[ad_1]

Lately, fast technological developments are the hallmark of the trendy monetary world. On this context, Nvidia (NASDAQ:)’s vital ascent within the synthetic intelligence (AI) sector indicators each development and cautious optimism. As Nvidia’s market valuation reaches unprecedented heights because of AI breakthroughs, the situation begs comparability to historic market cycles, however with one essential exception. Whereas harking back to the speculative frenzy typical of the dot-com bubble, this phenomenon is characterised by its fundamentals constructed on tangible innovation and stable monetary efficiency.

This text seeks to delineate the wonderful line between real technological progress of AI and speculative funding, asking whether or not the present enthusiasm is the daybreak of a brand new technological period or a mirrored image of previous monetary exuberance in a brand new guise.

Nvidia’s Definitive Edge within the AI Market Growth

Within the up to date tapestry of technological development, Nvidia has emerged as a cornerstone of the AI revolution, marking a big departure from the speculative dynamics of the dot-com period.

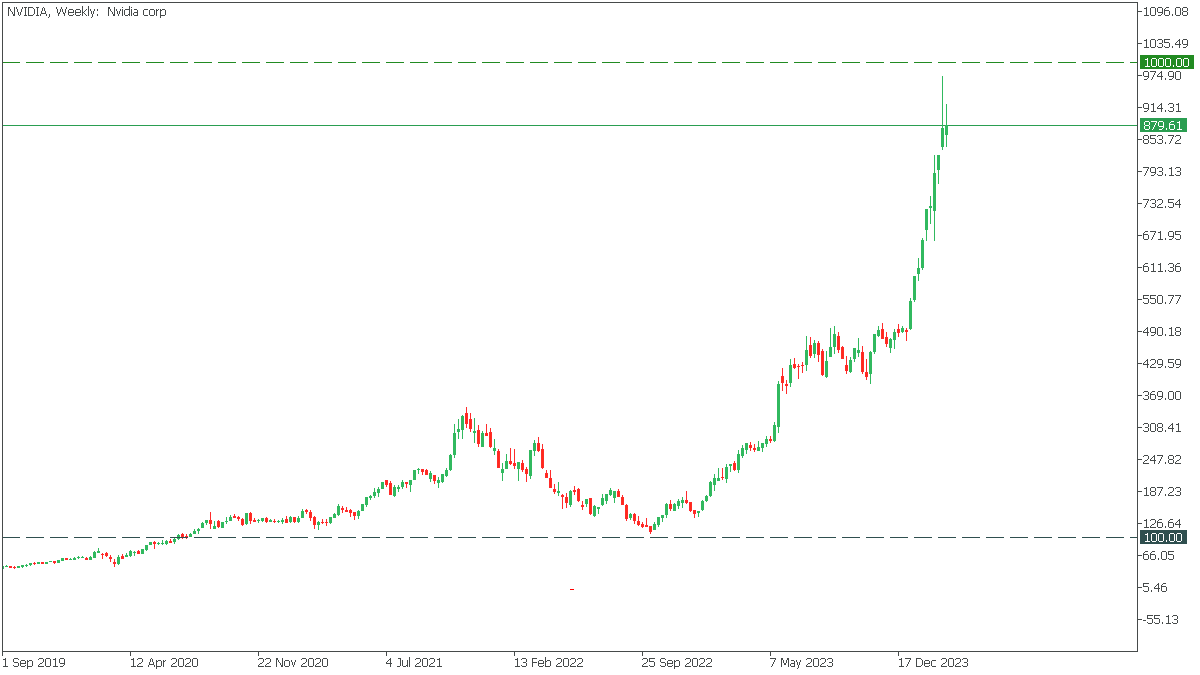

Nvidia’s transition from a specialised graphics processor producer to a pivotal determine in AI has redefined its market trajectory and monetary efficiency. The corporate reported an exponential 206% year-over-year enhance in its third-quarter income for 2024, reaching $18.12 billion, with web earnings escalating to $9.243 billion. The momentum continued unabated into the fourth quarter, with income surging to $22.1 billion, marking a 265% enhance from the previous 12 months. Such monetary milestones underscore Nvidia’s profitable exploitation of the AI growth, setting it other than the ephemeral successes of the dot-com bubble’s protagonists.

