[ad_1]

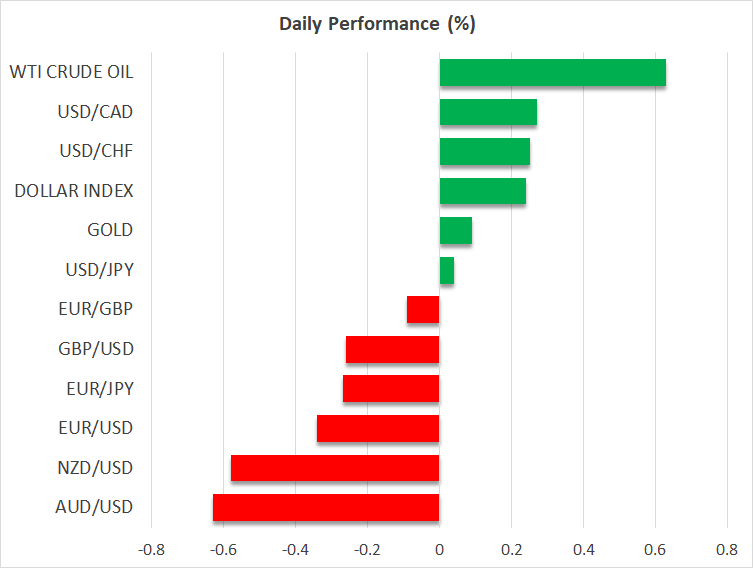

Greenback features as Waller alerts patienceThe US greenback completed Wednesday barely increased towards all however one in every of its main friends and continues to commerce on the entrance foot on Thursday as effectively. The one forex versus which it misplaced floor yesterday was the Japanese yen.

Greenback features as Waller alerts patienceThe US greenback completed Wednesday barely increased towards all however one in every of its main friends and continues to commerce on the entrance foot on Thursday as effectively. The one forex versus which it misplaced floor yesterday was the Japanese yen.

The dollar began the day on a comparatively quiet observe however feedback by Fed Governor Christopher Waller after Wall Road’s closing bell added some gasoline to the forex’s engines. Waller mentioned that the latest disappointment in inflation numbers confirms the case for the Fed to attend for some time earlier than urgent the speed lower button.

Waller’s remarks appear contradictive to Powell’s view on the press convention following final week’s determination, the place he mentioned that latest excessive inflation readings had not modified the narrative of slowly easing value pressures, and thereby aren’t a purpose to change the Committee’s plans.

