan workplace properties. In actual fact, the belief is the biggest proprietor of workplace actual property in New York Metropolis, with nearly all of its properties positioned in midtown Manhattan. It’s Manhattan’s largest workplace landlord, with 60 buildings totaling about 33 million sq. ft.

Supply: Investor Presentation

In mid-October, SLG reported (10/18/2023) monetary outcomes for the third quarter of fiscal 2023. Its same-store web working earnings grew 10.4% over the prior yr’s quarter and its occupancy price edged up sequentially from 89.8% to 89.9%. Nonetheless, as a consequence of some belongings gross sales and better curiosity expense, funds from operations (FFO) per share fell -23% over the prior yr’s quarter, from $1.66 to $1.27, although they exceeded the analysts’ consensus by $0.01.

Click on right here to obtain our most up-to-date Positive Evaluation report on SL Inexperienced Realty Corp. (SLG) (preview of web page 1 of three proven under):

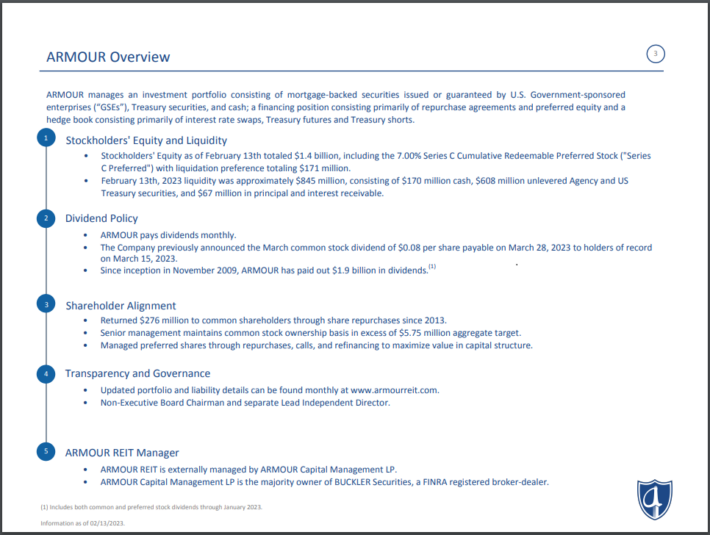

Month-to-month Dividend Inventory #1: ARMOUR Residential REIT Inc (ARR)

5-12 months Anticipated Complete Return: 31.2%

Dividend Yield: 31.7%

As an mREIT, ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) comparable to Fannie Mae and Freddie Mac. It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate dwelling loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different varieties of investments.

Supply: Investor Presentation

ARMOUR reported Q2 outcomes on July twenty sixth, 2023. The corporate reported a non-GAAP EPS of $0.23, lacking expectations by $0.03. The online curiosity earnings was $5.8 million, with an asset yield of 4.24% and a web value of funds of two.49%, leading to a web curiosity margin of 1.75%. The corporate paid widespread inventory dividends of $0.08 per share per 30 days.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

Last Ideas

Month-to-month dividend shares could be an interesting choice for buyers searching for a constant earnings stream, whether or not for assembly day by day wants or common compounding. Whereas no funding is risk-free, some month-to-month dividend shares have a monitor report of economic stability, regular profitability, and constant dividend funds.

Our checklist of the ten greatest month-to-month dividend shares introduced on this article contains firms from a wide range of industries that rank excessive primarily based on our 5-year anticipated complete return forecasts.

Whereas all the businesses on this checklist have robust anticipated complete returns, a few of them have beforehand minimize their dividend or pay distributions primarily based solely on how a lot they generate yearly. Nearly all of them have a dividend threat rating of F in our Positive Evaluation Analysis Database. In consequence, particular person buyers should carry out their due diligence earlier than making funding choices.

In case you are involved in discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets will likely be helpful:

Month-to-month Dividend Inventory Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link