The strategic foresight of Nvidia is obvious in its growth into the customized AI chips market, focusing on a burgeoning $30 billion sector and securing its place as an indispensable ally to tech behemoths like Amazon (NASDAQ:), Meta (NASDAQ:), and Google (NASDAQ:). This diversification consolidates Nvidia’s dominance in AI and displays its ambition to spearhead the revolution throughout a number of domains. In consequence, Nvidia’s market capitalization has catapulted past the $2 trillion mark, positioning it because the third most useful firm on Wall Avenue.

Nvidia, Weekly Timeframe

Nvidia’s rise has not solely marked it as a standout performer but additionally considerably swayed very important indexes just like the S&P 500, to which it contributed greater than 1 / 4 of the 4% acquire recorded earlier this 12 months, resulting in file highs for the index.

Whereas harking back to the dot-com period’s speculative exuberance, the present enthusiasm surrounding Nvidia and the broader AI market essentially differs. Investments in ventures with unproven fashions and unsure futures marked the dot-com bubble. In distinction, at this time’s market is buoyed by improvements with exact functions and strong financials, reflecting a extra mature and discerning funding panorama. Nonetheless, the potential for speculative extra stays, significantly with the prospect of Federal Reserve price cuts.

The AI Surge vs. The Dot-Com Bubble

The trajectory of Nvidia amidst the burgeoning AI revolution contrasts the speculative atmosphere of the dot-com period, significantly when analyzing crucial monetary metrics and market dynamics.

With income reaching $18.12 billion and web earnings ballooning to $9.243 billion, Nvidia’s monetary milestones in fiscal 2024 underscore a sustainable development mannequin. This period, outlined by speculative funding in web startups with scant income or viable enterprise fashions, is a far cry from at this time’s market. AI-driven firms like Nvidia are evaluated primarily based on substantial technological developments, stable earnings, and expansive market functions.

A crucial metric illuminating this distinction is the ‘s ahead price-to-earnings (P/E) ratio, which serves as a bellwether for market valuations. This ratio reached astronomical ranges through the dot-com period, reflecting widespread speculative funding disconnected from elementary firm efficiency. In distinction, at this time’s tech sector, regardless of its strong valuations, showcases extra grounded P/E ratios, indicating a market that, whereas smitten by AI’s potential, stays anchored in monetary realities. Nvidia’s valuation, for instance, displays not solely its present monetary success but additionally the broader recognition of AI’s transformative impression throughout industries.

Supply: Morningstar.com, Nvidia 2023 vs Cisco (NASDAQ:) 1999: Will Historical past Repeat?Evaluating Cisco’s dot-com period trajectory with Nvidia’s present path additional highlights the evolution of market dynamics. Cisco, emblematic of the web infrastructure growth, skilled a dramatic valuation surge that would not face up to the bubble’s burst. Nvidia, nevertheless, represents a unique paradigm—its development is pushed by the tangible utility of AI applied sciences throughout numerous sectors, suggesting a extra steady basis for its market valuation.

Supply: Morningstar.com, Nvidia 2023 vs Cisco (NASDAQ:) 1999: Will Historical past Repeat?Evaluating Cisco’s dot-com period trajectory with Nvidia’s present path additional highlights the evolution of market dynamics. Cisco, emblematic of the web infrastructure growth, skilled a dramatic valuation surge that would not face up to the bubble’s burst. Nvidia, nevertheless, represents a unique paradigm—its development is pushed by the tangible utility of AI applied sciences throughout numerous sectors, suggesting a extra steady basis for its market valuation.