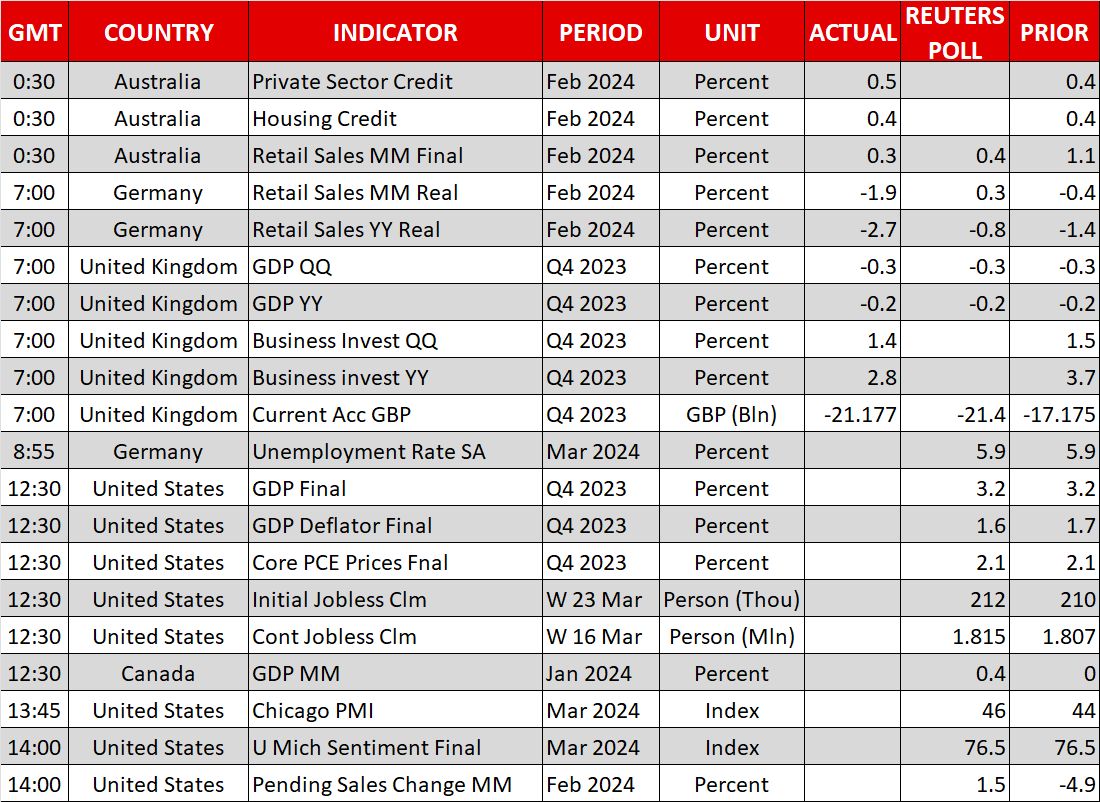

Provided that Waller was the primary amongst Fed policymakers to speak about fee cuts, buyers took his phrases significantly and lifted their implied path considerably. In line with Fed fund futures, the likelihood of a June lower slid to round 68%, whereas the overall variety of foundation factors price of fee reductions by the top of the yr got here right down to 75, matching as soon as once more the Fed’s personal projections.

The following large check for Fed expectations and the US greenback could also be tomorrow’s core PCE index, which is the Fed’s favourite gauge. Though Powell has already talked about that the stickiness in latest inflation knowledge isn’t a purpose for the Fed to carry its hearth, Waller’s opinion provides further significance to tomorrow’s knowledge.

One other spherical of knowledge pointing to stickier-than-previously-expected inflation might additional weigh on the likelihood of a June fee lower and thereby additional assist the greenback.

Japanese authorities able to interveneThe yen was the one main forex towards which the greenback misplaced floor yesterday, with the as soon as secure haven gaining after Japan’s three important financial authorities – the Financial institution of Japan, the Finance Ministry and Japan’s Finance Companies Company – held a gathering late in Tokyo buying and selling hours to debate the slide within the yen and advised that they have been able to intervene available in the market to cease speculative strikes.

Greenback/yen was buying and selling in a consolidative method barely beneath 152.00 forward of the assembly with the announcement pushing the value right down to 151.00. Though the pair rebounded barely later, it remained unaffected at this time by the BoJ’s abstract of opinions, which confirmed that finally week’s gathering, policymakers highlighted the necessity to proceed slowly and step by step in phasing out ultra-loose financial coverage.

That mentioned, though yen sellers could also be reluctant to push greenback/yen past 152.00, this might nonetheless occur if the greenback receives gasoline by tomorrow’s PCE knowledge. Such a break might ring the intervention alarm bells louder.

Wall Road trades within the inexperienced, gold shinesOn Wall Road, all three of its important indices closed within the inexperienced, with the Dow Jones gaining essentially the most and the S&P 500 securing a brand new closing report. The Nasdaq gained the least, maybe dragged down by Nvidia (NASDAQ:), which closed within the pink for a second straight session.

Extra knowledge suggesting that inflation within the US is proving stickier than anticipated might weigh on Wall Road, however any PCE-related retreat is unlikely to result in a long-lasting decline. Even when delayed, the following transfer on US rates of interest is prone to be decrease, which is constructive for companies which can be valued by discounting free money flows for the quarters and years forward, whereas latest exercise has proven that buyers are keen to cost extra future development alternatives associated to synthetic intelligence.

Gold additionally traded increased yesterday, regardless of the restoration within the US greenback. Maybe it’s because central banks proceed with elevated shopping for exercise in an try and diversify their forex reserves. This implies that even when the valuable steel is dragged down by a higher-than-expected core PCE fee tomorrow, the slide might show to be restricted and short-lived.

[ad_2]

Source link