[ad_1]

ra2studio

The UK primarily based personal fairness firm 3i Group (OTCPK:TGOPF) has had an excellent previous 12 months with an 83% rise in share value. However its upward climb is hardly only a function of the previous 12 months. Over the previous 5 years, it is up 3x. And that’s not all. It pays a dividend too. Prior to now 12 months alone, the whole returns at 88% are 5 proportion factors larger than the worth returns.

The plain query now could be whether or not its value rise can proceed, particularly retaining in thoughts its heavy publicity to the buyer sector, which is mentioned extra intimately right here.

Shopper sector targeted investments

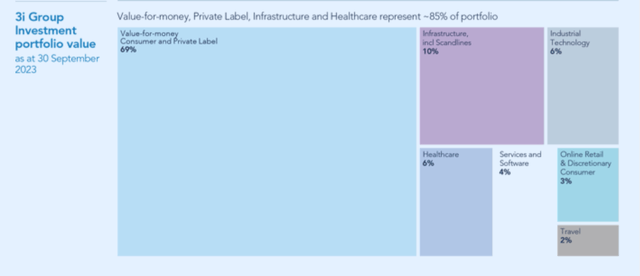

In precept, the fund invests in corporations throughout sectors. Nevertheless, it is onerous to disregard that 69% of its investments as of September 30, 2023 have been within the shopper sector. A lot of this funding in flip is in Motion, the Dutch non-food low cost retailer, which had a 63.5% share throughout the identical time. It additionally has an considerable curiosity in infrastructure investments (see chart under).

Supply: 3i Group

Monetary efficiency stays resilient

By way of efficiency, 3i is mainly in good condition. In its transient enterprise replace launched final week, the corporate updates on Motion’s sturdy monetary well being and in addition provides that “The remainder of the 3i portfolio continues to exhibit total resilience with the vast majority of corporations exhibiting good momentum into 2024.”.

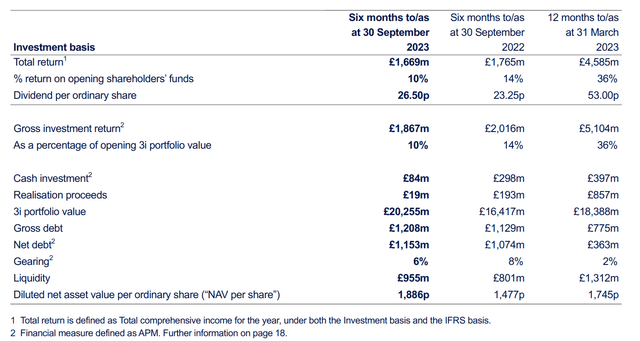

This, then is an extension of the final consequence replace obtainable for the half-year ending September 30, 2023 (H1 FY24). The entire return or web earnings as a proportion of shareholders’ funds continued to stay in double digits, at 10%, though they slowed down a bit from final 12 months (see desk under). At first look, the 5.4% YoY decline in web earnings seems regarding however seems that it’s because of overseas alternate translation and never for any elementary causes.

The portfolio worth has additionally seen a wholesome enhance of 23.4% year-on-year (YoY). The gearing ratio, which is the corporate’s web debt-to-assets ratio has additionally improved to six% from an already wholesome 8% in H1 FY23.

Key Financials, H1 FY24 (Supply: 3i Group)

Motion’s spectacular progress

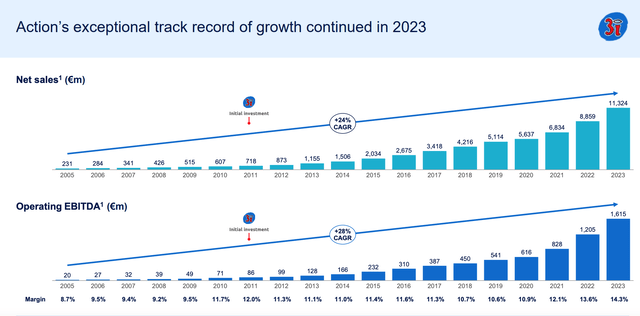

To get understanding of what’s subsequent for 3i, it’s important to take a more in-depth take a look at Motion’s efficiency, on which it’s critically dependent. The retailer too, provides no causes to fret. Between 2005 and 2023, it has seen its web gross sales compounded annual progress price [CAGR] at 24%. Additional, prior to now 5 years, its common web gross sales progress of twenty-two% far exceeds the 12% common for its friends. 2024 has additionally began on a robust observe, with like-for-like gross sales progress of 21% YoY for the primary 11 weeks of the 12 months.