Furthermore, the nuances of at this time’s market are formed by varied macroeconomic components, together with rates of interest and financial coverage, which considerably form investor sentiment and valuations.

In actual fact, evaluating the AI surge to the dot-com bubble exhibits that the market has discovered classes from the previous, and funding is now targeted on higher understanding the basic worth and transformational potential of applied sciences corresponding to AI.

Navigating the 2024 AI and Tech Market Increase

The convergence of AI innovation with strategic market buying and selling marks the arrival of a brand new section. 2024 is a watershed second, pushed by authoritative forecasts and the growing function of synthetic intelligence and know-how, heralding development and dynamism. As all the time, it’s important to know what to focus on, how you can commerce, and which methods to use as related and opinionated.

Superior methods for dominating the AI market ● Diversify investments into AI-impacted areas; ● Use analytical instruments, corresponding to shifting averages and RSI, to handle worth volatility within the AI sector by marking strategic entry and exit factors; ● Mix indicators and use shifting common crossover and RSI for pattern buying and selling, Bollinger Bands, and MACD to determine entry/exit factors and Fibonacci ranges to determine help and resistance; ● Think about long-term funding into firms doing extreme AI analysis and improvement and having a transparent AI technique (e.g., Nvidia).

The inventory market outlook for 2024 will depend on varied components, together with the Federal Reserve’s anticipated price adjustment to a strong financial system and breakthroughs in synthetic intelligence and know-how. Business luminaries are predicting a bull market, with figures corresponding to InvestorPlace’s Luke Lango predicting the S&P 500 to rise not less than 15%. This sentiment is bolstered by specialists at Constancy, who consider Fed price cuts and earnings development will maintain the bull market.

AI and know-how shares and considerably superior firms like Nvidia are anticipated to steer the market’s growth. The AI know-how sector stays the main focus of Wall Avenue’s consideration, paralleling the preliminary burst of a growth much like the dot-com period, albeit primarily based on extra exceptional development and profitability. On this context, the intricate market dynamics might be anticipated.

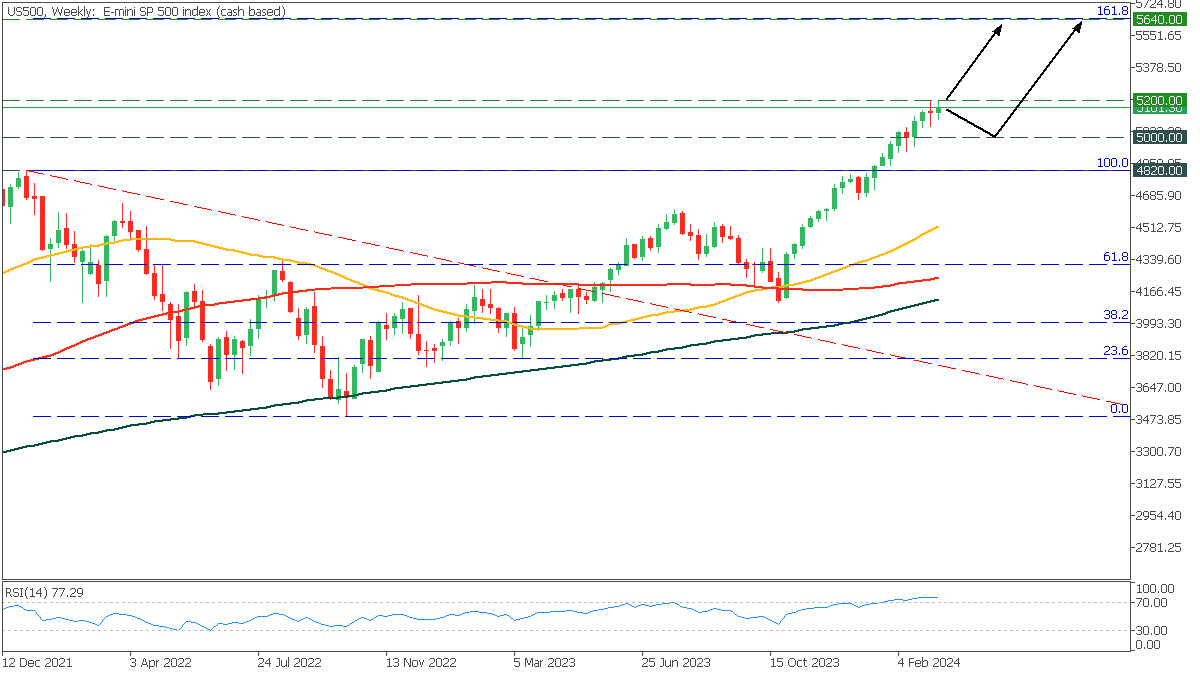

US500, Weekly Timeframe

Upon examination of the weekly chart of the S&P 500, it’s evident that the prevailing pattern is bullish, with sustained development noticed over 5 months. Now, the value is near the psychological mark of 5,200. RSI indicators overbought, however the shifting averages present the continuation of the bullish motion. If the value bounces off the 5,200 resistance, it might fall to five,000 help and soar to five,640. Within the occasion that the S&P 500 surpasses the 5,200 threshold, it could rally straight to 161.8 Fibonacci.

Main banks’ outlook on the 2024 development ● Barclays predicts a 12 months marked by uncertainty, with international development anticipated to decelerate to 2.4%, a lower from the earlier 12 months’s 3%. Inflation is anticipated to ease to 2.7%, reflecting the results of tighter financial insurance policies. ● Goldman Sachs presents a constructive outlook, forecasting strong international financial development at 2.6%. The US is anticipated to steer this development with a price of two.1%, buoyed by a slowdown in inflation and a powerful job market. ● Morgan Stanley emphasizes warning, particularly relating to US company earnings, which could not see the fast revenue re-acceleration anticipated by some. The agency highlights ongoing inflation and persistently high-interest charges as crucial challenges that would dampen client demand and company profitability. ● J.P. Morgan expects a difficult 12 months for equities, predicting solely modest S&P 500 earnings development between 2% and three%. The agency advises warning within the face of excessive valuations and geopolitical tensions.

The AI and know-how market is experiencing a big growth pushed by AI innovation and strategic market perception. Regardless of blended financial forecasts from main banks, this sector stays one of many development facilities, specializing in the potential for a continued bullish pattern within the main indices.

Conclusion

The AI growth essentially diverges from the dot-com bubble by being rooted in substantial technological developments and monetary achievements. Not like the speculative investments of the dot-com period, at this time’s AI sector showcases firms backed by stable income, groundbreaking innovation, and clear enterprise fashions. Nvidia stands as one of many foremost examples. This shift signifies a mature market the place development is pushed by precise efficiency and the sensible utility of know-how.

Moreover, the widespread integration of AI throughout varied industries highlights its enduring worth, contrasting with the transient nature of many dot-com investments. AI’s profound impression on healthcare, finance, and automotive sectors underlines its function as a cornerstone of future improvement, not only a fleeting pattern. This enduring presence means that the AI growth represents a brand new period of know-how funding targeted on sustainable development and long-term innovation.

*** Merchants and traders ought to concentrate on the important thing market milestones and the results for the long run financial system. Utilizing FBS, merchants can profit from rising and falling markets. The corporate presents over 5 hundred fifty buying and selling devices to construct buying and selling methods on. Disclosure: FBS is a global model current in over 150 nations. Unbiased firms united by the FBS model are dedicated to their shoppers and supply them alternatives to commerce Margin FX and CFDs. FBS Markets Inc. – Belize FSC 000102/6, Tradestone Ltd. – CySEC license quantity 331/17, Clever Monetary Markets Pty Ltd – ASIC License quantity 426359.

[ad_2]

Source link