The corporate’s working EBITDA has additionally been rising since 2005 at a CAGR of 28% as much as 2023. With quicker working EBITDA progress in comparison with web gross sales, the margin expanded to 14.3% from 8.7% in 2005. It has additionally improved from the ten.7% even 5 years in the past (see chart under). Motion additionally anticipates touching a 15% margin by 2026.

Supply: 3i Group

Think about the dividend yield on price

With a stable efficiency in H1 FY24, the corporate additionally elevated its dividends by 14% YoY. Whereas the prospects look good for the total 12 months too, even when it will increase them on the identical price for the total 12 months FY24, the dividend yield would nonetheless be considerably underwhelming at 1.9%, nonetheless. That is barely decrease than the TTM yield of two%. However as identified in the beginning, the gentle dividend yield obfuscates the influence of passive beneficial properties from the inventory over time.

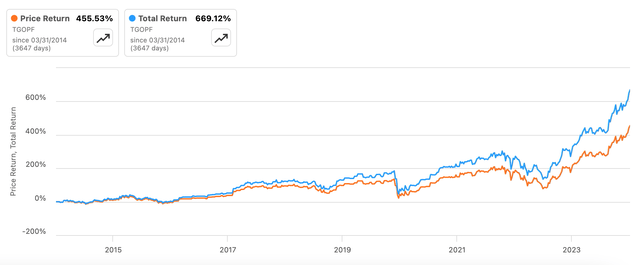

Think about this. The yield on price for an funding made in 3i 5 years in the past is 5.25% and 10.4% on an funding made 10 years in the past. Furthermore, over the previous decade, the whole returns on the inventory have been 214 proportion factors larger than simply the worth returns, that are fairly good in their very own proper (see chart under).

Worth and Complete Returns, 10y (Supply: Searching for Alpha)

The market multiples

Additional, the inventory’s market multiples look good too. Assuming that the overseas alternate traits stay unfavourable for the total 12 months FY24, like in H1 FY24, the web earnings will drop. Nevertheless, the ahead GAAP price-to-earnings (P/E) ratio nonetheless is available in at a low 6.2x, which compares effectively with its friends.

For instance, Blackstone (BX), the most important publicly listed personal fairness fund by market capitalisation, has a corresponding ratio of 25.6x. However even smaller funds by market capitalisation than 3i, like TPG (TPG), have a a lot larger ahead P/E at 22.1x. This means that there continues to be a major upside forward for 3i.

On the identical time, the NAV per share can also be price contemplating. If the quantity continues to develop by 27.7% YoY for the total 12 months FY24, the identical as in H1 FY24, the determine could be at GBP 22.3. Nevertheless, the 3i inventory is buying and selling at a 26% premium to this stage in its house itemizing on the London Inventory Change. This could usually put up a danger to its value now, however the inventory hasn’t been deterred by it within the current previous. Actually, it has constantly traded at a snug premium to NAV over the previous 12 months.

Heavy Motion funding poses a macro danger

What does pose a possible danger is its funding in Motion. It has labored out very effectively for 3i prior to now however the massive publicity to it renders the fund susceptible too. The danger comes from the challenged macroeconomic well being of Europe. Though it has pursuits throughout massive European nations like France and Germany, moreover the Netherlands, which may steadiness out its efficiency, it is onerous to disregard the eurozone’s weak progress as such. GDP barely grew within the ultimate quarter of 2024, by simply 0.1% YoY.

Some enchancment is predicted in 2024 to 0.8% as per the European Fee, however even that is pretty low progress. It’s not till 2025 that progress is predicted to enhance to 1%+ charges. Some extra respite is feasible as inflation comes off drastically to 2.7% this 12 months from 5.4% final 12 months. However the important thing level right here is that the economic system isn’t out of the woods but. As a shopper firm, Motion is vulnerable to being impacted. And by extension so is 3i.

What subsequent?

Nevertheless, it does need to be acknowledged that the chance to Motion in 2024 is already lowered from final 12 months. Which means there’s likelihood that it may possibly proceed to carry out this 12 months, as already evidenced in its gross sales for the primary 11 weeks of the 12 months. This bodes favourably for 3i, which too, has seen an honest whole return for H1 FY24, even because it has seen a web earnings contraction from final 12 months because of unfavourable alternate price dynamics.

Even when the web earnings for the total 12 months continues to say no on the identical price as that seen in H1FY24, the inventory’s ahead GAAP P/E ratio nonetheless seems to be good, although, compared to friends. Furthermore, its dividends add up considerably over time though its sustained value rise has stored the dividend yield low. It is also of consolation that the inventory usually trades at a premium to its NAV per share, as it’s doing now.

On steadiness, I consider the positives for 3i outweigh the dangers. I’m going with a Purchase score on it.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link